Us Busway Market

Taille du marché en milliards USD

TCAC :

%

USD

2.58 Billion

USD

4.60 Billion

2025

2033

USD

2.58 Billion

USD

4.60 Billion

2025

2033

| 2026 –2033 | |

| USD 2.58 Billion | |

| USD 4.60 Billion | |

|

|

|

|

U.S. Busway Market Segmentation, By Offering (Hardware and Service), Components (Busbar Trunking /Electrical Busway, Enclosures, Tap-off Units, Joint Connectors, Grounding Systems, End Caps and End Feeds, and Others), Type (3-Phase 4-Wire, 3-Phase 5-Wire, and Others), Implementation (Ceiling Overhead and Raised Floor), Insulation (Air-Insulated, Isolated Phase, and Busway), Conductor Materials (Copper Busway, Aluminum Busway, and Hybrid Busway), Phase Type ( Segregated Phase, Non-Segregated Phase, and Plug-In), Function (Feeder Busway, Lighting Busway, Distribution Busway, Trunking / Vertical Busway, and Others), Power Rating (Low Power Busway, Medium Power Busway, and High Power Busway), Vertical (IT (Telecommunication and Broadcasting), Residential, Commercial Buildings, Industrial Facilities, Healthcare, Transportation, Educational Institutions, Energy, Government and Military, Entertainment and Sports Venues, and Others), Distribution Channel (Indirect and Direct) - Industry Trends and Forecast to 2033

U.S. Busway Market Size

- The U.S. busway market size was valued at USD 2.58 billion in 2025 and is expected to reach USD 4.60 billion by 2033, at a CAGR of 7.6% during the forecast period

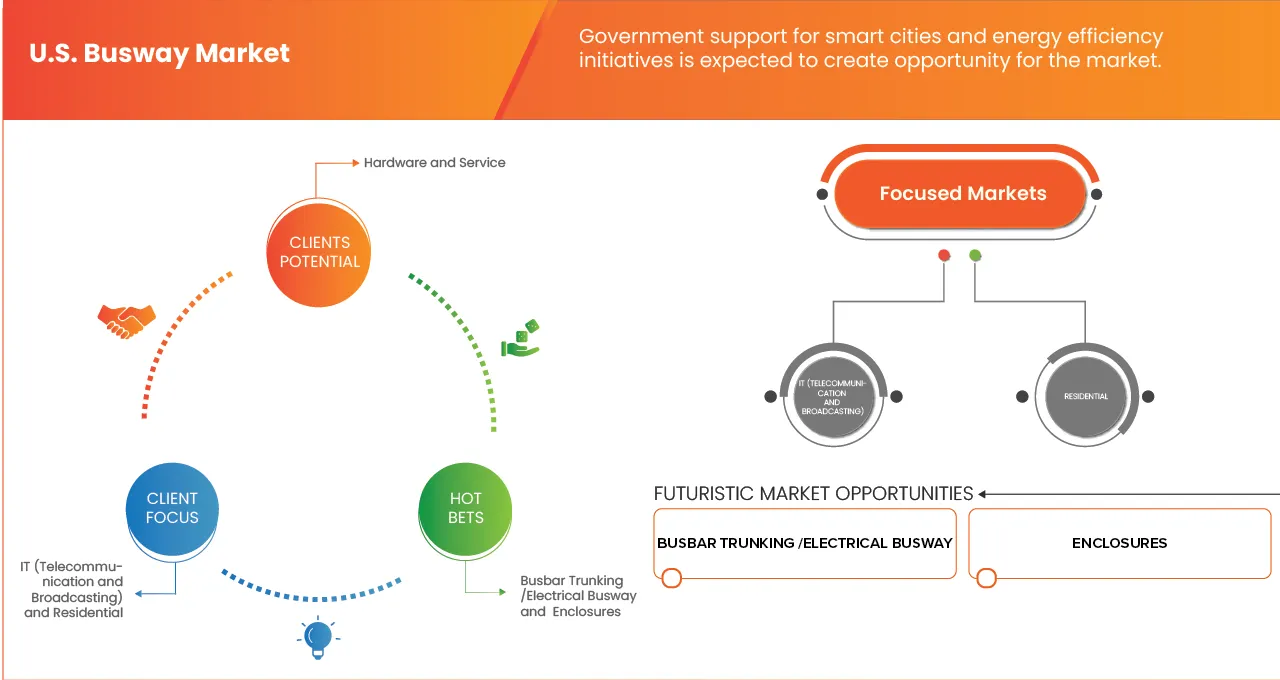

- The U.S. busway market is witnessing strong growth, driven by rising demand for efficient, reliable, and safe power distribution systems across commercial, industrial, and institutional sectors. Busway systems are increasingly preferred over traditional cabling due to their ease of installation, lower maintenance requirements, enhanced safety, and scalability. Market expansion is further supported by technological advancements, increasing emphasis on energy efficiency, and ongoing infrastructure development. Key growth drivers include the rapid expansion of data centers, growing automation across industries, and accelerating urbanization, all of which are boosting the adoption of modular and high-performance busway solutions. Continuous product innovations—such as advanced insulation materials, modular designs, and compatibility with renewable energy systems—are enhancing market competitiveness and long-term adoption.

- The market landscape is segmented across multiple dimensions, including offering, components, type, implementation, insulation, conductor material, phase type, function, power rating, vertical, and distribution channel. Based on offering, the market is divided into hardware and services. The hardware segment includes data center busways, plant busways, fast bus multi-motor systems, and others, with the data center category further segmented into Power Distribution Units (PDUs), high-strength enclosed busways, intensive insulation plug busways, and air splicing busways. The service segment comprises professional services—such as design and engineering, custom fabrication, and installation—and managed services, including maintenance, remote monitoring, and system upgrades.

- By 2026, the hardware segment is expected to dominate the U.S. busway market, driven by increasing power demand and the need for advanced, efficient power distribution infrastructure, particularly in data centers and industrial facilities. In comparison, the service segment is projected to grow at a slower pace, as installation and maintenance activities are typically periodic and follow initial hardware deployment rather than acting as primary demand drivers.

U.S. Busway Market Analysis

- The evolution of busway systems began in the early 20th century, driven by rapid industrialization and the growing need for safer and more efficient electrical power distribution. Traditional wiring methods, reliant on extensive copper or aluminum cabling, became increasingly complex and inefficient as power demands rose in large industrial and commercial facilities. To address these challenges, busway systems, also known as busducts—were introduced as a streamlined alternative capable of delivering higher current loads with improved safety and simplified installation. Over time, advancements in conductor materials, insulation technologies, and structural design have significantly enhanced busway performance, establishing them as a standard solution in modern electrical infrastructure.

- Today, busway systems are widely adopted across industrial plants, commercial buildings, data centers, and transportation hubs due to their flexibility, reliability, and scalability. Recent developments in the U.S. busway market reflect this growing demand. In May 2024, LS Cable & System announced plans to build a new bus duct manufacturing facility in Querétaro, Mexico, aimed at serving U.S. and Canadian markets. The facility, expected to be operational by mid-2025, will support rising demand from data centers, semiconductor fabs, EV manufacturing, and battery plants, highlighting the role of busway systems in supporting large-scale infrastructure and urban development across North America.

- Innovation within the market continues to accelerate. In September 2021, Vertiv introduced the Liebert RXA remote power panel and the Liebert MBX busway system, designed to address space constraints, scalability, and energy efficiency in high-density environments such as data centers. These solutions enable flexible overhead power distribution, enhanced safety, and optimized floor space utilization. Such advancements underscore the industry’s shift toward modular, energy-efficient, and sustainable power distribution systems, reinforcing the growing importance of busway technologies in meeting modern electrical demands.

- Busbar trunking / electrical busway segment is expected to dominate the market with a market share of 42.11% in 2026 due to its high power transmission efficiency, compact design, and lower energy losses compared to conventional cable systems. Additionally, ease of installation, reduced maintenance requirements, and superior safety features make busbar trunking systems highly suitable for commercial buildings, industrial facilities, data centers, and large infrastructure projects, further driving their adoption and market dominance.

Report Scope and U.S. Busway Market Segmentation

|

Attributes |

U.S. Busway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S. |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

U.S. Busway Market Trends

“Growing integration of renewable energy sources into power grids ”

- The growing integration of renewable energy sources into power grids is a significant driver for the U.S. busway market. As renewable energy installations, such as solar and wind farms, become increasingly prevalent, the need for efficient, scalable, and reliable power distribution systems has surged. Bus ducts, known for their prefabricated designs and reduced energy loss, are ideal for connecting renewable energy generation sites to power grids and distribution networks. Their ability to handle high power loads and adaptability to varied configurations make them essential in modernizing grid infrastructure to accommodate fluctuating energy inputs from renewable sources.

- Moreover, the growing focus on decarbonization and sustainable energy solutions in U.S. has led to significant investments in renewable energy projects. Both government and private sectors are prioritizing infrastructure upgrades to integrate renewable energy sources into existing power grids seamlessly. Bus ducts play a crucial role in facilitating this transition by offering compact, durable, and efficient power distribution solutions that align with the rising demand for energy storage systems and microgrids. This trend is expected to drive substantial growth in the busway market across U.S.

- The integration of renewable energy sources into power grids is accelerating the demand for advanced power distribution solutions like bus ducts. Their efficiency, scalability, and adaptability make them indispensable for modernizing grid infrastructure to support the transition to sustainable energy. As investments in renewable energy projects continue to rise, the busway market is poised for substantial growth, playing a crucial role in enabling a cleaner and more efficient energy future.

U.S. Busway Market Dynamics

Driver

“Rising focus on energy-efficient power distribution systems in industrial and commercial sectors”

- In the U.S., the rising focus on energy-efficient power distribution systems across industrial and commercial sectors is driving significant growth in the busway market. Industries are under increasing pressure to comply with stringent environmental regulations and reduce operational costs, creating a demand for solutions that minimize energy losses. Busways are particularly attractive in this context, as they provide more efficient energy transfer with lower electrical losses compared to traditional cable systems. Sectors with high power consumption, such as manufacturing facilities, data centers, and commercial buildings, are increasingly adopting busways to optimize energy use and enhance operational efficiency.

- The emphasis on sustainability and green building initiatives is further accelerating the adoption of energy-efficient busway systems in the U.S. These systems not only improve energy efficiency but also optimize space utilization, allowing businesses to enhance operational performance while reducing their environmental footprint. Busways offer design flexibility, enabling tailored solutions that meet specific energy needs and integrate seamlessly into modern infrastructure. As a result, more industries are incorporating busways into their energy management strategies, driving innovation and expanding the market.

- Recent developments highlight this trend. In September 2021, Vertiv launched the Liebert RXA remote power panel and the Liebert MBX busway system, offering flexible, space-saving, and energy-efficient solutions for high-density applications such as data centers. In April 2024, Schneider Electric introduced the I-Line Track, a medium-power busway designed for scalable, energy-efficient deployment in data centers. Additionally, in May 2022, Elsewedy Electric opened Africa’s first facility for producing busway dielectric epoxy insulation systems, providing energy-efficient, compact, and easy-to-install solutions. These innovations demonstrate the market’s focus on sustainability, operational efficiency, and energy optimization, reinforcing the adoption of busway systems as a critical component of U.S. power distribution infrastructure.

Restraint/Challenge

“Fluctuations in raw material availability ”

- The production of busways depends heavily on key materials such as copper, aluminum, steel, and specialized insulation, which are often subject to price volatility and supply chain disruptions. Variability in the availability of these raw materials can lead to higher production costs, manufacturing delays, and limited supply, affecting the timely delivery of busway systems to customers. This creates challenges for manufacturers trying to meet growing demand, particularly in regions experiencing significant infrastructure development and industrial expansion.

- Fluctuations in raw material prices can also reduce the competitiveness of busway solutions compared to alternative power distribution systems. Significant increases in material costs may force manufacturers to raise busway prices, making them less cost-effective for certain consumers and potentially limiting adoption in price-sensitive markets. To mitigate these challenges, companies in the busway market need to diversify suppliers, optimize production processes, and explore alternative materials to stabilize costs and maintain market competitiveness.

- Recent examples underscore the impact of raw material fluctuations on the busway market. In October 2024, aluminum prices on the London Metal Exchange rose by 1.8% to USD 2,640 per metric ton due to high alumina costs and rising demand from China, illustrating supply chain vulnerabilities. Similarly, in November 2024, copper prices fluctuated amid shortages of secondary copper and customs delays at Port Klang West in Malaysia, which were projected to reduce exports by 20%-40%. Such fluctuations increase production costs and create supply uncertainties, emphasizing the need for strategic management of raw material supply to ensure the stability and long-term growth of the busway market.

U.S. Busway Market Scope

The U.S. busway market is segmented into eleven notable segments which are based on offering, components, type, implementation, insulation, conductor material, phase type, function, power rating, vertical, distribution channel.

- By Offering

On the basis of offering, the market is segmented into hardware and service. In 2026, hardware segment is expected to dominate the U.S. busway market with 77.37% market share due to high demand for physical busway components such as busbars, enclosures, and tap-off units in new construction and infrastructure upgrades, along with their long operational life and one-time capital investment nature.

The hardware segment is expected to grow with the highest CAGR of 7.7% in the forecast period of 2026 to 2033 due to continued investments in industrial facilities, data centers, and commercial buildings, coupled with increasing replacement of conventional cable systems with busway solutions.

- By Components

On the basis of components, the market is segmented into busbar trunking / electrical busway, enclosures, tap-off units, joint connectors, grounding systems, end caps and end feeds, and others. In 2026, busbar trunking /electrical busway segment is expected to dominate the U.S. busway market with 42.11% market share due to its core role in power distribution, high current-carrying capacity, compact design, and lower power losses compared to traditional cabling systems.

The busbar trunking /electrical busway segment is expected to grow with the highest CAGR of 8.5% in the forecast period of 2026 to 2033 due to rising adoption in energy-intensive applications such as data centers, EV infrastructure, and industrial automation projects.

- By Type

On the basis of type, the market is segmented into 3-phase 4-wire, 3-phase 5-wire, and others. In 2026, 3-phase 4-wire segment is expected to dominate the U.S. busway market with 63.96% market share due to its wide applicability in commercial and industrial power distribution systems and cost-effectiveness compared to more complex configurations.

The 3-phase 4-wire segment is expected to grow with the highest CAGR of 7.8% in the forecast period of 2026 to 2033 due to expanding commercial construction activities and increased demand for efficient low- to medium-voltage power distribution solutions.

- By Implementation

On the basis of implementation, the market is segmented into ceiling overhead and raised floor. In 2026, ceiling overhead segment is expected to dominate the U.S. busway market with 59.24% market share due to its ease of installation, space optimization, improved safety, and suitability for industrial plants and warehouses.

The ceiling overhead segment is expected to grow with the highest CAGR of 7.9% in the forecast period of 2026 to 2033 due to rising adoption in manufacturing facilities and logistics centers seeking flexible and scalable power distribution layouts.

- By Insulation

On the basis of insulation, the market is segmented into air-insulated and isolated phase busway. In 2026, air-insulated segment is expected to dominate the U.S. busway market with 77.69% market share due to its cost efficiency, simpler design, and widespread acceptance in low- and medium-voltage applications.

The air-insulated segment is expected to grow with the highest CAGR of 7.7% in the forecast period of 2026 to 2033 due to increasing use in commercial buildings and industrial environments where standard insulation performance is sufficient.

- By Conductor Material

On the basis of conductor material, the market is segmented into copper busway, aluminum busway, and hybrid busway. In 2026, copper busway segment is expected to dominate the U.S. busway market with 54.92% market share due to its superior electrical conductivity, higher thermal performance, and reliability in high-load applications

The copper busway segment is expected to grow with the highest CAGR of 7.9% in the forecast period of 2026 to 2033 due to increasing deployment in critical infrastructure such as data centers, healthcare facilities, and industrial plants.

- By Phase Type

On the basis of phase type, the market is segmented into segregated phase, non-segregated phase, and plug-in. In 2026, non-segregated phase segment is expected to dominate the U.S. busway market with 48.67% market share due to its compact structure, cost advantages, and suitability for standard industrial and commercial applications.

The non-segregated phase segment is expected to grow with the highest CAGR of 7.8% in the forecast period of 2026 to 2033 due to growing demand for economical and space-saving power distribution solutions.

- By Function

On the basis of function, the market is segmented into feeder busway, lighting busway, distribution busway, trunking / vertical busway, and others. In 2026, feeder busway segment is expected to dominate the U.S. busway market with 36.92% market share due to its extensive use in transmitting power from substations to distribution points across industrial and commercial facilities.

The feeder busway segment is expected to grow with the highest CAGR of 7.9% in the forecast period of 2026 to 2033 due to rising industrial electrification and expansion of large-scale infrastructure projects.

- By Power Rating

On the basis of power rating, the market is segmented into low power busway, medium power busway, and high power busway. In 2026, medium power busway segment is expected to dominate the U.S. busway market with 49.66% market share due to its balanced suitability for both commercial and industrial applications.

The medium power busway segment is expected to grow with the highest CAGR of 7.9% in the forecast period of 2026 to 2033 due to increasing demand from manufacturing units, commercial complexes, and data centers.

- By Vertical

On the basis of vertical, the market is segmented into it (telecommunication and broadcasting), residential, commercial buildings, industrial facilities, healthcare, transportation, educational institutions, energy, government and military, entertainment and sports venues, and others. In 2026, industrial facilities segment is expected to dominate the U.S. busway market with 24.63% market share due to high power consumption needs, continuous operations, and growing automation across industries.

The industrial facilities segment is expected to grow with the highest CAGR of 8.4% in the forecast period of 2026 to 2033 due to ongoing industrial expansion, reshoring of manufacturing, and modernization of power infrastructure.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into indirect and direct. In 2026, indirect segment is expected to dominate the U.S. busway market with 74.54% market share due to the strong presence of distributors, system integrators, and EPC contractors offering bundled solutions and technical support.

The direct segment is expected to grow with the highest CAGR of 7.8% in the forecast period of 2026 to 2033 due to increasing preference among large enterprises for direct procurement from manufacturers to reduce costs and ensure customization.

U.S. Busway Market Insight

The U.S. busway market is set for robust growth, driven by a rising focus on energy-efficient power distribution systems in industrial and commercial sectors, rapid urbanization and large-scale infrastructure projects, growing integration of renewable energy sources into power grids, and rising innovations and technological advancements in busway design.

U.S. Busway Market Share

The busway industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Eaton (Ireland)

- EAE ELECTRIK (Turkey)

- Furukawa Electric Co., Ltd. (Japan)

- Honeywell International Inc. (U.S.)

- Powell Industries (U.S.)

- Starline Holdings, LLC. (U.S.)

- Chatsworth Products (U.S.)

- Panduit Corp. (U.S.)

- Delta Power Solutions (Taiwan)

- Rittal Pvt. Ltd (Germany)

- Vertiv Group Corp. (U.S.)

- Legrand (France)

- Anord Mardix (Ireland)

- MEGABARRE Group (Italy)

- USPWR (U.S.)

- LS Cable & System USA (U.S.)

Latest Developments in U.S. Busway Market

- In December 2024, Legrand has acquired Power Bus Way, a North American leader in Cable Bus power busbars for data centers. This marks the company’s eighth acquisition of the year, strengthening its position in the growing data center market with a focus on energy and digital transition.

- In September 2024, Legrand has announced the acquisition of UPSistemas in Colombia and APP in Australia, expanding its presence in the data center and cable management markets. These acquisitions bring total external growth operations this year to seven, contributing nearly Euro 350 million in annualized revenue.

- In October 2024, Schneider Electric has partnered with Noida International Airport to implement advanced building and energy management solutions, including Electrical SCADA and ADMS. These solutions will enhance energy efficiency, sustainability, and operational performance, supporting seamless airport operations while reducing carbon emissions.

- In October 2024, Eaton has expanded its Puducherry manufacturing facility, adding 120,000 square feet for Power Distribution products and an R&D center. The expansion doubles production capacity for critical products, supports India's "Make in India" initiative, and creates over 300 new jobs.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. BUSWAY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 VENDOR SHARE ANALYSIS

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET VERTICAL COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 BUSWAY PRODUCTS

4.2.1 U.S.

4.2.1.1 INDOOR BUSWAYS

4.2.1.2 OUTDOOR BUSWAYS

4.2.1.3 PLUG-IN BUSWAY

4.3 REGULATORY STANDARDS

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4.1 INDUSTRY ANALYSIS

4.4.1.1 GROWING DEMAND FOR ENERGY-EFFICIENT POWER DISTRIBUTION SYSTEMS

4.4.1.2 GROWING INTEGRATION OF RENEWABLE ENERGY SOURCES INTO POWER GRIDS

4.4.2 FUTURISTIC SCENARIO (FORECAST TO 2032)

4.4.3 CONCLUSION

4.5 CONCLUSION

4.6 PENETRATION AND GROWTH PROSPECTS MAPPING

4.6.1 MARKET PENETRATION

4.6.1.1 MARKET SIZE AND GROWTH PROJECTIONS:

4.7 CONSUMER BEHAVIOUR

4.8 TECHNOLOGY ANALYSIS

4.9 CHALLENGES

4.1 KEY CUSTOMERS

4.11 IN-HOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.12 TECHNOLOGY MATRIX

4.13 COMPANY COMPARATIVE ANALYSIS

4.14 COMPANY SERVICE PLATFORM MATRIX

4.15 USED CASES AND THEIR ANALYSIS

4.16 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING FOCUS ON ENERGY-EFFICIENT POWER DISTRIBUTION SYSTEMS IN INDUSTRIAL AND COMMERCIAL SECTORS

5.1.2 RAPID URBANIZATION AND LARGE-SCALE INFRASTRUCTURE PROJECTS

5.1.3 GROWING INTEGRATION OF RENEWABLE ENERGY SOURCES INTO POWER GRIDS

5.1.4 RISING INNOVATIONS AND TECHNOLOGICAL ADVANCEMENTS IN BUSWAY DESIGN

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN RAW MATERIAL AVAILABILITY

5.2.2 LACK OF AWARENESS AND TECHNICAL EXPERTISE REGARDING BUSWAY SYSTEMS

5.3 OPPORTUNITIES

5.3.1 INCREASED DEMAND FOR DATA CENTERS WITH HIGH-CAPACITY AND RELIABLE POWER DISTRIBUTION SYSTEMS

5.3.2 INTEGRATION OF IOT, SENSORS, AND REAL-TIME MONITORING TECHNOLOGIES INTO BUSWAY SYSTEMS

5.3.3 GOVERNMENT SUPPORT FOR SMART CITIES AND ENERGY EFFICIENCY INITIATIVES

5.4 CHALLENGES

5.4.1 COMPATIBILITY ISSUES WITH LEGACY ELECTRICAL SYSTEMS

5.4.2 LIMITED AVAILABILITY OF SKILLED WORKFORCE FOR BUSWAY INSTALLATION AND MAINTENANCE

6 U.S. BUSWAY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DATA CENTER

6.2.1.1 POWER DISTRIBUTION UNITS (PDUS)

6.2.1.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

6.2.1.3 AIR SPLICING BUSWAY (BMC)

6.2.1.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

6.2.1.5 PLANT BUSWAY

6.2.1.6 FAST BUS MULTI-MOTOR

6.2.1.7 OTHERS

6.3 SERVICE

6.3.1 MANAGED SERVICE

6.3.1.1 MAINTENANCE & REPAIRS

6.3.1.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

6.3.1.3 UPGRADES & EXPANSION SUPPORT

6.3.2 PROFESSIONAL SERVICE

6.3.2.1 DESIGN & ENGINEERING

6.3.2.2 CUSTOM FABRICATION

6.3.2.3 INSTALLATION & COMMISSIONING

7 U.S. BUSWAY MARKET, BY OFFERING

7.1 OVERVIEW

7.2 BUSBAR TRUNKING /ELECTRICAL BUSWAY

7.2.1 COPPER BUSWAY

7.2.2 ALUMINUM BUSWAY

7.2.3 HYBRID BUSWAY

7.3 ENCLOSURES

7.3.1 COPPER BUSWAY

7.3.2 ALUMINUM BUSWAY

7.3.3 HYBRID BUSWAY

7.4 TAP-OFF UNITS

7.4.1 COPPER BUSWAY

7.4.2 ALUMINUM BUSWAY

7.4.3 HYBRID BUSWAY

7.5 JOINT CONNECTORS

7.5.1 COPPER BUSWAY

7.5.2 ALUMINUM BUSWAY

7.5.3 HYBRID BUSWAY

7.6 GROUNDING SYSTEMS

7.6.1 COPPER BUSWAY

7.6.2 ALUMINUM BUSWAY

7.6.3 HYBRID BUSWAY

7.7 END CAPS AND END FEEDS

7.7.1 COPPER BUSWAY

7.7.2 ALUMINUM BUSWAY

7.7.3 HYBRID BUSWAY

7.8 OTHERS

8 U.S. BUSWAY MARKET, BY TYPE

8.1 OVERVIEW

8.2 3-PHASE 4-WIRE

8.2.1 CEILING OVERHEAD

8.2.2 RAISED FLOOR

8.3 3-PHASE 5-WIRE

8.3.1 CEILING OVERHEAD

8.3.2 RAISED FLOOR

8.4 OTHERS

8.4.1 CEILING OVERHEAD

8.4.2 RAISED FLOOR

9 U.S. BUSWAY MARKET, BY IMPLEMENTATION

9.1 OVERVIEW

9.2 CEILING OVERHEAD

9.3 RAISED FLOOR

10 U.S. BUSWAY MARKET, BY INSULATION\

10.1 OVERVIEW

10.2 AIR-INSULATED

10.3 ISOLATED PHASE BUSWAY

11 U.S. BUSWAY MARKET, BY CONDUCTOR MATERIAL

11.1 OVERVIEW

11.1.1 COPPER BUSWAY

11.1.2 ALUMINUM BUSWAY

11.1.3 HYBRID BUSWAY

12 U.S. BUSWAY MARKET, BY PHASE TYPE

12.1 OVERVIEW

12.2 NON-SEGREGATED PHASE

12.3 PLUG-IN

12.4 SEGREGATED PHASE

13 U.S. BUSWAY MARKET, BY FUNCTION

13.1 OVERVIEW

13.1.1 FEEDER BUSWAY

13.1.2 DISTRIBUTION BUSWAY

13.1.3 TRUNKING / VERTICAL BUSWAY

13.1.4 LIGHTING BUSWAY

13.1.5 OTHERS

14 U.S. BUSWAY MARKET, BY POWER RATING

14.1 OVERVIEW

14.2 MEDIUM POWER BUSWAY

14.2.1 COPPER BUSWAY

14.2.2 ALUMINUM BUSWAY

14.2.3 HYBRID BUSWAY

14.3 LOW POWER BUSWAY

14.3.1 COPPER BUSWAY

14.3.2 ALUMINUM BUSWAY

14.3.3 HYBRID BUSWAY

14.4 HIGH POWER BUSWAY

14.4.1 COPPER BUSWAY

14.4.2 ALUMINUM BUSWAY

14.4.3 HYBRID BUSWAY

15 U.S. BUSWAY MARKET, BY VERTICAL

15.1 OVERVIEW

15.1.1 INDUSTRIAL FACILITIES

15.1.2 COMMERCIAL BUILDINGS

15.1.3 IT (TELECOMMUNICATION AND BROADCASTING)

15.1.4 ENERGY

15.1.5 HEALTHCARE

15.1.6 TRANSPORTATION

15.1.7 RESIDENTIAL

15.1.8 GOVERNMENT AND MILITARY

15.1.9 EDUCATIONAL INSTITUTIONS

15.1.10 ENTERTAINMENT AND SPORTS VENUES

15.1.11 OTHERS

15.2 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.2.1 DATA CENTER

15.2.2 SERVER FARM

15.2.3 NETWORK OPERATION CENTERS (NOCS)

15.2.4 OTHERS

15.3 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.3.1 HARDWARE

15.3.2 SERVICE

15.4 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.4.1 DATA CENTER

15.4.2 SERVER FARM

15.4.3 NETWORK OPERATION CENTERS (NOCS)

15.4.4 OTHERS

15.5 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.5.1 POWER DISTRIBUTION UNITS (PDUS)

15.5.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.5.3 AIR SPLICING BUSWAY (BMC)

15.5.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.6 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.6.1 MANAGED SERVICE

15.6.2 PROFESSIONAL SERVICE

15.7 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.7.1 INSTALLATION & COMMISSIONING

15.7.2 CUSTOM FABRICATION

15.7.3 DESIGN & ENGINEERING

15.8 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.8.1 MAINTENANCE & REPAIRS

15.8.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.8.3 UPGRADES & EXPANSION SUPPORT

15.9 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.9.1 OFFICE COMPLEXES

15.9.2 SHOPPING MALLS

15.9.3 HOTELS

15.9.4 RETAIL STORES

15.1 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.10.1 HARDWARE

15.10.2 SERVICE

15.11 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.11.1 DATA CENTER

15.11.2 SERVER FARM

15.11.3 NETWORK OPERATION CENTERS (NOCS)

15.11.4 OTHERS

15.12 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.12.1 POWER DISTRIBUTION UNITS (PDUS)

15.12.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.12.3 AIR SPLICING BUSWAY (BMC)

15.12.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.13 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.13.1 MANAGED SERVICE

15.13.2 PROFESSIONAL SERVICE

15.14 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.14.1 INSTALLATION & COMMISSIONING

15.14.2 CUSTOM FABRICATION

15.14.3 DESIGN & ENGINEERING

15.15 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.15.1 MAINTENANCE & REPAIRS

15.15.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.15.3 UPGRADES & EXPANSION SUPPORT

15.16 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.16.1 DATA CENTER

15.16.2 SERVER FARM

15.16.3 NETWORK OPERATION CENTERS (NOCS)

15.16.4 OTHERS

15.17 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.17.1 HARDWARE

15.17.2 SERVICE

15.18 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.18.1 DATA CENTER

15.18.2 SERVER FARM

15.18.3 NETWORK OPERATION CENTERS (NOCS)

15.18.4 OTHERS

15.19 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.19.1 POWER DISTRIBUTION UNITS (PDUS)

15.19.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.19.3 AIR SPLICING BUSWAY (BMC)

15.19.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.2 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.20.1 MANAGED SERVICE

15.20.2 PROFESSIONAL SERVICE

15.21 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.21.1 INSTALLATION & COMMISSIONING

15.21.2 CUSTOM FABRICATION

15.21.3 DESIGN & ENGINEERING

15.22 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.22.1 MAINTENANCE & REPAIRS

15.22.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.22.3 UPGRADES & EXPANSION SUPPORT

15.23 U.S. ENERGY IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.23.1 DATA CENTER

15.23.2 SERVER FARM

15.23.3 NETWORK OPERATION CENTERS (NOCS)

15.23.4 OTHERS

15.24 U.S. ENERGY IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.24.1 HARDWARE

15.24.2 SERVICE

15.25 U.S. ENERGY IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.25.1 DATA CENTER

15.25.2 SERVER FARM

15.25.3 NETWORK OPERATION CENTERS (NOCS)

15.25.4 OTHERS

15.26 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.26.1 POWER DISTRIBUTION UNITS (PDUS)

15.26.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.26.3 AIR SPLICING BUSWAY (BMC)

15.26.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.27 U.S. ENERGY IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.27.1 MANAGED SERVICE

15.27.2 PROFESSIONAL SERVICE

15.28 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.28.1 INSTALLATION & COMMISSIONING

15.28.2 CUSTOM FABRICATION

15.28.3 DESIGN & ENGINEERING

15.29 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.29.1 MAINTENANCE & REPAIRS

15.29.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.29.3 UPGRADES & EXPANSION SUPPORT

15.3 U.S. HEALTHCARE IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.30.1 DATA CENTER

15.30.2 SERVER FARM

15.30.3 NETWORK OPERATION CENTERS (NOCS)

15.30.4 OTHERS

15.31 U.S. HEALTHCARE IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.31.1 HARDWARE

15.31.2 SERVICE

15.32 U.S. HEALTHCARE IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.32.1 DATA CENTER

15.32.2 SERVER FARM

15.32.3 NETWORK OPERATION CENTERS (NOCS)

15.32.4 OTHERS

15.33 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.33.1 POWER DISTRIBUTION UNITS (PDUS)

15.33.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.33.3 AIR SPLICING BUSWAY (BMC)

15.33.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.34 U.S. HEALTHCARE IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.34.1 MANAGED SERVICE

15.34.2 PROFESSIONAL SERVICE

15.35 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.35.1 INSTALLATION & COMMISSIONING

15.35.2 CUSTOM FABRICATION

15.35.3 DESIGN & ENGINEERING

15.36 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.36.1 MAINTENANCE & REPAIRS

15.36.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.36.3 UPGRADES & EXPANSION SUPPORT

15.37 U.S. TRANSPORTATION IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.37.1 DATA CENTER

15.37.2 SERVER FARM

15.37.3 NETWORK OPERATION CENTERS (NOCS)

15.37.4 OTHERS

15.38 U.S. TRANSPORTATION IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.38.1 HARDWARE

15.38.2 SERVICE

15.39 U.S. TRANSPORTATION IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.39.1 DATA CENTER

15.39.2 SERVER FARM

15.39.3 NETWORK OPERATION CENTERS (NOCS)

15.39.4 OTHERS

15.4 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.40.1 POWER DISTRIBUTION UNITS (PDUS)

15.40.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.40.3 AIR SPLICING BUSWAY (BMC)

15.40.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.41 U.S. TRANSPORTATION IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.41.1 MANAGED SERVICE

15.41.2 PROFESSIONAL SERVICE

15.42 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.42.1 INSTALLATION & COMMISSIONING

15.42.2 CUSTOM FABRICATION

15.42.3 DESIGN & ENGINEERING

15.43 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.43.1 MAINTENANCE & REPAIRS

15.43.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.43.3 UPGRADES & EXPANSION SUPPORT

15.44 U.S. RESIDENTIAL IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.44.1 APARTMENT COMPLEXES

15.44.2 SMART HOMES

15.44.3 GATED COMMUNITIES

15.44.4 OTHERS

15.45 U.S. RESIDENTIAL IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.45.1 HARDWARE

15.45.2 SERVICE

15.46 U.S. RESIDENTIAL IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.46.1 DATA CENTER

15.46.2 SERVER FARM

15.46.3 NETWORK OPERATION CENTERS (NOCS)

15.46.4 OTHERS

15.47 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.47.1 POWER DISTRIBUTION UNITS (PDUS)

15.47.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.47.3 AIR SPLICING BUSWAY (BMC)

15.47.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.48 U.S. RESIDENTIAL IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.48.1 MANAGED SERVICE

15.48.2 PROFESSIONAL SERVICE

15.49 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.49.1 INSTALLATION & COMMISSIONING

15.49.2 CUSTOM FABRICATION

15.49.3 DESIGN & ENGINEERING

15.5 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.50.1 1.78.2 MAINTENANCE & REPAIRS

15.50.2 1.78.3 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.50.3 1.78.4 UPGRADES & EXPANSION SUPPORT

15.51 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.51.1 DATA CENTER

15.51.2 SERVER FARM

15.51.3 NETWORK OPERATION CENTERS (NOCS)

15.51.4 OTHERS

15.52 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.52.1 HARDWARE

15.52.2 SERVICE

15.53 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.53.1 DATA CENTER

15.53.2 SERVER FARM

15.53.3 NETWORK OPERATION CENTERS (NOCS)

15.53.4 OTHERS

15.54 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.54.1 POWER DISTRIBUTION UNITS (PDUS)

15.54.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.54.3 AIR SPLICING BUSWAY (BMC)

15.54.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.55 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.55.1 MANAGED SERVICE

15.55.2 PROFESSIONAL SERVICE

15.56 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.56.1 INSTALLATION & COMMISSIONING

15.56.2 CUSTOM FABRICATION

15.56.3 DESIGN & ENGINEERING

15.57 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.57.1 MAINTENANCE & REPAIRS

15.57.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.57.3 UPGRADES & EXPANSION SUPPORT

15.58 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.58.1 DATA CENTER

15.58.2 SERVER FARM

15.58.3 NETWORK OPERATION CENTERS (NOCS)

15.58.4 OTHERS

15.59 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.59.1 HARDWARE

15.59.2 SERVICE

15.6 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.60.1 DATA CENTER

15.60.2 SERVER FARM

15.60.3 NETWORK OPERATION CENTERS (NOCS)

15.60.4 OTHERS

15.61 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.61.1 POWER DISTRIBUTION UNITS (PDUS)

15.61.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.61.3 AIR SPLICING BUSWAY (BMC)

15.61.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.62 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.62.1 MANAGED SERVICE

15.62.2 PROFESSIONAL SERVICE

15.63 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.63.1 INSTALLATION & COMMISSIONING

15.63.2 CUSTOM FABRICATION

15.63.3 DESIGN & ENGINEERING

15.64 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.64.1 MAINTENANCE & REPAIRS

15.64.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.64.3 UPGRADES & EXPANSION SUPPORT

15.65 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

15.65.1 DATA CENTER

15.65.2 SERVER FARM

15.65.3 NETWORK OPERATION CENTERS (NOCS)

15.65.4 OTHERS

15.66 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.66.1 HARDWARE

15.66.2 SERVICE

15.67 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.67.1 DATA CENTER

15.67.2 SERVER FARM

15.67.3 NETWORK OPERATION CENTERS (NOCS)

15.67.4 OTHERS

15.68 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.68.1 POWER DISTRIBUTION UNITS (PDUS)

15.68.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.68.3 AIR SPLICING BUSWAY (BMC)

15.68.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.69 U.S. OTHERS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.69.1 MANAGED SERVICE

15.69.2 PROFESSIONAL SERVICE

15.7 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.70.1 INSTALLATION & COMMISSIONING

15.70.2 CUSTOM FABRICATION

15.70.3 DESIGN & ENGINEERING

15.71 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.71.1 MAINTENANCE & REPAIRS

15.71.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.71.3 UPGRADES & EXPANSION SUPPORT

15.72 U.S. OTHERS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

15.72.1 HARDWARE

15.72.2 SERVICE

15.73 U.S. OTHERS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

15.73.1 DATA CENTER

15.73.2 SERVER FARM

15.73.3 NETWORK OPERATION CENTERS (NOCS)

15.73.4 OTHERS

15.74 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.74.1 POWER DISTRIBUTION UNITS (PDUS)

15.74.2 HIGH STRENGTH ENCLOSED BUSWAY (CFW)

15.74.3 AIR SPLICING BUSWAY (BMC)

15.74.4 INTENSIVE INSULATION PLUG BUSWAY (CMC)

15.75 U.S. OTHERS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

15.75.1 MANAGED SERVICE

15.75.2 PROFESSIONAL SERVICE

15.76 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.76.1 INSTALLATION & COMMISSIONING

15.76.2 CUSTOM FABRICATION

15.76.3 DESIGN & ENGINEERING

15.77 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.77.1 MAINTENANCE & REPAIRS

15.77.2 REMOTE MONITORING & PREDICTIVE MAINTENANCE

15.77.3 UPGRADES & EXPANSION SUPPORT

16 U.S. BUSWAY MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 INDIRECT

U.S. INDIRECT IN BUSWAY MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND) 219

16.3 DISTRIBUTORS / DEALERS

16.4 SYSTEM INTEGRATORS / EPCS

16.5 TURNKEY CONTRACTORS

16.6 DIRECT

16.7 U.S. DIRECT IN BUSWAY MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

16.7.1 COMPANY WEBSITE

16.7.2 ECOMMERCE PLATFORMS

17 U.S. BUSWAY MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: U.S.

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 LEGRAND

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 SCHNEIDER ELECTRIC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 VERTIV GROUP CORP.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENTS

19.4 DELTA POWER SOLUTIONS

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 EATON

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ABB

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANORD MARDIX

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 CHATSWORTH PRODUCTS

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 EAE ELECTRIC

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 FURUKAWA ELECTRIC CO., LTD.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 HONEYWELL INTERNATIONAL INC.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 S CABLE & SYSTEM USA

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 MEGABARRE GROUP, LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 PANDUIT CORP.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 POWELL INDUSTRIES

19.15.1 COMPANY SNAPSHOT

19.15.2 1.1.4 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 RITTAL PVT. LTD

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SEIMENS

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 STARLINE HOLDINGS, LLC.

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 USPWR

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 TECHNOLOGY MATRIX FOR KEY MARKET PLAYERS

TABLE 3 COMPANY COMPARATIVE ANALYSIS FOR TOP MARKET PLAYERS

TABLE 4 COMPANY SERVICE PLATFORM MATRIX FOR TOP MARKET PLAYERS

TABLE 5 USED CASE ANALYSIS

TABLE 6 U.S. BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 7 U.S. HARDWARE IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 U.S. SERVICE IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 U.S. BUSWAY MARKET, BY COMPONENTS, 2018-2033 (USD THOUSAND)

TABLE 13 U.S. BUSBAR TRUNKING /ELECTRICAL BUSWAY IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 14 U.S. ENCLOSURES IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 15 U.S. TAP-OFF UNITS IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 16 U.S. JOINT CONNECTORS IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 17 U.S. GROUNDING SYSTEMS IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 18 U.S. END CAPS AND END FEEDS IN BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 19 U.S. BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 U.S. 3-PHASE 4-WIRE IN BUSWAY MARKET, BY IMPLEMENTATION, 2018-2033 (USD THOUSAND)

TABLE 21 U.S. 3-PHASE 5-WIRE IN BUSWAY MARKET, BY IMPLEMENTATION, 2018-2033 (USD THOUSAND)

TABLE 22 U.S. OTHERS IN BUSWAY MARKET, BY IMPLEMENTATION, 2018-2033 (USD THOUSAND)

TABLE 23 U.S. OTHERS IN BUSWAY MARKET, BY IMPLEMENTATION, 2018-2033 (USD THOUSAND)

TABLE 24 U.S. BUSWAY MARKET, BY INSULATION, 2018-2033 (USD THOUSAND)

TABLE 25 U.S. BUSWAY MARKET, BY CONDUCTOR MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 26 U.S. BUSWAY MARKET, BY PHASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 U.S. BUSWAY MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 28 U.S. BUSWAY MARKET, BY POWER RATING, 2018-2033 (USD THOUSAND)

TABLE 29 U.S. MEDIUM POWER BUSWAY IN BUSWAY MARKET, BY POWER RATING, 2018-2033 (USD THOUSAND)

TABLE 30 U.S. LOW POWER BUSWAY IN BUSWAY MARKET, BY POWER RATING, 2018-2033 (USD THOUSAND)

TABLE 31 U.S. HIGH POWER BUSWAY IN BUSWAY MARKET, BY POWER RATING, 2018-2033 (USD THOUSAND)

TABLE 32 U.S. BUSWAY MARKET, BY VERTICAL, 2018-2033 (USD THOUSAND)

TABLE 33 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 34 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 35 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 U.S. INDUSTRIAL FACILITIES IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 41 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 42 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 U.S. COMMERCIAL BUILDINGS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 TABLE 42 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 48 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 49 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 U.S. IT (TELECOMMUNICATION AND BROADCASTING) IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 U.S. ENERGY IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 U.S. ENERGY IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 56 U.S. ENERGY IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 U.S. ENERGY IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 U.S. HEALTHCARE IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 62 U.S. HEALTHCARE IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 63 U.S. HEALTHCARE IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 U.S. HEALTHCARE IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 U.S. TRANSPORTATION IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 69 U.S. TRANSPORTATION IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 70 U.S. TRANSPORTATION IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 U.S. TRANSPORTATION IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 U.S. RESIDENTIAL IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 76 U.S. RESIDENTIAL IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 77 U.S. RESIDENTIAL IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 U.S. RESIDENTIAL IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 83 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 84 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 U.S. GOVERNMENT AND MILITARY IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 90 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 91 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 U.S. EDUCATIONAL INSTITUTIONS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 97 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 98 U.S. ENTERTAINMENT AND SPORTS VENUES IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 U.S. OTHERS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 U.S. OTHERS IN BUSWAY MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 104 U.S. OTHERS IN BUSWAY MARKET, BY HARDWARE TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 U.S. DATA CENTER IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 U.S. OTHERS IN BUSWAY MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 U.S. PROFESSIONAL SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 U.S. MANAGED SERVICES IN BUSWAY MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 U.S. BUSWAY MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 110 U.S. INDIRECT IN BUSWAY MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 111 U.S. DIRECT IN BUSWAY MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 U.S. BUSWAY MARKET: SEGMENTATION

FIGURE 2 U.S. BUSWAY MARKET: DATA TRIANGULATION

FIGURE 3 U.S. BUSWAY MARKET: DROC ANALYSIS

FIGURE 4 U.S. BUSWAY MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 U.S. BUSWAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. BUSWAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. BUSWAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. BUSWAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. BUSWAY MARKET: MULTIVARIATE MODELING

FIGURE 10 U.S. BUSWAY MARKET: TYPE TIMELINE CURVE

FIGURE 11 U.S. BUSWAY MARKET: VERTICAL COVERAGE GRID

FIGURE 12 U.S. BUSWAY MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE U.S. BUSWAY MARKET, BY OFFERING (2025)

FIGURE 14 U.S. BUSWAY MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RAPID URBANIZATION AND LARGE-SCALE INFRASTRUCTURE PROJECTS ARE EXPECTED TO DRIVE THE U.S. BUSWAY MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 HARDWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. BUSWAY MARKET IN 2026 & 2033

FIGURE 18 DROC ANALYSIS

FIGURE 19 U.S. BUSWAY MARKET: BY OFFERING, 2025

FIGURE 20 U.S. BUSWAY MARKET: BY COMPONENTS, 2025

FIGURE 21 U.S. BUSWAY MARKET: BY TYPE, 2025

FIGURE 22 U.S. BUSWAY MARKET: BY IMPLEMENTATION, 2025

FIGURE 23 U.S. BUSWAY MARKET: BY INSULATION, 2025

FIGURE 24 U.S. BUSWAY MARKET: BY CONDUCTOR MATERIAL, 2025

FIGURE 25 U.S. BUSWAY MARKET: BY PHASE TYPE, 2025

FIGURE 26 U.S. BUSWAY MARKET: BY FUNCTION, 2025

FIGURE 27 U.S. BUSWAY MARKET: BY POWER RATING, 2025

FIGURE 28 U.S. BUSWAY MARKET: BY VERTICAL, 2025

FIGURE 29 U.S. BUSWAY MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 30 U.S. BUSWAY MARKET: COMPANY SHARE 2025 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.