Global Nano Packaging Materials Market for Food Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

4.43 Billion

USD

8.51 Billion

2024

2032

USD

4.43 Billion

USD

8.51 Billion

2024

2032

| 2025 –2032 | |

| USD 4.43 Billion | |

| USD 8.51 Billion | |

|

|

|

|

Global Nano Packaging Materials Market for Food Market Segmentation, By Technology (Active Packaging, Intelligent and Smart Packaging and Controlled Release Packaging), Application (Bakery Products, Meat Products, Beverages, Fruit and Vegetables, Prepared Foods and Others) - Industry Trends and Forecast to 2032

Nano Packaging Materials Market for Food Market Size

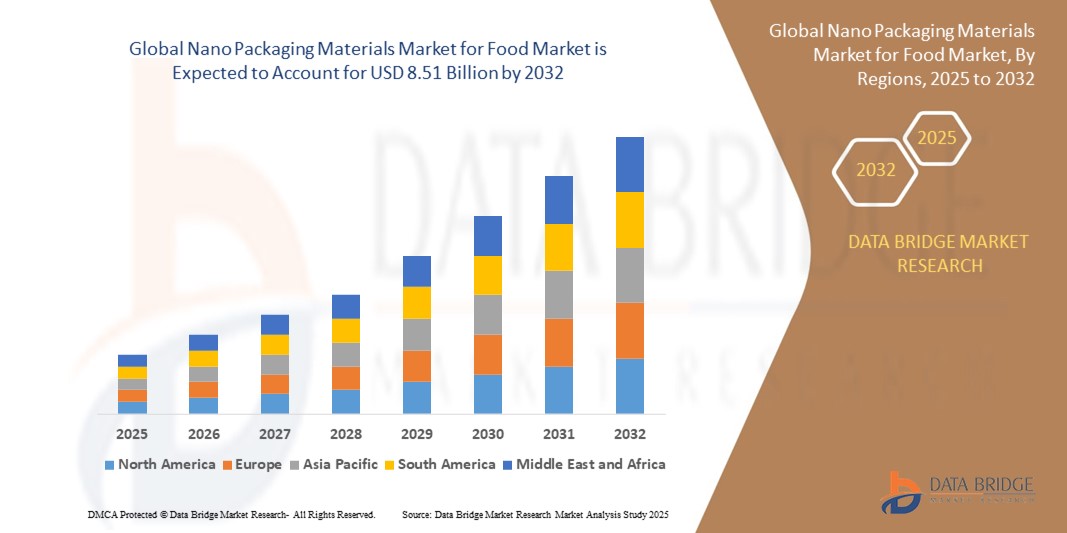

- The global nano packaging materials market for food market size was valued at USD 4.43 billion in 2024 and is expected to reach USD 8.51 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for food safety, extended shelf life, and improved barrier properties offered by nano packaging solutions

- Rising consumer awareness regarding freshness, contamination prevention, and sustainable packaging is further driving adoption across the food and beverage sector

Nano Packaging Materials Market for Food Market Analysis

- Nano packaging materials are increasingly being used to improve mechanical, thermal, and barrier properties of food packaging, ensuring longer shelf life and product safety

- Adoption is supported by innovations in nanocomposites, nano-coatings, and biodegradable nano-materials, enabling sustainable and high-performance packaging solutions

- Asia-Pacific dominated the nano packaging materials market for food with the largest revenue share of 42% in 2024, driven by rapid urbanization, rising packaged food consumption, and increasing adoption of advanced packaging technologies

- North America region is expected to witness the highest growth rate in the global nano packaging materials market for food market, driven by robust R&D investments, stringent food safety regulations, and widespread adoption of innovative packaging solutions across bakery, dairy, and perishable food segments

- The Active Packaging segment held the largest market revenue share in 2024, driven by its ability to extend shelf-life, inhibit microbial growth, and preserve product quality. Active packaging solutions often offer enhanced barrier properties, oxygen scavenging, and antimicrobial functionalities, making them highly suitable for perishable food items

Report Scope and Nano Packaging Materials Market for Food Market Segmentation

|

Attributes |

Nano Packaging Materials Market for Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nano Packaging Materials Market for Food Market Trends

Rising Adoption of Nano-Enhanced Packaging for Food Safety and Shelf-Life Extension

- The increasing use of nano packaging materials is transforming the food packaging landscape by enhancing barrier properties, antimicrobial protection, and mechanical strength. These innovations allow food products to remain fresher for longer, reducing spoilage and improving overall safety. In addition, nano coatings improve resistance to temperature fluctuations and physical damage during transportation, supporting global supply chain efficiency

- The high demand for intelligent and active packaging solutions in ready-to-eat, frozen, and perishable food segments is driving the adoption of nano coatings and nanocomposites. These materials are particularly valuable in markets with high consumption of packaged food and stringent safety regulations. They also enable real-time monitoring of food quality, freshness indicators, and contamination alerts, helping manufacturers reduce waste and improve consumer trust

- The affordability and versatility of modern nano packaging solutions are making them attractive for large-scale and small-scale food manufacturers alike, enabling improved shelf-life management without major logistical challenges. Furthermore, scalable production techniques and compatibility with existing packaging lines allow easy integration, reducing the need for significant capital investment

- For instance, in 2023, several food companies in Europe and North America implemented antimicrobial nano coatings in snack and dairy packaging, resulting in reduced spoilage and extended product shelf-life. These initiatives also led to lower returns, enhanced brand reputation, and increased adoption across multiple product categories, demonstrating measurable market benefits

- While nano packaging materials offer significant opportunities, consistent performance, regulatory compliance, and scalability remain essential for widespread adoption. Continuous research and development, along with industry collaboration, is critical to overcoming challenges and unlocking the full potential of nano-enhanced packaging

Nano Packaging Materials Market for Food Market Dynamics

Driver

Increasing Demand for Food Safety, Freshness, and Shelf-Life Preservation

- Rising consumer expectations for fresh, uncontaminated, and long-lasting food are pushing manufacturers to adopt nano packaging materials. Enhanced barrier properties protect against moisture, oxygen, and microbial contamination, reducing waste and improving quality. The trend is further fueled by increased awareness of health and hygiene, particularly in perishable and ready-to-eat products

- Regulatory pressure and stringent food safety standards in developed regions are encouraging adoption of innovative nano-enhanced packaging. This is creating demand for advanced nanocomposites, coatings, and intelligent packaging systems. Governments are offering incentives for compliance, which is motivating food manufacturers to shift toward technologically advanced solutions

- International organizations and industry bodies are promoting sustainable, high-performance packaging through funding programs, research, and technical guidance, supporting manufacturers in integrating nano solutions. Collaborative initiatives between universities, research institutes, and packaging companies are accelerating development of eco-friendly and high-efficiency nano materials

- For instance, in 2022, leading European food companies adopted nanocomposite packaging solutions for fresh dairy products, significantly lowering spoilage and aligning with EU food safety directives. This helped streamline supply chains, reduce environmental impact, and improve overall product traceability across distribution networks

- While demand for nano packaging is increasing, awareness, cost management, and technology standardization remain critical to achieving long-term adoption. Stakeholders must invest in training, certification, and education programs to ensure proper implementation and consumer confidence

Restraint/Challenge

High Cost of Nano Packaging Materials and Regulatory Hurdles

- Advanced nano packaging materials such as antimicrobial coatings, nanocomposites, and intelligent films carry a high cost, making them less accessible for small and medium-sized food producers. Price sensitivity remains a key adoption barrier. The high capital investment required for production and specialized equipment limits market penetration in emerging economies

- Many regions face strict regulatory frameworks for the use of nanomaterials in food packaging, requiring extensive safety testing and approvals, which can delay commercialization. Complex legal requirements and fragmented standards across countries make global market expansion challenging for manufacturers

- Supply chain limitations and lack of infrastructure for large-scale production of nano packaging solutions restrict availability, particularly in emerging markets. Dependence on specialized raw materials and limited supplier networks further exacerbate delays and increase operational costs for food companies

- For instance, in 2023, several food producers in Asia-Pacific delayed deployment of nano-enhanced packaging due to high costs and regulatory clearance requirements. This resulted in slower adoption rates despite strong market demand, highlighting the need for supportive policies and investment in infrastructure

- While technological advancements continue to improve cost efficiency and performance, overcoming regulatory and scalability challenges is crucial for market growth and global penetration. Continued innovation, strategic partnerships, and harmonized global standards are essential to unlock the full potential of nano packaging in the food sector

Nano Packaging Materials Market for Food Market Scope

The market is segmented on the basis of technology and application.

- By Technology

On the basis of technology, the nano packaging materials market for food is segmented into Active Packaging, Intelligent and Smart Packaging, and Controlled Release Packaging. The Active Packaging segment held the largest market revenue share in 2024, driven by its ability to extend shelf-life, inhibit microbial growth, and preserve product quality. Active packaging solutions often offer enhanced barrier properties, oxygen scavenging, and antimicrobial functionalities, making them highly suitable for perishable food items.

The Intelligent and Smart Packaging segment is expected to witness the fastest growth rate from 2025 to 2032, driven by features such as freshness indicators, temperature monitoring, and real-time quality tracking. Intelligent packaging provides better supply chain visibility, reduces food waste, and enhances consumer confidence, making it increasingly popular across retail and e-commerce food channels.

- By Application

On the basis of application, the market is segmented into Bakery Products, Meat Products, Beverages, Fruit and Vegetables, Prepared Foods, and Others. The Meat Products segment held a significant revenue share in 2024 due to the high demand for fresh and hygienic packaging that prevents spoilage, microbial contamination, and odor migration. Nano packaging materials for meat products help maintain quality during transportation and storage while meeting stringent food safety regulations.

The Bakery Products segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need to extend freshness, prevent staling, and improve shelf-life without chemical preservatives. Nano coatings and films are increasingly applied in bakery packaging to maintain texture, aroma, and appearance, supporting market expansion in both developed and emerging regions.

Nano Packaging Materials Market for Food Market Regional Analysis

- Asia-Pacific dominated the nano packaging materials market for food with the largest revenue share of 42% in 2024, driven by rapid urbanization, rising packaged food consumption, and increasing adoption of advanced packaging technologies

- Countries such as China, Japan, and India are witnessing strong demand for intelligent, active, and controlled-release packaging solutions to enhance food safety, shelf-life, and product quality

- This widespread adoption is supported by government initiatives promoting food safety, modernization of the food supply chain, and growing investments by domestic and international manufacturers in nanocomposite and coating technologies

China Nano Packaging Market Insight

The China nano packaging materials market for food captured the largest revenue share in 2024 within Asia-Pacific, fueled by the expanding middle class, high packaged food consumption, and technological adoption in the food industry. The country is focusing on food safety, extended shelf-life, and sustainable packaging, driving manufacturers to adopt advanced nanomaterials for bakery, dairy, meat, and beverage sectors.

Japan Nano Packaging Market Insight

The Japan nano packaging market is expected to witness the fastest growth rate from 2025 to 2032 due to a tech-savvy population, high demand for fresh and safe packaged foods, and strong emphasis on food quality. Integration of smart packaging and monitoring systems, alongside advanced barrier and antimicrobial solutions, is driving adoption in perishable products and convenience foods.

Europe Nano Packaging Market Insight

The Europe nano packaging materials market for food is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent food safety regulations and rising consumer awareness regarding product quality. Adoption is strong in bakery, dairy, and ready-to-eat foods, with manufacturers investing in antimicrobial coatings, oxygen scavenging films, and intelligent packaging solutions.

Germany Nano Packaging Market Insight

Germany’s nano packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by food safety compliance, technological adoption in processed food and beverage sectors, and high demand for sustainable packaging. Manufacturers focus on active and intelligent packaging to extend shelf-life, reduce spoilage, and meet consumer quality expectations.

U.K. Nano Packaging Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, supported by consumer preference for safe, fresh, and sustainable packaged food. The adoption of advanced nanomaterials in bakery, dairy, and convenience foods is facilitated by regulatory compliance, retail infrastructure, and investments in modern packaging solutions.

North America Nano Packaging Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032 in nano packaging materials for food, driven by high packaged food consumption, strict food safety standards, and the integration of intelligent packaging systems. Adoption is prominent in bakery, dairy, and meat products, with manufacturers investing in nanocomposite and antimicrobial solutions to meet regulatory requirements and consumer expectations.

U.S. Nano Packaging Market Insight

The U.S. nano packaging materials market for food is expected to witness the fastest growth rate from 2025 to 2032, driven by high packaged food consumption, stringent food safety standards, and growing demand for extended shelf-life solutions. Manufacturers are increasingly adopting active, intelligent, and controlled-release packaging to enhance food quality and safety across bakery, dairy, meat, and beverage segments. The trend is further supported by technological advancements, strong R&D infrastructure, and regulatory incentives promoting innovation in food packaging solutions.

Nano Packaging Materials Market for Food Market Share

The Nano Packaging Materials Market for Food industry is primarily led by well-established companies, including:

- AVERY DENNISON CORPORATION (U.S.)

- 3M (U.S.)

- BASF SE (Germany)

- Amcor plc (U.K.)

- Honeywell International Inc (U.S.)

- Chevron Phillips Chemical Company (U.S.)

- Sonoco Products Company (U.S.)

- danaflex (U.S.)

- Bemis Manufacturing Company (U.S.)

- Tetra Pak International S.A. (Switzerland)

- Sealed Air (U.S.)

- PPG Industries, Inc. (U.S.)

- Sidel Group (France)

- Dupont (U.S.)

- Dow (U.S.)

- Dupont Teijin Films U.S. Limited Partnership (U.S.)

- Klöckner Pentaplast (Germany)

- Crown (U.K.)

- Minerals Technologies Inc. (U.S.)

- Multisorb (U.S.)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。