Asia

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

9.03 Billion

2024

2032

USD

4.80 Billion

USD

9.03 Billion

2024

2032

| 2025 –2032 | |

| USD 4.80 Billion | |

| USD 9.03 Billion | |

|

|

|

|

Asia-Pacific Biosurgery Market Segmentation, By Product (Bone-Graft Substitutes, Soft-Tissue Attachments, Haemostatic Agents, Surgical Sealants and Adhesives, Adhesion Barriers and Staple-Line Reinforcement Agents), Application (General Surgery, Cardiovascular Surgery, Orthopaedic Surgery, Neurological Surgery, Reconstructive Surgery, Gynaecological Surgery, Thoracic Surgery and Urological Surgery) - Industry Trends and Forecast to 2032

Asia-Pacific Biosurgery Market Size

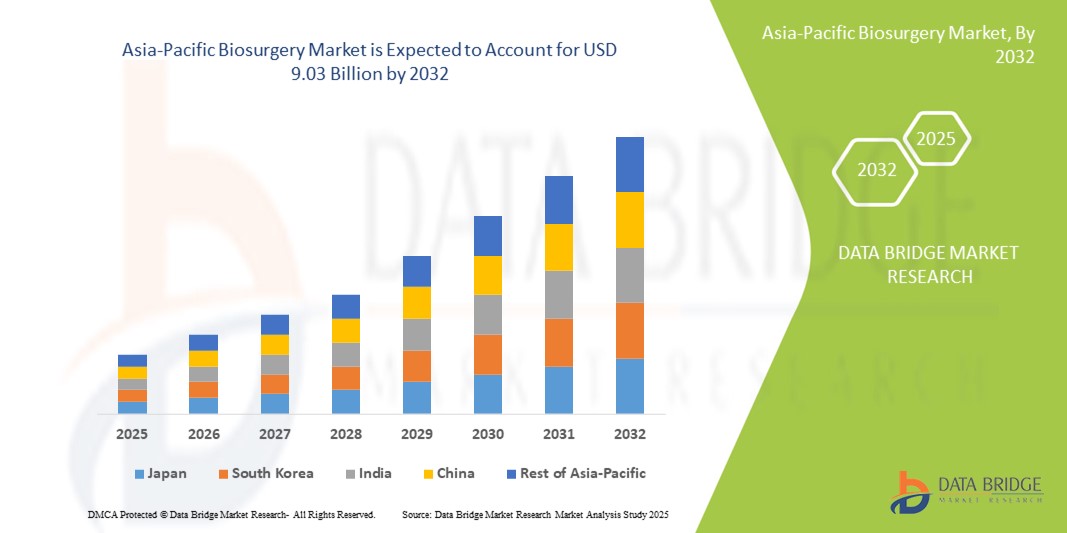

- The Asia-Pacific biosurgery market size was valued at USD 4.80 billion in 2024 and is expected to reach USD 9.03 billion by 2032, at a CAGR of 8.23% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced surgical procedures, rising prevalence of chronic diseases, and growing investments in healthcare infrastructure across the region, fostering higher utilization of biosurgical products

- Furthermore, escalating demand for minimally invasive surgeries, enhanced patient safety, and faster recovery times is positioning biosurgery solutions as a preferred choice among healthcare providers. These converging factors are accelerating the adoption of biosurgical products, thereby significantly boosting the industry’s growth

Asia-Pacific Biosurgery Market Analysis

- Biosurgery, encompassing advanced surgical products such as hemostats, sealants, and tissue adhesives, is becoming an essential component of modern surgical procedures in both hospitals and specialty clinics due to improved patient outcomes, reduced complications, and enhanced recovery times

- The escalating demand for biosurgery products is primarily driven by the rising prevalence of chronic diseases, increasing number of surgical procedures, and growing adoption of minimally invasive and technologically advanced surgeries

- Japan dominated the Asia-Pacific biosurgery market with the largest revenue share of 33.3% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key industry players, with significant uptake of biosurgical solutions in cardiovascular, orthopedic, and general surgeries

- China is expected to be the fastest growing country in the Asia-Pacific biosurgery market during the forecast period due to expanding healthcare infrastructure, increasing surgical volumes, and rising awareness about advanced surgical solutions

- Haemostatic Agents segment dominated the biosurgery market with a market share of 42.2% in 2024, driven by their critical role in controlling bleeding, ease of use, and broad applicability across multiple surgical specialties

Report Scope and Asia-Pacific Biosurgery Market Segmentation

|

Attributes |

Asia-Pacific Biosurgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Biosurgery Market Trends

Advancements in Minimally Invasive and AI-Assisted Surgical Solutions

- A significant and accelerating trend in the Asia-Pacific biosurgery market is the growing adoption of minimally invasive surgical procedures combined with AI-assisted surgical planning and robotic support systems. These technologies are enhancing surgical precision, reducing patient recovery times, and improving overall procedural outcomes

- For instance, advanced hemostats and tissue sealants are increasingly being used in laparoscopic and robotic-assisted surgeries, allowing surgeons to control bleeding more effectively and reduce post-operative complications. Companies such as Baxter and Johnson & Johnson are introducing AI-enabled surgical tools that optimize product usage and assist in procedural decision-making

- AI integration in biosurgical products enables predictive analytics for patient-specific risks, improved product selection during surgeries, and real-time monitoring of surgical outcomes. For instance, some robotic surgery platforms provide insights into optimal hemostat or sealant application, minimizing errors and improving recovery trajectories

- The integration of biosurgical products with broader hospital digital systems facilitates better inventory management, procedure tracking, and post-operative care coordination. Through centralized platforms, hospitals can streamline surgical workflows, enhance efficiency, and reduce wastage of expensive biosurgical materials

- This trend towards more intelligent, precise, and digitally connected surgical solutions is fundamentally reshaping expectations in operating rooms across the Asia-Pacific region. Consequently, companies are developing AI-enabled biosurgical products and smart delivery systems to meet the rising demand for technologically advanced surgical care

- The demand for biosurgery products that support minimally invasive procedures, enhanced surgical safety, and integration with digital surgical ecosystems is growing rapidly across both high-volume hospitals and specialty surgical centers, as healthcare providers increasingly prioritize efficiency, patient outcomes, and cost-effective solutions

Asia-Pacific Biosurgery Market Dynamics

Driver

Rising Surgical Volumes and Chronic Disease Prevalence

- The increasing number of surgical procedures and rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer are significant drivers for the heightened demand for biosurgery products in the Asia-Pacific region

- For instance, in 2024, Johnson & Johnson Medical Devices reported expanding adoption of advanced hemostats and sealants in hospitals across China and India, driven by growing surgical volumes and awareness of better post-operative outcomes

- As hospitals seek to improve patient safety, reduce complications, and shorten hospital stays, biosurgery products offer critical advantages such as faster hemostasis, reduced tissue trauma, and enhanced wound closure

- Furthermore, the increasing adoption of minimally invasive surgeries and advanced surgical techniques is making biosurgery products integral to modern surgical workflows, ensuring higher efficiency and better clinical outcomes

- Rising healthcare expenditure, expanding hospital infrastructure, and the growing preference for technologically advanced surgical solutions are key factors propelling biosurgery adoption in the region

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high costs of advanced biosurgery products, including hemostats, sealants, and tissue adhesives, remain a challenge, particularly for hospitals in developing Asia-Pacific countries with budget constraints. While basic products are widely used, premium, AI-enabled, or robotic-compatible solutions often carry a significant price premium

- Regulatory approval processes and varying standards across countries such as Japan, India, and China can delay product launches, making market entry more complex and time-consuming

- Companies must also ensure compliance with strict clinical safety and quality standards, which can increase R&D and operational costs. For example, rigorous testing requirements for tissue sealants and adhesives can extend time-to-market

- Overcoming these challenges through cost optimization, streamlined regulatory strategies, and localized manufacturing is crucial for sustained growth in the Asia-Pacific biosurgery market

- Increased awareness among hospitals regarding long-term clinical and economic benefits, combined with government support for healthcare infrastructure, is expected to gradually mitigate these restraints over the forecast period

Asia-Pacific Biosurgery Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the Asia-Pacific biosurgery market is segmented into bone-graft substitutes, soft-tissue attachments, hemostatic agents, surgical sealants and adhesives, adhesion barriers, and staple-line reinforcement agents. Hemostatic Agents dominated the market with the largest revenue share of 42.2% in 2024, driven by their essential role in controlling bleeding during various surgical procedures. These agents are widely used across cardiovascular, orthopedic, and general surgeries due to their proven efficacy in reducing intraoperative blood loss. The established clinical acceptance, ease of use, and broad applicability of hemostats make them a preferred choice among surgeons and hospitals. In addition, the increasing number of surgical procedures and rising focus on minimizing post-operative complications support the high adoption of hemostatic products. Hospitals also benefit from reduced surgical time and lower risk of transfusions, enhancing patient outcomes and operational efficiency. Key players are continually innovating with advanced hemostatic formulations that improve handling, speed of action, and compatibility with minimally invasive surgeries.

Surgical Sealants and Adhesives are anticipated to witness the fastest growth during 2025–2032, fueled by the rising demand for minimally invasive surgeries and enhanced wound closure solutions. These products help reduce post-operative complications, surgical site infections, and leakage in cardiovascular and gastrointestinal procedures. The adoption of advanced tissue adhesives is particularly high in reconstructive and thoracic surgeries where precise tissue approximation is critical. Technological advancements, including AI-assisted application systems and bioactive sealants, are further boosting growth. The increasing preference for products that accelerate recovery, shorten hospital stays, and improve patient comfort is driving adoption across hospitals and surgical centers. In addition, regulatory approvals and awareness campaigns in emerging Asia-Pacific countries such as China and India are expanding their market potential.

- By Application

On the basis of application, the Asia-Pacific biosurgery market is segmented into general surgery, cardiovascular surgery, orthopedic surgery, neurological surgery, reconstructive surgery, gynecological surgery, thoracic surgery, and urological surgery. Orthopedic Surgery dominated the market with the largest revenue share in 2024, driven by the rising prevalence of musculoskeletal disorders, trauma cases, and orthopedic interventions. Bone-graft substitutes and soft-tissue attachments are extensively used in spinal fusion, joint replacement, and fracture repair procedures, contributing to high product utilization. Advanced biosurgical products enhance patient recovery, reduce surgical complications, and improve structural outcomes, making them indispensable in orthopedic procedures. In addition, growing geriatric populations in countries such as Japan and South Korea are increasing surgical demand, further boosting the orthopedic biosurgery segment. Hospitals and surgical centers prioritize biosurgery solutions to ensure faster healing and lower revision surgery rates.

Cardiovascular Surgery is expected to witness the fastest growth from 2025 to 2032, owing to rising cases of cardiovascular diseases and the adoption of minimally invasive procedures. Hemostatic agents, surgical sealants, and adhesives are critical for controlling bleeding, sealing vascular grafts, and preventing post-operative leaks. Technological advancements such as bioactive sealants and AI-assisted surgical tools are enhancing precision and safety in cardiac procedures. Increasing investments in healthcare infrastructure in China, India, and Southeast Asian countries are driving higher procedure volumes, while awareness of improved patient outcomes encourages adoption among leading cardiac centers. Furthermore, the expansion of specialized cardiovascular hospitals and centers of excellence is expected to accelerate growth in this segment.

Asia-Pacific Biosurgery Market Regional Analysis

- Japan dominated the Asia-Pacific biosurgery market with the largest revenue share of 33.3% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key industry players, with significant uptake of biosurgical solutions in cardiovascular, orthopedic, and general surgeries

- Hospitals and surgical centers in the region prioritize technologically advanced biosurgical products such as hemostats, surgical sealants, and tissue adhesives to improve patient outcomes and reduce post-operative complications

- The widespread adoption of minimally invasive surgeries, coupled with growing awareness of the clinical benefits of biosurgery products, supports strong market penetration in Japan. Increasing geriatric population and high prevalence of chronic diseases further fuel the demand for biosurgical solutions in cardiovascular, orthopedic, and general surgeries

The Japan Biosurgery Market Insight

The Japan biosurgery market dominated the Asia-Pacific region in 2024, capturing the largest revenue share due to its advanced healthcare infrastructure, high surgical volumes, and strong emphasis on innovative surgical solutions. Hospitals extensively adopt hemostats, surgical sealants, and tissue adhesives to improve patient safety, minimize post-operative complications, and support minimally invasive procedures. Integration of biosurgical products with digital surgical systems and robotic platforms is accelerating efficiency and precision in operations. The aging population is driving demand for safer and easier-to-use surgical solutions in both residential hospitals and private healthcare settings. In addition, Japan’s focus on R&D and collaborations between hospitals and medical device companies ensures access to cutting-edge biosurgery technologies. Government support for healthcare innovation and digitalization further reinforces the market’s leadership position in the region.

China Biosurgery Market Insight

The China biosurgery market is expected to witness the fastest growth during the forecast period due to rising surgical volumes, expanding hospital infrastructure, and increasing prevalence of chronic diseases. Adoption of hemostats, sealants, and adhesives is accelerating across cardiovascular, orthopedic, and general surgeries. Government initiatives promoting digital healthcare and minimally invasive surgeries are boosting awareness and usage. Partnerships between global medical device companies and local manufacturers are improving affordability and accessibility. In addition, rising awareness among clinicians and patients about improved outcomes with advanced biosurgical solutions is driving rapid adoption.

India Biosurgery Market Insight

The India biosurgery market is growing steadily, fueled by expanding healthcare infrastructure, rising surgical volumes, and increasing awareness of advanced surgical care. Hemostats, sealants, and adhesives are increasingly adopted in hospitals across metropolitan and semi-urban regions. Government initiatives promoting smart hospitals and healthcare accessibility accelerate product adoption. Local manufacturers offering cost-effective solutions, combined with rising demand for minimally invasive surgeries, further support market growth.

South Korea Biosurgery Market Insight

The South Korea biosurgery market is expected to grow steadily due to rising adoption of minimally invasive surgeries, advanced hospital infrastructure, and a focus on high-quality patient care. Surgical products such as hemostats, adhesives, and sealants are being integrated into cardiovascular, orthopedic, and reconstructive procedures. Government initiatives encouraging digital health solutions and hospital modernization are further driving demand. In addition, South Korea’s technologically advanced hospitals and active R&D in surgical innovations are supporting faster uptake of biosurgical solutions

Asia-Pacific Biosurgery Market Share

The Asia-Pacific Biosurgery industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Olympus Corporation (Japan)

- Johnson & Johnson Medical Devices (U.S.)

- Baxter (U.S.)

- CryoLife (U.S.)

- Kuros Biosciences AG (Switzerland)

- KCI Medical (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Smith & Nephew (U.K.)

- Mölnlycke Health Care AB (Sweden)

- ConvaTec Group Plc (U.K.)

- Hollister Incorporated (U.S.)

- Hernia Repair Solutions (U.S.)

- Aroa Biosurgery Limited (New Zealand)

- Terumo Asia Holdings Pte. Ltd. (Singapore)

- PHC Holdings Corporation (Japan)

- Meril Life Sciences Pvt. Ltd. (India)

What are the Recent Developments in Asia-Pacific Biosurgery Market?

- In June 2025, Covestro, a world-leading polymer company, announced the launch of localized production of its new Desmopan® Rx medical-grade Thermoplastic Polyurethane (TPU) at its Changhua site in Taiwan. This development is significant as it enables a more flexible and efficient regional supply of high-quality materials for medical devices, such as surgical tubing and endoscopes, directly in the Asia-Pacific region

- In March 2025, SS Innovations unveiled its SSI MantraM Mobile Tele-Surgical Unit in India. This groundbreaking mobile unit is the first of its kind, integrating the SSi Mantra 3 Surgical Robotic System with high-speed connectivity to enable real-time remote surgical assistance and procedures. The system has regulatory approval from the Central Drugs Standard Control Organization (CDSCO) for telesurgery and tele-proctoring, positioning India at the forefront of remote healthcare innovation and expanding access to advanced surgical care in underserved areas

- In April 2023, Aroa Biosurgery, a New Zealand-based soft-tissue regeneration company, secured U.S. FDA 510(k) clearance for its Enivo™ system. This innovative system is designed to manage "dead space" in surgical wounds, particularly after procedures such as mastectomies. The clearance is a key development, allowing Aroa to expand its portfolio and enter the U.S. market, which has a ripple effect on its global strategy, including in the Asia-Pacific

- In February 2022, Gunze Limited, a leading Japanese medical device company, received medical device approval to manufacture and sell TENALEAF™, a new sheet-type absorbable adhesion barrier. This is the first of its kind to be made in Japan and provides surgeons with a new option for preventing post-operative adhesions in both open and minimally invasive surgeries. This development highlights the focus on localized innovation to meet the specific needs of the regional market

- In April 2021, Aroa Biosurgery launched Myriad Morcells™, a new product that received U.S. FDA 510(k) clearance. Myriad Morcells™ is a conformable powder format of Myriad Matrix™ that is designed to optimize contact with irregular wound beds. This product launch expanded Aroa's offerings in the soft tissue repair and reconstruction space, providing surgeons with a new tool to address complex wounds and further cementing the company's position in the market

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。