Global Balsa Wood Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

177.20 Billion

USD

297.70 Billion

2024

2032

USD

177.20 Billion

USD

297.70 Billion

2024

2032

| 2025 –2032 | |

| USD 177.20 Billion | |

| USD 297.70 Billion | |

|

|

|

|

Global Balsa Wood Market Segmentation, By Type ('Grain A' Type, 'Grain B' Type, and 'Grain C' Type), Application (Aerospace & Defense, Renewable Energy, Marine, Road & Rail, Industrial & Construction, and Others)- Industry Trends and Forecast to 2032

Balsa Wood Market Size

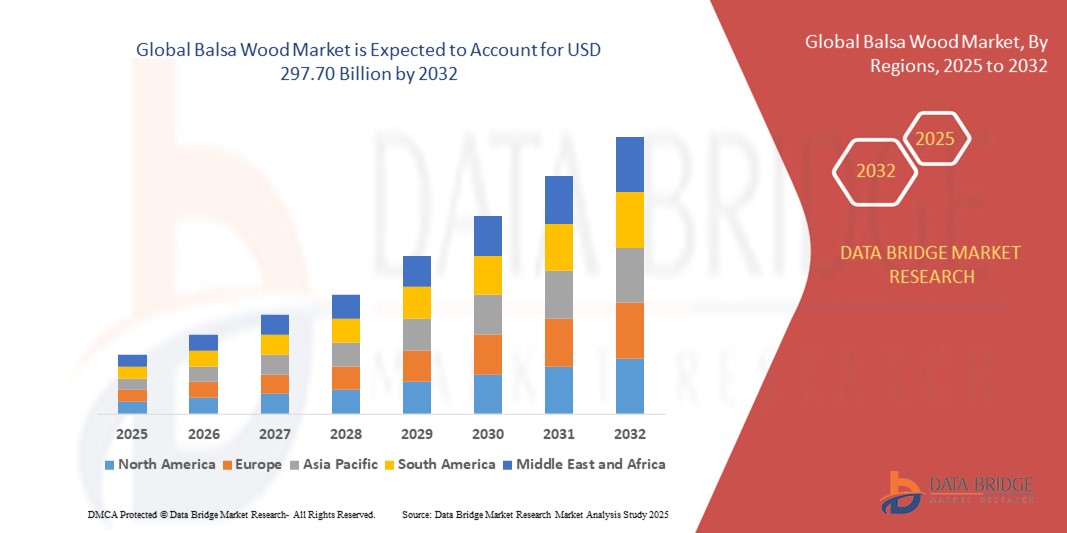

- The global balsa wood market size was valued at USD 177.2 billion in 2024 and is expected to reach USD 297.70 billion by 2032, at a CAGR of 6.7% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and sustainable wood in construction, aerospace, marine, and furniture applications. Balsa wood’s exceptional strength-to-weight ratio makes it ideal for engineered products, insulation panels, and model-making

- Increasing use of balsa wood in eco-friendly and renewable applications, along with innovations in engineered composites, is further accelerating market expansion

Balsa Wood Market Analysis

- Balsa wood’s versatility, including its use in sandwich panels, wind turbine blades, and hobby crafts, is creating new opportunities across industrial and commercial sectors

- The market is also witnessing technological improvements in wood treatment and processing, which enhance durability, fire resistance, and performance characteristics, boosting its commercial appeal

- North America dominated the balsa wood market with the largest revenue share of 36.2% in 2024, driven by increasing demand for lightweight and sustainable wood materials in aerospace, automotive, and marine industries

- Asia-Pacific region is expected to witness the highest growth rate in the global balsa wood market, driven by increasing urbanization, growing adoption of eco-friendly materials, government initiatives supporting sustainable industries, and expanding use in composites, marine, and renewable energy applications

- The ‘Grain A’ type segment held the largest market revenue share in 2024, driven by its superior strength-to-weight ratio and consistent quality, making it highly suitable for aerospace, marine, and industrial applications. Its uniform density and structural reliability make it the preferred choice for high-performance composite panels and insulation cores

Report Scope and Balsa Wood Market Segmentation

|

Attributes |

Balsa Wood Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Balsa Wood Market Trends

Rising Demand For Lightweight And Sustainable Wood Materials

- The increasing preference for lightweight and eco-friendly construction materials is transforming the balsa wood market by enabling its adoption in various industrial applications. The wood’s low density and high strength-to-weight ratio make it ideal for aerospace, marine, and automotive industries, improving structural efficiency and reducing fuel consumption. In addition, manufacturers are exploring innovative composite solutions to enhance mechanical properties, expand usage, and minimize overall material costs

- Growing use in model-making, crafts, and composite materials is accelerating the demand for high-quality balsa wood sheets and blocks. Its versatility and workability make it a preferred choice for hobbyists, manufacturers, and designers seeking sustainable alternatives. Furthermore, customization options for thickness, density, and grain allow better adaptation to niche applications, increasing its appeal across multiple sectors

- The cost-effectiveness and renewability of balsa wood are making it attractive for large-scale industrial use, supporting sustainable manufacturing and reducing environmental impact. Its rapid growth cycle and eco-certification potential further enhance market appeal. Investments in plantation management and certified supply chains are also boosting confidence among environmentally conscious industries

- For instance, in 2023, several European aerospace and marine component manufacturers reported increased utilization of balsa wood composites to reduce overall structural weight, improving efficiency and performance. The adoption has also led to decreased fuel consumption and enhanced sustainability credentials, supporting regulatory compliance and eco-friendly branding

- While demand for balsa wood is rising, long-term growth depends on continued availability, sustainable forestry practices, and optimized supply chains. Stakeholders must focus on ensuring quality, affordability, and environmental compliance to fully capitalize on market potential. Collaboration with local growers and investments in advanced processing technologies will also be critical to mitigate supply constraints and meet growing global demand

Balsa Wood Market Dynamics

Driver

Increasing Adoption In Aerospace, Marine, And Automotive Industries

- The lightweight and high-strength properties of balsa wood are driving its adoption in aerospace, marine, and automotive applications. Its use in composite panels, insulation, and cores enhances fuel efficiency, durability, and performance, promoting broader industrial uptake. In addition, the material supports innovation in hybrid composites, enabling safer, lighter, and more efficient vehicle designs

- Manufacturers are prioritizing sustainable and renewable materials, pushing balsa wood into eco-conscious product designs. Its compatibility with adhesives and resins in composites further strengthens its industrial value. The wood’s recyclability and biodegradable nature also align with corporate sustainability goals, creating additional market pull

- Government regulations and incentives promoting lightweight and environmentally friendly materials are accelerating adoption. Industries are increasingly integrating balsa wood in compliance with emission reduction and sustainability targets. Funding for green technologies and eco-certification initiatives is further incentivizing manufacturers to adopt balsa-based solutions

- For instance, in 2022, several European aircraft manufacturers incorporated balsa wood composites in fuselage and interior panels to reduce aircraft weight and improve fuel efficiency, boosting material demand. This implementation also helped companies meet strict EU carbon emission targets and enhance product marketability

- While industrial adoption is driving growth, supply chain optimization, sustainable harvesting, and consistent quality remain crucial for market expansion. Strategic partnerships with growers and investment in advanced processing techniques will help ensure reliable, scalable supply for industrial applications

Restraint/Challenge

Limited Availability And High Production Costs Of Premium Balsa Wood

- The availability of high-quality balsa wood is limited due to dependence on specific growing regions, impacting consistent supply for industrial applications. Variability in wood density and grain structure can pose challenges for large-scale manufacturing. Additional factors such as climate change, pest infestations, and export regulations further complicate availability

- High production and processing costs, including transportation from Latin American countries, make balsa wood less competitive compared to alternative lightweight materials such as synthetic foams or engineered composites. This cost factor restricts adoption in price-sensitive projects. Investment in local plantations and mechanized processing could partially offset these constraints, but costs remain a concern

- Market penetration is also hindered by regulatory constraints and environmental concerns related to deforestation and unsustainable harvesting. Ensuring sustainable forestry practices adds complexity and cost to production. Compliance with international eco-certification standards is critical but increases operational expenses for producers

- For instance, in 2023, several European marine and aerospace firms faced supply bottlenecks due to limited availability of premium balsa wood, resulting in delays and higher procurement costs. Such disruptions impacted production timelines, project budgets, and contractual commitments in high-value sectors

- While technological improvements in processing and certification are emerging, addressing supply limitations and production cost challenges is essential for sustained market growth and industrial acceptance globally. Adoption of plantation expansion, strategic sourcing, and process automation will be necessary to stabilize supply chains and meet increasing industrial demand

Balsa Wood Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the global balsa wood market is segmented into ‘Grain A’ type, ‘Grain B’ type, and ‘Grain C’ type. The ‘Grain A’ type segment held the largest market revenue share in 2024, driven by its superior strength-to-weight ratio and consistent quality, making it highly suitable for aerospace, marine, and industrial applications. Its uniform density and structural reliability make it the preferred choice for high-performance composite panels and insulation cores.

The ‘Grain B’ type segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in renewable energy, construction, and lightweight transportation applications. ‘Grain B’ type balsa wood is particularly valued for its cost-effectiveness, versatility, and ease of integration with adhesives and resins, supporting diverse industrial uses. Manufacturers are increasingly leveraging this type for sustainable and high-efficiency designs in multiple sectors.

- By Application

On the basis of application, the balsa wood market is segmented into aerospace & defense, renewable energy, marine, road & rail, industrial & construction, and others. The aerospace & defense segment held the largest market share in 2024, fueled by the growing demand for lightweight composite materials in aircraft, drones, and defense systems. Its ability to reduce overall structural weight while maintaining strength makes it a critical material in this industry.

The renewable energy segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of wind turbine blades and sustainable energy solutions. Balsa wood is preferred for its lightweight, high-strength properties and compatibility with composite technologies, contributing to enhanced efficiency and performance in renewable energy infrastructure.

Balsa Wood Market Regional Analysis

- North America dominated the balsa wood market with the largest revenue share of 36.2% in 2024, driven by increasing demand for lightweight and sustainable wood materials in aerospace, automotive, and marine industries

- The region benefits from established import channels, high-quality processing facilities, and growing industrial applications that prioritize strength-to-weight ratio and environmental sustainability

- This widespread adoption is further supported by increasing industrial investments, technological advancements in composite manufacturing, and rising demand for eco-friendly construction and design materials

U.S. Balsa Wood Market Insight

The U.S. balsa wood market captured the largest revenue share in North America in 2024, fueled by growing aerospace, automotive, and marine sectors that require high-performance, lightweight materials. The adoption of balsa wood in composite panels, insulation, and specialty applications is further enhancing structural efficiency while reducing fuel consumption and material costs. Increasing focus on sustainability and renewable resources in industrial production also supports market expansion.

Europe Balsa Wood Market Insight

The Europe balsa wood market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption in aerospace, marine, and renewable energy applications. European manufacturers and designers prefer balsa wood for its lightweight nature, high strength-to-weight ratio, and sustainability. The region’s commitment to eco-certified sourcing and green manufacturing practices further supports growth.

Germany Balsa Wood Market Insight

The Germany balsa wood market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strong aerospace, automotive, and renewable energy industries. High-quality balsa wood is increasingly used in composite panels, insulation, and lightweight structural components. Germany’s advanced manufacturing capabilities, regulatory support for eco-friendly materials, and focus on innovation are accelerating market adoption.

U.K. Balsa Wood Market Insight

The U.K. balsa wood market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing investments in renewable energy projects, sustainable construction, and marine composites. Increasing interest in lightweight, eco-friendly materials among manufacturers and hobbyists is accelerating adoption. Regulatory frameworks promoting environmental sustainability and the rise of green design initiatives are also key factors.

Asia-Pacific Balsa Wood Market Insight

The Asia-Pacific balsa wood market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in automotive, aerospace, and marine industries in China, Japan, and India. The region leverages both local production and imports from South America to meet industrial needs. Expanding use in composite manufacturing, renewable energy, and sustainable construction projects is further propelling growth.

Japan Balsa Wood Market Insight

The Japan balsa wood market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on lightweight composites for automotive, aerospace, and industrial applications. Japanese manufacturers favor balsa wood for its sustainability, compatibility with advanced adhesives and resins, and excellent strength-to-weight ratio. Rising eco-consciousness and industrial demand for high-performance materials further drive market expansion.

China Balsa Wood Market Insight

The China balsa wood market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, expanding aerospace and automotive sectors, and increasing imports of premium balsa wood. Its use in composites, insulation, and industrial applications supports lightweight and sustainable manufacturing. Government policies promoting eco-friendly and lightweight materials are also driving market growth.

Balsa Wood Market Share

The Balsa Wood industry is primarily led by well-established companies, including:

- 3A Composites GmbH (Germany)

- Schweiter Technologies AG (Switzerland)

- DIAB International AB (Sweden)

- CoreLite Inc. (U.S.)

- Gurit Holding AG (Switzerland)

- Carbon-Core Corp. (U.S.)

- Pacific Coast Marine (U.S.)

- Pontus Wood Group (U.K.)

- BALTEK Corporation (U.S.)

Latest Developments in Global Balsa Wood Market

- In 2024, Balsa USA launched a new aeronautical model kit featuring precision-cut balsa wood pieces. The kit is designed to enhance the accuracy and quality of model aircraft, appealing to hobbyists and educational institutions. This introduction reinforces Balsa USA’s presence in the model-building sector and boosts demand for high-precision balsa wood products

- In April 2023, 3A Composites Core Materials launched a new product line, Engicore Core Materials, aimed at the South and North American markets. The development focuses on providing customized core material solutions for diverse manufacturing processes and industry standards. This product line enables manufacturers to enhance efficiency, adapt quickly to production requirements, and improve overall material performance. The launch strengthens 3A Composites’ portfolio, offering greater versatility and reinforcing its position in the global composites market. It is expected to drive adoption across aerospace, marine, and industrial applications, positively impacting market growth

- In April 2023, 3A Composites Core Materials launched a new product range, Engicore Core Materials, targeting South and North American markets. The development aims to offer customized solutions that help manufacturers adapt quickly to diverse production processes and standard requirements, enhancing efficiency and versatility. This launch strengthens the company’s product portfolio and supports adoption in aerospace, marine, and industrial applications, positively impacting the global composites market

- In September 2022, Tornado Updraft introduced electric RC balsa wood model airplanes in collaboration with Nighthawk Gliders and PowerUp Gadgets. The kit features a precision balsa wood body and the PowerUp 4.0 fully electric motor, offering hobbyists an engaging build-and-fly experience. This innovation enhanced the model aircraft segment by combining lightweight materials with modern electric propulsion, attracting enthusiasts and expanding market reach

- In April 2022, INCA BioBalsa announced the construction of a new advanced facility in Alberta, Canada, to produce high-grade biocomposites. These balsa substitutes are designed for wind turbine blades, marine vessels, and automotive applications, addressing scarcity of natural balsa resources. The facility strengthens sustainable supply chains and supports industrial adoption in lightweight structural components, driving market growth

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。