Asia

Market Size in USD Billion

CAGR :

%

USD

583.99 Million

USD

995.92 Million

2025

2033

USD

583.99 Million

USD

995.92 Million

2025

2033

| 2026 –2033 | |

| USD 583.99 Million | |

| USD 995.92 Million | |

|

|

|

|

Asia Pacific Endoscopic Retrograde Cholangiopancreatography Devices Market Segmentation, By Product Type (Endotherapy Devices, Endoscopes, Imaging Devices, and Others), Modality (Single Use, Standalone, Handheld), Procedure (Biliary Sphicterectomy, Biliary Stenting, Biliary Dilation, Pancreatic Duct Stenting, Pancreatic Sphicterectomy), Application (Bile Duct, Pancreas, Gall Bladder, Liver and Others), End User(Hospitals, Ambulatory Surgical Center, Diagnostic Laboratories and Others), Facility Type (Large, Medium and Small), Distribution Channel (Direct Tenders, Third Party Distribution, and Retail Sales) - Industry Trends and Forecast to 2033

Endoscopic Retrograde Cholangiopancreatography Devices Market Size

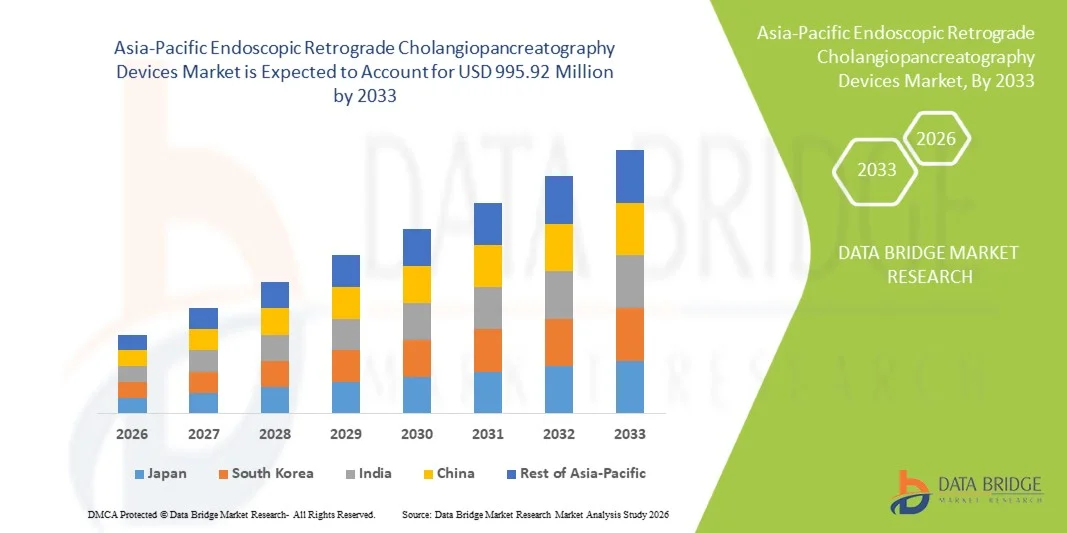

- The Asia-Pacific endoscopic retrograde cholangiopancreatography devices market size was valued at USD 583.99 Million in 2025 and is expected to reach USD 995.92 Million by 2033, at a CAGR of6.90% during the forecast period

- The market growth is largely fueled by the rising prevalence of gastrointestinal and pancreatic disorders, along with continuous technological advancements in endoscopic imaging and minimally invasive treatment techniques, leading to increased adoption of ERCP procedures across hospitals and specialty clinics

- Furthermore, growing demand for accurate diagnosis, reduced patient recovery time, and improved therapeutic outcomes is establishing Endoscopic Retrograde Cholangiopancreatography (ERCP) devices as a critical solution in modern gastroenterology care, thereby significantly boosting the industry's growth

Endoscopic Retrograde Cholangiopancreatography Devices Market Analysis

- Endoscopic Retrograde Cholangiopancreatography (ERCP) devices, used for the diagnosis and treatment of biliary and pancreatic duct disorders, are critical tools in modern gastroenterology due to their minimally invasive nature, high procedural accuracy, and ability to combine diagnostic imaging with therapeutic intervention in a single procedure

- The growing demand for ERCP devices is primarily driven by the rising prevalence of gallstones, biliary strictures, pancreatic cancer, and chronic pancreatitis, along with increasing adoption of minimally invasive endoscopic procedures, advancements in endoscopic imaging technologies, and expanding access to specialized gastrointestinal care

- China dominated the ERCP devices market with an estimated revenue share of approximately 38.5% in 2025, supported by a large patient pool with gastrointestinal disorders, rapid expansion of hospital infrastructure, increasing adoption of advanced endoscopic technologies, strong domestic manufacturing capabilities, and rising healthcare expenditure across public and private sectors

- India is expected to be the fastest-growing country in the ERCP devices market during the forecast period, driven by improving access to advanced gastrointestinal procedures, rapid growth of tertiary and specialty hospitals, increasing medical tourism, rising awareness of minimally invasive endoscopic treatments, and supportive government initiatives to strengthen healthcare infrastructure

- The large facilities segment accounted for the largest market revenue share of 47.2% in 2025, driven by high patient volumes and advanced procedural capabilities

Report Scope and Endoscopic Retrograde Cholangiopancreatography Devices Market Segmentation

|

Attributes |

Endoscopic Retrograde Cholangiopancreatography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Endoscopic Retrograde Cholangiopancreatography Devices Market Trends

“Advancements in Device Design and Procedural Efficiency”

- A key and steadily evolving trend in the Asia-Pacific endoscopic retrograde cholangiopancreatography (ERCP) Devices market is the continuous advancement in device design aimed at improving procedural efficiency, clinical precision, and patient safety. Manufacturers are increasingly focusing on enhancing the ergonomics, flexibility, and imaging capabilities of ERCP devices to support complex biliary and pancreatic interventions

- For instance, leading companies such as Olympus Corporation and Boston Scientific have introduced advanced ERCP endoscopes and accessories with improved maneuverability and high-definition visualization, enabling gastroenterologists to perform intricate diagnostic and therapeutic procedures with greater accuracy and reduced procedure time. These innovations support effective stone removal, stent placement, and bile duct visualization during ERCP procedures

- Technological improvements in guidewires, sphincterotomes, balloons, and stents are enhancing procedural success rates and reducing complication risks. For example, hydrophilic-coated guidewires and precision-controlled sphincterotomes allow smoother navigation through complex biliary anatomy, minimizing trauma and improving access to targeted ducts

- The integration of advanced imaging technologies, such as enhanced fluoroscopy compatibility and improved endoscope optics, is enabling clearer visualization of the biliary and pancreatic ducts. This facilitates more accurate diagnosis and targeted therapeutic interventions, particularly in cases involving strictures, tumors, or gallstones

- These advancements are reshaping clinical expectations by enabling safer, faster, and more effective ERCP procedures, leading to shorter hospital stays and improved patient outcomes. Consequently, manufacturers are increasingly investing in research and development to introduce next-generation ERCP devices that meet the evolving demands of gastroenterologists and healthcare facilities

- The growing demand for minimally invasive gastrointestinal procedures, coupled with the need for higher procedural success rates, is accelerating the adoption of technologically advanced ERCP devices across hospitals and specialized endoscopy centers worldwide.

Endoscopic Retrograde Cholangiopancreatography Devices Market Dynamics

Driver

“Rising Prevalence of Biliary and Pancreatic Disorders”

- The increasing Asia-Pacific prevalence of biliary and pancreatic disorders, including gallstones, bile duct obstructions, pancreatitis, and cholangiocarcinoma, is a major driver fueling demand for ERCP devices. These conditions often require both diagnostic evaluation and therapeutic intervention, making ERCP a critical procedure in modern gastroenterology

- For instance, the growing incidence of gallstone disease and pancreatic cancer has led to a higher number of ERCP procedures performed annually in hospitals and endoscopy units. According to clinical observations, ERCP is widely used for stone extraction, stent placement, and management of biliary strictures, significantly boosting demand for related devices and accessories

- An aging Asia-Pacific population is further contributing to market growth, as elderly individuals are more prone to gastrointestinal and hepatobiliary disorders that require endoscopic intervention. This demographic shift is increasing the procedural volume of ERCP across both developed and emerging healthcare markets

- In addition, improved access to healthcare services and the expansion of specialized gastroenterology centers are enabling earlier diagnosis and treatment of biliary and pancreatic conditions, further driving adoption of ERCP devices

- The increasing preference for minimally invasive procedures over traditional surgical approaches is also propelling market growth. ERCP offers reduced recovery time, lower complication rates, and shorter hospital stays, making it a preferred option for both patients and clinicians

- Ongoing training programs and skill development initiatives for endoscopists are enhancing procedural expertise, which in turn supports wider utilization of ERCP devices in routine clinical practice across hospitals and ambulatory surgical centers

Restraint/Challenge

“High Procedure Costs and Risk of Procedure-Related Complications”

- The high cost associated with ERCP procedures and related devices presents a significant challenge to market expansion, particularly in cost-sensitive and resource-limited healthcare settings. Advanced ERCP devices, including specialized endoscopes, stents, and accessories, often involve substantial upfront and maintenance costs for healthcare providers

- For instance, hospitals in developing regions may face budget constraints that limit the adoption of advanced ERCP equipment, leading to lower procedural availability despite growing clinical need. The cost burden may also affect patient access in regions with limited insurance coverage or reimbursement support

- Another major restraint is the risk of procedure-related complications, such as post-ERCP pancreatitis, infections, bleeding, and perforation. These risks can lead to clinician hesitancy and cautious patient selection, particularly for high-risk cases

- The requirement for highly skilled and experienced endoscopists further limits widespread adoption, as inadequate expertise can increase complication rates and negatively impact patient outcomes. This creates disparities in ERCP availability between well-equipped tertiary hospitals and smaller healthcare facilities

- Strict regulatory requirements and lengthy approval processes for new ERCP devices can also slow market entry for innovative products, delaying technological adoption and increasing development costs for manufacturers

- Addressing these challenges through improved device safety profiles, enhanced physician training programs, favorable reimbursement policies, and cost-effective product development will be essential for ensuring sustained growth in the Asia-Pacific Endoscopic Retrograde Cholangiopancreatography Devices market

Endoscopic Retrograde Cholangiopancreatography Devices Market Scope

The market is segmented on the basis of product type, modality, procedure, application, end user, facility type, and distribution channel.

• By Product Type

On the basis of product type, the Endoscopic Retrograde Cholangiopancreatography Devices market is segmented into endotherapy devices, endoscopes, imaging devices, and others. The endoscopes segment dominated the market with the largest revenue share of 41.6% in 2025, primarily due to their essential role in ERCP procedures for visualization and access to the biliary and pancreatic ducts. Endoscopes are indispensable in both diagnostic and therapeutic ERCP, making them a core investment for hospitals and specialty clinics. Technological advancements such as high-definition imaging, improved maneuverability, and enhanced durability have further supported widespread adoption. The increasing volume of ERCP procedures globally, especially in developed healthcare systems, continues to drive demand. In addition, the replacement cycle of endoscopes due to wear and stringent infection-control regulations contributes to sustained revenue generation. Strong hospital procurement budgets and rising gastrointestinal disease prevalence further reinforce segment dominance.

The endotherapy devices segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by rising demand for minimally invasive therapeutic interventions during ERCP procedures. These devices, including sphincterotomes, guidewires, and stents, are increasingly used for targeted treatment rather than diagnosis alone. Growing preference for therapeutic ERCP over surgical alternatives is accelerating adoption. Advancements in device precision and material biocompatibility are enhancing clinical outcomes. The rising incidence of biliary and pancreatic disorders globally further supports growth. In addition, expanding applications in complex procedures and increasing physician expertise are expected to fuel strong CAGR during the forecast period.

• By Modality

On the basis of modality, the Endoscopic Retrograde Cholangiopancreatography Devices market is segmented into single use, standalone, and handheld. The standalone segment accounted for the largest market revenue share of 46.3% in 2025, owing to its widespread use in hospital and large clinical settings where integrated ERCP systems are preferred. Standalone systems offer high performance, durability, and compatibility with advanced imaging and accessory devices. These systems are typically used in high-volume centers performing complex ERCP procedures, driving consistent demand. Their reliability and ability to support long procedures make them a preferred choice among gastroenterologists. In addition, strong capital investment by hospitals in developed regions supports segment dominance. The availability of service contracts and long operational life further enhances adoption.

The single-use segment is projected to grow at the fastest CAGR of 9.4% from 2026 to 2033, driven by increasing concerns regarding cross-contamination and hospital-acquired infections. Single-use devices eliminate the need for reprocessing and reduce infection risks, making them attractive in modern healthcare settings. Regulatory emphasis on patient safety and infection prevention is accelerating adoption. Rising acceptance in outpatient and ambulatory centers further boosts growth. Technological improvements have also enhanced the performance of disposable devices. As healthcare facilities focus on safety and compliance, this segment is expected to expand rapidly.

• By Procedure

On the basis of procedure, the Endoscopic Retrograde Cholangiopancreatography Devices market is segmented into biliary sphincterotomy, biliary stenting, biliary dilation, pancreatic duct stenting, and pancreatic sphincterotomy. The biliary stenting segment dominated the market with a revenue share of 38.9% in 2025, supported by the high prevalence of biliary obstructions and strictures worldwide. Biliary stenting is a common therapeutic intervention in ERCP for managing gallstones, tumors, and strictures. The increasing incidence of cholangiocarcinoma and pancreatic cancer has significantly increased procedural volume. Technological advancements in stent materials, including metal and drug-eluting stents, further enhance adoption. Hospitals prefer biliary stenting due to its effectiveness and reduced need for repeat procedures. This widespread clinical application continues to drive segment dominance.

The pancreatic duct stenting segment is expected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rising awareness and diagnosis of pancreatic disorders. Increased use of ERCP for preventing post-procedure pancreatitis is supporting adoption. Growing expertise among clinicians and improved stent designs are enhancing success rates. The rising burden of chronic pancreatitis and pancreatic trauma further contributes to growth. In addition, expanding indications for pancreatic interventions are fueling procedural demand. These factors collectively support strong forecast-period growth.

• By Application

On the basis of application, the Endoscopic Retrograde Cholangiopancreatography Devices market is segmented into bile duct, pancreas, gall bladder, liver, and others. The bile duct segment held the largest market revenue share of 44.8% in 2025, driven by the high prevalence of bile duct stones, strictures, and malignancies. ERCP is most commonly performed for bile duct-related conditions, making this application dominant. Increasing aging population and lifestyle-related disorders further elevate disease incidence. Technological improvements in imaging and therapeutic accessories have enhanced treatment success. Hospitals frequently perform bile duct ERCP procedures, ensuring steady demand. This strong procedural volume continues to support segment leadership.

The pancreas segment is anticipated to grow at the fastest CAGR of 9.1% from 2026 to 2033, driven by increasing diagnosis of pancreatic diseases. Rising cases of pancreatitis and pancreatic cancer are expanding ERCP utilization. Improved diagnostic accuracy and early intervention strategies are also contributing to growth. Increasing physician training and awareness further support adoption. The growing role of ERCP in pancreatic duct management strengthens demand. These factors collectively drive rapid segment expansion.

• By End User

On the basis of end user, the Endoscopic Retrograde Cholangiopancreatography Devices market is segmented into hospitals, ambulatory surgical centers, diagnostic laboratories, and others. The hospitals segment dominated the market with a revenue share of 52.7% in 2025, due to the availability of advanced infrastructure and skilled gastroenterologists. Hospitals handle a high volume of complex ERCP procedures, driving equipment demand. Integrated imaging facilities and post-procedure care capabilities further support dominance. Strong reimbursement frameworks in developed regions also favor hospital-based procedures. In addition, public and private investments in hospital expansion contribute to sustained growth.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 8.5% from 2026 to 2033, driven by the accelerating shift toward outpatient and minimally invasive care models. ASCs provide a cost-effective alternative to hospitals while maintaining high procedural efficiency and patient safety standards. Shorter patient stays and quicker recovery times make ASCs increasingly attractive for ERCP procedures. Advances in endoscopic technology and imaging systems have significantly improved the safety and feasibility of performing ERCP in outpatient settings. Growing pressure on hospitals to reduce inpatient burden is further supporting ASC adoption. Favorable reimbursement structures in several countries are encouraging outpatient procedures. Increasing patient preference for same-day discharge also contributes to growth. Expansion of standalone ASCs in urban and semi-urban regions is widening access. Rising investments by private healthcare providers are strengthening infrastructure. Improved physician expertise in outpatient ERCP procedures further supports growth. Streamlined workflows and lower operational costs enhance ASC competitiveness. Collectively, these factors are expected to sustain strong CAGR during the forecast period.

• By Facility Type

On the basis of facility type, the market is segmented into large, medium, and small facilities. The large facilities segment accounted for the largest market revenue share of 47.2% in 2025, driven by high patient volumes and advanced procedural capabilities. These facilities typically include tertiary-care hospitals and specialty centers that manage complex ERCP cases. Availability of advanced imaging systems, anesthesia support, and post-procedure intensive care strengthens dominance. Large facilities often serve as referral hubs for surrounding regions, increasing procedural throughput. Strong capital investment enables frequent technology upgrades. Presence of highly skilled gastroenterologists and multidisciplinary teams improves clinical outcomes. These facilities are better equipped to handle complications associated with ERCP. Long-term procurement contracts further support revenue stability. High trust among patients also favors large hospitals. Government funding and public healthcare support contribute to sustained demand. Growing prevalence of complex biliary and pancreatic disorders further reinforces dominance. Overall, infrastructure strength and clinical expertise continue to drive leadership.

The medium facilities segment is projected to witness the fastest CAGR of 8.3% from 2026 to 2033, supported by expanding healthcare access in emerging and developing regions. These facilities are increasingly upgrading their endoscopy units to include ERCP capabilities. Rising regional disease burden is prompting investment in mid-sized hospitals. Government initiatives to strengthen secondary healthcare infrastructure are accelerating growth. Medium facilities offer a balance between affordability and advanced care. Improved availability of trained specialists supports procedural expansion. Increasing partnerships with device manufacturers enable technology adoption. Growth of medical tourism in tier-2 cities further supports demand. Shorter waiting times compared to large hospitals attract patients. Expanding insurance coverage improves affordability. Rising private-sector investment also contributes to expansion. These combined factors are expected to drive strong forecast-period growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, third-party distribution, and retail sales. The direct tenders segment dominated the market with a revenue share of 49.5% in 2025, driven by bulk procurement by hospitals, healthcare networks, and government institutions. Direct tendering enables cost optimization through large-volume purchases. Public hospitals frequently rely on tender-based systems for transparency and compliance. Long-term supply agreements ensure uninterrupted device availability. This channel also allows manufacturers to secure stable revenue streams. Standardization of equipment across facilities supports operational efficiency. Strong relationships between suppliers and large buyers reinforce dominance. Tenders often include maintenance and service contracts, enhancing value. High-value capital equipment is commonly procured through this channel. Large healthcare systems prefer direct sourcing to reduce intermediary costs. Regulatory preference for formal procurement processes further supports dominance. As a result, direct tenders continue to lead the market.

The third-party distribution segment is expected to grow at the fastest CAGR of 8.8% from 2026 to 2033, driven by expanding geographic reach and supply chain efficiency. Distributors play a critical role in penetrating emerging and remote markets. Small and medium healthcare facilities often rely on distributors for flexible purchasing options. Distributors offer localized support, training, and after-sales services. Growing private healthcare expansion increases reliance on distributor networks. Improved logistics infrastructure enhances timely product availability. Manufacturers benefit from reduced operational burden through partnerships. Increasing product variety handled by distributors boosts adoption. Faster market entry for new devices supports growth. Rising healthcare spending in developing regions further accelerates demand. Distributor-led promotions and awareness campaigns expand customer base. These factors collectively support rapid CAGR growth.

Endoscopic Retrograde Cholangiopancreatography Devices Market Regional Analysis

- The Asia-Pacific endoscopic retrograde cholangiopancreatography (ERCP) devices market is projected to expand at a strong CAGR throughout the forecast period, driven by a large and growing patient population suffering from gastrointestinal and hepatobiliary disorders, rapid expansion of hospital infrastructure, and increasing healthcare expenditure across both public and private sectors

- The region is witnessing rising adoption of advanced endoscopic technologies as healthcare systems focus on improving diagnostic accuracy and therapeutic outcomes for complex biliary and pancreatic conditions. The increasing prevalence of gallstones, bile duct strictures, pancreatitis, and pancreatic cancers is significantly boosting demand for minimally invasive ERCP procedures across major economies in the region

- Furthermore, growing investments in tertiary and specialty hospitals, improving physician expertise, and rising awareness regarding the clinical advantages of ERCP over conventional surgical interventions are supporting market growth. The expansion of domestic manufacturing capabilities and greater availability of cost-effective ERCP devices are further accelerating market penetration across both urban and semi-urban healthcare centers

China Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

China endoscopic retrograde cholangiopancreatography (ERCP) devices market dominated the ERCP devices market in the Asia-Pacific region with an estimated revenue share of approximately 38.5% in 2025, supported by a large patient pool affected by gastrointestinal disorders and the rapid expansion of hospital infrastructure across the country. The growing burden of digestive diseases, combined with an aging population, is driving higher demand for advanced diagnostic and therapeutic ERCP procedures. The increasing adoption of advanced endoscopic technologies across public and private hospitals is significantly improving procedural efficiency and clinical outcomes. In addition, China’s strong domestic manufacturing capabilities are enhancing the availability and affordability of ERCP devices, including endoscopes, guidewires, stents, and accessory instruments. Rising healthcare expenditure, coupled with government initiatives aimed at strengthening hospital capacity and improving access to advanced medical technologies, continues to reinforce China’s leadership position in the regional ERCP devices market.

India Endoscopic Retrograde Cholangiopancreatography Devices Market Insight

India endoscopic retrograde cholangiopancreatography (ERCP) devices market is expected to be the fastest-growing country in the Asia-Pacific ERCP devices market during the forecast period, driven by improving access to advanced gastrointestinal procedures and the rapid growth of tertiary and specialty hospitals. The rising incidence of gastrointestinal and hepatobiliary disorders, along with increasing awareness of minimally invasive endoscopic treatments, is contributing to higher adoption of ERCP procedures across the country. The expansion of private healthcare facilities, growth in medical tourism, and increasing investments in advanced diagnostic and therapeutic technologies are further accelerating market growth. Supportive government initiatives aimed at strengthening healthcare infrastructure and expanding access to specialized care are enhancing the availability of ERCP services beyond major metropolitan areas. In addition, growing physician training programs and improvements in endoscopy expertise are supporting wider adoption of ERCP devices, positioning India as a key growth engine in the Asia-Pacific market.

Endoscopic Retrograde Cholangiopancreatography Devices Market Share

The Endoscopic Retrograde Cholangiopancreatography Devices industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Olympus Corporation (Japan)

- Cook Medical (U.S.)

- Medtronic plc (Ireland)

- FUJIFILM Holdings Corporation (Japan)

- CONMED Corporation (U.S.)

- STERIS plc (Ireland)

- B. Braun Melsungen AG (Germany)

- Pentax Medical (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Ambu A/S (Denmark)

- Micro-Tech Endoscopy (China)

- Taewoong Medical (South Korea)

- Endo-Flex GmbH (Germany)

- US Endoscopy (U.S.)

Latest Developments in Asia-Pacific Endoscopic Retrograde Cholangiopancreatography Devices Market

- In January 2023, Advantech introduced the MIO-5377R single-board computer for endoscopic systems, designed to enhance performance, reliability and functionality of endoscopic video platforms — technology that can benefit ERCP workflows with improved system stability and imaging fidelity

- In August 2024, PENTAX Medical received U.S. FDA clearance for its DEC Duodenoscope (ED34-i10T2s) with STERRAD 100NX sterilization compatibility, establishing it as the first flexible gastrointestinal endoscope validated for hydrogen peroxide gas plasma sterilization to help mitigate infection risks associated with reusable ERCP instruments

- In September 2024, Ambu A/S gained FDA clearance for its Ambu aScope Duodeno single-use duodenoscope, designed for ERCP procedures to eliminate cross-contamination risks inherent in reusable duodenoscopes and support improved infection control in GI endoscopy units

- In October 2024, FUJIFILM Holdings Corporation launched a strategic collaboration with European hospitals to conduct clinical trials of its new ELUXEO Lite ERCP System, featuring multi-light imaging technology to improve visualization of bile duct lesions during ERCP, reflecting efforts to enhance diagnostic precision and physician usability

- In January 2025, Olympus Corporation introduced its EVIS X1 Duodenoscope with advanced imaging and ergonomic enhancements intended to support complex ERCP procedures, aiming to reduce infection risks and elevate procedural efficiency in therapeutic endoscopy

- In April 2025, Medtronic plc announced plans to expand its ERCP device portfolio by investing in robot-assisted endoscopic platforms, including development work on AI-driven navigation to support real-time imaging and precision during ERCP procedures

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。