Global Aromatic Solvents Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

8.60 Billion

USD

11.26 Billion

2024

2032

USD

8.60 Billion

USD

11.26 Billion

2024

2032

| 2025 –2032 | |

| USD 8.60 Billion | |

| USD 11.26 Billion | |

|

|

|

|

Global Aromatic Solvents Market Segmentation, By Product (Benzene, Toluene, Xylene, and Solvent Naphtha), Application (Paints and Coatings, Adhesives, Printing Inks, Cleaning and Degreasing, and Others), End-Users (PharmaceuticalsOilfield Chemicals, Automotive, Paints and Coatings, Pesticides, Textiles, Cleaners, Chemical Intermediates, Electronics, Adhesive and Sealants, Perfumes, and Cosmetics) - Industry Trends and Forecast to 2032

What is the Global Aromatic Solvents Market Size and Growth Rate?

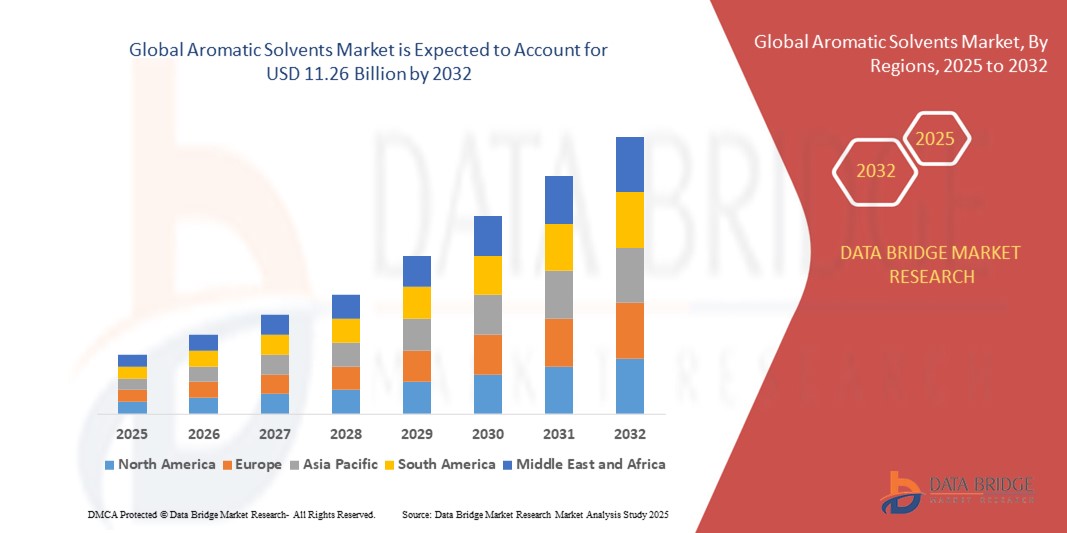

- The global aromatic solvents market size was valued at USD 8.60 billion in 2024 and is expected to reach USD 11.26 billion by 2032, at a CAGR of 3.42% during the forecast period

- The increase in demand for these solvents from the paint and coating industries due to their high solvency property, as well as their growing popularity, are the primary drivers driving the aromatic solvents market. These solvents dissolve or disperse a wide range of components to produce high-quality pigments, extenders, additives, and binders, increasing their demand

- The introduction of severe regulatory rules promoting the investigation of substitutes owing to concerns about the emission of volatile organic compounds (VOCs) and the trend towards non-aromatic solvents, on the other hand, are factors projected to hinder the aromatic solvents market

What are the Major Takeaways of Aromatic Solvents Market?

- The chemical industry relies heavily on various solvents, including aromatic solvents, for a wide range of applications, including synthesis, formulation, extraction, and as reaction media. The global chemical industry is experiencing steady growth, driven by factors such as population expansion, urbanization, and industrialization

- As chemical production rises, the demand for solvents, including aromatic solvents, also increases. Many chemical products are solvent-based, and aromatic solvents play a crucial role in their formulation. These products include printing inks, varnishes, and specialty chemicals used in diverse applications

- The growth in the chemical industry is a key driver for the aromatic solvents market due to the versatile and essential role these solvents play in various chemical processes. As chemical production expands to meet the demands of multiple sectors, the demand for aromatic solvents continues to rise, making them a fundamental component of the global chemical industry supply chain

- Asia-Pacific dominated the Aromatic Solvents market with the largest revenue share of 43.87% in 2024, driven by rapid industrialization, expanding chemical manufacturing, and increased adoption of solvents across end-use industries such as paints, coatings, and pharmaceuticals

- North America Aromatic Solvents market is poised to grow at the fastest CAGR of 10.26% during the forecast period of 2025 to 2032, fueled by rising demand for high-performance solvents in industrial manufacturing, paints and coatings, and pharmaceuticals

- The toluene segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use as a solvent in paints, coatings, adhesives, and chemical intermediates

Report Scope and Aromatic Solvents Market Segmentation

|

Attributes |

Aromatic Solvents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aromatic Solvents Market?

Rising Demand for Eco-Friendly and Sustainable Solvents

- A significant trend in the global aromatic solvents market is the increasing shift towards eco-friendly and sustainable solvent formulations. Manufacturers are focusing on reducing VOC emissions, using bio-based feedstocks, and developing greener production processes, meeting both regulatory requirements and consumer demand for environmentally responsible products

- For instance, companies such as Shell and ExxonMobil have introduced low-VOC aromatic solvents suitable for industrial coatings and paints, minimizing environmental impact while maintaining performance standards

- The adoption of sustainable solvents is further driven by regulatory initiatives such as REACH in Europe and EPA guidelines in the U.S., which encourage the replacement of traditional aromatic hydrocarbons with safer alternatives

- This trend is reshaping the market, compelling manufacturers to innovate and offer products that align with sustainability goals without compromising performance, durability, or cost-efficiency

- As industries including coatings, paints, adhesives, and printing increasingly prioritize green chemistry, demand for eco-friendly aromatic solvents is expected to rise steadily across regions

- Companies such as BASF and PPG Industries are expanding their portfolios with bio-based and low-toxicity solvents, reflecting the market’s transition toward sustainability and regulatory compliance

What are the Key Drivers of Aromatic Solvents Market?

- The rising demand for high-performance solvents across industries such as coatings, adhesives, automotive, and pharmaceuticals is a primary driver for the Aromatic Solvents market

- For instance, in March 2024, BASF launched a new line of specialty aromatic solvents designed for high-performance coatings, addressing both environmental regulations and industrial efficiency. Such product launches are expected to boost market growth

- Regulatory pressures limiting VOC emissions, coupled with growing consumer and industrial awareness about environmental sustainability, are encouraging the adoption of bio-based and low-toxicity aromatic solvents

- Increasing industrialization in emerging economies, particularly in Asia-Pacific, is driving demand for aromatic solvents in paints, adhesives, and automotive applications.

- The versatility of aromatic solvents, including their ability to dissolve a wide range of materials and improve product stability and performance, further supports market expansion

- Growing trends toward energy-efficient and eco-conscious formulations are propelling R&D investments and new product developments in the aromatic solvents industry globally

Which Factor is Challenging the Growth of the Aromatic Solvents Market?

- The stringent environmental regulations governing VOC emissions, solvent disposal, and workplace safety pose challenges for market expansion, especially in North America and Europe

- For instance, non-compliance with REACH, EPA, or OSHA standards can lead to fines, product recalls, or production halts, increasing operational costs for solvent manufacturers

- The fluctuating prices of crude oil and raw materials also create cost pressure, impacting profitability and making it difficult for smaller players to compete with established multinational companies

- In addition, growing demand for water-based and non-aromatic solvent alternatives may reduce the market share of traditional aromatic solvents over time.

- While manufacturers are developing greener alternatives, transitioning production and reformulating products require substantial capital and time, slowing adoption

- Overcoming these challenges will depend on continued innovation, regulatory alignment, and consumer education on the benefits of aromatic solvents in industrial and specialty applications

How is the Aromatic Solvents Market Segmented?

The market is segmented on the basis of product, application, and end-users.

- By Product

On the basis of product, the aromatic solvents market is segmented into benzene, toluene, xylene, and solvent naphtha. The toluene segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use as a solvent in paints, coatings, adhesives, and chemical intermediates. Toluene’s efficiency in dissolving various resins and its ability to enhance product performance makes it a preferred choice across multiple industries.

The xylene segment is expected to witness the fastest CAGR of 19.2% from 2025 to 2032, fueled by growing demand in the printing inks, automotive coatings, and electronics sectors. Xylene’s high solvency, low toxicity compared to other aromatics, and effectiveness in industrial applications are key factors contributing to its accelerating adoption globally. Increasing industrialization in emerging economies is expected to further support this segment’s growth.

- By Application

On the basis of application, the aromatic solvents market is segmented into paints and coatings, adhesives, printing inks, cleaning and degreasing, and others. The paints and coatings segment held the largest market revenue share of 42.1% in 2024, driven by the increasing construction activities, automotive refinishing, and demand for high-performance industrial coatings. Aromatic solvents in this segment improve drying times, adhesion, and finish quality, making them indispensable in both industrial and decorative coatings.

The printing inks segment is anticipated to witness the fastest CAGR of 18.5% from 2025 to 2032, fueled by growth in packaging, commercial printing, and flexible media. Rising demand for high-quality, fast-drying, and environmentally compliant inks is encouraging manufacturers to adopt aromatic solvents with low VOC content and high solvency efficiency, ensuring superior print quality and regulatory compliance.

- By End-Users

On the basis of end-users, the aromatic solvents market is segmented into pharmaceuticals, oilfield chemicals, automotive, paints and coatings, pesticides, textiles, cleaners, chemical intermediates, electronics, adhesives and sealants, perfumes, and cosmetics. The paints and coatings end-user segment dominated the market with a 36.7% revenue share in 2024, driven by high industrial and construction sector consumption and the need for durable, high-performance coatings.

The automotive segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, fueled by rising vehicle production and the demand for specialty coatings, adhesives, and cleaning solutions in automotive manufacturing. Growth in emerging markets, combined with the adoption of eco-friendly solvents in automotive applications, is expected to further propel the use of aromatic solvents across this end-user segment globally.

Which Region Holds the Largest Share of the Aromatic Solvents Market?

- Asia-Pacific dominated the aromatic solvents market with the largest revenue share of 43.87% in 2024, driven by rapid industrialization, expanding chemical manufacturing, and increased adoption of solvents across end-use industries such as paints, coatings, and pharmaceuticals

- Countries in the region, including China, Japan, and India, are witnessing growing demand due to urbanization, rising disposable incomes, and technological advancements in chemical processing and manufacturing

- This widespread adoption is further supported by a robust manufacturing ecosystem, availability of raw materials, and cost-effective production, establishing Aromatic Solvents as a preferred choice for industrial, commercial, and consumer applications

China Aromatic Solvents Market Insight

The China aromatic solvents market captured the largest revenue share of 42% in 2024 within APAC, fueled by strong domestic chemical production, the expanding middle class, and high industrial consumption. Growth is driven by rising applications in paints, coatings, adhesives, and electronics manufacturing. Government initiatives supporting chemical manufacturing and export-oriented industries further boost market adoption. China’s extensive industrial base ensures steady demand for cost-effective and high-performance aromatic solvents across multiple sectors, making it a dominant contributor to the APAC Aromatic Solvents market.

Japan Aromatic Solvents Market Insight

The Japan aromatic solvents market is gaining momentum due to advanced manufacturing technologies, a strong industrial base, and high-quality standards in chemical processing. Adoption is driven by the demand for specialty solvents in electronics, automotive, and pharmaceutical sectors. Japanese manufacturers prioritize environmentally friendly solvents with low VOC content, enhancing market acceptance. In addition, integration of aromatic solvents in high-tech coatings and precision chemical applications is fueling growth. Japan’s focus on innovation and stringent quality requirements makes it a critical market within the APAC region.

India Aromatic Solvents Market Insight

The India aromatic solvents market is experiencing robust growth due to rapid urbanization, increased industrial activity, and expanding end-use industries such as paints, adhesives, and pharmaceuticals. Rising export opportunities and government incentives for chemical manufacturing further stimulate demand. The country’s large workforce and cost-effective production capacity position India as a key contributor to the APAC Aromatic Solvents market. In addition, growing domestic consumption in construction, automotive, and consumer goods sectors is driving adoption across industrial and commercial applications.

Which Region is the Fastest Growing Region in the Aromatic Solvents Market?

North America aromatic solvents market is poised to grow at the fastest CAGR of 10.26% during the forecast period of 2025 to 2032, fueled by rising demand for high-performance solvents in industrial manufacturing, paints and coatings, and pharmaceuticals. Increasing awareness regarding quality standards, sustainability, and solvent efficiency is driving adoption. The presence of advanced chemical manufacturers and ongoing innovations in environmentally compliant solvents further support growth. North America’s expanding industrial base, coupled with the demand for specialty applications, ensures rapid market expansion.

U.S. Aromatic Solvents Market Insight

The U.S. aromatic solvents market captured the largest revenue share of 81% in North America in 2024, driven by growth in automotive coatings, printing inks, and industrial chemical sectors. Adoption is supported by increasing demand for high-purity solvents, regulatory compliance, and technological innovations in solvent formulations. The country’s focus on environmentally friendly and low-VOC solvents enhances market potential. Rising industrial automation, smart manufacturing processes, and the presence of major chemical manufacturers contribute to the steady expansion of the Aromatic Solvents market in the U.S., positioning it as a key growth engine for the North American region.

Which are the Top Companies in Aromatic Solvents Market?

The aromatic solvents industry is primarily led by well-established companies, including:

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- SK Global Chemical Co., Ltd. (South Korea)

- Shell (Netherlands)

- BASF SE (Germany)

- LyondellBasell (U.S.)

- China National Petroleum Corporation (China)

- Reliance Industries Limited (India)

- TotalEnergies (France)

- CPC Corporation (Taiwan)

- Bharat Petroleum Corporation Limited (India)

- Chevron Phillips Chemical Company LLC (U.S.)

- Formosa Plastics Group (Taiwan)

- HCS Group (Germany)

- Indian Oil Corporation Ltd (India)

- Pon Pure Chemicals Group (India)

- Recochem Corporation (Canada)

- TOP SOLVENT CO., LTD (Japan)

- WM Barr & Co., Inc. (U.S.)

What are the Recent Developments in Global Aromatic Solvents Market?

- In January 2023, Clariter and TotalEnergies Fluids, a division of TotalEnergies, launched the world’s first sustainable ultra-pure solvent, produced from recycled plastic waste for use in pharmaceuticals, cosmetics, and other high-demand applications. The solvent meets stringent pharmacopoeia-standard purity criteria, being safe, colorless, odorless, and tasteless. By utilizing plastic waste as feedstock, the environmental impact is significantly reduced, while contributing to the mitigation of end-of-life plastic pollution, marking a major advancement in sustainable solvent production

- In April 2022, Solvay developed Rhodiasolv IRIS, a next-generation solvent with strong eco-friendly properties, previously manufactured in China but now produced at Solvay’s Melle, France site starting in 2023. This development ensures localized, environmentally conscious production while maintaining high-quality standards, supporting the company’s sustainability and innovation goals in solvent manufacturing

- In February 2021, Hengyi Industries, in collaboration with Honeywell International Inc., advanced aromatics production at the petrochemical complex in Pulau Muara Besar, Brunei, utilizing Honeywell UOP technology. The facility can process approximately 200,000 barrels per day, addressing the rising demand for paraxylene in Asia and driving significant investment in innovative petrochemical technologies, boosting regional production capabilities and efficiency

- In January 2021, Ineos Group Ltd. acquired BP plc’s global aromatics & acetyls division for USD 5 billion, strengthening Ineos’s global position and expanding its international reach in the petrochemical sector. This acquisition enhances the company’s capabilities, broadens its product portfolio, and reinforces its competitive advantage in global aromatics and acetyls markets, marking a significant strategic milestone

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。