アジア太平洋地域の貨物輸送管理市場、輸送モード別(道路、鉄道、海上、航空)、提供内容(ソリューションとサービス)、導入モード(クラウドまたはホスト型およびオンプレミス)、組織規模(大企業および中小企業)、業界別(製造、小売および電子商取引、輸送、日用消費財(FMCG)、ヘルスケア、食品および飲料、石油およびガス、エネルギーおよび公共事業、電子機器、自動車、ITおよび通信、その他)– 2029年までの業界動向と予測。

アジア太平洋地域の貨物輸送管理市場の分析と規模

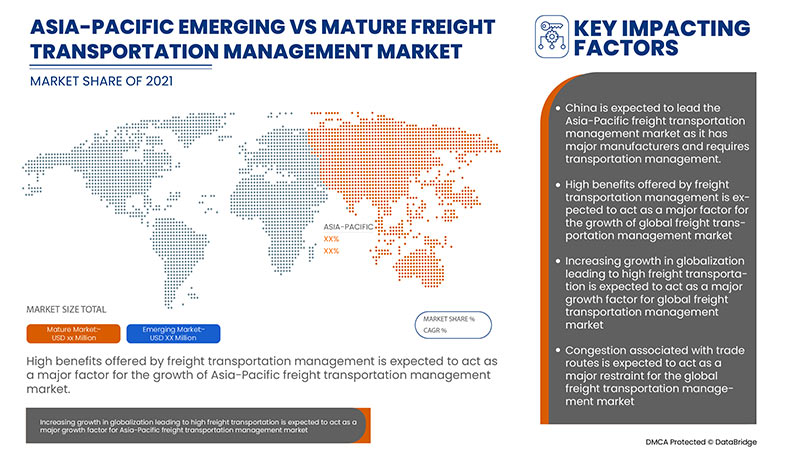

貨物輸送管理には、貨物の効率と商業輸送の効率を高めるためのさまざまな戦略の形成が組み込まれています。貨物輸送管理は、渋滞や汚染の影響などの社会的コストを考慮しながら、荷送人のコストを削減することに重点を置いています。貨物輸送管理によって提供される高いメリットにより、市場での貨物輸送管理ソリューションの需要が高まっています。グローバルな貨物輸送管理市場は、貨物輸送の増加につながるグローバル化の進行により急速に成長しています。企業は、より大きな市場シェアを獲得するために新製品を発売しています。

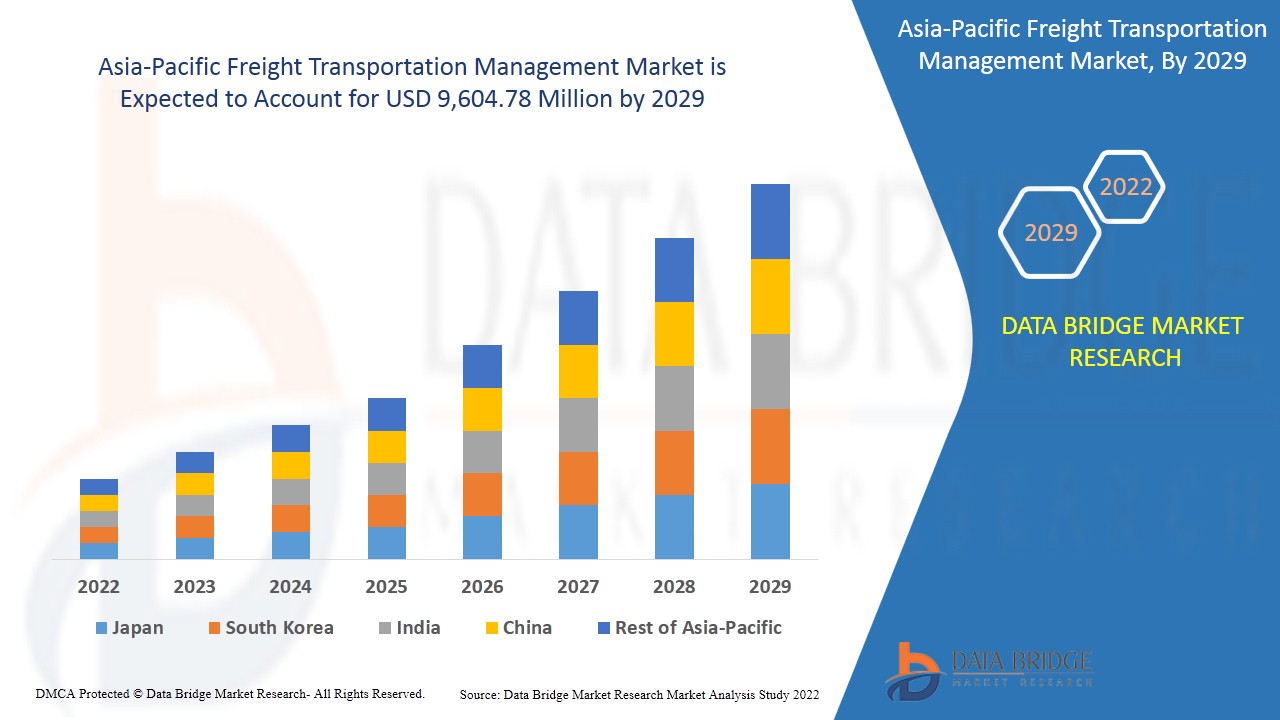

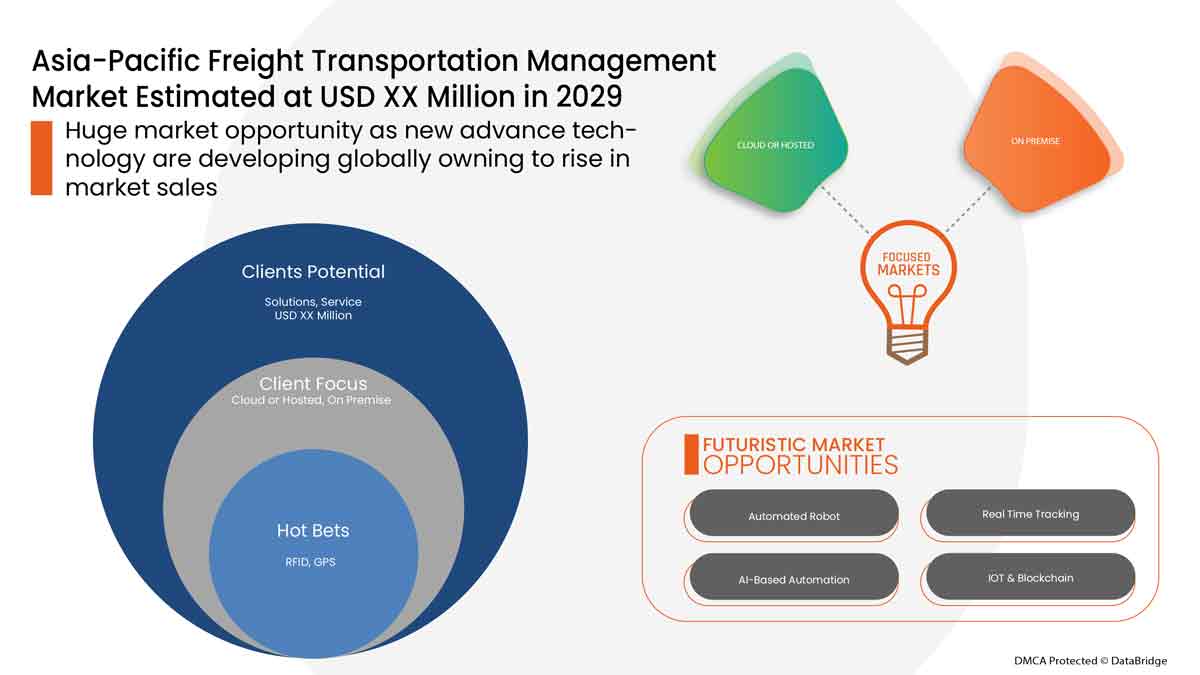

Data Bridge Market Research の分析によると、貨物輸送管理市場は予測期間中に 7.7% の CAGR で成長し、2029 年までに 96 億 478 万米ドルに達する見込みです。「道路」は、資本投資が少なく、ドアツードアの断片化された管理を提供できるため、最も重要な輸送モード セグメントを占めています。貨物輸送管理市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

百万米ドル |

|

対象セグメント |

輸送モード(道路、鉄道、海上、航空)、提供内容(ソリューションとサービス)、導入モード(クラウドまたはホスト型およびオンプレミス)、組織規模(大企業および中小企業)、業界(製造、小売および電子商取引、輸送、日用消費財(FMCG)、ヘルスケア、食品および飲料、石油およびガス、エネルギーおよび公共事業、電子機器、自動車、ITおよび通信、その他)別 |

|

対象国 |

中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域(APAC) |

|

対象となる市場プレーヤー |

CTSI-GLOBAL、GEODIS、THE DESCARTES SYSTEMS GROUP INC、Manhattan Associates、Transplace、Softeon、GlobalTranz、Oracle、SAP SE、Accenture、Blue Yonder Group、Inc.、E2open、LLC.、Trimble Inc.、DSV、Werner Enterprises、Supply Chain Solutions、CH Robinson Worldwide、Inc.、TRANSPOREON GmbH、MercuryGate など |

市場の定義

貨物輸送管理には、貨物の効率と商業輸送の効率を高めるためのさまざまな戦略の形成が組み込まれています。貨物輸送管理は、渋滞や汚染の影響などの社会的コストを考慮しながら、荷送人のコストを削減することに重点を置いています。これは、荷送人が適切な輸送手段を使用するのに役立ちます。たとえば、鉄道と水上輸送は、同じ目的でのトラックの使用と比較して、長距離で非常に効率的です。これは、積載率を高め、貨物車両の走行距離を削減するために、ルーティングとスケジュールを改善するのに役立ちます。これは、各旅行に最適なサイズの車両を使用し、車両の走行距離を削減し、外部コストを削減する方法で車両が運用および保守されるようにする車両管理プログラムの実装に役立ちます。

貨物輸送管理は、道路、鉄道、海上、航空など、さまざまな輸送手段に使用されます。道路経路を介した貨物の移動は、このセグメントで呼ばれます。これは、単一の通関書類プロセスを必要とするため、最も一般的な輸送手段です。鉄道輸送手段は燃料効率が非常に高く、「グリーン」輸送手段と呼ぶことができます。海上輸送は、石炭、農産物、鉄鉱石、および原油やガスなどの湿ったバルク製品などのバルク商品の移動に使用されます。航空輸送は、最も速い輸送手段であり、「ジャストインタイム」(JIT) 在庫補充を実現するために広く使用されています。

貨物輸送管理市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

- 貨物輸送管理によってもたらされる大きなメリット

長年にわたり、非常に効率的なサプライ チェーンを持つことが極めて重要になってきました。この要件を満たすのが貨物輸送管理です。貨物輸送管理システムは、企業が製品をある目的地から別の目的地にコスト効率よく、信頼性が高く、効率的に移動するのに役立ちます。このシステムにより、データの可視性が向上し、より優れた分析が可能になるため、世界の貨物輸送管理市場の成長が促進されます。

- 鉄道貨物輸送の需要増加

鉄道貨物輸送は、陸上での貨物輸送に鉄道を利用します。化学薬品、建設原材料、農業、自動車、エネルギー (石炭、石油、風力タービン)、森林生産物など、さまざまな貨物の輸送に使用されます。鉄道は重い貨物を鉄道で迅速に輸送できます。鉄道は最もよく使用される輸送形態の 1 つであり、世界中に巨大なインフラが構築されています。輸送における鉄道の使用が増えるにつれて、鉄道貨物輸送を管理するための貨物輸送管理の成長が加速します。

- 道路における貨物輸送管理の高利用

デジタル化の進展により、さまざまな産業に変革が起こり、電子商取引が誕生しました。電子商取引の成長により、企業はサプライチェーンを高度に効率化し、輸送時間を短縮し、顧客に遅滞なく製品を提供することが必要になりました。これにより、道路を通じた国内輸送の流れが増加し、多数のトラックが使用されています。道路技術の急速な成長は、世界の貨物輸送管理市場の成長を促進しています。

- 貿易ルートに関連する混雑

道路や水路の交通量と渋滞が増加するにつれて、貨物および輸送サービス事業者は、信頼できるスケジュールを維持することがますます困難になっています。これは、サプライチェーンとトラックに依存するビジネスに影響を与えます。これらは、それぞれ、公共のカバレッジと民間の地域事業者の両方にとってますます重要になっています。さらに、道路でのいくつかの事故や海での油流出は、輸送システムにとって予期しない課題となる可能性があり、システムの管理が困難になります。最近のCOVID-19はまた、いくつかの物流業務を停止させ、サプライチェーン業務全体に深刻な損害を与えています。これらのパラメータは、世界の貨物輸送管理市場の成長に対する大きな制約として機能します。

- 貿易に関する政府の制限と規制

国際貿易では、米中貿易戦争とCOVID-19パンデミックにより、さまざまな制限や規制の変更が見られました。国境を越えた輸送は制限され、コストが増加しますが、これは輸送管理システムでは予測できず、サプライチェーンと在庫の非効率性につながり、世界の貨物輸送管理市場にとって大きな制約となっています。

COVID-19後の貨物輸送管理市場への影響

COVID-19 created a major impact on the freight transportation management market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the freight transportation management market is rising due to the government policies to boost international trade post covid. Also the benefits offered by freight transportation management for optimizing costs and routs is rising the demand for freight transportation management in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the freight transportation management. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Development

- In March 2021, SAP SE announced its partnership with Sedna Systems. Under this partnership, the companies will be integrating SAP TMS with Sedna Systems' team collaboration and e-mail management solution, which can help the customers to gain a whole control over transportation management-related data. Thus with this, the company will be able to solidify its position in the market.

- In February 2022, Oracle announced the introduction of new logistics management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). The company has updated its Oracle Fusion Cloud Transportation Management which can help organizations to reduce costs and risk, improve the customer experience, and become more adaptable to business disruptions. Thus with this, the company will be able to attract more customers in the market.

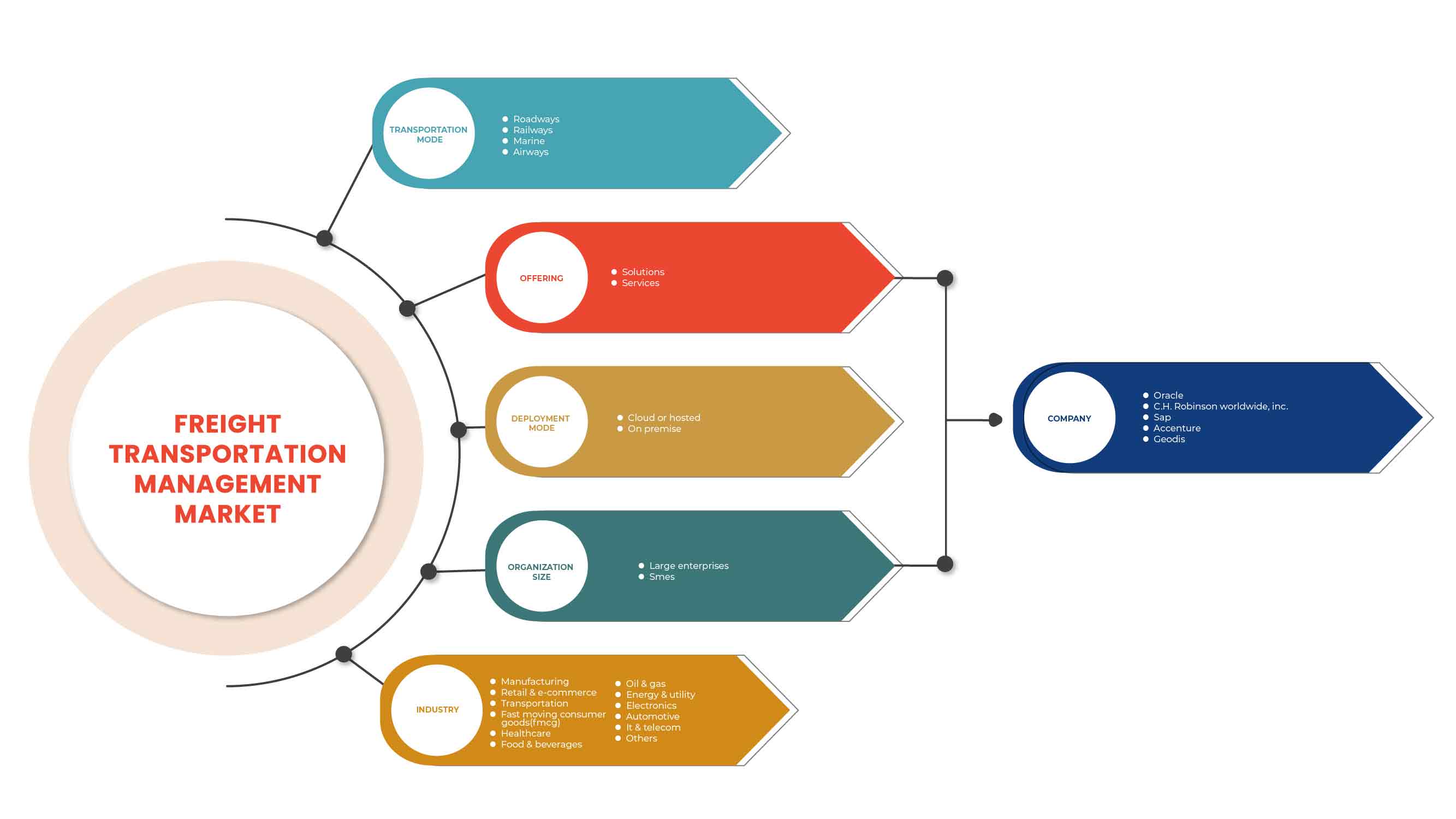

Asia-Pacific Freight Transportation Management Market Scope

The Freight Transportation Management market is segmented on the basis of transportation mode, by offering, by deployment mode, by organization size and by industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Transportation Mode

- Roadways

- Railways

- Marine

- Airways

On the basis of transportation mode, the global freight transportation management market is segmented into Roadways, Railways, Marine and Airways.

By Offering

- Solutions

- Services

On the basis of by offering, the global freight transportation management market has been segmented into solutions and services.

By Deployment Mode

- Cloud or Hosted

- On Premise

On the basis of deployment mode, the global freight transportation management market has been segmented into cloud or hosted and on premise.

By Organization Size

- Large Enterprises

- SMES

On the basis of organization size, the global freight transportation management market has been segmented into large enterprises and SMES.

By Industry

- Manufacturing

- Retail & E-Commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- It & Telecom

- Others

On the basis of industry, the global freight transportation management market has been segmented into manufacturing, retail & e-commerce, transportation, fast moving consumer goods (FMCG), healthcare, food & beverages, oil & gas, energy & utility, electronics, automotive, IT & telecom and others.

Freight Transportation Management Market Regional Analysis/Insights

The freight transportation management market is analysed and market size insights and trends are provided by country, transportation mode, offering, deployment mode, organization size and industry as referenced above.

The countries covered in the freight transportation management market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC).

China dominates the Asia-Pacific freight transportation management market. China is likely to be the fastest-growing Asia-Pacific Freight Transportation Management market. The rising infrastructure, commercial, and industrial developments in emerging countries such as China, Japan, India, and South Korea are credited with the market's dominance. China dominates the Asia-Pacific region due to the high manufacturing and outsourced manufacturing capacities of major companies leading to exports from the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Freight Transportation Management Market Share Analysis

貨物輸送管理市場の競争環境は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、貨物輸送管理市場に関連する会社の焦点にのみ関連しています。

貨物輸送管理市場で活動している主要企業には、CTSI-GLOBAL、GEODIS、THE DESCARTES SYSTEMS GROUP INC、Manhattan Associates、Transplace、Softeon、GlobalTranz、Oracle、SAP SE、Accenture、Blue Yonder Group, Inc.、E2open, LLC、Trimble Inc.、DSV、Werner Enterprises、Supply Chain Solutions、CH Robinson Worldwide, Inc.、TRANSPOREON GmbH、MercuryGate などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TRANSPORTATION MODE TIMELINE CURVE

2.1 MARKET INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH BENEFITS OFFERED BY FREIGHT TRANSPORTATION MANAGEMENT

5.1.2 INCREASING ASIA PACIFICIZATION LEADING TO HIGH FREIGHT TRANSPORTATION

5.1.3 INCREASING DEMAND FOR RAIL FREIGHT TRANSPORTS

5.1.4 HIGH USE OF FREIGHT TRANSPORTATION MANAGEMENT IN ROADWAYS

5.1.5 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATERWAYS

5.2 RESTRAINTS

5.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

5.2.2 GOVERNMENT RESTRICTIONS AND REGULATIONS ON TRADE

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF NEW ADVANCED TECHNOLOGIES

5.3.2 INCREASING GROWTH IN E-COMMERCE

5.3.3 GROWING INCLINATION TOWARDS DIGITALIZATION

5.3.4 INCREASING USE OF GREEN FREIGHT

5.4 CHALLENGES

5.4.1 RISK ASSOCIATED WITH CYBER-ATTACKS

5.4.2 LACK OF TRAINING AND EDUCATION

5.4.3 LACK OF DIGITAL LITERACY IN VARIOUS REGIONS

6 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE

6.1 OVERVIEW

6.2 ROADWAYS

6.3 RAILWAYS

6.4 MARINE

6.5 AIRWAYS

7 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTIONS

7.2.1 FREIGHT 3PL SOLUTIONS

7.2.1.1 CROSS DOCK OPERATION

7.2.1.2 LOAD OPTIMIZATION PLATFORM

7.2.1.3 FREIGHT ORDER MANAGEMENT

7.2.1.4 BROKERAGE OPERATIONAL MANAGEMENT

7.2.1.5 BUSINESS INTELLIGENCE SOLUTION

7.2.1.6 OTHERS

7.2.2 FREIGHT TRANSPORTATION COST MANAGEMENT SYSTEM

7.2.3 FREIGHT MOBILITY SOLUTION

7.2.3.1 GPS

7.2.3.2 RFID

7.2.4 FREIGHT SECURITY SOLUTIONS

7.2.4.1 CARGO TRACKING

7.2.4.2 INTRUSION DETECTION

7.2.4.3 VIDEO SURVEILLANCE

7.2.5 FREIGHT INFORMATION MANAGEMENT SYSTEM

7.2.6 FLEET TRACKING SOLUTION

7.2.7 FLEET MAINTENANCE SOLUTION

7.2.8 FREIGHT OPERATION MANAGEMENT SOLUTION

7.2.8.1 AUDIT AND PAYMENT SOLUTION

7.2.8.2 SUPPLIER AND VENDOR MANAGEMENT

7.2.8.3 CRM

7.2.8.4 OTHERS

7.2.9 WAREHOUSE MANAGEMENT SYSTEM

7.3 SERVICES

7.3.1 INTEGRATION SERVICES

7.3.2 MANAGED SERVICES

7.3.3 BUSINESS SERVICES

8 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD OR HOSTED

8.2.1 SUBSCRIPTION BASED

8.2.2 TRANSACTION BASED

8.3 ON PREMISE

9 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY

10.1 OVERVIEW

10.2 MANUFACTURING

10.3 RETAIL & E-COMMERCE

10.4 TRANSPORTATION

10.5 FAST MOVING CONSUMER GOODS (FMCG)

10.6 HEALTHCARE

10.7 FOOD & BEVERAGES

10.8 OIL & GAS

10.9 ENERGY & UTILITY

10.1 ELECTRONICS

10.11 AUTOMOTIVE

10.12 IT & TELECOM

10.13 OTHERS

11 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 INDONESIA

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ORACLE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 APPLICATION PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 C.H. ROBINSON WORLDWIDE, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAP SE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ACCENTURE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 GEODIS

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 3GTMS

14.6.1 COMPANY SNAPSHOT

14.6.2 PLATFORM PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BLUE YONDER GROUP, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CTSI-ASIA PACIFIC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DSV

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 E2OPEN, LLC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 ASIA PACIFICTRANZ

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MANHATTAN ASSOCIATES

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 MERCURYGATE

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SOFTEON

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SUPPLY CHAIN SOLUTIONS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 THE DESCARTES SYSTEMS GROUP INC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TRANSPLACE

14.17.1 COMPANY SNAPSHOT

14.17.2 SOLUTION PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 TRIMBLE INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TRANSPOREON GMBH

14.19.1 COMPANY SNAPSHOT

14.19.2 PLATFORM PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WERNER ENTERPRISES

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC ROADWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC RAILWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MARINE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC AIRWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 8 ASIA PACIFIC SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC 3PL IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC FREIGHT MOBILITY SOLUTION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC FREIGHT OPERATION MANAGEMENT SOLUTION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 14 ASIA PACIFIC SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ON PREMISE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LARGE ENTERPRISES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 21 ASIA PACIFIC SMES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 22 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MANUFACTURING IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 24 ASIA PACIFIC RETAIL & E-COMMERCE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 25 ASIA PACIFIC TRANSPORTATION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 26 ASIA PACIFIC FAST MOVING CONSUMER GOODS (FMCG) IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 27 ASIA PACIFIC HEALTHCARE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 28 ASIA PACIFIC FOOD & BEVERAGES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 29 ASIA PACIFIC OIL & GAS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 30 ASIA PACIFIC ENERGY & UTILITY IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 31 ASIA PACIFIC ELECTRONICS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 32 ASIA PACIFIC AUTOMOTIVE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 33 ASIA PACIFIC IT & TELECOM IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 34 ASIA PACIFIC OTHERS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 35 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 48 CHINA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 49 CHINA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 CHINA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CHINA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CHINA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 CHINA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 59 CHINA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 60 JAPAN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 JAPAN SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 72 INDIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 73 INDIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 INDIA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDIA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 INDIA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 INDIA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 83 INDIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDONESIA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 117 INDONESIA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 INDONESIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 132 THAILAND FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 134 THAILAND SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 THAILAND FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 143 THAILAND FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 158 PHILIPPINES SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 168 REST OF ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 10 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: SEGMENTATION

FIGURE 11 HIGH BENEFITS OFFERED BY FREIGHT TRANSPORTATION MANAGEMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ROADWAYS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET IN 2022 & 2029

FIGURE 13 EUROPE IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET

FIGURE 15 EXPORTED VALUE OF THE PRODUCT FROM 2015-2019, IN USD MILLION

FIGURE 16 TOTAL INLAND FREIGHT TRANSPORT, TONES-KILOMETERS, MILLION

FIGURE 17 U.S.-NORTH AMERICAN FREIGHT BY MODE: 2018-2019 (USD BILLION)

FIGURE 18 TONNAGE LOADED AND DISCHARGE, 2020 (BILLIONS OF TONS)

FIGURE 19 CONTAINER PORT TRAFFIC

FIGURE 20 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY TRANSPORTATION MODE, 2021

FIGURE 21 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY OFFERING, 2021

FIGURE 22 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 23 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 24 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY INDUSTRY, 2021

FIGURE 25 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY TRANSPORTATION MODE (2022-2029)

FIGURE 30 ASIA PACIFIC FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。