Europe Crop Protection Products Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

21.68 Billion

USD

30.86 Billion

2024

2032

USD

21.68 Billion

USD

30.86 Billion

2024

2032

| 2025 –2032 | |

| USD 21.68 Billion | |

| USD 30.86 Billion | |

|

|

|

|

Europe Crop Protection Products Market Segmentation, By Active Ingredient (Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephate, Boscalid, Bendiocarb, 1-Methylcyclopropene, Calcium Chloride, Daminozide, Benzyl Adenine, and Others), Product Type (Herbicides, Insecticides, Fungicides, Plant Growth Regulators, Acaricides, Fumigants, Nemathists, Spread Adhesives, and Others) Origin (Synthetic and Biopesticides), Form (Liquid and Dry), Application (Foliar Spray, Seed Treatment, Soil Treatment, Post-Harvest, Chemigation, and Others), Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Turf and Ornamentals, and Other Crops)- Industry Trends and Forecast to 2032

Europe Crop Protection Products Market Size

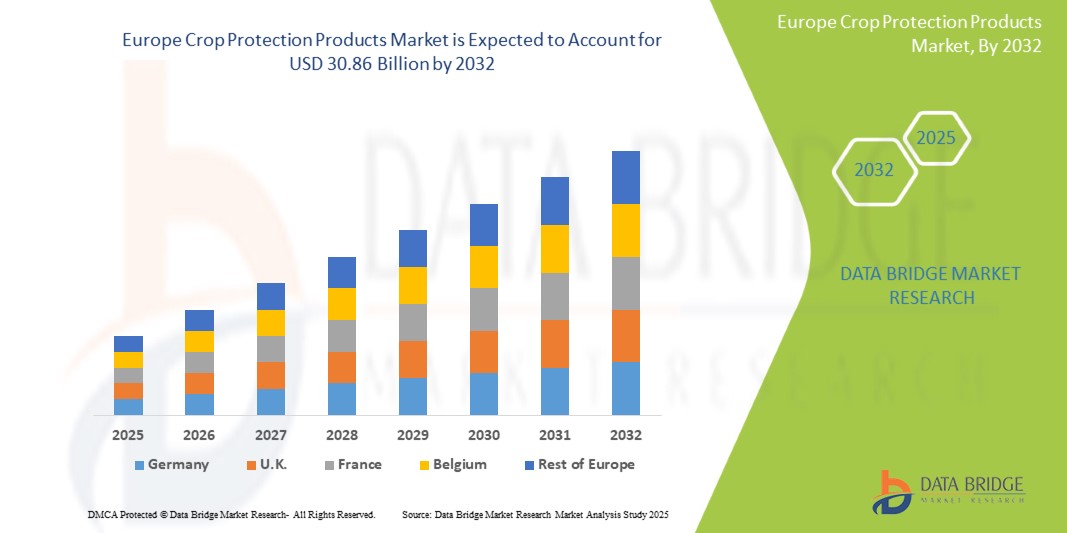

- The Europe crop protection products market size was valued at USD 21.68 billion in 2024 and is expected to reach USD 30.86 billion by 2032, at a CAGR of 4.51% during the forecast period

- The market growth is largely fuelled by the increasing need to enhance agricultural productivity, rising demand for food security, and the adoption of advanced farming practices

- The growing pressure to reduce crop losses due to pests, weeds, and diseases, along with the expansion of commercial farming, further supports market expansion

Europe Crop Protection Products Market Analysis

- The crop protection products market is experiencing steady growth as farmers and agribusinesses increasingly prioritize effective solutions to safeguard yields and improve quality

- Rising adoption of sustainable and bio-based crop protection alternatives is reshaping the competitive landscape, aligning with stricter regulatory standards and consumer demand for safe agricultural produce

- Germany crop dominated the Europe crop protection products market with the largest revenue share in 2024, fueled by the emphasis on sustainable agriculture and crop yield optimization. Farmers are adopting innovative chemical and biological crop protection solutions to comply with strict European Union regulations

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe crop protection products market due to increasing adoption of innovative crop protection technologies, growing demand for sustainable pest and disease management practices, and government initiatives supporting environmentally responsible farming. The shift toward modernized agricultural techniques and precision farming is further boosting market growth.

- The Bacillus Thuringiensis (BT) segment held the largest market revenue share in 2024 driven by its broad-spectrum pest control properties and compatibility with sustainable farming practices. BT-based solutions are widely preferred for their efficiency, low environmental impact, and suitability for a variety of crops

Report Scope and Europe Crop Protection Products Market Segmentation

|

Attributes |

Europe Crop Protection Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Crop Protection Products Market Trends

Rising Adoption of Advanced Crop Protection Solutions

- The growing shift toward advanced crop protection solutions is transforming the agriculture landscape by enabling higher crop yields and reducing losses due to pests, weeds, and diseases. These solutions allow for timely and precise application, improving overall productivity and profitability for farmers. Increasing awareness about crop health and the long-term benefits of modern formulations is further accelerating adoption across diverse farming systems

- The increasing demand for sustainable and bio-based pesticides and herbicides is accelerating adoption of eco-friendly formulations. These products help maintain soil health and reduce environmental impact while ensuring crop protection. Farmers and agribusinesses are increasingly integrating these solutions into long-term crop management strategies, responding to regulatory pressures and consumer preferences for safer produce

- Improved affordability and ease of use of modern crop protection products are encouraging wider adoption among smallholder and commercial farmers. Frequent use supports better crop monitoring and reduces the risk of large-scale losses. Technological advancements, such as pre-measured formulations and smart application devices, are making effective crop protection accessible even in less mechanized farms

- For instance, in recent years, farmers using integrated pest management kits and precision herbicide application tools have reported higher crop quality and reduced chemical wastage. These tools enable targeted action, lower production costs, and enhance long-term soil sustainability. The adoption of these innovations is also fostering knowledge sharing and better compliance with environmental safety standards

- While advanced crop protection products improve yields and efficiency, their success depends on continued innovation, farmer education, and cost-effectiveness. Manufacturers must focus on scalable, safe, and environmentally responsible solutions to fully capitalize on market demand. Collaboration with agricultural extension services and training programs is key to maximizing their effectiveness and long-term market penetration

Europe Crop Protection Products Market Dynamics

Driver

Increasing Incidence of Pests, Weeds, and Plant Diseases

- Rising pest and weed infestations, along with plant diseases, are driving the demand for effective crop protection products. Farmers and agribusinesses are prioritizing solutions that minimize yield loss and maintain crop quality. Growing global food demand and the need for consistent supply chains are further intensifying the adoption of protective measures

- Awareness of the financial impact of untreated crop threats, including reduced productivity and revenue loss, is motivating regular use of pesticides, herbicides, and fungicides. Proper crop protection directly supports farm profitability and long-term operational sustainability. Increasing collaborations between agronomists and farmers are helping optimize product selection and timing for maximum efficiency

- Governmental guidelines and agricultural organizations promoting safe and effective crop protection practices are further supporting market growth. Regulatory frameworks encourage integrated pest management and environmentally friendly formulations. Incentives and subsidies for adopting advanced products are also playing a key role in expanding usage among different farm sizes

- For instance, recent agricultural programs have incentivized the use of integrated crop protection solutions, encouraging adoption of both conventional and bio-based products. Training initiatives and awareness campaigns are complementing these programs to ensure proper application and reduce misuse. The result is improved crop health, reduced chemical residues, and enhanced sustainability metrics

- While pest prevalence and regulatory support drive the market, widespread adoption requires proper training, technology integration, and affordable solutions for all types of farmers. Continued investment in digital farming tools and precision agriculture devices further enhances the effectiveness of crop protection strategies. Partnerships with distributors and cooperatives are helping to bridge the gap for smallholder farmers

Restraint/Challenge

High Cost of Advanced Crop Protection Products and Access Limitations

- The high price of advanced crop protection chemicals, formulations, and precision application tools makes them less accessible for small-scale farmers. Premium products are often limited to commercial operations, restricting widespread usage. Cost barriers are particularly significant in regions with lower farm incomes or fragmented distribution networks

- Lack of technical knowledge and training on effective application methods reduces the efficiency of crop protection products, especially among smallholder farmers. Incorrect usage can lead to crop damage, chemical resistance, or environmental hazards. Educating farmers on dosage, timing, and safety protocols is critical to maximizing both productivity and safety

- Supply chain constraints for specialized formulations and equipment further limit availability, leading to suboptimal usage or reliance on traditional methods. Delays in delivery and inconsistent product quality can negatively impact crop cycles. Strengthening logistics, warehousing, and local manufacturing capabilities is essential to overcome these challenges

- For instance, surveys indicate that a significant portion of farmers delay or reduce pesticide applications due to cost or lack of proper guidance, resulting in crop losses. Such gaps highlight the need for affordable, easy-to-use, and widely accessible crop protection solutions. Market stakeholders must develop strategies that combine product innovation with practical deployment models

- While innovation in crop protection continues, addressing affordability, accessibility, and training remains critical. Market players must focus on cost-effective solutions, decentralized distribution, and educational programs to unlock long-term market potential. Collaboration with government agencies, NGOs, and cooperatives can accelerate adoption and improve overall farm productivity

Europe Crop Protection Products Market Scope

The market is segmented on the basis of active ingredient, product type, origin, form, application, and crop type.

• By Active Ingredient

On the basis of active ingredient, the Europe crop protection products market is segmented into Bacillus Thuringiensis (BT), Azoxystrobin, Bifenthrin, Fludioxonil, Acephate, Boscalid, Bendiocarb, 1-Methylcyclopropene, Calcium Chloride, Daminozide, Benzyl Adenine, and Others. The Bacillus Thuringiensis (BT) segment held the largest market revenue share in 2024 driven by its broad-spectrum pest control properties and compatibility with sustainable farming practices. BT-based solutions are widely preferred for their efficiency, low environmental impact, and suitability for a variety of crops.

The Azoxystrobin segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high effectiveness against fungal diseases and growing adoption across fruits, vegetables, and cereals. Azoxystrobin formulations are increasingly preferred for their reliability, longer residual activity, and compatibility with integrated pest management programs.

• By Product Type

On the basis of product type, the Europe crop protection products market is segmented into Herbicides, Insecticides, Fungicides, Plant Growth Regulators, Acaricides, Fumigants, Nemathists, Spread Adhesives, and Others. The Herbicides segment held the largest market revenue share in 2024 driven by the increasing need for effective weed management and higher crop yields. Herbicides offer precise application, minimize crop damage, and are widely adopted across large-scale cereal and grain production systems.

The Insecticides segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising pest infestations and the growing importance of crop loss prevention. Advanced insecticide formulations provide targeted action, reduced chemical use, and enhanced crop protection efficiency, increasing adoption among commercial and smallholder farmers.

• By Origin

On the basis of origin, the Europe crop protection products market is segmented into Synthetic and Biopesticides. The Synthetic segment held the largest market revenue share in 2024 driven by its broad efficacy, cost-effectiveness, and extensive availability across crop types. Synthetic formulations remain widely adopted for large-scale commercial farming.

The Biopesticides segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for eco-friendly and sustainable crop protection solutions. Biopesticides are gaining popularity due to low environmental impact, regulatory compliance, and suitability for organic farming practices.

• By Form

On the basis of form, the Europe crop protection products market is segmented into Liquid and Dry. The Liquid segment held the largest market revenue share in 2024 driven by ease of application, faster absorption, and compatibility with automated spraying systems. Liquids are widely used for foliar sprays and post-harvest treatment.

The Dry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by adoption in seed treatment, soil treatment, and precision farming applications. Dry formulations are preferred for their stability, longer shelf life, and suitability for mechanized equipment.

• By Application

On the basis of application, the Europe crop protection products market is segmented into Foliar Spray, Seed Treatment, Soil Treatment, Post-Harvest, Chemigation, and Others. The Foliar Spray segment held the largest market revenue share in 2024 driven by its ability to provide rapid and targeted pest and disease control. Foliar sprays are widely adopted for high-value crops due to efficiency and convenience.

The Seed Treatment segment is expected to witness the fastest growth rate from 2025 to 2032, driven by early-stage crop protection needs and increasing adoption in fruits, vegetables, and cereals. Seed treatments help reduce pest attacks, improve germination, and enhance overall crop performance.

• By Crop Type

On the basis of crop type, the Europe crop protection products market is segmented into Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Turf and Ornamentals, and Other Crops. The Cereals and Grains segment held the largest market revenue share in 2024 driven by large-scale cultivation and global staple crop demand. These crops require extensive weed and pest management to maintain yields.

The Fruits and Vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumption, higher value, and demand for quality and safe produce. Precision crop protection solutions and bio-based products are increasingly adopted in these high-value crops to ensure food safety and yield optimization.

Europe Crop Protection Products Market Regional Analysis

- Germany crop dominated the Europe crop protection products market with the largest revenue share in 2024, fueled by the emphasis on sustainable agriculture and crop yield optimization. Farmers are adopting innovative chemical and biological crop protection solutions to comply with strict European Union regulations

- The demand for environmentally friendly, high-performance products, coupled with Germany’s well-developed agricultural infrastructure, is promoting widespread adoption

U.K. Crop Protection Products Market Insight

The U.K. crop protection products market is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of sustainable and efficient pest, weed, and disease control solutions. Farmers are leveraging advanced herbicides, fungicides, and insecticides to maintain productivity and meet food safety standards. Government programs promoting environmentally responsible crop protection practices are expected to support long-term growth.

Europe Crop Protection Products Market Share

The Europe crop protection products industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Belchim Crop Protection (Belgium)

- Koppert Biological Systems (Netherlands)

- Sipcam Oxon (Italy)

- Agriphar (Belgium)

- Certis Europe (Netherlands)

- Nufarm Europe GmbH (Austria)

- Andermatt Biocontrol (Switzerland)

Latest Developments in Europe Crop Protection Products Market

- In June 2024, The Syngenta and InstaDeep have partnered to accelerate crop seed trait research by leveraging AI Large Language Models. This partnership enhances Syngenta Seeds' R&D capabilities by increasing speed, precision, and efficiency in accelerating trait development. Large Language Models (LLMs) are designed to shorten research cycles and strengthen decision-making processes, delivering valuable solutions to farmers. The combined expertise exemplifies transformative product innovation for corn and soybean crops through collaboration and cutting-edge technology

- In August 2023, The Company had made substantial investments to enhance its portfolio of biological solutions for plant and seed health. Following its acquisition of Valagro in 2020, the company has consistently invested in research and development, while also expanding its range of advanced biological solutions through a series of commercial partnerships and research collaborations. This partnership helps to increase the more global presence

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。