Asia

Market Size in USD Billion

CAGR :

%

USD

2.11 Billion

USD

7.07 Billion

2025

2033

USD

2.11 Billion

USD

7.07 Billion

2025

2033

| 2026 –2033 | |

| USD 2.11 Billion | |

| USD 7.07 Billion | |

|

|

|

|

Asia-Pacific Biopesticides Market Segmentation, By Type (Bioinsecticides, Biofungisides, Bionematicides, Bioherbicides, and Others), Source (Microbials, Biochemical, and Insects), Form (Dry and Liquid), Application (Foliar Application, Fertigation, Soil Treatment, Seed Treatment, and Other), Category (Agriculture and Horticulture), Crops (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Turf & Ornamentals, and Other Crops) - Industry Trends and Forecast to 2033

What is the Asia-Pacific Biopesticides Market Size and Growth Rate?

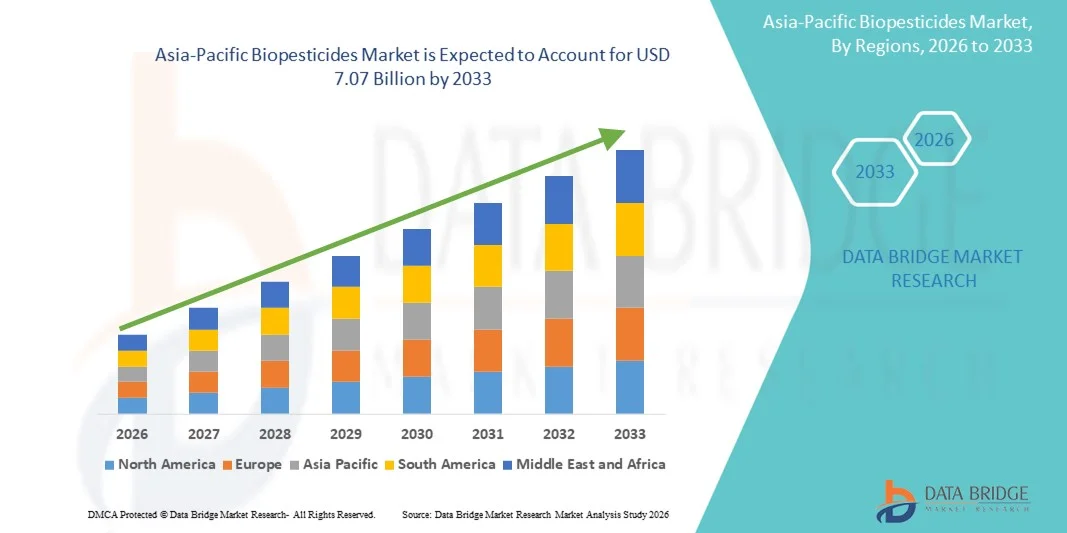

- The Asia-Pacific biopesticides market size was valued at USD 2.11 billion in 2025 and is expected to reach USD 7.07 billion by 2033, at a CAGR of 5.1% during the forecast period

- The demand for biopesticides is increasing due to its potential applications. Biopesticides offer various advantages such as helps reducing the environmental pollution, soil contamination and also reduces the toxic traces from the food chain

- Biopesticides decompose easily in comparison to chemical pesticides and also helps in increasing the yield of the crop. Biopesticides are often used as the component of integrated pest management (IPM) programs to get the most efficient results

What are the Major Takeaways of Biopesticides Market?

- Rise in number of funding for biopesticides products to support sustainable farming is expected to drive the biopesticides market. Stringent regulations on biopesticides are expected to restrict the growth of the biopesticides market

- Rise in environmental pollution caused by chemical pesticides is expected to open the growth opportunity for the biopesticides market. High prices of biopesticides are expected to challenge the growth of the biopesticides market

- In China, the biopesticides market dominated the Asia-Pacific region with an estimated 38.7% revenue share in 2025, driven by rapid industrialization, large-scale automotive and machinery manufacturing, and increasing adoption in construction, renewable energy, and heavy equipment sectors

- In India, the market is projected to register the fastest CAGR of 8.1% from 2026 to 2033, supported by rising adoption in automotive, construction, renewable energy, and industrial machinery applications

- The Biofungicides segment dominated the market with a 38.7% share in 2025, driven by its extensive use in controlling fungal diseases across fruits, vegetables, cereals, and high-value crops

Report Scope and Biopesticides Market Segmentation

|

Attributes |

Biopesticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Biopesticides Market?

Rising Adoption of Sustainable, Eco-Friendly, and Targeted Biopesticides

- The biopesticides market is witnessing increased demand for environmentally safe, biodegradable, and crop-specific pest control solutions across agriculture, horticulture, and greenhouse sectors

- Manufacturers are developing microbial, botanical, and biochemical-based formulations to enhance efficacy, reduce chemical residues, and improve soil and plant health

- Emphasis on regulatory compliance, reduced environmental impact, and organic farming certifications is driving adoption among large-scale and smallholder farmers

- For instance, companies such as Syngenta, Koppert, Andermatt Biocontrol, Bayer, and Marrone Bio Innovations are expanding their portfolios with microbial biofungicides, bioinsecticides, and RNAi-based pest control products

- Growing use of biopesticides in fruits, vegetables, cereals, and specialty crops is sustaining market expansion

- As agriculture increasingly focuses on sustainability, reduced chemical dependency, and precision crop protection, biopesticides are expected to remain vital for next-generation farming solutions

What are the Key Drivers of Biopesticides Market?

- Rising demand for residue-free, environmentally friendly, and effective pest management solutions is significantly boosting biopesticides adoption across global agriculture

- For instance, during 2024–2025, Bayer, Syngenta, Koppert, Andermatt Biocontrol, and Marrone Bio Innovations launched microbial, botanical, and RNAi-based products designed for high efficacy, crop specificity, and reduced environmental impact

- Increasing adoption of organic farming, sustainable agriculture initiatives, and integrated pest management (IPM) strategies is driving demand

- Advances in microbial strain development, formulation technology, and delivery mechanisms are improving effectiveness, shelf life, and ease of application

- Government incentives, subsidies, and favorable regulations for eco-friendly crop protection solutions are promoting biopesticide usage over chemical pesticides

- Supported by growing global awareness of sustainable agriculture and food safety concerns, the Biopesticides market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Biopesticides Market?

- Higher costs of microbial or botanical formulations compared to synthetic pesticides limit adoption in price-sensitive markets

- Limited awareness, technical expertise, and availability of biopesticides in developing regions slows market penetration

- Performance variability under extreme weather, pest pressure, or crop-specific conditions may restrict application in certain agricultural setups

- Regulatory hurdles, complex registration processes, and compliance requirements can delay product launches and adoption

- Competition from low-cost chemical pesticides and conventional crop protection methods exerts pricing pressure and reduces market share

- To overcome these challenges, companies are focusing on cost-effective formulations, farmer education, demonstration trials, and region-specific products to drive broader adoption of Biopesticides

How is the Biopesticides Market Segmented?

The market is segmented on the basis of type, source, form, application, category, and crops.

- By Type

The market is segmented into Bioinsecticides, Biofungicides, Bionematicides, Bioherbicides, and Others. The Biofungicides segment dominated the market with a 38.7% share in 2025, driven by its extensive use in controlling fungal diseases across fruits, vegetables, cereals, and high-value crops. Biofungicides enhance crop yield, reduce chemical residues, and improve soil health, making them a preferred choice for sustainable and organic farming practices.

The Bioinsecticides segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for effective pest management solutions in fruits, vegetables, and cash crops, along with increasing adoption of integrated pest management (IPM) strategies worldwide.

- By Source

The market is segmented into Microbials, Biochemical, and Insects. The Microbials segment dominated with 42.1% share in 2025 due to high efficacy against pathogens and pests, versatility across crops, and compatibility with organic farming.

The Biochemical segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by advancements in pheromones, plant extracts, and bio-stimulants that offer targeted pest control with minimal environmental impact.

- By Form

Based on form, the market is segmented into Dry and Liquid. The Liquid segment dominated with a 55.4% share in 2025, attributed to ease of application, uniform coverage, and compatibility with modern spraying and fertigation systems.

The Dry segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of granules and powders for soil treatment, seed coating, and long-term shelf stability in diverse climatic conditions.

- By Application

The market is segmented into Foliar Application, Fertigation, Soil Treatment, Seed Treatment, and Others. Foliar Application dominated with 37.6% share in 2025 due to its effectiveness in rapid disease and pest control across high-value crops, vegetables, and fruits.

Seed Treatment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising focus on preventive crop protection, early-stage pest and pathogen control, and enhanced germination rates.

- By Category

On the basis of category, the market is segmented into Agriculture and Horticulture. The Agriculture segment dominated with a 63.2% share in 2025, driven by extensive use across cereals, grains, oilseeds, and large-scale crop cultivation.

The Horticulture segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing adoption of biopesticides in fruits, vegetables, ornamental plants, and greenhouse operations seeking sustainable, high-quality production.

- By Crops

The market is segmented into Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Turf & Ornamentals, and Other Crops. Fruits & Vegetables dominated with a 40.8% share in 2025 due to high pest pressure, regulatory restrictions on chemical pesticides, and the need for residue-free produce.

Oilseeds & Pulses are projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising global demand, adoption of sustainable farming practices, and increasing awareness of biopesticides’ role in improving crop yield and soil health.

Which Region Holds the Largest Share of the Biopesticides Market?

- In China, the biopesticides market dominated the Asia-Pacific region with an estimated 38.7% revenue share in 2025, driven by rapid industrialization, large-scale automotive and machinery manufacturing, and increasing adoption in construction, renewable energy, and heavy equipment sectors

- Rising demand for lightweight, durable, and maintenance-free Biopesticides for high-load applications reinforces the country’s market leadership

- Strong OEM collaborations, advanced manufacturing capabilities, and continuous R&D investments further strengthen long-term market growth, making China a central hub for Biopesticides adoption in Asia-Pacific

Japan Biopesticides Market Insight

In Japan, growth is fueled by advanced automotive, aerospace, and industrial machinery sectors. Biopesticides are widely applied in robotics, wind turbines, and precision equipment due to their low friction, high wear resistance, and maintenance-free performance. Focus on energy-efficient, lightweight solutions and strong domestic manufacturing and OEM partnerships ensures steady adoption and long-term market expansion in high-precision industrial applications.

India Biopesticides Market Insight

In India, the market is projected to register the fastest CAGR of 8.1% from 2026 to 2033, supported by rising adoption in automotive, construction, renewable energy, and industrial machinery applications. Expanding manufacturing hubs, increasing EV adoption, and government-backed industrial modernization programs drive demand for fiber and metal matrix composite Biopesticides. Focus on energy efficiency, precision casting, and sustainable production accelerates regional market penetration.

South Korea Biopesticides Market Insight

In South Korea, growth is supported by automotive, electronics, and industrial equipment sectors, where Biopesticides are preferred for high-load, low-maintenance, and wear-resistant operations. Increasing deployment in EV components, robotics, and renewable energy installations accelerates adoption. Strong OEM partnerships, technological innovation, and R&D investments reinforce the country’s competitive position in the Asia-Pacific market.

Australia Biopesticides Market Insight

In Australia, steady growth is driven by construction, mining, and renewable energy sectors. Biopesticides are increasingly used in heavy machinery, industrial equipment, and wind turbines to enhance durability, load performance, and service life. Government-supported industrial upgrades, infrastructure development, and renewable energy initiatives encourage adoption, while expanding local manufacturing and industrial exports support long-term market expansion in the region.

Which are the Top Companies in Biopesticides Market?

The biopesticides industry is primarily led by well-established companies, including:

- Syngenta Crop Protection AG (Switzerland)

- Bionema (U.K.)

- Vegalab SA (Switzerland)

- STK bio-ag technologies (India)

- Andermatt Biocontrol AG (Switzerland)

- Koppert Biological Systems (Netherlands)

- Corteva (U.S.)

- Bayer AG (Germany)

- Biobest Group NV (Belgium)

- Certis USA L.L.C. (U.S.)

- Valent BioSciences LLC (U.S.)

- Novozymes (Denmark)

- BASF SE (Germany)

- IPL Biologicals Limited (India)

- Terramera Inc. (Canada)

- Khandelwal Bio Fertilizer (India)

- Isagro (Italy)

- Gowan Company (U.S.)

- Parry America, Inc. (U.S.)

- Barrix Agro Sciences Pvt Ltd (India)

- BioWorks Inc. (U.S.)

- Marrone Bio Innovations (U.S.)

- FMC Corporation (U.S.)

- UPL (India)

- Nufarm (Australia)

- Bioline AgriSciences Ltd (Canada)

- Biofa GmbH (Germany)

- BioConsortia, Inc. (U.S.)

- McLaughlin Gormley King Company (U.S.)

- W. Neudorff GmbH KG (Germany)

What are the Recent Developments in Global Biopesticides Market?

- In May 2024, Bioceres Crop Solutions Corp announced that Brazil's Ministry of Agriculture and Livestock (MAPA - Ministério da Agricultura e Pecuária) approved three new bio-insecticidal and bio-nematocidal solutions derived from inactivated cells of the company’s proprietary Burkholderia platform, strengthening the company’s sustainable crop protection offerings and expanding adoption across Brazil

- In May 2024, FMC Corporation signed an agreement with Optibrium to accelerate the discovery of novel crop protection technologies, including biopesticides leveraging ML and AI, aimed at enhancing research efficiency and innovation in sustainable agriculture

- In April 2024, Bayer signed an agreement with UK-based AlphaBio Control on a new biological insecticide, marking the first of its kind for arable crops such as oilseed, rapeseed, and cereals, which strengthens Bayer’s product portfolio and promotes sustainable crop protection solutions

- In March 2024, BASF invested in a new fermentation plant at its Ludwigshafen site to produce biological and biotechnology-based crop protection products, including fungicides and seed treatments, scheduled to begin operations in the second half of 2025, supporting farmers with advanced biopesticide solutions

- In December 2023, Syngenta introduced CERTANO, its first biological product for sugarcane production, which acts as a microbiological bionematicide and biofungicide with immediate and long-lasting action, enhancing plant growth and offering sustainable protection for sugarcane crops

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。