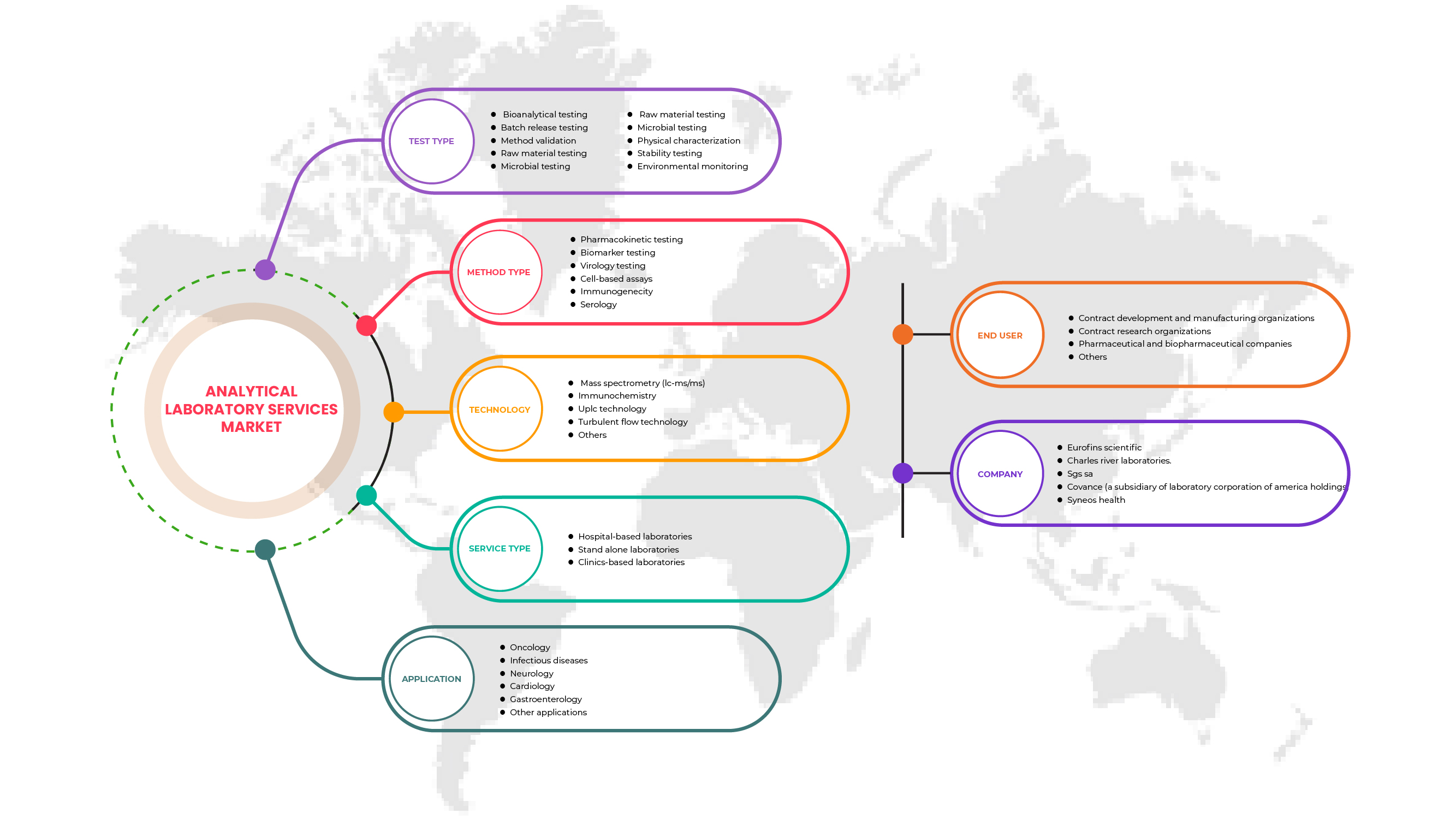

ヨーロッパの分析ラボサービス市場、テストタイプ別(バイオ分析テスト、バッチリリーステスト、安定性テスト、原材料テスト、物理的特性評価、メソッド検証、微生物テスト、環境モニタリング)、サービスタイプ別(病院ベースのラボ、独立ラボ、クリニックベースのラボ)、メソッドタイプ別(細胞ベースのアッセイ、ウイルステスト、バイオマーカーテスト、薬物動態テスト、免疫原性および血清学)、アプリケーション別(腫瘍学、神経学、感染症、消化器病学、心臓病学、その他のアプリケーション)、テクノロジー別(質量分析(LC-MS / MS)、免疫化学、UPLCテクノロジー、乱流テクノロジー、その他)、エンドユーザーチャネル別(製薬会社およびバイオ医薬品会社、受託開発製造組織、受託研究組織、その他)-2029年までの業界動向と予測。

ヨーロッパの分析ラボサービス市場の分析と規模

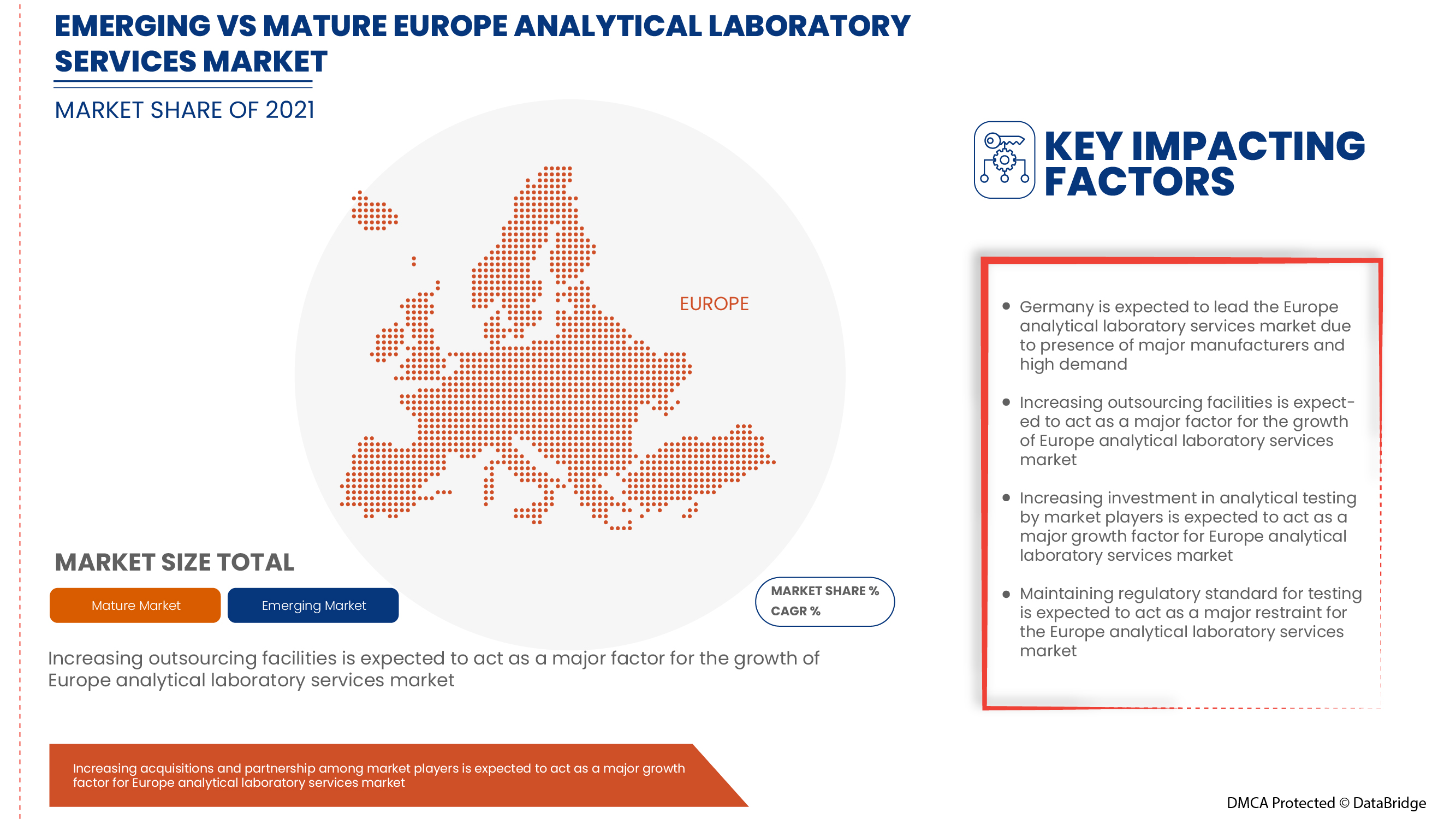

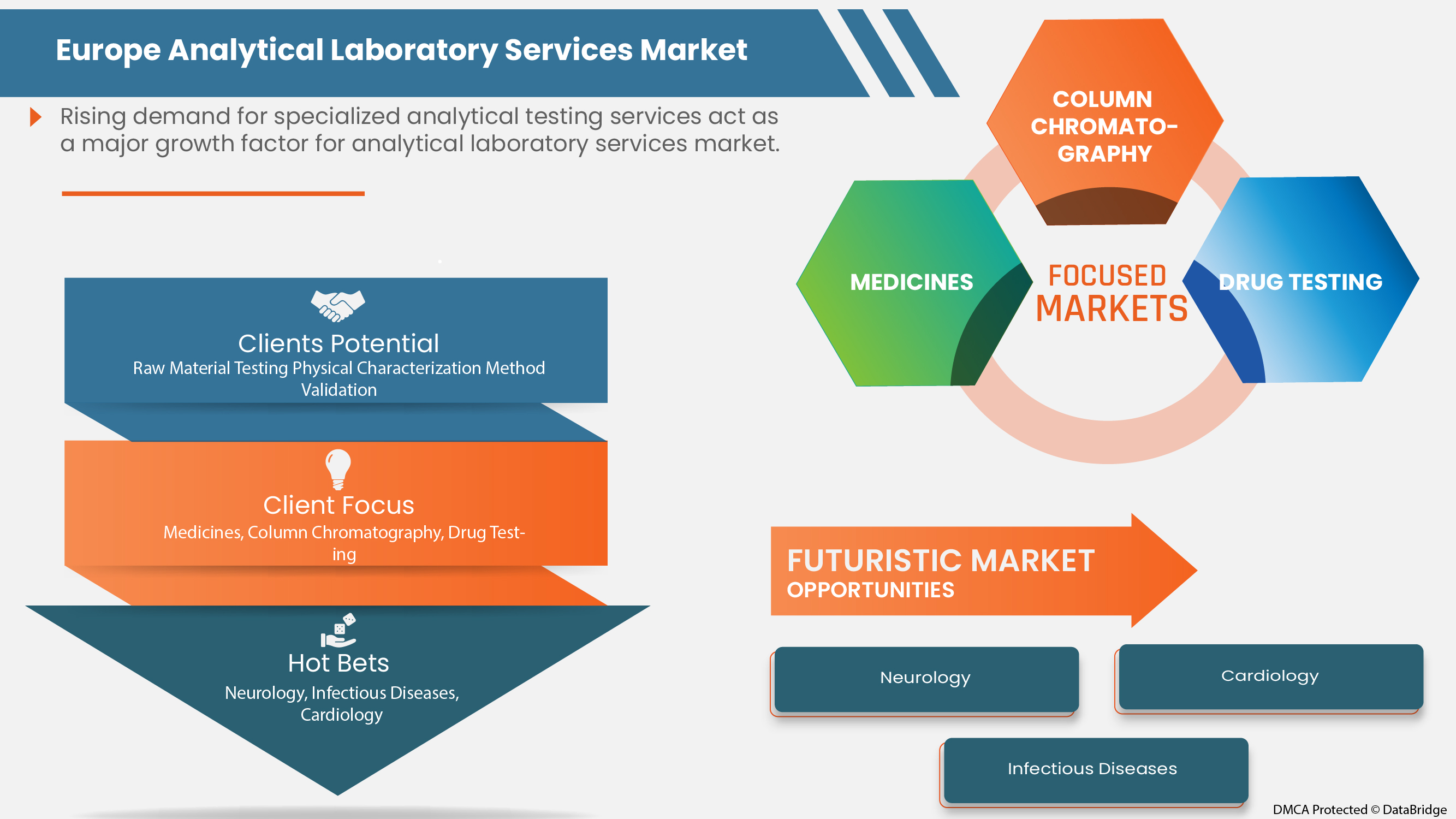

市場では、バイオ分析試験、原材料試験、バッチリリース試験、製品検証、物理的特性評価など、多数の分析サービスが提供されています。これらのサービスは、製薬会社、バイオ医薬品会社、医療機器会社などのヘルスケア部門で広く採用されています。これらのサービスは、正確性、品質、効率性の信頼できる情報源を提供します。これらは、腫瘍学、神経学、感染症、心臓病学などの分野で応用されています。ヨーロッパの分析ラボサービス市場は、分析試験機能を強化する政府の取り組みの増加と、医薬品の承認と臨床試験の数の増加に伴い成長しています。さらに、さまざまな治療領域での多数の高分子とバイオシミラーの使用と開発の増加、および新しいラボを設立するための政府による支出の増加は、ラボサービス市場の成長を加速させる他の要因です。

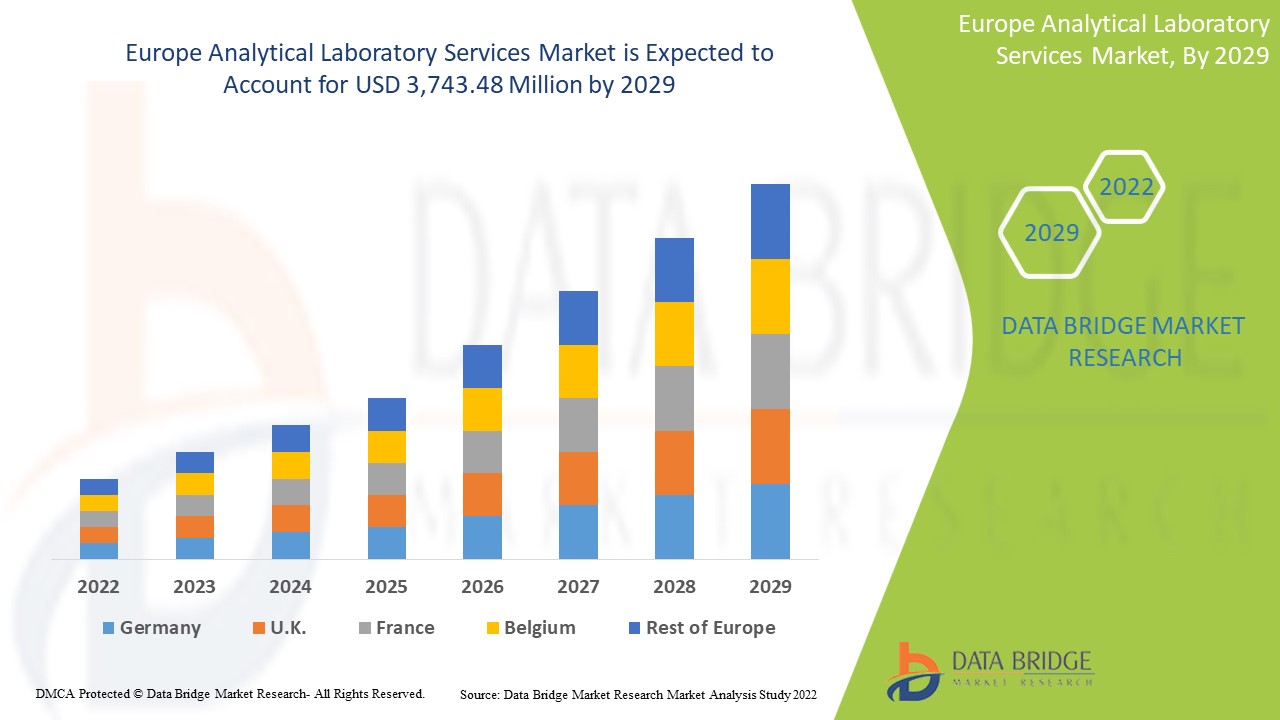

Data Bridge Market Research の分析によると、ヨーロッパの分析ラボ サービス市場は、予測期間中に 14.8% の CAGR で成長し、2029 年までに 37 億 4,348 万米ドルに達すると予想されています。ヨーロッパの分析ラボ サービス市場では、バイオ分析テスト セグメントが最大の提供セグメントを占めています。ヨーロッパの分析ラボ サービス市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (カスタマイズ可能 2019-2014) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

試験タイプ別(バイオ分析試験、バッチリリース試験、安定性試験、原材料試験、物理的特性評価、方法の検証、微生物試験、環境モニタリング)、サービスタイプ別(病院ベースの研究所、独立系研究所、診療所ベースの研究所)、方法タイプ別(細胞ベースのアッセイ、ウイルス学試験、バイオマーカー試験、薬物動態試験、免疫原性および血清学)、アプリケーション別(腫瘍学、神経学、感染症、消化器学、心臓病学、その他のアプリケーション)、テクノロジー別(質量分析法(LC-MS/MS)、免疫化学、UPLCテクノロジー、乱流テクノロジー、その他)、エンドユーザーチャネル別(製薬会社およびバイオ医薬品会社、受託開発製造組織、受託研究組織、その他) |

|

対象国 |

ドイツ、フランス、イギリス、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、アイルランド、トルコ、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

Eurofins Scientific、Q2 Solutions(IQVIAの子会社)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、BioAgilytix Labs、Pharmaceutical Research Associates Inc.、ALS Limited、Covance(Laboratory Corporation of America Holdingsの子会社)、Intertek Group plc、Evotec SE、Charles River Laboratories、Medpace、WuXi AppTec、PPD Inc.(Thermo Fisher Scientific Inc.の子会社)など |

市場の定義

分析ラボ サービスは、幅広い化学分析および微生物学的分析に関係しています。分析ラボ サービスには、方法の開発と検証、濃度確認のためのサンプル分析、IND、NDA、ANDA 申請用の予備製剤および最終医薬品の純度、均質性、安定性分析が含まれます。分析サービスは「材料試験」とも呼ばれ、特定のサンプルの化学組成や特性を識別するために使用されるさまざまな手法を説明するために使用されます。医薬品、食品、電子機器、プラスチックなどの業界のメーカーは、リバース エンジニアリングや故障分析、製品の汚染物質や汚れの特定に分析試験を使用することがよくあります。

市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

-

医薬品と医療機器への支出の増加

製薬業界とバイオテクノロジー業界の台頭により、薬物動態試験やその他のバッチ試験、微生物試験などのサービスを提供するために医薬品市場に依存しているため、これらの分析サービスの市場が拡大するでしょう。したがって、予測期間中、ヨーロッパの分析ラボサービス市場の成長の原動力となることが期待されます。

-

分析試験能力を強化する政府の取り組み

Government funding and initiative to expand the analytical services will help the market grow and increase the market players in the forecast period. This is expected to increase the market size and act as a driver for the growth of the Europe analytical laboratory services market in the forecast period.

-

Increasing number of drug approvals and clinical trials

The market players give the analytical testing process under contract research. Furthermore, the increasing biopharmaceutical industry with increased drug production and research for novel products is expected to act as a driver for the growth of the Europe analytical laboratory services market in the forecast period.

Opportunities

-

Increasing collaboration among market players

Collaborations in the market is the primary factor that is expected to create opportunities in the market. Agreements, partnerships, and collaborations are performed to overcome hurdles such as limited Europe presence and supply chain and to increase the service portfolio. In the Europe analytical laboratory services market, various market players have performed this, creating opportunities in the market.

Restraints/Challenges

- High cost setting of an advanced analytical lab

The considerable investment needed to set up a bioanalytical facility with a limited and highly efficient instrument is expected to limit the market growth due to high investment costs. This is expected to act as a restraint on the growth of the Europe analytical laboratory services market in the forecast period.

COVID-19 Impact on Europe Analytical Laboratory Services Market

COVID-19 created a major impact on various industries as almost every country has opted for the shutdown of every facility except the ones dealing in the essential goods. The government took some strict actions, such as the shutdown of facilities and sale of non-essential goods, blocked international trade and many more, to prevent the spread of COVID-19. The only business dealing with this pandemic situation were the essential services allowed to open and run the processes.

COVID-19 has impacted the market of analytical laboratory services negatively. Due to the cancellation of the clinical trial, the demand for analytical services was also disrupted. The major portion of these analytical services comes from the clinical trials and CRO, which get badly impacted. However, some of the market players, such as Eurofins Scientific, which can provide analytical support, were successful in minimizing the loss during COVID-19. The supply chain was disrupted as the material and solvent that were mandatory for these analytical testing faced challenges in the customs department and were not allowed to cross international borders.

Hence, COVID-19 has negatively impacted the analytical testing business, but the strategic initiative of the market players is somehow gaining success in minimizing the loss in the net revenue or segmental revenue.

Recent Developments

- In February 2021, Eurofins Scientific announced that they had acquired Beacon Discovery, preeminent drug discovery and contract research organization (CRO). This will increase the company's access to contract research and will increase its revenue for the company

- In April 2021, SGS SA announced that the company SYNLAB Analytics & Services is now be called SGS Analytics which is due to the acquisition of the leading European environmental, food & health sciences testing and tribology services company. The acquisition will continue growth and innovation by helping businesses to comply with ever increasing regulations designed to ensure food, pharmaceutical, and environmental safety

Europe Analytical Laboratory Services Market Scope

The Europe analytical laboratory services market is segmented on the basis of test type, service type, method type, application, technology, and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Test Type

- Bioanalytical testing

- Batch release testing

- Method validation

- Raw material testing

- Microbial testing

- Physical characterization

- Stability testing

- Environmental monitoring

On the basis of test type, the Europe analytical laboratory services market is segmented into bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing and environmental monitoring.

By Service Type

- Hospital-based laboratories

- Stand-alone laboratories

- Clinics-based laboratories

On the basis of service type, the Europe analytical laboratory services market is segmented into hospital-based laboratories, stand-alone laboratories and clinic-based laboratories.

By Method Type

- Pharmacokinetic testing

- Biomarker testing

- Virology testing

- Cell-based assays

- Immunogenicity

- Serology

On the basis of method type, the Europe analytical laboratory services market is segmented into cell-based assays, virology testing, biomarker testing, pharmacokinetic testing, immunogenicity and serology.

By Application

- Oncology

- Neurology

- Infectious diseases

- Cardiology

- Gastroenterology

- Others

On the basis of application, the Europe analytical laboratory services market is segmented into oncology, neurology, infectious diseases, gastroenterology, cardiology and other applications.

By Technology

- Mass spectroscopy

- Immunochemistry

- UPLC technology

- Turbulent flow technology

- Others

On the basis of technology, the Europe analytical laboratory services market is segmented into mass spectroscopy, immunochemistry, UPLC technology, turbulent flow technology and others.

By End-User

- Pharmaceutical and biopharmaceutical companies

- Contract development and manufacturing organizations

- Contract research organizations

- Others

エンドユーザーに基づいて、ヨーロッパの分析ラボサービス市場は、製薬およびバイオ製薬業界、契約開発および製造組織、契約研究組織、その他に分類されます。

ヨーロッパの分析ラボサービス市場の地域分析/洞察

ヨーロッパの分析ラボサービス市場が分析され、上記のように国、テストの種類、サービスの種類、方法の種類、アプリケーション、テクノロジー、エンドユーザー別に市場規模の洞察と傾向が提供されます。

ヨーロッパの分析ラボサービス市場レポートで取り上げられている国は、ドイツ、フランス、イギリス、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、アイルランド、トルコ、およびその他のヨーロッパ諸国です。

ドイツは、医薬品生産の増加に伴うバイオ医薬品産業の拡大により、ヨーロッパで最も急速に成長する分析ラボサービス市場となる可能性が高いです。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、ヨーロッパ ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮され、国別データの予測分析が提供されます。

競争環境とヨーロッパの分析ラボサービス市場シェア分析

ヨーロッパの分析ラボ サービス市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、ヨーロッパでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、ヨーロッパの分析ラボ サービス市場に関連する会社の焦点にのみ関連しています。

ヨーロッパの分析ラボサービス市場で分析ラボサービスを提供している大手企業には、Eurofins Scientific、Q2 Solutions(IQVIAの子会社)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、BioAgilytix Labs、Pharmaceutical Research Associates Inc.、ALS Limited、Covance(Laboratory Corporation of America Holdingsの子会社)、Intertek Group plc、Evotec SE、Charles River Laboratories、Medpace、WuXi AppTec、PPD Inc.(Thermo Fisher Scientific Inc.の子会社)などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe ANALYTICAL LABORATORY SERVICES MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- Method type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- PREMIUM INSIGHTS

- REGULATORY SCENARIO IN EUROPE ANALYTICAL LABORATORY SERVICES MARKET

- Qualification of Analytical Instruments in the QC

- Validation of Analytical Procedures

- REGULATORY GUIDELINES FOR CHINA

- REGULATORY GUIDELINES FOR EMA GMP REQUIREMENT (FOR QUALITY)

- Market Overview

- drivers

- growing expenditure on drugs and medical devices

- government initiatives to strengthen analytical testing capabilities

- increasing number of drug approvals & clinical trials

- rising demand for specialized analytical testing services

- increasing investment in analytical testing by market players

- Restraints

- Limitation in analyzing novel complex products

- Cost of laboratory testing for drug development

- maintenance and updating of equipment

- High cost setting an advanced analytical lab

- opportunities

- Increasing collaboration among market players

- IncreAsing outsourcing facilities

- Increasing trend of artificial intelligence in testing services

- challenges

- Maintaining regulatory standard for testing

- development and maintenance of expertise

- IMPACT OF COVID-19 ON THE EUROPE ANALYTICAL LABORATORY SERVICES MARKET

- IMPACT ON PRICE

- IMPACT IN DEMAND

- IMPACT ON SUPPLY

- STRATEGIC INITIATIVES

- CONCLUSION

- Europe analytical laboratory services MARKET, BY test type

- overview

- bioanalytical testing

- Pharmacokinetic test

- Pharmacodynamic test

- bioequivalence test

- bioavailability test

- other test

- batch release testing

- method validation

- raw material testing

- microbial testing

- physical characterization

- stability testing

- environmental monitoring

- EUROPE ANALYTICAL LABORATORY SERVICES MARKET, BY service type

- overview

- hospital-based laboratories

- standalone laoratories

- clinics-based laboratories

- Europe Analytical laboratory services MARKET, BY method type

- overview

- Pharmacokinetic Testing

- Biomarker Testing

- Virology Testing

- In Vitro Virology Testing

- In Vivo Virology Testing

- Species-Specific Viral PCR Assays

- Cell-Based Assays

- Viral Cell-Based Assays

- Bacterial Cell-Based Assays

- Immunogenicity

- Serology

- Europe Analytical laboratory services MARKET, BY Application

- overview

- Oncology

- Infectious Diseases

- Neurology

- Cardiology

- Gastroenterology

- Other Applications

- Europe Analytical laboratory services MARKET, BY technology

- overview

- Mass Spectrometry (LC-MS/MS)

- Immunochemistry

- UPLC Technology

- Turbulent Flow Technology

- others

- Europe analytical laboratory services Market, By end user

- overview.

- contract development and manufacturing organizations

- contract research organizations

- pharmaceutical and biopharmaceutical companies

- others

- EUROPE ANALYTICAL LABORATORY SERVICES MARKET, by Geography

- Europe

- Germany

- france

- u.k.

- ITALY

- Spain

- RUSSIA

- turkey

- Ireland

- BElgium

- Netherlands

- switzerland

- rest of europe

- Europe Analytical Laboratory Services Market: COMPANY landscape

- company share analysis: Europe

- SWOT

- company profiles

- eurofins scientific

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- charles river Laboratories

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SGS SA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- covance (A subsidiary of Laboratory Corporation of America Holdings)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- wuxi apptec

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Syneos Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- Pharmaceutical Research Associates Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- AGENZIA ITALIANA DEL FARMACO - AIFA

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- ALS Limited

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIOAGILYTIX LABS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Central drugs standard control organization

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- EUROPEAN MEDICINES AGENCY

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- evotec se

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- FEDERAL INSTITUTE FOR DRUGS & MEDICAL DEVICES (BFARM)

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- FOOD SAFETY AND DRUG ADMINISTRATION DEPARTMENT

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Frontage Labs

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE & SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- ICON PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- INTERTEK GROUP PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- INDUSTRY & SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MEDPACE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- National Medical Products administration

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- Pace Analytical Services, LLC

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- pharmaceuticals and medical devices agency

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- q2 solutions (a subsidiary of iqvia)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- SHANGHAI MEDICILON INC.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- SPANISH AGENCY FOR MEDICINES AND HEALTH PRODUCTS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- solvias Ag

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- toxikon

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- VxP Pharma, Inc.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

表のリスト

TABLE 1 Europe ANALYTICAL LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 2 Europe Bioanalytical testing in Analytical Laboratory Services Market, By Region, 2019-2028 (USD Million)

TABLE 3 Europe BioANALYTICAL testing in analytical LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 4 Europe batch release testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 5 Europe method validation in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 6 Europe raw material testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 7 Europe microbial testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 8 Europe physical characterization in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 9 Europe stability testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 10 Europe environmental monitoring in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 11 Europe ANALYTICAL LABORATORY SERVICES Market, By DIAGNOSTICS TYPE, 2019-2028 (USD Million)

TABLE 12 Europe Hospital-Based Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 13 Europe standalone Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 14 Europe clinics-based laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 15 Europe Pharmacokinetic Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 16 Europe Biomarker Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 17 Europe Virology Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 18 Europe Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 19 Europe Cell-Based Assays in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 20 Europe Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 21 Europe Immunogenicity in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 22 Europe Serology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 23 Europe oncology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 24 Europe infectious diseases in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 25 Europe neurology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 26 Europe Cardiology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 27 Europe gastroenterology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 28 Europe other applications in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 29 Europe Mass Spectrometry (LC-MS/MS) in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 30 Europe immunochemistry in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 31 Europe UPLC Technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 32 Europe turbulent flow technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 33 Europe others in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 34 Europe analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 35 Europe contract development and manufacturing organizations in analytical laboratory services market, By end user, 2019-2028 (USD Million), By Region

TABLE 36 Europe contract research organizations in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 37 Europe pharmaceutical and biopharmaceutical companies in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 38 Europe others in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 39 Europe analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 40 Europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 41 Europe Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 42 Europe Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 43 Europe Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 44 Europe Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 45 Europe Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 46 Europe Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 47 Europe Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 48 Europe Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 49 GERMANY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 50 GERMANY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 51 GERMANY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 52 GERMANY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 53 GERMANY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 54 GERMANY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 55 GERMANY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 56 GERMANY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 57 GERMANY Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 58 FRANCE Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 59 FRANCE Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 62 FRANCE Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 63 FRANCE Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 64 FRANCE Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 65 FRANCE Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 66 FRANCE Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 67 U.K. Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 68 U.K. Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 69 U.K. Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 70 U.K. Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 71 U.K. Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 72 U.K. Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 73 U.K. Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 74 U.K. Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 75 U.K. Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 76 ITALY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 77 ITALY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 78 ITALY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 79 ITALY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 80 ITALY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 81 ITALY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 82 ITALY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 83 ITALY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 84 italy Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 85 SPAIN Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 86 SPAIN Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 87 SPAIN Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 88 SPAIN Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 89 SPAIN Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 90 SPAIN Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 91 SPAIN Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 92 SPAIN Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 93 SPAIN Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 94 RUSSIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 95 RUSSIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 96 RUSSIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 97 RUSSIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 98 RUSSIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 99 RUSSIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 100 RUSSIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 101 RUSSIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 102 russia Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 103 TURKEY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 104 TURKEY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 105 TURKEY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 106 TURKEY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 107 TURKEY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 108 TURKEY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 109 TURKEY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 110 TURKEY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 111 turkey Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 112 IRELAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 113 IRELAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 114 IRELAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 115 IRELAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 116 IRELAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 117 IRELAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 118 IRELAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 119 IRELAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 120 ieland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 121 BELGIUM Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 122 BELGIUM Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 123 BELGIUM Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 124 BELGIUM Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 125 BELGIUM Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 126 BELGIUM Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 127 BELGIUM Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 128 BELGIUM Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 129 belgium Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 130 NETHERLANDS Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 131 NETHERLANDS Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 132 NETHERLANDS Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 133 NETHERLANDS Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 134 NETHERLANDS Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 135 NETHERLANDS Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 136 NETHERLANDS Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 137 NETHERLANDS Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 138 Netherlands Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 139 SWITZERLAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 140 SWITZERLAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 141 SWITZERLAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 142 SWITZERLAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 143 SWITZERLAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 144 SWITZERLAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 145 SWITZERLAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 146 SWITZERLAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 147 switzerland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 148 rest of europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

図表一覧

FIGURE 1 Europe analytical laboratory services MARKET: SEGMENTATION

FIGURE 2 EUROPE ANALYTICAL LABORORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 Europe ANALYTICAL LABORATORY SERVICES Market: DROC ANALYSIS

FIGURE 4 Europe ANALYTICAL LABORATORY SERVICES market: Europe VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe ANALYTICAL LABORATORY SERVICES Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 Europe ANALYTICAL LABORATORY SERVICES market: SEGMENTATION

FIGURE 12 GROWING EXPENDITURE ON DRUGS and medical devices is DRIVing THE Europe ANALYTICAL LABORATORY SERVICES MARKET IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 13 Bioanalytical Testing SEGMENT is expected to account for the largest share of the Europe ANALYTICAL LABORATORY SERVICES MARKET in 2021 & 2028

FIGURE 14 OVERVIEW OF DIFFERENT GUIDELINES AROUND THE GLOBE

FIGURE 15 CGMP REQUIREMENT FOR ANALYTICAL LABORATORY INCLUDES:

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGEs OF EUROPE ANALYTICAL LABORATORY SERVICES MARKET

FIGURE 17 Increasing Prescription of Drugs

FIGURE 18 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, 2020

FIGURE 19 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, 2020-2028 (USD Million)

FIGURE 20 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, CAGR (2021-2028)

FIGURE 21 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, LIFELINE CURVE

FIGURE 22 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, 2020

FIGURE 23 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE 2020-2028 (USD Million)

FIGURE 24 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, CAGR (2021-2028)

FIGURE 25 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, LIFELINE CURVE

FIGURE 26 Europe Analytical laboratory services market: BY method type, 2020

FIGURE 27 Europe Analytical laboratory services market: BY method type, 2020-2028 (USD Million)

FIGURE 28 Europe Analytical laboratory services market: BY method type, CAGR (2020-2028)

FIGURE 29 Europe Analytical laboratory services market: BY method type, LIFELINE CURVE

FIGURE 30 Europe Analytical laboratory services market: BY application, 2020

FIGURE 31 Europe Analytical laboratory services market: BY application, 2020-2028 (USD Million)

FIGURE 32 Europe Analytical laboratory services market: BY application, CAGR (2020-2028)

FIGURE 33 Europe Analytical laboratory services market: BY application, LIFELINE CURVE

FIGURE 34 Europe Analytical laboratory services market: BY technology, 2020

FIGURE 35 Europe Analytical laboratory services market: BY technology, 2020-2028 (USD Million)

FIGURE 36 Europe Analytical laboratory services market: BY technology, CAGR (2020-2028)

FIGURE 37 Europe Analytical laboratory services market: BY technology, LIFELINE CURVE

FIGURE 38 Europe analytical laboratory services market: By end user, 2020

FIGURE 39 Europe analytical laboratory services market: By end user, 2020-2028 (USD Million)

FIGURE 40 Europe analytical laboratory services market: By end user, CAGR (2020-2028)

FIGURE 41 Europe analytical laboratory services market: By end user, LIFELINE CURVE

FIGURE 42 Europe ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 43 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 44 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 45 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 46 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 47 Europe Analytical Laboratory Services Market: company share 2020 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。