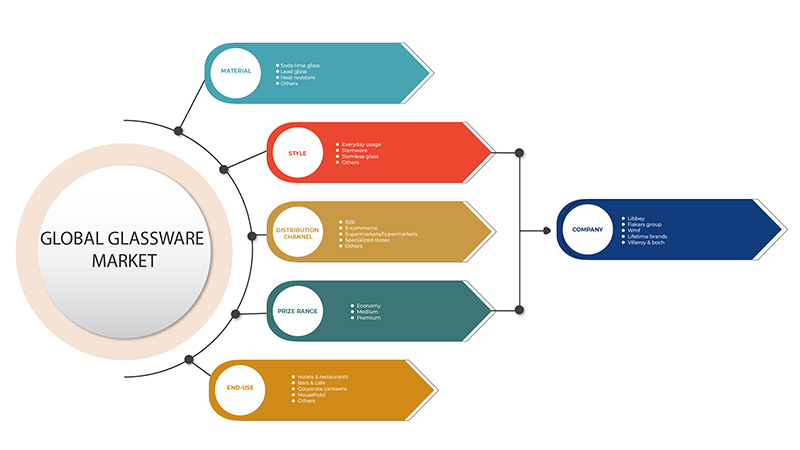

アジア太平洋地域のガラス製品市場、材質別(ソーダ石灰ガラス、鉛ガラス、耐熱ガラスなど)、スタイル別(ステムレスガラス、ステムウェア、日常使用など)、流通チャネル別(B2B、専門店、スーパーマーケット/ハイパーマーケット、Eコマースなど)、価格帯別(中価格、高級、エコノミー)、最終用途別(ホテル・レストラン、バー・カフェ、家庭用、企業食堂など)業界動向と2029年までの予測。

市場分析と規模

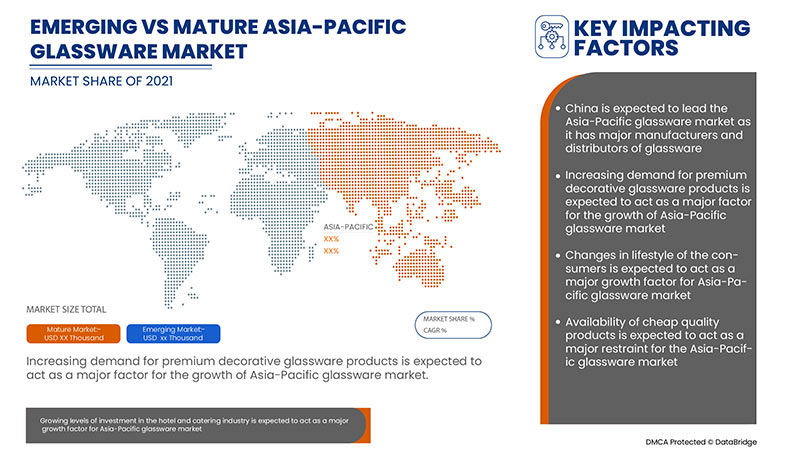

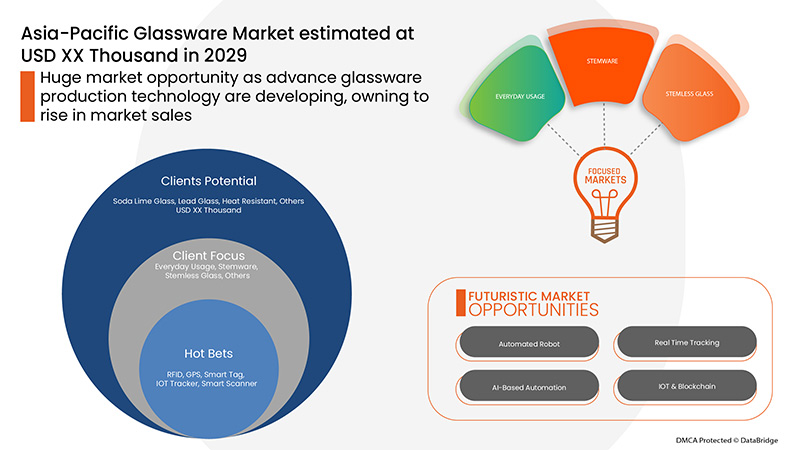

ホテルおよびケータリング業界への投資の増加は、予測期間中のガラス製品市場の成長の原動力となることが期待されています。消費者のライフスタイルの変化は、2022~2029年の予測期間中のガラス製品市場の成長の原動力となることが期待されています。ガラス製品生産技術の進歩は、将来的にガラス製品市場に成長の機会をもたらすことが期待されています。

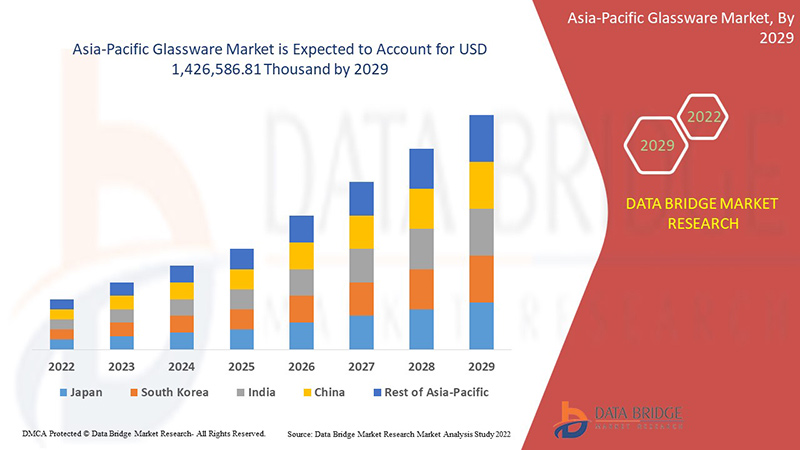

Data Bridge Market Research の分析によると、ガラス製品市場は予測期間中に 5.6% の CAGR で成長し、2029 年までに 1,426,586.81 千米ドルに達すると予想されています。「ソーダ石灰」は、傷がつきにくい表面を提供するため、最も目立つ材料セグメントを占めています。ガラス製品市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

売上高は千米ドル、販売数量は個数、価格は米ドル |

|

対象セグメント |

材質別(ソーダ石灰ガラス、鉛ガラス、耐熱ガラス、その他)、スタイル別(ステムレスグラス、ステムウェア、日常使用、その他)、流通チャネル別(B2B、専門店、スーパーマーケット/ハイパーマーケット、Eコマース、その他)、価格帯別(中価格、高級、エコノミー)、最終用途別(ホテル・レストラン、バー・カフェ、家庭用、企業食堂、その他) |

|

対象国 |

中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、ニュージーランド、タイ、インドネシア、フィリピン、香港、台湾、ミャンマー、ラオス、カンボジア、その他のアジア太平洋地域 (APAC) |

|

対象となる市場プレーヤー |

Hrastnik1860、Oneida、NoritakeChina、Ocean Glass Public Company Limited、Lenox Corporation、Treo.in、Libbey Inc、Fiskars Group、WMF(Groupe SEBの子会社)、Lifetime Brands、Inc、Villeroy & Boch、Bormioli Rocco SpA、Wonderchef Home Appliances Pvt. Ltd.、The Zrike Company、Inc、Shandong Hikingpac Co., Ltd.、Addresshome、Stölzle Lausitz GmbH、Eagle Glass Deco (P.) Ltd.、Degrenne、Cello World、MYBOROSIL、Jiangsu Rongtai Glass Products Co., Ltd.、Cumbria Crystal、Garbo Glasswareなど |

市場の定義

ガラスは、一般に透明または半透明の、もろくて硬い素材です。砂、ソーダ、石灰、その他の鉱物の混合物から作られることがあります。最も一般的なガラスの形成方法は、原材料を加熱して溶融液にし、その後混合物を急速に冷却して強化ガラスを作るというものです。ガラスの種類は、機械的性質と熱的性質に基づいて分類され、どの用途に最も適しているかが識別されます。

ソーダ石灰ガラス: ソーダ石灰ガラスは、窓ガラスや、飲み物、食品、特定の商品を入れるボトルや瓶などのガラス容器に使用される最も一般的なガラスです。

鉛ガラス: 鉛ガラスは、酸化鉛の含有量が多く、非常に透明度と明るさに優れたガラスです。

耐熱性: 耐熱ガラスは熱ストレスに耐えることを目的としており、キッチンや工業用途でよく使用されます。

ガラス製品市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

- ホテル・ケータリング業界への投資の増加

観光業は、世界中のホテルやレストラン部門のビジネスを強化し、ホテル業界に大きな可能性をもたらしました。この業界は、主に観光業を通じて繁栄してきましたが、さまざまな国の多様な風景、信仰、社会が、さまざまな地域からの観光客に大きな魅力を与えています。多くの国のホテルおよびケータリング部門は、過去 20 年間で徐々に拡大しており、今後数年間は、さまざまな種類のガラス製品の需要の増加と相まって、発展が予測されています。

- 消費者のライフスタイルの変化

消費者の生活は絶えず変化しています。消費者の習慣や価値観は、既存および新しいトレンド、絶えず変化する人口構成、世界的な文化的激変、テクノロジーの急速な発展の影響を受けます。企業は、変化する行動や信念に従って顧客の好みを深く理解することで、新たな可能性を活かすことができます。最近では、あらゆる世代の消費者が日常生活の多くの分野でブランド製品に注目するようになっています。

- 世界中で高級レストランの人気が高まっている

高級レストランとは、高品質の食材、盛り付け、完璧なサービスを重視した専門料理店または多国籍料理店のことです。このカテゴリは 15% という高いペースで成長しており、高級ミシュランの星付きレストランやその他の地元の競合店の進出を後押ししています。したがって、高級で繊細な料理に対する需要の高まりは、主にホテルやレストランでのさまざまな種類のガラス製品ブランドの成功によって実現されています。

- 安価で高品質な製品の入手可能性

Glass is one of the most complex and adaptable materials, and it is utilized in nearly every industry. The extensive use of glass contributes to the creation of a very hi-tech and modern appearance in both residential and commercial structures. Glass comes in a variety of shapes and sizes to suit a variety of applications and is used in a variety of architectural applications such as doors, windows, and partitions. Glass has come a long way from its humble beginnings as a windowpane to become a sophisticated structural component in the current day.

- Rising demand for steel and paper base drinkware

Paper and plastic are increasingly being used to make disposable plates and glasses, owing to their great environmental performance and rising demand for e-commerce and delivery services. Consumers, brands, and retailers all have high expectations for recyclable paper-based goods. The recycling rate of paper-based materials is around 85 percent, and the paper value chain is improving day by day. To reach even higher recycling objectives while extending the usefulness of paper-based packaging, it is critical, to begin with, the design phase, taking into account both the intended purpose and the end-of-life.

Post-COVID-19 Impact on Glassware Market

COVID-19 created a major impact on the glassware market as almost every country has opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing with this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the glassware market is rising due to the government policies to boost international trade post-COVID-19. Also, the opening of lockdown is boosting the hospitality industry which is rising the demand for Glassware in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the Glassware. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade have led to the market's growth.

Recent Developments

- In October 2020, Libbey Inc. announced the confirmation of a plan of reorganization and expected to complete its court-supervised restructuring and emerge with a stronger balance sheet in the upcoming weeks. The company made this announcement to succeed in the current business operating environment.

- In October 2021, Lenox Corporation acquired Oneida Consumer LLC with its brand of table top products including flatware, dinnerware, and cutlery. The collaboration was undertaken to market a leading portfolio of brands and innovative goods with unrivalled customer awareness across a wide range of retail channels.

Asia-Pacific Glassware Market Scope

The glassware market is segmented based on material, style, distribution channel, price range, and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Material

- Soda Lime Glass

- Lead Glass

- Heat Resistant

- Others

Based on material, the glassware market is segmented into soda lime glass, lead glass, heat resistant, and others.

By Style

- Stemless Glass

- Stemware

- Everyday Usage

- Others

Based on style, the glassware market has been segmented into stemless glass, stemware, everyday usage, and others.

By Distribution Channel

- B2B

- Specialized Stores

- Supermarkets/Hypermarkets

- E-Commerce

- Others

Based on distribution channel, the glassware market has been segmented into b2b, specialized stores, supermarkets/hypermarkets, e-commerce, and others.

By Price Range

- Medium

- Premium

- Economy

Based on price range, the glassware market has been segmented into medium, premium, and economy.

By End-Use

- Hotels & Restaurants

- Bars & Cafe

- Household

- Corporate Canteens

- Others

Based on end-use, the glassware market has been segmented into hotels & restaurants, bars & café, household, corporate canteens, and others.

Glassware Market Regional Analysis/Insights

The glassware market is analysed and market size insights and trends are provided by country, material, style, distribution channel, price range, and end-use as referenced above.

The countries covered in the glassware market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Hong Kong. Taiwan, Myanmar, Laos, Cambodia. Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China dominates the Asia-Pacific glassware market. China is likely to be the fastest-growing Asia-Pacific Glassware market. The rising infrastructure, commercial, and industrial developments in emerging countries such as China, Japan, India, and South Korea are credited with the market's dominance. With the increasing development in the countries number of restaurants and bars is increasing, which will boost the demand for glassware products in the Asia-Pacific region.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境とガラス製品の市場シェア分析

ガラス製品市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、ガラス製品市場に関連する会社の焦点にのみ関連しています。

ガラス製品市場で事業を展開している主要企業には、Hrastnik1860、Oneida、Noritake China、Ocean Glass Public Company Limited、Lenox Corporatio、Treo.in、Libbey Inc、Fiskars Group、WMF (Groupe SEB の子会社)、Lifetime Brands, Inc、Villeroy & Boch、Bormioli Rocco SpA、Wonderchef Home Appliances Pvt. Ltd.、The Zrike Company, Inc、Shandong Hikingpac Co., Ltd.、Addresshome、Stölzle Lausitz GmbH、Eagle Glass Deco (P.) Ltd.、Degrenne. Cello World、MYBOROSIL、Jiangsu Rongtai Glass Products Co., Ltd.、Cumbria Crystal、Garbo Glassware などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 ASIA PACIFIC GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 ASIA PACIFIC GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 ASIA PACIFIC GLASSWARE MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 SOUTH KOREA

11.1.5 SINGAPORE

11.1.6 MALAYSIA

11.1.7 THAILAND

11.1.8 AUSTRALIA AND NEW ZEALAND

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 HONG KONG

11.1.12 TAIWAN

11.1.13 MYANMAR

11.1.14 LAOS

11.1.15 CAMBODIA

11.1.16 REST OF ASIA-PACIFIC

12 ASIA PACIFIC GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 ASIA PACIFIC SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 ASIA PACIFIC LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 ASIA PACIFIC HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 ASIA PACIFIC GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC GLASSWARE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC GLASSWARE MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 39 ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 41 ASIA-PACIFIC GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 50 CHINA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 51 CHINA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CHINA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 CHINA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 59 INDIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 60 INDIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 INDIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 62 INDIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 INDIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 INDIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 68 INDIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 69 JAPAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 70 JAPAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 71 JAPAN GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 72 JAPAN STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 JAPAN WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 JAPAN GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 78 JAPAN GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH KOREA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH KOREA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 81 SOUTH KOREA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH KOREA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH KOREA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 SOUTH KOREA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH KOREA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 89 SINGAPORE GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 90 SINGAPORE GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 91 SINGAPORE GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 92 SINGAPORE STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 SINGAPORE RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 SINGAPORE WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 SINGAPORE STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 SINGAPORE GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 97 SINGAPORE GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 98 SINGAPORE GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 99 MALAYSIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 100 MALAYSIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 101 MALAYSIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 102 MALAYSIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 MALAYSIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 MALAYSIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 MALAYSIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 MALAYSIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 107 MALAYSIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 108 MALAYSIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 109 THAILAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 110 THAILAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 111 THAILAND GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 112 THAILAND STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 THAILAND RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 THAILAND WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 THAILAND STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 THAILAND GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 117 THAILAND GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 118 THAILAND GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 119 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 120 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 122 AUSTRALIA AND NEW ZEALAND STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 AUSTRALIA AND NEW ZEALAND RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 AUSTRALIA AND NEW ZEALAND WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 AUSTRALIA AND NEW ZEALAND STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 127 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 128 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 131 INDONESIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 132 INDONESIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 INDONESIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 INDONESIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 INDONESIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 137 INDONESIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 138 INDONESIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 139 PHILIPPINES GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 140 PHILIPPINES GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 141 PHILIPPINES GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 142 PHILIPPINES STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 PHILIPPINES RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 PHILIPPINES WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 PHILIPPINES STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 PHILIPPINES GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 PHILIPPINES GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 148 PHILIPPINES GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 149 HONG KONG GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 150 HONG KONG GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 151 HONG KONG GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 152 HONG KONG STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 HONG KONG RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 HONG KONG WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 HONG KONG STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 HONG KONG GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 157 HONG KONG GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 158 HONG KONG GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 159 TAIWAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 160 TAIWAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 161 TAIWAN GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 162 TAIWAN STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 TAIWAN RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 TAIWAN WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 TAIWAN STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 TAIWAN GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 TAIWAN GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 168 TAIWAN GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 169 MYANMAR GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 170 MYANMAR GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 171 MYANMAR GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 172 MYANMAR STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 MYANMAR RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 MYANMAR WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 MYANMAR STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 MYANMAR GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 177 MYANMAR GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 178 MYANMAR GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 179 LAOS GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 180 LAOS GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 181 LAOS GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 182 LAOS STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 LAOS RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 LAOS WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 LAOS STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 LAOS GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 187 LAOS GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 188 LAOS GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 189 CAMBODIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 190 CAMBODIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 191 CAMBODIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 192 CAMBODIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 193 CAMBODIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 194 CAMBODIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 CAMBODIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 CAMBODIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 197 CAMBODIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 198 CAMBODIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

図表一覧

FIGURE 1 ASIA PACIFIC GLASSWARE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC GLASSWARE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 ASIA PACIFIC GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE ASIA PACIFIC GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC GLASSWARE MARKET

FIGURE 22 ASIA PACIFIC LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 ASIA PACIFIC GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 ASIA PACIFIC GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 ASIA-PACIFIC GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 ASIA-PACIFIC GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 ASIA PACIFIC GLASSWARE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。