カナダのフリート管理市場、提供内容(ソリューションとサービス)、リースタイプ(リースありとリースなし)、輸送モード(自動車、船舶、鉄道車両、航空機)、車両タイプ(内燃機関と電気自動車)、ハードウェア(GPS追跡デバイス、ダッシュカメラ、Bluetooth追跡タグ、データロガー、その他)、フリートサイズ(小規模フリート(1〜5台の車両)、中規模フリート(5〜20台の車両)、大規模およびエンタープライズフリート(20〜50台以上の車両)、通信範囲(短距離通信と長距離通信)、展開モデル(オンプレミス、クラウド、ハイブリッド)、テクノロジー(GNSS、セルラーシステム、電子データ交換(EDI)、リモートセンシング、計算方法と意思決定、RFID、その他)、機能(ドライバー行動の監視、燃料消費、資産管理、ELD苦情、ルート管理、車両メンテナンスの更新、配送スケジュール、事故防止、リアルタイムの車両位置、業界(モバイルアプリ、その他)、運用(個人および商用)、業種(中小企業および大企業)、エンドユーザー(自動車、運輸および物流、小売、製造、食品および飲料、エネルギーおよび公共事業、鉱業、政府、医療、農業、建設、その他) - 2030 年までの業界動向と予測。

カナダの車両管理市場の分析と規模

予測期間中に車両管理市場の成長を後押しすると予想される主な要因は、航空宇宙、鉄鋼、電力、化学など、いくつかの産業用途の増加です。さらに、負荷変動に対する耐性の向上は車両管理の利点であり、車両管理市場の成長をさらに促進すると予想されます。

Data Bridge Market Research の分析によると、カナダの車両管理市場は、予測期間中に 8.1% の CAGR で成長し、2030 年までに 2,204,927.30 千米ドルに達すると予想されています。車両管理市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年 - 2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021(2015~2020年にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

提供内容(ソリューションとサービス)、リースタイプ(リースありとリースなし)、輸送モード(自動車、船舶、鉄道車両、航空機)、車両タイプ(内燃機関と電気自動車)、ハードウェア(GPS 追跡デバイス、ダッシュ カメラ、Bluetooth 追跡タグ、データ ロガーなど)、車両規模(小規模車両群(1~5 台)、中規模車両群(5~20 台)、大規模およびエンタープライズ車両群(20~50 台以上)、通信範囲(短距離通信と長距離通信)、導入モデル(オンプレミス、クラウド、ハイブリッド)、テクノロジー(GNSS、セルラー システム、電子データ交換(EDI)、リモート センシング、計算方法と意思決定、RFID など)、機能(ドライバーの行動の監視、燃料消費、資産管理、ELD 苦情、ルート管理、車両メンテナンスの更新、配送スケジュール、事故防止、リアルタイムの車両位置、モバイル アプリなど)、業務(個人および商業)、ビジネスタイプ(中小企業および大企業)、エンドユーザー(自動車、運輸および物流、小売、製造、食品および飲料、エネルギーおよび公共事業、鉱業、政府、医療、農業、建設、その他) |

|

対象国 |

カナダ |

|

対象となる市場プレーヤー |

Element Fleet Management Corp. (米国)、Verizon. (米国)、Geotab Inc. (カナダ)、Motive Technologies, Inc. (米国)、Jim Pattison Lease (カナダ)、Holman, Inc. (米国)、Cisco Systems, Inc. (米国)、Donlen (米国)、Omnitracs (Solera の一部門) (米国)、Wheels Inc. (米国)、DENSO CORPORATION (日本)、AT&T (米国)、Continental AG (ドイツ)、ORBCOMM (米国)、Summit Fleet Leasing and Management (カナダ)、Siemens (ドイツ)、ADDISON LEASING OF CANADA LTD (カナダ)、Robert Bosch GmbH (ドイツ)、RAM Tracking (英国)、TRANSFLO (米国)、Foss National Leasing Ltd. (カナダ)、Samsara Inc. (米国)、Sierra Wireless。 (米国)、Mendix Technology BV (オランダ)、ALD Automotive (フランス)、IBM (米国)、ADDISON LEASING OF CANADA LTD (カナダ)、Robert Bosch GmbH (ドイツ)、RAM Tracking (英国)、TRANSFLO (米国) など |

市場の定義

フリート管理とは、企業の車両群を管理するプロセスと実践のことです。フリート管理には、自動車、トラック、バン、および業務目的で使用されるその他の車両が含まれます。また、車両の取得、メンテナンス、燃料管理、ドライバー管理、安全性とコンプライアンスなど、多くの実践も含まれます。フリート管理の目標は、会社の車両の使用を最適化して、効率を改善し、コストを削減し、安全性を強化することです。効果的なフリート管理は、生産性の向上、ダウンタイムの削減、車両の耐用年数の延長に役立ちます。また、ドライバーの行動の改善、事故の削減、規制やポリシーへの準拠の確保にも役立ちます。フリート管理は、輸送、物流、配送サービス、建設など、さまざまな業界で使用されています。近年、GPS 追跡やテレマティクスなどの高度なテクノロジーにより、フリート管理はより効果的かつ効率的になっています。

カナダのフリート管理市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

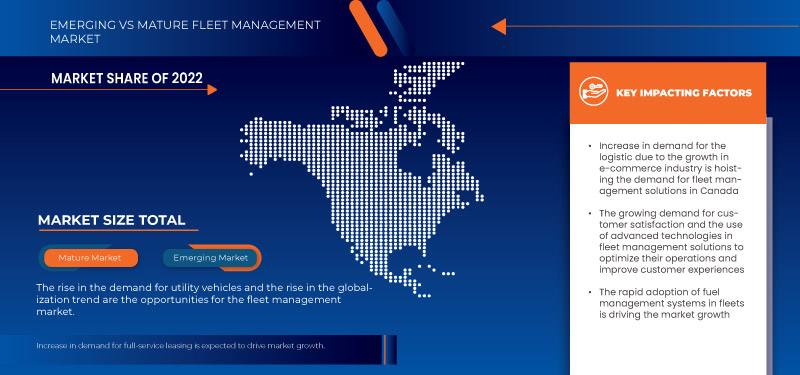

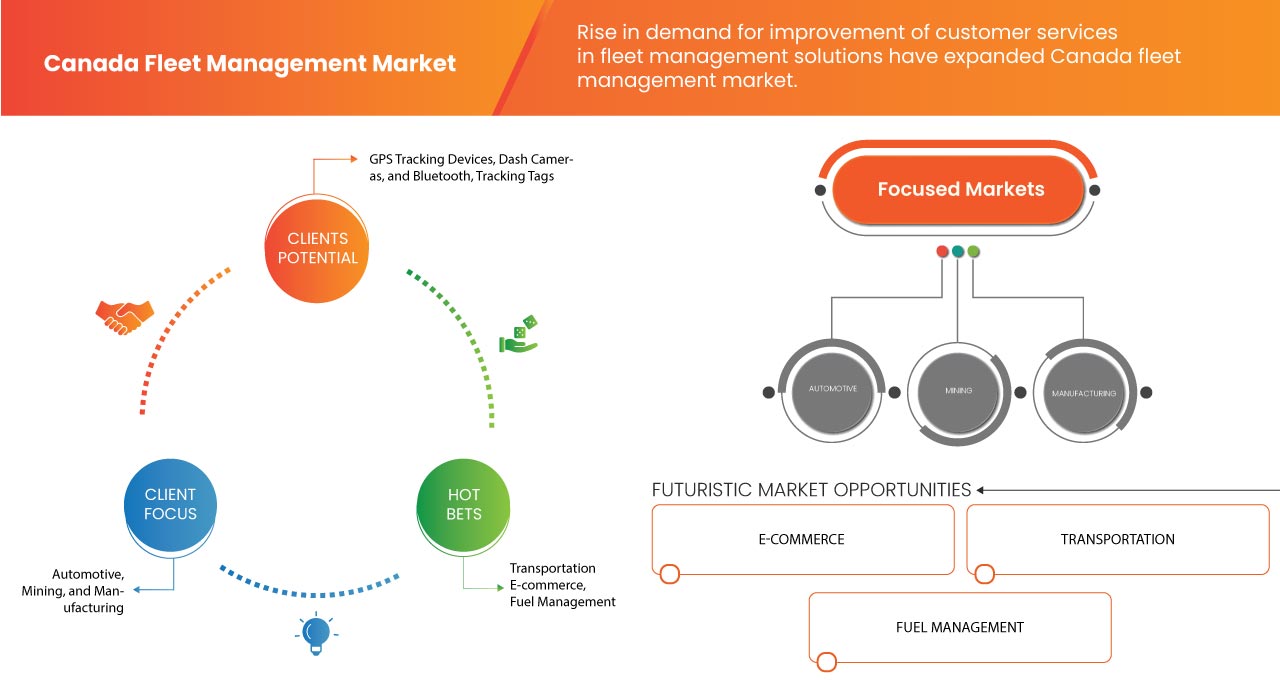

- 電子商取引業界による物流需要の増加

フリート管理とは、組織が配送車両を管理および調整して、最適な効率を達成し、コストを削減できるようにする方法です。フリート管理の方法は、宅配業者と配達員を監視および記録するために使用されます。これには、フリート管理者が燃料管理からルートの計画まで活動を調整しやすくするテクノロジのシステムが必要です。これは、フリート管理ソフトウェアを使用して簡単に管理できます。電子商取引業界の成長は、物流業界に大きな影響を与えています。物流は、計画された運用、倉庫、および生産ネットワーク組織に直接影響を与えるため、電子商取引業界のバックボーンであると考えられてきました。インターネットビジネスのセグメントの成長に関連する高まる需要に対処するために、彼らはますます再評価に依存するでしょう。ラストマイルの配送または需要の満足のいずれかのためにこの方針を採用すると、予測可能で信頼性が高く、生産的で、ミスのない配送を保証できるようになります。したがって、これは、電子商取引ビジネス業界の予想される成長による圧力を管理および拡大する上で大きな要因になる可能性があります。

- 顧客サービスの向上に対する需要の高まり

今日の顧客は以前よりも賢くなり、期待も高まっています。顧客満足度と幸福度は、どの企業にとっても最も重要な考慮事項の 1 つです。業種に関係なく、不満を持つ顧客は長く顧客でいられないため、顧客を満足させ、大切にされていると感じさせることが重要です。これは、顧客維持が長期的な成功の鍵となる物流や車両管理にも当てはまります。車両管理のパフォーマンス向上による顧客サービスと満足度の向上は、カナダの車両管理市場を後押しすると予想される重要な要素です。今日の競争の激しい市場では、企業は顧客満足度の重要性を認識し、車両管理ソリューションの高度なテクノロジーを使用して業務を最適化し、顧客体験を向上させています。

機会

- ユーティリティビークルの需要増加

ユーティリティ ビークルは、商品や乗客を運ぶために設計され、使用される車両です。これらの車両には、トラック、バン、バス、および商用目的で使用される同様の車両が含まれます。ユーティリティ ビークル市場は、カナダの自動車産業の重要な構成要素であり、過去数十年にわたって著しい成長を遂げています。ユーティリティ ビークルの需要の増加は、e コマース業界の成長、都市化の進行、効率的な輸送システムの必要性など、いくつかの要因に起因しています。輸送ニーズのためにユーティリティ ビークルに依存する企業が増えるにつれて、フリート管理サービスとソフトウェアの需要も増加すると予想されます。ユーティリティ ビークルの需要増加の理由の 1 つは、e コマース業界の成長です。オンライン ショッピング プラットフォームの数が増えるにつれて、輸送サービスの需要が増加しています。ユーティリティ ビークルの使用がより一般的になり、フリート管理がより重要になっています。

制約/課題

- 接続効率の低下

近年、物流および輸送業界は大きく変化しました。デジタル化、ビッグデータの出現、接続性などの概念が導入され、多くの車両が現在、これらの新しいテクノロジーの初期バージョンを使用しています。多くの場合、それらは車両管理者の日常的な業務方法を変えています。接続性は、最も重要かつ効果的な概念の 1 つです。これにより、車両管理者は車両全体の概要を把握し、車載デバイスから実用的なデータを提供する自動化プロセスを通じて、ドライバー、トラック、トレーラーと連絡を取り合うことができます。テレマティクス デバイスと接続されたソフトウェア ソリューションを通じて、車両に軽微な問題が発生したときに車両の問題を警告できるため、より早く問題に対処し、故障が発生する前に対処できます。これにより、実行中の修理や定期メンテナンスを事前に行う柔軟性が得られ、トラックがより頻繁に路上に留まり、より多くの時間を商品の配送に費やすことができます。

- ルート有効化に関する不適切なガイダンス

A vehicle tracking system can be defined as a part of a fleet management system, which enables the fleet operator to find out the vehicle's location throughout the vehicle's journey against time. Apart from utilizing the data generated by the vehicle tracking system for enforcing the bus schedule, this data also provides important inputs for decision-making. The system facilitates the computation of the exact distance traveled in a given period, the computation of the speed of the bus at a given location, the analysis of the time taken by the vehicle to cover a certain distance, and so on. It becomes a very powerful tool in the case of operating agencies.

Recent Developments

- In June 2023, Siemens Xcelerator partnership with Helixx marks a crucial step in their pursuit of revolutionizing electric vehicle manufacturing. By integrating Siemens' industry software and services, Helixx aims to swiftly deploy its innovative EV manufacturing system worldwide, fostering sustainable economic growth through accessible zero-emission urban mobility solutions. This collaboration underscores Helixx's groundbreaking concept of Helixx Mobility Hubs, which will enable global licensed factories to produce a diverse range of electric vehicles, amplifying their impact far beyond initial production projections.

- In June 2023, Foss National Leasing Ltd. one-year update of the Foss EV Pilot Program, the company integration of electric vehicles (EVs) into the fleet has yielded insightful operational data, aiding clients in their EV adoption journey. This program effectively contributes to smoother transitions towards sustainable fleet management solutions by addressing uncertainties. In conclusion, the company's ongoing efforts signify the program's pivotal role in facilitating informed decisions for a greener and more efficient future.

Canada Fleet Management Market Scope

The Canada fleet management market is segmented on the basis of offering, lease type, mode of transport, vehicle type, hardware, fleet size, communication range, deployment model, technology, functions, operations, business type, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Services

On the basis of offering, the market is segmented into solutions and services.

Lease Type

- On-Lease

- Without Lease

On the basis of lease type, the market is segmented into on-lease and without lease.

Mode of Transport

- Automotive

- Marine

- Rolling Stock

- Aircraft

On the basis of mode of transport, the market is segmented into automotive, marine, rolling stock, and aircraft.

Vehicle Type

- Internal Combustion Engine

- Electric Vehicle

On the basis of vehicle type, the market is segmented into internal combustion engine and electric vehicle.

Hardware

- GPS Tracking Devices

- Dash Cameras

- Bluetooth Tracking Tags

- Data Loggers

- Others

On the basis of hardware, the market is segmented into GPS tracking devices, DASH cameras, bluetooth tracking tags, data loggers, and others.

Fleet Size

- Small Fleets (1-5 Vehicles)

- Medium Fleets (5-20 Vehicles)

- Large & Enterprise Fleets (20-50+ Vehicles)

On the basis of fleet size, the market is segmented into small fleets (1-5 vehicles), medium fleets (5-20 vehicles), and large and enterprise fleets (20-50+ vehicles).

Communication Range

- Short-Range Communication

- Long Range Communication

On the basis of communication range, the market is segmented into short-range communication and long-range communication.

Deployment Model

- On-Premise

- Cloud

- Hybrid

On the basis of deployment model, the market is segmented into on-premise, cloud, and hybrid.

Technology

- GNSS

- Cellular Systems

- Electronic Data Interchange (EDI)

- Remote Sensing

- Computational Methods & Decision-Making

- RFID

- Others

On the basis of technology, the market is segmented into GNSS, cellular systems, electronic data interchange (EDI), remote sensing, computational methods & decision-making, RFID, and others.

Functions

- Asset Management

- Route Management

- Fuel Consumption

- Real Time Vehicle Location

- Delivery Schedule

- Accident Prevention

- Mobile Apps

- Monitoring Driver Behavior

- Vehicle Maintenance Updates

- ELD Compliance

- Others

On the basis of functions, the market is segmented into asset management, route management, fuel consumption, real time vehicle location, delivery schedule, accident prevention, mobile apps, monitoring driver behavior, vehicle maintenance updates, ELD compliance, and others.

Operations

- Private

- Commercial

On the basis of operations, the market is segmented into private and commercial.

Business Type

- Small Business

- Large Business

On the basis of business type, the market is segmented into small business and large business.

End User

- Automotive

- Transportation & Logistics

- Retail

- Manufacturing

- Food & Beverages

- Energy & Utilities

- Mining

- Government

- Healthcare

- Agriculture

- Construction

- Others

On the basis of end user, the market is segmented into automotive, transportation & logistics, retail, manufacturing, food & beverages, energy & utilities, mining, government, healthcare, agriculture, construction, and others.

Competitive Landscape and Canada Fleet Management Market Share Analysis

Canada fleet management market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the fleet management market.

この市場で活動している主要企業としては、Element Fleet Management Corp. (米国)、Verizon. (米国)、Geotab Inc. (カナダ)、Motive Technologies, Inc. (米国)、Jim Pattison Lease (カナダ)、Holman, Inc. (米国)、Cisco Systems, Inc. (米国)、Donlen (米国)、Omnitracs (Solera の一部門) (米国)、Wheels Inc. (米国)、DENSO CORPORATION (日本)、AT&T (米国)、Continental AG (ドイツ)、ORBCOMM (米国)、Summit Fleet Leasing and Management (カナダ)、Siemens (ドイツ)、ADDISON LEASING OF CANADA LTD (カナダ)、Robert Bosch GmbH (ドイツ)、RAM Tracking (英国)、TRANSFLO (米国)、Foss National Leasing Ltd. (カナダ)、Samsara Inc. (米国)、Sierra Wireless などが挙げられます。 (米国)、Mendix Technology BV (オランダ)、ALD Automotive (フランス)、IBM (米国)、ADDISON LEASING OF CANADA LTD (カナダ)、Robert Bosch GmbH (ドイツ)、RAM Tracking (英国)、TRANSFLO (米国) など。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CANADA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF GLOBALIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS

6.1 OVERVIEW

6.2 ASSET MANAGEMENT

6.3 ROUTE MANAGEMENT

6.4 FUEL CONSUMPTION

6.5 REAL TIME VEHICLE LOCATION

6.6 DELIVERY SCHEDULE

6.7 ACCIDENT PREVENTION

6.8 MOBILE APPS

6.9 MONITORING DRIVER BEHAVIOR

6.1 VEHICLE MAINTENANCE UPDATES

6.11 ELD COMPLIANCE

6.12 OTHERS

7 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 COMMERCIAL

7.3 PRIVATE

8 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

8.1 OVERVIEW

8.2 LARGE BUSINESS

8.2.1 FLORIST & GIFT DELIVERY BUSINESS

8.2.2 CATERING & FOOD DELIVERING COMPANY

8.2.3 CLEANING SERVICE COMPANY

8.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

8.2.5 LANDSCAPING BUSINESS

8.3 SMALL BUSINESS

8.3.1 RENTAL CAR/TRUCK COMPANY

8.3.2 MOVING COMPANY

8.3.3 TAXI COMPANY

8.3.4 DELIVERY COMPANY

8.3.5 LONG HAUL SEMI-TRUCK COMPANY

9 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE

9.1 OVERVIEW

9.2 ON-LEASE

9.3 WITHOUT LEASE

9.3.1 OPEN ENDED

9.3.2 CLOSE ENDED

10 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

10.1 OVERVIEW

10.1.1 AUTOMOTIVE

10.1.2 LIGHT COMMERCIAL VEHICLE

10.1.2.1 PICK UP TRUCKS

10.1.2.2 VANS

10.1.2.2.1 PASSENGER VAN

10.1.2.2.2 CARGO VAN

10.1.2.3 MINI BUS

10.1.2.4 OTHERS

10.1.3 PASSENGER CARS

10.1.3.1 SUV

10.1.3.2 HATCHBACK

10.1.3.3 SEDAN

10.1.3.4 COUPE

10.1.3.5 CROSSOVER

10.1.3.6 CONVERTIBLE

10.1.3.7 OTHERS

10.1.4 HEAVY COMMERCIAL VEHICLE

10.1.4.1 TRUCKS

10.1.4.2 TRAILERS

10.1.4.3 FORKLIFTS

10.1.4.4 SPECIALIST VEHICLES (SUCH AS MOBILE CONSTRUCTION MACHINERY)

10.1.5 MARINE

10.1.6 ROLLING STOCK

10.1.7 AIRCRAFT

11 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 INTERNAL COMBUSTION ENGINE

11.2.1 PETROL

11.2.2 DIESEL

11.2.3 CNG

11.2.4 OTHERS

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 PLUG-IN ELECTRIC VEHICLE (PEV)

11.3.3 HYBRID ELECTRIC VEHICLES (HEVS)

12 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE

12.1 OVERVIEW

12.2 GPS TRACKING DEVICES

12.3 DASH CAMERAS

12.4 BLUETOOTH TRACKING TAGS

12.5 DATA LOGGERS

12.6 OTHERS

13 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE

13.1 OVERVIEW

13.2 SMALL FLEETS (1-5 VEHICLES)

13.3 MEDIUM FLEETS (5-20 VEHICLES)

13.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

14 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

14.1 OVERVIEW

14.2 SHORT RANGE COMMUNICATION

14.3 LONG RANGE COMMUNICATION

15 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

15.1 OVERVIEW

15.2 ON-PREMISE

15.3 CLOUD

15.4 HYBRID

16 CANADA FLEET MANAGEMENT MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOLUTIONS

16.2.1 ETA PREDICTIONS

16.2.1.1 STREAMLINED ROUTES

16.2.1.2 DETAILED LOCATION DATA

16.2.1.3 BREAKDOWN NOTIFICATION

16.2.2 OPERATIONS MANAGEMENT

16.2.2.1 FLEET TRACKING & GEO-FENCING

16.2.2.2 ROUTING & SCHEDULING

16.2.2.3 REAL & IDLE TIME MONITORING

16.2.3 PERFORMANCE MANAGEMENT

16.2.3.1 DRIVER MANAGEMENT

16.2.3.1.1 TRACKING

16.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

16.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

16.2.3.2 FLEET MANAGEMENT & TRACKING

16.2.3.2.1 REAL TIME ROUTING

16.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

16.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

16.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

16.2.5 SAFETY & COMPLIANCE MANAGEMENT

16.2.6 FLEET ANALYTICS AND REPORTING

16.2.7 CONTRACT MANAGEMENT

16.2.7.1 BY STRUCTURE

16.2.7.1.1 LEASING

16.2.7.1.2 FUEL MANAGEMENT AND EV CHARGING

16.2.7.1.3 MAINTENANCE SPEND PLANNING

16.2.7.1.4 ACCIDENT MANAGEMENT

16.2.7.1.5 VEHICLE REGISTRATION

16.2.7.1.6 ADMINISTRATIVE COST

16.2.7.1.7 OTHERS

16.2.7.2 BY MODEL

16.2.7.2.1 LONG TERM CONTRACT

16.2.7.2.2 SHORT TERM CONTRACT

16.2.8 RISK MANAGEMENT

16.2.9 ELECTRIFICATION

16.2.10 REMARKETING

16.2.11 OTHERS

16.3 SERVICES

16.3.1 PROFESSIONAL SERVICES

16.3.1.1 SUPPORT & MAINTENANCE

16.3.1.2 IMPLEMENTATION

16.3.1.3 CONSULTING

16.3.2 MANAGED SERVICES

17 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 GNSS

17.3 CELLULAR SYSTEMS

17.4 ELECTRONIC DATA INTERCHANGE (EDI)

17.5 REMOTE SENSING

17.6 COMPUTATIONAL METHOD & DECISION MAKING

17.7 RFID

17.8 OTHERS

18 CANADA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.1.8 RISK MANAGEMENT

18.2.1.9 ELECTRIFICATION

18.2.1.10 REMARKETING

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.1.8 RISK MANAGEMENT

18.3.1.9 ELECTRIFICATION

18.3.1.10 REMARKETING

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.1.8 RISK MANAGEMENT

18.4.1.9 ELECTRIFICATION

18.4.1.10 REMARKETING

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.1.8 RISK MANAGEMENT

18.5.1.9 ELECTRIFICATION

18.5.1.10 REMARKETING

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.1.8 RISK MANAGEMENT

18.6.1.9 ELECTRIFICATION

18.6.1.10 REMARKETING

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.1.8 RISK MANAGEMENT

18.7.1.9 ELECTRIFICATION

18.7.1.10 REMARKETING

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 FLEET ANALYTICS AND REPORTING

18.8.1.7 CONTRACT MANAGEMENT

18.8.1.8 RISK MANAGEMENT

18.8.1.9 ELECTRIFICATION

18.8.1.10 REMARKETING

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 FLEET ANALYTICS AND REPORTING

18.9.1.7 CONTRACT MANAGEMENT

18.9.1.8 RISK MANAGEMENT

18.9.1.9 ELECTRIFICATION

18.9.1.10 REMARKETING

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 FLEET ANALYTICS AND REPORTING

18.10.1.7 CONTRACT MANAGEMENT

18.10.1.8 RISK MANAGEMENT

18.10.1.9 ELECTRIFICATION

18.10.1.10 REMARKETING

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 FLEET ANALYTICS AND REPORTING

18.11.1.7 CONTRACT MANAGEMENT

18.11.1.8 RISK MANAGEMENT

18.11.1.9 ELECTRIFICATION

18.11.1.10 REMARKETING

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 FLEET ANALYTICS AND REPORTING

18.12.1.7 CONTRACT MANAGEMENT

18.12.1.8 RISK MANAGEMENT

18.12.1.9 ELECTRIFICATION

18.12.1.10 REMARKETING

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 CANADA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: CANADA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 ELEMENT FLEET MANAGEMENT CORP.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 SOLUTION PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 VERIZON

21.2.1 COMPANY SNAPSHOT

21.2.3 SOLUTION PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 GEOTAB INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 SOLUTION PORTFOLIO

21.3.3 RECENT DEVELOPMENTS

21.4 MOTIVE TECHNOLOGIES, INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 JIM PATTISON LEASE (A SUBSIDIARY OF THE JIM PATTISON GROUP)

21.5.1 COMPANY SNAPSHOT

21.5.2 SOLUTION PORTFOLIO

21.5.3 RECENT DEVELOPMENT

21.6 ADDISON LEASING OF CANADA LTD

21.6.1 COMPANY SNAPSHOT

21.6.2 SOLUTION PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ALD AUTOMOTIVE

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 SOLUTION PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 AT&T INTELLECTUAL PROPERTY

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 SOLUTION PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CISCO SYSTEMS, INC.

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 SOLUTION PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 CONTINENTAL AG

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 SOLUTION PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 DENSO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 SOLUTION PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 DONLEN

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 SOLUTION PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 FOSS NATIONAL LEASING LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 SOLUTION PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 HOLMAN, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 SOLUTION PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 IBM CORPORATION

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 SOLUTION PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 MENDIX TECHNOLOGY BV

21.16.1 COMPANY SNAPSHOT

21.16.2 SOLUTION PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 OMNITRACS

21.17.1 COMPANY SNAPSHOT

21.17.2 SOLUTION PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 ORBCOMM

21.18.1 COMPANY SNAPSHOT

21.18.2 SOLUTION PORTFOLIO

21.18.3 RECENT DEVELOPMENT

21.19 RAM TRACKING

21.19.1 COMPANY SNAPSHOT

21.19.2 SOLUTION PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 ROBERT BOSCH GMBH

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 SOLUTION PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 SAMSARA INC.

21.21.1 COMPANY SNAPSHOT

21.21.2 SOLUTION PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SIEMENS

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 SOLUTION PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 SIERRA WIRELESS

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 SOLUTION PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 SUMMIT FLEET LEASING AND MANAGEMENT LEASING AND MANAGEMENT

21.24.1 COMPANY SNAPSHOT

21.24.2 SOLUTION PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 TRANSFLO

21.25.1 COMPANY SNAPSHOT

21.25.2 SOLUTION PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 WHEELS INC.

21.26.1 COMPANY SNAPSHOT

21.26.2 SOLUTION PORTFOLIO

21.26.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

表のリスト

TABLE 1 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 2 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 3 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 9 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 CANADA LIGHT COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 CANADA VANS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 CANADA PASSENGER CARS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 CANADA HEAVY COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 CANADA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 CANADA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 18 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 21 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 36 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 39 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 54 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 57 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 60 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 63 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 66 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

図表一覧

FIGURE 1 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 CANADA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 CANADA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 CANADA FLEET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 CANADA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CANADA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 CANADA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 CANADA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 9 CANADA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 10 CANADA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND OF FULL SERVICE LEASING IS EXPECTED TO DRIVE THE CANADA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF CANADA FLEET MANAGEMENT MARKET

FIGURE 15 CANADA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 16 CANADA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 17 CANADA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 18 CANADA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 19 CANADA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 20 CANADA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 21 CANADA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 22 CANADA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 23 CANADA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 24 CANADA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 CANADA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 CANADA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 27 CANADA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 28 CANADA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。