Europe Colorants Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

6.20 Billion

USD

610.00 Billion

2024

2032

USD

6.20 Billion

USD

610.00 Billion

2024

2032

| 2025 –2032 | |

| USD 6.20 Billion | |

| USD 610.00 Billion | |

|

|

|

|

Europe Colorants Market Segmentation, By Color (Natural Color, Synthetic Color), Composition (Organic, Inorganic), Product (Pigments, Dyes, Color concentrates, Master batches), End-User (Packaging, Paper and Printing, Textiles, Building and Construction, Automotive, Consumer Goods, Others) - Industry Trends and Forecast to 2032

Europe Colorants Market Size

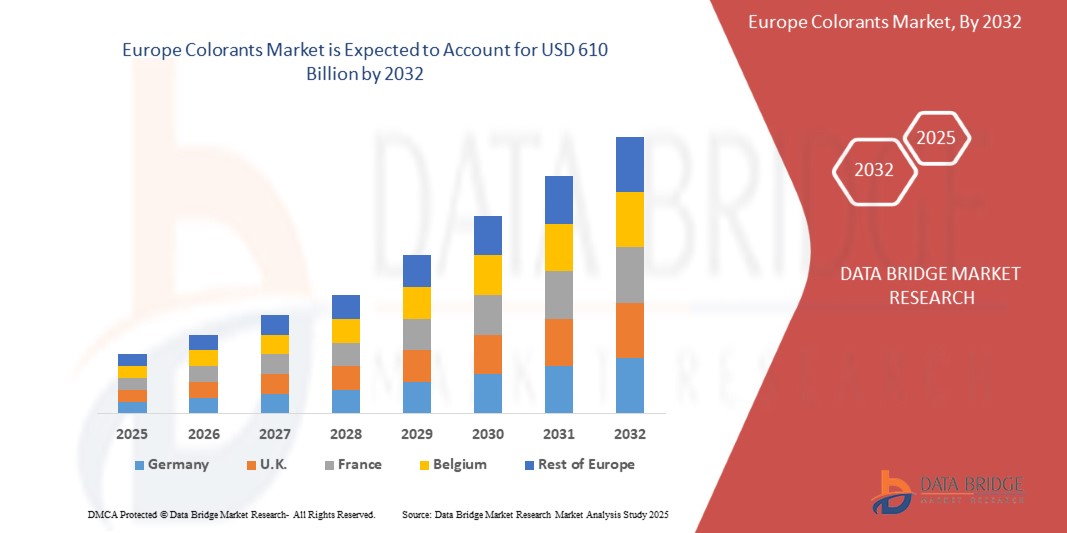

- The Europe Colorants market size was valued at USD 6.2 billion in 2024 and is expected to reach USD 610 billion by 2032, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by rising demand across industries such as plastics, textiles, food & beverages, and personal care, driven by the increasing preference for vibrant, sustainable, and high-performance coloring agents.

- Furthermore, technological advancements in formulation techniques and the growing shift towards natural and bio-based colorants are fostering innovation and new product development. These trends are accelerating the adoption of colorant solutions, thereby significantly boosting the industry's growth across Europe.

Europe Colorants Market Analysis

- Colorants, which include dyes, pigments, and other coloring agents, are increasingly vital components in industries such as plastics, textiles, food & beverages, personal care, and construction due to their ability to enhance aesthetic appeal, brand identity, and product functionality.

- The escalating demand for colorants is primarily fueled by rising consumer preferences for visually appealing products, the growth of end-use industries, and increasing emphasis on sustainable and bio-based colorant alternatives.

- Germany dominates the Colorants market with the largest revenue share of approximately 32% in 2025, characterized by a mature industrial base, stringent environmental regulations encouraging eco-friendly formulations, and strong R&D capabilities among regional players—particularly in Germany, France, and Italy.

- France is expected to be the fastest growing region in the Colorants market during the forecast period due to rapid industrialization, expanding urban population, and increased demand for colored consumer goods.

- The pigments segment is expected to dominate the Colorants market with a market share of around 43.2% in 2025, driven by its extensive use in paints & coatings, plastics, and construction applications, coupled with innovation in high-performance and sustainable pigment technologies.

Report Scope and Europe Colorants Market Segmentation

|

Attributes |

Europe Colorants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Colorants Market Trends

Sustainability and Bio-Based Innovation Driving Market Transformation

- A significant and accelerating trend in the Europe Colorants market is the growing shift toward sustainable and bio-based colorant solutions across key industries such as packaging, textiles, food & beverage, and personal care. This transformation is being propelled by strict EU environmental regulations (like REACH and CLP), heightened consumer awareness, and corporate sustainability goals.

- For instance, Clariant’s range of natural colorants, derived from renewable sources such as agricultural waste and food-grade botanicals, is seeing rapid adoption, particularly in cosmetic and personal care applications. Similarly, GNT Group’s EXBERRY® coloring foods, made from fruits and vegetables, are gaining traction among food manufacturers looking to meet clean-label expectations.

- Leading manufacturers are investing in green chemistry and eco-friendly processes to reduce carbon footprints and eliminate hazardous substances like heavy metals and azo compounds from synthetic dyes and pigments. BASF and DIC Corporation, for example, are prioritizing sustainable innovation in their colorant portfolios through biodegradable formulations and energy-efficient production techniques.

- This trend is further supported by consumer preferences for ethically sourced and non-toxic ingredients, particularly in premium product segments. As a result, major retailers and brands across Europe are mandating the use of certified natural or low-impact colorants in their supply chains.

- The integration of advanced biotechnology, fermentation processes, and waste-to-value systems is also fostering next-gen colorant development, enabling manufacturers to create vibrant, stable, and regulatory-compliant natural colors at scale. Companies like Symrise and LANXESS are at the forefront of this movement, using biotechnological platforms to create scalable alternatives to synthetic dyes.

- The demand for sustainable, high-performance, and regulatory-compliant colorants is growing rapidly across Europe’s industrial and consumer markets. As a result, colorant producers that can offer innovative, eco-conscious solutions are expected to gain significant competitive advantage in the years ahead.

Europe Colorants Market Dynamics

Driver

Rising Demand for Sustainable and Regulatory-Compliant Color Solutions

- The increasing emphasis on environmental sustainability, coupled with stringent regulatory frameworks such as REACH and CLP in Europe, is a major driver accelerating the demand for eco-friendly and compliant colorants across industries.

- For instance, in March 2024, Clariant introduced a new line of 100% bio-based pigments for plastics and coatings under its "EcoCircle" initiative, aiming to support circular economy practices and reduce carbon emissions. Such innovations by leading players are expected to boost the growth of the colorants industry over the forecast period.

- As businesses and consumers become more conscious of their environmental impact, there is growing demand for natural, non-toxic, and biodegradable colorants, especially in food, cosmetics, textiles, and packaging.

- Furthermore, industry players are increasingly investing in green chemistry and sustainable raw materials to align with carbon neutrality goals and brand transparency expectations. This shift is also fueled by end-user preferences for clean-label, ethically sourced, and plant-based products.

- The trend toward sustainability is not only transforming product development but also reshaping supply chains and procurement practices, with companies seeking traceable and certified colorant ingredients. As a result, colorants that meet these evolving standards are seeing a rapid increase in market penetration across the European region.

Restraint/Challenge

Regulatory Complexity and High Compliance Costs

- The stringent and evolving regulatory landscape in Europe, particularly under frameworks like REACH, CLP, and the EU Green Deal, poses a significant challenge for colorant manufacturers. Compliance with these regulations requires extensive testing, documentation, and reformulation efforts to ensure safety and sustainability standards are met.

- For instance, the reclassification of certain pigments and dyes as substances of very high concern (SVHC) under REACH has forced companies to invest in costly research and development to create safer alternatives, thereby increasing operational expenses.

- Addressing these regulatory demands through consistent innovation, robust testing infrastructure, and close collaboration with regulatory bodies is crucial for market players to maintain compliance and avoid penalties or market restrictions. Industry leaders such as BASF and LANXESS are investing heavily in regulatory compliance systems and green chemistry to navigate these complexities.

- Additionally, the high cost of reformulating products to meet environmental and health standards can be particularly burdensome for small and mid-sized enterprises (SMEs), potentially limiting their market participation and innovation capabilities.

- While these regulations aim to ensure consumer and environmental safety, the associated financial and administrative burdens can delay product launches, disrupt supply chains, and reduce overall market competitiveness.

- Overcoming these challenges will require coordinated industry efforts, government support for sustainable innovation, and streamlined regulatory processes that balance safety with economic viability.

Europe Colorants Market Scope

The market is segmented on the basis of color, composition, product, and end-user.

- By Color

On the basis of color, the Europe Colorants market is segmented into Natural Color and Synthetic Color. The Synthetic Color segment dominates the largest market revenue share in 2025, driven by its wide applicability, cost-efficiency, and superior color intensity across industries such as plastics, textiles, and paints & coatings. Synthetic colorants also offer consistent performance and a broader palette, which makes them favorable for industrial applications.

The Natural Color segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for clean-label and eco-friendly products, especially in food, cosmetics, and personal care. Regulatory support and rising awareness of health risks associated with synthetic additives are further accelerating the demand for plant- and mineral-based colorants.

- By Composition

On the basis of composition, the market is segmented into Organic and Inorganic colorants. The Organic segment is projected to dominate the market share in 2025 due to its widespread use in vibrant dyes and pigments for applications such as textiles, packaging, and personal care. Organic colorants are known for their strong tinting strength, flexibility in formulation, and aesthetic appeal.

Meanwhile, the Inorganic segment is anticipated to register steady growth, especially in industrial and construction sectors, owing to their high thermal stability, UV resistance, and durability. These features make inorganic pigments ideal for applications in coatings, ceramics, and plastics exposed to harsh conditions.

- By Product

On the basis of product, the market is segmented into Pigments, Dyes, Color Concentrates, and Master Batches. The Pigments segment holds the largest revenue share in 2025, owing to its dominant role in paints & coatings, plastics, inks, and cosmetics. Their opacity, resistance to fading, and broad color range contribute to continued demand across industrial and decorative applications.

The Color Concentrates segment is expected to experience the fastest growth through 2032, especially in plastic manufacturing, due to their high color strength, reduced waste, and customizable properties. Master batches are also gaining popularity as they simplify the manufacturing process and ensure consistent coloration in polymer-based products.

- By End-User

On the basis of end-user, the market is segmented into Packaging, Paper and Printing, Textiles, Building and Construction, Automotive, Consumer Goods, and Others. The Packaging segment dominates the market share in 2025, driven by the rapid growth of e-commerce and demand for visually appealing, brand-centric, and sustainable packaging solutions.

The Textiles segment is anticipated to witness the fastest CAGR during the forecast period, fueled by rising fashion trends, increasing disposable incomes, and growing demand for colored fabrics and garments. In addition, sustainability trends in textile manufacturing are encouraging the adoption of eco-friendly dyes and pigments.

Europe Colorants Market Country Analysis

Germany Colorants Market Insight

Germany dominates the European Colorants market with the largest revenue share in 2025, attributed to its well-established chemical manufacturing base and strict environmental policies. The country’s strong automotive, construction, and textile industries generate high demand for advanced, durable colorants. Germany’s leadership in sustainability initiatives encourages the use of bio-based and non-toxic pigments, aligning with consumer and regulatory expectations. Continuous innovation by German companies in eco-friendly colorants and government incentives for green manufacturing practices support robust market growth.

France Colorants Market Insight

France Colorants market is anticipated to register significant growth, fueled by expanding demand in the cosmetics, food & beverage, and luxury textile segments. French consumers’ preference for natural and organic products is encouraging manufacturers to develop and market natural colorants extensively. Moreover, France’s growing packaging industry is adopting vibrant, sustainable color solutions to cater to evolving consumer preferences and strict environmental standards. Supportive government policies promoting circular economy practices further contribute to the market’s positive outlook.

Italy Colorants Market Insight

Italy’s Colorants market is expected to experience steady growth, driven by the flourishing fashion and textile sectors, where color plays a critical role in product differentiation and consumer appeal. The Italian market is also seeing increased adoption of sustainable pigments and dyes to comply with environmental regulations and meet consumer demand for green products. Additionally, Italy’s strong presence in automotive and furniture manufacturing is driving demand for specialized, high-performance colorants.

Europe Colorants Market Share

The Colorants industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DIC Corporation (Japan)

- Clariant (Switzerland)

- Cathay Industries (Hong Kong)

- Colorchem International Corp (Taiwan)

- DuPont (U.S.)

- Dow (U.S.)

- Huntsman International LLC (U.S.)

- Bayer AG (Germany)

- Cabot Corporation (U.S.)

- LANXESS (Germany)

- Avient (U.S.)

- Sun Chemical (U.S.)

- Hansen Holding A/S (Denmark)

- SETHNESS ROQUETTE (France)

- Jagson Colorchem Ltd (India)

- Penn Color, Inc. (U.S.)

- GNT Group B.V. (Netherlands)

- Symrise (Germany)

Latest Developments in Europe Colorants Market

- In April 2025, the U.S. Food and Drug Administration (FDA) approved three new natural food colorants—galdieria extract blue, butterfly pea flower extract, and calcium phosphate. This move aims to phase out synthetic dyes like Red 3 and Yellow 5, aligning with growing consumer demand for cleaner, safer ingredients. The transition is expected to influence global colorant formulations, especially in food and beverage sectors

- In October 2024, BASF unveiled its automotive color trend theme, "ROUTING," highlighting a shift towards intense red shades with purple undertones, as well as dynamic metallic effects and pastel tones like beige and light green. This theme reflects evolving consumer preferences for vibrant and nuanced automotive colors

- In August 2024, Dow celebrated the recognition of five of its products in the 2024 R&D 100 Awards, marking the 13th consecutive year the company has received this prestigious acknowledgment. These award-winning technologies highlight Dow's commitment to innovation and excellence in research and development

- In March 2024, DIC Corporation's subsidiary, Sun Chemical, showcased a range of innovative effect pigments, natural colorants, and ingredients at Chinaplas 2024. These offerings support the sustainable transformation of plastics, catering to the growing demand for eco-friendly materials in the industry

- As of December 2023, Clariant announced the completion of its transition to a fully per- and polyfluoroalkyl substances (PFAS)-free additive portfolio. This move underscores the company's commitment to sustainable and customer-focused innovation, aligning with global regulatory trends favoring safer chemical alternatives

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。