Asia

Market Size in USD Billion

CAGR :

%

USD

8.84 Billion

USD

12.96 Billion

2024

2032

USD

8.84 Billion

USD

12.96 Billion

2024

2032

| 2025 –2032 | |

| USD 8.84 Billion | |

| USD 12.96 Billion | |

|

|

|

|

Asia-Pacific Polystyrene Packaging Market Segmentation, By Type (Bowls, Tubs, Boxes, Cups, Bags, Pouches, Bottles, Wraps and Films, Plate, and Others), Application (Fruits, Vegetable, Fish, Sea Products, Meat Products, Milk Products/Dairy Products, Bakery & Confectionery, Snacks, and Cooked Food), End-User (Food & Beverages, Pharmaceuticals, and Personal & Home Care) - Industry Trends and Forecast to 2032

Asia-Pacific Polystyrene Packaging Market Size

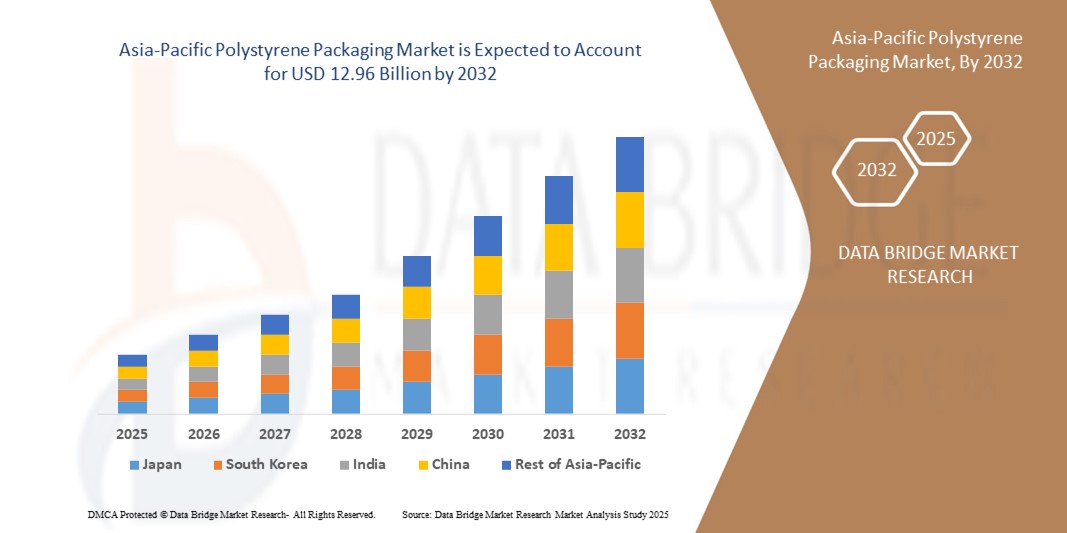

- The Asia-Pacific polystyrene packaging market size was valued at USD 8.84 billion in 2024 and is expected to reach USD 12.96 billion by 2032, at a CAGR of 4.9% during the forecast period

- The market growth is largely fueled by the increasing demand for convenient, lightweight, and cost-effective packaging solutions across the food and beverage, pharmaceutical, and personal care sectors, driving widespread adoption of polystyrene packaging materials

- Furthermore, rising consumer preference for hygienic, insulated, and durable packaging for perishable and ready-to-eat products is establishing polystyrene as a preferred material in both retail and foodservice applications. These converging factors are accelerating the uptake of polystyrene packaging solutions, thereby significantly boosting the industry's growth

Asia-Pacific Polystyrene Packaging Market Analysis

- Polystyrene packaging includes containers, trays, cups, boxes, films, and other formats used for storing, transporting, and displaying food, beverages, and consumer products. The material offers benefits such as lightweight design, thermal insulation, durability, and cost efficiency, making it suitable for diverse applications

- The escalating demand for polystyrene packaging is primarily fueled by the growth of e-commerce, food delivery services, and packaged convenience foods, coupled with the need for safe, hygienic, and attractive packaging that preserves product quality during storage and transportation

- China dominated the polystyrene packaging market in 2024, due to its extensive manufacturing capacity, strong presence of food processing industries, and growing demand for affordable packaging solutions across urban centers

- India is expected to be the fastest growing country in the polystyrene packaging market during the forecast period due to rising demand for packaged food and beverages, rapid urbanization, and expansion of the retail and e-commerce sectors

- Boxes segment dominated the market with a market share of 35.1% in 2024, due to its extensive use in food delivery, takeaway services, and e-commerce packaging. Boxes made from polystyrene are valued for their lightweight, shock resistance, and cost-effectiveness, making them a preferred choice for businesses seeking durability and affordability. Their ability to provide insulation and preserve product freshness, particularly in food and perishable goods, further reinforces their dominance in markets. Growing urbanization and the expansion of quick-service restaurants (QSRs) also strongly support the continued demand for polystyrene boxes

Report Scope and Polystyrene Packaging Market Segmentation

|

Attributes |

Polystyrene Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Polystyrene Packaging Market Trends

Shift Toward Lightweight and Multifunctional Polystyrene Packaging Designs

- A key trend shaping the polystyrene packaging market is the accelerated transition toward lightweight formats that provide durability, cost efficiency, and ease of handling. Manufacturers are focusing on reducing material consumption while retaining protective and cushioning properties critical for food and fragile product packaging

- For instance, Dart Container Corporation has introduced lightweight insulated polystyrene cups and containers designed for the foodservice sector. These solutions enhance consumer convenience and also demonstrate how companies are advancing innovative multifunctional designs to retain market appeal amidst regulatory challenges

- Demand for multifunctional packaging solutions is rising, with polystyrene being adapted for use across both foodservice and industrial applications. Functional attributes such as thermal insulation, moisture resistance, and structural rigidity make it highly relevant for maintaining product quality and safety during transportation

- Advances in molding and extrusion technologies are enabling more versatile designs including compartmentalized trays, resealable formats, and shape-customized protective inserts. Such innovations widen the applicability of polystyrene packaging, offering better functionality while optimizing material use

- Growing integration of recycled polystyrene into packaging formats is another emerging direction. Companies are investing in chemical recycling methods to reintroduce recovered material into new packaging, aligning cost-efficiency with sustainability requirements without compromising protective benefits

- Overall, these shifts toward lightweighting, recyclability, and multifunctionality are redefining the role of polystyrene in packaging. The focus is gradually moving from traditional single-use designs to solutions that optimize performance, sustainability, and regulatory compliance, setting the future course of this industry

Asia-Pacific Polystyrene Packaging Market Dynamics

Driver

Growing Demand for Convenient, Hygienic, and Insulated Food Packaging

- The rising consumer preference for packaged and takeaway foods has significantly increased demand for hygienic and insulated packaging. Polystyrene, with its thermal insulation and lightweight structure, is widely used for maintaining food freshness and preventing contamination during delivery and use

- For instance, Huhtamaki has expanded its polystyrene-based food packaging portfolio to meet heightened demand from quick-service restaurants and online food delivery platforms. Such developments highlight how leading players are addressing shifting consumption patterns through packaging suitable for convenience-driven lifestyles

- The ability of polystyrene packaging to offer superior thermal insulation makes it attractive for hot and cold beverages, frozen foods, and ready-to-eat meals. This ensures that consumers receive products in optimal condition, enhancing brand trust and consumer satisfaction

- Foodservice industries globally are seeing rising demand for takeaway and delivery services. This has amplified the use of polystyrene containers, cups, and trays as they provide both easy handling and safety during transportation, which is crucial for high-volume food operations

- Taken together, the continued expansion of fast food consumption, growing meal delivery platforms, and the need for packaging that combines convenience with hygiene reinforce the role of polystyrene packaging. This consistent demand is establishing it as a cornerstone packaging solution in the evolving foodservice landscape

Restraint/Challenge

Environmental Concerns and Regulations on Single-Use Plastics

- Mounting environmental concerns regarding single-use polystyrene packaging present a central challenge to the market. Polystyrene is often criticized for its persistence in landfills and marine ecosystems, driving consumer hesitation and regulatory scrutiny

- For instance, the European Union has implemented strict bans on expanded polystyrene foodservice products under its Single-Use Plastics Directive. Such measures are compelling manufacturers to redesign offerings or shift to recyclable and biodegradable alternatives to maintain competitiveness

- The limited recycling infrastructure for polystyrene compounds the problem, as mechanical recycling processes remain costly and geographically uneven. This results in significant volumes of used packaging ending up in waste streams, raising sustainability concerns

- Consumer demand is steadily shifting toward brands offering eco-friendly solutions, pressuring companies reliant on traditional polystyrene to either innovate recycling solutions or risk reputational damage. These pressures are especially strong in regions with progressive climate policies and well-informed consumers

- Ultimately, the environmental challenges surrounding single-use polystyrene are forcing a structural transformation of the industry. Investing in closed-loop recycling, developing alternative materials, and adapting to regulatory frameworks are essential steps for ensuring long-term industry viability and acceptance

Asia-Pacific Polystyrene Packaging Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the polystyrene packaging market is segmented into bowls, tubs, boxes, cups, bags, pouches, bottles, wraps and films, plates, and others. The boxes segment dominated the largest market revenue share of 35.1% in 2024, primarily due to its extensive use in food delivery, takeaway services, and e-commerce packaging. Boxes made from polystyrene are valued for their lightweight, shock resistance, and cost-effectiveness, making them a preferred choice for businesses seeking durability and affordability. Their ability to provide insulation and preserve product freshness, particularly in food and perishable goods, further reinforces their dominance in markets. Growing urbanization and the expansion of quick-service restaurants (QSRs) also strongly support the continued demand for polystyrene boxes.

The cups segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by rising consumption of ready-to-drink beverages and on-the-go food culture. Polystyrene cups are widely used in cafes, restaurants, and institutional catering due to their insulating properties and ease of disposal. The rapid rise of coffee chains and takeaway beverage services is directly fueling the demand for polystyrene cups. Furthermore, their cost efficiency compared to alternatives and adaptability to both hot and cold drinks make them attractive for vendors in emerging economies, thereby accelerating their growth trajectory.

- By Application

On the basis of application, the polystyrene packaging market is segmented into fruits, vegetables, fish and sea products, meat products, milk products/dairy products, bakery & confectionery, snacks, and cooked food. The meat products segment held the largest market revenue share in 2024, driven by the rising demand for hygienic, contamination-free, and temperature-resistant packaging. Polystyrene’s insulation properties make it highly suitable for maintaining the quality and shelf life of meat products during storage and transportation. With meat consumption increasing across both developed and developing countries, demand for safe and affordable packaging solutions has positioned polystyrene as a preferred choice. In addition, regulatory emphasis on food safety further enhances adoption in this category.

The bakery & confectionery segment is expected to grow at the fastest rate from 2025 to 2032, supported by increasing consumption of packaged desserts, cakes, and confectionery items globally. Polystyrene packaging offers lightweight, moisture-resistant, and attractive designs that help maintain product presentation and freshness. The booming demand for convenience-based snacks and bakery goods, particularly among urban populations, has driven manufacturers to adopt cost-effective packaging formats. The rise of artisanal bakeries and confectionery chains in emerging economies is further expected to boost the growth of this segment over the forecast period.

- By End-User

On the basis of end-user, the polystyrene packaging market is segmented into food & beverages, pharmaceuticals, and personal & home care. The food & beverages segment dominated the largest revenue share in 2024, owing to the widespread application of polystyrene packaging in food delivery, retail, and large-scale catering. Its excellent insulation properties, lightweight design, and low production costs make it the go-to packaging material for preserving food freshness and ensuring safe handling. The growing penetration of online food delivery platforms and the rising preference for convenient packaged meals are further supporting its dominance in this segment.

The pharmaceuticals segment is projected to record the fastest growth from 2025 to 2032, driven by increasing demand for safe, sterile, and durable packaging solutions. Polystyrene is widely used for packing medical devices, drug containers, and laboratory consumables due to its clarity, resilience, and cost efficiency. The rising need for protective packaging to prevent contamination, coupled with the expansion of pharmaceutical production, is pushing adoption in this sector. Furthermore, ongoing innovation in pharmaceutical cold-chain logistics amplifies the role of polystyrene packaging, fueling accelerated growth in the coming years.

Asia-Pacific Polystyrene Packaging Market Regional Analysis

- China dominated the polystyrene packaging market with the largest revenue share in 2024, driven by its extensive manufacturing capacity, strong presence of food processing industries, and growing demand for affordable packaging solutions across urban centers

- Rising consumption of packaged and ready-to-eat foods, combined with rapid growth in e-commerce and food delivery services, reinforces China’s leadership in the regional market

- The availability of low-cost raw materials, presence of leading domestic packaging manufacturers, and continuous investments in advanced packaging technologies consolidate China’s dominant position during the forecast period. Expanding retail networks and increasing consumer preference for convenience-based packaging further strengthen market penetration across both metropolitan and semi-urban areas

Japan Polystyrene Packaging Market Insight

The Japan market is anticipated to grow steadily from 2025 to 2032, supported by its advanced packaging sector and strong emphasis on high-quality, safe, and sustainable packaging solutions. Japanese consumers are increasingly adopting premium and innovative polystyrene packaging, reflecting the country’s focus on precision, hygiene, and aesthetic appeal. The demand for compact, eco-conscious, and multifunctional packaging formats is rising due to urban living and evolving consumer lifestyles. Continuous R&D investments, coupled with collaborations between Japanese packaging firms and global players, reinforce the market’s steady growth outlook. Japan’s commitment to innovation, quality, and consumer trust underpins its strong regional positioning.

India Polystyrene Packaging Market Insight

India is projected to register the fastest CAGR in the Asia Pacific polystyrene packaging market during 2025–2032, fueled by rising demand for packaged food and beverages, rapid urbanization, and expansion of the retail and e-commerce sectors. Growing middle-class households and increasing disposable incomes are accelerating adoption of cost-effective and durable packaging solutions. The demand for affordable and lightweight polystyrene packaging is particularly strong among quick-service restaurants and food delivery services. Expanding distribution networks, digital retail growth, and partnerships with global packaging manufacturers are enhancing product accessibility. Government initiatives to strengthen food safety and rising focus on modern trade channels ensure India’s emergence as the fastest-growing market in the region.

Asia-Pacific Polystyrene Packaging Market Share

The polystyrene packaging industry is primarily led by well-established companies, including:

- Alpek (Mexico)

- Ohishi Sangyo (Japan)

- Sonoco Products Company (U.S.)

- KANEKA CORPORATION (Japan)

- MONOTEZ (Greece)

- SUNPOR (Austria)

- Versalis S.p.A. (Italy)

- NEFAB GROUP (Sweden)

- Heubach Corporation (U.S.)

- Synthos (Poland)

Latest Developments in Asia-Pacific Polystyrene Packaging Market

- In July 2025, INEOS Styrolution, a global leader in styrenics, successfully commercialized its 100% bio-attributed polystyrene, Styrolution PS ECO 158K BC100. With food trays already available in Japanese retail stores, this marks a major step toward sustainable packaging adoption in Asia. The launch strengthens the market’s shift toward bio-based materials, providing food retailers with eco-friendly alternatives without compromising on functionality. This development broadens the application scope of bio-attributed polystyrene and also enhances consumer acceptance, positioning the company as a frontrunner in the circular economy transition within the packaging industry

- In February 2025, Trinseo introduced the first transparent dissolution recycled polystyrene (rPS) product in Europe for direct food contact applications. Approved under the EU Regulation 2022/1616, this innovation allows safe use of recycled plastics in sensitive food packaging, a breakthrough in compliance and sustainability. The launch strengthens the presence of rPS in the European market, offering manufacturers and retailers a reliable material aligned with strict regulatory standards. This move is expected to accelerate the integration of circular solutions in food packaging and create new growth avenues for eco-conscious polystyrene applications

- In October 2024, Versalis, Eni’s chemical subsidiary, unveiled its new recycled-content polystyrene grades under the brand "Versalis Revive PS" for packaging applications. These materials are designed for thermoformed trays and containers, combining mechanical strength with environmental responsibility. The introduction of recycled-content polystyrene broadens sustainable packaging options in the European market and positions Versalis as a competitive player in circular materials. This launch supports the food industry’s need for safe yet eco-friendly packaging, while boosting the adoption of recycled plastics in mainstream applications

- In March 2023, TotalEnergies partnered with Ecolab to develop advanced polystyrene packaging solutions incorporating chemically recycled materials. This collaboration focused on creating food-safe trays and containers with a significantly reduced carbon footprint. The partnership underlines the growing momentum for chemical recycling technologies in polystyrene and accelerates their adoption in food-grade applications. By aligning with global sustainability goals, this development is expected to enhance consumer trust in recycled packaging and expand demand across retail and foodservice channels

- In May 2022, Alpek, S.A.B. de C.V. finalized its USD 620 million acquisition of OCTAL Holding SAOC after securing all regulatory approvals. The acquisition provided Alpek with expanded capabilities in PET sheet and packaging solutions, diversifying its portfolio to serve global food packaging markets. By integrating OCTAL’s expertise in high-quality sheet products, Alpek strengthened its supply chain and expanded its global footprint. This strategic move boosted competitiveness in the polystyrene packaging sector by offering more integrated solutions to food and beverage companies

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。