North America Stainless Steel Market

Taille du marché en milliards USD

TCAC :

%

USD

50.12 Billion

USD

71.13 Billion

2024

2032

USD

50.12 Billion

USD

71.13 Billion

2024

2032

| 2025 –2032 | |

| USD 50.12 Billion | |

| USD 71.13 Billion | |

|

|

|

|

Segmentation du marché nord-américain de l'acier inoxydable, par type de produit (produits plats, produits longs, tubes et tuyaux, raccords et brides, etc.), nuance (acier inoxydable austénitique, acier inoxydable ferritique, acier inoxydable duplex, acier inoxydable martensitique, acier inoxydable durci par précipitation (PH) et autres), procédé de fabrication (laminage à chaud, laminage à froid, moulage, forgeage et extrusion), méthode de production (production primaire, transformation secondaire et transformation finale), résistance (acier inoxydable à faible résistance, acier inoxydable à résistance moyenne et acier inoxydable à haute résistance), revêtement et finition de surface (revêtements et finitions de surface), vertical (construction et infrastructures, automobile et transport, biens de consommation et électroménagers, équipements et machines industriels, médical et santé, aérospatiale et défense, énergie et électricité, transformation des aliments et des boissons, électronique et technologie, et applications environnementales) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de l'acier inoxydable

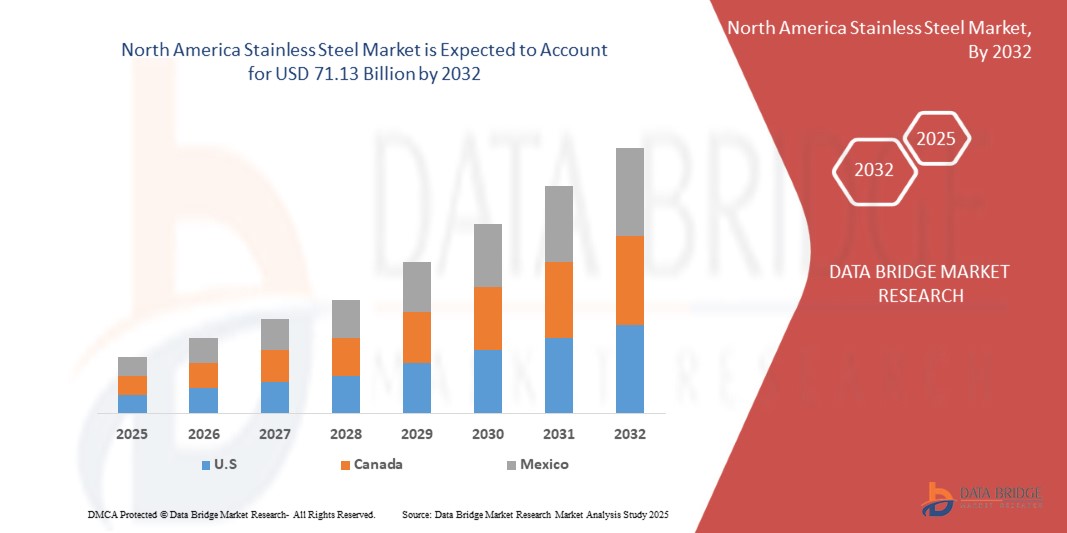

- Le marché nord-américain de l'acier inoxydable était évalué à 50,12 milliards USD en 2024 et devrait atteindre 71,13 milliards USD d'ici 2032.

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 4,68 %, principalement grâce à l'industrialisation croissante et à l'expansion des infrastructures.

- Cette croissance est également stimulée par l'utilisation croissante de l'acier inoxydable dans les applications d'énergie propre, la préférence croissante pour les matériaux résistants à la corrosion et durables, et des réglementations environnementales et de sécurité plus strictes qui favorisent les matériaux recyclables et à faibles émissions.

Analyse du marché de l'acier inoxydable

- Le marché de l'acier inoxydable connaît une croissance soutenue, portée par le développement croissant des infrastructures, l'urbanisation et la demande croissante des secteurs de l'automobile, de la construction et de l'énergie. Sa résistance à la corrosion, sa durabilité et son esthétique en font un matériau de choix pour les applications structurelles et décoratives. Cependant, l'expansion du marché est freinée par la fluctuation des prix des matières premières, notamment du nickel et du chrome, et par les préoccupations environnementales liées aux méthodes de production traditionnelles.

- La demande d'acier inoxydable est fortement stimulée par l'accent mis par le secteur de la construction sur des matériaux durables et faciles d'entretien. De plus, son adoption croissante dans les véhicules électriques, en raison de sa légèreté et de sa résistance, stimule la demande dans le secteur automobile. Les industries agroalimentaire et des équipements médicaux continuent également de dépendre fortement de l'acier inoxydable pour ses caractéristiques hygiéniques et non réactives.

- Les nuances d'acier inoxydable austénitiques dominent le marché. Parallèlement, les nuances duplex et ferritiques gagnent du terrain dans des applications spécifiques telles que le traitement chimique et le dessalement, grâce à leur robustesse et leur résistance aux chlorures. Les innovations technologiques, notamment les méthodes de production à faible émission de carbone et les technologies de recyclage améliorées, devraient remodeler le paysage concurrentiel et favoriser la durabilité dans l'industrie de l'acier inoxydable.

Portée du rapport et segmentation du marché de l'acier inoxydable

|

Attributs |

Informations clés sur le marché de l'acier inoxydable |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de l'acier inoxydable

« Innovation axée sur la durabilité et développement d'alliages avancés »

- L’une des tendances marquantes du marché nord-américain de l’acier inoxydable est l’accent croissant mis sur l’innovation axée sur la durabilité et le développement d’alliages d’acier inoxydable avancés.

- Le marché connaît une demande accrue de produits en acier inoxydable résistants à la corrosion, légers et performants dans divers secteurs, notamment l'automobile, la construction et les énergies renouvelables. Cette tendance est étroitement liée aux objectifs de décarbonation et aux principes de l'économie circulaire.

Par exemple, en août 2023, Outokumpu a lancé une nouvelle gamme d'aciers inoxydables à faibles émissions, produits à partir d'une forte teneur en matières recyclées et d'énergies renouvelables. Cette initiative soutient les objectifs du Pacte vert pour l'Europe et renforce le rôle de l'acier inoxydable dans les infrastructures résilientes au changement climatique.

- Les fabricants investissent de plus en plus dans la technologie des fours à arc électrique (FAE), la production à partir de ferraille et les méthodes de captage du carbone afin de réduire l'empreinte environnementale de l'acier inoxydable. Parallèlement, des formulations d'alliages avancés sont adaptées à des applications critiques telles que le stockage de l'hydrogène, les véhicules électriques et la construction navale.

- Alors que les normes environnementales se durcissent à l'échelle mondiale, notamment en Amérique du Nord, les utilisateurs finaux privilégient l'acier inoxydable certifié pour ses performances environnementales. Cette tendance stimule l'innovation produit, l'adoption de certifications (par exemple, DEP, matériaux conformes LEED) et une intégration plus poussée de la chaîne d'approvisionnement afin d'atteindre les objectifs de développement durable dans tous les secteurs.

Dynamique du marché de l'acier inoxydable

Conducteur

« Industrialisation croissante et expansion des infrastructures »

- L'une des principales tendances qui propulsent le marché nord-américain de l'acier inoxydable est l'accélération des activités industrielles et le développement des infrastructures dans les économies émergentes et développées. L'acier inoxydable est un matériau essentiel pour les machines industrielles, les équipements de process et les applications de construction, en raison de sa robustesse, de sa résistance à la corrosion et de sa longue durée de vie.

- La vague actuelle de modernisation industrielle, notamment la fabrication intelligente, les projets d'énergie renouvelable et les initiatives de développement urbain, entraîne une demande constante d'acier inoxydable dans la fabrication d'équipements, les composants structurels et les systèmes de traitement des fluides.

- Des secteurs tels que la construction, la production d'électricité, le traitement chimique et le pétrole et le gaz augmentent leurs dépenses d'investissement pour atteindre les objectifs de croissance post-pandémique, ce qui conduit à une utilisation accrue de l'acier inoxydable dans les environnements lourds, à haute température et corrosifs.

- Alors que les gouvernements investissent dans des plans nationaux d'infrastructures – tels que les villes intelligentes, les corridors énergétiques et les parcs industriels –, le rôle de l'acier inoxydable pour garantir la performance, la sécurité et la durabilité prend de l'importance. Cette tendance devrait accélérer l'adoption de l'acier inoxydable dans les économies industrielles à forte croissance d'Amérique latine.

Opportunité

« Intégration dans les industries vertes et les applications durables »

- L'intégration aux industries vertes s'impose comme une tendance transformatrice sur le marché nord-américain de l'acier inoxydable, portée par la volonté de développement durable, l'adoption des énergies renouvelables et les pratiques d'économie circulaire. Sa recyclabilité à 100 %, sa durabilité et sa résistance à la corrosion en font un matériau idéal pour les infrastructures énergétiques propres et les industries respectueuses de l'environnement.

- Le marché bénéficie de plus en plus de l'utilisation de l'acier inoxydable dans les châssis de panneaux solaires, les composants d'éoliennes, les systèmes de stockage d'hydrogène et les installations de traitement des eaux. Ces secteurs privilégient les matériaux offrant longévité et impact environnemental minimal.

- Par exemple, en 2024, Aperam a lancé une nouvelle gamme de solutions en acier inoxydable spécialement conçues pour être utilisées dans les systèmes à hydrogène et à énergie propre, renforçant ainsi le rôle de l'alliage dans les stratégies de décarbonisation.

- De plus, l'acier inoxydable devient partie intégrante des certifications de bâtiments écologiques (telles que LEED et BREEAM) et est de plus en plus utilisé dans les projets de construction durable en raison de son faible coût de cycle de vie et de ses performances environnementales.

- L'alignement de l'acier inoxydable sur les initiatives vertes ouvre non seulement de nouveaux marchés d'utilisation finale, mais favorise également les innovations collaboratives entre les sidérurgistes et les industries des technologies propres. Cette intégration devrait renforcer la pertinence de l'acier inoxydable dans la transition vers la neutralité carbone, stimulant ainsi la croissance à long terme du marché.

Retenue/Défi

« Coûts élevés et volatilité des matières premières dans la production d'acier inoxydable »

- Le marché de l'acier inoxydable est fortement impacté par les fluctuations des coûts de matières premières essentielles telles que le nickel, le chrome et le molybdène. Ces intrants sont soumis à la volatilité des prix en raison des tensions géopolitiques, des restrictions commerciales, des déséquilibres entre l'offre et la demande et des fluctuations des prix de l'énergie, ce qui exerce une forte pression sur les coûts des fabricants.

- L'instabilité des prix affecte non seulement les économies de production, mais perturbe également les stratégies d'approvisionnement à long terme, réduit les marges bénéficiaires et nuit à la compétitivité des petits et moyens producteurs. Ces fluctuations de coûts entraînent souvent des ajustements de prix en aval, influençant l'accessibilité et l'adoption de l'acier inoxydable dans les principaux secteurs d'utilisation finale.

- Par exemple, fin 2023, le London Metal Exchange a signalé une hausse de 20 % des prix du nickel suite aux restrictions d’exportation imposées par les principaux pays producteurs, dont l’Indonésie et les Philippines, ce qui a eu un impact direct sur les prix de l’acier inoxydable.

- En outre, le Forum international de l'acier inoxydable (ISSF) a souligné au premier trimestre 2024 que les prix du molybdène ont grimpé en flèche en raison d'une offre limitée et d'une demande croissante des secteurs de l'énergie et de la transformation chimique, entraînant des effets de répercussion des coûts sur l'ensemble de la chaîne de valeur de l'acier inoxydable.

- Le coût élevé et imprévisible des matières premières constitue un frein majeur pour les producteurs d'acier inoxydable. Il limite les investissements en R&D, affecte la stabilité des prix et complique la budgétisation des projets pour les utilisateurs finaux des secteurs des infrastructures, de l'automobile et de l'industrie lourde. Les fabricants explorent désormais de plus en plus d'alternatives, comme la production à partir de ferraille et la diversification des approvisionnements, pour atténuer ces difficultés et préserver la résilience du marché.

Portée du marché de l'acier inoxydable

Le marché est segmenté en fonction du type de produit, du type de qualité, de la méthode de production, de la résistance, du revêtement et de la finition de surface, ainsi que de la verticale et du processus de fabrication.

• Par produit

En fonction du produit, le marché de l'acier inoxydable est segmenté en produits plats, produits longs, tubes et tuyaux, raccords et brides, entre autres. Le segment des produits plats devrait dominer le marché avec une part de marché de 45,69 % en 2025, grâce à leur utilisation intensive dans l'automobile, la construction et les applications industrielles grâce à leur excellente formabilité, leur résistance à la corrosion et leur soudabilité. Ces caractéristiques en font des produits plats idéaux pour les composants structurels, les appareils électroménagers et les infrastructures.

Le segment des produits plats devrait connaître le taux de croissance le plus rapide de 5,10 % entre 2025 et 2032, soutenu par la demande croissante des secteurs commercial et hôtelier pour des tôles et des bobines en acier inoxydable esthétiques et durables dans les applications de design d'intérieur et d'architecture.

• Par type de note

Le marché de l'acier inoxydable est segmenté en fonction de sa nuance : acier inoxydable austénitique, acier inoxydable ferritique, acier inoxydable duplex, acier inoxydable martensitique, acier inoxydable à durcissement par précipitation (PH), etc. L'acier inoxydable austénitique devrait connaître une croissance record avec une part de marché de 33,19 % en 2025, grâce à sa résistance supérieure à la corrosion, sa bonne formabilité et sa polyvalence pour des applications telles que les ustensiles de cuisine, les équipements de traitement chimique et les façades de bâtiments.

Le segment de l'acier inoxydable austénitique devrait également connaître le TCAC le plus rapide de 2025 à 2032, alimenté par une adoption croissante dans les secteurs de l'alimentation et des boissons, de la santé et de la marine, où une hygiène élevée et une résistance à la corrosion sont essentielles.

• Par procédé de fabrication

En fonction du procédé de fabrication, le marché de l'acier inoxydable est segmenté en deux catégories : laminage à chaud, laminage à froid, moulage, forgeage et extrusion. Le segment du laminage à chaud devrait connaître une croissance record avec une part de marché de 42,46 % en 2025, grâce à sa rentabilité et à sa capacité à produire des composants à grande échelle utilisés dans la construction, la construction navale et les pipelines.

Le laminage à chaud devrait également connaître le TCAC le plus rapide entre 2025 et 2032, en raison de son utilisation croissante dans la fabrication de composants lourds et de la demande croissante de projets de développement d'infrastructures qui nécessitent des sections en acier épaisses.

• Par méthode de production

En fonction du mode de production, le marché de l'acier inoxydable est segmenté en deux catégories : production primaire (production d'acier inoxydable brut), transformation secondaire (affinage et alliage) et transformation finale. En 2025, le segment de la production primaire (production d'acier inoxydable brut) représentait la plus grande part de chiffre d'affaires du marché, soit 63,34 %, grâce à la hausse de la demande d'acier, à l'urbanisation et aux investissements dans les infrastructures industrielles et de transport.

Le segment de production primaire devrait connaître le TCAC le plus rapide de 2025 à 2032, soutenu par les extensions de capacité, les avancées technologiques dans les processus de fusion et d'alliage de l'acier et l'adoption croissante de fours à arc électrique pour atteindre les objectifs de durabilité.

• Par force

En termes de résistance, le marché de l'acier inoxydable est segmenté en aciers inoxydables à résistance moyenne, à faible résistance et à haute résistance. En 2025, le segment de l'acier inoxydable à résistance moyenne représentait la plus grande part de marché, soit 65,72 %, grâce à ses propriétés équilibrées qui le rendent adapté à un large éventail d'applications, notamment les ustensiles de cuisine, les panneaux architecturaux et les composants de transport.

Le segment de résistance moyenne devrait connaître le TCAC le plus rapide de 2025 à 2032, grâce à son utilisation croissante dans les structures porteuses à charge moyenne et les environnements à corrosion modérée, offrant à la fois des avantages en termes de coût et de performance.

• Par revêtement et finition de surface

En termes de revêtement et de finition de surface, le marché de l'acier inoxydable est segmenté en finitions de surface et en revêtements. Le segment des finitions de surface devrait dominer le marché avec une part de 73,25 % en 2025, en raison de la demande croissante de finitions esthétiques et fonctionnelles dans les secteurs de l'architecture, des équipements de cuisine et de l'électronique grand public. Ces finitions améliorent à la fois l'esthétique et la résistance à la corrosion.

Le segment des finitions de surface devrait connaître le TCAC le plus rapide de 2025 à 2032, alimenté par les progrès des techniques de polissage, de brossage et de texturation, et par la demande croissante de surfaces en acier inoxydable d'aspect haut de gamme dans les applications industrielles et grand public.

• Par verticalité

Sur le plan vertical, le marché de l'acier inoxydable est segmenté comme suit : construction et infrastructures, automobile et transports, transformation des aliments et boissons, équipements et machines industriels, médecine et santé, énergie et électricité, biens de consommation et électroménagers, aérospatiale et défense, électronique et technologies, applications environnementales, etc. Le segment construction et infrastructures devrait dominer le marché avec une part de marché de 21,41 % en 2025, grâce à la durabilité, à la résistance à la corrosion et à la facilité d'entretien de l'acier inoxydable, qui le rendent idéal pour les charpentes, les ponts, les revêtements et les toitures.

Le secteur de la construction et des infrastructures devrait également connaître le TCAC le plus rapide de 2025 à 2032, soutenu par les investissements dans les infrastructures, l'expansion urbaine et l'accent croissant mis sur les matériaux de construction durables et résilients.

Analyse régionale du marché de l'acier inoxydable

- L'Amérique du Nord devrait connaître une croissance sur le marché de l'acier inoxydable avec une part de marché de 23,28 % en 2025, grâce à une industrialisation rapide, au développement des infrastructures et à l'augmentation des investissements dans la construction et la fabrication.

- La forte demande de la région est également attribuée à la présence d'importants producteurs d'acier inoxydable, aux secteurs de l'automobile et des biens de consommation en pleine croissance et aux politiques gouvernementales favorables soutenant la croissance industrielle.

- La forte demande dans les domaines du bâtiment, des transports et de l'énergie, ainsi que les avantages en termes de coûts et l'abondance des matières premières, positionnent l'Amérique du Nord comme une région clé pour la consommation d'acier inoxydable.

Aperçu du marché américain de l'acier inoxydable

Le marché américain de l'acier inoxydable devrait croître de 63,58 % en 2025, porté par une demande accrue dans les secteurs de la construction, du pétrole et du gaz, et de l'automobile. Les investissements dans la modernisation des infrastructures, ainsi que l'accent mis sur le développement durable et l'efficacité des matériaux, soutiennent l'expansion du marché. L'acier inoxydable est plébiscité pour sa robustesse, sa résistance à la corrosion et son esthétique dans les projets des secteurs public et privé.

Part de marché de l'acier inoxydable

L'industrie de l'acier inoxydable est principalement dirigée par des entreprises bien établies, notamment :

- Shandong Baosteel Industry Co., Ltd. (Chine)

- Ternium (Luxembourg/Mexique/Argentine)

- ArcelorMittal (Luxembourg)

- MITSUI & CO., LTD. (Japon)

- NUCOR (États-Unis)

- NIPPON STEEL CORPORATION (Japon)

- Tata Steel (Inde)

- JINDAL INOXYDABLE (Inde)

- Outokumpu (Finlande)

- China Ansteel Group Corporation Limited (Chine)

- China BaoWu Steel Group Corporation Limited (Chine)

- Acciai Speciali Terni SpA (Italie)

- Acier inoxydable universel (États-Unis)

- Daido Steel Co., Ltd. (Japon)

- Delong Metal (Chine)

- Acerinox (Espagne)

- Yieh Corp. (Taïwan)

- Nitech Stainless Inc (Inde)

- JFE Steel Corporation (Japon)

- SSG Standard Solutions Group AB (Suède)

- PazdelRío (Colombie)

- POSCO (Corée du Sud)

Derniers développements sur le marché nord-américain de l'acier inoxydable

- En février, Nippon Steel Corporation a annoncé son projet d'acquisition d'US Steel pour 14,9 milliards de dollars américains, afin de renforcer sa compétitivité et sa présence industrielle en Amérique du Nord. Cette opération s'inscrit dans la stratégie de Nippon Steel visant à garantir des capacités de fabrication avancées et des chaînes d'approvisionnement stables. L'entreprise étend sa présence internationale, optimise son envergure opérationnelle et stimule sa croissance future grâce à une consolidation transfrontalière.

- En mai, Aperam a annoncé le développement de la première gamme de produits circulaires en acier inoxydable d'Europe, utilisant des intrants à base de ferraille et des méthodes de recyclage en boucle fermée sur ses sites de production. Cette initiative s'inscrit dans le cadre des réglementations environnementales de l'UE et des objectifs d'économie circulaire. L'entreprise innove dans la métallurgie durable, conquiert des parts de marché respectueuses de l'environnement et réduit les émissions liées à la production.

- En mars, Outokumpu a conclu un accord à long terme sur les énergies renouvelables en Finlande, garantissant ainsi une énergie bas carbone pour ses procédés de production d'acier inoxydable. Cette initiative s'inscrit dans la continuité de ses objectifs climatiques à l'horizon 2030 et contribue à la réduction de son empreinte carbone. L'entreprise contribue ainsi à ses objectifs de développement durable, renforce la perception de sa marque verte et assure la stabilité de ses coûts énergétiques à long terme.

- En avril, Nitech Stainless Inc. a lancé une nouvelle gamme de tubes et tuyaux en acier inoxydable duplex et super duplex, destinée aux industries chimiques, pétrolières et gazières, ainsi qu'au dessalement. Cette nouvelle gamme répond à des normes strictes de résistance à la corrosion et offre de nombreuses possibilités de personnalisation. L'entreprise élargit ainsi sa gamme de produits, répond à la demande spécifique de l'industrie et renforce sa position de fournisseur d'alliages haute performance.

- En janvier, Gibbs Wire & Steel Company LLC a étendu sa capacité de distribution en ouvrant un nouveau centre de service dans le sud-est des États-Unis, permettant ainsi une livraison plus rapide de bobines et de fils refendus de précision aux clients de la région. Ce centre améliore la flexibilité logistique et la réactivité de l'entreprise. L'entreprise améliore son service client, soutient sa croissance régionale et optimise l'efficacité de sa chaîne d'approvisionnement.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTENSITY FOR COMPETITIVE RIVAL

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 CARBON EMISSIONS AND REGULATORY PRESSURES

4.3.3 SHIFT TOWARDS LOW-CARBON AND GREEN STEEL

4.3.4 CLIMATE-RESILIENT SUPPLY CHAINS

4.3.5 INVESTOR AND CONSUMER EXPECTATIONS

4.3.6 NORTH AMERICA COOPERATION AND INDUSTRY INITIATIVES

4.3.7 CONCLUSION

4.4 COMPARATIVE OVERVIEW OF GLOBAL

4.5 RAW MATERIAL COVERAGE

4.5.1 NICKEL

4.5.2 IRON ORE

4.5.3 CHROMIUM

4.5.4 SILICON

4.5.5 MOLYBDENUM

4.5.6 OTHERS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.1.4 INCREASED DEMAND FROM AUTOMOTIVE AND TRANSPORTATION MANUFACTURING SECTORS.

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.3.3 RISING DEMAND FOR SUSTAINABLE AND RECYCLABLE MATERIALS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLAT PRODUCTS

7.2.1 FLAT PRODUCTS, BY TYPE

7.2.1.1 SHEETS, BY TYPE

7.2.1.2 SHEETS, BY THICKNESS

7.2.1.3 COILS, BY TYPE

7.2.1.4 PLATES, BY TYPE

7.2.1.5 STRIPS, BY TYPE

7.3 LONG PRODUCTS

7.3.1 LONG PRODUCTS, BY TYPE

7.3.1.1 BARS, BY TYPE

7.3.1.2 BARS, BY SIZE/WIDTH

7.3.1.3 BARS, BY GRADE

7.3.1.4 RODS, BY TYPE

7.3.1.5 WIRES, BY TYPE

7.3.1.6 ANGLES, BY TYPE

7.4 PIPES & TUBES

7.4.1 PIPES & TUBES, BY TYPE

7.4.1.1 SEAMLESS PIPES, BY PRODUCT

7.4.1.2 WELDED PIPES, BY PRODUCT

7.4.1.3 TUBES, BY PRODUCT

7.5 FITTINGS & FLANGES

7.5.1 FITTINGS & FLANGES, BY TYPE

7.5.1.1 PIPE FITTINGS, BY PRODUCT

7.5.1.1.1 ELBOWS, BY PRODUCT

7.5.1.2 FLANGES, BY TYPE

7.6 OTHERS

8 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE

8.1 OVERVIEW

8.2 AUSTENITIC STAINLESS STEEL

8.3 FERRITIC STAINLESS STEEL

8.4 DUPLEX STAINLESS STEEL

8.5 MARTENSITIC STAINLESS STEEL

8.6 PRECIPITATION-HARDENED (PH) STAINLESS STEEL

8.7 OTHERS

9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD

9.1 OVERVIEW

9.2 PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION)

9.3 SECONDARY PROCESSING

9.4 FINAL PROCESSING

10 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH

10.1 OVERVIEW

10.2 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

10.3 MEDIUM STRENGTH STAINLESS STEEL

10.4 LOW STRENGTH STAINLESS STEEL

10.5 HIGH STRENGTH STAINLESS STEEL

11 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 CONSTRUCTION & INFRASTRUCTURE

11.2.1 CONSTRUCTION & INFRASTRUCTURE, BY PRODUCT TYPE

11.2.2 CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION

11.2.2.1 STRUCTURAL COMPONENTS, BY TYPE

11.2.2.2 BRIDGES & TRANSPORTATION INFRASTRUCTURE, BY TYPE

11.2.2.3 PUBLIC BUILDINGS & URBAN INFRASTRUCTURE, BY TYPE

11.2.2.4 WATER SUPPLY & SEWAGE TREATMENT, BY TYPE

11.3 AUTOMOTIVE & TRANSPORTATION

11.3.1 AUTOMOTIVE & TRANSPORTATION, BY PRODUCT TYPE

11.3.2 AUTOMOTIVE & TRANSPORTATION, BY APPLICATION

11.3.2.1 AUTOMOTIVE INDUSTRY, BY TYPE

11.3.2.2 RAILWAYS, BY TYPE

11.3.2.3 MARINE INDUSTRY, BY TYPE

11.3.2.4 AEROSPACE INDUSTRY, BY TYPE

11.4 FOOD & BEVERAGE PROCESSING

11.4.1 FOOD & BEVERAGES, BY PRODUCT TYPE, BY PRODUCT TYPE

11.4.2 FOOD & BEVERAGES PROCESSING, BY APPLICATION

11.4.2.1 DAIRY INDUSTRY, BY TYPE

11.4.2.2 BREWING & DISTILLATION, BY TYPE

11.4.2.3 MEAT & POULTRY PROCESSING, BY TYPE

11.4.2.4 PACKAGING & STORAGE, BY TYPE

11.5 INDUSTRIAL EQUIPMENT & MACHINERY

11.5.1 INDUSTRIAL EQUIPMENT & MACHINERY, BY PRODUCT TYPE, BY PRODUCT TYPE

11.5.2 INDUSTRIAL EQUIPMENT & MACHINERY, BY APPLICATION

11.5.2.1 CHEMICAL & PETROCHEMICAL INDUSTRY, BY TYPE

11.5.2.2 HEAVY MACHINERY & MANUFACTURING, BY TYPE

11.5.2.3 MINING & METALLURGY, BY TYPE

11.5.2.4 TEXTILE INDUSTRY, BY TYPE

11.6 MEDICAL & HEALTHCARE

11.6.1 MEDICAL & HEALTHCARE, BY PRODUCT TYPE

11.6.2 MEDICAL & HEALTHCARE, BY APPLICATION

11.6.2.1 SURGICAL INSTRUMENTS, BY TYPE

11.6.2.2 MEDICAL IMPLANTS & PROSTHETICS, BY TYPE

11.6.2.3 HOSPITAL INFRASTRUCTURE, BY TYPE

11.7 ENERGY & POWER

11.7.1 ENERGY & POWER, BY PRODUCT TYPE

11.7.2 ENERGY & POWER, BY APPLICATION

11.7.2.1 OIL AND GAS INDUSTRY, BY TYPE

11.7.2.2 POWER GENERATION, BY TYPE

11.7.2.3 RENEWABLE ENERGY, BY TYPE

11.8 CONSUMER GOODS & HOME APPLIANCES

11.8.1 CONSUMER GOODS & HOME APPLIANCES, BY PRODUCT TYPE

11.8.2 CONSUMER GOODS & HOME APPLIANCES, BY APPLICATION

11.8.2.1 HOME APPLIANCES, BY TYPE

11.8.2.2 KITCHEN & COOKWARE, BY TYPE

11.8.2.3 FURNITURE & DÉCOR, BY TYPE

11.9 AEROSPACE & DEFENSE

11.9.1 AEROSPACE & DEFENSE, BY PRODUCT TYPE

11.9.2 AEROSPACE & DEFENSE, BY APPLICATION

11.9.2.1 DEFENSE EQUIPMENT, BY TYPE

11.9.2.2 SPACE INDUSTRY, BY TYPE

11.1 ELECTRONICS & TECHNOLOGY

11.10.1 ELECTRONICS & TECHNOLOGY, BY PRODUCT TYPE

11.10.2 ELECTRONICS & TECHNOLOGY, BY APPLICATION

11.10.2.1 SEMICONDUCTOR INDUSTRY, BY TYPE

11.10.2.2 CONSUMER ELECTRONICS, BY TYPE

11.11 ENVIRONMENTAL APPLICATIONS

11.11.1 ENVIRONMENTAL APPLICATIONS, BY PRODUCT TYPE

11.11.2 ENVIRONMENTAL APPLICATIONS, BY APPLICATION

11.11.2.1 WATER TREATMENT, BY TYPE

11.11.2.2 WASTE MANAGEMENT & RECYCLING, BY TYPE

11.12 OTHERS

12 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH

12.1 OVERVIEW

12.2 SURFACE FINISHES

12.2.1 SURFACE FINISHES, BY TYPE

12.2.2 MILL FINISHES, BY TYPE

12.2.3 POLISHED FINISHES, BY TYPE

12.2.4 PATTERNED & TEXTURED FINISHES, BY TYPE

12.3 COATINGS

12.3.1 COATINGS, BY TYPE

13 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS

13.1 OVERVIEW

13.2 HOT ROLLING

13.3 COLD ROLLING

13.4 CASTING

13.5 FORGING

13.6 EXTRUSION

14 NORTH AMERICA STAINLESS STEEL MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA STAINLESS STEEL MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 SHANDONG BAOSTEEL INDUSTRY CO., LTD

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 TERNIUM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ARCELORMITTAL

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MITSUI & CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NUCOR CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ACCIAI SPECIALI TERNI S.P.A

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ACERINOX

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS/NEWS

17.8 CHINA ANSTEEL GROUP CORPORATION LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 RECENT FINANCIALS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 CHINA BAOWU STEEL GROUP CORPORATION LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 DAIDO STEEL CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 DELONG METAL

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 JFE STEEL CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 JINDAL STAINLESS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NIPPON STEEL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 OUTOKUMPU

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 PAZDELRIO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 TATA STEEL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 UNIVERSAL STAINLESS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 YIEH CORP.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 POSCO

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 KEY EN STANDARDS FOR STAINLESS STEEL:

TABLE 2 KEY STANDARDS FOR STAINLESS STEEL

TABLE 3 KEY STAINLESS STEEL STANDARDS:

TABLE 4 KEY STAINLESS STEEL STANDARDS

TABLE 5 KEY STAINLESS STEEL STANDARDS

TABLE 6 KEY STAINLESS STEEL STANDARDS

TABLE 7 KEY STAINLESS STEEL STANDARDS

TABLE 8 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 10 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 12 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 20 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 29 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 35 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 41 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA AUSTENITIC STAINLESS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA FERRITIC STAINLESS STEEL POLYMERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA DUPLEX STAINLESS-STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA MARTENSITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA SECONDARY PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA MEDIUM STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA LOW STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 145

TABLE 64 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA AEROSPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD & BEVERAGE PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA FOOD & BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA FOOD & BEVERAGES PROCESSING IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DAIRY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA STAINLESS STEEL MARKET, BY COATINGS & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 148 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 150 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 160 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 168 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 172 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 174 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 175 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 178 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 179 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 180 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 181 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 182 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 183 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 184 BY PRODUCTION METHOD

TABLE 185 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 187 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 189 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 190 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 196 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 197 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 203 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 204 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 207 NORTH AMERICA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 208 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 209 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 210 NORTH AMERICA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 211 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 213 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 215 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 216 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 220 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 221 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 222 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 226 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 231 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 232 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 236 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 237 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 240 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 241 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 247 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 248 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 249 U.S. FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 U.S. SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 U.S. SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 252 U.S. COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 U.S. PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 254 U.S. STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 255 U.S. LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 U.S. BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 U.S. BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 258 U.S. BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 259 U.S. RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 260 U.S. WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 U.S. ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 262 U.S. PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 263 U.S. SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 264 U.S. WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 U.S. TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 U.S. FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 267 U.S. PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 U.S. ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 U.S. FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 U.S. STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 271 U.S. AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 U.S. 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 U.S. 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 U.S. FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 U.S. DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 U.S. PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 277 U.S. STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 278 U.S. HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 279 U.S. COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 280 U.S. CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 281 U.S. FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 282 U.S. EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 283 BY PRODUCTION METHOD

TABLE 284 U.S. PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 U.S. SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 U.S. FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 287 U.S. STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 288 U.S. STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 289 U.S. SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 U.S. MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 291 U.S. POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 U.S. PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 293 U.S. COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 294 U.S. STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 295 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 296 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 297 U.S. STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 U.S. BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 U.S. PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 300 U.S. WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 302 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 303 U.S. AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 U.S. RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 U.S. MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 U.S. AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 308 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 309 U.S. DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 310 U.S. BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 U.S. MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 U.S. PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 313 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 314 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 315 U.S. CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 U.S. HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 U.S. MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 318 U.S. TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 320 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 U.S. SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 U.S. MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 U.S. HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 325 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 326 U.S. OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 327 U.S. POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 328 U.S. RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 330 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 U.S. HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 U.S. KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 U.S. FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 335 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 336 U.S. DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 U.S. SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 339 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 340 U.S. SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 341 U.S. CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 342 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 343 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 344 U.S. WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 345 U.S. WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 347 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 348 CANADA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 CANADA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 CANADA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 351 CANADA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 CANADA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 CANADA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 CANADA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 CANADA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 CANADA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 357 CANADA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 358 CANADA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 CANADA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 CANADA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 CANADA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 CANADA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 CANADA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 CANADA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 365 CANADA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 366 CANADA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 367 CANADA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 368 CANADA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 369 CANADA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 370 CANADA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 371 CANADA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 372 CANADA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 CANADA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 CANADA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 375 CANADA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 376 CANADA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 377 CANADA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 378 CANADA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 379 CANADA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 380 CANADA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 381 CANADA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 382 BY PRODUCTION METHOD

TABLE 383 CANADA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 384 CANADA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 CANADA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 CANADA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 387 CANADA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 388 CANADA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 389 CANADA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 390 CANADA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 391 CANADA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 392 CANADA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 393 CANADA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 394 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 395 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 396 CANADA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 397 CANADA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 398 CANADA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 399 CANADA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 400 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 401 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 402 CANADA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 403 CANADA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 404 CANADA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 CANADA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 406 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 407 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 408 CANADA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 409 CANADA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 410 CANADA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 411 CANADA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 412 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 413 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 414 CANADA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 415 CANADA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)