Global Cryo

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

3.98 Billion

2024

2032

USD

1.30 Billion

USD

3.98 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Global Cryo-Electron Microscopy Market Segmentation, By Product Type (Hardware and Software), Method Type (Electron Crystallography, Single Particle Analysis, Cryo-Electron Tomography, and Others), Nano Formulations (Lipid Nanoparticle Formulations (LNFS), Metal Oxide Formulations, Metal Formulations, and Others), Technology (Transmission Electron Microscopy (TEM), Scanning Electron Microscopy (SEM), and Nuclear Magnetic Resonance (NMR) Microscopy), Mounting Technique (Surface Mounting, Edge Mounting, Film Emulsion Mounting, Rivet Mounting, and Others), Application (Biological Science, Material Science, Nanotechnology, Lifesciences, Medical, Semiconductors, and Others) End User (Research Laboratories and Institutes, Forensic and Diagnostic Laboratories, Pharmaceutical and Biotechnology Companies, Contract Research Organization, and Others), Distribution Channel (Direct Tenders, Third Party Distribution, and Others) - Industry Trends and Forecast to 2032

Cryo-Electron Microscopy Market Size

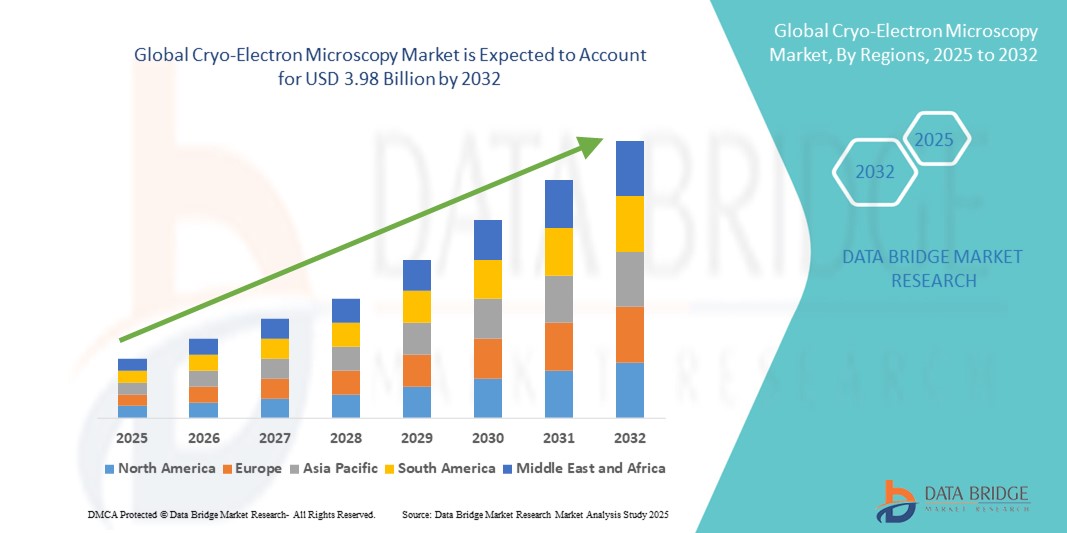

- The global cryo-electron microscopy market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 3.98 billion by 2032, at a CAGR of 14.99% during the forecast period

- The market growth is largely driven by increasing demand for advanced structural biology tools in drug discovery and life sciences research, enabling high-resolution visualization of biomolecules

- Furthermore, the growing prevalence of chronic and infectious diseases, coupled with the rising need for precision medicine and academic research advancements, is establishing cryo-EM as a key imaging technology of choice. These converging factors are accelerating the adoption of cryo-electron microscopy solutions, thereby significantly boosting the industry's growth

Cryo-Electron Microscopy Market Analysis

- Cryo-electron microscopy (cryo-EM), enabling high-resolution imaging of biomolecules in their native state, is increasingly becoming an indispensable tool in structural biology, drug discovery, and advanced life sciences research due to its ability to deliver detailed molecular insights without crystallization

- The accelerating demand for cryo-EM is primarily driven by the growing need for precision medicine, rising investments in biomedical research, and the adoption of advanced imaging solutions by pharmaceutical and academic institutions worldwide

- North America dominated the cryo-electron microscopy market with the largest revenue share of 40.2% in 2024, supported by strong research funding, established biotechnology and pharmaceutical sectors, and the presence of leading instrument manufacturers, with the U.S. spearheading adoption in both academia and industry

- Asia-Pacific is expected to be the fastest growing region in the cryo-electron microscopy market during the forecast period, propelled by expanding research infrastructure, government initiatives in life sciences, and increasing collaborations with global pharmaceutical companies

- The single particle analysis segment dominated the cryo-electron microscopy market with a market share of 47% in 2024, driven by its ability to determine structures of proteins and large complexes with high accuracy, fueling breakthroughs in drug development and disease mechanism studies

Report Scope and Cryo-Electron Microscopy Market Segmentation

|

Attributes |

Cryo-Electron Microscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cryo-Electron Microscopy Market Trends

Advancements Through AI and Automation Integration

- A significant and accelerating trend in the global cryo-EM market is the integration of artificial intelligence (AI) and automated data processing tools, which enhance image reconstruction, particle picking, and structural analysis efficiency

- For instance, Thermo Fisher Scientific’s latest cryo-EM platforms incorporate AI-driven image analysis workflows, enabling researchers to achieve faster high-resolution results with reduced manual intervention. Similarly, JEOL and Hitachi are deploying automation modules that optimize sample loading, imaging, and data acquisition

- AI integration in cryo-EM enables predictive modeling, denoising of images, and refinement of 3D structures, accelerating structural determination of complex biomolecules. Automated systems allow researchers to handle higher throughput with consistent reproducibility while minimizing human error

- The combination of AI and automated workflows supports seamless integration with laboratory information management systems (LIMS) and cloud-based data platforms, enabling centralized control and collaborative research across multiple sites

- This trend toward more intelligent, automated, and high-throughput cryo-EM systems is reshaping expectations for molecular imaging, prompting companies such as Thermo Fisher Scientific and JEOL to develop platforms with end-to-end AI and automation capabilities

- The demand for cryo-EM systems with advanced AI and automation features is growing rapidly across academic, pharmaceutical, and biotechnology sectors, driven by the need for faster, accurate, and reproducible structural data

Cryo-Electron Microscopy Market Dynamics

Driver

Rising Demand in Structural Biology and Drug Discovery

- The increasing focus on precision medicine, structural biology research, and complex biomolecular studies is a major driver for cryo-EM adoption

- For instance, in March 2024, Thermo Fisher Scientific introduced enhanced AI-assisted cryo-EM software for pharmaceutical research, enabling faster protein-ligand structure analysis and accelerating drug development pipelines

- As the demand for high-resolution molecular imaging rises, cryo-EM offers unparalleled capabilities for visualizing proteins, viruses, and other macromolecules in near-native states, facilitating breakthroughs in drug discovery and biomedical research

- In addition, the growing prevalence of chronic and infectious diseases is boosting research funding and infrastructure investment, further increasing the adoption of cryo-EM in both academia and industry

- The integration of cryo-EM into drug discovery pipelines, collaborative research programs, and multi-site facilities continues to drive the market forward, enhancing throughput, efficiency, and reproducibility

Restraint/Challenge

High Capital Investment and Technical Expertise Requirement

- The high acquisition cost of cryo-EM instruments, coupled with substantial maintenance and operational expenses, poses a significant barrier to market expansion, particularly for smaller research institutions or emerging markets

- For instance, comprehensive cryo-EM setups, including microscopes, detectors, and automation modules, can cost several million USD, limiting accessibility to well-funded laboratories

- In addition, cryo-EM requires highly skilled personnel for sample preparation, imaging, and data interpretation, creating a technical expertise barrier that slows adoption. Companies such as Thermo Fisher and JEOL provide training and support, but the learning curve remains steep

- Furthermore, managing large volumes of imaging data and integrating results into research workflows requires robust IT infrastructure, which can be challenging for institutions with limited resources

- Addressing these challenges through cost-effective instrument options, cloud-based data analysis solutions, and comprehensive training programs will be critical to expanding the global cryo-EM market

Cryo-Electron Microscopy Market Scope

The market is segmented on the basis of product type, method type, nano formulations, technology, mounting technique, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the cryo-electron microscopy market is segmented into hardware and software. The hardware segment dominated the market in 2024 with the largest revenue share, driven by the essential need for advanced electron microscopes, cryo-stages, and high-resolution detectors. Hardware forms the backbone of cryo-EM research and is widely used in structural biology, pharmaceutical R&D, and nanotechnology studies. Its dominance is supported by continuous technological upgrades that improve imaging resolution, throughput, and automation. Recurring maintenance and service contracts further strengthen revenue contribution from this segment. Leading companies focus on integrating hardware solutions with compatible software for seamless data acquisition and analysis. High-capacity laboratories and academic research centers prefer hardware investments to enable long-term, scalable cryo-EM workflows.

The software segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing adoption of AI-assisted data processing, automated particle picking, and 3D reconstruction solutions. Advanced software accelerates structural determination and reduces human error, enabling researchers to analyze complex biomolecules faster. Cloud-based and subscription software models also make cryo-EM more accessible to smaller laboratories and emerging markets. Integration of software with LIMS and cloud storage systems enhances collaboration and reproducibility across research facilities, driving demand for advanced analytics platforms.

- By Method Type

On the basis of method type, the cryo-electron microscopy market is segmented into electron crystallography, single particle analysis, cryo-electron tomography, and others. The single particle analysis segment dominated the market in 2024 with a market share of 47%, owing to its capability to resolve high-resolution structures of proteins, viruses, and macromolecular complexes without requiring crystallization. It is widely applied in pharmaceutical R&D, vaccine development, and structural biology research. The segment’s dominance is reinforced by automated software pipelines and AI-assisted reconstruction, which streamline data analysis and improve accuracy. Single particle analysis remains critical for understanding disease mechanisms and enabling drug design innovations. Its adoption is supported by substantial investment from academia, biotech, and pharmaceutical companies globally. This method continues to benefit from ongoing research innovations that improve sample preparation and imaging efficiency.

The cryo-electron tomography segment is expected to grow the fastest during the forecast period, driven by rising applications in cellular biology, nanotechnology, and advanced material studies. Cryo-ET allows 3D visualization of complex cellular structures in near-native conditions, offering detailed insights into molecular interactions. Integration with complementary imaging techniques such as correlative light and electron microscopy further enhances its utility. Increasing demand for precise cellular-level imaging and visualization of protein complexes fuels adoption in research and industrial laboratories. Technological advancements in automation, high-speed detectors, and low-dose imaging contribute to accelerating growth of this segment.

- By Nano Formulations

On the basis of nano formulations, the cryo-electron microscopy market is segmented into lipid nanoparticle formulations (LNFs), metal oxide formulations, metal formulations, and others. The lipid nanoparticle formulations segment dominated the market in 2024, driven by its importance in analyzing mRNA vaccines, drug delivery systems, and therapeutic nanoparticles. LNFs are widely used in pharmaceutical and biomedical research for structural characterization of nanoparticles, aiding in design and optimization. Collaboration between pharmaceutical companies and academic laboratories reinforces demand for cryo-EM analysis of lipid-based formulations. Its established use in R&D and clinical applications makes it a high-revenue contributor. The segment benefits from technological advancements that enable precise imaging and structural determination. Cryo-EM provides detailed structural insights, accelerating development of effective nanoparticle-based therapies.

The metal oxide formulations segment is projected to witness the fastest growth from 2025 to 2032, attributed to expanding use in materials science, catalysis research, and semiconductor applications. Researchers increasingly rely on cryo-EM to visualize nanoscale morphology, composition, and crystallinity of metal oxides. Growth is further supported by industrial demand for high-performance materials and advanced nanostructures. Innovations in imaging techniques and sample preparation enhance resolution and reproducibility, accelerating adoption. Expanding research in energy storage, electronics, and advanced materials is driving strong growth in this segment.

- By Technology

On the basis of technology, the cryo-electron microscopy market is segmented into transmission electron microscopy (TEM), scanning electron microscopy (SEM), and nuclear magnetic resonance (NMR) microscopy. The TEM segment dominated the market in 2024, owing to its superior resolution and widespread use in single particle analysis and cryo-electron tomography. TEM is preferred for structural biology, nanotechnology, and pharmaceutical research. Technological advancements in low-dose imaging, direct electron detectors, and automated workflows enhance its efficiency and accuracy. Continuous integration with AI-based software and data management platforms strengthens its adoption in academic and industrial laboratories. High investment in TEM infrastructure ensures long-term dominance in the market. TEM remains a core platform for understanding molecular and cellular structures in near-native states.

The SEM segment is expected to witness the fastest growth from 2025 to 2032, driven by expanding applications in material science, surface characterization, and nanostructure imaging. High-resolution SEM with cryogenic capabilities is increasingly used for advanced materials and semiconductor research. Its integration with complementary TEM workflows provides comprehensive structural insights. Industrial adoption in electronics, catalysis, and materials manufacturing supports strong growth. Automation and improved detector technology further accelerate the uptake of SEM solutions. The segment benefits from increasing research collaborations and industrial R&D investments.

- By Mounting Technique

On the basis of mounting technique, the cryo-electron microscopy market is segmented into surface mounting, edge mounting, film emulsion mounting, rivet mounting, and others. The film emulsion mounting segment dominated the market in 2024, as it provides stable support for delicate biological samples, minimizing structural distortion during imaging. Its compatibility with automated sample loaders enhances throughput and reliability. Film emulsion mounting is widely adopted in pharmaceutical, academic, and biotechnology research for high-resolution studies. Continuous advancements in support films and grid preparation techniques further solidify its market dominance. Leading laboratories prioritize this mounting method for reproducibility and accuracy. It remains a standard method for cryo-EM sample preparation globally.

The edge mounting segment is expected to witness the fastest growth from 2025 to 2032, due to its increasing use in materials science, nanotechnology, and semiconductor applications where precise orientation is critical. Improved tools for edge mounting and automated handling facilitate broader adoption. Researchers prefer this technique for analyzing thin films, nanosheets, and engineered nanostructures. Increasing industrial applications and academic interest in advanced material imaging drive rapid growth. Ongoing R&D in sample preparation technologies further enhances its market potential.

- By Application

On the basis of application, the cryo-electron microscopy market is segmented into biological science, material science, nanotechnology, life sciences, medical, semiconductors, and others. The biological science segment dominated the market in 2024, driven by widespread use in protein structure determination, virus research, and drug discovery. Cryo-EM allows detailed structural insights without the need for crystallization, facilitating vaccine development and therapeutic innovation. High adoption in pharmaceutical, academic, and government research institutions supports consistent market leadership. Increasing R&D funding and collaboration initiatives further reinforce this segment’s dominance. Cryo-EM in biological science enables precision medicine and accelerates understanding of disease mechanisms.

The nanotechnology segment is expected to witness the fastest growth from 2025 to 2032, as cryo-EM is increasingly used to visualize nanoparticles, nanostructures, and advanced materials. Its high-resolution imaging capability supports innovations in electronics, catalysis, and energy storage. Integration with AI and automation accelerates research timelines and throughput. Industrial adoption in semiconductor and material engineering research drives rapid expansion. Growing demand for nanoscale characterization in both academic and commercial research underpins strong growth potential.

- By End User

On the basis of end user, the cryo-electron microscopy market is segmented into research laboratories and institutes, forensic and diagnostic laboratories, pharmaceutical and biotechnology companies, contract research organizations, and others. The research laboratories and institutes segment dominated the market in 2024, due to high investments in fundamental research, structural biology, and academic programs. These institutions are the primary adopters of high-end cryo-EM systems for structural analysis and teaching. Established collaborations with pharmaceutical and biotech companies strengthen demand further. Large-scale laboratories prefer comprehensive cryo-EM platforms that include hardware, software, and training support. High adoption in universities and government-funded research centers ensures sustained dominance.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest growth from 2025 to 2032, as cryo-EM becomes integral to drug discovery, vaccine development, and therapeutic research. The technology accelerates structural studies, reduces dependency on crystallization, and allows detailed visualization of complex biomolecules. Increasing investment in R&D, integration with AI-based workflows, and collaborative research projects drive rapid adoption. Its application in preclinical and clinical research pipelines enhances research efficiency. The commercial sector’s need for high-throughput and accurate molecular imaging fuels the segment’s growth trajectory.

- By Distribution Channel

On the basis of distribution channel, the cryo-electron microscopy market is segmented into direct tenders, third-party distribution, and others. The direct tenders segment dominated the market in 2024, owing to the high-value and highly specialized nature of cryo-EM instruments that require manufacturer-led installation, training, and maintenance. Direct procurement ensures technical compliance, warranty coverage, and seamless integration with laboratory infrastructure. Research institutions and pharmaceutical companies prefer this channel for complex systems. Dedicated service contracts and long-term support reinforce its dominance. Direct tenders also allow customization according to laboratory-specific requirements, making it a preferred choice globally.

The third-party distribution segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing presence of authorized resellers, refurbished instrument providers, and lease-based models. This channel makes cryo-EM technology more accessible to smaller laboratories, startups, and emerging markets. It supports flexible financing, quicker deployment, and localized technical assistance. Rising adoption of refurbished and cost-effective solutions enhances market penetration. Collaboration with distributors also enables companies to expand their geographic reach efficiently.

Cryo-Electron Microscopy Market Regional Analysis

- North America dominated the cryo-electron microscopy market with the largest revenue share of 40.2% in 2024, supported by strong research funding, established biotechnology and pharmaceutical sectors, and the presence of leading instrument manufacturers, with the U.S. spearheading adoption in both academia and industry

- The region benefits from well-established research institutions, universities, and biotechnology hubs that are early adopters of high-end cryo-EM systems for drug discovery, vaccine development, and molecular-level studies

- This widespread implementation of AI-assisted workflows, automated imaging, and high-resolution detectors further strengthens market penetration in North America, enabling faster and more accurate structural analysis

U.S. Cryo-Electron Microscopy Market Insight

The U.S. cryo-electron microscopy market captured the largest revenue share of 42% in 2024, driven by substantial investments in structural biology, pharmaceutical R&D, and life sciences research. Research institutions, universities, and biotechnology hubs are early adopters of advanced cryo-EM instruments for protein structure determination, vaccine development, and drug discovery. The growing trend of integrating AI and automated workflows with high-resolution detectors enhances efficiency and accelerates molecular-level studies. Strong government and private R&D funding, coupled with collaborations between academic and industrial laboratories, further propel market growth. Increasing adoption in commercial pharmaceutical research and high-throughput laboratories reinforces the U.S. as a dominant regional market. Continuous technological innovation and skilled workforce availability strengthen the country’s leadership in cryo-EM adoption.

Europe Cryo-EM Market Insight

The Europe cryo-electron microscopy market is projected to expand at a robust CAGR during the forecast period, fueled by extensive research funding, growing structural biology initiatives, and collaborative projects across EU countries. Countries such as Germany, the U.K., and France are driving adoption through investments in pharmaceutical R&D, nanotechnology, and academic research programs. The increasing use of high-resolution imaging for vaccine development, molecular studies, and advanced material characterization supports market growth. European institutions also benefit from integration of automated imaging and AI-assisted reconstruction workflows. The demand for precision medicine and structural research in residential, commercial, and research laboratories is steadily rising. Furthermore, regulatory support and government-backed innovation programs enhance the adoption of cryo-EM systems across the region.

U.K. Cryo-EM Market Insight

The U.K. cryo-electron microscopy market is expected to grow at a significant CAGR during the forecast period, driven by the country’s focus on life sciences research, structural biology, and drug discovery. Rising concerns about infectious diseases, vaccine development, and molecular-level research encourage adoption of cryo-EM in academic and industrial laboratories. The U.K.’s well-established research infrastructure, combined with high R&D investment and collaborative programs with pharmaceutical companies, promotes widespread deployment. Integration of AI-driven data analysis and automated workflows supports faster and more precise structural studies. Increasing emphasis on high-throughput molecular imaging in universities and biotechnology centers fuels the growth of cryo-EM systems. The region’s focus on innovation and advanced research capabilities strengthens its market outlook.

Germany Cryo-EM Market Insight

The Germany cryo-electron microscopy market is anticipated to expand at a considerable CAGR during the forecast period, driven by strong emphasis on structural biology, material science, and pharmaceutical research. High awareness of molecular imaging and digital research technologies encourages laboratories to adopt advanced cryo-EM platforms. Germany’s robust research infrastructure, coupled with the presence of leading cryo-EM instrument manufacturers, facilitates deployment in both academic and commercial settings. Integration of AI-assisted imaging and automated sample handling systems enhances efficiency and throughput. The country’s focus on precision medicine and innovation in drug discovery strengthens market adoption. In addition, regulatory support for advanced scientific research contributes to Germany’s growing share in the European cryo-EM market.

Asia-Pacific Cryo-EM Market Insight

The Asia-Pacific cryo-electron microscopy market is expected to grow at the fastest CAGR of 25% during the forecast period, driven by increasing investments in biotechnology, nanotechnology, and life sciences research in countries such as China, Japan, and India. Rapid urbanization, technological advancements, and government initiatives supporting digitalization in research infrastructure accelerate adoption. APAC is emerging as a manufacturing and innovation hub for cryo-EM systems, improving affordability and accessibility for academic and commercial laboratories. Expanding pharmaceutical and biotechnology R&D, coupled with collaborations with global instrument providers, enhances market penetration. Rising interest in vaccine development, infectious disease research, and precision medicine further supports growth. The region’s growing technical expertise and skilled workforce facilitate wider adoption of advanced cryo-EM platforms.

Japan Cryo-EM Market Insight

The Japan cryo-electron microscopy market is gaining momentum due to the country’s high-tech research culture, rapid urbanization, and demand for precision in molecular studies. Adoption is driven by increasing use of cryo-EM in pharmaceutical R&D, structural biology, and vaccine development. Integration with AI-based data analysis and automated imaging workflows accelerates research throughput. Japan’s advanced life sciences infrastructure and strong focus on innovation promote deployment across universities, biotech firms, and research institutes. Growing collaborations with international companies support access to cutting-edge cryo-EM systems. Furthermore, the need for high-resolution imaging in cellular and molecular studies encourages broader adoption across residential, commercial, and research laboratories.

India Cryo-EM Market Insight

The India cryo-electron microscopy market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a growing biotechnology sector, and expanding life sciences research. India’s increasing adoption of advanced laboratory technologies, coupled with government initiatives promoting scientific infrastructure and smart research centers, drives market growth. Academic and pharmaceutical laboratories are increasingly investing in cryo-EM for structural biology, drug discovery, and vaccine research. Availability of cost-effective cryo-EM solutions and partnerships with global instrument manufacturers enhances accessibility. The rise of smart research labs and biotechnology startups further propels adoption. India’s expanding middle-class research workforce and focus on innovation are key factors shaping market expansion in the region.

Cryo-Electron Microscopy Market Share

The cryo-electron microscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher Corporation (U.S.)

- JEOL Ltd. (Japan)

- Hitachi High-Tech Corporation (Japan)

- Leica Microsystems GmbH (Germany)

- Carl Zeiss AG (Germany)

- Gatan, Inc. (U.S.)

- Oxford Instruments plc (U.K.)

- Olympus Corporation (Japan)

- KEYENCE Corporation (Japan)

- FEI Company (U.S.)

- Bruker Corporation (U.S.)

- Delong Instruments (Czech Republic)

- Tescan Orsay Holding (Czech Republic)

- Park Systems Corp. (South Korea)

- NanoImaging Services (U.S.)

- Helix BioStructures (U.S.)

- Generate Biomedicines (U.S.)

- Intertek Group plc (U.K.)

- Creative Biostructure (U.S.)

What are the Recent Developments in Global Cryo-Electron Microscopy Market?

- In April 2025, Thermo Fisher Scientific introduced the Krios 5 Cryo-Transmission Electron Microscope (TEM). This next-generation, atomic-resolution platform is designed to boost productivity and performance with enhanced automation, including AI-powered experimental setup. The Krios 5 aims to improve the speed and fidelity of structural biology workflows such as single-particle analysis (SPA) and cryo-electron tomography (cryo-ET), enabling researchers to gain new insights into diseases and accelerate drug discovery

- In April 2025, Thermo Fisher Scientific announced a technology alliance agreement with the Chan Zuckerberg Institute for Advanced Biological Imaging (CZ Imaging Institute). This partnership aims to advance cryo-EM technology by focusing on the development and refinement of laser phase plate technology. The goal is to enhance the capabilities of cryo-EM to visualize human cells at unprecedented resolution, which can lead to new therapeutic developments and scientific discoveries

- In December 2024, the Instruct Centre FR2 in Grenoble introduced the Titan Krios G4 cryo-electron microscope. Equipped with advanced features such as a cold field emission gun, Selectris X energy filter, and Falcon 4i electron detector, this addition significantly enhances the center's imaging capabilities for structural biology research

- In January 2022, ICU Medical Inc. completed its acquisition of Smiths Medical from Smiths Group plc. The acquisition, valued at approximately USD 2.35 billion, was a major strategic move to expand ICU Medical's product portfolio to include a wider range of critical care and infusion therapy products. This consolidation created a leading U.S.-based infusion therapy company with an estimated pro forma combined revenue of around USD 2.5 billion, enhancing its global reach and strengthening its ability to compete in the medical device market

- In May 2021, the Institute of Molecular Genetics (IMG) of the Czech Academy of Sciences announced a scientific partnership with the Brno-based electron microscope manufacturer, TESCAN. As part of this collaboration, TESCAN provided the IMG with its new AMBER cryo-electron microscope. This partnership is designed to connect developers of top laboratory devices with researchers for the direct application of new technologies in practice

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。