欧州医薬品溶剤市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.08 Billion

2024

2032

USD

1.38 Billion

USD

2.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.08 Billion | |

|

|

|

|

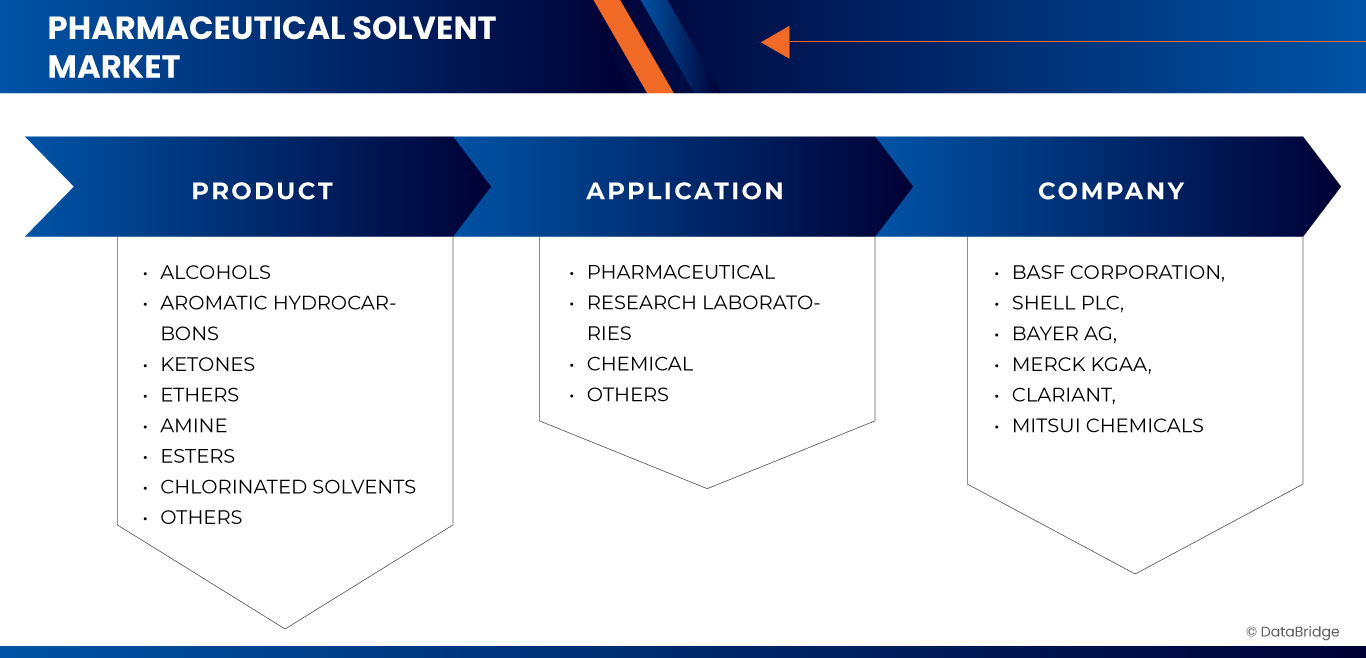

ヨーロッパの医薬品溶剤市場のセグメンテーション、製品別(アルコール、芳香族炭化水素、ケトン、エーテル、アミン、エステル、塩素化溶剤など)、用途別(製薬、研究機関、化学薬品など)、国別(ドイツイギリスフランスイタリアスペインロシアオランダスイスベルギートルコデンマークスウェーデンノルウェー、ポーランドフィンランド、その他のヨーロッパ諸国) - 2032年までの業界動向と予測

医薬品溶剤市場規模

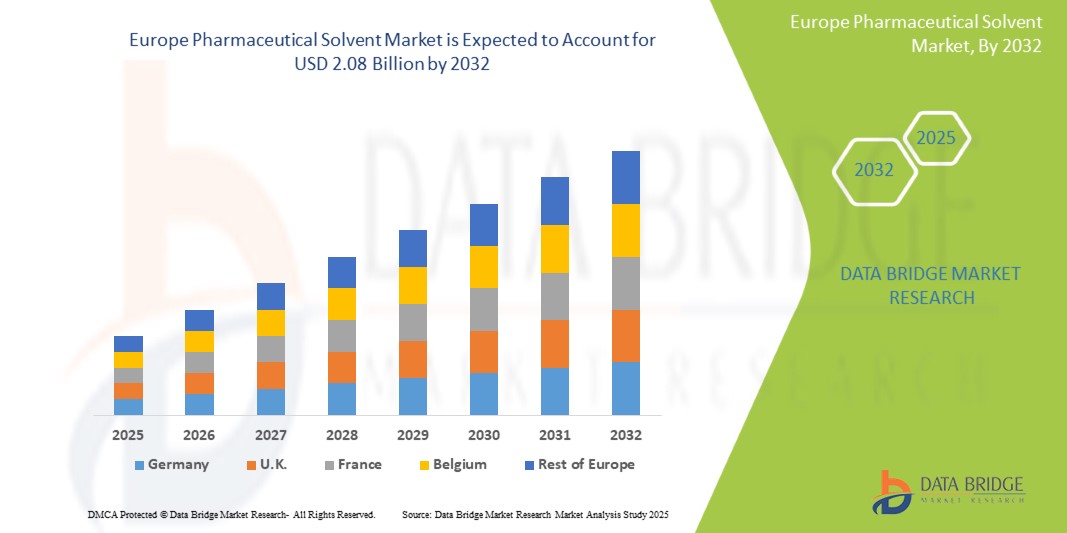

- ヨーロッパの医薬品溶剤市場規模は2024年に13億8000万米ドルと評価され、予測期間中に5.3%のCAGRで成長し、2032年までに20億8000万米ドルに達すると予想されています。

- この成長は、人口の高齢化、眼疾患の増加、眼科技術の進歩などの要因によって推進されている。

医薬品溶剤市場分析

- 医薬品溶媒は、医薬品の配合と製造に使用される重要な成分であり、さまざまな医薬品の製造中に有効成分を溶解し、化学反応を促進する重要な役割を果たします。

- 医薬品溶剤の需要は、慢性疾患の増加、医薬品生産の増加、医薬品開発技術の進歩によって大きく推進されています。

- スイスは、先進的な医療インフラ、強力な医薬品製造基盤、高品質の医薬品製剤に対する需要の増加により、医薬品溶剤市場を独占すると予想されています。

- スイスは、医療の質に対する意識の高まりと研究開発への継続的な投資により、予測期間中に医薬品溶剤市場で最も急速に成長する地域になるとも予測されています。

- アルコールセグメントは、医薬品の合成、抽出、精製プロセスにおける広範な用途により、29.59%のシェアで市場を席巻すると予想されています。高い溶解力、様々な医薬品有効成分(API)との適合性、そして規制当局の承認により、製薬業界全体で好まれる選択肢となっています。

レポートの範囲と医薬品溶剤市場のセグメンテーション

|

属性 |

医薬品溶剤の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

ヨーロッパ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

医薬品溶剤市場の動向

「欧州の医薬品業界におけるグリーンで持続可能な溶剤への関心の高まり」

- 欧州の医薬品溶剤市場を形成する重要なトレンドは、環境規制の厳格化と企業の持続可能性目標によって推進される、環境に優しく持続可能な溶剤の需要の高まりです。

- この移行により、バイオベースの低毒性溶媒の使用が促進され、有害廃棄物が削減され、医薬品の処方および製造中の労働者の安全性が向上します。

- たとえば、乳酸エチルや超臨界 CO₂ などのグリーン溶媒は、医薬品の合成および抽出プロセスにおいて、従来の石油化学ベースの溶媒のより安全な代替品としてますます採用されつつあります。

- この傾向は、溶媒選択戦略を変革し、よりクリーンな生産慣行を促進し、欧州の製薬業界全体で持続可能な溶媒技術の需要を高めています。

医薬品溶剤市場の動向

ドライバ

「各種医薬品製造用アルコール溶剤の需要増加」

- 欧州の医薬品溶剤市場は、エタノールやイソプロパノールなどのアルコール系溶剤の需要の高まりに牽引され、著しい成長を遂げています。

- これらの溶媒は、医薬品の処方、合成、精製プロセスに不可欠です。この急増の要因としては、慢性疾患の増加、人口の高齢化、そして医薬品研究開発の進歩などが挙げられます。

- Additionally, the industry's shift towards green chemistry and sustainable practices is influencing solvent selection, with a growing preference for bio-based alcohol solvents. This trend underscores the critical role of alcohol solvents in ensuring the efficacy and safety of pharmaceutical product.

For instance,

- In February, 2025 findings from Drugs.com indicate that alcohol is widely used in pharmaceutical preparations as a solvent, preservative, and disinfectant. Its versatility allows it to dissolve a variety of active ingredients, aiding in drug formulation. Due to its antimicrobial properties and effectiveness in drug stability, alcohol plays a vital role in manufacturing various oral and topical medications

- In August, 2024, as per article published in Springer Nature, the role of alcohol solvents, particularly methanol and ethanol, in efficiently removing residual solvents like dichloromethane from pharmaceutical formulations, such as PLGA microparticles. This reflects the growing demand for alcohol-based solvents in drug manufacturing, driven by regulatory requirements and the need for safe, effective drug delivery systems

- The increasing reliance on alcohol solvents in Europe's pharmaceutical sector highlights their essential role in drug development and manufacturing. As the industry progresses towards sustainable practices, the demand for high-quality, bio-based alcohol solvents is expected to rise, ensuring compliance with environmental regulations and enhancing product safety

Opportunity

“Expansion of Biosimilars and High-Potency Drugs”

- The increasing development and production of biosimilars and High-Potency Active Pharmaceutical Ingredients (HPAPIs) across Europe significantly elevate the demand for high-purity, precision-grade solvents.

- These solvents are essential for ensuring product safety, maintaining chemical stability, and meeting rigorous containment and regulatory requirements associated with handling sensitive drug substances.

- Europe’s leadership in biosimilar approvals, supported by a strong regulatory framework and advanced biomanufacturing infrastructure, drives substantial growth in this segment. As pharmaceutical companies scale up production of complex biologics and potent compounds, the need for specialized solvents intensifies. This trend opens a lucrative and sustainable opportunity for the Europe pharmaceutical solvent market, especially in the high-value niche of solvent innovation and customization.

For instance,

- In February 2025, according to the article published by Dolphin Pharmaceuticals, the increasing demand for targeted cancer therapies and advanced biologics is accelerating the production of high-potency active pharmaceutical ingredients (HPAPIs), which require stringent manufacturing conditions. Solvents and catalysts play a critical role in enabling precise chemical reactions and purifications essential for these complex drugs. This drives demand for high-quality solvents, creating a significant growth opportunity for the Europe pharmaceutical solvent market

- In August 2022, as per the article published by GaBi, Europe remains at the forefront of biosimilar development, with the European Medicines Agency (EMA) approving 88 biosimilars to date under a centralized regulatory framework. This leadership fosters a surge in biosimilar manufacturing, requiring high-purity solvents for synthesis and purification. The region’s dominance in biosimilars drives solvent demand, offering a substantial opportunity for the market

- In July 2022, based on the article published by Rapid Life Sciences Ltd, the growing demand for drug products with high potency active pharmaceutical ingredients (HPAPIs) is boosting the role of Contract Development and Manufacturing Organizations (CDMOs) that offer end-to-end solutions. These processes require precision-grade solvents for synthesis and formulation. As CDMO activity expands across Europe, it significantly increases the need for high-quality solvents, presenting a strong opportunity for the pharmaceutical solvent market

- The expanding landscape of biosimilars and high-potency drug development in Europe is driving a sustained need for high-purity, specialized solvents. With strong regulatory support, advanced manufacturing infrastructure, and growing CDMO involvement, Europe is well-positioned to lead this segment. These factors collectively present a robust and long-term growth opportunity for the Europe pharmaceutical solvent market

Restraint/Challenge

“Health and Safety Concerns Regarding Pharmaceutical Solvents”

- Pharmaceutical solvents, especially petrochemical-based ones such as benzene, toluene, methylene chloride, and acetone, pose significant health and safety risks to workers and the environment.

- Prolonged exposure to these solvents results in severe health issues including neurotoxicity, respiratory complications, skin disorders, and organ damage, particularly affecting the liver and kidneys. Inhalation of vapors during manufacturing, coupled with the flammable and volatile nature of these chemicals, increases the risk of workplace accidents and environmental contamination.

- This presents a substantial challenge for the Europe pharmaceutical solvent market, as it restricts formulation flexibility and adds financial and procedural burdens to manufacturers.

For instance,

- SCAT Europeが2024年10月に発表した情報によると、溶剤蒸気は呼吸器疾患、皮膚や眼への刺激、臓器損傷、火災や爆発のリスク、環境汚染など、深刻な危険をもたらします。職場における溶剤の使用管理が不十分だと、労働災害や規制違反につながる可能性があります。これらのリスクに対処するために、厳格な安全プロトコルの導入が求められ、運用コストの増加につながるため、健康と安全への懸念は市場にとって大きな課題となっています。

- 2020年8月、Veeprho Pharmaceuticals sroが発表したデータによると、残留溶媒は製造後に医薬品原料に残留する有毒な揮発性化合物です。微量であっても、医薬品の安全性、有効性、安定性を損なう可能性があり、臓器毒性や発がん性などのリスクがあります。ICH Q3C(R8)などの厳格な規制では、厳格な試験と除去が求められ、コンプライアンスコストと複雑さが増大し、市場にとって大きな課題となっています。

- 2022年、ScienceDirectに掲載された論文によると、有機溶剤への慢性的な職業曝露は、認知機能の低下、気分障害、記憶喪失、視覚・聴覚障害、末梢神経障害を引き起こすことが報告されています。発達性神経毒性や騒音との共曝露による聴力低下は、リスクをさらに高めます。これらの深刻な健康影響は、安全対策の強化と規制遵守を必要とし、コスト増加と市場にとって大きな課題となっています。

- 医薬品溶剤、特に石油化学系溶剤に関連する健康と安全への懸念は、欧州の医薬品溶剤市場にとって大きな課題となっています。職業上の曝露、残留溶剤の毒性、そして長期的な健康影響のリスクを考慮すると、厳格な安全対策、規制遵守、そして継続的なモニタリングが求められます。これらの要因は、運用コストの増加だけでなく、処方の柔軟性を制限し、最終的には市場全体の効率性と競争力に悪影響を及ぼします。

医薬品溶剤市場の展望

市場は製品とアプリケーションに基づいて細分化されています。

|

セグメンテーション |

サブセグメンテーション |

|

製品別 |

|

|

アプリケーション別 |

|

2025年には、アルコールセグメントが製品セグメントで最大のシェアを占め、市場を支配すると予想されています。

アルコール類は、医薬品の製剤、抽出、精製プロセスへの幅広い適用性から、2025年には医薬品溶剤市場において最大のシェア(29.59%)を占めると予想されています。その優れた溶媒特性、費用対効果、そして規制当局の承認も需要をさらに押し上げています。さらに、エタノールやイソプロパノールなどのアルコール類は、原薬(API)と賦形剤の両方で広く使用されています。

医薬品は、予測期間中に最大のシェアを占めると予想されます。

2025年には、医薬品分野が54.60%という最大のシェアを占め、市場を席巻すると予想されています。これは、医薬品の処方および製造における高純度溶媒の需要増加によるものです。研究開発活動の活発化、医薬品製造の拡大、そして厳格な品質基準が、この分野の成長をさらに後押ししています。これらの溶媒は、製品の有効性と安全性を確保するために不可欠です。

医薬品溶剤市場の地域分析

「スイスは医薬品溶剤市場で最大のシェアを誇り、最高のCAGRを記録している」

- 欧州の医薬品溶剤市場は着実な成長を遂げており、強力な医薬品製造基盤、高品質の基準、そして支援的な規制環境により、スイスが主要国として台頭しています。

- スイスは、大手製薬会社の存在、熟練した労働力、医薬品の開発と生産における革新への強い注力により、大きなシェアを占めています。

- 同国は国際的な品質基準の遵守を重視しており、研究と製造のためのインフラが整備されているため、市場の強さに貢献しています。

- さらに、高度な医薬品製剤のための高純度溶媒の採用の増加と、持続可能でグリーンな化学の実践への傾向の高まりが、地域全体の市場成長を牽引しています。

医薬品溶剤市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、グローバルプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

市場で活動している主要なマーケットリーダーは次のとおりです。

- BASFコーポレーション(ドイツ)

- シェルPLC(英国)

- バイエルAG(ドイツ)

- メルクKGaA(ドイツ)

- クラリアント(スイス)

- 三井化学株式会社(日本)

- エクソンモービルコーポレーション(米国)

- ダウ(米国)

- ヌーリオン(オランダ)

- ブラスケム(ブラジル)

- デュポン(米国)

- イーストマンケミカルカンパニー(米国)

- LyondellBasell Industries Holdings BV(オランダ)

- アクティリス(米国)

- SKケミカルズ(韓国)

- Carl Roth GmbH + Co. KG(ドイツ)

- ケムコUK(英国)

- PCCグループ(ドイツ)

- Advion Interchim Scientific (U.S.)

Latest Developments in Europe Pharmaceutical Solvent Market

- In May, Bayer AG company announced unveiled its new Solida-1 pharmaceutical production facility in Leverkusen, Germany. Set to become operational in 2024, the USD 311.69 million single-storey facility is positioned to be one of the most advanced pharmaceutical production plants in the world. Solida-1 is part of Bayer’s USD 1.13 billion investment program aimed at strengthening its global pharmaceutical manufacturing network.

- In July, Merck has completed the acquisition of EyeBio, strengthening its ophthalmology pipeline with Restoret, a novel Wnt pathway agonist for diabetic macular edema and neovascular age-related macular degeneration. The deal includes additional preclinical assets targeting retinal diseases. This strategic acquisition diversifies Merck’s late-stage portfolio and supports its vision of advancing innovative treatments for vision-related conditions.

- In November, Clariant presented its latest portfolio of healthcare solutions at the upcoming CPHI India tradeshow, taking place in Delhi NCR from November 26 to 28, 2024. This year’s exhibition will highlight Clariant Health Care’s ‘Made in India’ product range, the capabilities of its Bonthapally facility, and its deep expertise in biologics, generics, and excipient production.

- In June 2024, Carl Roth GmbH & Co. KG’s facility in Karlsruhe, Germany, has been awarded EXCiPACT GMP certification for its role as a supplier of pharmaceutical excipients.

- In December, Dow has partnered with Macquarie Asset Management to establish Diamond Infrastructure Solutions, a new infrastructure provider focusing on operational efficiency and customer acquisition. Macquarie will acquire a 40% stake in select U.S. Gulf Coast assets, with an option to increase to 49%. The deal is expected to generate up to $3 billion in proceeds for Dow

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MARKET APPLICATION COVERAGE GRID

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.3 CLIMATE CHANGE SCENARIO – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.4 PRICING ANALYSIS – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.4.1 RAW MATERIAL COSTS

4.4.2 PURITY AND GRADE

4.4.3 REGULATORY COMPLIANCE COSTS

4.4.4 REGIONAL PRICING VARIABILITY

4.4.5 SUPPLY CHAIN & LOGISTICS

4.4.6 COMPETITIVE LANDSCAPE

4.4.7 FORECASTED PRICING TRENDS (2025–2032)

4.5 PRODUCTION CAPACITY OVERVIEW – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.5.1 KEY PRODUCTION HUBS

4.5.2 CAPACITY UTILIZATION TRENDS

4.5.3 IMPACT OF GREEN CHEMISTRY INITIATIVES

4.5.4 CAPACITY CONSTRAINTS & CHALLENGES

4.6 RAW MATERIAL COVERAGE

4.6.1 IMPORT-EXPORT ANALYSIS

4.6.2 PRODUCTION–CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TARIFFS AND ITS IMPACT ON THE MARKET – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.8.1 DEFINITION AND IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.8.2 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 TARIFF REGULATIONS IN KEY MARKETS

4.8.4.1 MEDICARE/MEDICAID TARIFF POLICIES

4.8.4.2 CMS PRICING MODELS

4.8.4.3 OTHER COUNTRY-SPECIFIC SYSTEMS

4.8.4.4 TARIFFS ON MEDICAL DEVICES & EQUIPMENT

4.8.4.5 IMPORT/EXPORT DUTIES ON MEDICAL EQUIPMENT

4.8.4.6 IMPACT ON PRICING AND AVAILABILITY OF HIGH-END MEDICAL TECHNOLOGY

4.8.5 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.6 TARIFF EXEMPTIONS AND INCENTIVES

4.8.7 DUTY-FREE IMPORTS FOR ESSENTIAL MEDICINES AND VACCINES

4.8.8 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.9 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.9 VENDOR SELECTION CRITERIA:

5 REGULATION COVERAGE – EUROPE PHARMACEUTICAL SOLVENT MARKET

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 INCREASE IN THE MANUFACTURING OF INNOVATIVE GENERIC MEDICATIONS, ESPECIALLY WITHIN EMERGING ECONOMIES

6.1.2 INCREASE IN DEMAND FOR ALCOHOL SOLVENTS FOR MANUFACTURING OF VARIOUS DRUGS.

6.1.3 GROWTH IN PHARMACEUTICAL, AND HEALTHCARE SECTOR ACROSS THE EUROPE

6.1.4 RISE IN ADOPTION OF GREEN MATERIALS AND CHEMICALS FOR DRUG

6.2 RESTRAINT

6.2.1 ADOPTION OF GREEN SOLVENTS POSES OPERATIONAL AND TECHNICAL CHALLENGES

6.2.2 SHORTAGE OF SPECIALIZED WORKFORCE HINDERING SOLVENT PRODUCTION EFFICIENCY

6.3 OPPORTUNITY

6.3.1 EXPANSION OF BIOSIMILARS AND HIGH-POTENCY DRUGS

6.3.2 RISE IN CLINICAL TRIALS AND R&D INVESTMENTS

6.3.3 INCREASING FOCUS ON PERSONALIZED MEDICINE AND ORPHAN DRUGS.

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FORMULATION TECHNOLOGIES

6.4.2 HEALTH AND SAFETY CONCERNS REGARDING PHARMACEUTICAL SOLVENTS

7 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ALCOHOLS

7.2.1 METHANOL

7.2.2 ETHANOL

7.2.3 1-BUTANOL

7.2.4 2-BUTANOL

7.2.5 2-METHOXYETHANOL

7.2.6 3-METHYL-1-PROPANOL

7.2.7 2-METHYL-1-PROPANOL

7.2.8 1-PENTANOL

7.2.9 1-PROPANOL

7.2.10 2-PROPANOL (ISOPROPYL ALCOHOL)

7.2.11 ISOPROPANOL

7.2.12 PROPYLENE GLYCOL

7.2.13 OTHERS

7.3 AROMATIC HYDROCARBONS

7.3.1 TOLUENE

7.3.2 XYLENE

7.3.3 ETHYLBENZENE

7.3.4 OTHERS

7.4 KETONES

7.4.1 ACETONE

7.4.2 CYCLOHEXANONE

7.4.3 METHYL ETHER KETONE

7.4.4 METHYL ETHYL KETONE

7.4.5 METHYL ISOBUTYL KETONE

7.4.6 OTHERS

7.5 ETHERS

7.5.1 DIETHYL ETHER

7.5.2 TETRAHYDROFURAN

7.5.3 METHOXYMETHANE

7.5.4 METHYL TERT-BUTYL ETHER

7.5.5 POLYETHYLENE GLYCOL

7.5.6 ANISOLE

7.5.7 DI-N-PROPYL ETHER

7.5.8 OTHERS

7.6 AMINE

7.6.1 MONOETHANOLAMIDE (MEA)

7.6.2 ANILINE

7.6.3 DIETHANOLAMINE (DEA)

7.6.4 METHYL DIETHANOLAMINE (MDEA)

7.6.5 TRIMETHYLAMINE

7.6.6 OTHERS

7.7 ESTERS

7.7.1 ACETYL ACETATE

7.7.2 ETHYL ACETATE

7.7.3 BUTYL ACETATE

7.7.4 OTHERS

7.8 CHLORINATED SOLVENTS

7.8.1 TRICHLOROETHYLENE (TCE)

7.8.2 DICHLOROMETHANE

7.8.3 PERCHLOROETHYLENE (PCE)

7.8.4 TRICHLOROETHANE (TCA)

7.8.5 CARBON TETRACHLORIDE

7.8.6 OTHERS

7.9 OTHERS

8 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PHARMACEUTICAL

8.3 RESEARCH LABORATORIES

8.4 CHEMICAL

8.5 OTHERS

9 EUROPE PHARMACEUTICAL SOLVENT MARKET BY COUNTRIES

9.1 EUROPE

9.1.1 SWITZERLAND

9.1.2 ITALY

9.1.3 GERMANY

9.1.4 FRANCE

9.1.5 U.K.

9.1.6 SPAIN

9.1.7 BELGIUM

9.1.8 NETHERLANDS

9.1.9 RUSSIA

9.1.10 TURKEY

9.1.11 LUXEMBURG

9.1.12 REST OF EUROPE

10 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 BASF CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT UPDATES

12.2 SHELL PLC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 BAYER AG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 MERCK KGAA

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CLARIANT

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ACTYLIS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATES

12.7 ADVION INTERCHIM SCIENTIFIC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRASKEM

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 CARL ROTH GMBH + CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT/NEWS

12.1 CHEMCO UK

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 DOW

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 DUPONT

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 EASTMAN CHEMICAL COMPANY

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 EXXON MOBIL CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 MITSUI CHEMICALS, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 NOURYON

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATES

12.18 PCC GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATES

12.19 SEQENS

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 SK CHEMICALS

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 3 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 4 EUROPE ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 13 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 14 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 15 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 16 SWITZERLAND ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 SWITZERLAND AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 SWITZERLAND KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 SWITZERLAND ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 SWITZERLAND AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 SWITZERLAND ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 SWITZERLAND CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 26 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 27 ITALY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ITALY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ITALY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 ITALY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ITALY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 ITALY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ITALY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 ITALY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 37 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 38 GERMANY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 48 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 49 FRANCE ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 FRANCE AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 FRANCE KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 FRANCE ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 FRANCE AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 FRANCE ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 FRANCE CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 59 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 60 U.K. ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.K. AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.K. KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.K. ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.K. AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 U.K. ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.K. CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 69 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 70 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 71 SPAIN ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SPAIN AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SPAIN KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SPAIN ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SPAIN AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 SPAIN ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SPAIN CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 81 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 82 BELGIUM ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 BELGIUM AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 BELGIUM KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 BELGIUM ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 BELGIUM AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 BELGIUM ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 BELGIUM CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 92 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 93 NETHERLANDS ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NETHERLANDS AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NETHERLANDS KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NETHERLANDS ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NETHERLANDS AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 98 NETHERLANDS ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NETHERLANDS CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 102 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 103 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 104 RUSSIA ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 RUSSIA AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 RUSSIA KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 RUSSIA ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 RUSSIA AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 RUSSIA ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 RUSSIA CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 113 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 114 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 115 TURKEY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 TURKEY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 TURKEY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 120 TURKEY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 TURKEY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 125 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 126 LUXEMBURG ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 LUXEMBURG AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 LUXEMBURG KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 LUXEMBURG ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 LUXEMBURG AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 LUXEMBURG ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 LUXEMBURG CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 134 REST OF EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 135 REST OF EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 136 REST EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/METRIC TONS)

図表一覧

FIGURE 1 EUROPE PHARMACEUTICAL SOLVENT MARKET: SEGMENTATION

FIGURE 2 EUROPE PHARMACEUTICAL SOLVENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHARMACEUTICAL SOLVENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHARMACEUTICAL SOLVENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHARMACEUTICAL SOLVENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHARMACEUTICAL SOLVENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE PHARMACEUTICAL SOLVENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PHARMACEUTICAL SOLVENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PHARMACEUTICAL SOLVENT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN THE MANUFACTURING OF INNOVATIVE GENERIC MEDICATIONS, ESPECIALLY WITHIN EMERGING ECONOMIES IS DRIVING THE GROWTH OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET FROM 2025 TO 2032

FIGURE 12 THE ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET IN 2025 AND 2032

FIGURE 13 EUROPE PHARMACEUTICAL SOLVENT MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC ANALYSIS

FIGURE 16 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, 2024

FIGURE 17 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, 2025 TO 2032 (USD THOUSAND)

FIGURE 18 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, CAGR (2025- 2032)

FIGURE 19 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, 2024

FIGURE 21 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 22 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 23 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 EUROPE PHARMACEUTICAL SOLVENT MARKET SNAPSHOT

FIGURE 25 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。