Global Bag Filling Machine Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

5.27 Billion

USD

7.28 Billion

2024

2032

USD

5.27 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 5.27 Billion | |

| USD 7.28 Billion | |

|

|

|

|

Global Bag Filling Machine Market Segmentation, By Type (Small Bag Filling Equipment, Large Bag Filling Equipment, and Bulk Bag Filling Equipment), Application (Feed Industry, Chemical Industry, and Food and Beverage)- Industry Trends and Forecast to 2032

Bag Filling Machine Market Size

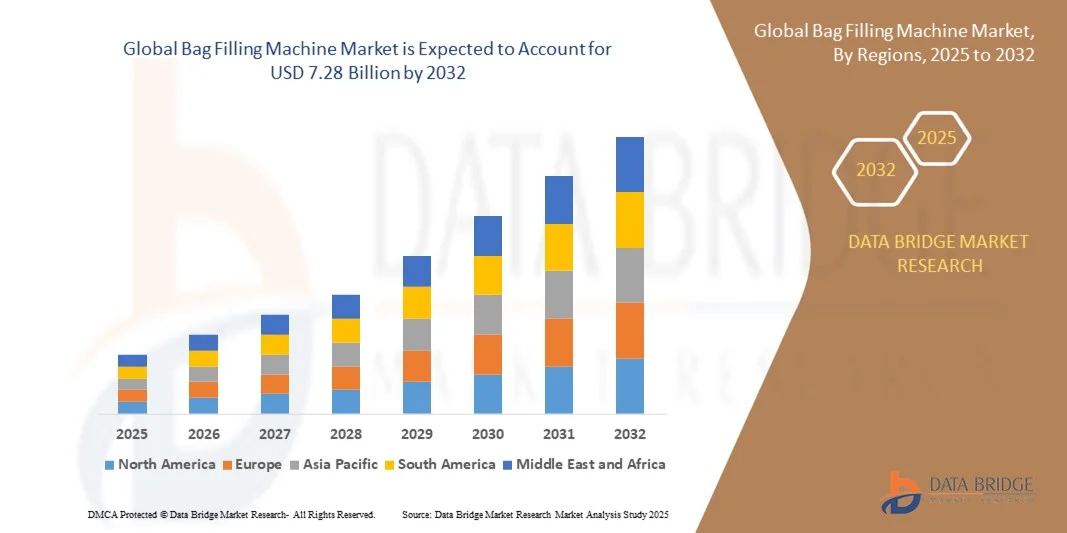

- The global bag filling machine market size was valued at USD 5.27 billion in 2024 and is expected to reach USD 7.28 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fuelled by the increasing demand for automated packaging solutions across food, beverage, pharmaceutical, and chemical industries, which enhance operational efficiency and reduce labor costs

- Rising adoption of smart and IoT-enabled filling machines is enabling real-time monitoring, precise filling, and reduced product wastage, further driving market expansion

Bag Filling Machine Market Analysis

- The market is witnessing technological advancements in multi-head weighers, volumetric fillers, and form-fill-seal systems, which improve productivity and ensure compliance with industry standards

- Manufacturers are increasingly focusing on customizable solutions to cater to diverse packaging sizes, materials, and product types, enhancing market penetration and customer satisfaction

- North America dominated the bag filling machine market with the largest revenue share of 35.6% in 2024, driven by increasing automation in food, feed, and chemical packaging industries, as well as growing awareness of efficient and hygienic packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global bag filling machine market, driven by urbanization, growing manufacturing hubs, and increasing demand for efficient, high-speed packaging solutions in emerging economies such as China, Japan, and India

- The Bulk Bag Filling Equipment segment held the largest market revenue share in 2024, driven by its ability to handle high-volume production efficiently and reduce manual labor requirements. These machines are widely adopted in large-scale manufacturing facilities for grains, powders, and other bulk products, ensuring accuracy, speed, and minimal spillage

Report Scope and Bag Filling Machine Market Segmentation

|

Attributes |

Bag Filling Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bag Filling Machine Market Trends

Increasing Automation and Precision in Bag Filling Operations

- The growing adoption of automated bag filling machines is transforming packaging operations by improving speed, accuracy, and consistency in filling processes. These machines help reduce spillage, product loss, and manual labor requirements, enhancing overall operational efficiency. In addition, integration with other packaging line equipment enables end-to-end automation, reducing human errors and boosting productivity across large manufacturing units

- Rising demand for hygienic and contamination-free packaging in food, pharmaceuticals, and chemical industries is driving the adoption of advanced bag filling systems with precise dosing and sealing capabilities. These machines are especially valuable in high-volume production environments, ensuring compliance with strict health and safety standards while reducing product recalls and contamination risks

- Compact, versatile, and easy-to-operate bag filling solutions are gaining traction among both large-scale manufacturers and small enterprises, offering flexibility in packaging different types of products with minimal downtime. The modular designs allow customization for various bag sizes, materials, and product types, making these machines suitable for multi-product production lines

- For instance, in 2023, several food processing companies in Europe implemented fully automated bag filling lines for grains and powdered products, resulting in faster throughput, reduced product waste, and improved packaging uniformity. These implementations also enhanced operational monitoring and data tracking for better quality control and process optimization

- While automation is boosting efficiency, the adoption of bag filling machines depends on factors such as machine compatibility, cost, and maintenance requirements, requiring continued innovation and user training for maximum benefit. Ongoing software and sensor advancements are also crucial to accommodate evolving packaging standards and ensure seamless integration with smart factory initiatives

Bag Filling Machine Market Dynamics

Driver

Rising Demand for Efficient, Accurate, and Hygienic Packaging Solutions

- The increasing demand for high-speed, precise, and contamination-free packaging is driving the adoption of automated bag filling machines. Enhanced efficiency and accuracy minimize product loss and improve overall production quality. In addition, these machines reduce human dependency, enabling manufacturers to maintain consistent output during peak production periods

- Growing industrialization and expansion of the food, chemical, and pharmaceutical sectors are prompting manufacturers to invest in reliable and scalable bag filling systems that support large-scale operations. The ability to handle diverse product types, from powders to granules, encourages adoption in multi-segment facilities

- Regulatory emphasis on hygienic packaging and quality standards further encourages the use of modern bag filling machines, especially in markets with stringent food safety and pharmaceutical compliance requirements. These machines also help companies meet international export standards, reducing barriers to entry in global markets

- For instance, in 2022, several pharmaceutical companies in North America upgraded their bag filling lines with automated dosing systems, improving packaging precision, reducing contamination risk, and aligning with FDA quality guidelines. The upgrades also enhanced production traceability and operational analytics for improved decision-making

- While efficiency and compliance are driving adoption, manufacturers must focus on cost-effectiveness, ease of integration, and maintenance support to achieve sustained market growth. Continuous innovation in machine design and operator training programs is essential to maintain productivity and adaptability in evolving industry landscapes

Restraint/Challenge

High Initial Investment and Technical Complexity of Automated Systems

- Advanced bag filling machines involve significant capital expenditure, making them less accessible for small and medium-sized enterprises. The high upfront cost can delay adoption despite long-term operational benefits, especially for companies with limited budgets or fluctuating production volumes

- Operating and maintaining sophisticated bag filling equipment requires trained personnel, which may be scarce in smaller or rural manufacturing units. Technical complexity can lead to downtime and operational inefficiencies if not properly managed, necessitating ongoing employee training and support from service providers

- Supply chain constraints for spare parts and specialized components may limit machine availability and scalability, particularly in emerging markets where support infrastructure is limited. Delays in replacement parts or maintenance services can result in production stoppages, impacting overall profitability

- For instance, in 2023, several SMEs in Asia-Pacific reported delays in implementing automated bag filling systems due to high investment requirements and a lack of trained technicians, slowing production upgrades. These delays also hindered companies’ ability to meet increasing demand and maintain competitive positioning in the market

- While technology continues to advance, addressing cost, training, and service challenges is crucial for wider adoption and long-term market penetration. Manufacturers and solution providers must focus on affordable financing options, comprehensive training programs, and robust after-sales support to ensure successful integration and sustained operational efficiency

Bag Filling Machine Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the bag filling machine market is segmented into Small Bag Filling Equipment, Large Bag Filling Equipment, and Bulk Bag Filling Equipment. The Bulk Bag Filling Equipment segment held the largest market revenue share in 2024, driven by its ability to handle high-volume production efficiently and reduce manual labor requirements. These machines are widely adopted in large-scale manufacturing facilities for grains, powders, and other bulk products, ensuring accuracy, speed, and minimal spillage.

The Small Bag Filling Equipment segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption among small and medium-sized enterprises. These compact and versatile machines are ideal for low-to-medium production volumes, offering easy operation, quick setup, and adaptability for multiple bag sizes, making them suitable for small-scale food, chemical, and feed industries.

- By Application

On the basis of application, the market is segmented into Feed Industry, Chemical Industry, and Food and Beverage. The Food and Beverage segment accounted for the largest market share in 2024 due to the high demand for hygienic and precise packaging in food products, powders, and grains. Automated bag filling solutions in this segment help maintain product quality, reduce contamination risk, and improve operational efficiency across large production lines.

The Feed Industry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for packaged animal feed and pet food globally. These machines enable precise portioning, faster filling speeds, and reduced wastage, ensuring consistent quality and supporting the growing livestock and pet care markets.

Bag Filling Machine Market Regional Analysis

- North America dominated the bag filling machine market with the largest revenue share of 35.6% in 2024, driven by increasing automation in food, feed, and chemical packaging industries, as well as growing awareness of efficient and hygienic packaging solutions

- Manufacturers in the region highly value precision, accuracy, and contamination-free packaging offered by advanced bag filling machines, which reduce spillage, product loss, and manual labor requirements

- This widespread adoption is further supported by strong industrial infrastructure, high disposable incomes, and the growing preference for automated and scalable packaging solutions, establishing bag filling machines as a preferred choice for both small and large-scale operations

U.S. Bag Filling Machine Market Insight

The U.S. bag filling machine market captured the largest revenue share in North America in 2024, fueled by rapid adoption of automated bag filling systems across food, chemical, and feed industries. Companies are increasingly prioritizing packaging efficiency, hygiene, and operational consistency. The growing integration of Industry 4.0 technologies, predictive maintenance, and smart manufacturing solutions is significantly contributing to market expansion.

Europe Bag Filling Machine Market Insight

The Europe bag filling machine market is expected to witness the fastest growth rate from 2025 to 2032, led by stringent food safety regulations and the demand for efficient packaging in chemical and feed sectors. Adoption is supported by urbanization, technological advancements, and a strong emphasis on operational efficiency. European manufacturers are increasingly deploying automated bag filling solutions for both new production lines and retrofitting existing facilities.

U.K. Bag Filling Machine Market Insight

The U.K. bag filling machine market is expected to witness the fastest growth rate from 2025 to 2032 steadily due to increasing automation in food, feed, and chemical industries. Rising concerns about packaging hygiene and efficiency are encouraging companies to adopt high-precision bag filling systems. The country’s well-developed industrial infrastructure and adoption of digitalized manufacturing solutions further support market growth.

Germany Bag Filling Machine Market Insight

The Germany bag filling machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by a focus on automation, precision, and efficiency in packaging processes. The country’s strong industrial base, emphasis on technological innovation, and regulatory standards for hygiene and quality are key factors supporting market adoption. Advanced bag filling machines are increasingly integrated into food, feed, and chemical production lines for optimized operations.

Asia-Pacific Bag Filling Machine Market Insight

The Asia-Pacific bag filling machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from food, feed, and chemical industries, coupled with increasing automation and modernization of manufacturing facilities. Countries such as China, India, and Japan are leading in adoption due to government incentives, a growing industrial base, and an increasing focus on efficiency and hygiene. The region’s emergence as a manufacturing hub is also enhancing accessibility and affordability of bag filling machines.

China Bag Filling Machine Market Insight

China continues to lead the Asia-Pacific region in bag filling machine adoption, attributed to rapid industrialization, large-scale manufacturing of food, feed, and chemical products, and high rates of automation integration. The country’s focus on smart factories, precision machinery, and scalable solutions ensures consistent demand for both domestic use and export, driving market growth.

Japan Bag Filling Machine Market Insight

The Japan bag filling machine market is expected to witness the fastest growth rate from 2025 to 2032 due to rapid automation adoption in industrial and commercial packaging. Japanese manufacturers prioritize precision, speed, and hygiene, driving demand for advanced bag filling systems. The integration of machines with digital monitoring and control systems is further supporting efficiency and reducing material waste across food and chemical production.

Bag Filling Machine Market Share

The Bag Filling Machine industry is primarily led by well-established companies, including:

- Inpak Systems, Inc. (U.S.)

- WEIGHPACK (Italy)

- Premier Tech Ltd. (Canada)

- AMS Ferrari S.r.l. (Italy)

- MONDI (Austria)

- AMTEC Packaging Machines (Italy)

- DS Smith (U.K.)

- easterninstruments (U.S.)

- Accutek Packaging Equipment Companies, Inc. (U.S.)

- Cavicchi Impianti srl (Italy)

- Brovind - GBV Impianti srl (Italy)

- Ave Technologies S.r.l (Italy)

- MAQUINARIA INDUSTRIAL DARA (Spain)

- Filamatic (U.S.)

- Tech-Long Europe (China)

- IC Filling Systems (Italy)

- NK Industries Limited (U.K.)

- Pack Leader Machinery Inc. (U.S.)

- FUJI MACHINERY CO., LTD. (Japan

- Matrix Packaging Machinery, LLC. (U.S.)

- MESPACK (Spain)

- Nichrome Packaging Solutions (India)

- Omori Machinery Co. Ltd (Japan)

- Ossid, LLC (U.S.)

Latest Developments in Global Bag Filling Machine Market

- In March 2021, Scholle IPN, a U.S.-based manufacturer of bag-in-box packaging products, completed the acquisition of Bossar Packaging Pvt. Ltd. The acquisition aims to combine the strengths of both companies to provide sustainable, vertically integrated solutions for the global bag filling machine market. This strategic move is expected to enhance operational capabilities, expand the product portfolio, and offer more eco-friendly and efficient packaging solutions, strengthening Scholle IPN’s position in the global market

- In November 2021, SIG Group, a Switzerland-based packaging company, launched SIG NEO, an advanced filling machine for family-size carton packs. The equipment achieves speeds of up to 18,000 packs per hour while reducing the carbon footprint per filled pack by 25% compared to the previous generation. With lower water and utility consumption and minimized waste, SIG NEO enhances production efficiency, supports sustainability goals, and sets a new benchmark in high-speed, eco-friendly filling technology for the global market

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。