Asia

Market Size in USD Billion

CAGR :

%

USD

1.47 Billion

USD

2.20 Billion

2024

2032

USD

1.47 Billion

USD

2.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.47 Billion | |

| USD 2.20 Billion | |

|

|

|

|

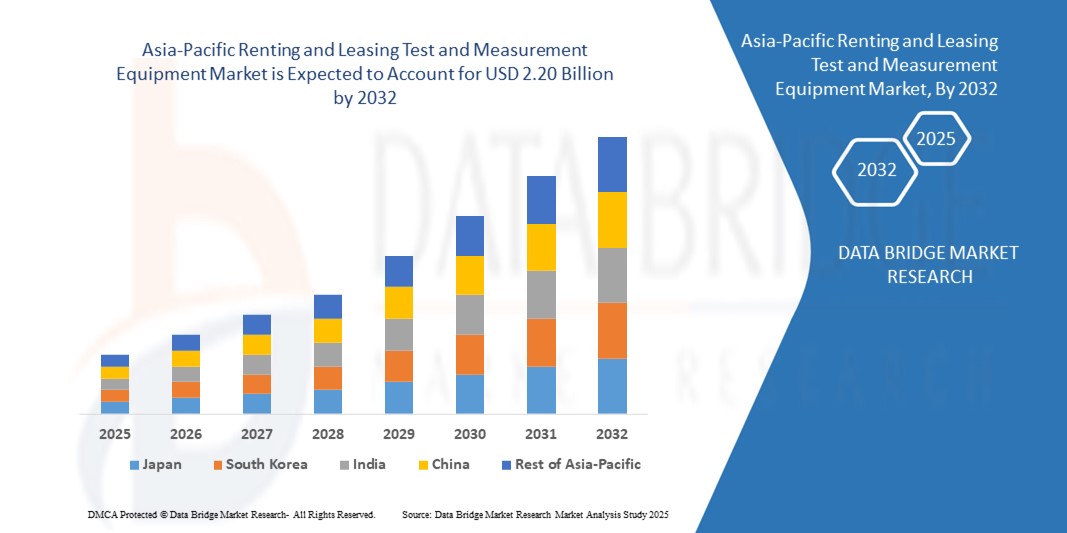

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Segmentation, By Offering (Hardware and Services), Component (Cable Assemblies, Connectors, Value Added Accessories, and Others), System Type (Sensing System, Connectivity System, Safety & Security System, Human Machine Interface (HMI), Power & Energy Management System, Motor Control System, and Lighting System), Type (Rent and Lease), Features (Diagnostic Equipment, Electrical Sensing, Metering ICS, and Others), End-User (IT & Telecommunication, Automotive, Aerospace & Defense, Industrial, Consumer Electronics, Energy & Utilities, Medical Equipment, and Others)- Industry Trends and Forecast to 2032

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Size

- The Asia-Pacific renting and leasing test and measurement equipment market size was valued at USD 1.47 billion in 2024 and is expected to reach USD 2.20 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for cost-effective access to advanced testing solutions and the rising adoption of flexible business models across industries

- The growing emphasis on reducing capital expenditure while ensuring access to the latest technologies is also accelerating market adoption

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Analysis

- The market is witnessing strong growth as enterprises across electronics, telecom, automotive, and manufacturing industries opt for renting and leasing models to optimize costs and maintain operational agility

- Increasing technological complexity, shorter product life cycles, and the need for regular upgrades are compelling companies to adopt flexible access rather than outright purchases

- China dominated the Asia-Pacific renting and leasing test and measurement equipment market in 2024, driven by its large-scale industrial base, rapid expansion of electronics and telecom sectors, and strong government support for digital and smart manufacturing initiatives

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific renting and leasing test and measurement equipment market due to increasing adoption of flexible rental and leasing solutions, growing demand for high-precision testing instruments in automotive and semiconductor industries, and rising investments in smart manufacturing and digital transformation initiatives

- The Services segment held the largest market revenue share in 2024, driven by the growing preference for full-service leasing solutions, including calibration, maintenance, and technical support. Service-based agreements offer operational convenience and reduce the need for in-house expertise, making them highly popular among enterprises

Report Scope and Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Segmentation

|

Attributes |

Asia-Pacific Renting and Leasing Test and Measurement Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Trends

Shift Toward Flexible Access Models

- The growing preference for renting and leasing models is reshaping the test and measurement equipment industry by enabling organizations to access advanced tools without heavy upfront investments. This approach supports cost optimization and allows companies to adapt to rapidly changing technology cycles

- The rising need for short-term access to high-performance testing systems in sectors such as telecom, electronics, and automotive is accelerating the adoption of flexible rental agreements. These models provide companies with the agility to scale testing capacity based on project requirements

- The affordability and operational convenience of leasing contracts are making them attractive for small and mid-sized enterprises, enabling access to equipment that would otherwise be cost-prohibitive. This ensures improved testing capabilities without long-term financial commitments

- For instance, in 2023, several electronics manufacturers adopted rental models for advanced oscilloscopes and spectrum analyzers to support product development, avoiding large capital expenditures while maintaining high-quality testing standards

- While renting and leasing models are expanding access and reducing financial risk, their success depends on continued innovation in service offerings, transparent pricing, and robust customer support. Providers must focus on customized agreements and bundled services to capture rising demand

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Dynamics

Driver

Rising Demand for Cost Optimization and Access to Latest Technologies

- The increasing cost of advanced testing equipment is driving companies toward renting and leasing as a cost-efficient alternative. By avoiding large upfront expenses, organizations can redirect capital toward core operations and R&D activities. This approach also enables companies to respond quickly to fluctuating project demands without being tied to depreciating assets, ensuring operational flexibility

- Businesses are increasingly aware of the benefits of accessing the latest testing technologies without the burden of ownership. This has led to a surge in short- and medium-term contracts across industries with fast-evolving product cycles. Leasing allows firms to trial new instruments, upgrade regularly, and maintain competitive advantage without committing to long-term investments

- Market growth is further supported by service providers offering calibration, maintenance, and upgrades as part of leasing contracts, ensuring uninterrupted operations and equipment reliability. Companies also benefit from technical support, software updates, and equipment replacement guarantees, reducing downtime and operational risks

- For instance, in 2022, several telecom operators adopted leasing agreements for 5G testing instruments to accelerate deployment while minimizing financial risk, boosting demand for flexible rental solutions. This practice helped them scale testing infrastructure quickly and efficiently, supporting faster rollout of critical network services

- While cost savings and technology access are strong growth drivers, the market requires continuous innovation in service delivery, improved customization, and global availability to ensure sustained adoption. Providers investing in digital platforms for asset tracking, predictive maintenance, and remote support are likely to see accelerated growth

Restraint/Challenge

High Dependence on Equipment Availability and Service Reliability

- The limited availability of specialized test and measurement equipment in certain markets creates bottlenecks, as rental companies cannot always meet the demand for niche or high-end instruments. This restricts timely access and delays critical projects. Companies often face scheduling conflicts, which can impact product development timelines and overall operational efficiency

- In many developing regions, there is a lack of reliable rental service providers capable of maintaining equipment quality and ensuring consistent performance. This creates trust issues and limits adoption among enterprises. Maintenance gaps, calibration delays, and absence of trained personnel further exacerbate challenges in these regions

- Market penetration is also restricted by logistical challenges, including transportation, installation, and calibration delays, particularly for large or complex systems. These hurdles increase downtime and reduce operational efficiency. Companies may face additional costs for on-site setup, extended lead times, and transportation risks, which can discourage adoption in remote locations

- For instance, in 2023, multiple small-scale enterprises in region reported project delays due to unavailability of leased equipment and inadequate technical support, highlighting gaps in service quality and accessibility. These delays also affected compliance with regulatory standards and testing schedules, demonstrating the critical need for robust provider networks

- While renting and leasing models reduce upfront costs, ensuring widespread adoption depends on strengthening supply chains, enhancing after-sales service, and expanding provider networks to deliver reliable and timely solutions. Integration of digital monitoring, predictive maintenance, and scalable service contracts can mitigate risks and boost confidence among potential users

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Scope

The market is segmented on the basis of offering, component, system type, type, features, and end-user.

- By Offering

On the basis of offering, the market is segmented into Hardware and Services. The Services segment held the largest market revenue share in 2024, driven by the growing preference for full-service leasing solutions, including calibration, maintenance, and technical support. Service-based agreements offer operational convenience and reduce the need for in-house expertise, making them highly popular among enterprises.

The Hardware segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing availability of advanced testing instruments for rent or lease. Hardware rentals allow businesses to access the latest equipment without heavy capital expenditure, supporting short-term projects and rapid technological upgrades.

- By Component

On the basis of component, the market is segmented into Cable Assemblies, Connectors, Value Added Accessories, and Others. The Value Added Accessories segment held the largest revenue share in 2024, fueled by demand for comprehensive rental packages that include adapters, probes, and calibration kits, ensuring seamless operation with leased equipment.

The Connectors segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for compatible and high-performance connectors that enhance the usability of rented or leased testing devices across multiple applications.

- By System Type

On the basis of system type, the market is segmented into Sensing System, Connectivity System, Safety & Security System, Human Machine Interface (HMI), Power & Energy Management System, Motor Control System, and Lighting System. The Connectivity System segment held the largest market revenue share in 2024, driven by increased adoption in IT, telecom, and electronics sectors that require reliable testing of communication networks and devices.

The Sensing System segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing demand for precision measurement and real-time data acquisition tools offered through flexible leasing models.

- By Type

On the basis of type, the market is segmented into Rent and Lease. The Rent segment held the largest revenue share in 2024, as businesses increasingly prefer short-term rentals for project-specific testing and prototyping, which reduces upfront costs and minimizes equipment obsolescence.

The Lease segment is expected to witness the fastest growth rate from 2025 to 2032, driven by long-term contracts that provide continuous access to high-end test and measurement devices along with value-added services, ensuring operational efficiency and cost optimization.

- By Features

On the basis of features, the market is segmented into Diagnostic Equipment, Electrical Sensing, Metering ICS, and Others. The Diagnostic Equipment segment held the largest market revenue share in 2024, supported by high demand across industrial, automotive, and telecommunication sectors for precision testing and troubleshooting.

The Electrical Sensing segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing adoption of rented and leased electrical testing instruments for energy monitoring, compliance, and safety applications.

- By End-User

On the basis of end-user, the market is segmented into IT & Telecommunication, Automotive, Aerospace & Defense, Industrial, Consumer Electronics, Energy & Utilities, Medical Equipment, and Others. The IT & Telecommunication segment held the largest revenue share in 2024, driven by rapid deployment of network infrastructure and increasing adoption of rental and leasing solutions for testing high-speed communication systems.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing reliance on advanced testing and diagnostic equipment in vehicle R&D and manufacturing processes offered through flexible rental and leasing models.

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Regional Analysis

- China dominated the Asia-Pacific renting and leasing test and measurement equipment market in 2024, driven by its large-scale industrial base, rapid expansion of electronics and telecom sectors, and strong government support for digital and smart manufacturing initiatives

- Companies are leveraging rental and leasing models to access high-end testing instruments without heavy upfront investment, enabling rapid deployment of R&D and quality control operations

- This widespread adoption is further supported by the growing need for precision testing in manufacturing, telecom, and automotive sectors, establishing flexible leasing solutions as a key operational strategy

Japan Renting and Leasing Test and Measurement Equipment Market

The Japan renting and leasing test and measurement equipment market is expected to witness the fastest growth rate from 2025 to 2032 due to increasing demand for high-performance testing tools and precision instruments in automotive, electronics, and semiconductor industries. Enterprises are rapidly adopting leasing solutions to maintain access to the latest equipment and reduce financial risk while supporting advanced R&D and production processes. Rising investments in IoT, AI, and smart factory initiatives are significantly driving demand for flexible rental and service-based testing equipment models.

Asia-Pacific Renting and Leasing Test and Measurement Equipment Market Share

The Asia-Pacific renting and leasing test and measurement equipment industry is primarily led by well-established companies, including:

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Hitachi Cooling & Heating (Japan)

- Fujitsu Limited (Japan)

- Huawei Technologies Co., Ltd. (China)

- Lenovo Group Ltd. (China)

- Advantech Co., Ltd. (Taiwan)

- Delta Electronics, Inc. (Taiwan)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。