Asia

Market Size in USD Billion

CAGR :

%

USD

10.95 Billion

USD

20.87 Billion

2024

2032

USD

10.95 Billion

USD

20.87 Billion

2024

2032

| 2025 –2032 | |

| USD 10.95 Billion | |

| USD 20.87 Billion | |

|

|

|

|

Asia-Pacific Medical Device Packaging Market Segmentation, By Material (Polymer, Paper and Paperboard, Nonwoven Material, Others), Container Type (Bags and Pouches, Trays, Boxes, Others), Packaging Type (Primary, Secondary, Tertiary), Applications (Equipment’s and Tools, Devices, IVD, Implants) - Industry Trends and Forecast to 2032

Medical Device Packaging Market Size

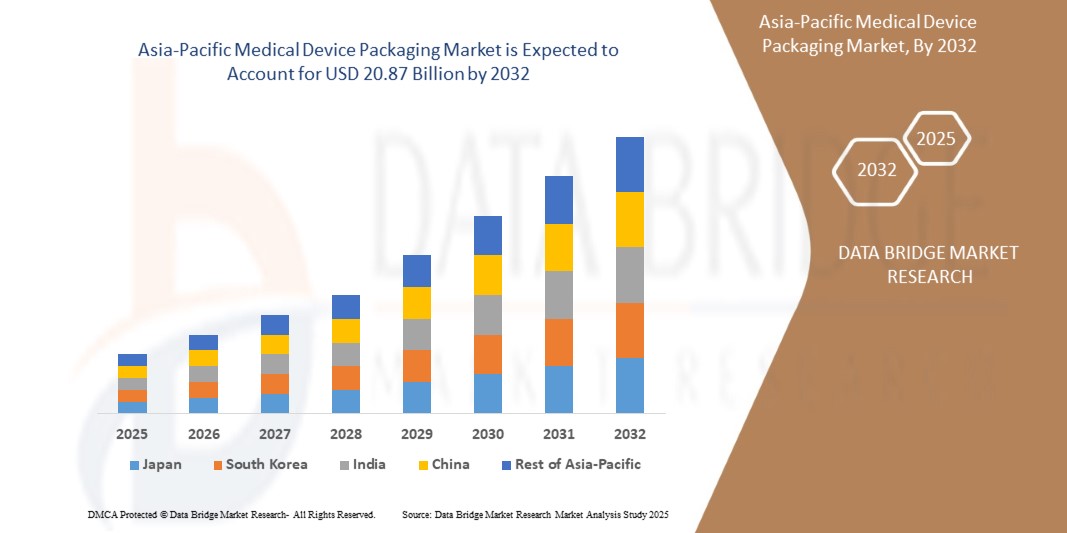

- The Asia-Pacific medical device packaging market was valued atUSD 10.95 billion in 2024and is expected to reachUSD 20.87 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 8.4%,primarily driven by the rising spending towards IoT in the healthcare sector

- The increase in demand for medical devices such as medical supplies, in-vitro diagnostic equipment and reagents, dental goods, surgical implants and instruments, electro-medical equipment and irradiation apparatuses accelerate the market growth.

Medical Device Packaging Market Analysis

- The Asia-Pacific medical device packaging market is experiencing robust growth, propelled by factors such as expanding healthcare infrastructure, rising chronic disease prevalence, and increasing demand for sterile and sustainable packaging solutions.

- Countries like China, India, and Japan are leading this surge due to their strong manufacturing capabilities and supportive government initiatives.

- The shift towards eco-friendly materials and advanced packaging technologies is further improving the market dynamics.

- China is expected to dominate the market with a share of more than 35% of the market share by 2032 as a result of high concentration of medical device manufacturers coupled with positive outlook towards healthcare infrastructure development on a national level

- India is projected to foresee fastest growth movement thanks to the supportive government policies aimed at promoting the industry output in various segments including medical devices

Report Scope and Medical Device Packaging Market Segmentation

|

Attributes |

Medical Device Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Packaging Market Trends

“Adoption of Sustainable Packaging Solutions”

- Manufacturers are increasingly using recyclable and biodegradable materials to reduce environmental impact. This is attributed to the fact that stricter environmental regulations are pushing companies to adopt sustainable packaging practices.

- Growing awareness among consumers about environmental issues is driving demand for green packaging. The companies are also coming with sustainable packaging which are providing the competitive edge by appealing to environmentally conscious stakeholders.

- For instance, DKSH is driving new standards of innovation for sustainable packaging and waste management in Asia Pacific's rapidly changing medical markets. Their efforts focus on ensuring the timely and safe delivery of healthcare products while addressing environmental concerns.

Sustainable packaging is reshaping the Asia-Pacific medical device market by aligning industry practices with environmental goals. This shift not only supports regulatory compliance but also strengthens brand reputation among eco-conscious consumers and stakeholders.

Medical Device Packaging Market Dynamics

Driver

“Growing Healthcare Infrastructure in Asia-Pacific”

- Governments are heavily funding hospitals and clinics, boosting demand for medical devices and packaging. This is due to the increased number of hospitals and diagnostic centers in China and India

- Rural and semi-urban outreach drives higher usage of packaged medical supplies. Countries like India and Thailand attract international patients, raising the need for reliable device packaging.

For instance,

- The government of China has been investing in county-level hospitals to enhance medical capacity, which is crucial for improving healthcare services across the country.

Governments of key countries including China and India have been increasing spending on improving healthcare infrastructure. This trend is expected to promote the scope of packaging in medical devices in the near future.

Opportunity

“High Demand for Sustainable Packaging Solutions”

- Governments are encouraging eco-friendly packaging through sustainability mandates, fostering innovation and market entry. Companies adopting sustainable packaging gain competitive advantage by aligning with growing environmental awareness among consumers and healthcare providers.

- Advances in recyclable and biodegradable materials are reducing long-term costs and enhancing operational efficiency. Furthermore, the adoption of sustainability goals and

For instance,

- DuPont's Tyvek material, known for its durability and recyclability, is being increasingly adopted in medical device packaging across Asia-Pacific, aligning with sustainability goals.

Eco-friendly packaging increases global marketability, meeting environmental standards in key export destinations, making it a key growth opportunity in the Medical Device Packaging market.

Restraint/Challenges

“The Need to Comply with Stringent Regulatory Standards”

- Medical device packaging industry participants are adhere to stringent regulatory standards to ensure the safety, sterility, and efficacy of the devices. These standards are crucial for maintaining the integrity of medical devices throughout their lifecycle, from manufacturing to end-use delivery

- The industry participants require documentation and rigorous testing to ensure compliance with global standards. As a result, the packaging validation is considered as one of the critical components in order to maintaining the sterility, safety, and integrity of medical devices throughout their lifecycle.

For instance,

- Regulations such as FDA 21 CFR Part 820, EU MDR, and ISO 116072 ensure that packaging materials and systems maintain sterility during transport and storage.

The compliance with stringent regulations in medical device industry regarding the packaging of the product forms is expected to increase operating costs at various levels, which will in turn have credible threat to the industry in the near future.

Medical Device Packaging Market Scope

The market is segmented on the basis of material, container type, packaging type, and applications.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Container Type |

|

|

By Packaging Type |

|

|

By Applications |

|

In 2025, the polymer segment is projected to dominate the market with a largest share in application segment

Polymer dominated the market and accounted for a revenue share of 64.7% in 2024. These materials are considered as safe, hygienic, versatile, and durable, offering aesthetic flexibility from opaque to clear. Their lightweight, cost-effective nature makes them an ideal choice for medical device packaging. Polymer packaging maintains the sterility and integrity of medical devices and diagnostic equipment.

The Pouches and bags is expected to account for the largest share during the forecast period in Container Type market

In 2025, Pouches and bags led the medical device packaging market and accounted for a revenue share of 35.9% in 2024. These products and capable enough to efficiently pack the medical devices of all sizes, offering easy storage and handling. Furthermore, pouches and bags are manufactured from materials such as LLDPE and PET which protect devices from light, moisture, and gases.

Medical Device Packaging Market Regional Analysis

“China is the Dominant Region in the Medical Device Packaging Market”

- TheChinaholds a significant share due to its robust manufacturing capabilities, significant investments in research and development, and a rapidly aging population

- In addition, Government initiatives like "Made in China" have further bolstered domestic production of high-value medical devices, increasing demand for advanced packaging solutions.

“India is Projected to Register the Highest Growth Rate”

- India is expected to witness the highest growth rate in theMedical Device Packaging market, driven by expanding healthcare infrastructure, increasing demand for medical devices, and supportive government initiatives promoting manufacturing and innovation in packaging solutions

- India's large and growing population, coupled with rising healthcare awareness, further contributes to the demand for advanced and sustainable medical device packaging.

Medical Device Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.),

- Mitsubishi Electric Corporation (Japan),

- Texchem Polymer Engineering Division (Malaysia),

- Klockner Pentaplast (U.S.),

- 3M (U.S.),

- Nelipak (U.S.)

- Plastic Ingenuity (U.S.),

- Technipaq Inc. (U.S.),

- Amcor plc (Switzerland),

- DOW (U.S.),

- Berry Global (U.S.),

- Wihuri Group (Finland),

- Oliver (U.S.),

- Beacon Converters (U.S.)

- CONSTANTIA (Austria)

Latest Developments in Asia-Pacific Medical Device Packaging Market

- In February 2024, China's National Medical Products Administration (NMPA) released the 2024 edition of the Medical Device Standards Catalogue, which now includes a total of 1,974 standards. The catalogue is structured into two main sections. The first section focuses on aspects such as quality management systems, unique device identification (UDI), and medical device packaging. The second section covers a wide range of device types, including standards for biological evaluations, electrical equipment, disinfection and sterilization processes, surgical instruments, and implantable surgical devices.

- In May 2024, DuPont announced plans to restructure its business by splitting into three separate companies. With operations across the Asia-Pacific—particularly in Australia, China, and India—the company will form two new independent businesses, one concentrating on electronics and the other on water technologies. The remaining business, to be known as New DuPont, will position itself as a diversified industrial leader. New DuPont aims to strengthen its presence in the fast-growing healthcare sector, with a focus on biopharmaceutical consumables, medical devices, and packaging solutions for medical applications.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。