Asia

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

3.79 Billion

2024

2032

USD

1.06 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Asia-Pacific and U.S. Warehouse Management System Market Segmentation, By Components (Cranes, Automated Storage & Retrieval System, Robots, Conveyors and Sortation Systems, Automated Guided Vehicles, and Others), Functions (Receiving & Putaway, Inventory Control, Yard & Dock Management, Slotting, Picking, Workforce & Task Management, Shipping, and Others), Offering (Software and Services), Deployment (Cloud/SaaS and On-Premise), Tier Type (Advanced WMS, Intermediate WMS, and Basic WMS), End User (E-Commerce, Food & Beverages, Third-Party Logistics, Electrical & Electronics, Automotive, Metals and Machinery, Healthcare, Chemicals, and Others) - Industry Trends and Forecast to 2032

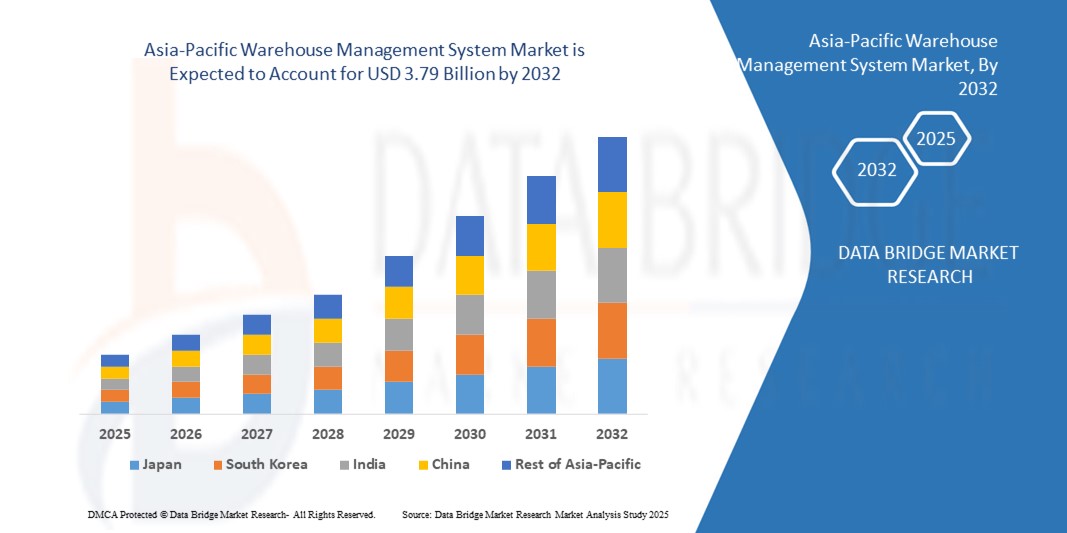

Asia-Pacific Warehouse Management System Market Size

- The Asia-Pacific warehouse management system market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 3.79 billion by 2032, at a CAGR of 17.30% during the forecast period and U.S. warehouse management system market size was valued at USD 991.8 million in 2024 and is expected to reach USD 3506.54 million by 2032, at a CAGR of 17.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation, robotics, and digital supply chain technologies across warehouses and distribution centers, leading to improved operational efficiency, reduced labor costs, and enhanced inventory management

- Furthermore, rising demand from e-commerce, retail, manufacturing, and third-party logistics sectors for real-time visibility, accurate inventory tracking, and streamlined warehouse operations is establishing warehouse management systems as a critical solution for modern supply chains. These converging factors are accelerating the adoption of warehouse management systems, thereby significantly boosting the industry's growth

Asia-Pacific Warehouse Management System Market Analysis

- Warehouse management systems are software solutions that enable companies to manage and optimize warehouse operations, including inventory control, order fulfillment, receiving and putaway, picking, shipping, and workforce management. These systems integrate with automation, robotics, and enterprise resource planning platforms to enhance efficiency and accuracy in warehouse operations

- The escalating demand for warehouse management systems is primarily fueled by the growth of e-commerce and omnichannel retailing, increasing complexity of supply chains, rising labor costs, and the need for faster, more accurate order fulfillment. Businesses are increasingly adopting cloud-based, AI-powered, and mobile-accessible WMS solutions to achieve operational agility and competitiveness

- China dominated the warehouse management system market in 2024, due to its rapidly growing e-commerce sector, expanding manufacturing base, and increasing adoption of automation and digital supply chain solutions

- Asia-Pacific is expected to be the fastest growing country in the warehouse management system market during the forecast period due to

- Services segment dominated the market with a market share of 81.41% in 2024, due to the increasing demand for implementation, customization, training, and maintenance solutions that ensure seamless integration and optimal performance of warehouse management systems. Businesses are prioritizing professional services to reduce deployment risks, enhance operational efficiency, and leverage the full potential of advanced software capabilities. In addition, the growing complexity of warehouse operations and the need for continuous support and updates further contribute to the dominance of the services segment in the market

Report Scope and Warehouse Management System Market Segmentation

|

Attributes |

Warehouse Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

U.S. |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Warehouse Management System Market Trends

Integration of AI and Robotics to Automate Warehouse Operations

- The integration of artificial intelligence and robotics into warehouse management systems is rapidly enhancing operational efficiency and scalability. These technologies allow warehouses to increase speed, accuracy, and productivity while minimizing labor-intensive tasks and human error in complex logistics environments

- For instance, GreyOrange has deployed advanced AI-driven robots for automated sorting and picking operations across warehouses of brands such as Flipkart. This illustrates how robotics and AI are transforming warehouse functions and redefining standards for order accuracy and throughput efficiency

- AI-enabled warehouse management systems are increasingly being used for predictive analytics, which helps forecast demand, optimize inventory placement, and streamline order processing. These capabilities provide immense value for companies looking to balance fast-moving markets with cost control and service quality

- Robotics integration supports optimized workflows through automated picking systems, robotic arms for palletizing, and autonomous guided vehicles for material handling. Together, these solutions significantly lower cycle times and enhance flexibility for handling seasonal or fluctuating demand

- The trend is also expanding to small and mid-sized businesses, where cloud-enabled AI and robotics integration is being adopted to level operational efficiency with major retailers. This democratization of advanced warehouse automation is opening new avenues for broader market penetration

- In conclusion, the fusion of AI and robotics within warehouse management systems is reshaping how warehouses operate. By enabling automation, precision, and real-time intelligence, these advancements are driving the industry toward smarter, future-ready supply chain infrastructures

Asia-Pacific Warehouse Management System Market Dynamics

Driver

Growing Demand for Real-Time Inventory Visibility and Faster Order Fulfillment

- The increasing demand for real-time inventory visibility combined with the pressure to fulfill orders quickly is a key driver fueling the adoption of warehouse management systems. Companies are seeking systems that allow them to track, manage, and optimize inventory accurately while supporting seamless order processing

- For instance, Manhattan Associates has developed advanced WMS solutions enabling retailers to achieve real-time inventory insights across both distribution centers and stores. Their deployment with major retail brands exemplifies how WMS is critical in ensuring faster and more efficient customer fulfillment experiences

- Real-time visibility ensures that stock discrepancies are minimized while order accuracy is maximized. This provides companies with the ability to reduce backorders, avoid costly stockouts, and deliver improved customer satisfaction through reliable availability of products

- The rise of omnichannel retailing is further adding to demand for warehouse management systems. With customers expecting next-day or even same-day delivery, businesses require systems that coordinate inventory across multiple channels to provide unified fulfillment

- In summary, the growing importance of speed and accuracy in order fulfillment is making real-time visibility a strategic necessity for modern enterprises. Warehouse management systems have thus become essential tools for achieving competitive advantage in high-demand markets

Restraint/Challenge

High Costs and Complexity of System Implementation

- The high initial investment and complexity associated with implementing warehouse management systems remain a significant challenge for organizations. Costs related to software licensing, hardware infrastructure, customization, and integration can be substantial for many businesses

- For instance, companies adopting SAP Extended Warehouse Management often report extensive implementation timelines and high consulting and training costs. This demonstrates how extensive resources are required to transition from traditional warehouse processes to fully optimized WMS platforms

- Integration difficulties further add to the complexity, as WMS must seamlessly incorporate with ERP systems, order management platforms, and transportation management systems. Ensuring compatibility and smooth data flow between multiple platforms often extends project timelines and escalates costs

- In addition, training warehouse staff to effectively operate and manage advanced WMS solutions requires both time and investment, creating temporary productivity slowdowns during transition phases. This becomes particularly challenging for businesses managing high volumes daily

- Ultimately, the combined barriers of cost and complexity slow down large-scale adoption, especially for small and mid-sized enterprises. Developing more cost-effective cloud-based solutions, user-friendly interfaces, and modular implementation strategies will be critical to reducing these restraints and expanding global adoption opportunities

Asia-Pacific Warehouse Management System Market Scope

The market is segmented on the basis of components, functions, offering, deployment, tier type, and end-user.

- By Components

On the basis of components, the Warehouse Management System Market is segmented into cranes, automated storage and retrieval systems, robots, conveyors and sortation systems, automated guided vehicles, and others. The automated storage and retrieval systems segment dominated the largest market revenue share in 2024, driven by its efficiency in automating storage and retrieval processes while minimizing labor costs and human error. Warehouses increasingly rely on automated storage and retrieval systems for high-density storage, faster order fulfillment, and seamless integration with existing warehouse infrastructure. The ability to handle diverse product types and optimize space utilization further reinforces its preference among large-scale and e-commerce warehouses.

The automated guided vehicles segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their increasing adoption in automated material handling and intralogistics. Automated guided vehicles provide flexible and autonomous transport solutions within warehouses, reducing dependency on manual labor and streamlining workflow. Their compatibility with robotics and Warehouse Management System software makes them particularly suitable for high-volume operations and dynamic warehouse layouts, driving demand across logistics and manufacturing sectors.

- By Functions

On the basis of functions, the Warehouse Management System Market is segmented into receiving and putaway, inventory control, yard and dock management, slotting, picking, workforce and task management, shipping, and others. The inventory control segment held the largest market revenue share in 2024, owing to its critical role in ensuring accurate stock levels, reducing overstocking or stockouts, and supporting real-time warehouse visibility. Advanced inventory management features, including barcoding, radio-frequency identification tracking, and integration with enterprise resource planning systems, have made this function indispensable for modern warehouses seeking operational efficiency and cost reduction.

The picking segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by the rising need for faster and more accurate order fulfillment in e-commerce and retail sectors. Automated and semi-automated picking solutions, often integrated with robotics and artificial intelligence, reduce picking errors, optimize labor allocation, and enhance throughput, making it a high-growth functional area in warehouse operations.

- By Offering

On the basis of offering, the Warehouse Management System Market is segmented into software and services. The services segment dominated the largest market revenue share of 81.41% in 2024, supported by the increasing demand for implementation, customization, training, and maintenance solutions that ensure seamless integration and optimal performance of warehouse management systems. Businesses are prioritizing professional services to reduce deployment risks, enhance operational efficiency, and leverage the full potential of advanced software capabilities. In addition, the growing complexity of warehouse operations and the need for continuous support and updates further contribute to the dominance of the services segment in the market.

The software segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for real-time visibility, automation, and data-driven decision-making in warehouses. Warehouse Management System software enables centralized control over inventory, order management, and workflow optimization, providing actionable insights that enhance operational efficiency and reduce operational costs.

- By Deployment

On the basis of deployment, the Warehouse Management System Market is segmented into cloud or software-as-a-service and on-premise. The on-premise segment held the largest market revenue share in 2024 due to the preference of large enterprises for greater control over data security, customization, and compliance requirements. On-premise Warehouse Management System solutions provide organizations with the flexibility to integrate with existing information technology infrastructure and meet stringent regulatory standards in sensitive sectors such as healthcare and chemicals.

The cloud or software-as-a-service segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, fueled by the increasing adoption of flexible, scalable, and cost-effective solutions. Cloud-based Warehouse Management System allows real-time access from multiple locations, reduces upfront infrastructure costs, and supports rapid deployment, making it highly attractive to small and medium-sized enterprises and multi-location e-commerce operations seeking agility and digital transformation.

- By Tier Type

On the basis of tier type, the Warehouse Management System Market is segmented into advanced Warehouse Management System, intermediate Warehouse Management System, and basic Warehouse Management System. The advanced Warehouse Management System segment dominated the largest market revenue share in 2024, driven by its comprehensive features, including artificial intelligence-powered analytics, automation integration, and real-time performance monitoring. Large-scale warehouses and e-commerce operations prefer advanced Warehouse Management System for optimizing complex workflows, improving accuracy, and enhancing supply chain visibility across multiple nodes.

The intermediate Warehouse Management System segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption among mid-sized enterprises seeking a balance between cost and functional sophistication. Intermediate Warehouse Management System offers modular capabilities, ease of integration, and sufficient automation, enabling growing businesses to enhance warehouse efficiency without heavy upfront investments.

- By End User

On the basis of end user, the Warehouse Management System Market is segmented into e-commerce, food and beverages, third-party logistics, electrical and electronics, automotive, metals and machinery, healthcare, chemicals, and others. The e-commerce segment held the largest market revenue share in 2024, driven by the exponential growth of online retail and the need for faster, error-free order fulfillment. Efficient Warehouse Management System enables e-commerce players to manage high-volume, small-batch orders, optimize inventory turnover, and meet consumer expectations for same-day or next-day deliveries.

The third-party logistics segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, fueled by the rising outsourcing of warehousing and distribution services. Third-party logistics providers increasingly rely on Warehouse Management System to offer scalable, integrated, and technology-driven logistics solutions, enabling them to manage multiple clients, ensure timely deliveries, and enhance operational efficiency across their networks.

Asia-Pacific Warehouse Management System Market Regional Analysis

- China dominated the warehouse management system market with the largest revenue share in 2024, driven by its rapidly growing e-commerce sector, expanding manufacturing base, and increasing adoption of automation and digital supply chain solutions

- Robust investments in warehouse infrastructure, coupled with the government’s push for smart logistics and Industry 4.0 initiatives, reinforce China’s leadership in the regional market

- The presence of leading domestic warehouse technology providers, collaborations with global solution vendors, and the introduction of cost-effective yet technologically advanced warehouse management systems continue to consolidate

Japan Warehouse Management System Market Insight

The Japan warehouse management system market is anticipated to grow steadily from 2025 to 2032, supported by its advanced manufacturing and logistics sectors and strong emphasis on operational efficiency and digital transformation. Japanese companies are increasingly adopting automated storage solutions, robotics, and integrated software systems to optimize warehouse operations. The demand for compact, multifunctional, and highly efficient warehouse management systems is rising due to limited warehouse space and high labor costs. Continuous research and development investments and partnerships between Japanese solution providers and global technology firms reinforce the market’s steady growth outlook. Japan’s focus on innovation, reliability, and supply chain optimization underpins its strong regional positioning.

India Warehouse Management System Market Insight

India warehouse management system market is projected to register the fastest compound annual growth rate in the Asia Pacific region during 2025–2032, fueled by the rapid expansion of e-commerce, rising manufacturing activities, and increasing adoption of automation and cloud-based warehouse management solutions. Growing awareness of operational efficiency, cost optimization, and digital supply chain management is accelerating adoption among small and medium-sized enterprises. The demand for affordable, scalable, and easy-to-deploy warehouse management systems is particularly strong among emerging businesses. Expanding retail and logistics networks, rapid growth of e-commerce, and government initiatives promoting digital infrastructure are enhancing product accessibility. India’s rising focus on warehouse modernization ensures its emergence as the fastest-growing market in the region.

U.S. Warehouse Management System Market Insight

The U.S. warehouse management system market is anticipated to grow steadily from 2025 to 2032, supported by ongoing technological advancements, increased investments in automated warehouses, and a strong focus on digital transformation. Companies are prioritizing software-driven solutions that enable predictive analytics, demand forecasting, and smart inventory management. Continuous collaborations between U.S. technology providers and global vendors, along with supportive policies promoting smart logistics, reinforce the steady growth outlook. The country’s focus on innovation, operational efficiency, and supply chain resilience underpins its strong regional positioning in the warehouse management system market.

Asia-Pacific Warehouse Management System Market Share

The warehouse management system industry is primarily led by well-established companies, including:

- Blue Yonder Group, Inc. (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- Infor (U.S.)

- Manhattan Associates (U.S.)

- Tecsys Inc. (Canada)

- SENKO Co., Ltd. (Japan)

- Softeon (U.S.)

- Accelogix LLC (U.S.)

- Datex Corporation (U.S.)

- Made4net (U.S.)

- CAMELOT 3PL SOFTWARE (Germany)

- ShipBob, Inc. (U.S.)

- JAPAN LOGISTIC SYSTEMS CORP. (Japan)

- Synergy Logistics Ltd (U.K.)

- Honeywell International Inc. (U.S.)

- IBM Corporation (U.S.)

- NEC Corporation (Japan)

- Cisco Systems, Inc. (U.S.)

- Extensiv (U.S.)

- The Raymond Corporation (U.S.)

Latest Developments in Asia-Pacific and U.S. Warehouse Management System Market

- In March 2024, Made4net demonstrated its WarehouseExpert Warehouse Management System and end-to-end supply chain execution solutions at MODEX 2024. The demonstration highlighted the system's integration with robotics and automation technologies, emphasizing its capabilities in improving the speed and efficiency of supply chains. This development underscores the growing trend of incorporating automation into warehouse management systems to enhance operational efficiency and meet the demands of modern supply chains

- In November 2023, Blue Yonder, a leading supply chain solutions provider, announced the acquisition of Doddle, a technology business focused on first- and last-mile logistics. This acquisition enables Blue Yonder to offer a more comprehensive logistics suite, addressing the challenges of optimizing first- and last-mile logistics, which have historically been difficult to manage. By integrating Doddle's technology into its existing suite of commerce and returns capabilities, Blue Yonder aims to build more sustainable and profitable end-to-end supply chains

- In November 2023, Epicor, a global leader in industry-specific enterprise software, announced the acquisition of Elite EXTRA, a leading provider of cloud-based last-mile delivery solutions. This acquisition expands Epicor's ability to help its customers across various industries simplify last-mile logistics and compete more effectively in a hyper-competitive market. By integrating Elite EXTRA's solutions, Epicor aims to enhance its offerings in the "make, move, and sell" industries, providing customers with advanced last-mile delivery capabilities

- In February 2021, The Raymond Corporation announced the launch of a new automated transtacker as an addition to its intralogistics solutions offerings. The automated transtacker, equipped with order manager software, fully integrates with warehouse management systems to optimize performance and eliminate errors. This development provides companies with a flexible solution for high-density and high-selectivity storage facilities, diversifying their automation portfolio with new products

- In March 2021, Extensiv launched an enhanced small parcel suite with expanded functionality to drive greater efficiency and a paperless warehouse for third-party logistics providers offering e-commerce and omnichannel fulfillment. The solution helps companies streamline and efficiently manage small parcel functionality, reducing packing time and increasing profitability. By integrating this suite into their warehouse management systems, businesses can enhance their pack and ship processes, leading to improved operational efficiency

- In May 2025, Körber Supply Chain announced the launch of an advanced warehouse management system module with AI-driven predictive analytics. The new module allows warehouses to forecast demand, optimize inventory allocation, and proactively manage operational bottlenecks. This development strengthens Körber’s position in the market by enabling customers to enhance warehouse productivity, reduce operational costs, and improve service levels in increasingly complex supply chains

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。