Asia

Market Size in USD Billion

CAGR :

%

USD

155.47 Billion

USD

259.46 Billion

2024

2032

USD

155.47 Billion

USD

259.46 Billion

2024

2032

| 2025 –2032 | |

| USD 155.47 Billion | |

| USD 259.46 Billion | |

|

|

|

|

Asia-Pacific Processed Meat Market Segmentation, By Product Type (Beef, Pork, Goat, Lamb, Chicken, Turkey, Duck, and Fish), Type (Fresh Processed Meat, Frozen Meat, Chilled Meat, Canned Meat, Dried / Semi Dried Meat, Fermented Meat, and Others), Category (Cured and Uncured), Nature (Conventional and Organic), Packaging Type (Trays, Pouches, Boxes, Cannisters, and Others), Packaging Material (Plastic, Glass, Paper / Cardboard, Metal, and Others), End-User (Food Service Sector and Household), Distribution Channel (Store-based Retailers and Non-Store Based Retailers) - Industry Trends and Forecast to 2032

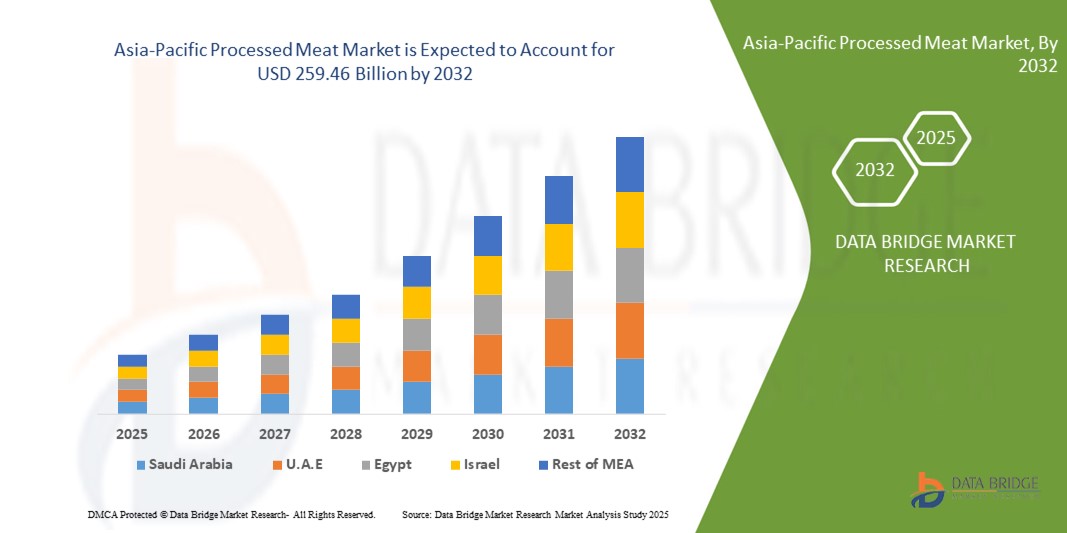

What is the Asia-Pacific Processed Meat Market Size and Growth Rate?

- The Asia-Pacific processed meat market size was valued at USD 155.47 billion in 2024 and is expected to reach USD 259.46 billion by 2032, at a CAGR of 6.3% during the forecast period

- Processed meat can be defined as meat supplemented with several additives and preservatives such as acidifiers, minerals, salts, and various other seasoning and flavoring agents. The meat is primarily processed to enhance its quality, prevent degeneration, and add flavors to its original composition. It can be red meat or white meat from swine, poultry, cattle, or sea animal meat

What are the Major Takeaways of Processed Meat Market?

- The rise in the incidences of obesity because of the high consumption of processed meat-based products is projected to impede the growth of the processed meat market in the timeline period. In addition, growing fast food and restaurant chains can further provide potential opportunities for the growth of the Asia-Pacific processed meat market in the coming years. However, the stringent government regulations might further challenge the growth of the Asia-Pacific processed meat market

- China dominated the processed meat market with the largest revenue share of 55.69% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing adoption of convenient and ready-to-cook meat products

- The India processed meat market is witnessing fastest growth rate of 11.69%, due to increasing urbanization, higher disposable incomes, and the rising popularity of convenient, protein-rich foods

- The chicken segment dominated the market in 2024 with a revenue share of 32.5%, driven by high consumption across households and food service sectors due to its affordability, versatility, and wide availability

Report Scope and Processed Meat Market Segmentation

|

Attributes |

Processed Meat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Processed Meat Market?

Enhanced Convenience and Ready-to-Cook Solution

- A significant trend in the Asia-Pacific processed meat market is the growing demand for ready-to-cook and pre-seasoned meat products, offering convenience and reduced preparation time for consumers

- For instance, companies such as JBS Foods and NH Foods are introducing marinated chicken and beef cuts, allowing households to cook meals quickly without additional seasoning

- Innovations in vacuum-packed, pre-portioned, and frozen ready-to-cook products enable longer shelf life and minimize food waste

- Processed meats with added functional ingredients, such as fortified proteins or low-sodium options, are gaining traction among health-conscious consumers

- Retailers are integrating e-commerce platforms with home delivery of frozen processed meat packs, enhancing convenience and accessibility

- This trend toward ready-to-cook, pre-portioned, and functional processed meats is shaping consumer expectations and driving market expansion in both urban and semi-urban regions

What are the Key Drivers of Processed Meat Market?

- Rising urbanization and busier lifestyles are increasing consumer preference for convenient, pre-prepared meat products

- For instance, in 2024, Cargill launched value-added frozen meat packs targeting working households across the U.S. and Asia, enhancing market reach

- Health-conscious consumers are seeking protein-rich and low-fat processed meat options, prompting companies to introduce fortified or leaner products

- Expanding cold chain infrastructure and retail modernization, including supermarkets and e-commerce platforms, are facilitating wider availability and distribution

- Consumers increasingly value traceability and safety certifications, which boost confidence in processed meat products over traditional fresh meat

- The combination of convenience, safety, and functional nutrition is driving steady adoption in households, restaurants, and food service sectors

Which Factor is Challenging the Growth of the Processed Meat Market?

- Growing concerns over health risks associated with processed meats, including high sodium and preservatives, can limit consumption

- For instance, increasing awareness of links between processed meat intake and chronic diseases has prompted some consumers to reduce usage

- Regulatory compliance and labeling requirements for additives and nutritional claims add complexity and cost for manufacturers

- Fluctuating raw material prices, such as beef or chicken, impact production costs and retail pricing

- Meeting consumer demand for both convenience and health-friendly products requires continuous innovation and investment, which can be a barrier for smaller players

- Addressing health concerns, improving transparency, and offering affordable, nutritious processed meat options are critical for sustained market growth

How is the Processed Meat Market Segmented?

The market is segmented on the basis of product type, type, category, nature, packaging type, packaging material, end-user, and distribution channel.

- By Product Type

On the basis of product type, the processed meat market is segmented into beef, pork, goat, lamb, chicken, turkey, duck, and fish. The chicken segment dominated the market in 2024 with a revenue share of 32.5%, driven by high consumption across households and food service sectors due to its affordability, versatility, and wide availability. Chicken-based processed meats, such as nuggets, sausages, and ready-to-cook portions, are particularly popular among urban consumers seeking convenience.

The beef segment is expected to witness the fastest CAGR of 18.2% from 2025 to 2032, propelled by growing demand for high-protein, premium meat products in developed regions and among health-conscious consumers. Increasing inclusion of beef in ready-to-cook meals and frozen value-added packs also contributes to its rapid growth. Overall, the diversity of product types allows manufacturers to cater to regional taste preferences and dietary habits.

- By Type

On the basis of type, the processed meat market is segmented into fresh processed meat, frozen meat, chilled meat, canned meat, dried/semi-dried meat, fermented meat, and others. The frozen meat segment held the largest market revenue share of 41.7% in 2024, driven by its longer shelf life, ease of storage, and suitability for retail and e-commerce channels. Frozen products allow households and foodservice providers to maintain stock without frequent purchases, enhancing convenience.

The dried/semi-dried meat segment is projected to register the fastest CAGR of 19.4% during 2025–2032, supported by growing demand for portable, ready-to-eat snack options and high-protein alternatives. Innovative packaging and flavor varieties in dried meats are further driving adoption, particularly among millennials and health-conscious consumers seeking on-the-go nutrition.

- By Category

On the basis of category, the market is segmented into cured and uncured processed meats. The cured segment dominated with a revenue share of 55.3% in 2024, fueled by widespread consumption of ham, bacon, sausages, and salami that are easy to store, cook, and incorporate into meals. Curing also enhances shelf life and flavor, making these products attractive for both households and the food service sector.

The uncured segment is expected to witness the fastest growth at a CAGR of 16.8% from 2025 to 2032, driven by rising health awareness and consumer preference for preservative-free or “clean label” products. Manufacturers are innovating with natural curing agents, reducing sodium, and marketing uncured meats as healthier alternatives.

- By Nature

On the basis of nature, the market is segmented into conventional and organic processed meats. The conventional segment held the largest revenue share of 72.6% in 2024 due to widespread availability, lower cost, and strong retail penetration. Conventional processed meats remain the primary choice for price-sensitive consumers in developing regions.

The organic segment is anticipated to witness the fastest CAGR of 20.3% during 2025–2032, driven by growing health consciousness, increasing disposable incomes, and demand for chemical-free, sustainably sourced meat products. Organic processed meats, often labeled antibiotic-free and hormone-free, are gaining traction among urban households and premium foodservice providers, emphasizing quality and food safety.

- By Packaging Type

On the basis of packaging type, the market is segmented into trays, pouches, boxes, cannisters, and others. The trays segment dominated in 2024 with a revenue share of 38.9%, favored for ready-to-cook portions, convenience, and stackable storage in retail and home refrigerators. Trays also allow clear visibility of the product, enhancing purchase decisions.

The pouch segment is expected to register the fastest CAGR of 21.1% from 2025 to 2032, due to its lightweight, flexible, and eco-friendly properties, making it ideal for frozen, marinated, and ready-to-eat products. Pouches also support vacuum sealing and extended shelf life, supporting growth in e-commerce and home delivery channels.

- By Packaging Material

On the basis of packaging material, the market is segmented into plastic, glass, paper/cardboard, metal, and others. Plastic dominated with a 60.2% revenue share in 2024, driven by cost-effectiveness, versatility, and protective features for frozen and chilled processed meats. Plastic packaging ensures product safety, reduces spoilage, and is compatible with modern retail supply chains.

The metal segment is projected to witness the fastest CAGR of 17.5% from 2025 to 2032, primarily due to growth in canned meats, which are popular for long-term storage, military rations, and emergency preparedness kits.

- By End-User

On the basis of end-user, the market is segmented into food service sector and household. The household segment held the largest market revenue share of 66.4% in 2024, supported by rising convenience-oriented lifestyles, ready-to-cook meal adoption, and urbanization. Households increasingly prefer pre-portioned and frozen processed meats for easy meal preparation.

The food service sector is expected to witness the fastest CAGR of 18.9% during 2025–2032, driven by growing demand from restaurants, hotels, and catering businesses seeking consistent quality, longer shelf life, and reduced labor costs in meal preparation.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based retailers and non-store-based retailers. Store-based retailers dominated with a revenue share of 71.3% in 2024, owing to the presence of supermarkets, hypermarkets, and specialty meat stores offering wide product variety and freshness assurance.

The non-store-based segment, including e-commerce and direct-to-consumer platforms, is projected to witness the fastest CAGR of 22.4% from 2025 to 2032, fueled by the convenience of home delivery, increasing online grocery adoption, and urban consumers’ preference for contactless shopping.

Which Region Holds the Largest Share of the Processed Meat Market?

- China dominated the processed meat market with the largest revenue share of 55.69% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing adoption of convenient and ready-to-cook meat products. The region’s growing focus on health-conscious diets, protein-rich food options, and innovative packaging solutions is boosting demand

- Countries such as China, Japan, and India are leading adoption, supported by evolving consumer preferences, modern retail expansion, and the rise of online grocery platforms

- In addition, the region’s increasing population density and growing middle-class households are contributing to higher per-capita consumption of processed meats, positioning APAC as a critical growth market globally

Japan Processed Meat Market Insight

The Japan Processed Meat market is expanding steadily due to high urbanization, busy lifestyles, and a preference for convenience foods. Ready-to-cook and pre-portioned meat products are increasingly popular among working households. Consumers prioritize health and safety, driving demand for low-sodium, preservative-controlled, and fortified processed meats. Retailers are responding with frozen and vacuum-packed products suitable for home use and small foodservice operations. Japan’s aging population further supports the demand for easy-to-prepare, safe, and high-quality processed meats. In addition, modern retail formats and e-commerce platforms are making these products more accessible nationwide.

India Processed Meat Market Insight

The India Processed Meat market is witnessing fastest growth rate of 11.69%, due to increasing urbanization, higher disposable incomes, and the rising popularity of convenient, protein-rich foods. Ready-to-cook chicken, mutton, and fish products are gaining traction in urban households. The expansion of modern retail, cold chain infrastructure, and e-commerce platforms facilitates wider accessibility. Health-conscious consumers are seeking low-fat, preservative-controlled, and hygienically packaged processed meats. In addition, the rise of foodservice chains and fast-food outlets is driving demand for bulk processed meat supplies. Affordability, convenience, and changing lifestyles position India as a key emerging market in APAC.

Which are the Top Companies in Processed Meat Market?

The Processed Meat industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- JBS Foods (Brazil)

- NH Foods Ltd. (Japan)

- Louis Dreyfus Company (Netherlands)

- HKScan (Finland)

- OSI Group (U.S.)

- Charoen Pokphand Foods PCL. (Thailand)

- Sanderson Farms, Incorporated. (U.S.)

- National Beef Packing Company L.L.C. (U.S.)

- Gruppo Veronesi (Italy)

- Danish Crown A.M.B.A (Denmark)

- The Kraft Heinz Company (U.S.)

What are the Recent Developments in Asia-Pacific Processed Meat Market?

- In April 2023, ASSA ABLOY Group, a Asia-Pacific leader in access solutions, launched a strategic initiative in South Africa aimed at strengthening the security of residential and commercial properties through its advanced Processed Meat technologies. This initiative underscores the company's dedication to delivering innovative, reliable access control solutions tailored to the unique security needs of the local market. By leveraging its Asia-Pacific expertise and cutting-edge product offerings, ASSA ABLOY is addressing regional challenges and reinforcing its position in the rapidly growing Asia-Pacific Processed Meat market

- In March 2023, HavenLock Inc., a veteran-led company based in Tennessee, introduced the Power G version of its Processed Meating system, specifically engineered for schools and commercial environments. The innovative Haven Lockdown System is designed to enhance security protocols, offering a reliable and effective solution for emergency situations. This advancement highlights HavenLock's commitment to developing cutting-edge safety technologies that safeguard vulnerable spaces, ensuring greater protection and peace of mind for institutions and their communities

- In March 2023, Honeywell International Inc. successfully deployed the Bengaluru Safe City Project, aimed at enhancing urban safety through its advanced Processed Meat and security technologies. This initiative harnesses state-of-the-art solutions to create a more secure and resilient city environment, underscoring Honeywell's dedication to utilizing its expertise in innovative security systems. The project highlights the increasing significance of smart technology in urban safety, contributing to the development of safer, smarter communities

- In February 2023, Sentrilock, LLC, a leading provider of electronic lockbox solutions for the real estate industry, announced a strategic partnership with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR) to create a smart electronic lockbox marketplace for REALTOR members. This collaboration is designed to enhance security and streamline accessibility for real estate professionals, facilitating more efficient and secure property transactions. The initiative underscores Sentrilock's commitment to driving innovation and improving operational effectiveness within the real estate sector

- In January 2023, Schlage, a leading provider of access and home security solutions under Allegion Plc, unveiled the Schlage Encode Smart Wi-Fi Lever at the NAHB International Builders’ Show (IBS) 2023. This innovative residential Processed Meat, equipped with Wi-Fi connectivity, enables users to manage access remotely through a dedicated app. The Schlage Encode lever highlights the company’s commitment to integrating advanced technology into home security systems, offering homeowners enhanced convenience and control while ensuring robust security

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。