Europe Glyoxal Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

133.92 Million

USD

193.17 Million

2025

2033

USD

133.92 Million

USD

193.17 Million

2025

2033

| 2026 –2033 | |

| USD 133.92 Million | |

| USD 193.17 Million | |

|

|

|

|

Europe Glyoxal Market Segmentation, By Grade (Industrial Grade, Pharmaceutical Grade), Purity (90%–99%, 40%–60%, Others), Production Process (Catalytic Oxidation of Ethylene Glycol, Oxidation of Acetylene, Others), Packaging (Bottles, Drums, Jerrycans, Composite IBC, Bulk), Application (Cross-Linking, Chemical Intermediates, and Other), End-use Chemicals (2-Imidazolidinone, 2-Methylimidazole, Allantoin, Dihydroxyethylene Urea (DHEU), Ethylene Glycol Diformate, Glycoluril, Glyoxal Phenol Resin, Glyoxal Sodium Bisulfite, Glyoxal Urea Resin, Glyoxalated Polyacrylamide (GPAM), Glyoxalated Starch, Glyoxal-bis(2-Hydroxyanil), Glyoxylic Acid, Imidazole, Methylol Glyoxal, Quinoxaline, Quinoxaline Derivatives, Tetramethylol Acetylenediurea, Urea-Glyoxal Concentrate) End-Use Industry (Textile, Leather, Pharmaceuticals, Water Treatment, Paints and Coatings, Cosmetics and Personal Care, Household Products, Pulp and Paper, Electrical and Electronics, Packaging, Oil and Gas, Others) - Industry Trends and Forecast to 2033

Europe Glyoxal Market Size

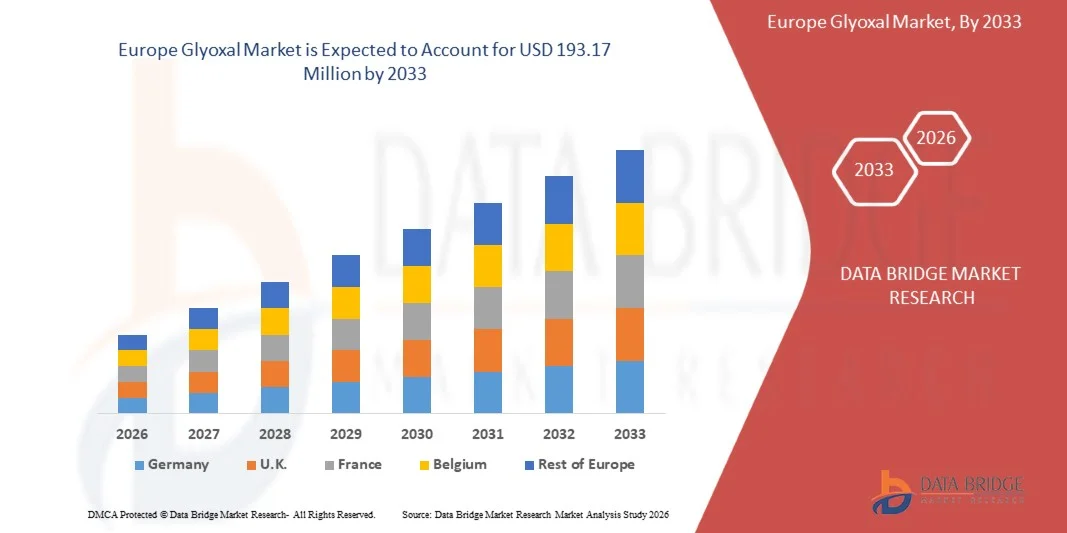

- The Europe Glyoxal Market is expected to reach USD 193.17 million by 2033 from USD 133.92 million in 2025 growing with a CAGR of 4.8% in the forecast period of 2026 to 2033.

- The Europe Glyoxal Market is witnessing steady growth driven by its expanding use across textiles, paper, leather, pharmaceuticals, agrochemicals, and oil & gas industries, where glyoxal is valued for its cross-linking, binding, and finishing properties.

Europe Glyoxal Market Analysis

- The Europe Glyoxal Market serves diverse industries including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Demand is driven by its strong crosslinking properties and role as a key intermediate in specialty and performance chemical formulations.

- Rising textile finishing activities, increasing paper packaging consumption, and growing use of eco-friendly resins are major demand drivers. Expansion of pharmaceutical manufacturing and stricter wastewater treatment regulations further support sustained glyoxal consumption worldwide.

- The market features a mix of multinational chemical producers and regional manufacturers. Competition is based on product purity, application-specific grades, pricing, supply reliability, and compliance with environmental and safety regulations across key end-use industries.

- Germany dominates the Europe glyoxal market and likely to lead with 24.95% of market share in 2026 supported by large-scale manufacturing capacity, low production costs, and abundant raw material availability. Strong downstream demand from textiles, resins, paper, and leather industries, along with an extensive chemical supply chain, further reinforces its leadership.

- The Germany glyoxal market is expected to grow at a CAGR of around 5.2% from 2026 to 2033, driven by rising demand from the textile and agrochemical industries and increasing use in resins and coatings for industrial applications. Expanding industrialization and urbanization in the region further fuel market growth.

- In 2025, the Industrial Grade segment is expected to dominate the glyoxal market with an 81.89% share due to its widespread use in manufacturing resins, adhesives, and paper treatment chemicals. The segment benefits from high demand in large-scale industrial applications and cost-effectiveness for bulk production, making it the preferred choice over other grades.

Report Scope and Europe Glyoxal Market Segmentation

|

Attributes |

Europe Glyoxal Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Glyoxal Market Trends

“Integration with smart manufacturing, warehouse processing, and e-commerce packaging ecosystems”

- Glyoxal is increasingly utilized in smart manufacturing environments for textile finishing, paper treatment, and resin applications, supporting consistent quality control, process optimization, and data-driven production decisions aligned with Industry 4.0 initiatives.

- In warehouse and processing facilities, glyoxal-based formulations aid in material stabilization, coating performance, and moisture resistance, improving handling efficiency, storage durability, and downstream processing reliability.

- The growing use of glyoxal in packaging adhesives, paper strengthening, and surface treatments supports the expansion of e-commerce by enhancing packaging integrity, load stability, and product protection across logistics networks.

For Instance,

- In January 2025, glyoxal-based chemical solutions were increasingly integrated into automated textile and paper processing lines, combined with advanced process controls and digital monitoring systems to improve efficiency, consistency, and sustainability across industrial operations, highlighting glyoxal’s role in next-generation manufacturing ecosystems.

- Recent industry developments indicate rising adoption of specialty aldehyde-based chemicals, including glyoxal, in high-performance packaging and industrial applications as e-commerce and logistics volumes grow, reinforcing its expanding role beyond traditional end-use sectors.

Europe Glyoxal Market Dynamics

Driver

“Rising industrial modernization and performance-driven chemical application requirements”

- The Europe industrial sector is witnessing accelerated adoption of glyoxal-based solutions driven by increasingly complex performance requirements across textiles, paper, resins, leather, and specialty chemical applications. Manufacturers are prioritizing glyoxal for its cross-linking, binding, and finishing properties that enhance product strength, durability, and functional performance. As industrial processes evolve toward higher efficiency and quality consistency, demand is growing for chemical formulations that support controlled reactions, reduced emissions, and improved end-product reliability.

- The expanding role of glyoxal within industrial modernization initiatives has created a dynamic environment for chemical producers to innovate, leading to advancements in formulation purity, application versatility, and process compatibility. In response to this demand-driven shift, manufacturers are investing in the development of customized glyoxal grades tailored for specific end-use requirements, including low-formaldehyde systems, specialty resins, and high-performance textile treatments.

- These innovations are largely driven by the operational needs of modern industries, which require adaptable chemical solutions capable of performing reliably under varied processing conditions and regulatory constraints. As industries continue to integrate glyoxal into advanced manufacturing and finishing workflows, this momentum not only influences supplier investment strategies but also reinforces glyoxal’s role as a critical intermediate in enhancing industrial productivity and material performance.

For instance,

- In September 2023, industry publications highlighted increased adoption of glyoxal in advanced textile finishing processes aimed at improving fabric strength and wrinkle resistance while meeting stricter environmental compliance standards.

- As of February 2024, chemical industry insights indicated that manufacturers across Europe intensified the use of glyoxal-based resins and paper treatment solutions to support sustainable production practices and reduce reliance on higher-toxicity alternatives.

- In February 2025, regional industry developments across Asia-Pacific emphasized growing investments in specialty aldehyde production, including glyoxal, to meet rising demand from packaging, construction, and industrial manufacturing sectors focused on performance enhancement and regulatory alignment.

- The growing adoption of glyoxal across the global industrial sector underscores its increasing importance as a multifunctional chemical solution aligned with evolving performance, efficiency, and sustainability requirements. As industries continue to advance toward higher-quality outputs and more controlled manufacturing processes, glyoxal’s cross-linking, binding, and finishing capabilities position it as a critical enabler of enhanced material strength, durability, and functional consistency.

- Ongoing innovations in formulation purity and application-specific customization further reinforce its relevance across textiles, paper, resins, leather, and specialty chemicals. Supported by rising investments, regulatory alignment efforts, and expanding industrial use cases across major regions, glyoxal is expected to maintain a strategically significant role in driving industrial productivity and supporting the transition toward more sustainable and high-performance manufacturing practices.

Restraint/Challenge

“Lack of Harmonized Europe Regulatory Frameworks for Chemical Manufacturing and Usage”

- The absence of harmonized Europe regulations governing chemical manufacturing, handling, and end-use applications presents a notable challenge for the Europe Glyoxal Market, as regulatory requirements differ significantly across countries and regions.

- Regulatory authorities apply varying standards related to chemical classification, permissible exposure limits, environmental compliance, labeling, transportation, and wastewater discharge. This regulatory fragmentation compels glyoxal manufacturers and downstream users to modify formulations, documentation, safety protocols, and compliance strategies for each market, increasing operational complexity, compliance costs, and time to market.

- As a result, companies face constraints in scaling glyoxal production and distribution Europe, particularly for cross-border trade and multinational supply chains serving textiles, paper, resins, and specialty chemical applications.

For instance,

- In 2025, regional environmental authorities in Asia and Europe introduced differing compliance requirements for aldehyde-based chemicals, including glyoxal, with variations in emission thresholds and reporting obligations, illustrating regulatory inconsistencies that complicate standardized production and export strategies.

- In May 2025, national and local regulatory bodies in emerging markets enforced stricter chemical handling and transportation restrictions beyond existing central guidelines, creating temporary operational disruptions for glyoxal manufacturers and distributors who were required to obtain additional approvals and modify logistics workflows during the enforcement period.

- In conclusion, the lack of harmonized global regulatory frameworks continues to pose a structural challenge for the Global Glyoxal Market, limiting the ease of standardized production, distribution, and cross-border trade. Divergent regional requirements related to chemical classification, environmental compliance, handling, and transportation increase operational complexity and elevate compliance costs for manufacturers and downstream users.

- These regulatory inconsistencies not only slow market entry and scalability but also necessitate frequent adjustments to formulations, documentation, and logistics strategies across regions. As a result, regulatory fragmentation remains a key constraint on global market expansion, underscoring the need for greater alignment and transparency in chemical governance to support more efficient international supply chains and sustainable market growth.

Europe Glyoxal Market Scope

Europe Glyoxal Market is categorized into Seven notable segments which are based on grade, purity, production process, packaging application, end-use chemicals and end-use industry.

By Grade

Based on grade, the Europe Glyoxal Market is primarily segmented into Industrial Grade and Pharmaceutical Grade.

By 2026, the Industrial Grade segment is projected to dominate the market, accounting for 81.81% of the total share. This dominance is attributed to its extensive applications across various industries, including textiles, paper processing, resins, leather treatment, and water treatment. The high-volume consumption of industrial-grade glyoxal is further supported by its cost-effectiveness and efficiency in large-scale operations. Additionally, the rapid expansion of industrial and manufacturing sectors in the Europe region is driving strong and sustained demand. As a result, industrial-grade glyoxal is expected to remain the key growth driver within the regional market.

The Pharmaceutical Grade segment in the Europe Glyoxal Market is expected to grow fastest from 2026 to 2033, driven by rising demand in pharmaceutical synthesis, stringent regulatory requirements for high-purity chemicals, and the expansion of advanced drug manufacturing and specialty applications. These factors boost the adoption of high-quality glyoxal in APIs and innovative drug formulations.

By purity

On the basis of purity, the Europe Glyoxal Market is segmented into 90%–99%, 40%–60%, and Others.

By 2026, the 40%–60% purity segment is expected to dominate the market, accounting for 72.86% of the total share. This segment’s prominence is attributed to its superior performance, higher reactivity, and suitability for advanced applications across pharmaceuticals, specialty resins, textiles, and cosmetics. Its consistent quality, along with adherence to stringent industry standards, further drives strong and sustained demand. Additionally, the balance between effectiveness and cost-efficiency makes this purity range highly preferred by manufacturers. As a result, the 40%–60% purity segment is projected to remain the primary contributor to growth in the Europe Glyoxal Market.

The 90%-99% purity segment in the Europe Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its widespread use in pharmaceutical and specialty chemical applications that require high-purity glyoxal, along with increasing demand for advanced drug formulations and regulatory-compliant production processes.

By production process

On the basis of production process, the Europe Glyoxal Market is segmented into Catalytic Oxidation of Ethylene Glycol, Oxidation of Acetylene, and Others.

By 2026, the Catalytic Oxidation of Ethylene Glycol segment is expected to dominate the market, accounting for 89.89% of the total share. This segment’s dominance is driven by its higher production efficiency, better yield control, and lower impurity levels compared to acetylene-based processes. Additionally, it offers improved safety and is more environmentally compliant, making it highly suitable for large-scale manufacturing. The cost-effectiveness and scalability of this method further reinforce its preference among manufacturers. As a result, the catalytic oxidation route is poised to remain the primary driver of growth in the Europe Glyoxal Market.

The “Oxidation of Acetylene” production process segment in the Europe Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its ability to produce high-purity glyoxal suitable for pharmaceutical and specialty chemical applications, along with rising demand for advanced drug formulations and compliance with strict quality and regulatory standards.

By packaging

On the basis of packaging, the Europe Glyoxal Market is segmented into Drums, Composite IBC, Bulk, Jerrycans, and Bottles.

By 2026, the Drums segment is expected to dominate the market, accounting for 39.96% of the total share. This dominance is attributed to its versatility, ease of handling, and safe storage, particularly for small-quantity applications. Bottles are especially suitable for pharmaceuticals, cosmetics, and specialty chemical uses, where precision and safety are critical. Additionally, their wide availability and cost-effective production further drive strong adoption across industries. The convenience and reliability of bottle packaging make it a preferred choice for manufacturers and end-users alike.

The “Composite IBC” packaging segment in the Europe Glyoxal Market is expected to witness the fastest growth from 2026 to 2033, driven by its efficiency in storing and transporting bulk chemicals, enhanced safety and chemical resistance, and increasing demand from pharmaceutical, specialty chemical, and industrial users who require reliable, large-capacity packaging solutions.

By application

On the basis of packaging, the Europe Glyoxal Market is segmented into Application Cross-Linking, Chemical Intermediates, Others.

By 2026, the Cross-Linking segment is expected to dominate the market, accounting for 65.28% of the total share. This dominance is attributed to its versatility, ease of handling, and safe storage, particularly for small-quantity applications. Bottles are especially suitable for pharmaceuticals, cosmetics, and specialty chemical uses, where precision and safety are critical. Additionally, their wide availability and cost-effective production further drive strong adoption across industries. The convenience and reliability of bottle packaging make it a preferred choice for manufacturers and end-users alike.

The Chemical Intermediates application segment in the Europe Glyoxal Market is expected to be the fastest-growing segment from 2026 to 2033, driven by increasing demand for resins, polymers, and specialty chemicals, the expansion of the chemical manufacturing industry, and the use of glyoxal as a versatile cross-linking and reactive intermediate in industrial and specialty applications.

By end-use chemicals

On the basis of end-use chemicals, the Europe Glyoxal Market is segmented into Dihydroxyethylene Urea (DHEU), 2-Imidazolidinone, Glyoxalated Polyacrylamide (GPAM), Glyoxylic Acid, Glyoxalated Starch, Glyoxal Phenol Resin, Glyoxal Urea Resin, Ethylene Glycol Diformate, Urea-Glyoxal Concentrate, Quinoxaline Derivatives, Methylol Glyoxal, Glyoxal-Bis(2-Hydroxyanil), Glyoxal Sodium Bisulfite, Quinoxaline, 2-Methylimidazole, Imidazole, Glycoluril, Allantoin, and Tetramethylol Acetylenediurea.

By 2026, the Dihydroxyethylene Urea (DHEU) segment is expected to dominate the market, accounting for 20.03 % of the total share. Its dominance is driven by its wide applicability in textile finishing, paper treatment, and resin manufacturing. The segment benefits from high reactivity, consistent performance, and compatibility with various industrial processes. Additionally, growing demand for high-quality textiles and specialty chemical products in the Europe region supports its strong market position. DHEU’s cost-effectiveness and efficiency further reinforce its preference among manufacturers and end-users.

The 2-Imidazolidinone end-use chemicals segment in the Europe Glyoxal Market is expected to be the fastest-growing from 2026 to 2033, driven by its increasing use in pharmaceuticals, agrochemicals, and specialty chemical applications. Its growth is fueled by the rising demand for high-purity glyoxal as a key intermediate in synthesizing 2-Imidazolidinone for advanced formulations and regulatory-compliant chemical production.

By end-user

On the basis of end-user, the Europe Glyoxal Market is segmented into Textile, Pulp and Paper, Leather, Paints and Coatings, Water Treatment, Pharmaceuticals, Household Products, Cosmetics and Personal Care, Packaging, Electrical and Electronics, Oil and Gas, and Others.

By 2026, the Textile segment is expected to dominate the market, accounting for 35.36% of the total share. This growth is driven by its widespread use in fabric finishing, wrinkle resistance, and crease-proof treatments. The increasing demand for durable and high-quality textiles, coupled with rapid expansion in the apparel and home furnishing industries, further supports market growth. Additionally, rising consumer preference for premium and long-lasting fabrics boosts the adoption of glyoxal-based solutions. As a result, the Textile segment is poised to remain the key contributor to the Europe Glyoxal Market.

The Pulp and Paper end-user segment in the Europe Glyoxal Market is expected to be the fastest-growing from 2026 to 2033, driven by the increasing demand for wet-strength resins and chemical additives that enhance paper durability and quality. Growth is supported by the expansion of the paper and packaging industry and the shift toward high-performance, sustainable paper products.

Europe Glyoxal Market Regional Analysis

- Germany is the dominating country in the Europe Glyoxal Market accounting share of 24.95% in 2026 supported by a strong regulatory framework, advanced chemical manufacturing capabilities, and a well-established industrial base.

- Increasing utilization across textiles, paper processing, construction chemicals, resins, and specialty chemicals, along with sustained investments in sustainable and high-purity chemical production, continues to drive long-term market expansion in the country

France Glyoxal Market Insight

The France Glyoxal Market is expanding, fueled by rising demand from paper processing, textile finishing, pharmaceuticals, and specialty chemical applications. Government focus on sustainable chemical usage and increased adoption of low-emission formulations are supporting market development across industrial sectors.

U.K. Glyoxal Market Insight

The U.K. Glyoxal Market is witnessing steady growth, supported by increasing usage in paper processing, textile finishing, pharmaceuticals, and specialty chemicals. Stringent environmental regulations, coupled with a strong focus on sustainable manufacturing and low-emission formulations, continue to drive adoption across major industrial applications.

Europe Glyoxal Market Share

The Glyoxal is primarily led by well-established companies, including:

- Amzole India Pvt. Ltd (India)

- Asis Scientific Pty Ltd (Australia)

- Ataman Chemicals (India)

- BASF SE (Germany)

- Bidvest Chemical (South Africa)

- Bisley Asia (M) Sdn Bhd (Malaysia)

- Eastman Chemical Company (U.S.)

- Fluorochem Limited (U.K.)

- Fujifilm Wako Pure Chemical Corporation (Japan)

- Glentham Life Sciences Limited (U.K.)

- GetChem Co., Ltd. (China)

- Hanna Instruments Ltd (U.S.)

- Himedia Laboratories (India)

- Kanto Kagaku (Japan)

- Kemira Oyj (Finland)

- Merck KGaA (Germany)

- Meru Chem Pvt. Ltd (India)

- Muby Chemicals (India)

- Multichem Specialities Private Limited (India)

- Oakwood Products Inc. (U.S.)

- Otto Chemie Pvt. Ltd (India)

- Oxford Lab Fine Chem LLP (India)

- Santa Cruz Biotechnology Inc. (U.S.)

- Sasol (South Africa)

- Silver Fern Chemical, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Univar Solutions LLC (U.S.)

- Weylchem International GmbH (Germany)

- Zhishang Chemical (China)

Latest Developments in Europe Glyoxal Market

- In October 2025, Multichem Specialities Private Limited was recognized among the Top 10 Specialty Chemical Distributors 2025 by Industry Outlook Magazine, highlighting its quality, innovation, and dependable service in the specialty chemicals sector. In July 2025, the company also organized a successful blood donation drive in collaboration with Breach Candy Hospital Trust, engaging employees and community members to support healthcare needs.

- In February 2024, Multichem Specialities Private Limited participated in Vitafoods India, strengthening its presence in the nutraceuticals and specialty ingredients segment while engaging with customers and partners to showcase its expanding chemical portfolio.

- In October 2024, Otto Chemie Pvt. Ltd. expanded its portfolio of high-purity laboratory chemicals and reagents, enhancing its presence in pharmaceutical, research, and industrial sectors. The company also strengthened its distribution network and supply chain capabilities to meet growing demand across India and international markets.

- In July 2024, Otto Chemie Pvt. Ltd. organized a blood donation and health awareness drive in collaboration with local hospitals, reflecting the company’s commitment to community welfare and employee participation in social responsibility initiatives.

- In March 2025, Oxford Lab Fine Chem LLP implemented eco-friendly packaging solutions and optimized waste management practices in its production and distribution processes, reinforcing the company’s commitment to sustainable and responsible chemical manufacturing.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。