世界の飲料香料市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

25.92 Billion

USD

42.58 Billion

2024

2032

USD

25.92 Billion

USD

42.58 Billion

2024

2032

| 2025 –2032 | |

| USD 25.92 Billion | |

| USD 42.58 Billion | |

|

|

|

|

世界の飲料香料市場のセグメンテーション、成分別(香料、香料キャリア、香味増強剤など)、由来別(天然、人工、天然由来)、形態別(乾燥、液体)、タイプ別(チョコレート、ブラウニー、乳製品、ハーブ、植物、果物、野菜など)、飲料タイプ別(アルコール飲料、ノンアルコール飲料)、エンドユーザー別(飲料、ベーカリー、乳製品、冷凍食品、動物性食品、ペットフード) - 2032年までの業界動向と予測

飲料フレーバー市場規模

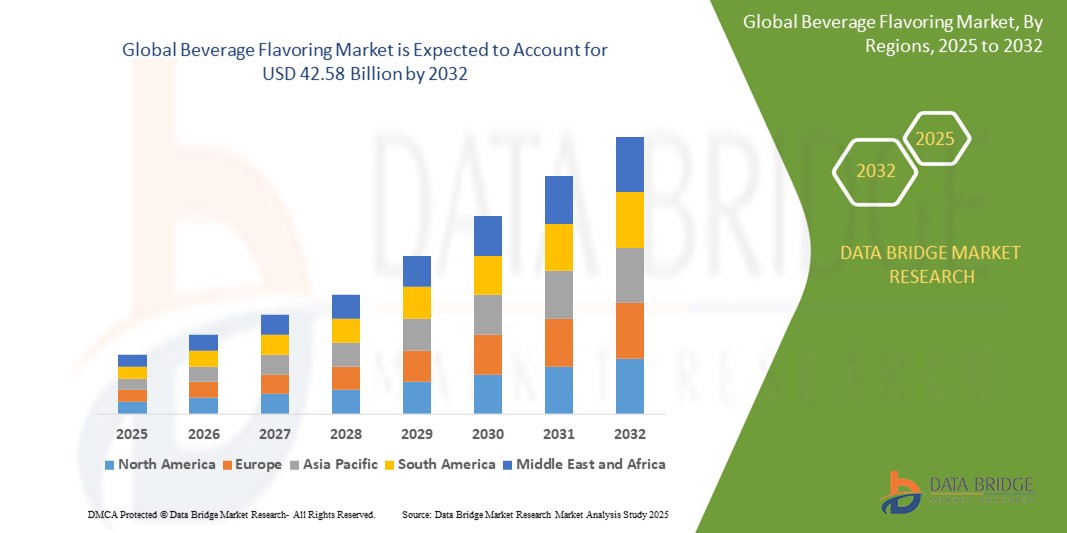

- 世界の飲料香料市場規模は2024年に259.2億米ドルと評価され、予測期間中に6.4%のCAGRで成長し、2032年までに425.8億米ドル に達すると予想されています。

- 市場の成長は、主に、便利ですぐに飲める製品に対する消費者の需要の増加、オーガニックやクリーンラベルの原料を好む健康意識の高まり、新興国における飲料部門の拡大によって促進されている。

- さらに、機能性飲料フレーバーの革新、職人技が光る特選飲料の台頭、そして植物由来および天然由来の代替フレーバーの人気が高まっていることも、市場拡大に貢献しています。これらの要因が相まって、世界の飲料フレーバー市場の力強い成長軌道を裏付けています。

飲料フレーバー市場分析

- 膨張剤、乳化剤、酵素、甘味料、ベーキングパウダーを含む飲料香料は、工業飲料および職人の飲料生産部門全体で飲料の食感、風味、外観、保存期間を向上させる上で重要な役割を果たします。

- 飲料フレーバーの需要増加は、主にジュース、ソフトドリンク、エナジードリンク、機能性飲料などのフレーバー飲料の消費量の増加と、より健康的で天然のクリーンラベル原料を求める消費者の嗜好の変化によって推進されています。

- 成熟した飲料業界、フレーバー付き飲料や機能性飲料の一人当たりの消費量の高さ、プレミアム、ナチュラル、オーガニックのフレーバーソリューションに対する需要の増加に支えられ、ヨーロッパは2025年に最大の収益シェアで世界の飲料フレーバー市場を支配します。

- アジア太平洋地域は、急速な都市化、中流階級人口の拡大、食習慣の変化、すぐに飲める飲料や機能性飲料の人気の高まりにより、予測期間中に世界の飲料フレーバー市場で最も急速に成長する地域になると予想されています。

- 乳化剤セグメントは、飲料配合の安定化、口当たりの改善、保存期間の延長、フレーバー飲料の一貫性と品質の向上という重要な役割により、2025年には34.2%の市場シェアで飲料フレーバー市場を支配すると予想されています。

レポートの範囲と飲料フレーバー市場のセグメンテーション

|

属性 |

Beverage Flavoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beverage Flavoring Market Trends

“Health-Driven Innovation and Clean Label Movement Reshape Beverage Industry”

- A significant and accelerating trend in the Global Beverage Flavoring Market is the growing consumer demand for clean-label, organic, and health-oriented ingredients, driven by increased health awareness, dietary restrictions, and lifestyle changes across global populations

- Manufacturers are increasingly focusing on natural and plant-based beverage flavoring solutions, such as fruit extracts, natural emulsifiers, and botanical infusions, to replace artificial additives and preservatives while maintaining product quality and shelf life

- In response to rising allergies, dietary preferences, and lifestyle choices, there is a surge in the development of allergen-free, sugar-reduced, and fortified beverage flavorings, catering to niche but rapidly growing health-conscious consumer segments

- Functional beverage flavorings—including those enriched with vitamins, minerals, antioxidants, and probiotics—are gaining traction as consumers seek beverages that offer both indulgence and nutritional benefits, especially in categories like functional drinks, energy beverages, and wellness shots

- This trend is further reinforced by clean-label certification initiatives and technological innovations in ingredient processing, which enable improved taste, aroma, and stability without the need for synthetic additives—reshaping product development strategies across the global beverage industry

Beverage Flavoring Market Dynamics

Driver

“Rising Consumer Demand for Clean-Label and Functional Beverage Ingredients”

- Increasing consumer preference for clean-label, natural, and health-focused beverages is a key driver of the Global Beverage Flavoring Market, fueled by growing health awareness, food safety concerns, and evolving dietary trends worldwide

- Demand for additive-free, organic, and non-GMO beverage flavorings—such as natural fruit extracts, botanical flavors, and plant-based sweeteners—is accelerating, particularly among health-conscious consumers in North America and Europe

- Leading ingredient manufacturers are investing heavily in developing enzyme-based and plant-derived flavor enhancers that replace synthetic additives while maintaining or improving flavor profile and shelf life

- Functional beverage flavorings enriched with vitamins, antioxidants, minerals, and probiotics are increasingly incorporated into ready-to-drink and health-oriented beverages, catering to consumers seeking enhanced nutritional benefits

- This trend is bolstered by the growing popularity of plant-based, low-calorie, and specialty functional drinks, prompting beverage producers to diversify flavor portfolios and innovate with natural and clean-label ingredients

Restraint/Challenge

“Raw Material Price Volatility and Complex Regulatory Landscape”

- A major challenge facing the Beverage Flavoring Market is the fluctuation in raw material prices for key ingredients such as natural extracts, essential oils, and organic sweeteners, which impact production costs and pricing

- Securing consistent supply of high-quality, sustainable raw materials at competitive prices is increasingly difficult, especially for small- and mid-sized manufacturers with less bargaining power

- Factors such as climate change, crop yield variability, and global supply chain disruptions exacerbate price volatility and affect availability, leading to potential inventory and cost management issues

- Moreover, stringent regulatory requirements regarding ingredient safety, labeling, allergen disclosure, and additive restrictions differ across countries and regions, necessitating continuous compliance monitoring

- Overcoming these challenges requires strategic supplier partnerships, diversified sourcing, investment in regulatory expertise, and innovation in alternative flavor ingredient development to maintain product quality and market competitiveness

Beverage Flavoring Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, Beverage Flavoring market is segmented into enzymes, starch, fiber, colors, flavors, emulsifiers, antimicrobials, fats, dry baking mix and others. The emulsifiers segment dominates the largest market revenue share of 44.2% in 2025, owing to its crucial role in improving dough stability, enhancing texture, and extending the shelf life of baked goods. Emulsifiers are widely used across bread, cakes, pastries, and industrial baking applications to ensure consistent quality and product appeal.

The enzymes segment is anticipated to witness the fastest growth rate of 7.9% from 2025 to 2032, driven by increasing demand for natural and clean-label alternatives to chemical additives. Enzymes help improve dough handling, reduce processing time, and maintain freshness, making them increasingly popular in health-focused and organic bakery formulations.

- By Application

On the basis of application into bread, cookies & biscuits, rolls & pies, cakes & pastries and others. The bread segment held the largest market revenue share in 2025, driven by the global staple nature of bread and high consumption volumes across both developed and emerging markets. Ongoing innovations in high-fiber, multigrain, and gluten-free bread varieties continue to fuel demand for specialized Beverage Flavoring in this category.

The cakes & pastries segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising consumer interest in indulgent, premium, and customized baked goods. Urbanization, increased disposable income, and the popularity of bakery cafés and quick-service restaurants are further contributing to the growing demand for diverse and innovative baking ingredient solutions in this segment.

Beverage Flavoring Market Regional Analysis

- Europe dominates the Beverage Flavoring Market with the largest revenue share of 31.7% in 2024, driven by a well-established bakery tradition, high consumption of bread and pastry products, and growing demand for premium, organic, and clean-label Beverage Flavoring

- The region’s strong presence of artisanal bakeries and industrial baking companies is fostering innovation in natural preservatives, non-GMO emulsifiers, and fiber-enriched flour blends to meet evolving health and wellness trends

- Additionally, stringent food safety regulations, rising awareness of food allergens, and growing consumer interest in gluten-free and vegan bakery options are propelling market growth across countries like Germany, France, and the United Kingdom

- The presence of major ingredient suppliers such as DSM, Lesaffre, and Corbion in the region supports ongoing research, product development, and sustainable sourcing practices, positioning Europe as a key innovation hub in the global Beverage Flavoring landscape

U.S. Beverage Flavoring Market Insight

The U.S. Beverage Flavoring market captured the largest revenue share of over 69.34% within North America in 2025, driven by the country's well-established bakery sector, high consumption of packaged bakery goods, and increasing demand for clean-label and functional ingredients. The rise of health-conscious consumers is fueling the adoption of organic flours, natural emulsifiers, and enzyme-based improvers. Additionally, innovation in gluten-free and keto-friendly baked goods, supported by R&D investment and private-label expansion, is boosting ingredient demand across retail and foodservice sectors.

Europe Beverage Flavoring Market Insight

The Europe Beverage Flavoring market is projected to expand at a stable CAGR throughout the forecast period, supported by a mature bakery culture and rising demand for premium and artisan bakery products. Consumers in key countries such as Germany, France, and the Netherlands are increasingly opting for whole grain, high-fiber, and reduced-sugar baked goods. Regulatory initiatives promoting clean labeling and transparency, along with a shift toward plant-based and allergen-free baking solutions, are driving ingredient innovation and market growth across the region.

U.K. Beverage Flavoring Market Insight

The U.K. Beverage Flavoring market is anticipated to grow at a robust CAGR during the forecast period, driven by evolving consumer preferences for healthier bakery products and sustainable sourcing. Rising popularity of vegan and free-from bakery options has prompted manufacturers to adopt alternative flours, natural sweeteners, and non-dairy fat sources. Collaboration between food tech startups and ingredient suppliers is further fostering the development of innovative baking solutions in the country.

Germany Beverage Flavoring Market Insight

The Germany Beverage Flavoring market is expected to witness consistent growth, fueled by the country’s strong tradition of bread and pastry consumption and its innovation-driven food processing industry. Demand for clean-label ingredients, particularly enzymes, emulsifiers, and wholegrain flours, is on the rise. Moreover, Germany's push toward sustainability and reduced food waste is encouraging the use of multifunctional and shelf-life-extending Beverage Flavoring in both artisanal and industrial bakeries.

Asia-Pacific Beverage Flavoring Market Insight

The Asia-Pacific Beverage Flavoring market is poised to grow at the fastest CAGR of over 9% in 2025, fueled by rapid urbanization, rising disposable incomes, and the growing influence of Western-style bakery consumption. Countries like China, India, and Japan are seeing a surge in demand for packaged bakery items, spurring the adoption of baking enzymes, dry mixes, and natural flavor enhancers. The expansion of bakery café chains and convenience stores, along with increasing awareness of nutrition, is driving market growth across the region.

Japan Beverage Flavoring Market Insight

The Japan Beverage Flavoring market is gaining momentum due to the country’s focus on convenience, nutrition, and food quality. The market benefits from a growing demand for premium and functional bakery products, such as high-protein breads and low-sugar pastries. Technological advancements in ingredient processing and strong consumer preference for visually appealing, portion-controlled baked goods are encouraging innovation and adoption of specialty Beverage Flavoring.

China Beverage Flavoring Market Insight

The China Beverage Flavoring market accounted for the largest market share in Asia-Pacific in 2025, driven by increasing consumption of Western-style bakery products, including bread, cakes, and pastries. Urban middle-class growth, rising awareness of healthy eating, and the proliferation of bakery chains are fueling demand for functional and clean-label ingredients. Government support for domestic food manufacturing and emphasis on food quality and safety are further boosting the adoption of advanced Beverage Flavoring.

Beverage Flavoring Market Share

The Beverage Flavoring industry is primarily led by well-established companies, including:

- Archer Daniels Midland Company (ADM) (U.S.)

- Cargill, Incorporated (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- Kerry Group plc (Ireland)

- Corbion N.V. (Netherlands)

- Ingredion Incorporated (U.S.)

- Tate & Lyle PLC (U.K.)

- IFF (International Flavors & Fragrances Inc.) (U.S.)

- Lesaffre Group (France)

- Puratos Group (Belgium)

- AB Mauri (Associated British Foods plc) (U.K.)

- Bakels Group (Switzerland)

- Lallemand Inc. (Canada)

- Novozymes A/S (Denmark)

- Corbion Caravan (U.S.)

- Pak Group (USA) – makers of Bellarise® (U.S.)

- DSM-Firmenich (Switzerland)

Latest Developments in Global Beverage Flavoring Market

- In March 2024, Kerry Group introduced a new line of plant-based Beverage Flavoring under its “Radicle™” portfolio, targeting the growing demand for vegan and clean-label bakery products. The new formulations include plant-based emulsifiers and enzyme blends that enhance texture, shelf life, and dough handling in baked goods.

- In January 2024, Cargill launched BakeMax™ Ultra, an innovative range of bakery fats and oils developed to improve aeration, stability, and mouthfeel in pastries and cakes. This development supports bakery manufacturers seeking to optimize performance while reducing saturated fat content.

- In October 2023, Corbion N.V. expanded its sustainable bakery ingredient line with the release of a new clean-label mold inhibition solution, Verdad® MP100, which uses natural vinegar and fermentation technology to extend shelf life without synthetic additives.

- In August 2023, Lesaffre opened a new baking ingredient application center in Mexico to accelerate product development and customer collaboration across Latin America. The facility focuses on localizing solutions for artisanal and industrial bakers using innovative yeast and enzyme technologies.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。