Global Nerve Repair Biomaterials Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

11.16 Billion

USD

32.98 Billion

2024

2032

USD

11.16 Billion

USD

32.98 Billion

2024

2032

| 2025 –2032 | |

| USD 11.16 Billion | |

| USD 32.98 Billion | |

|

|

|

|

Global Nerve Repair Biomaterials Market Segmentation, By Products (Neurostimulation and Neuromodulation Devices), Application (Neurostimulation and Neuromodulation Applications, Direct Nerve Repair or Neurorrhaphy, Nerve Grafting, and Stem Cell Therapy) - Industry Trends and Forecast to 2032

Nerve Repair Biomaterials Market Size

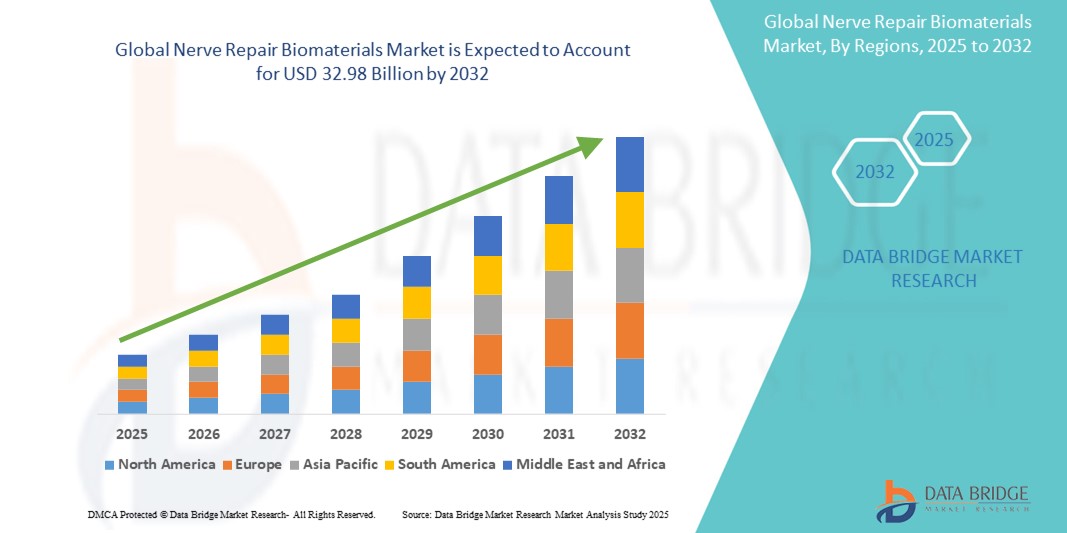

- The global nerve repair biomaterials market size was valued atUSD 11.16 billion in 2024and is expected to reachUSD 32.98 billion by 2032, at aCAGR of 14.50%during the forecast period

- This growth is driven by factors such as the rising prevalence of nerve injuries, increasing geriatric population, and advancements in biomaterial technologies enhancing nerve regeneration outcomes

Nerve Repair Biomaterials Market Analysis

- Nerve repair biomaterials are specialized materials designed to support the regeneration and repair of damaged peripheral and central nerves, aiding in functional recovery after nerve injuries. These include nerve conduits, wraps, and matrices used in neurosurgical and reconstructive procedures

- The demand for nerve repair biomaterials is significantly driven by the rising incidence of nerve injuries, growing geriatric population, and increasing adoption of biomaterials over traditional autografts due to reduced donor site complications

- North America is expected to dominate the nerve repair biomaterials market with a market share of 32.5%, due to advanced healthcare infrastructure, high levels of research and development investment, and strong demand for innovative medical technologies

- Asia-Pacific is expected to be the fastest growing region in the nerve repair biomaterials market with a market share of 26.5%, during the forecast period due to rapid expansion of healthcare infrastructure, growing healthcare awareness, and rising surgical volumes

- The neuromodulation devices segment is expected to dominate the market with a market share of 68.5% due to their increasing use in treating nerve-related conditions, such as chronic pain and nerve injuries

Report Scope and Nerve Repair Biomaterials Market Segmentation

|

Attributes |

Nerve Repair Biomaterials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nerve Repair Biomaterials Market Trends

“Technological Innovations in Biomaterials for Enhanced Nerve Regeneration”

- One prominent trend in the global nerve repair biomaterials market is the rapid advancement in bioengineered materials, including biodegradable polymers, growth factor-releasing scaffolds, andnanofiber-based conduits

- These innovations improve functional recovery by providing a supportive microenvironment for axonal growth, reducing inflammation, and enhancing cellular adhesion and proliferation

- For instance, nerve guidance conduits integrated with controlled drug release and bioactive coatings are being developed to mimic natural nerve architecture, accelerating the regeneration process in peripheral nerve injuries

- Such technological advancements are revolutionizing nerve repair strategies, promoting the shift from autografts to synthetic or semi-synthetic alternatives, thereby fueling the demand for next-generation biomaterials in clinical nerve regeneration

Nerve Repair Biomaterials Market Dynamics

Driver

“Rising Incidence of Nerve Injuries and Increasing Preference for Advanced Biomaterials”

- The growing number of traumatic injuries, surgical nerve damage, and neurodegenerative disorders is significantly driving demand for effective nerve repair solutions, including advanced biomaterials

- With increasing sports-related injuries, road accidents, and a rising geriatric population prone to peripheral neuropathies, the need for reliable nerve regeneration techniques has surged globally

- Compared to traditional autografts, biomaterial-based solutions offer reduced donor site morbidity, shorter recovery times, and better patient outcomes, leading to a growing preference among healthcare providers

For instance,

- In June 2022, a study published in Frontiers in Neurology highlighted that peripheral nerve injuries affect approximately 2.8% of trauma patients worldwide and emphasized the clinical need for biomaterial alternatives to autografts for improved functional recovery

- As a result of these trends, the nerve repair biomaterials market is witnessing strong growth as healthcare systems adopt innovative, biocompatible materials to meet increasing clinical demands for nerve regeneration

Opportunity

“Advancing Nerve Repair with Biomaterial Innovation”

- Biomaterials for nerve repair are being integrated with advanced technologies, such as 3D printing andnanotechnology, to enhance the regeneration of nerve tissues, improving functional recovery and reducing complications in nerve repair surgeries

- Biomaterials, including collagen, chitosan, and synthetic polymers, are being optimized for their ability to mimic natural nerve structures, providing a scaffold that supports nerve growth, reduces scar formation, and facilitates better functional outcomes in patients with nerve injuries

- Recent advancements in nerve repair biomaterials also include the incorporation of growth factors or neurotrophic proteins that promote nerve regeneration and enhance the healing process

For instance,

- In February 2025, a study published in the Journal of Biomaterials Science, Polymer Edition reported the development of a novel composite biomaterial using 3D-printed scaffolds combined with neurotrophic factors to accelerate nerve regeneration in animal models. The study showed that these scaffolds supported nerve growth and improved sensory and motor function in nerve injury models, suggesting promising potential for human applications

- The integration of advanced biomaterials in nerve repair can lead to improved patient outcomes, faster recovery, and enhanced quality of life. With the ability to tailor materials for individual patients, surgeons can achieve more precise nerve repairs, reducing the risk of long-term disabilities and improving the likelihood of full functional recovery

Restraint/Challenge

“High Costs of Nerve Repair Biomaterials Impeding Market Growth”

- The high cost of advanced nerve repair biomaterials presents a significant challenge, particularly in low- and middle-income regions, where the financial burden on healthcare facilities and patients can hinder widespread adoption of these technologies

- Biomaterials, such as 3D-printed scaffolds, synthetic polymers, and collagen-based products, are often expensive due to complex manufacturing processes, the incorporation of growth factors, and the need for high-quality materials that ensure optimal nerve regeneration outcomes

- The substantial cost of these advanced biomaterials can restrict their use in smaller hospitals and clinics, as well as limit patient access to cutting-edge treatments, leading to slower market penetration and increased reliance on traditional methods

For instance,

- In October 2024, a report by the International Journal of Neurobiology and Biomaterials highlighted the financial challenges associated with advanced biomaterial development for nerve repair. The report emphasized that while the performance of these biomaterials is promising, the high cost of production and the need for specialized infrastructure to implement them pose significant barriers to widespread clinical use, particularly in underserved healthcare markets

- Consequently, these cost limitations could contribute to disparities in access to nerve repair treatments and technologies, potentially delaying the adoption of more effective, long-term solutions and limiting the market’s overall growth potential

Nerve Repair Biomaterials Market Scope

The market is segmented on the basis of products and application.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Application |

|

In 2025, the neuromodulation devices is projected to dominate the market with a largest share in product segment

The neuromodulation devices segment is expected to dominate the nerve repair biomaterials market with the largest share of 68.5% in 2025 due to their increasing use in treating nerve-related conditions, such as chronic pain and nerve injuries. These devices are gaining popularity for their ability to promote nerve regeneration and functional recovery through electrical stimulation, enhancing the efficacy of biomaterials. In addition, advancements in device technology and growing patient demand for non-invasive treatment options are driving their market growth.

The direct nerve repair or neurorrhaphy is expected to account for the largest share during the forecast period in application market

In 2025, the direct nerve repair or neurorrhaphy segment is expected to dominate the market with the largest market share of 25.5% due to its established effectiveness in restoring nerve continuity in cases of nerve injuries. This technique remains the gold standard for nerve repair, as it provides direct reconnection of nerve ends, ensuring optimal regeneration and minimizing scar formation. In addition, it is widely adopted due to its simplicity and proven success in various clinical settings.

Nerve Repair Biomaterials Market Regional Analysis

“North America Holds the Largest Share in the Nerve Repair Biomaterials Market”

- North America dominates the nerve repair biomaterials market with a market share of estimated 32.5%, driven, by advanced healthcare infrastructure, high levels of research and development investment, and strong demand for innovative medical technologies

- U.S. holds a market share of 67.3%, due to the increasing prevalence of nerve-related conditions, high adoption of advanced treatments, and a robust presence of key market players offering cutting-edge biomaterials for nerve repair

- The presence of well-established reimbursement policies, along with growing healthcare awareness and a high number of surgical procedures, further strengthen the market in the region.

- In addition, the increasing demand for nerve repair treatments, including those for traumatic injuries and neurodegenerative diseases, is contributing to the growth of the market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Nerve Repair Biomaterials Market”

- Asia-Pacific is expected to witness the highest growth rate in the nerve repair biomaterials market with a market share of 26.5%, driven by rapid expansion of healthcare infrastructure, growing healthcare awareness, and rising surgical volumes

- Countries such as China, India, and Japan are emerging as key markets due to their large aging populations, higher incidence of nerve injuries, and increasing awareness about advanced nerve repair solutions

- Japan, with its advanced medical technology, high number of trained surgeons, and government support for healthcare innovation, remains a significant market for nerve repair biomaterials

- India is projected to register the highest CAGR in the nerve repair biomaterials market, fueled by expanding healthcare infrastructure, increasing prevalence of nerve-related disorders, and the growing adoption of advanced nerve repair technologies

Nerve Repair Biomaterials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic(Ireland)

- Boston Scientific Corporation(U.S.)

- Abbott(U.S.)

- Axogen Corporation (U.S.)

- Baxter(U.S.)

- LivaNova PLC (U.k.)

- Integra LifeSciences Corporation (U.S.)

- NEVRO CORP (U.S.)

- NeuroPace, Inc. (U.S.)

- Regenity (U.S.)

- Soterix Medical Inc. (U.S.)

- Synapse Biomedical Inc. (U.S.)

- Aleva Neurotherapeutics (Switzerland)

- KeriMedical SA (Switzerland)

- BioWave (U.S.)

- NeuroSigma, Inc. (U.S.)

- tVNS Technologies GmbH (Germany)

Latest Developments in Global Nerve Repair Biomaterials Market

- In November 2024, Axogen, Inc. announced that the U.S. Food and Drug Administration (FDA) accepted its Biologics License Application (BLA) for the Avance Nerve Graft

- In October 2024, Integra LifeSciences announced the launch of SurgiMend PRS Meshed Collagen Matrix, designed for plastic and reconstructive surgery. While this product is primarily indicated for soft tissue reconstruction, its collagen matrix technology may have implications for nerve repair applications, providing a scaffold that supports tissue regeneration

- In September 2024, Axogen, Inc. announced the completion of its Biologics License Application (BLA) submission to the U.S. Food and Drug Administration (FDA) for the Avance Nerve Graft. This submission marks a significant step in transitioning the Avance Nerve Graft from a tissue product to a biologic, aiming to enhance its regulatory standing and market reach

- In September 2024, Stryker Corporation announced the completion of its acquisition of NICO Corporation, a privately held company specializing in minimally invasive surgery for brain tumor removal and stroke care. This strategic acquisition is expected to enhance Stryker's capabilities in the nerve repair and regeneration market by integrating NICO's innovative technologies into its existing portfolio

- In January 2020, Medtronic received CE Mark for its InterStim Micro neurostimulator and InterStim SureScan MRI leads. The technologies are clear for commercial sale and clinical use in Europe and offer full-body MRI scan eligible and lifestyle-friendly choice

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。