Asia

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

5.60 Billion

2024

2032

USD

4.06 Billion

USD

5.60 Billion

2024

2032

| 2025 –2032 | |

| USD 4.06 Billion | |

| USD 5.60 Billion | |

|

|

|

|

Asia-Pacific Nuclear Medicine Equipment Market Segmentation, By Product (Single Photon-Emission Computed Tomography (SPECT), Hybrid PET and Planar Scintigraphy), Application (Cardiology, Oncology, Neurology and Other Applications), End User (Hospitals, Imaging Centers, Academic and Research Centers and Other End Users)- Industry Trends and Forecast to 2032

Asia-Pacific Nuclear Medicine Equipment Market Size

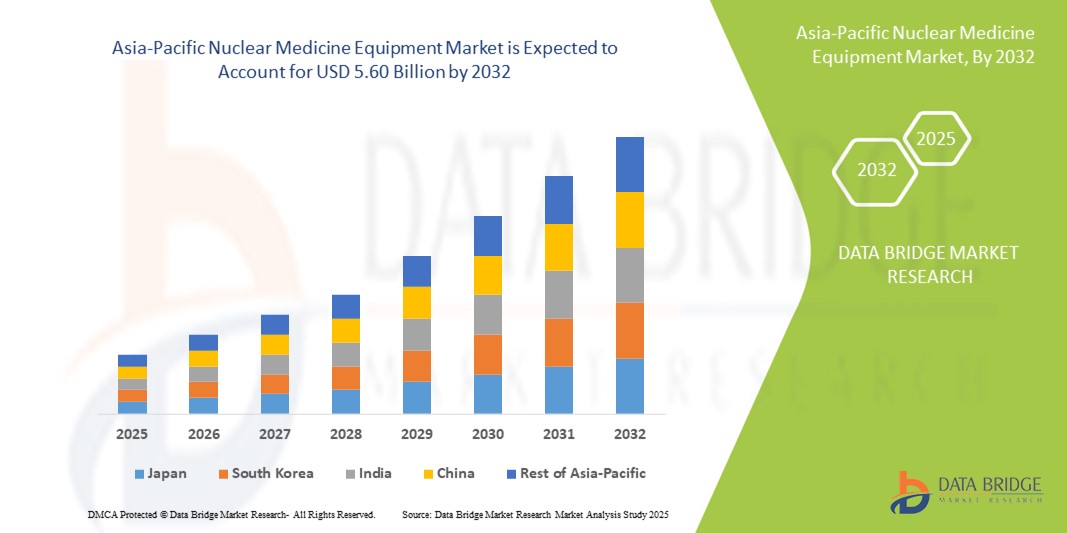

- The Asia-Pacific nuclear medicine equipment market size was valued at USD 4.06 billion in 2024 and is expected to reach USD 5.60 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer and cardiovascular diseases, coupled with the growing adoption of advanced diagnostic imaging technologies across emerging economies in the region

- Furthermore, increasing healthcare investments, supportive government initiatives for modernizing diagnostic infrastructure, and the rising demand for accurate, non-invasive imaging solutions are positioning nuclear medicine equipment as a critical diagnostic tool of choice. These converging factors are accelerating adoption, thereby significantly boosting the industry's growth

Asia-Pacific Nuclear Medicine Equipment Market Analysis

- Nuclear medicine equipment, including PET, SPECT, and gamma cameras, are increasingly vital tools for advanced diagnostic imaging and therapy in both hospitals and diagnostic centers due to their high accuracy, non-invasive nature, and ability to detect diseases at early stages

- The escalating demand for nuclear medicine equipment is primarily fueled by the rising prevalence of cancer and cardiovascular diseases, growing healthcare infrastructure investments, and increasing adoption of technologically advanced imaging solutions

- Japan dominated the Asia-Pacific nuclear medicine equipment market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative imaging modalities, and the presence of leading equipment manufacturers, with substantial growth in PET and SPECT installations driven by integration with AI-assisted diagnostics and hybrid imaging systems

- China is expected to be the fastest growing country in the Asia-Pacific nuclear medicine equipment market during the forecast period due to expanding nuclear medicine facilities, rising healthcare expenditure, and increasing awareness of early disease diagnosis

- Hybrid PET segment dominated the nuclear medicine equipment market with a market share of 45.8% in 2024, driven by its superior imaging resolution, accuracy in oncological applications, and increasing integration with multimodal imaging technologies

Report Scope and Asia-Pacific Nuclear Medicine Equipment Market Segmentation

|

Attributes |

Asia-Pacific Nuclear Medicine Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Nuclear Medicine Equipment Market Trends

Advancements in Hybrid PET and SPECT Imaging Technologies

- A significant and accelerating trend in the Asia-Pacific nuclear medicine equipment market is the integration of hybrid imaging systems such as PET/CT and SPECT/CT, which enhance diagnostic accuracy and clinical decision-making across oncology, cardiology, and neurology applications

- For instance, the Siemens Biograph mCT combines PET and CT imaging, enabling clinicians to visualize metabolic activity alongside anatomical structures in a single scan, improving early disease detection and treatment monitoring

- Hybrid imaging technologies allow for reduced scan times, lower radiation doses, and higher resolution images, facilitating precise diagnosis and patient-specific therapy planning. For instance, GE Healthcare’s Discovery NM/CT 670 system integrates SPECT with CT to improve lesion localization and quantification

- The growing adoption of AI-enabled image reconstruction and quantitative analysis in nuclear medicine equipment further enhances the clinical utility of these systems, allowing for faster, more accurate interpretation of scans. Through AI-assisted algorithms, hospitals can better detect subtle anomalies and track disease progression

- This trend towards more accurate, efficient, and integrated imaging systems is fundamentally reshaping diagnostic expectations, driving manufacturers such as Canon Medical Systems to develop hybrid nuclear medicine equipment with AI-based image optimization and dose reduction technologies

- The demand for hybrid PET and SPECT systems with advanced imaging and AI integration is growing rapidly across both hospitals and imaging centers, as clinicians increasingly prioritize precision, efficiency, and comprehensive diagnostic capabilities

Asia-Pacific Nuclear Medicine Equipment Market Dynamics

Driver

Increasing Prevalence of Cancer and Cardiovascular Diseases

- The rising incidence of cancer, cardiovascular disorders, and neurological diseases across Asia-Pacific countries is a major driver for the growing adoption of nuclear medicine equipment in hospitals and diagnostic centers

- For instance, in 2024, the National Cancer Center Japan reported a substantial increase in PET/CT scan utilization to detect early-stage cancers, highlighting the rising clinical demand for advanced nuclear imaging modalities

- Growing awareness among clinicians and patients about early disease detection and accurate diagnosis is accelerating investments in high-resolution SPECT and Hybrid PET systems, providing reliable and non-invasive imaging solutions

- Furthermore, government healthcare initiatives and increasing funding for diagnostic infrastructure are encouraging hospitals to upgrade equipment and adopt the latest nuclear medicine technologies, enhancing access to advanced imaging services

- The increasing focus on precision medicine and targeted therapies is making nuclear medicine equipment indispensable for treatment planning and monitoring, as accurate imaging enables optimized patient-specific care

Restraint/Challenge

High Equipment Costs and Regulatory Compliance Hurdles

- The high initial investment required for nuclear medicine equipment, including Hybrid PET and SPECT systems, is a significant challenge for adoption, particularly among smaller hospitals and diagnostic centers in developing countries

- For instance, the cost of a fully integrated PET/CT scanner can exceed several million USD, limiting accessibility for budget-conscious healthcare providers despite its clinical advantages

- Strict regulatory requirements for equipment safety, radiation compliance, and import approvals pose additional hurdles, delaying installation and increasing operational complexity for manufacturers and end users

- Moreover, the need for specialized trained personnel to operate and maintain nuclear medicine systems further adds to operational costs and restricts rapid deployment, particularly in emerging economies

- Addressing these challenges through financing solutions, government subsidies, and training programs for medical staff will be vital for sustained market growth and wider adoption of nuclear medicine equipment across Asia-Pacific

Asia-Pacific Nuclear Medicine Equipment Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the Asia-Pacific nuclear medicine equipment market is segmented into Single Photon-Emission Computed Tomography (SPECT), Hybrid PET, and Planar Scintigraphy. The Hybrid PET segment dominated the market with the largest revenue share of 45.8% in 2024, driven by its superior imaging resolution, high sensitivity in oncological and cardiology applications, and ability to provide both anatomical and functional imaging in a single scan. Hospitals and imaging centers increasingly prefer Hybrid PET systems due to their accuracy in early disease detection and treatment monitoring, which enhances clinical decision-making. In addition, AI-assisted image reconstruction and integration with other imaging modalities have strengthened its adoption across leading medical facilities. Hybrid PET systems are also favored for their role in theranostics, enabling personalized treatment planning and therapy assessment. The segment’s dominance is reinforced by continuous technological advancements and a growing focus on precision medicine.

The SPECT segment is anticipated to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by increasing adoption in cardiology and neurology applications. SPECT systems are widely used for functional imaging of the heart and brain, offering cost-effective, reliable diagnostics in emerging markets such as China and India. Improvements in SPECT detector technology, image resolution, and integration with CT scanners are enhancing its clinical utility and adoption in hospitals and imaging centers. The relatively lower cost compared to Hybrid PET systems makes SPECT attractive for mid-tier healthcare providers. In addition, SPECT’s compatibility with a broad range of radiopharmaceuticals supports diverse diagnostic applications, further boosting market growth.

- By Application

On the basis of application, the market is segmented into cardiology, oncology, neurology, and other applications. The Oncology segment dominated the market with a revenue share of 41.6% in 2024, driven by the rising prevalence of cancer and the growing importance of early diagnosis and treatment planning. Nuclear medicine equipment, particularly Hybrid PET and SPECT, is increasingly used for tumor detection, staging, and monitoring therapeutic response. Oncology departments in hospitals and specialized cancer centers are rapidly adopting these systems due to their precision and ability to support personalized treatment approaches. Advances in radiopharmaceuticals and AI-based image analysis are further enhancing the accuracy and speed of oncology diagnostics. The rising awareness of early cancer detection among patients and clinicians is reinforcing the dominance of this application segment.

The Cardiology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing prevalence of cardiovascular diseases across Asia-Pacific countries and rising adoption of nuclear cardiology imaging. Techniques such as myocardial perfusion imaging using SPECT and PET help in the assessment of heart function and ischemia, facilitating timely interventions. Government initiatives to improve cardiac care infrastructure and rising investments in diagnostic centers are accelerating the use of nuclear medicine equipment in cardiology. The segment benefits from technological advancements, including hybrid imaging systems and AI-assisted quantitative analysis, which improve diagnostic accuracy and patient outcomes.

- By End User

On the basis of end user, the market is segmented into hospitals, imaging centers, academic and research centers, and other end users. The Hospitals segment dominated the market with the largest revenue share of 52.4% in 2024, driven by the presence of well-equipped radiology departments, high patient volumes, and growing investments in advanced nuclear medicine systems. Hospitals prefer Hybrid PET and SPECT equipment for accurate diagnosis, treatment monitoring, and research purposes. Integration with AI-based workflow solutions, PACS, and hospital information systems further increases operational efficiency. In addition, hospitals often have dedicated teams of trained nuclear medicine specialists, ensuring optimal utilization of these high-end imaging systems. The demand for advanced nuclear medicine equipment in hospitals is also supported by government healthcare initiatives and private sector investments in Asia-Pacific countries.

The Imaging Centers segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing number of standalone diagnostic centers and rising patient preference for specialized imaging services. Imaging centers are rapidly adopting cost-effective SPECT systems and hybrid imaging technologies to provide accurate, non-invasive diagnostics with shorter wait times. Flexible financing models and leasing options offered by equipment manufacturers are also supporting the expansion of imaging centers in emerging markets. Growing awareness of early diagnosis, coupled with technological advancements, is driving demand for nuclear medicine equipment in outpatient settings. Imaging centers’ focus on patient convenience and high-throughput diagnostics is boosting market growth.

Asia-Pacific Nuclear Medicine Equipment Market Regional Analysis

- Japan dominated the Asia-Pacific nuclear medicine equipment market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative imaging modalities, and the presence of leading equipment manufacturers, with substantial growth in PET and SPECT installations driven by integration with AI-assisted diagnostics and hybrid imaging systems

- Hospitals and imaging centers in Japan increasingly utilize Hybrid PET and SPECT systems for oncology, cardiology, and neurology applications, owing to their high diagnostic accuracy and efficiency in early disease detection and treatment monitoring

- This widespread adoption is further supported by strong government healthcare initiatives, a skilled workforce of nuclear medicine specialists, and the presence of leading equipment manufacturers, establishing nuclear medicine systems as preferred diagnostic tools in hospitals and specialized imaging centers across the country

The Japan Nuclear Medicine Equipment Market Insight

The Japan nuclear medicine equipment market dominated the Asia-Pacific region with the largest revenue share of 39% in 2024, driven by advanced healthcare infrastructure, widespread adoption of Hybrid PET and SPECT systems, and a strong focus on early disease detection. Hospitals and imaging centers prioritize precise diagnostics in oncology, cardiology, and neurology applications, leveraging AI-assisted imaging for improved accuracy and workflow efficiency. Government initiatives supporting advanced diagnostic facilities and the presence of leading equipment manufacturers further strengthen market dominance. In addition, Japan’s aging population and emphasis on precision medicine drive demand for advanced nuclear medicine equipment across both residential healthcare and specialized centers.

China Nuclear Medicine Equipment Market Insight

The China nuclear medicine equipment market is expected to be the fastest growing in the Asia-Pacific region during the forecast period, fueled by rapid healthcare infrastructure expansion, rising prevalence of cancer and cardiovascular diseases, and increasing adoption of Hybrid PET and SPECT imaging systems. Hospitals and imaging centers are investing in modern diagnostic technologies for early disease detection and precision therapy planning. Government initiatives promoting healthcare modernization, AI-assisted imaging integration, and local manufacturing capabilities are accelerating market growth. The expanding availability of affordable nuclear medicine equipment and growing awareness among clinicians and patients are further driving adoption across urban and semi-urban areas.

India Nuclear Medicine Equipment Market Insight

The India nuclear medicine equipment market is witnessing strong growth, driven by expanding hospitals, rising number of diagnostic centers, and increasing prevalence of cancer and cardiovascular disorders. Adoption of Hybrid PET and SPECT systems is rising for early disease detection and treatment planning. Government initiatives promoting smart hospitals and healthcare infrastructure modernization support market growth. The availability of cost-effective equipment and increasing awareness among healthcare providers further fuel adoption across urban and tier-2 cities. In addition, growing demand in oncology and cardiology departments in both public and private hospitals strengthens market expansion.

Australia Nuclear Medicine Equipment Market Insight

The Australia nuclear medicine equipment market is experiencing steady growth due to advanced healthcare infrastructure, high adoption of Hybrid PET and SPECT systems, and growing focus on oncology and cardiology diagnostics. Hospitals and imaging centers emphasize early disease detection and precision therapy. Government funding, private healthcare investments, and integration of AI-assisted imaging technologies are driving adoption. The country’s strong medical tourism sector and demand for state-of-the-art diagnostic services further support market expansion. Growing awareness of hybrid imaging benefits and increasing hospital capacities also contribute to steady market growth.

Asia-Pacific Nuclear Medicine Equipment Market Share

The Asia-Pacific Nuclear Medicine Equipment industry is primarily led by well-established companies, including:

- GE Healthcare (U.K.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Curium Pharma (France)

- Telix Pharmaceuticals (Australia)

- China Isotope & Radiation Corporation (China)

- Nordion Inc. (Canada)

- NTP. (South Africa)

- Jubilant Radiopharma (India)

- AdvanCell (Australia)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Institute of Nuclear Energy Research (INER) (Taiwan)

- Jiangsu Huayi Technology Co., Ltd. (China)

- Zhejiang Jiutai New Drug Co., Ltd. (China)

- Cyclopharma Laboratories (France)

- Mediso Ltd. (Hungary)

- Neusoft Medical Systems Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Nuclear Medicine Equipment Market?

- In August 2025, Esco Lifesciences Group participated in the 6th Malaysia Nuclear Medicine Annual Conference (MNMAC 2025). The company showcased its advanced systems for controlled environments, emphasizing safety, compliance, and technological innovation in nuclear medicine. Esco's involvement underscores its commitment to supporting the growth and development of nuclear medicine in Malaysia

- In June 2025, AIIMS Raipur became the only government hospital in Chhattisgarh to establish advanced nuclear medicine infrastructure. The facility installed an automated radio synthesizer and Gallium generator, enabling in-house production of next-generation PET radiotracers such as PSMA, DOTA, FAPI, and Exendin PET. This development enhances diagnostic precision, supports personalized treatment strategies, and reduces reliance on external suppliers, leading to faster treatment decisions and increased patient throughput

- In June 2025, the International Atomic Energy Agency (IAEA) hosted its first workshop to assist countries in the Asia-Pacific region in developing strategic funding documents to expand access to nuclear medicine and radiotherapy services. This initiative aims to address the growing burden of cancer in the region by facilitating the establishment of comprehensive cancer care programs that integrate nuclear medicine technologies

- In April 2025, Sumitomo Corporation announced a strategic partnership with SHINE Technologies to distribute fusion-derived medical isotopes in Japan and other Asian countries. This collaboration aims to establish a stable supply chain for medical isotopes, enhancing the availability of radiopharmaceuticals essential for nuclear medicine diagnostics and therapies. The partnership represents SHINE’s first comprehensive collaboration encompassing its entire business portfolio

- In February 2025, WORK Medical Technology Group Ltd. entered into a strategic partnership with Shanghai Chartwell Medical Device Co., Ltd. in February 2025. This alliance focuses on advancing nuclear medicine, imaging, and rehabilitation technologies. The collaboration includes joint investments, co-development of advanced technologies, and expansion into international markets, aiming to enhance the accessibility and quality of nuclear medicine equipment

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。