アジア太平洋地域のテクスチャードバター市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

364.21 Million

USD

465.27 Million

2024

2032

USD

364.21 Million

USD

465.27 Million

2024

2032

| 2025 –2032 | |

| USD 364.21 Million | |

| USD 465.27 Million | |

|

|

|

アジア太平洋地域のテクスチャードバター市場のセグメンテーション、タイプ別(無塩テクスチャードバターと有塩テクスチャードバター)、製品タイプ別(動物性(牛乳)バターと植物性バター)、カテゴリー別(オーガニックと従来型)、用途別(ベーカリー、アイスクリーム、ソースと調味料、菓子類、その他)– 2032年までの業界動向と予測

テクスチャードバター市場規模

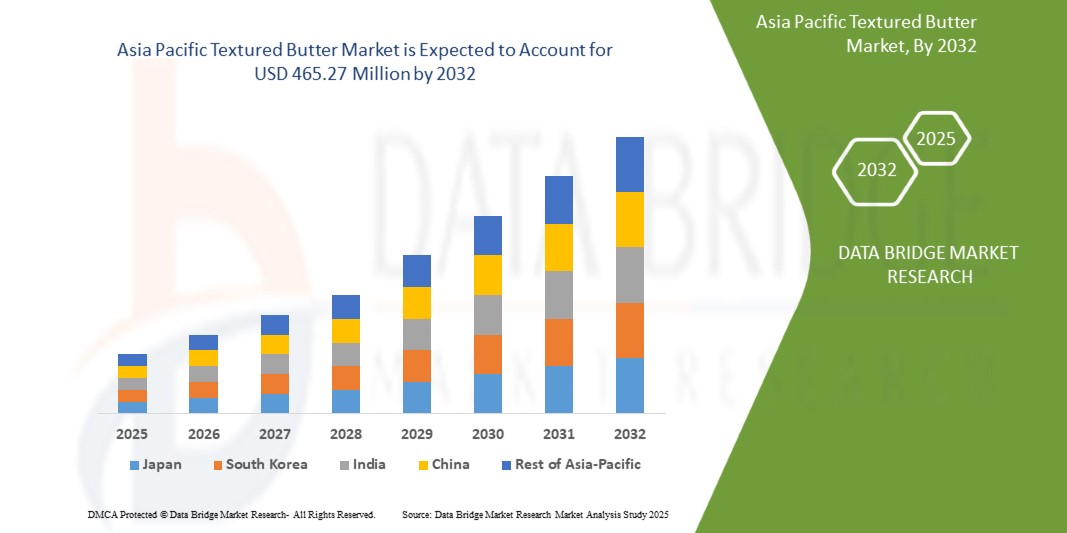

- アジア太平洋地域のテクスチャードバター市場は2024年に3億6,421万米ドルと評価され、 2032年までに4億6,527万米ドルに達すると予想されています。

- 2025年から2032年の予測期間中、市場は3.17%のCAGRで成長すると予想されます。これは主に、強化された感覚的な食品体験、クリーンラベルのトレンド、小売業と食品サービス部門の両方でプレミアムで塗りやすいバターの選択肢に対する消費者の需要の高まりによって推進されます。

- この成長は、高級乳製品の需要増加、クリーンラベルや天然原料に対する消費者の嗜好の増加、食品加工やバターの質感の革新などの要因によって推進されている。

アジア太平洋地域のテクスチャードバター市場分析

- 職人技が光る高級乳製品への消費者の関心の高まりが、テクスチャードバターの需要を牽引しています。このトレンドは、味覚嗜好の変化、健康志向、そして特に先進国や都市部におけるグルメ料理や家庭料理における濃厚でクリーミーな食感への関心によって推進されています。

- 食品加工技術の進歩により、メーカーは食感、伸びやすさ、口当たりが向上したバターを提供できるようになりました。これらの革新は、パンや菓子などの特定の調理用途に対応し、商業食品メーカーと一般消費者の両方にとってバターの魅力を高めています。

- テクスチャードバター市場は、クリーンラベル、オーガニック認証、そして最小限の加工が施された製品を求める消費者の増加に伴い、成長を遂げています。特に牧草飼育やオーガニック由来のバターは、より健康的な脂肪分選択肢として認識されており、伝統的なバターと植物由来のバターの両方で人気が高まっています。

- 例えば、英国では全脂肪乳製品の復活が見られます。マークス&スペンサーやヨー・バレーといった小売業者は、消費者のクリーミーな食感への嗜好と、低脂肪の加工食品への懐疑的な見方に支えられ、全乳とバターの売上が増加していると報告しています。

- テクスチャードバターは、ベーカリー、菓子、ソース、調理済み食品など、様々な食品分野で人気が高まっています。その汎用性と風味と粘稠性を高める能力から、家庭用と業務用の厨房の両方に欠かせない材料となっており、アジア太平洋地域で市場を拡大しています。

レポートの範囲と市場セグメンテーション

|

属性 |

アジア太平洋地域のテクスチャードバター主要市場分析 |

|

対象セグメント |

|

|

対象国 |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

アジア太平洋地域のテクスチャードバター市場の動向

「高級な職人技の乳製品への需要の高まり」

- アジア太平洋地域のテクスチャードバター市場は、グルメや職人技が光る製品への消費者需要の高まりによって形成されています。人々がプレミアムな食体験を求めるにつれ、豊かな味わいと見た目の美しさを持つテクスチャードバターは、家庭のキッチンだけでなく高級レストランでも人気を集めており、特に都市部や先進国市場では、品質と美観が購買決定に影響を与える傾向にあります。

- 健康志向の消費者は、オーガニックやクリーンラベルの製品を好む傾向が顕著で、テクスチャードバター市場の成長を牽引しています。天然脂肪を豊富に含み、加工が最小限に抑えられているテクスチャードバターは、低脂肪食品よりもホールフードを重視する現在の栄養トレンドに合致しており、バランスの取れた高品質な食生活への組み込みを促進しています。

- パンデミック後のライフスタイルの変化によって加速した家庭でのパン作りや料理の急増は、テクスチャードバターのような特殊な食材の需要を高めました。その風味と粘稠度の高さは、ベーカリー製品、ソース、スプレッドなどの用途に好まれ、食品カテゴリーにおける用途の多様化に貢献しています。

- 例えば、職人の手による地元産の製品に対する消費者の嗜好の高まりは、テクスチャードバターを含むグルメ食品への幅広い傾向を示しています。

- メーカーは、ビーガンや乳糖不耐症の消費者のニーズに応えるため、植物由来や乳糖不使用の代替品を導入することで、テクスチャードバター市場における革新を進めています。これらの製品革新は、持続可能な包装や調達への取り組みと相まって、消費者基盤の拡大と長期的な市場成長を支えています。

アジア太平洋地域のテクスチャードバター市場の動向

ドライバー

「高級乳製品の需要増加」

- Consumers today are more conscious about the ingredients and processing methods used in their food, leading to a surge in demand for premium dairy products that offer superior taste, texture, and nutritional benefits

- Textured butter, known for its enhanced spreadability, smoothness, and consistency, is becoming a preferred choice among both home cooks and professional chefs. The rise of fine dining, bakery, and confectionery industries has further fueled this trend, as textured butter enhances the quality of pastries, desserts, and premium food offerings. In addition, health-conscious consumers are opting for high-quality butter alternatives that contain fewer additives and preservatives while retaining natural richness

- For instance, In October 2024, Danone announced a USD 21.60 million investment to expand its operations in Punjab, capitalizing on the rising demand for premium dairy products in India. As consumers increasingly seek healthier and high-quality dairy options, Danone aims to grow its market share, competing with established players such as Amul

- In August 2024,edairynews published an article which states that the demand for premium dairy products in India surged as health-conscious consumers prioritized quality over cost. Driven by a growing awareness of natural ingredients, organic, grass-fed, and hormone-free options, the market is seeing increasing consumer preference for products offering superior taste and health benefits, reshaping the dairy sector

- The growth of organic and grass-fed dairy products has contributed to the increasing demand for premium butter varieties. Consumers are willing to pay a premium for products that are ethically sourced, environmentally friendly, and free from artificial ingredients. As a result, dairy manufacturers are innovating with different textures, flavors, and organic certifications to cater to this expanding market segment, further driving the textured butter market’s growth

Opportunities

“Shifting Consumer Inclination Towards Sustainable And Ethical Sourced Products”

- Consumers are increasingly shifting towards sustainable and ethically sourced textured butter, creating significant opportunities for the market. With rising awareness of environmental impact and ethical farming, buyers prefer butter made from responsibly sourced dairy. They look for certifications such as organic, fair trade, and grass-fed, ensuring that the product aligns with their values

- Sustainable sourcing involves eco-friendly farming practices that protect natural resources, reduce carbon footprints, and support biodiversity. Ethical sourcing ensures fair wages for farmers and humane treatment of animals. Many brands are now adopting transparent supply chains to meet these consumer expectations

- The growing demand for such products encourages manufacturers to invest in responsible sourcing and sustainable production methods. Companies that focus on eco-friendly packaging, reduced waste, and ethical ingredient sourcing can gain a competitive edge in the Asia Pacific textured butter market. As consumer preferences continue to evolve, businesses that align with sustainability and ethical standards will likely experience increased brand loyalty and market growth. This trend presents a lucrative opportunity for manufacturers to expand their product range while meeting the demand for responsible food choices

For instance,

- In January 2023, a study published on Sustainably Produced Butter: The Effect of Product Knowledge, interest in Sustainability, and Consumer Characteristics on Purchase Frequency highlights that consumer knowledge, interest in sustainability, and product certifications such as organic and fair trade significantly influence the purchase frequency and preferences for ethically sourced butter. This trend emphasizes the growing demand for responsibly produced dairy products

- In August 2024, an article published by Ethical Consumer Research Association Ltd highlights that consumers are increasingly opting for butter and spreads with ethical certifications such as fair-trade and organic, prioritizing sustainability and responsible sourcing in their purchasing decisions

- An article published by the World Wildlife Fund states that sustainable agriculture practices, including eco-friendly dairy farming methods and responsible sourcing, are crucial for protecting natural resources, reducing carbon footprints, and promoting biodiversity

Consumers are increasingly demanding sustainably and ethically sourced textured butter, driving market opportunities. With rising awareness of environmental impact and ethical farming, brands focusing on responsible sourcing, eco-friendly packaging, and transparent supply chains gain a competitive edge. This trend boosts market growth, encouraging manufacturers to align with sustainability and ethical standards.

Restraints/Challenges

“High Production Costs Of Textured Butter”

- Textured butter, due to its specialized production process, requires more advanced technology and higher-quality raw materials, such as organic or grass-fed cream. These factors contribute to its increased cost compared to regular butter. The need for precise manufacturing techniques to achieve the desired consistency and texture further drives up production expenses

- For manufacturers, the higher costs associated with sourcing premium ingredients, maintaining quality control, and investing in specialized equipment can limit the scalability and affordability of textured butter, especially in price-sensitive markets. This, in turn, can restrict its widespread adoption, particularly among small and medium-sized businesses in the food industry that may struggle to absorb the added costs

For instance,

- 2024年12月、Fast Companyのレポートは、サプライチェーンの混乱、労働力不足、生産コストの上昇によりバター価格が高騰していることを指摘しました。特にテクスチャードバターに関しては、これらの要因がシェフと消費者の両方に負担をかけ、高品質のバターと原材料の価格をさらに引き上げています。

- 2024年4月、ウィリアム・リード社は、バター価格の上昇は異常気象、政情不安、エネルギーコストの上昇といった要因によるもので、乳製品価格の上昇とバター生産コストの上昇につながっていると指摘しました。この高騰は、需要の持続により今後も続くと予想されます。

特に発展途上市場においては、消費者の価格に対する敏感さがテクスチャードバターの需要を阻害する可能性があります。消費者はより手頃な価格の代替品を選ぶ傾向があるためです。その結果、テクスチャードバター市場の成長は、特に食品業界全体におけるより安価な油脂との競争において、課題に直面しています。

アジア太平洋地域のテクスチャードバター市場の 展望

市場は、タイプ、製品タイプ、カテゴリ、およびアプリケーションに基づいて分割されています。

|

セグメンテーション |

サブセグメンテーション |

|

タイプ別 |

|

|

製品タイプ別 |

|

|

カテゴリー別 |

|

|

アプリケーション別 |

|

アジア太平洋地域のテクスチャードバター市場の地域分析

「中国はアジア太平洋地域のテクスチャードバター市場において支配的な国である」

- 中国は、食生活の西洋化と中流階級の増加を背景に、乳製品に対する消費者需要が急速に高まっており、テクスチャードバター市場を席巻する勢いを見せています。この変化は、高級ベーカリーや食品加工業者が求める品質基準を満たすため、特にニュージーランドと欧州連合からのバター輸入量を大幅に増加させました。さらに、国内のベーカリー・菓子業界の拡大も、高品質バターの需要をさらに高めています。

「中国は最高の成長率を記録すると予測されている」

- 中国は、食生活の西洋化と中流階級の増加に伴う乳製品に対する消費者需要の高まりにより、テクスチャードバター市場において最も高い成長率を記録すると予測されています。この傾向により、高級ベーカリーや食品加工業者が求める品質基準を満たすため、特にニュージーランドと欧州連合からのバター輸入が大幅に増加しました。さらに、国内のベーカリー・菓子業界の拡大も、高品質バターの需要をさらに押し上げています。

テクスチャードバターの市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、地域展開、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

アジア太平洋地域のテクスチャードバター市場リーダーは以下のとおりです。

- フレシャールSAS(フランス)

- フリースラントカンピナプロフェッショナル(オランダ)

- ロイヤルVIVBuisman(オランダ)

- ウエルツェナ・イングリディエンツ(ドイツ)

- LACTALIS(フランス)

- NUMIDIA BV(オランダ)

- レイクランドデイリーズ(アイルランド)

- コーマン(ベルギー)

アジア太平洋地域のテクスチャードバター市場の最新動向

- ラクタリス・イングリディエンツは1月、バター製品のパッケージに新しいグラフィック・アイデンティティを導入します。このアップデートは、ブランド認知度の向上と製品プレゼンテーションの近代化に向けた継続的な取り組みの一環です。新しいデザインは、ラクタリスの品質、革新性、持続可能性へのコミットメントを反映し、消費者にとってより魅力的なパッケージを目指しています。この開発により、ラクタリス・イングリディエンツはブランド認知度を高め、消費者への訴求力を高め、品質、革新性、持続可能性へのコミットメントをさらに強化することができます。

- レイクランド・デイリーズは3月、ベルギーに拠点を置くバター脂肪事業であるデ・ブラント・デイリー・インターナショナルNVの買収を完了しました。これは、付加価値を高め、欧州市場におけるプレゼンスを拡大することを目指しています。これにより、欧州のバター市場における地位が強化され、新たな市場と製品カテゴリーを開拓しました。この戦略的動きは、農家への収益向上と、既存および将来の顧客への世界クラスの製品提供のさらなる発展につながると期待されています。

- 2月、フリースランド・カンピナは、効率性と持続可能性の向上に向けた取り組みの一環として、バター生産拠点をオランダのロッヘムに移転する意向を発表しました。この移転には、2025年初頭までにデン・ボッシュ工場を閉鎖する計画が含まれており、約90名の従業員に影響が及びます。同社は従業員に対し、支援と代替の雇用機会を提供します。この移転は、生産プロセスの最適化と長期的な業務改善の両立を目指しています。フリースランド・カンピナは、この決定は最終的な実施に先立ち、従業員との協議と規制当局の承認が必要となることを強調しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 VIETNAM

11.1.12 INDONESIA

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 129 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 131 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 146 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 148 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 150 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 165 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 167 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 169 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 184 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 186 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 188 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 203 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 205 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 207 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 222 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 224 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 239 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 241 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 243 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 245 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 260 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 262 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 264 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 279 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 281 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 283 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 REST OF ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

図表一覧

FIGURE 1 ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 2 ASIA-PACIFIC TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 21 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。