Asia

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

3.16 Billion

2024

2032

USD

1.69 Billion

USD

3.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.69 Billion | |

| USD 3.16 Billion | |

|

|

|

|

Asia-Pacific Polyimide Films Market Segmentation, By Raw Materials (Pyromellitic Dianhydride (PMDA), 4,4’-Oxydianiline (ODA), Biphenyl-Tetracarboxylic Acid Dianhydride (BPDA), Phenylenediamine (PDA)), Film Thickness (0.5 mil, 1 mil, 2 mil, 3 mil, 5 mil and Others), Color (Amber, White, Transparent and Others), Distribution Channel (E-Commerce, Specialty Stores and Others), Application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure Sensitive Tapes, Wires and Cables, Motors/Generators, Insulation Blankets, Insulation Tubing, Etching, Lithium-Ion Battery Cell/Pouch Wrap, Ceramic Board Replacement, Thermally Conductive Flex Circuits, Shims and Others), End-User (Electronics, Automotive, Aerospace, Solar, Medical, Mining and Drillings, Building and Construction, Labelling, Chemical Processing, Plastics and Packaging, Industrial, Energy and Others)- Industry Trends and Forecast to 2032

Asia-Pacific Polyimide Films Market Size

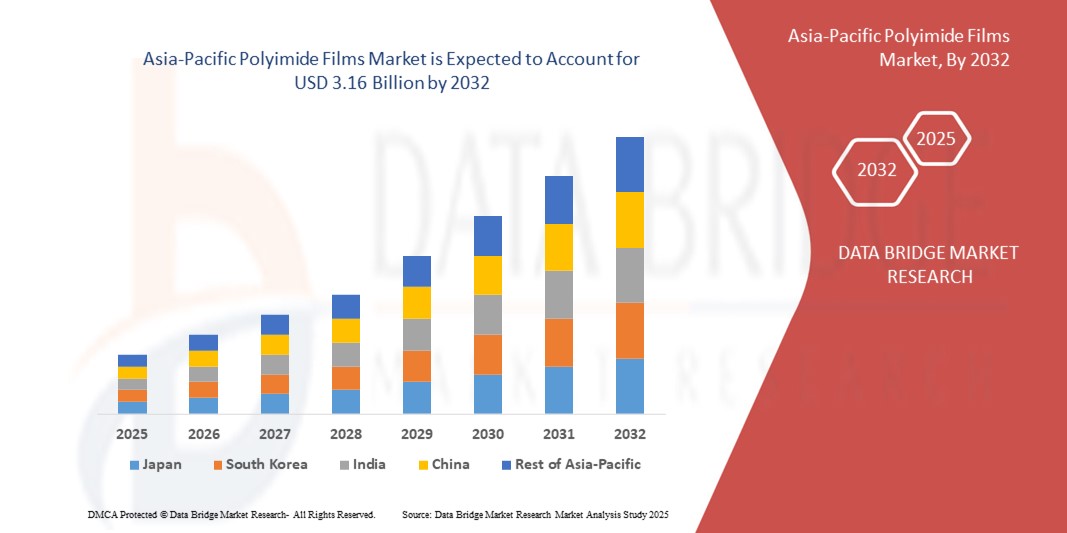

- The Asia-Pacific polyimide films market size was valued at USD 1.69 billion in 2024 and is expected to reach USD 3.16 billion by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight, durable, and high-performance materials across key industries such as electronics, automotive, aerospace, and flexible displays

- Increasing adoption of polyimide films in flexible printed circuit boards, insulation materials, and wearable electronics is further contributing to market expansion

Asia-Pacific Polyimide Films Market Analysis

- The Asia-Pacific polyimide films market is witnessing robust growth due to the increasing penetration of electronics manufacturing hubs, particularly in countries such as China, Japan, South Korea, and Taiwan, which are global leaders in semiconductors and consumer electronics

- The growing shift toward electric vehicles and renewable energy projects is further enhancing the need for heat-resistant and reliable insulation materials, positioning polyimide films as a critical component in next-generation technologies

- China dominated the Asia-Pacific polyimide films market with the largest revenue share of 46.23% in 2024, driven by its strong electronics manufacturing ecosystem, rapid adoption of electric vehicles, and the increasing demand for advanced insulation materials

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific polyimide films market due to continuous innovation in high-performance materials, growing demand from aerospace and automotive sectors, and increasing focus on energy-efficient technologies

- The PMDA segment held the largest market revenue share in 2024 owing to its extensive use in producing high-performance polyimide films with superior thermal and mechanical properties. Its widespread adoption across electronics and automotive applications reinforces its dominant market position

Report Scope and Asia-Pacific Polyimide Films Market Segmentation

|

Attributes |

Asia-Pacific Polyimide Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Polyimide Films Market Trends

Growing Adoption of Flexible Electronics and Wearable Devices

- The increasing demand for flexible electronics is reshaping the polyimide films market in Asia-Pacific, as these films provide excellent thermal stability, mechanical strength, and dielectric properties. Their use in displays, foldable devices, and wearables supports miniaturization and lightweight product development. This enhances design flexibility and accelerates innovation across consumer electronics

- The rising penetration of wearable devices and foldable smartphones in markets such as China, South Korea, and Japan is fueling polyimide film consumption. Manufacturers are increasingly adopting transparent and colorless polyimide films to replace traditional glass, ensuring durability and high optical clarity. This is particularly critical in next-generation device production

- Cost-effectiveness, scalability, and the reliability of polyimide films make them attractive for large-scale production of flexible circuits and microelectronics. Their suitability for high-frequency signal transmission and compact circuit boards further boosts demand from electronics and semiconductor industries

- For instance, in 2023, leading smartphone brands in China launched foldable devices incorporating transparent polyimide films for enhanced screen durability and flexibility. This shift reinforced the material’s role as a preferred choice for next-generation consumer electronics

- While flexible electronics are a major driver, the trend’s success depends on continued advancements in film processing, localized supply chain capabilities, and cost optimization to meet the rising demand across emerging economies in the region

Asia-Pacific Polyimide Films Market Dynamics

Driver

Expanding Demand in Electric Vehicles and Aerospace Applications

- The surge in electric vehicle (EV) production across Asia-Pacific is significantly driving the need for high-performance insulation materials such as polyimide films. Their application in battery insulation, motor windings, and flexible printed circuits ensures safety, reliability, and improved energy efficiency in EVs. As EV adoption accelerates across China, Japan, and South Korea, the demand for durable and lightweight materials continues to rise

- Aerospace manufacturers are adopting polyimide films for wiring insulation, lightweight components, and thermal management systems due to their excellent resistance to extreme conditions. These properties enable safer and more fuel-efficient aircraft designs, aligning with growing investments in commercial and defense aviation. The material’s proven track record in aerospace reliability is reinforcing its adoption across global supply chains

- Government policies supporting EV adoption and aviation growth further strengthen the demand base. Incentives such as subsidies, regulatory standards, and emission reduction targets encourage manufacturers to adopt advanced materials. The integration of polyimide films in these industries is supported by their proven durability, high temperature resistance, and compliance with international safety benchmarks

- For instance, in 2022, Japan’s EV sector reported an increased adoption of polyimide films for battery module insulation, ensuring both safety and extended performance of high-capacity lithium-ion batteries. This trend reflects the growing trust in polyimide’s role in meeting the safety and efficiency requirements of next-generation mobility. The example highlights how regional industries are becoming early adopters of advanced insulation solutions

- While EV and aerospace demand strongly push growth, consistent innovation, scalability of production, and reducing costs remain essential to fully harness these opportunities across diverse applications. Manufacturers must focus on developing cost-effective processing methods, expanding production capacity, and ensuring localized material availability. Strategic partnerships will also play a crucial role in addressing these challenges and supporting sustained growth

Restraint/Challenge

High Production Costs and Supply Chain Dependency on Raw Materials

- The high cost of manufacturing polyimide films, driven by complex processing methods and advanced equipment requirements, poses a barrier for small and mid-sized manufacturers. This makes the material less competitive against low-cost alternatives in price-sensitive applications. Consequently, wider market adoption in lower-end industries such as packaging and consumer goods remains limited

- Dependency on specialized raw materials, including aromatic dianhydrides and diamines, creates supply chain risks in Asia-Pacific. Price volatility and limited domestic production capabilities in certain countries add to procurement challenges, affecting long-term cost stability. This reliance on imports also increases vulnerability to global trade fluctuations and regulatory barriers

- Market growth is further hindered by production scalability issues, as achieving consistent quality in large volumes requires advanced technologies and expertise. Not all regional players possess the technical know-how to achieve uniformity in product performance, leading to production bottlenecks. These challenges prevent smaller firms from competing effectively with established global suppliers

- For instance, in 2023, several electronics manufacturers in Southeast Asia reported delays and increased costs due to shortages of raw materials required for polyimide film production, highlighting vulnerabilities in supply chain resilience. Such disruptions impact delivery timelines, increase dependency on costly imports, and hinder innovation cycles. These factors limit the ability of regional firms to keep pace with growing demand

- While polyimide films hold immense potential, overcoming cost and supply challenges through process innovation, localized material sourcing, and technology investments is critical to unlocking wider adoption in the Asia-Pacific region. Developing recycling solutions and alternative raw material sources can also reduce risks. Governments and private sector collaboration will be crucial in addressing these hurdles effectively

Asia-Pacific Polyimide Films Market Scope

The market is segmented on the basis of raw materials, film thickness, color, distribution channel, application, and end-user.

- By Raw Materials

On the basis of raw materials, the Asia-Pacific polyimide films market is segmented into Pyromellitic Dianhydride (PMDA), 4,4’-Oxydianiline (ODA), Biphenyl-Tetracarboxylic Acid Dianhydride (BPDA), and Phenylenediamine (PDA). The PMDA segment held the largest market revenue share in 2024 owing to its extensive use in producing high-performance polyimide films with superior thermal and mechanical properties. Its widespread adoption across electronics and automotive applications reinforces its dominant market position.

The BPDA segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to deliver films with enhanced dimensional stability, chemical resistance, and lower moisture absorption. These properties make BPDA-based polyimide films increasingly popular in demanding applications such as aerospace, solar, and flexible printed circuits, where long-term reliability and durability are critical.

- By Film Thickness

On the basis of film thickness, the market is segmented into 0.5 mil, 1 mil, 2 mil, 3 mil, 5 mil, and others. The 1 mil segment accounted for the largest revenue share in 2024, as it offers an optimal balance of flexibility, insulation, and durability, making it widely used in electronics, flexible printed circuits, and wire insulation. Its versatile properties support its dominance in consumer electronics and industrial applications.

The 0.5 mil segment is expected to witness the fastest growth rate from 2025 to 2032 due to its suitability for ultra-thin and miniaturized devices. With the increasing demand for compact electronics and lightweight automotive components, thinner films are being adopted in advanced circuit boards, sensors, and battery components, accelerating their uptake across the region.

- By Color

On the basis of color, the market is segmented into amber, white, transparent, and others. The amber segment held the largest market revenue share in 2024, supported by its extensive use in electronics, aerospace, and automotive applications where durability and resistance to high temperatures are critical. Its proven performance across multiple industries ensures strong market demand.

The transparent segment is expected to witness the fastest growth rate from 2025 to 2032, as it allows easier inspection and monitoring of circuits and components. This property is increasingly valuable in flexible displays, optoelectronic devices, and solar applications, driving its adoption across advanced manufacturing industries.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into e-commerce, specialty stores, and others. The specialty stores segment dominated the market in 2024, as customers prefer direct purchases from authorized distributors for quality assurance, customized solutions, and technical support. Strong relationships with industrial buyers reinforce this channel’s leadership.

The e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing digitization of procurement processes and the convenience of online purchasing. Increasing availability of polyimide films on specialized B2B platforms is further supporting rapid adoption of this channel across small and mid-sized enterprises.

- By Application

On the basis of application, the market is segmented into flexible printed circuits, specialty fabricated products, pressure sensitive tapes, wires and cables, motors/generators, insulation blankets, insulation tubing, etching, lithium-ion battery cell/pouch wrap, ceramic board replacement, thermally conductive flex circuits, shims, and others. Flexible printed circuits accounted for the largest revenue share in 2024, driven by the widespread adoption of polyimide films in electronics manufacturing for their flexibility, durability, and heat resistance.

The lithium-ion battery cell/pouch wrap segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rapid expansion of electric vehicles and renewable energy storage systems. Polyimide films provide superior insulation and thermal stability in batteries, ensuring enhanced performance, safety, and extended lifecycle.

- By End-User

On the basis of end-user, the market is segmented into electronics, automotive, aerospace, solar, medical, mining and drillings, building and construction, labelling, chemical processing, plastics and packaging, industrial, energy, and others. The electronics segment dominated the market in 2024, as polyimide films are extensively used in smartphones, tablets, semiconductors, and flexible displays, making it the largest consumer of these films.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the surge in electric vehicle production across Asia-Pacific. Applications in EV batteries, motor insulation, and flexible circuits are driving significant adoption, establishing the automotive sector as a key growth driver for the regional polyimide films market.

Asia-Pacific Polyimide Films Market Regional Analysis

- China dominated the Asia-Pacific polyimide films market with the largest revenue share of 46.23% in 2024, driven by its strong electronics manufacturing ecosystem, rapid adoption of electric vehicles, and the increasing demand for advanced insulation materials

- The country’s large-scale production of semiconductors, batteries, and flexible electronics creates consistent demand for polyimide films, which are valued for their superior thermal stability and reliability

- This dominance is further supported by significant government initiatives to promote renewable energy, advancements in automotive technology, and ongoing investments in aerospace, ensuring China’s continued leadership in the regional market

Japan Polyimide Films Market Insight

The Japan polyimide films market is expected to witness the fastest growth in Asia-Pacific from 2025 to 2032, fueled by advancements in electric vehicle technology and the country’s strong presence in high-performance electronics. Japanese manufacturers are increasingly integrating polyimide films into lithium-ion battery insulation, lightweight aerospace components, and next-generation circuit applications. The market is further driven by Japan’s emphasis on innovation, stringent quality standards, and rising adoption of sustainable technologies. Moreover, ongoing investments in defense, renewable energy, and consumer electronics manufacturing are accelerating the demand for polyimide films, positioning Japan as the fastest-growing market in the region.

Asia-Pacific Polyimide Films Market Share

The Asia-Pacific polyimide films industry is primarily led by well-established companies, including:

- Kaneka Corporation (Japan)

- UBE Industries, Ltd. (Japan)

- SKC Colon PI (South Korea)

- DuPont Teijin Films (China)

- Sumitomo Chemical (Japan)

- Taimide Tech Inc. (Taiwan)

- Yunda Electronic Materials Co., Ltd. (China)

- Loparex (China)

- Jingyi Film Material Co., Ltd. (China)

- Shengyuan Group (China)

- Nitto Denko (China) Co., Ltd. (China)

- Formosa Plastics Corporation (Taiwan)

- SABIC (Saudi Arabia)

- Showa Denko K.K. (Japan)

Latest Developments in Asia-Pacific Polyimide Films Market

- In November 2020, Kaneka Corporation had developed “Pixeo IB”, which is a super heat-resistant polyimide film for high-speed, high frequency 5G. The offering of samples began in October, and a full-scale rollout were scheduled for 2021. “Pixeo IB” reduces the dielectric loss tangent in high frequencies down to 0.0025, the global best level for polyimide film

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。