North America Liver Fibrosis Treatment Market

Taille du marché en milliards USD

TCAC :

%

USD

7.55 Billion

USD

16.87 Billion

2024

2032

USD

7.55 Billion

USD

16.87 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 16.87 Billion | |

|

|

|

Marché nord-américain du traitement de la fibrose hépatique, par type de traitement (médicament et chirurgie/thérapie), stades (F2, F1, F3 et F4), indication (stéatohépatite non alcoolique (NASH), fibrose induite par les hépatites B et C, maladie alcoolique du foie (ALD), maladies auto-immunes du foie, troubles génétiques et autres), sexe (homme et femme), utilisateur final (hôpitaux, cliniques spécialisées, cliniques, centres ambulatoires et de recherche, et autres), canal de distribution (vente directe et au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain du traitement de la fibrose hépatique

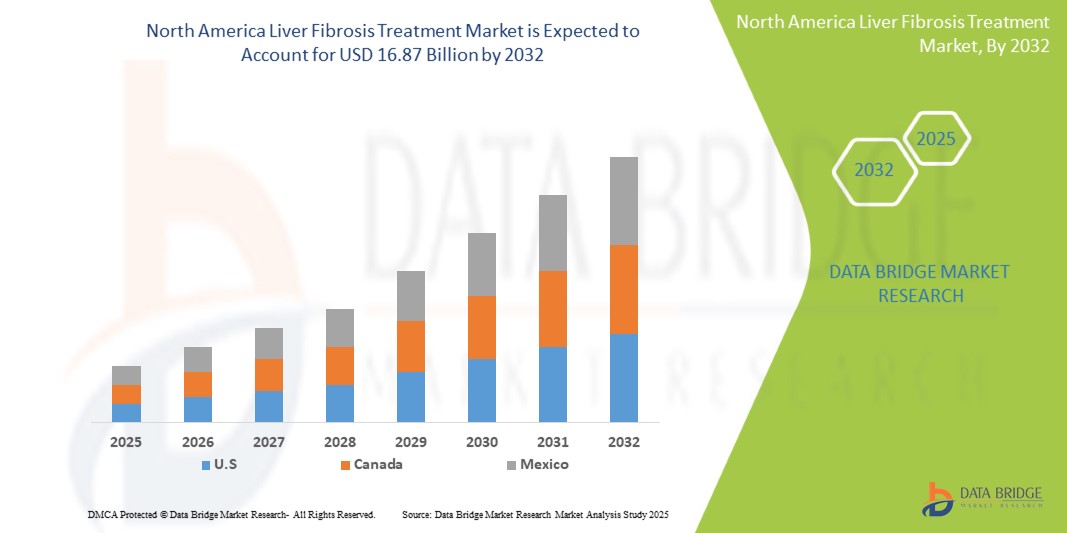

- Le marché nord-américain du traitement de la fibrose hépatique était évalué à 7,55 milliards USD en 2024 et devrait atteindre 16,87 milliards USD d'ici 2032.

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 10,8 %, principalement grâce à la sensibilisation croissante des consommateurs aux solutions de santé naturelles.

- Cette croissance est due à des facteurs tels que la prévalence croissante des maladies du foie. De plus, l’accessibilité financière entraîne une augmentation de la consommation d’alcool.

Analyse du marché nord-américain du traitement de la fibrose hépatique

- Le nombre croissant de maladies du foie crée une population de patients plus importante ayant besoin d'options thérapeutiques efficaces, en particulier pour des affections telles que l'hépatite B et C. Des facteurs contributifs tels que l'augmentation de la consommation d'alcool, les mauvaises habitudes alimentaires et l'augmentation des taux d'obésité ont tous conduit à un nombre croissant de personnes diagnostiquées avec ces affections du foie.

- À mesure que les lésions hépatiques progressent, le risque de fibrose hépatique augmente, ce qui impose aux systèmes de santé une charge importante pour proposer des options thérapeutiques efficaces. Cette demande croissante stimule le développement et la disponibilité de thérapies ciblées, alimentant ainsi la croissance du marché, les professionnels de santé recherchant des solutions innovantes pour gérer cette maladie.

- De plus, la sensibilisation accrue des professionnels de santé et du grand public a permis à un plus grand nombre de personnes dépistées et diagnostiquées à des stades plus précoces de la maladie hépatique. Les progrès des techniques diagnostiques, notamment l'imagerie non invasive et les analyses sanguines, ont facilité l'identification précoce de la fibrose hépatique. Cette détection précoce permet des interventions rapides, stimulant ainsi la demande de traitements innovants permettant d'inverser ou de gérer efficacement la fibrose hépatique.

- Par exemple, en août 2023, selon un article publié par le NCBI, les maladies du foie étaient responsables de deux millions de décès par an et de 4 % de tous les décès (soit un décès sur 25 dans le monde) ; environ deux tiers des décès liés au foie surviennent chez les hommes. Cette statistique alarmante souligne le besoin urgent de traitements efficaces et l'important fardeau que représentent les maladies du foie pour la santé publique, incitant les systèmes de santé et les laboratoires pharmaceutiques à privilégier le développement de thérapies innovantes ciblant spécifiquement la fibrose hépatique et ses causes sous-jacentes.

- Par conséquent, les sociétés pharmaceutiques et les chercheurs médicaux sont obligés d’investir dans le développement de nouvelles options thérapeutiques, propulsant ainsi le marché alors que les parties prenantes visent à lutter contre l’incidence croissante des maladies du foie et leurs complications associées.

Portée du rapport et segmentation du marché nord-américain du traitement de la fibrose hépatique

|

Attributs |

Marché mondial du traitement de la fibrose hépatique : informations clés |

|

Segments couverts |

|

|

Pays couverts |

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Liver Fibrosis Treatment Market Trends

“Increasing Prevalence of Liver Diseases”

- The increasing prevalence of liver diseases is emerging as a significant North America health concern, contributing substantially to healthcare burdens worldwide

- Factors such as excessive alcohol consumption, rising obesity rates, viral hepatitis infections, and unhealthy lifestyles are leading to a surge in conditions like fatty liver disease, cirrhosis, and liver cancer

- The growing incidence of non-alcoholic fatty liver disease (NAFLD), particularly linked to diabetes and metabolic syndrome, is also alarming. As a result, there is an increased demand for early diagnosis, effective treatment options, and public health initiatives. This trend is expected to drive innovation and growth in the liver disease treatment market

North America Liver Fibrosis Treatment Market Dynamics

Drivers

“Rising Consumption of Alcohol”

- Rising alcohol consumption is a significant contributor to the North America liver fibrosis treatment market due to its direct correlation with the incidence of liver diseases, particularly Alcoholic Liver Disease (ALD)

- As more individuals consume alcohol regularly and in larger quantities, the risk of developing liver-related complications, including liver fibrosis and cirrhosis, increases significantly

- Chronic alcoholism leads to inflammation, fat accumulation, and, ultimately, fibrosis as the liver undergoes repeated damage and repair

- This growing prevalence of alcohol-related liver conditions creates a pressing demand for effective treatments and management strategies to help mitigate liver damage and improve patient outcomes

For instance,

- In October 2024, as per an article published by the International Journal of Mental Health Systems, the prevalence of alcohol consumption was 54.5% and 47.7% at the baseline and follow-up, respectively. Moreover, 12% of men reported to have newly started drinking. This prevalence of alcohol consumption leads to an increased incidence of liver fibrosis North Americaly, potentially impacting market growth

- In June 2024, as per STAT, alcohol-related deaths are on the rise, and experts are particularly concerned about an increase among young people and women. The U.S. saw a 25.5% spike in alcohol-related deaths between 2019 and 2020 — accounting for 3% of all deaths. Moreover, the largest increases in alcohol-related deaths were among people 25 to 34 and 35 to 44 years old, wherein deaths in both groups increased by over 37%

- Moreover, the increasing societal acceptance and normalization of alcohol consumption, particularly in younger demographics, further exacerbate the issue, leading to a greater number of individuals at risk for liver fibrotic changes

- This trend promotes the growth of the liver fibrosis treatment market and emphasizes the importance of public health initiatives aimed at reducing alcohol consumption and preventing liver disease

Opportunities

“Emerging Technologies and Advanced Treatments in Liver Fibrosis Management”

-

Emerging technologies like gene therapy, targeted molecular therapies, and biologic agents are transforming the treatment landscape

-

Recent innovations focus on drugs that specifically target fibrosis progression pathways, such as FXR agonists, TGF-β inhibitors, and anti-inflammatory agents. In addition, non-invasive diagnostic tools like elastography are improving early detection

-

These advancements offer more effective, personalized treatments for conditions such as NASH (Non-Alcoholic Steatohepatitis) and cirrhosis, leading to better patient outcomes

-

In February 2024, an article published in Springer Nature, The article reviews emerging approaches for diagnosing and inhibiting liver fibrogenesis. Advances include non-invasive biomarkers, imaging technologies, and cell therapies like mesenchymal stem cells. Promising antifibrotic drugs, including pirfenidone and obeticholic acid, along with innovations in tissue engineering, nanotechnology, and microfluidic models, show potential for personalized, precision treatments

-

A September 2021, article by NCBI highlighted that Emerging technologies in liver fibrosis treatment focus on advanced therapies targeting molecular pathways like hepatic stellate cell activation. Innovations such as gene therapy, biologics, small molecule inhibitors, and non-invasive diagnostics improve early detection and treatment. Stem cell therapies and tissue engineering also offer promise for reversing fibrosis and enhancing recovery

-

With the continuous evolution of treatment strategies and diagnostic technologies, liver fibrosis therapies are advancing rapidly

-

These innovations provide hope for better management of liver diseases, ensuring that patients have access to more effective, personalized treatments with fewer side effects, ultimately improving North America health outcomes

Restraints/Challenge

“Limited Awareness of Liver Diseases”

- La méconnaissance des maladies du foie entrave un diagnostic précoce et une prise en charge adaptée. De nombreuses personnes ignorent les facteurs de risque et les symptômes associés aux maladies du foie, attribuant souvent des signes vagues de la maladie à d'autres affections moins graves.

- Ce manque de connaissances retarde les consultations médicales jusqu'à ce que la maladie progresse vers des stades avancés, tels que la fibrose hépatique ou la cirrhose, où les options de traitement deviennent plus complexes et moins efficaces.

- Par conséquent, les diagnostics tardifs réduisent le potentiel de succès du traitement et limitent la croissance globale du marché en limitant la population de patients recherchant des soins rapides.

Par exemple,

- En avril 2024, Lupin a déclaré que les patients ne sont pas conscients de leur état avant que la maladie n'atteigne un stade critique, ce qui rend urgente une réévaluation de l'approche en matière de sensibilisation, de dépistage et de prise en charge de la santé hépatique. Cependant, la compréhension limitée des maladies hépatiques et des facteurs de risque associés constitue un obstacle majeur à la prise en charge de la santé hépatique.

- En juillet 2021, selon une étude menée auprès de 11 700 adultes (18 ans et plus) dans le cadre de cinq enquêtes nationales sur la santé et la nutrition, près de 96 % des adultes atteints de NAFLD aux États-Unis ignoraient leur maladie du foie, en particulier les jeunes adultes. Par conséquent, il est essentiel de sensibiliser et d'informer davantage sur la santé du foie afin d'améliorer les résultats des patients et de favoriser une approche plus proactive de la prise en charge de la fibrose hépatique et de favoriser le développement du marché des traitements.

- En janvier 2021, Springer Nature a rapporté que parmi les 825 patients inclus dans l'analyse de recherche réalisée dans le cadre de l'article « Manque de sensibilisation aux lésions hépatiques chez les patients atteints de diabète de type 2 », 8,1 % (IC à 95 % : 5,1 %-12,7 %) des patients atteints de stéatose savaient qu'ils souffraient d'une maladie hépatique. De plus, dans un échantillon représentatif à l'échelle nationale d'adultes américains atteints de diabète de type 2, la prévalence de la fibrose hépatique avancée est élevée. Moins de 20 % des personnes atteintes de fibrose avancée savent qu'elles souffrent d'une maladie hépatique.

- Une sensibilisation limitée entrave les résultats potentiels du traitement pour les patients et freine la croissance du marché en réduisant le nombre de personnes qui s'engagent très tôt dans les services de santé.

- Ainsi, une sensibilisation et une éducation accrues sur la santé du foie sont essentielles pour améliorer le diagnostic précoce, renforcer l'efficacité du traitement et, en fin de compte, favoriser un marché plus robuste pour les thérapies contre la fibrose hépatique.

Portée du marché nord-américain du traitement de la fibrose hépatique

Le marché est segmenté en fonction du type de produit, du traitement, de la source, de l'application, de la voie d'administration, du mode d'achat, de la tranche d'âge, du sexe, de l'utilisateur final et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par type de traitement |

|

|

Par étapes |

|

|

Par indication |

|

|

Par utilisateur final |

|

|

Par canal de distribution |

|

Analyse régionale du marché nord-américain du traitement de la fibrose hépatique

« Les États-Unis sont le pays dominant sur le marché du traitement de la fibrose hépatique »

- Les États-Unis sont en tête du marché du traitement de la fibrose hépatique en Amérique du Nord, grâce à leur solide infrastructure de soins de santé, à la forte prévalence des maladies liées au foie et à l'accent mis sur le diagnostic précoce et les stratégies d'intervention.

- Le pays bénéficie d’une couverture médicale étendue, de politiques de remboursement bien établies et d’une demande croissante d’options de diagnostic et de traitement non invasives.

- Le leadership des États-Unis en matière de recherche clinique et sa participation active aux campagnes de sensibilisation aux maladies du foie soutiennent davantage la croissance du marché

- L’adoption croissante de thérapies avancées, la sensibilisation croissante des patients et les initiatives gouvernementales visant à lutter contre les maladies chroniques du foie contribuent à la domination des États-Unis dans la région.

« Les États-Unis devraient enregistrer le taux de croissance le plus élevé »

- Les États-Unis sont également le marché qui connaît la croissance la plus rapide, alimenté par l’innovation continue dans les biomarqueurs de la fibrose, l’augmentation des investissements en R&D des sociétés pharmaceutiques et la hausse des taux de stéatose hépatique liée à l’alcool et non alcoolique.

- Ces facteurs positionnent collectivement les États-Unis comme une plaque tournante centrale pour le traitement de la fibrose hépatique en Amérique du Nord, ce qui en fait à la fois le marché le plus vaste et le plus en expansion de la région.

Part de marché du traitement de la fibrose hépatique en Amérique du Nord

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence en Amérique du Nord, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- F. Hoffmann-La Roche SA (Suisse)

- Abbott (États-Unis)

- La Renon Healthcare Pvt. Ltd. (Inde)

- GENFIT SA (France)

- Madrigal Pharmaceuticals (États-Unis)

- Aligos Therapeutics (États-Unis)

- Pfizer Inc. (États-Unis)

- Enanta Pharmaceuticals, Inc. (États-Unis)

- Bristol-Myers Squibb Company (États-Unis)

- Vertex Pharmaceuticals Incorporated (États-Unis)

- Takeda Pharmaceutical Company Limited (Japon)

- Hepion Pharmaceuticals (États-Unis)

- Echosens (France)

- Galectin Therapeutics, Inc. (États-Unis)

- Conatus Pharmaceuticals (États-Unis)

- Tvardi Therapeutics (États-Unis)

- Viking Therapeutics (États-Unis)

- Calliditas Therapeutics AB (Suède)

- Novomedix (États-Unis)

- Galecto Biotech (Danemark)

- Pilant Therapeutics, Inc. (États-Unis)

- Sagimet Biosciences (États-Unis)

- Gyre Therapeutics, Inc. (États-Unis)

- Akero Therapeutics, Inc. (États-Unis)

- CureVac SE (Allemagne)

- Novo Nordisk A/S (Danemark)

- Ipsen Pharma (France)

- AdAlta Limited (Australie)

- Alentis Therapeutics AG (Suisse)

- Gilead Sciences, Inc. (États-Unis)

- AbbVie Inc. (États-Unis)

- Merck & Co., Inc. (États-Unis)

- Novartis AG (Suisse)

- Intercept Pharmaceuticals, Inc. (États-Unis)

Derniers développements sur le marché nord-américain du traitement de la fibrose hépatique

- En juin 2024, Gilead Sciences a présenté ses nouvelles recherches lors du congrès 2024 de l'Association européenne pour l'étude du foie (EASL) à Milan, portant sur des maladies hépatiques telles que la cholangite biliaire primitive (CBP), l'hépatite B (VHB), le virus de l'hépatite delta (VHD), entre autres. Les principales présentations porteront sur les données à long terme de l'étude ASSURE sur le séladelpar dans la CBP, les résultats de l'utilisation du ténofovir dans la prévention du cancer du foie chez les patients infectés par le VHB, et les conclusions des études MYR204 et MYR301 sur l'Hepcludex dans le traitement du VHD. Ces recherches soulignent l'engagement de Gilead à faire progresser les options thérapeutiques pour les maladies hépatiques.

- En octobre 2024, Intercept Pharmaceuticals, Inc. a présenté ses efforts continus pour explorer les différences et disparités raciales dans la prise en charge de la cholangite biliaire primitive (CBP). L'entreprise s'intéresse aux difficultés que rencontrent différentes populations en matière de diagnostic, de traitement et de prise en charge de la CBP. En explorant ces disparités, Intercept vise à améliorer l'accès aux soins et les résultats thérapeutiques pour tous les patients, réduisant ainsi potentiellement les obstacles à un traitement efficace des maladies du foie, dont la fibrose.

- En novembre 2022, la Food and Drug Administration (FDA) américaine a approuvé Vemlidy (ténofovir alafénamide) pour le traitement de l'infection chronique par le virus de l'hépatite B (VHB) chez les patients pédiatriques âgés de 12 ans et plus atteints d'une maladie hépatique compensée. Cette autorisation prolonge l'utilisation de Vemlidy, initialement approuvé en 2016 pour les adultes atteints d'une infection chronique par le VHB. Cette autorisation s'appuie sur un essai clinique de phase II démontrant l'efficacité et la sécurité de Vemlidy chez ce groupe de patients plus jeunes.

- En septembre 2022, Gilead Sciences a finalisé l'acquisition de MiroBio, une société de biotechnologie britannique spécialisée dans le rétablissement de l'équilibre immunitaire grâce à des agonistes ciblant les récepteurs inhibiteurs immunitaires. Cette acquisition, évaluée à environ 405 millions de dollars, apporte à Gilead la plateforme de découverte de MiroBio et son portefeuille d'agonistes des récepteurs inhibiteurs immunitaires. Le principal anticorps expérimental de MiroBio, le MB272, cible les cellules immunitaires pour supprimer les réponses immunitaires inflammatoires et est actuellement en phase 1 d'essais cliniques. Cette acquisition renforce les efforts de Gilead dans le traitement des maladies chroniques à médiation immunitaire.

- En mars 2021, Gilead Sciences et Novo Nordisk ont élargi leur collaboration dans le traitement de la stéatohépatite non alcoolique (NASH) en lançant un essai clinique de phase IIb. L'étude évalue l'innocuité et l'efficacité du sémaglutide, un agoniste du récepteur du GLP-1 de Novo Nordisk, associé au cilofexor (un agoniste du récepteur FXR) et au firsocostat (un inhibiteur de l'ACC) de Gilead chez des patients atteints de cirrhose due à la NASH. L'essai évaluera l'impact des traitements sur la fibrose hépatique et la résolution de la NASH. Le recrutement devrait débuter au second semestre 2021.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.2.1 LIVER TRANSPLANTATION VOLUME AND THEIR COST FOR LIVER FIBROSIS BY COUNTRY

4.2.2 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES FOR LIVER FIBROSIS: VOLUME AND COST BY COUNTRY

4.2.3 PARTIAL HEPATECTOMY (LIVER RESECTION) COST BY COUNTRY

4.2.4 CELL-BASED THERAPY COST FOR LIVER FIBROSIS TREATMENT BY COUNTRY

4.3 EPIDEMIOLOGY

4.3.1 INCIDENCE OF ALL BY GENDER

4.3.2 TREATMENT RATE

4.3.3 TREATMENT RATE

4.3.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.3.5 PATIENT TREATMENT SUCCESS RATES

4.4 MARKETED DRUG ANALYSIS

4.5 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5.1 PATIENT FLOW DIAGRAM

4.5.2 KEY PRICING STRATEGIES

4.5.3 KEY PATIENT ENROLLMENT STRATEGIES

5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF LIVER DISEASES

6.1.2 RISING CONSUMPTION OF ALCOHOL

6.1.3 RISING LIVER TRANSPLANTATION RATES

6.1.4 GROWING INCIDENCE OF NON-ALCOHOLIC FATTY LIVER DISEASE (NAFLD) & NASH

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF LIVER DISEASES

6.2.2 REGULATORY CHALLENGES

6.3 OPPORTUNITIES

6.3.1 EMERGING TECHNOLOGIES AND ADVANCED TREATMENTS IN LIVER FIBROSIS MANAGEMENT

6.3.2 PROGRESS IN PIPELINE PRODUCTS FOR LIVER FIBROSIS TREATMENT

6.3.3 STRATEGIC MERGERS AND ACQUISITIONS AMONG THE KEY PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF EFFECTIVE AND APPROVED ANTI-FIBROTIC DRUGS

6.4.2 HIGH COST OF TREATMENTS IN LIVER FIBROSIS CARE

7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 ANTIVIRAL AGENTS

7.2.1.1 VELPATASVIR/SOFOSBUVIR

7.2.1.2 TENOFOVIR

7.2.1.3 LEDIPASVIR/SOFOSBUVIR

7.2.1.4 SOFOSBUVIR

7.2.1.5 ENTECAVIR

7.2.2 ANTIFIBROTIC AGENTS

7.2.2.1 OBETICHOLIC ACID

7.2.2.2 TGF-Β INHIBITORS

7.2.2.3 CONNECTIVE TISSUE GROWTH FACTOR (CTGF) INHIBITORS

7.2.2.4 LYSYL OXIDASE-LIKE 2 (LOXL2) INHIBITORS

7.2.2.5 OTHERS

7.2.3 ANTI-INFLAMMATORY DRUGS

7.2.3.1 CORTICOSTEROIDS

7.2.3.1.1 PREDNISONE

7.2.3.1.2 DEXAMETHASONE

7.2.3.2 TUMOR NECROSIS FACTOR (TNF) INHIBITORS

7.2.3.2.1 INFLIXIMAB

7.2.3.2.2 ETANERCEPT

7.2.3.3 INTERLEUKIN (IL) INHIBITORS

7.2.3.3.1 IL-6 INHIBITORS (TOCILIZUMAB)

7.2.3.3.2 IL-1 INHIBITORS (ANAKINRA)

7.2.4 IMMUNOSUPPRESSANTS

7.2.4.1 MYCOPHENOLATE MOFETIL

7.2.4.2 TACROLIMUS

7.2.4.3 CYCLOSPORINE

7.2.5 MARKETED DRUGS

7.2.5.1 VELPATASVIR/SOFOSBUVIR

7.2.5.2 TENOFOVIR

7.2.5.3 LEDIPASVIR/SOFOSBUVIR

7.2.5.4 OBETICHOLIC ACID (OCA)

7.2.5.5 SOFOSBUVIR

7.2.5.6 PIRFENIDONE

7.2.5.7 OTHERS

7.2.6 PIPELINE DRUGS

7.2.7 BRANDED DRUGS

7.2.7.1 EPCLUSA

7.2.7.2 VIREAD AND VEMLIDY

7.2.7.3 OCALIVA

7.2.7.4 HARVONI

7.2.7.5 SOVALDI

7.2.7.6 BARACLUDE

7.2.7.7 ACTOS

7.2.7.8 OTHERS

7.2.8 GENERIC DRUGS

7.2.9 ORAL

7.2.10 PARENTERAL

7.2.11 OTHERS

7.3 SURGERY/THERAPY

7.3.1 LIVER TRANSPLANTATION

7.3.2 ORTHOTOPIC LIVER TRANSPLANT (OLT)

7.3.3 LIVING DONOR LIVER TRANSPLANT (LDLT)

7.3.4 SPLIT LIVER TRANSPLANTATION

7.3.5 DOMINO LIVER TRANSPLANT

7.3.6 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES

7.3.6.1 ENDOSCOPIC VARICEAL LIGATION (EVL)

7.3.6.2 TRANSJUGULAR INTRAHEPATIC PORTOSYSTEMIC SHUNT (TIPS)

7.3.6.3 LIVER ABLATION PROCEDURES

7.3.6.3.1 RADIOFREQUENCY ABLATION (RFA)

7.3.6.3.2 MICROWAVE ABLATION (MWA)

7.3.7 PARTIAL HEPATECTOMY (LIVER RESECTION)

7.3.7.1 SEGMENTAL RESECTION

7.3.7.2 LOBECTOMY

7.3.7.3 WEDGE RESECTION

7.3.8 CELL-BASED THERAPY

7.3.8.1 STEM CELL THERAPY

7.3.8.1.1 MESENCHYMAL STEM CELLS (MSCS)

7.3.8.1.2 HEMATOPOIETIC STEM CELLS (HSCS)

7.3.8.2 GENE THERAPY

7.3.8.2.1 CRISPR-BASED LIVER REGENERATION

7.3.8.2.2 HEPATIC STELLATE CELL (HSC) INHIBITORS

7.3.8.2.3 SIRNA-BASED THERAPIES

7.3.8.2.4 HEPATOCYTE APOPTOSIS INHIBITORS

7.3.8.2.4.1 OXIDATIVE STRESS INHIBITORS

7.3.8.2.4.2 EMRICASAN

7.3.8.2.4.3 PENTOXIFYLLINE

7.3.8.2.4.4 LOSARTAN

7.3.8.2.4.5 METHYL FERULIC ACID

7.3.8.2.4.6 OTHERS

7.4 OTHERS

8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES

8.1 OVERVIEW

8.2 F2

8.3 F1

8.4 F3

8.5 F4

9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 NON-ALCOHOLIC STEATOHEPATITIS (NASH)

9.3 HEPATITIS B & C-INDUCED FIBROSIS

9.3.1 CHRONIC HEPATITIS B VIRUS (HBV) FIBROSIS

9.3.2 CHRONIC HEPATITIS C VIRUS (HCV) FIBROSIS

9.4 ALCOHOLIC LIVER DISEASE (ALD)

9.5 AUTOIMMUNE LIVER DISEASES

9.5.1 AUTOIMMUNE HEPATITIS (AIH)

9.5.2 PRIMARY BILIARY CHOLANGITIS (PBC)

9.5.3 PRIMARY SCLEROSING CHOLANGITIS (PSC)

9.6 GENETIC DISORDERS

9.6.1 HEMOCHROMATOSIS

9.6.2 WILSON’S DISEASE

9.6.3 ALPHA-1 ANTITRYPSIN DEFICIENCY

9.7 OTHERS

10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER

10.1 OVERVIEW

10.2 MALE

10.2.1 40-55 YEARS

10.2.2 ABOVE 55 YEARS

10.2.3 BELOW 40 YEARS

10.3 FEMALE

10.3.1 ABOVE 55 YEARS

10.3.2 40-55 YEARS

10.3.3 BELOW 40 YEARS

11 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC HOSPITALS

11.2.2 PRIVATE HOSPITALS

11.3 SPECIALTY CLINICS

11.3.1 HEPATOLOGY CLINICS

11.3.2 GASTROENTEROLOGY CLINICS

11.4 CLINICS

11.5 AMBULATORY AND RESEARCH CENTERS

11.6 OTHERS

12 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.2.1 RETAIL SALES

12.2.1.1 HOSPITAL PHARMACY

12.2.1.2 RETAIL PHARMACY

12.2.1.3 ONLINE PHARMACY

13 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 GILEAD SCIENCES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 ABBVIE, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MERCK & CO, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NOVARTIS AG

16.4.1 COMPANY SNAPSHOTS

16.4.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 PIPELINE PRODUCT PORTFOLIO

16.4.6 RECENT DEVELOPMENT

16.5 INTERCEPT PHARMACEUTICALS, INC.

16.5.1 COMPANY SNAPSHOTS

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 PIPELINE PRODUCT PORTFOLIO

16.5.6 RECENT NEWS

16.6 ABBOTT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 1.1.5 RECENT DEVELOPMENT

16.7 ALIGOS THERAPEUTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ALNICHE LIFE SCIENCES PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ALENTIS THERAPEUTICS AG

16.9.1 COMPANY SNAPSHOT

16.9.2 PIPELINE PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ADALTA LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PIPELINE PRODUCT PORTFOLIO

16.10.4 RECENT NEWS

16.11 AKERO THERAPEUTICS, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PIPELINE PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BRISTOL-MYERS SQUIBB

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CALLIDITAS THERAPEUTICS AB

16.13.1 COMPANY SNAPSHOT

16.13.2 PIPELINE PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CUREVAC SE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 CONATUSPHARMA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT/NEWS

16.16 ENANTA PHARMACEUTICALS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 ECHOSENS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT/NEWS

16.18 F. HOFFMANN-LA ROCHE LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 GALECTO BIOTECH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PIPELINE PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT/NEWS

16.2 GALECTIN THERAPEUTICS, INC.

16.20.1 COMPANY SNAPSHOTS

16.20.2 REVENUE ANALYSIS AND SEGMENTAL ANALYSIS

16.20.3 PIPELINE PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 GYRE THERAPEUTICS, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT/NEWS

16.22 GENFIT SA

16.22.1 COMPANY SNAPSHOTS

16.22.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.22.3 PIPELINE PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 HEPION PHARMACEUTICALS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PIPELINE PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 IPSEN PHARMA

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PIPELINE PRODUCT PORTFOLIO

16.24.4 RECENT NEWS/DEVELOPMENTS

16.25 LA RENON HEALTHCARE PVT. LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 MADRIGAL PHARMACEUTICALS

16.26.1 COMPANY SNAPSHOTS

16.26.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 NOVO NORDISK A/S

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PIPELINE PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 NOVOMEDIX

16.28.1 COMPANY SNAPSHOT

16.28.2 PIPELINE PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 PILANT THERAPEUTICS, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PIPELINE PRODUCT PORTFOLIO

16.29.4 RECENT NEWS

16.3 PFIZER INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PIPELINE PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT/NEWS

16.31 SAGIMET BIOSCIENCES

16.31.1 COMPANY SNAPSHOTS

16.31.2 REVENUE ANALYSIS

16.31.3 1.1.4 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT/NEWS

16.32 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 PIPELINE PRODUCT PORTFOLIO

16.32.4 PRODUCT PORTFOLIO

16.32.5 RECENT DEVELOPMENT

16.33 TVARDI THERAPEUTICS

16.33.1 COMPANY SNAPSHOT

16.33.2 PIPELINE PRODUCT PORTFOLIO

16.33.3 RECENT DEVELOPMENT/NEWS

16.34 VERTEX PHARMACEUTICALS INCORPORATED

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 PRODUCT PORTFOLIO

16.34.4 RECENT DEVELOPMENT

16.35 VIKING THERAPEUTICS

16.35.1 COMPANY SNAPSHOT

16.35.2 REVENUE ANALYSIS

16.35.3 PIPELINE PRODUCT PORTFOLIO

16.35.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA INCIDENCE OF CIRRHOSIS BY GENDER (2019)

TABLE 2 TREATMENT ADHERENCE LEVELS IN LIVER DISEASE PATIENTS

TABLE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 16 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 17 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 24 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA F2 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA F1 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA F3 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA F4 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA NON-ALCOHOLIC STEATOHEPATITIS (NASH) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ALCOHOLIC LIVER DISEASE (ALD) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA AMBULATORY AND RESEARCH CENTERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA DIRECT TENDER IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 78 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 86 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 88 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 89 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 91 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 92 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 94 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 95 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 97 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 98 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 130 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 131 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 133 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 134 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 136 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 138 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 139 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 141 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 142 U.S. INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 144 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 145 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 147 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 148 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 180 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 181 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 183 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 184 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 186 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 188 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 189 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 191 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 192 CANADA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 195 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 197 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 198 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 228 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 230 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 231 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 233 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 234 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 236 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 238 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 239 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 241 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 242 MEXICO INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 244 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 245 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 247 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 248 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 249 MEXICO MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LIVER DISEASES IS EXPECTED TO DRIVE THE GROWTH OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET FROM 2025 TO 2032

FIGURE 12 THE MEDICATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET IN 2025-2032

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

FIGURE 14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

FIGURE 17 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2024

FIGURE 22 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2024

FIGURE 26 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2024

FIGURE 30 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL 2024

FIGURE 38 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.