Global Interactive Dog Toys Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

362.50 Million

USD

527.47 Million

2024

2032

USD

362.50 Million

USD

527.47 Million

2024

2032

| 2025 –2032 | |

| USD 362.50 Million | |

| USD 527.47 Million | |

|

|

|

|

Global Interactive Dog Toys Market Segmentation, By Product Type (Puzzle Toys, Fetch Toys, Chew Toys, Treat Dispensing Toys, Tug Toys, Interactive Balls, Plush Toys with Squeakers, Electronic Toys, and Rubber Toys), Distribution Channel (Online Retail, Specialty Pet Stores, Supermarkets/Hypermarkets, Veterinary Clinics, Department Stores, and Others), Consumer Demographics (Age of Dog Owners, Income Level, Urban areas, Rural Areas, and Pet Ownership Trends), Price Range (Economy/Budget-friendly, Mid-range, and Premium/Luxury), Material Used (Rubber, Nylon, Plush, Plastic, Fabric, and Natural Materials) - Industry Trends and Forecast to 2032

What is the Global Interactive Dog Toys Market Size and Growth Rate?

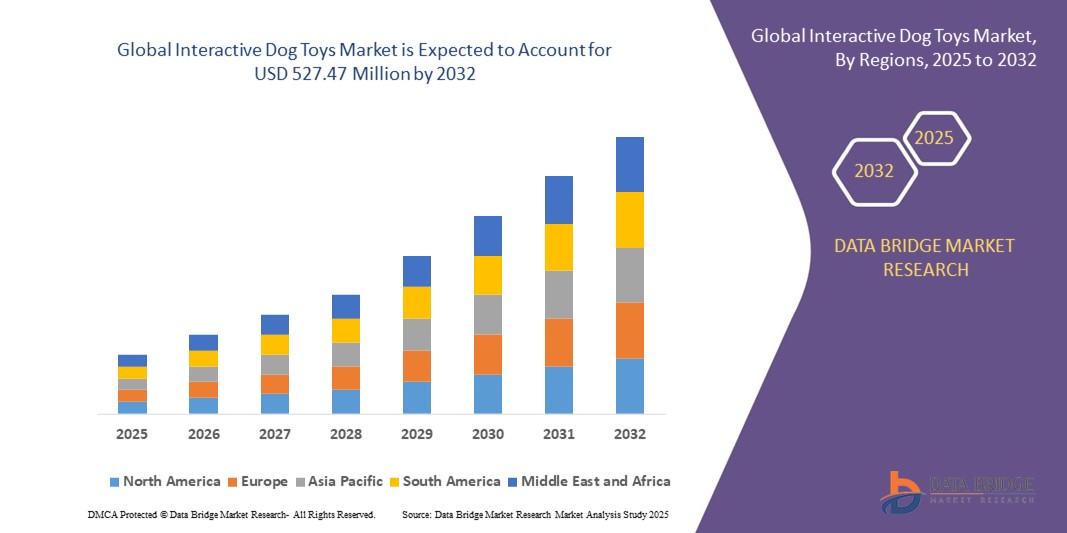

- The global interactive dog toys market size was valued at USD 362.50 million in 2024 and is expected to reach USD 527.47 million by 2032, at a CAGR of 4.80% during the forecast period

- The global interactive dog toys market is anticipated for steady growth due to increased pet ownership, heightened awareness of pet mental health, busy lifestyles necessitating convenient pet entertainment solutions, technological advancements enhancing toy features, and the trend of treating pets as family members, driving demand for products that enhance their well-being and happiness

What are the Major Takeaways of Interactive Dog Toys Market?

- The continuous evolution of technology has significantly impacted the design and functionality of global interactive dog toys. Motion sensors, artificial intelligence, Bluetooth connectivity, and programmable features to create toys that offer more engaging and personalized experiences for dogs

- These technology advancements improve the toys' ability to keep dogs engaged mentally and physically. Pet owners are becoming more and more attracted to these cutting-edge products as smart toys that can change difficulty levels, give treats, or give feedback based on a dog's interaction are introduced

- Asia-Pacific dominated the interactive dog toys market with the largest revenue share of 42.3% in 2024, driven by the increasing adoption of pet-centric products, rising disposable incomes, and a growing population of dog owners in countries such as China, Japan, and India

- North America interactive dog toys market is poised to grow at the fastest CAGR of 11.9% during the forecast period of 2025 to 2032, fueled by rising pet humanization, premiumization of pet products, and increasing demand for smart and interactive toys

- The Puzzle Toys segment dominated the market with a largest revenue share of 28.5% in 2024, driven by the increasing awareness among pet owners regarding mental stimulation and enrichment for dogs

Report Scope and Interactive Dog Toys Market Segmentation

|

Attributes |

Interactive Dog Toys Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Interactive Dog Toys Market?

Enhanced Play and Engagement Through Smart Features

- A major and accelerating trend in the global interactive dog toys market is the growing incorporation of smart technology, AI, and mobile app connectivity into pet toys, enhancing play experience, engagement, and monitoring of pets

- For instance, smart treat-dispensing toys such as iFetch allow pet owners to schedule playtime and dispense treats remotely via a mobile app, ensuring pets stay active and entertained even when owners are away. Similarly, robotic toys such as Petcube Bites integrate camera functionality, enabling interaction with pets through voice and video commands

- AI-powered features in interactive dog toys enable behavior tracking, personalized play routines, and smart treat dispensing based on pet activity patterns. Certain models also send notifications to owners if pets are underactive or exhibit unusual behavior, enhancing pet care

- The seamless integration of interactive dog toys with smart home ecosystems and digital assistants allows centralized control for multiple toys and connected devices, creating a more interactive and automated play environment

- This trend toward more intelligent, engaging, and connected pet toys is redefining pet owners’ expectations, with companies such as Outward Hound and KONG Company developing AI-enabled and app-controlled toys to enhance both engagement and convenience

- The demand for interactive dog toys with smart features and connectivity is rapidly increasing across both urban and suburban households, as pet owners prioritize convenience, health, and entertainment for their pets

What are the Key Drivers of Interactive Dog Toys Market?

- The rising pet ownership globally, especially in urban areas, coupled with increasing awareness of pet health and enrichment, is a key driver for the demand for interactive dog toys

- For instance, in 2023, iFetch expanded its robotic ball launchers for dogs, offering smart app-controlled features that allow owners to interact with their pets remotely, driving innovation and market adoption

- Pet owners are seeking toys that offer mental stimulation, physical activity, and personalized interaction, which interactive dog toys provide more effectively than conventional toys

- The growth of connected devices and IoT applications in pet care is further integrating smart pet toys into the modern household, enabling remote control, tracking, and customized play routines

- The convenience of automated treat dispensing, app-based control, and smart scheduling is boosting adoption among busy pet owners, with DIY and app-enabled interactive dog toys becoming increasingly popular in both small and large households

Which Factor is Challenging the Growth of the Interactive Dog Toys Market?

- Concerns around data privacy and connectivity issues of app-enabled and smart pet toys present a challenge to broader adoption. Since many toys connect to Wi-Fi or Bluetooth, they may be susceptible to technical glitches or unauthorized access

- For instance, high-profile security vulnerabilities reported in smart pet devices have made some consumers hesitant to adopt connected toys for their pets

- Addressing these concerns through secure connectivity, firmware updates, and reliable software is essential for building consumer trust. Premium toys with advanced robotics or AI features often carry a higher price tag, which can be a barrier for price-sensitive buyers

- While entry-level and basic smart toys are becoming more affordable, the perceived cost of high-end interactive toys may still limit adoption in some markets

- Overcoming these challenges through consumer education, enhanced security features, and affordable smart toy options will be critical to sustaining market growth and increasing penetration across pet-owning households

How is the Interactive Dog Toys Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product Type

On the basis of product type, the interactive dog toys market is segmented into Puzzle Toys, Fetch Toys, Chew Toys, Treat Dispensing Toys, Tug Toys, Interactive Balls, Plush Toys with Squeakers, Electronic Toys, and Rubber Toys. The Puzzle Toys segment dominated the market with a largest revenue share of 28.5% in 2024, driven by the increasing awareness among pet owners regarding mental stimulation and enrichment for dogs. Puzzle Toys encourage problem-solving and reduce boredom, making them highly preferred in urban households with limited outdoor space.

The Treat Dispensing Toys segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by their growing popularity in smart homes and integration with app-based control systems. These toys offer both play and reward, engaging pets for longer durations while allowing owners to manage feeding and training remotely, contributing to higher adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Retail, Specialty Pet Stores, Supermarkets/Hypermarkets, Veterinary Clinics, Department Stores, and Others. The Online Retail segment dominated with a market share of 41.2% in 2024, owing to the convenience of home delivery, a wide product assortment, and competitive pricing. E-commerce platforms also enable access to smart and tech-enabled Interactive Dog Toys, which are otherwise limited in physical stores.

The Specialty Pet Stores segment is projected to register the fastest growth rate of 20.8% during 2025–2032, driven by personalized customer service, expert advice, and exclusive products catering to premium and smart dog toys. Consumers increasingly prefer niche pet stores for innovative toys and products that offer better quality, durability, and advanced features.

- By Consumer Demographics

On the basis of consumer demographics, the market is segmented into Age of Dog Owners, Income Level, Urban Areas, Rural Areas, and Pet Ownership Trends. The Urban Areas segment held the largest revenue share of 45.6% in 2024, supported by a rising number of pet owners living in apartments and cities with limited outdoor space. Urban pet owners seek toys that provide both mental and physical stimulation indoors, including tech-enabled and interactive solutions.

The Income Level – High Income segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, driven by increasing disposable income and willingness to invest in premium and smart toys for pets. Growing trends in pet humanization, adoption of smart pet care devices, and lifestyle-focused purchases further support market growth.

- By Price Range

On the basis of price range, the market is segmented into Economy/Budget-friendly, Mid-range, and Premium/Luxury. The Mid-range segment dominated the market with a share of 38.7% in 2024, as it offers a balanced combination of affordability, durability, and interactive features. Mid-range toys, including smart treat dispensers and puzzle toys, cater to the largest group of pet owners seeking value for money without compromising quality.

The Premium/Luxury segment is projected to record the fastest CAGR of 21.5% from 2025 to 2032, attributed to the increasing adoption of smart toys, tech-enabled devices, and innovative materials offering higher engagement, monitoring capabilities, and advanced safety standards.

- By Material Used

On the basis of material, the interactive dog toys market is segmented into Rubber, Nylon, Plush, Plastic, Fabric, and Natural Materials. The Rubber segment held the largest market share of 36.8% in 2024, owing to its durability, safety, and suitability for chewing and interactive activities. Rubber toys are especially preferred for aggressive chewers and for long-lasting play.

The Plush segment is expected to witness the fastest growth rate of 22% from 2025 to 2032, driven by the rising popularity of interactive and squeaky plush toys that combine comfort, entertainment, and bonding experiences for dogs, particularly in urban and indoor settings.

Which Region Holds the Largest Share of the Interactive Dog Toys Market?

- Asia-Pacific dominated the interactive dog toys market with the largest revenue share of 42.3% in 2024, driven by the increasing adoption of pet-centric products, rising disposable incomes, and a growing population of dog owners in countries such as China, Japan, and India

- Consumers in the region highly value toys that combine entertainment, mental stimulation, and health benefits for pets, making interactive dog toys increasingly popular

- This widespread adoption is further supported by the emergence of domestic manufacturers, government initiatives promoting pet welfare, and the rise of e-commerce platforms, establishing Asia-Pacific as the leading region in the global interactive dog toys market

China Interactive Dog Toys Market Insight

China interactive dog toys market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing pet adoption, and the expanding middle class. Pet owners are increasingly seeking interactive, tech-enabled, and treat-dispensing toys for both indoor and outdoor use. The availability of affordable and diverse Interactive Dog Toys, coupled with strong domestic production, is significantly driving market expansion in China, making it a critical growth hub for global manufacturers.

Japan Interactive Dog Toys Market Insight

Japan interactive dog toys market is growing steadily due to the country’s high-tech culture, increasing urbanization, and a focus on pet wellbeing. Japanese consumers prioritize innovative, safe, and interactive toys that provide mental stimulation for dogs, particularly in indoor living spaces. Integration with smart home devices and app-based control for toys is gaining popularity, while the aging population encourages demand for easy-to-use and convenient solutions in both residential and commercial settings.

Which Region is the Fastest Growing Region in the Interactive Dog Toys Market?

North America interactive dog toys market is poised to grow at the fastest CAGR of 11.9% during the forecast period of 2025 to 2032, fueled by rising pet humanization, premiumization of pet products, and increasing demand for smart and interactive toys. High disposable incomes, tech-savvy consumers, and the popularity of online retail channels are accelerating the adoption of advanced Interactive Dog Toys in the U.S. and Canada.

U.S. Interactive Dog Toys Market Insight

U.S. market captured the largest share within North America in 2024, driven by increasing consumer spending on pets, rising awareness of mental stimulation for dogs, and the adoption of interactive, app-controlled toys. The popularity of subscription-based toy services and smart toys integrated with voice assistants or mobile applications further supports market growth, positioning the U.S. as a key contributor to the region’s rapid expansion.

Canada Interactive Dog Toys Market Insight

Canada interactive dog toys market is witnessing steady growth, supported by rising pet ownership, the preference for high-quality and eco-friendly toys, and increasing adoption of tech-enabled products. Consumers are drawn to interactive and treat-dispensing toys that promote pet wellness, while the growing e-commerce ecosystem facilitates easier access to innovative products across urban and suburban areas.

Which are the Top Companies in Interactive Dog Toys Market?

The interactive dog toys industry is primarily led by well-established companies, including:

- KONG Company (U.S.)

- Outward Hound (U.S.)

- Radio Systems Corporation (U.S.)

- Petco Animal Supplies, Inc. (U.S.)

- ETHICAL PRODUCTS INC. (U.S.)

- West Paw (U.S.)

- TRIXIE Heimtierbedarf GmbH & Co. KG (Germany)

- iFetch (U.S.)

- Chuckit (U.S.)

- ETHICAL PRODUCTS INC. (U.S.)

- West Paw (U.S.)

What are the Recent Developments in Global Interactive Dog Toys Market?

- In December 2023, FetchCo, a sustainable pet product company, launched its new eco-friendly Global Interactive Dog Toys line, "GreenPaws Play," featuring toys made from recycled materials and sustainable resources. The line includes treat-dispensing puzzles and natural rubber chew toys, appealing to eco-conscious pet owners, and this launch reinforces FetchCo’s commitment to sustainability and innovation in the pet toy market

- In November 2023, BARK, a global omnichannel dog brand, partnered with Dunkin’ Joy in Childhood Foundation to introduce a special collection of dog toys, allowing visitors to Dunkin’ restaurants to purchase Dunkin’ Iced Coffee Combo Dog Toy for USD 15 or Dunkin’ Sausage, Egg, and Cheese Dog Toy for USD 13. This initiative expanded BARK’s market presence and created an engaging cause-related consumer experience

- In October 2023, FetchCo again announced its "GreenPaws Play" line of eco-friendly Global Interactive Dog Toys, made from sustainable and recycled materials, offering treat-dispensing and chew toys for dogs. This reiteration highlighted FetchCo’s dedication to reducing environmental impact while enhancing pet playtime and product innovation

- In July 2023, Earth Rated, a leader in multi-use wipes and pet clean-up products, launched a new range of dog toys designed to reduce boredom, provide mental stimulation, and promote daily exercise, strengthening the bond between dogs and owners. This expansion into interactive toys marked a strategic move to diversify Earth Rated’s product portfolio

- In May 2023, Playology introduced "We’ve Got Happy Down to a Science," showcasing its full product lineup and emphasizing scientifically-informed toy designs that stimulate instinct-driven play. The launch coincided with Playology’s sponsorship of the 147th Westminster Kennel Club Dog Show, highlighting the brand’s focus on innovative, research-backed pet play solutions

- In November 2022, Nylabone, part of Central Garden & Pet Company, unveiled a new range of play toys designed to encourage creative and engaging activities for dogs. This launch expanded Nylabone’s interactive toy offerings and reinforced its position in the pet enrichment segment

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。