Global Antimicrobial Coating for Medical Devices Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

7.04 Billion

USD

18.32 Billion

2024

2032

USD

7.04 Billion

USD

18.32 Billion

2024

2032

| 2025 –2032 | |

| USD 7.04 Billion | |

| USD 18.32 Billion | |

|

|

|

|

Global Antimicrobial Coating for Medical Devices Market Segmentation, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, and Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminium, Copper, Zinc, Gallium, and Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, and Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, and Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, and Others), Form (Liquid, Powder, and Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, and Others) - Industry Trends and Forecast to 2032

What is the Global Antimicrobial Coating for Medical Devices Market Size and Growth Rate?

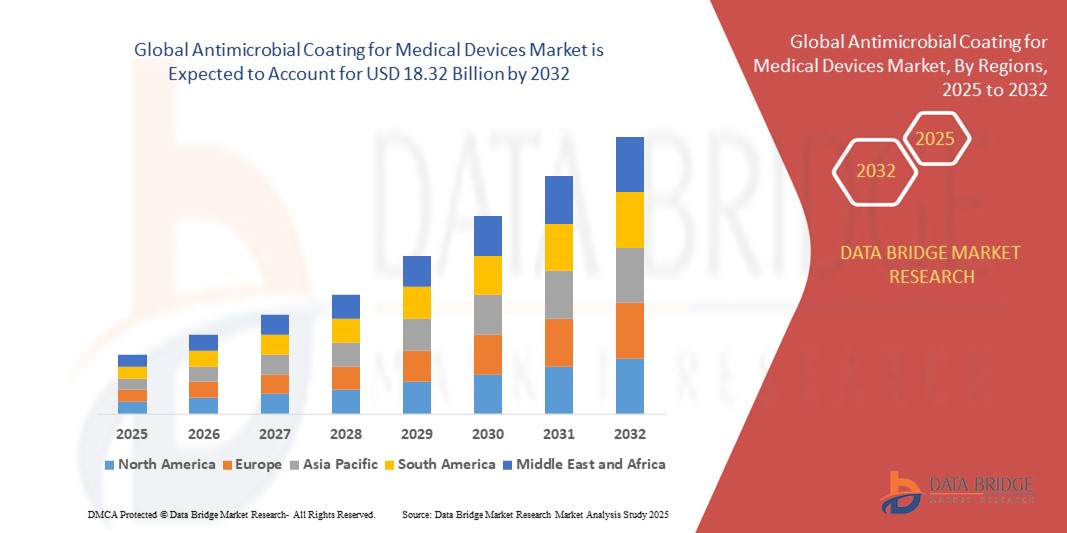

- The global Antimicrobial Coating for Medical Devices market size was valued at USD 7.04 billion in 2024 and is expected to reach USD 18.32 billion by 2032, at a CAGR of 12.70% during the forecast period

- Antimicrobial coatings are microbe-resistant coatings that include antimicrobial agents preventing microbial impurities. They have extensive application utilization in the construction, food, and healthcare industry. They are applied to the doors, glass panels, walls, doors, HVAC tents, counters, and so forth

- Antimicrobial coatings are microbe-resistant coatings that include antimicrobial agents preventing microbial impurities. They have extensive application utilization in the construction, food, and healthcare industry. They are applied to the doors, glass panels, walls, doors, HVAC tents, counters, and so forth

What are the Major Takeaways of Antimicrobial Coating for Medical Devices Market?

- The growing demand for antimicrobial surfaces owing to the increasing number of diseases and increasing demand for indoor air quality products such as HVAC are some of the major driving factors for market growth. In modern society, the major issue that people face is the growing number of diseases that are caused by the presence of microorganisms

- Asia-Pacific dominated the antimicrobial coating for medical devices market with the largest revenue share of 41.2% in 2024, driven by the rising prevalence of healthcare-associated infections (HAIs), rapid advancements in healthcare infrastructure, and strong government initiatives to improve patient safety standards

- North America is projected to grow at the fastest CAGR of 11.36% during 2025–2032, driven by stringent infection control regulations, increasing surgical procedures, and high demand for advanced antimicrobial solutions

- The silver antimicrobial coating segment dominated the market with the largest share of 48.6% in 2024, driven by its proven effectiveness in controlling microbial growth and strong biocompatibility with medical devices such as catheters, surgical instruments, and implants

Report Scope and Antimicrobial Coating for Medical Devices Market Segmentation

|

Attributes |

Antimicrobial Coating for Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Antimicrobial Coating for Medical Devices Market?

Rising Adoption of Nanotechnology-Enabled Antimicrobial Coatings

- A major trend in the global antimicrobial coating for medical devices market is the rising use of nanotechnology, particularly silver nanoparticles, copper nanostructures, and zinc-based nanomaterials, which provide highly effective and long-lasting antimicrobial protection

- These coatings inhibit bacterial adhesion and biofilm formation, a key issue in devices such as catheters, implants, and surgical tools, thereby enhancing patient safety and reducing infection rates

- For instance, DSM Biomedical has been focusing on nanosilver technologies for antimicrobial medical coatings, ensuring biocompatibility and durability in clinical use

- Nanotechnology-enabled coatings also enhance device lifespan by resisting microbial degradation while reducing the need for antibiotics, aligning with global efforts to combat antimicrobial resistance (AMR)

- Furthermore, regulatory authorities are increasingly encouraging the use of advanced antimicrobial materials to improve hospital infection control outcomes

- This trend is fundamentally reshaping innovation pipelines in the medical device industry, as companies prioritize nano-based antimicrobial solutions to meet rising healthcare safety standards

What are the Key Drivers of Antimicrobial Coating for Medical Devices Market?

- The rising prevalence of hospital-acquired infections (HAIs) and increasing concerns about patient safety are driving strong demand for antimicrobial coatings on medical devices

- For instance, in July 2023, BioCote Limited partnered with Eco Finish to provide antimicrobial surface coatings in commercial pools, showcasing cross-industry applications that can translate into medical environments

- Growing adoption of minimally invasive surgeries (MIS) and implantable devices, which require biocompatible coatings to prevent microbial colonization, is fueling market growth

- Government initiatives and regulatory frameworks, such as U.S. FDA and European MDR guidelines, are encouraging the integration of antimicrobial coatings into medical devices to enhance infection control

- Increasing healthcare spending and technological innovations in healthcare infrastructure across North America, Europe, and Asia-Pacific are further accelerating adoption

- Overall, the need to reduce infection risks, extend device longevity, and comply with stricter medical standards is a powerful growth driver for the market

Which Factor is Challenging the Growth of the Antimicrobial Coating for Medical Devices Market?

- A key challenge in this market is regulatory and safety concerns related to the toxicity and long-term biocompatibility of antimicrobial agents, especially nanoparticles such as nanosilver and copper

- For instance, regulatory bodies such as the European Chemicals Agency (ECHA) have tightened restrictions on silver use due to concerns over cytotoxicity, raising barriers to widespread adoption

- The high cost of advanced antimicrobial coatings compared to conventional device materials also limits adoption, particularly in developing regions with constrained healthcare budgets

- Moreover, antimicrobial resistance (AMR) poses a challenge, as excessive or improper use of certain antimicrobial agents may accelerate bacterial resistance, reducing coating effectiveness

- Manufacturers also face complex approval processes, requiring extensive clinical validation to prove safety and efficacy, which slows down product commercialization

- Overcoming these hurdles through cost-efficient innovations, safer nanomaterial formulations, and streamlined approval pathways will be essential for the market’s long-term growth

How is the Antimicrobial Coating for Medical Devices Market Segmented?

The market is segmented on the basis of product type, coating, type, additives, material, resin type, form, and application.

- By Product Type

On the basis of product type, the antimicrobial coating for medical devices market is segmented into silver antimicrobial coating, copper antimicrobial coating, and others. The silver antimicrobial coating segment dominated the market with the largest share of 48.6% in 2024, driven by its proven effectiveness in controlling microbial growth and strong biocompatibility with medical devices such as catheters, surgical instruments, and implants. Silver coatings offer long-lasting protection, making them the most widely used material for infection prevention in clinical settings.

The copper antimicrobial coating segment is anticipated to grow at the fastest CAGR of 20.2% from 2025 to 2032, as copper demonstrates strong antimicrobial activity against a broad spectrum of pathogens while being cost-effective. In addition, growing adoption of copper coatings in developing regions, coupled with their effectiveness in high-contact surfaces, is expected to accelerate their demand. The “Others” category, including hybrid coatings, continues to gain attention for niche medical applications.

- By Coating

On the basis of coating, the market is segmented into Silver, Chitosan, Titanium Dioxide, Aluminium, Copper, Zinc, Gallium, and Others. The silver coating segment dominated the market with the largest revenue share of 42.3% in 2024, attributed to its established efficacy in inhibiting microbial growth and wide-scale adoption across surgical and implantable devices. Silver coatings are preferred due to their ability to continuously release antimicrobial ions, ensuring long-term infection resistance.

However, the chitosan coating segment is projected to register the fastest CAGR of 19.8% between 2025 and 2032, driven by its natural origin, biodegradability, and excellent antimicrobial performance. Chitosan’s compatibility with various polymers makes it highly suitable for sustainable, eco-friendly medical applications. Other segments such as titanium dioxide and zinc are also gaining traction, particularly in orthopedic implants and surface-protective layers, supported by ongoing R&D. This diverse coating landscape is expected to support innovation and broaden adoption across specialized medical devices.

- By Type

On the basis of type, the antimicrobial coating for medical devices market is segmented into Escherichia Coli, Pseudomonas, Listeria, and Others. The Escherichia Coli (E. coli) segment held the largest revenue share of 39.5% in 2024, as infections caused by E. coli remain one of the most common in healthcare facilities, particularly in urinary catheters and surgical procedures. Growing focus on reducing hospital-acquired infections (HAIs) has further propelled the demand for antimicrobial coatings specifically designed to target E. coli.

Meanwhile, the Pseudomonas segment is expected to witness the fastest CAGR of 18.7% during 2025–2032, fueled by its high resistance to antibiotics and prevalence in patients with chronic wounds and respiratory issues. Coatings that combat pseudomonas colonization are increasingly being integrated into implantable and critical care devices. The “Others” category, including staphylococcus and MRSA-resistant coatings, also continues to grow steadily due to the rise in multi-drug resistant organisms in healthcare environments.

- By Additives

On the basis of additives, the market is segmented into Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, and Zinc Antimicrobial Additives. The Silver Ion Antimicrobial Additives segment dominated the market with the largest share of 46.7% in 2024, driven by the widespread usage of silver ions in coatings for surgical instruments, catheters, and orthopedic implants. Silver ions are known for their broad-spectrum antimicrobial properties and controlled ion release, ensuring consistent protection.

However, the organic antimicrobial additives segment is projected to grow at the fastest CAGR of 21.3% from 2025 to 2032, as they are biocompatible, eco-friendly, and suitable for polymer-based devices. The rising demand for sustainable and non-toxic alternatives in healthcare is fueling adoption. Copper and zinc-based additives also show promising growth, particularly in low-cost devices, as they provide effective antimicrobial resistance while being economical for large-scale applications.

- By Material

On the basis of material, the antimicrobial coating for medical devices market is segmented into Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, and Others. The silver nanoparticles segment captured the largest market share of 44.1% in 2024, supported by its proven clinical safety, strong antimicrobial performance, and ability to prevent biofilm formation. Silver nanoparticles are particularly popular in coatings for implantable devices and surgical tools due to their sustained release mechanism.

The graphene materials segment is anticipated to witness the fastest CAGR of 22.5% between 2025 and 2032, owing to its exceptional antimicrobial and mechanical properties. Graphene-based coatings provide added durability and conductivity, making them ideal for next-generation medical devices. Meanwhile, hydrogel- and polymer-based coatings are also gaining interest for their tunability and biocompatibility. Overall, advancements in nanomaterials are driving innovation in medical coatings to address infection risks more effectively.

- By Resin Type

On the basis of resin type, the market is segmented into Epoxy, Acrylic, Polyurethane, Polyester, and Others. The epoxy segment dominated the market with the largest revenue share of 41.8% in 2024, due to its high durability, strong adhesion, and excellent antimicrobial compatibility, making it widely used for surgical instruments and implantable devices. Epoxy resins provide long-lasting surface protection while maintaining structural integrity under sterilization procedures.

The polyurethane segment is expected to expand at the fastest CAGR of 20.7% from 2025 to 2032, fueled by its flexibility, lightweight properties, and increasing application in catheters and guidewires. Polyurethane resins also support advanced nanomaterial integration, making them suitable for next-generation antimicrobial solutions. Acrylic and polyester resins hold steady growth opportunities, especially in disposable devices, owing to their cost-effectiveness and ease of processing. Resin type selection continues to play a critical role in ensuring durability, sterility, and cost efficiency in medical coatings.

- By Form

On the basis of form, the antimicrobial coating for medical devices market is segmented into Liquid, Powder, and Aerosol. The liquid form segment accounted for the largest revenue share of 47.2% in 2024, owing to its ease of application, versatility, and widespread use in coating catheters, surgical instruments, and implantable devices. Liquid coatings also ensure even distribution and strong adherence, which is essential for medical-grade devices.

The powder segment is projected to witness the fastest CAGR of 19.4% during 2025–2032, driven by its growing adoption in advanced medical manufacturing processes, such as powder coating for orthopedic implants and disposable instruments. Powder coatings offer durability, low waste generation, and enhanced antimicrobial effectiveness. Aerosol-based coatings continue to see niche adoption in small-scale applications, particularly in temporary or surface-level antimicrobial protection solutions. The balance of cost-effectiveness and efficiency will determine growth trajectories across forms.

- By Application

On the basis of application, the antimicrobial coating for medical devices market is segmented into Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, and Others. The catheters segment dominated the market with the largest revenue share of 45.9% in 2024, as urinary and central venous catheters are highly prone to microbial colonization, often leading to hospital-acquired infections. The adoption of antimicrobial-coated catheters has significantly reduced infection risks, making them a standard in healthcare facilities worldwide.

The implantable devices segment is anticipated to record the fastest CAGR of 21.6% between 2025 and 2032, driven by the increasing prevalence of cardiovascular and orthopedic implants and the urgent need to mitigate infection risks. Surgical instruments and guidewires also continue to see steady adoption of coatings for sterilization and safety. Overall, application-based growth is strongly influenced by infection control protocols and the rising demand for reliable, coated medical solutions.

Which Region Holds the Largest Share of the Antimicrobial Coating for Medical Devices Market?

- Asia-Pacific dominated the antimicrobial coating for medical devices market with the largest revenue share of 41.2% in 2024, driven by the rising prevalence of healthcare-associated infections (HAIs), rapid advancements in healthcare infrastructure, and strong government initiatives to improve patient safety standards

- The region benefits from a rapidly expanding medical device manufacturing base, particularly in countries such as China, Japan, and India, which are at the forefront of antimicrobial technology adoption

- Increasing investments in hospital modernization, coupled with growing awareness about infection prevention, are fueling the widespread use of antimicrobial coatings in surgical instruments, catheters, and implantable devices

China Antimicrobial Coating for Medical Devices Market Insight

The China antimicrobial coating for medical devices market dominated Asia-Pacific with the largest share in 2024, driven by rapid urbanization, a growing middle-class population, and increased healthcare spending. Hospitals and clinics are increasingly adopting antimicrobial coatings for surgical instruments, catheters, and implantable devices to prevent infections. Domestic medical device manufacturers are expanding production to meet rising demand, while government initiatives supporting smart hospitals and infection control enhance adoption. The combination of strong regulatory support, cost-effective production, and technological advancements is positioning China as the leading hub for antimicrobial coatings in the medical devices sector in Asia-Pacific.

Japan Antimicrobial Coating for Medical Devices Market Insight

The Japan antimicrobial coating for medical devices market is growing steadily, fueled by an aging population and rising demand for infection-resistant medical devices. Hospitals and clinics are adopting advanced coatings such as silver nanoparticles and titanium dioxide to improve patient safety. Regulatory frameworks supporting infection control and innovation further drive market adoption. Technological advancement, combined with a high emphasis on healthcare quality, enables integration of antimicrobial coatings in surgical instruments, catheters, and implantable devices. As awareness about hospital-acquired infections increases, the Japanese market is poised for sustained growth in the adoption of antimicrobial coating technologies.

India Antimicrobial Coating for Medical Devices Market Insight

The India antimicrobial coating for medical devices market is expanding rapidly due to rising healthcare investments, urbanization, and government initiatives promoting local manufacturing under “Make in India.” Hospitals and clinics increasingly adopt antimicrobial coatings for catheters, surgical instruments, and implants to reduce infection risks. Growing awareness of hospital-acquired infections, combined with a rising number of private healthcare facilities, is driving adoption. Technological partnerships and local production of cost-effective coatings make these solutions accessible to a wider range of healthcare providers. The market is expected to sustain growth as the country’s healthcare infrastructure modernizes and the demand for infection prevention solutions escalates.

Which Region is the Fastest Growing Region in the Antimicrobial Coating for Medical Devices Market?

North America is projected to grow at the fastest CAGR of 11.36% during 2025–2032, driven by stringent infection control regulations, increasing surgical procedures, and high demand for advanced antimicrobial solutions. The region benefits from a mature healthcare infrastructure, widespread adoption of innovative coatings, and strong R&D investments by leading companies in the U.S. and Canada.

U.S. Antimicrobial Coating for Medical Devices Market Insight

The U.S. market is the fastest growing in North America, capturing 82% revenue share in 2024, driven by stringent infection control standards and high adoption of advanced antimicrobial coatings. Hospitals, outpatient clinics, and surgical centers increasingly use silver-based and copper-based coatings to prevent infections. Strong R&D investments and FDA-approved innovations enhance the reliability and efficiency of coated devices. Demand for catheters, implants, and surgical instruments with antimicrobial protection continues to rise, while healthcare providers prioritize patient safety. The U.S. market benefits from a technologically advanced healthcare system and the continuous development of innovative coating solutions.

Canada Antimicrobial Coating for Medical Devices Market Insight

The Canada antimicrobial coating for medical devices market is witnessing steady growth due to increasing infection control awareness and supportive healthcare regulations. Hospitals and surgical centers are adopting antimicrobial coatings for surgical instruments, catheters, and implants to ensure patient safety and reduce hospital-acquired infections. Investments in advanced healthcare technologies, coupled with collaborations between domestic and international manufacturers, are driving adoption. Regulatory frameworks emphasizing hygiene and infection prevention promote the integration of antimicrobial solutions. The market benefits from a technologically inclined healthcare infrastructure, rising patient expectations, and growing demand for safer, long-lasting medical devices with enhanced antimicrobial properties.

Mexico Antimicrobial Coating for Medical Devices Market Insight

The Mexico antimicrobial coating for medical devices market is growing rapidly, driven by improvements in healthcare infrastructure, increasing medical tourism, and expanding hospital capacities. Adoption of antimicrobial coatings is rising in surgical instruments, catheters, and implants to prevent infections and meet international healthcare standards. Collaborations between global manufacturers and local healthcare providers are accelerating the availability of innovative solutions. Government initiatives supporting modernized hospitals and stricter infection control protocols further encourage adoption. The market benefits from cost-effective production, a growing private healthcare sector, and increased awareness about the importance of infection prevention, positioning Mexico as a key emerging market in North America.

Which are the Top Companies in Antimicrobial Coating for Medical Devices Market?

The antimicrobial coating for medical devices industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Specialty Coating Systems Inc. (U.S.)

- Covalon Technologies Ltd. (Canada)

- AST Products, Inc. (U.S.)

What are the Recent Developments in Global Antimicrobial Coating for Medical Devices Market?

- In March 2023, AkzoNobel formed a strategic partnership with BioCote to expand the reach of their antimicrobial powder coatings under the “Interpon” brand, enabling application on a variety of internal surfaces including ceiling tiles, window frames, metal doors, metal office partitions, and elevator doors, strengthening the company’s position in the antimicrobial coatings market

- In April 2022, Specialty Coating Systems, Inc., announced the addition of Specialty Coating Systems (Vietnam) Co. Ltd., an ISO 9001:2015-certified facility providing conformal coating services across consumer and industrial electronics, transportation, aerospace, and medical devices, enhancing business opportunities and brand recognition in Vietnam

- In March 2021, Specialty Coating Systems, Inc., a global leader in Parylene conformal coating services, announced its acquisition of Diamond-MT, Inc., a provider of Parylene and liquid conformal coating services, creating new avenues for growth and market expansion for the company

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。