Europe Polyurethane Foam Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

8.34 Billion

USD

12.45 Billion

2024

2032

USD

8.34 Billion

USD

12.45 Billion

2024

2032

| 2025 –2032 | |

| USD 8.34 Billion | |

| USD 12.45 Billion | |

|

|

|

Europe Polyurethane Foam Market Segmentation, By Product (Flexible Foam, Rigid Foam, and Spray Foam), Category (Open Cell and Closed Cell), Density Composition (Low-Density Composition, Medium-Density Composition, and High-Density Composition), Process (Molded Foam, Slabstock Foam, Spraying, and Lamination), End-User (Bedding & Furniture, Building & Construction, Automotive, Electronics, Packaging, Footwear, and Others) - Industry Trends and Forecast to 2032

Polyurethane Foam Market Analysis

The polyurethane foam market is experiencing steady growth, driven by increasing demand from industries such as construction, automotive, and furniture due to its excellent insulation and cushioning properties. The market is broadly divided into rigid and flexible foams, with rigid foams seeing strong adoption in insulation applications and flexible foams widely used in bedding and furniture. Rising sustainability concerns and environmental regulations are encouraging the development of bio-based and low-emission alternatives. The Asia-Pacific region leads the market, fueled by rapid urbanization, infrastructure expansion, and industrial growth. Additionally, innovations in lightweight and energy-efficient foam solutions continue to shape the industry's future.

Polyurethane Foam Market Size

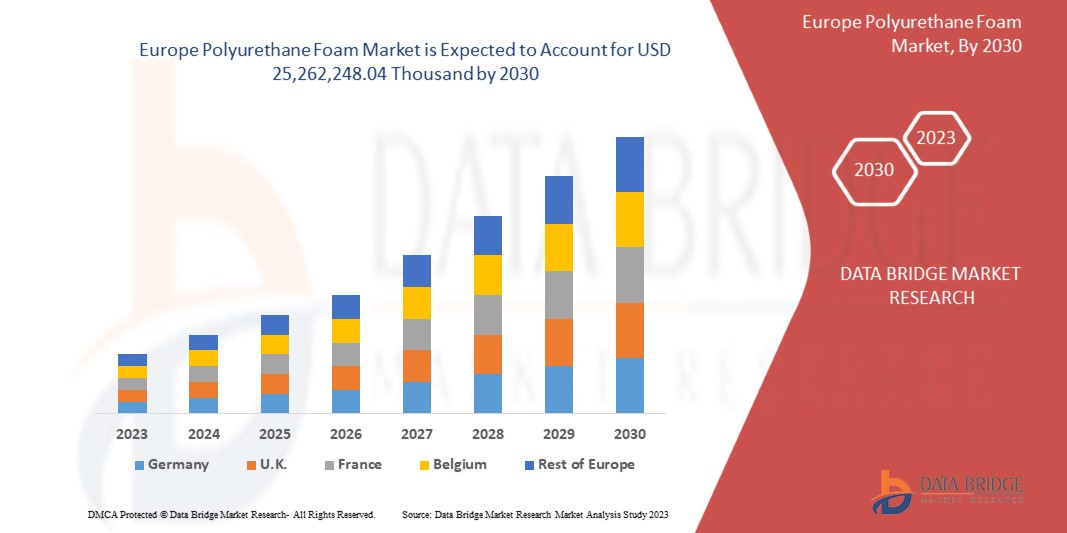

Europe polyurethane foam market is expected to reach USD 12.45 billion by 2032 from USD 8.34 billion in 2024, growing with a substantial CAGR of 5.3% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Polyurethane Foam Market Trends

“Positive Outlook Toward the Construction Sector”

The construction industry can be a major driving force in expanding the polyurethane foam market. Construction-related activities are rising due to foreign direct investment in emerging economies. Cement, wood, glass, metals, and clay are some of the most common materials used in the construction industry. Polyurethane is used in construction to create high-performance products that are strong but light in weight, function well, and are long-lasting and adaptable. Polyurethane foam is a flexible chemical product utilized in many typical construction applications such as bonding, filling, sealing, and insulation. Its high thermal and acoustic insulation capabilities make it a perfect product for water pipe insulation, bonding and sealing roofs and walls, and, most significantly, installing window and door frames. Such growth of construction-related activities and the wide application of polyurethane foam in the construction industry has increased the market growth of polyurethane foam.

Report Scope and Polyurethane Foam Market Segmentation

|

Attributes |

Polyurethane Foam Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.K., France, Germany, Spain, Italy, Netherlands, Luxemburg, Turkey, Belgium, Russia, Switzerland, and Rest of Europe |

|

Key Market Players |

Henkel AG & Co. KGaA (Germany), Saint-Gobain (France), Huntsman International LLC (U.S.), BASF (Germany), INOAC CORPORATION (Japan), Dow (U.S.), SEKISUI CHEMICAL CO., LTD. (Japan), Sunpreeth Engineers (India), Recticel NV/SA (Belgium), Sheela Foam Ltd. (India), Eurofoam S.r.l. (Italy), Rogers Corporation (U.S.), UFP Technologies, Inc. (U.S.), General Plastics Manufacturing Company, Inc. (U.S.), Meenakshi Polymers Pvt. Ltd. (India), Foamcraft Inc. (U.S.), ALSTONE INDUSTRIES PVT. LTD. (India), Wisconsin Foam Products (U.S.), Tirupati Foam Ltd (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyurethane Foam Market Definition

Polyurethane foam is a polymer obtained by reacting diisocyanate and polyol. Polyurethane foam is generally called PU foam or PUR foam. Polyurethane foam provides insulation and protection to the materials from external sources that cause corrosion. The type of reagent or catalyst used with isocyanate in polyurethane foam production depends on the PU foam's application. There are three types of polyurethane foam available: rigid, flexible, and spray foam.

Polyurethane Foam Market Dynamics

Drivers

- Growing Acceptance in the Automotive and Aviation Sector

Polyurethane foam is a polymeric material with high tensile strength, low weight, chemical resistance, processability, and mechanical characteristics that have been utilized in various applications. Due to its distinctive properties, there has been a growing demand for lightweight and high-performance materials in the aerospace and automotive industries. In the automotive industry, automotive foam plays an important role as it serves a significant role in passenger safety and comfort, from automotive seating to carpet underlay. Polyurethane foam is used in the automotive industry for trims, seats, headrests, acoustic insulation, and air conditioning filters. This is because foam is a material that provides a wide range of properties, such as vibration blocking, sound absorption, and insulation. Both open and closed-cell foams can be used in automotive cushioning and seating in modern cars. Polyurethane foam in current automobiles offers vehicles greater mileage due to its durable and extremely lightweight nature further lowering the overall weight of a car. As a result, fuel efficiency is improved and has reduced environmental impact. Such high-end-use applications in the automotive sector will drive the market growth of polyurethane foam.

The application of polyurethane foam in the aerospace industry is too diverse. It is used in structural pieces such as passenger cabin walls, baggage sections, ceilings, lavatory elements, flight deck pads, and class and section dividers. The foam can protect the aircraft and passengers inside it from excessive temperature fluctuations. Aerospace foam density also aids in the prevention of air leakage into and out of the aircraft, hence preserving cabin pressure. It may also serve as a sound barrier that protects passengers from the high decibel levels of airplane engines. For instance, In June 2022, according to an article published by Linden Industries, LLC. Polyurethane foam is widely used in automotive interiors for its cushioning, durability, and noise-reduction properties. It enhances comfort and support in car seats and headrests while also providing shock absorption. Dashboards and door panels use it to insulate and minimize road noise. Its durability ensures longevity despite frequent use. Essential in improving safety and passenger experience, it remains a key material in vehicle construction

- Rising Demand for Various Home Furnishing Applications

Home furnishing is objects placed in a room to make it more comfortable and pleasant. They include any moveable things such as furniture, curtains, carpets, and décor items that complement the room's design. Polyurethane foams are widely applied in home furnishing due to their unique characteristics, such as low density, high mechanical properties, and low thermal conductivity. Polyurethane foams are lightweight porous materials that have promising performance characteristics. Such materials are further applied in end applications in cushions present in furniture items such as sofas and chairs, which drives the growth of the polyurethane foam market.

人口増加、都市化の進展、高品質のマットレスへの傾向、制度的インフラの改善などの要因が、不動産およびホスピタリティ分野におけるマットレスの販売を促進しています。 柔軟なポリウレタンフォームは、一定の圧縮と弾力性を可能にするセル構造を持ち、クッション効果をもたらします。 この特徴は、家具、マットレス、枕、カーペットの用途に広く使用されています。 住宅、ホスピタリティ、鉄道などのセクターの成長も、ポリウレタンフォームマットレス市場の成長要因の1つです。 例えば、 ISPFによると、調査はインド睡眠製品連盟によって実施されました。インドのマットレス市場全体は約1,860万個で、マットレスの年間新規需要は700万個と予想されています。 さらに、マットレスの平均交換サイクルは12年で、マットレスの交換需要は1,160万個でした。 この調査では、家具チャネルが新規需要に不可欠であり、マットレスの総売上の50%を占めていることも明らかになりました。さらに、フォームベースのマットレスは総売上の52.6%を占め、スプリングベースのマットレスは13.5%、ココヤシベースのマットレスは34%を占めました。

機会

- 環境に優しいフォームの有利な見通し

ポリウレタンフォームは、最も適応性の高いポリマーの一つであることから、業界において最も重要な材料の一つとなっています。自動車業界ではシート、室内装飾材、バンパーに、家具業界ではシートクッション、ソファ、マットレスの充填材として、包装分野では断熱・防音材として、建築業界では断熱・防音材として、その他様々な用途で使用されています。低密度、低熱伝導率、優れた機械特性に加え、ポリウレタンフォームの主な利点の一つは、市場の用途要件に合わせて密度と剛性を調整できることです。

しかし、このポリマーは主に石油由来です。環境への懸念から、再生可能な原材料の使用やポリウレタンフォームのリサイクルなど、より持続可能な方法でポリウレタンを製造することが求められています。持続可能な素材の使用に向けた消費者行動の変化、政府の厳格な規則や規制、そしてフォーム製造における石油由来原材料の使用量を削減するためのメーカーの取り組みは、環境に優しいフォームへの前向きな見通しにつながったいくつかの要因です。これらの取り組みは、生分解性で環境に優しいポリウレタンフォームの開発につながるでしょう。メーカーはまた、他社と協力し、ポリウレタンフォームのリサイクル施設の開発にも取り組んでいます。例えば、Crain Communications, Inc.が発表した記事によると、2023年9月、コベストロはセレナグループと提携し、建築断熱材用の持続可能なポリウレタン(PU)フォームを開発しました。同社は、コベストロのバイオアトリビュートMDIを改良版Ultra-Fast 70フォームに使用し、二酸化炭素排出量を60%削減しました。このフォームは90分以内に硬化し、容器1つあたり70リットルの収量を提供しました。化石燃料由来のフォームと同等の品質で、シームレスな統合を可能にしました。セレナは、フォーム製品にバイオベースのポリオールとリサイクルPET素材を採用しました。

- 国内市場への投資に関する政府の支援政策

可処分所得の増加、急速な都市化、多様な産業用途、高い消費、外国直接投資の増加、そして有望な輸出ポテンシャルは、インドや中国などの発展途上国における化学産業の成長を促す要因です。特殊化学品やポリマー製品の製造における様々な機会が今後生まれ、巨大な国内需要が創出されるでしょう。発展途上国は、原材料と最終製品の生産において自給自足を実現できるようになります。さらに、先進国からの投資や新興国における化学工場の設立は、ヨーロッパのポリウレタンフォーム市場の成長に多大な機会をもたらす可能性があります。

ポリウレタンフォームは、自動車、家具、建設、包装、繊維、履物など、さまざまな業界で用途があります。これらの業界の市場成長は、発展途上国の経済をさらに押し上げるでしょう。研究開発活動、技術の進歩、エンドユーザー産業からの需要の増加、有利な政策と枠組みが、これらの国の化学産業の成長に影響を与えています。たとえば、アラブニュースによると、2022年9月、2016年にサウジアラビアのビジョン2030が発表されて以来、インフラと不動産プロジェクトに総額1.1兆米ドルが費やされ、サウジアラビアは世界最大の建設現場になる道を順調に進んでいます。サウジアラビアは、555,000戸以上の住宅、275,000室以上のホテル、430万平方メートル以上の小売スペース、610万平方メートル以上のオフィススペースが王国に計画されており、簡単に世界最大の建設現場になるでしょう。このような大規模なインフラ整備により、今後数年間で建設分野でポリウレタンフォームが広く使用されるようになるだろう。

制約/課題

- ポリウレタンフォーム製造における有害化学物質の使用

ポリウレタンフォームは、家具から断熱材まで、さまざまな用途に使用されています。しかし、ポリウレタンフォームの製造にさまざまな化学物質を使用することで、製造に携わる労働者の環境と健康への懸念が生じています。ポリウレタンは、原油由来のさまざまなポリオールとジイソシアネートの重合生成物です。このプロセスには、さまざまな発泡剤、硬化剤、難燃剤、界面活性剤、触媒が関与しています。一般的に使用されるポリオールは、ポリエチレングリコール、ポリプロピレングリコール、ポリテトラメチレングリコールです。同時に、トルエンジイソシアネート(TDI)とメチレンジフェニルジイソシアネート(MDI)は、一般的に使用されているジイソシアネート材料です。例えば、2023年3月、米国環境保護庁(EPA)によると、MDIやTDIなどのジイソシアネートは、関連する労働者に喘息、肺損傷、場合によっては死亡を引き起こすと言われています。EPAは、作業ユニットでのそれらの保護管理のための行動計画を策定しました。製造工程における揮発性有機化合物の放出は環境問題を引き起こすと言われている。

- 原材料価格の変動

どの分野の製造プロセスも原材料価格に左右されます。原材料価格の変動が大きいほど、製品コストと市場成長の変動リスクが高まります。

ポリウレタンフォームの主要原料は、原油由来のポリオールとジイソシアネートです。これらの原料価格は、気候、サプライチェーン、需要、入手可能性、制約、国の経済状況など、様々な要因によって決定されます。例えば、Polymerupdateが2024年11月に発表した記事によると、石油精製会社は精製マージンの低迷により2024年第3四半期に大幅な収益性の低下に直面し、2024年9月には精製マージンは1バレルあたり1.3米ドルに下落し、新型コロナウイルス感染症のピーク以来の最低値を記録しました。これは、原油価格の低迷、ロシア産原油の供給増加、そして特に中国からの需要の低迷が原因です。欧州の経済成長率は2024年も3.1%で安定を維持しましたが、地政学的緊張と中国の不動産セクターによる下振れリスクが懸念されます。また、EV、バイオ燃料、LNGの普及により、アジアと欧州における石油燃料需要が減少したことも打撃となりました。新たな精製能力の導入により、マージンはさらに圧迫されました。

原材料不足と出荷遅延の影響と現在の市場シナリオ

データブリッジ・マーケット・リサーチは、市場のハイレベルな分析を提供し、原材料不足や輸送遅延の影響と現在の市場環境を考慮した情報を提供します。これは、戦略的な可能性を評価し、効果的な行動計画を策定し、企業の重要な意思決定を支援することにつながります。

標準レポートのほかに、予測される出荷遅延からの調達レベルの詳細な分析、地域別の販売代理店マッピング、商品分析、生産分析、価格マッピングの傾向、調達、カテゴリパフォーマンス分析、サプライチェーンリスク管理ソリューション、高度なベンチマーキング、その他の調達および戦略サポートのサービスも提供しています。

経済減速が製品の価格と入手可能性に及ぼす予想される影響

経済活動が減速すると、産業は打撃を受け始めます。DBMRが提供する市場分析レポートと情報サービスでは、景気後退が製品の価格設定と入手しやすさに及ぼす予測的な影響が考慮されています。これにより、お客様は競合他社よりも一歩先を行き、売上高と収益を予測し、損益支出を見積もることができます。

ポリウレタンフォーム市場の展望

市場は、製品、カテゴリー、密度構成、プロセス、エンドユーザーに基づいてセグメント化されています。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

製品

- 柔軟なフォーム

- 硬質フォーム

- スプレーフォーム

カテゴリ

- オープンセル

- 閉鎖セル

密度構成

- 低密度構成

- 中密度構成

- 高密度構成

プロセス

- 成形フォーム

- スラブストックフォーム

- スプレー

- ラミネーション

エンドユーザー

- 寝具と家具

- 建築・建設

- 自動車

- エレクトロニクス

- パッケージ

- 履物

- その他

Polyurethane Foam Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product, category, density composition, process, and end-user as referenced above.

The countries covered in the market are U.K., France, Germany, Spain, Italy, Netherlands, Luxemburg, Turkey, Belgium, Russia, Switzerland, and rest of Europe.

Germany is expected to dominate the European polyurethane market due to its strong industrial base, advanced automotive sector, and high demand for energy-efficient construction materials. The country is home to leading polyurethane manufacturers, benefiting from cutting-edge research and development, as well as a well-established supply chain. Additionally, stringent regulations promoting sustainable and high-performance materials drive innovation and increased adoption of polyurethane products.

Germany is expected to be one of the fastest-growing markets due to rising investments in eco-friendly and high-performance polyurethane solutions. The country’s push toward sustainable construction, lightweight automotive components, and advanced insulation materials supports market expansion. Moreover, increasing demand from industries such as furniture, electronics, and footwear further fuels growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Polyurethane Foam Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Polyurethane Foam Market Leaders Operating in the Market Are:

- Henkel AG & Co. KGaA (Germany)

- Saint-Gobain (France)

- Huntsman International LLC (U.S.)

- BASF (Germany)

- INOAC CORPORATION (Japan)

- Dow (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)

- Sunpreeth Engineers (India)

- Recticel NV/SA (Belgium)

- Sheela Foam Ltd. (India)

- Eurofoam S.r.l. (Italy)

- Rogers Corporation (U.S.)

- UFP Technologies, Inc. (U.S.)

- General Plastics Manufacturing Company, Inc. (U.S.)

- Meenakshi Polymers Pvt. Ltd. (India)

- Foamcraft Inc. (U.S.)

- ALSTONE INDUSTRIES PVT. LTD. (India)

- Wisconsin Foam Products (U.S.)

- Tirupati Foam Ltd (India)

Latest Developments in Polyurethane Foam Market:

- In September 2022, Saint-Gobain has received all the required approvals from relevant authorities for the acquisition of GCP Applied Technologies Inc.,(a major Europe player in construction chemicals). This acquisition helps company to gain more recognition in the field of construction chemicals

- In May 2020, Huntsman Corporation announced the rebranding of its world-leading spray polyurethane foam business as Huntsman Building Solutions. Huntsman Building Solutions is a worldwide platform under Huntsman's Polyurethanes division. This rebranding helped the company to expand its business in the polyurethane foam business

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 EUROPE POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 EUROPE POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 EUROPE POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 EUROPE POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 EUROPE POLYURETHANE FOAM MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 SPAIN

12.1.5 ITALY

12.1.6 POLAND

12.1.7 NETHERLANDS

12.1.8 RUSSIA

12.1.9 TURKEY

12.1.10 BELGIUM

12.1.11 SWEDEN

12.1.12 SWITZERLAND

12.1.13 DENMARK

12.1.14 FINLAND

12.1.15 NORWAY

12.1.16 REST OF EUROPE

13 EUROPE POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 EUROPE FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 EUROPE FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 EUROPE RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 EUROPE RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 EUROPE SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 EUROPE SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 EUROPE POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 EUROPE OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 EUROPE OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 EUROPE CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 EUROPE CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 EUROPE POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 EUROPE LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 EUROPE LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 EUROPE MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 EUROPE MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 EUROPE HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 EUROPE HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 EUROPE POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 EUROPE MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 EUROPE MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 EUROPE SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 EUROPE SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 EUROPE SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 EUROPE SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 EUROPE LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 EUROPE LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 EUROPE POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 EUROPE ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 EUROPE ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 EUROPE OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 EUROPE OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 EUROPE POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 EUROPE POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 EUROPE POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 EUROPE POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 GERMANY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 GERMANY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 GERMANY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 GERMANY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 GERMANY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 FRANCE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 FRANCE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 FRANCE POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 FRANCE POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 FRANCE POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 FRANCE POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 FRANCE POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 FRANCE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 FRANCE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 U.K. POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 U.K. POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 U.K. POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 U.K. POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 U.K. BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 U.K. FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SPAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 SPAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 SPAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 SPAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 156 SPAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 157 SPAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 158 SPAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 159 SPAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 160 SPAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 161 SPAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 162 SPAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 163 SPAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SPAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 165 SPAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SPAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 167 SPAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SPAIN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SPAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 170 SPAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SPAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 SPAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SPAIN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 ITALY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 176 ITALY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 178 ITALY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 180 ITALY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 182 ITALY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 184 ITALY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ITALY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 189 ITALY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ITALY ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 ITALY PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 192 ITALY PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 POLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 POLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 198 POLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 POLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 200 POLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 201 POLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 202 POLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 203 POLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 204 POLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 205 POLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 206 POLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 POLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 POLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 POLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 POLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 211 POLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 POLAND ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 POLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 214 POLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 POLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 216 POLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 POLAND OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 NETHERLANDS POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 219 NETHERLANDS POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 220 NETHERLANDS POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 NETHERLANDS POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 222 NETHERLANDS POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 223 NETHERLANDS POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 224 NETHERLANDS POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 225 NETHERLANDS POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 226 NETHERLANDS POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 227 NETHERLANDS POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 228 NETHERLANDS BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 229 NETHERLANDS BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NETHERLANDS BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 231 NETHERLANDS BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 NETHERLANDS AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 NETHERLANDS AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NETHERLANDS ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NETHERLANDS PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 RUSSIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 RUSSIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 242 RUSSIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 RUSSIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 244 RUSSIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 245 RUSSIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 246 RUSSIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 RUSSIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 248 RUSSIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 RUSSIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 250 RUSSIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 RUSSIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 TURKEY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 264 TURKEY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 266 TURKEY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 267 TURKEY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 268 TURKEY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 269 TURKEY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 270 TURKEY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 271 TURKEY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 272 TURKEY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 273 TURKEY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 TURKEY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 275 TURKEY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 TURKEY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 277 TURKEY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 TURKEY ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 TURKEY PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 280 TURKEY PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 TURKEY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 282 TURKEY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 TURKEY OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 BELGIUM POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 285 BELGIUM POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 286 BELGIUM POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 287 BELGIUM POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 288 BELGIUM POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 289 BELGIUM POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 290 BELGIUM POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 291 BELGIUM POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 292 BELGIUM POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 293 BELGIUM POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 294 BELGIUM BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 295 BELGIUM BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 BELGIUM BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 297 BELGIUM BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 BELGIUM AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 299 BELGIUM AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 BELGIUM ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 BELGIUM PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 302 BELGIUM PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 BELGIUM FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 304 BELGIUM FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 BELGIUM OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWEDEN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 307 SWEDEN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 308 SWEDEN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 309 SWEDEN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 310 SWEDEN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 311 SWEDEN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 312 SWEDEN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 313 SWEDEN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 314 SWEDEN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 315 SWEDEN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 316 SWEDEN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 317 SWEDEN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 SWEDEN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 319 SWEDEN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SWEDEN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 321 SWEDEN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 SWEDEN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 SWEDEN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 324 SWEDEN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SWEDEN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 326 SWEDEN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SWEDEN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SWITZERLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 329 SWITZERLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 330 SWITZERLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 331 SWITZERLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 332 SWITZERLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 333 SWITZERLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 334 SWITZERLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 335 SWITZERLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 336 SWITZERLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 337 SWITZERLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 338 SWITZERLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 339 SWITZERLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 SWITZERLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 341 SWITZERLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 SWITZERLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 343 SWITZERLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SWITZERLAND ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SWITZERLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 346 SWITZERLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 SWITZERLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 348 SWITZERLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 SWITZERLAND OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 DENMARK POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 351 DENMARK POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 352 DENMARK POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 353 DENMARK POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 354 DENMARK POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 355 DENMARK POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 356 DENMARK POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 357 DENMARK POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 358 DENMARK POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 359 DENMARK POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 360 DENMARK BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 361 DENMARK BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 DENMARK BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 363 DENMARK BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 DENMARK AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 365 DENMARK AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 DENMARK ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 DENMARK PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 368 DENMARK PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 DENMARK FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 370 DENMARK FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 DENMARK OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 FINLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 373 FINLAND POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 374 FINLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 375 FINLAND POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 376 FINLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 377 FINLAND POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 378 FINLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 379 FINLAND POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 380 FINLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 381 FINLAND POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 382 FINLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 383 FINLAND BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 FINLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 385 FINLAND BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 FINLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 387 FINLAND AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 FINLAND ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 FINLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 390 FINLAND PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 FINLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 392 FINLAND FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 FINLAND OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 NORWAY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 395 NORWAY POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 396 NORWAY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 397 NORWAY POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 398 NORWAY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 399 NORWAY POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 400 NORWAY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 401 NORWAY POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 402 NORWAY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 403 NORWAY POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 404 NORWAY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 405 NORWAY BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 NORWAY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 407 NORWAY BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 NORWAY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 409 NORWAY AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 NORWAY ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 NORWAY PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 412 NORWAY PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 NORWAY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 414 NORWAY FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 NORWAY OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 REST OF EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 417 REST OF EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

図表一覧

FIGURE 1 EUROPE POLYURETHANE FOAM MARKET

FIGURE 2 EUROPE POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 EUROPE POLYURETHANE FOAM MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 EUROPE POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE EUROPE POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE EUROPE POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE POLYURETHANE FOAM MARKET

FIGURE 21 EUROPE POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 EUROPE POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 EUROPE POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 EUROPE POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 EUROPE POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 EUROPE POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 EUROPE POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。