Europe Injectable Drug Delivery Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

155.98 Billion

USD

368.64 Billion

2024

2032

USD

155.98 Billion

USD

368.64 Billion

2024

2032

| 2025 –2032 | |

| USD 155.98 Billion | |

| USD 368.64 Billion | |

|

|

|

|

Europe Injectable Drug Delivery Market Segmentation, By Type (Injectable Drug Delivery Devices and Injectable Drug Delivery Formulation), Usage Pattern (Curative Care, Immunization, and Other), Mode Of Administration (Skin, Circulatory/Muskoskeletal, Organs, and Central Nervous System), Application (Autoimmune Disease, Hormonal Disorders, Orphan Diseases, Oncology, and Others), End User (Hospitals and Clinics, Home Healthcare, Research Laboratories, Pharmaceutical and Biotechnological Companies, and Others), Distribution Channel (Hospital Pharmacy, Pharmacy Stores, Direct Tender, and Online Pharmacy)- Industry Trends and Forecast to 2032

Europe Injectable Drug Delivery Market Size

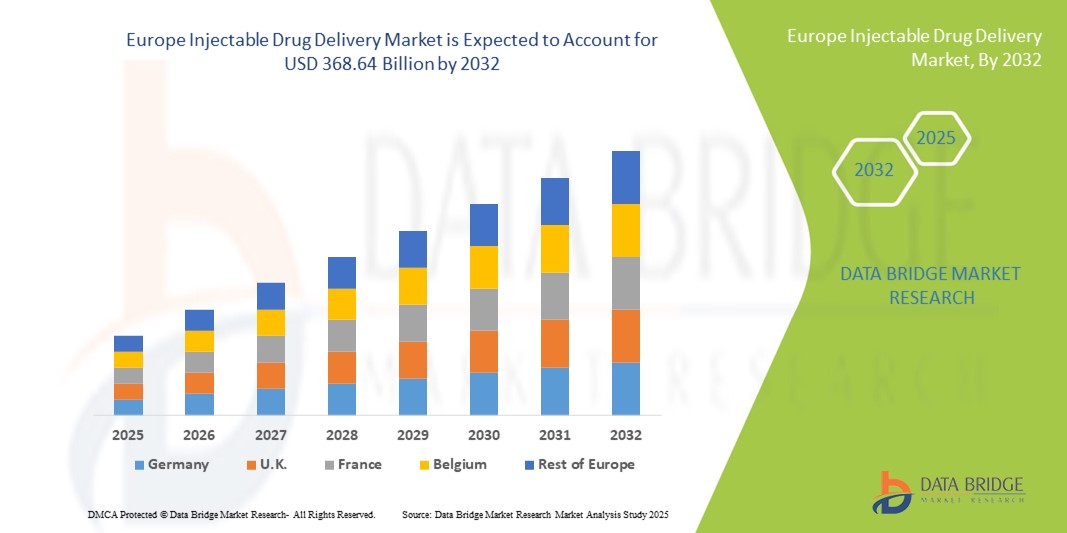

- The Europe injectable drug delivery market size was valued at USD 155.98 billion in 2024 and is expected to reach USD 368.64 billion by 2032, at a CAGR of 11.35% during the forecast period

- The market growth is largely driven by the increasing prevalence of chronic diseases, rising demand for self-administration therapies, and ongoing innovations in drug delivery technologies such as auto-injectors, prefilled syringes, and wearable injectors

- Furthermore, growing emphasis on patient-centric healthcare solutions, combined with supportive regulatory frameworks and the expansion of biologics and biosimilars, is positioning injectable drug delivery systems as a preferred choice in both hospital and homecare settings. These factors are collectively fueling the adoption of injectable drug delivery solutions, thereby accelerating market growth

Europe Injectable Drug Delivery Market Analysis

- Injectable drug delivery systems, including devices and formulations, are increasingly essential in modern healthcare due to their precision, ease of use, and compatibility with biologics, vaccines, and high-viscosity drugs across hospitals, clinics, and homecare settings

- The rising demand for injectable drug delivery is primarily driven by the growing prevalence of chronic and orphan diseases, increasing adoption of self-administration therapies, and technological innovations in safe, user-friendly, and integrated delivery systems

- Germany dominated the Europe injectable drug delivery market with the largest revenue share of 37.2% in 2024, supported by advanced healthcare infrastructure, high adoption of biologics, strong regulatory frameworks, and a significant presence of key market players, with increasing uptake of both injectable drug delivery devices and formulations in hospitals and home healthcare

- Italy is expected to be the fastest growing country in the Europe injectable drug delivery market during the forecast period due to rising healthcare expenditure, growing awareness of immunization programs, and increasing demand for curative care and specialized therapies

- Injectable drug delivery devices segment dominated the market with a market share of 42.8% in 2024, driven by innovations in auto-injectors, prefilled syringes, and wearable injectors that enhance convenience, safety, and patient compliance

Report Scope and Europe Injectable Drug Delivery Market Segmentation

|

Attributes |

Europe Injectable Drug Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Injectable Drug Delivery Market Trends

Advancements in Connected and Patient-Centric Devices

- A significant and accelerating trend in the Europe injectable drug delivery market is the development of connected and smart delivery devices, such as auto-injectors and wearable injectors, enabling real-time monitoring and enhanced patient adherence

- For instance, connected auto-injectors can transmit injection data to healthcare providers, allowing remote tracking of therapy adherence and dosage accuracy, improving patient outcomes

- Integration with digital health platforms enables features such as injection reminders, dose logging, and alerts for missed doses. For instance, smart prefilled syringes can notify patients or caregivers via smartphone apps, improving compliance for chronic disease management

- Such interconnected delivery systems facilitate centralized management of patient therapy, integrating injection tracking with broader health monitoring tools such as glucose meters or blood pressure monitors

- This trend toward intelligent, patient-centric, and digitally connected injectable devices is transforming user expectations for therapy administration. Consequently, companies such as Ypsomed are developing smart injectors with real-time monitoring, app connectivity, and dose tracking for enhanced patient convenience

- The demand for connected, data-enabled injectable devices is growing rapidly across both hospital and homecare settings, as patients and healthcare providers increasingly prioritize convenience, accuracy, and adherence in drug administration

Europe Injectable Drug Delivery Market Dynamics

Driver

Increasing Prevalence of Chronic Diseases and Self-Administration Preference

- The rising prevalence of chronic and autoimmune diseases, coupled with growing patient preference for self-administered therapies, is a significant driver for the increasing demand for injectable drug delivery systems

- For instance, patients with diabetes or rheumatoid arthritis are increasingly adopting auto-injectors and prefilled syringes for home use, reducing dependency on hospital visits and improving convenience

- Injectable devices offer enhanced safety, precision dosing, and ease of use, supporting effective therapy adherence and reducing administration errors. For instance, smart pens with dose memory enable patients to accurately track their medication usage

- Furthermore, the growing focus on patient-centric healthcare solutions and personalized treatment plans is driving adoption of injectable drug delivery systems that are easier to use at home

- Convenience, accuracy, reduced hospital dependency, and patient empowerment are key factors propelling adoption in both hospital and homecare settings. The trend toward digital health integration and telemedicine further accelerates market growth

Restraint/Challenge

High Device Costs and Regulatory Compliance Requirements

- The relatively high cost of advanced injectable devices and strict regulatory requirements pose significant challenges to broader market penetration in Europe. Advanced auto-injectors and wearable injectors often come with premium pricing, which can limit adoption, particularly in price-sensitive segments

- For instance, smart connected injectors with digital monitoring features are priced higher than traditional prefilled syringes, making affordability a concern for some healthcare providers and patients

- Regulatory hurdles related to safety, efficacy, and device approval processes increase time-to-market and development costs. For instance, compliance with MDR (Medical Device Regulation) in the EU requires extensive clinical evaluation and documentation

- Ensuring patient safety, device reliability, and regulatory compliance while managing costs is critical for market acceptance

- Overcoming these challenges through cost-effective device design, streamlined approval pathways, and patient education on the benefits of advanced injectable systems is vital for sustained growth

Europe Injectable Drug Delivery Market Scope

The market is segmented on the basis of type, usage pattern, mode of administration, application, end user, and distribution channel.

- By Type

On the basis of type, the Europe injectable drug delivery market is segmented into injectable drug delivery devices and injectable drug delivery formulations. The injectable drug delivery devices segment dominated the market with the largest revenue share of 42.8% in 2024, driven by innovations in auto-injectors, prefilled syringes, and wearable injectors that improve patient convenience and adherence. Hospitals and home healthcare providers increasingly prefer devices that enable precise dosing, minimize errors, and support self-administration, particularly for chronic and autoimmune disease treatments. Device adoption is further fueled by integration with digital health platforms that provide monitoring, reminders, and adherence tracking. The availability of devices compatible with high-viscosity biologics and vaccines enhances their preference over traditional formulations. Strong R&D investments by leading players in device ergonomics, safety, and connectivity also support market dominance. Leading companies are focusing on connected devices that allow real-time feedback and therapy monitoring to increase patient engagement.

The injectable drug delivery formulation segment is expected to witness the fastest growth from 2025 to 2032 due to rising adoption of biologics, vaccines, and specialty drugs. Formulations that require stable, accurate, and efficient delivery, such as high-concentration biologics, are driving demand for advanced injectable formulations. Pharmaceutical companies are investing in novel formulations that reduce dosing frequency, improve patient compliance, and enable home administration. In addition, the increasing focus on orphan drugs and targeted therapies is boosting the need for specialized injectable formulations. Rising regulatory approvals for new drugs and biosimilars in Europe also support the growth of this segment. The growing pipeline of complex biologics further accelerates demand for innovative formulations.

- By Usage Pattern

On the basis of usage pattern, the market is segmented into curative care, immunization, and other. The curative care segment dominated in 2024 due to high demand for injectable treatments for chronic diseases, autoimmune disorders, and oncology therapies. Hospitals and clinics increasingly rely on injectable therapies to deliver precise and effective treatments, and patient preference for self-administration further strengthens this segment. Healthcare providers value injectable solutions for their ability to deliver controlled dosages, reduce hospitalization time, and improve treatment adherence. The segment also benefits from ongoing innovations in device ergonomics and safety features. Curative care applications often leverage digital monitoring tools to optimize therapy outcomes, further enhancing the attractiveness of this segment. Integrated healthcare platforms combining therapy tracking and patient management also support segment growth.

The immunization segment is expected to witness the fastest growth during the forecast period, driven by increasing vaccination programs across Europe, including influenza, COVID-19 boosters, and other preventive immunizations. Prefilled syringes and auto-injectors are preferred for their ease of use, reduced risk of contamination, and faster administration in mass immunization campaigns. Growing awareness of preventive healthcare, government initiatives, and increasing public health expenditure further support this segment’s expansion. Companies are also investing in combination vaccines and innovative delivery formats to meet immunization demand efficiently.

- By Mode of Administration

On the basis of mode of administration, the market is segmented into skin, circulatory/musculoskeletal, organs, and central nervous system (CNS). The circulatory/musculoskeletal segment dominated in 2024 due to the high prevalence of injectable therapies for arthritis, cardiovascular conditions, and other systemic disorders. Hospitals and homecare patients increasingly prefer injections for rapid drug absorption, precise dosing, and long-acting formulations. This segment benefits from innovations in auto-injectors and wearable injectors that enhance patient compliance and minimize administration pain. Integration with digital platforms to track therapy adherence further strengthens the segment. The increasing prevalence of chronic musculoskeletal and cardiovascular conditions drives long-term demand. Companies are also developing ergonomically designed devices to improve patient comfort and usability.

The CNS segment is expected to witness the fastest growth during the forecast period due to rising prevalence of neurological disorders and increasing adoption of injectable therapies targeting CNS conditions such as multiple sclerosis and Parkinson’s disease. Technological advancements in drug delivery devices, including needle-free injectors and smart infusion systems, are facilitating safer and more convenient CNS therapy administration. Growing patient awareness and homecare options contribute to the segment’s expansion. Increasing R&D in CNS-targeted biologics is also boosting demand for specialized injectables.

- By Application

On the basis of application, the market is segmented into autoimmune disease, hormonal disorders, orphan diseases, oncology, and others. The autoimmune disease segment dominated in 2024, driven by rising prevalence of conditions such as rheumatoid arthritis, psoriasis, and Crohn’s disease. Prefilled syringes and auto-injectors are preferred for self-administration, improving patient compliance and reducing hospital visits. Hospitals and homecare providers value devices that allow accurate dosing and minimal injection discomfort. Pharmaceutical R&D efforts targeting biologics for autoimmune disorders further drive market growth. Integration with digital adherence tools enhances patient engagement. Supportive government policies for chronic disease management also boost segment adoption.

The oncology segment is expected to witness the fastest growth from 2025 to 2032 due to increasing demand for injectable cancer therapies, including monoclonal antibodies and targeted biologics. Rising incidence of cancer, combined with patient preference for home-administered therapies, is fueling adoption. Innovative formulations and connected delivery devices that improve safety, dosing accuracy, and adherence are supporting this segment’s rapid expansion. Hospitals and specialized cancer clinics are increasingly adopting these advanced solutions. Investment in personalized oncology therapies also contributes to segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals and clinics, home healthcare, research laboratories, pharmaceutical and biotechnological companies, and others. Hospitals and clinics dominated the market in 2024 with the largest revenue share due to high patient volumes, advanced healthcare infrastructure, and reliance on injectable therapies for both acute and chronic conditions. These settings prefer devices and formulations that ensure precise dosing, minimize administration errors, and support integrated patient care. Strong partnerships with pharmaceutical companies also facilitate access to advanced injectable solutions. Hospitals also benefit from digital integration for therapy management. Government healthcare policies and reimbursement support further strengthen hospital adoption.

The home healthcare segment is expected to witness the fastest growth during the forecast period due to rising preference for self-administration therapies, aging population, and increasing chronic disease prevalence. Connected and user-friendly devices, along with digital monitoring, enhance patient adherence and convenience, driving growth. Expansion of homecare services and remote patient management solutions also supports the segment. The segment benefits from increasing awareness about patient empowerment and cost reduction in healthcare delivery.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, pharmacy stores, direct tender, and online pharmacy. Hospital pharmacy dominated in 2024 due to direct access to injectable therapies for in-patient and outpatient treatment, ensuring controlled dispensing and proper handling. Hospitals prefer sourcing devices and formulations from trusted suppliers to maintain quality and regulatory compliance. Integration with hospital inventory and digital monitoring systems also supports this segment’s dominance. Hospital pharmacies also facilitate bulk procurement and supply chain efficiency. Established relationships with pharmaceutical manufacturers further strengthen their market position.

The online pharmacy segment is expected to witness the fastest growth during the forecast period due to increasing e-pharmacy adoption, convenience, and rising demand for home-delivered injectable therapies. Digital platforms provide easy access to both devices and formulations, especially for chronic disease management and preventive care, supporting this channel’s rapid expansion. Online pharmacies are also leveraging telemedicine and digital consultation to enhance service offerings. Rising internet penetration and consumer comfort with online purchases further accelerate growth.

Europe Injectable Drug Delivery Market Regional Analysis

- Germany dominated the Europe injectable drug delivery market with the largest revenue share of 37.2% in 2024, supported by advanced healthcare infrastructure, high adoption of biologics, strong regulatory frameworks, and a significant presence of key market players, with increasing uptake of both injectable drug delivery devices and formulations in hospitals and home healthcare

- Healthcare providers and patients in the country increasingly value devices and formulations that ensure precise dosing, ease of self-administration, and integration with digital monitoring platforms to enhance therapy adherence

- This widespread adoption is further supported by substantial R&D investments, a robust pharmaceutical and biotech industry presence, and growing awareness of patient-centric care, establishing injectable drug delivery systems as a preferred choice in both hospital and home healthcare settings

The Germany Injectable Drug Delivery Market Insight

Germany dominated the Europe injectable drug delivery market with the largest revenue share of 37.2% in 2024, driven by advanced healthcare infrastructure, high adoption of biologics, and strong regulatory support for innovative drug delivery devices and formulations. Hospitals and homecare providers increasingly prefer auto-injectors, prefilled syringes, and wearable devices for precise dosing, reduced administration errors, and improved patient compliance. Integration with digital health platforms enables therapy monitoring, reminders, and adherence tracking, further strengthening adoption. Germany’s focus on innovation, patient-centric care, and sustainable healthcare solutions promotes widespread uptake across both hospital and homecare applications. Leading pharmaceutical and biotech players are heavily investing in connected drug delivery technologies, enhancing device safety and convenience. The combination of robust R&D, regulatory support, and high patient awareness establishes Germany as the dominant market in Europe.

U.K. Injectable Drug Delivery Market Insight

The U.K. injectable drug delivery market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for self-administration therapies and homecare injectable solutions. Increasing prevalence of chronic conditions, such as autoimmune disorders and hormonal imbalances, encourages patients to adopt prefilled syringes and auto-injectors. The U.K.’s strong healthcare infrastructure, coupled with increasing digital health adoption, is expected to continue stimulating market growth. Patients and providers are also prioritizing safe, user-friendly, and connected delivery systems to enhance adherence and therapy monitoring.

France Injectable Drug Delivery Market Insight

The France injectable drug delivery market is projected to grow steadily, supported by increasing demand for biologics, vaccines, and self-administration therapies. French healthcare providers and patients are adopting prefilled syringes and auto-injectors to improve therapy compliance, safety, and convenience. Strong regulatory support, advanced hospital infrastructure, and increasing patient awareness about chronic disease management further bolster market growth. The integration of digital health solutions, such as therapy monitoring apps, enhances adoption across both hospital and homecare settings.

Italy Injectable Drug Delivery Market Insight

The Italy injectable drug delivery market is expected to witness the fastest growth during the forecast period, driven by rising healthcare expenditure, growing chronic disease prevalence, and increasing patient preference for self-administered therapies. Hospitals and homecare providers are increasingly adopting advanced auto-injectors and prefilled syringes to improve adherence and reduce hospital dependency. Government initiatives promoting immunization and chronic disease management also support market expansion. The adoption of digital health monitoring platforms enhances patient engagement and therapy accuracy.

Europe Injectable Drug Delivery Market Share

The Europe Injectable Drug Delivery industry is primarily led by well-established companies, including:

- Terumo Corporation (Japan)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- SCHOTT Pharma AG & Co. KGaA (Germany)

- Gerresheimer AG (Germany)

- Enable Injections, Inc. (U.S.)

- MedinCell S.A. (France)

- Biogen Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GSK plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

What are the Recent Developments in Europe Injectable Drug Delivery Market?

- In July 2025, Terumo Corporation announced the commercial launch of its Immucise Intradermal Injection System in Europe. This device is designed to deliver vaccines and other approved drugs via the intradermal route, offering benefits such as reduced injection volume and improved patient comfort. The launch underscores Terumo's commitment to advancing drug delivery technologies in the European market

- In March 2025, Enable Injections announced that its enFuse Syringe Transfer System received CE Mark approval under the EU Medical Device Regulation. This wearable drug delivery platform is designed to enhance patient comfort and compliance by enabling self-administration of biologics at home

- In July 2024, Sanofi is contemplating an investment of up to USD 1.78 billion to upgrade its long-acting insulin production facility in Frankfurt, Germany. This move reflects Germany's attractiveness as a hub for pharmaceutical manufacturing, especially in light of recent investments from companies such as Eli Lilly and Daiichi Sankyo

- In May 2024, Eisai and Biogen began a rolling submission to the U.S. FDA for an under-the-skin injectable version of their Alzheimer's drug, Leqembi. The new formulation aims to offer a more convenient dosing schedule compared to the currently approved intravenous form, which requires bi-weekly infusions. If approved, the injectable version could significantly enhance patient adherence and expand market access

- In November 2023, Eli Lilly announced plans to build its first manufacturing facility in Germany, investing USD 2.70 billion in a high-tech plant in Alzey. This facility aims to enhance the production of injectable products and devices, addressing the rising demand for diabetes and obesity treatments, including the company's Mounjaro and Zepbound drugs

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。