Global Ocular Pain Intravitreal Treatment Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

79.21 Million

USD

146.61 Million

2024

2032

USD

79.21 Million

USD

146.61 Million

2024

2032

| 2025 –2032 | |

| USD 79.21 Million | |

| USD 146.61 Million | |

|

|

|

|

Global Ocular Pain Intravitreal Treatment Market Segmentation, By Drug Type (Anti-inflammatory agents, Analgesics, Anti-infectives, Biologics, and Sustained-release implants), Indication (Post-operative ocular pain, Intraocular inflammation, Endophthalmitis, Retinal vascular disease–associated pain, and neuropathic ocular pain), Delivery Route (Intravitreal injection, Periocular, Intracameral, and subretinal), End User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty eye clinics, and Pharmacies) - Industry Trends and Forecast to 2032

Ocular Pain Intravitreal Treatment Market Size

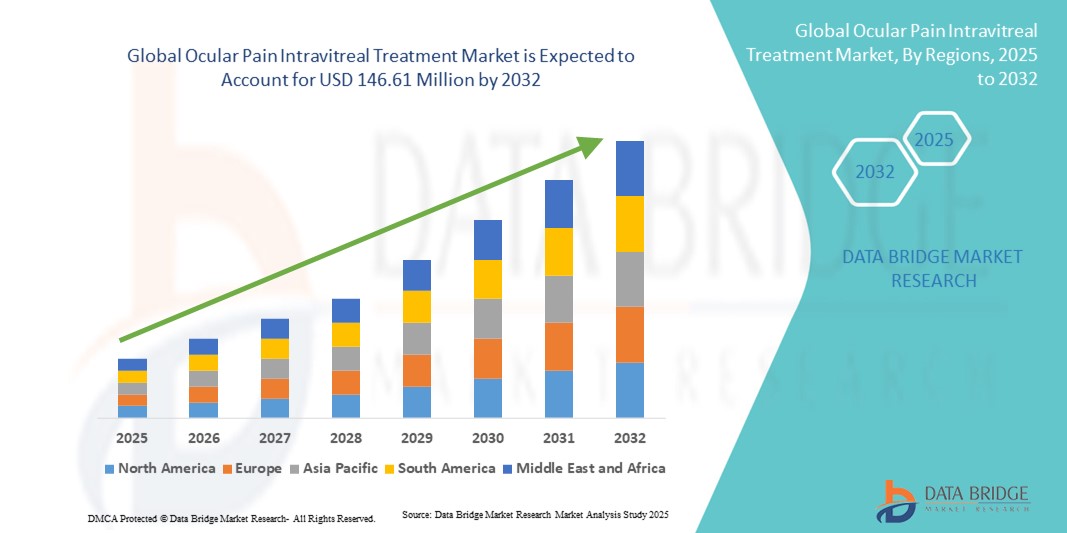

- The global ocular pain intravitreal treatment market size was valued at USD 79.21 million in 2024 and is expected to reach USD 146.61 million by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely driven by the rising prevalence of ophthalmic disorders such as uveitis, endophthalmitis, and post-surgical complications, which often result in significant ocular pain requiring intravitreal interventions

- Furthermore, the increasing adoption of sustained-release implants, targeted anti-inflammatory agents, and innovative analgesic formulations is positioning intravitreal delivery as a preferred modality for effective ocular pain management. These clinical and technological advancements are accelerating treatment uptake, thereby fueling the market’s expansion globally

Ocular Pain Intravitreal Treatment Market Analysis

- Ocular pain intravitreal treatments, including anti-inflammatory agents, analgesics, anti-infectives, biologics, and sustained-release implants, are emerging as critical therapeutic options for managing pain caused by uveitis, endophthalmitis, retinal vascular disease, and post-operative complications, due to their targeted delivery and longer therapeutic effect

- The rising demand for these treatments is primarily fueled by the increasing prevalence of ophthalmic disorders, growing surgical volumes in ophthalmology, and the need for effective, long-acting solutions that minimize repeated interventions and enhance patient outcomes

- North America dominated the ocular pain intravitreal treatment market with the largest revenue share of 42.5% in 2024, supported by advanced healthcare infrastructure, a robust pipeline of ocular drugs and implants, and high adoption of intravitreal therapies across hospitals and specialty eye clinics in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the ocular pain intravitreal treatment market during the forecast period, driven by a rising burden of ophthalmic diseases, expanding access to advanced eye care, and increased investments in ophthalmology-focused research and infrastructure

- The anti-inflammatory agents segment dominated the ocular pain intravitreal treatment market with a share of 43% in 2024, attributed to the widespread use of corticosteroids and steroid implants as the gold standard for reducing ocular inflammation and associated pain

Report Scope and Ocular Pain Intravitreal Treatment Market Segmentation

|

Attributes |

Ocular Pain Intravitreal Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Intravitreal Treatment Market Trends

Advancements in Sustained-Release Implants and Targeted Therapies

- A significant and accelerating trend in the global ocular pain intravitreal treatment market is the rapid adoption of sustained-release implants and biologics designed to provide long-lasting relief from inflammation and pain, reducing the burden of repeated intravitreal injections

- For instance, the Ozurdex (dexamethasone intravitreal implant) has gained strong clinical acceptance for managing ocular pain associated with uveitis and macular edema, demonstrating how extended-release technologies are reshaping treatment protocols

- Newer research pipelines are focusing on targeted drug delivery systems that enhance therapeutic precision, improve ocular tissue penetration, and minimize systemic side effects, further driving innovation in intravitreal pain therapies

- For instance, investigational biologics and depot-based analgesic formulations are being developed to offer more effective and sustained relief for patients with chronic ocular pain or recurrent inflammatory conditions

- The integration of advanced polymer technology and nanocarrier systems into intravitreal therapies facilitates controlled drug release, thereby offering more predictable treatment outcomes and fewer intervention visits

- This trend towards longer-acting, precision-targeted, and patient-friendly intravitreal treatments is redefining ophthalmic pain management, creating new benchmarks for efficacy and convenience

Ocular Pain Intravitreal Treatment Market Dynamics

Driver

Rising Burden of Ophthalmic Disorders and Surgical Interventions

- The increasing prevalence of ophthalmic conditions such as uveitis, endophthalmitis, and retinal vascular diseases, combined with rising rates of cataract and vitrectomy surgeries, is significantly driving the demand for intravitreal treatments for ocular pain

- For instance, in 2024, the American Academy of Ophthalmology highlighted a surge in post-surgical ocular inflammation cases, emphasizing the role of intravitreal corticosteroids and implants in effective pain management

- As patient awareness of advanced ocular therapies grows, intravitreal treatments are being recognized as essential tools for long-term control of ocular inflammation, delivering sustained relief and preserving vision outcomes

- Furthermore, expanding healthcare infrastructure and reimbursement support in developed markets are propelling the adoption of intravitreal pain management solutions across hospitals and specialty eye clinics

- The proven ability of intravitreal therapies to deliver targeted, localized drug concentrations makes them a preferred choice over systemic medications, reinforcing their dominance in ophthalmic pain treatment strategies.

- The shift toward personalized medicine and ongoing innovations in ophthalmology pipelines further strengthen the growth trajectory of intravitreal pain management solutions globally

Restraint/Challenge

Invasive Delivery Method and Regulatory Compliance Hurdles

- Concerns surrounding the invasive nature of intravitreal injections, including risks of infection, retinal detachment, and patient discomfort, pose a significant challenge to widespread acceptance of ocular pain intravitreal treatments

- For instance, multiple reports of endophthalmitis associated with intravitreal procedures have led to heightened caution among both patients and providers, limiting uptake in certain regions

- Addressing these safety concerns through innovations in minimally invasive delivery systems, improved injection devices, and enhanced physician training is crucial to strengthen patient confidence

- In addition, stringent regulatory pathways for intravitreal therapies, requiring extensive clinical trials and safety evaluations, can delay product approvals and market entry for novel pain management drugs and implants

- The relatively high cost of advanced implants and biologics compared to traditional topical or systemic pain therapies creates barriers to adoption, especially in cost-sensitive healthcare markets

- Overcoming these challenges through affordable pricing models, streamlined regulatory strategies, and enhanced patient education on treatment benefits will be vital for sustained growth in the intravitreal pain treatment market

Ocular Pain Intravitreal Treatment Market Scope

The market is segmented on the basis of drug type, indication, delivery route, and end user.

- By Drug Type

On the basis of drug type, the ocular pain intravitreal treatment market is segmented into anti-inflammatory agents, analgesics, anti-infectives, biologics, and sustained-release implants. Anti-inflammatory agents dominated the market with the largest revenue share in 2024, accounting for 43%. Corticosteroids such as dexamethasone and triamcinolone are widely used for managing inflammation and ocular pain linked to conditions such as uveitis and post-surgical complications. Their proven efficacy, well-established clinical guidelines, and availability in both intravitreal injection and implant forms make them the preferred first-line therapy. Hospitals and ophthalmologists also favor anti-inflammatory drugs due to their ability to deliver rapid relief, reduce recurrence rates, and maintain long-term therapeutic outcomes. In addition, the increasing availability of sustained-release steroid implants further enhances this segment’s dominance.

The biologics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the expanding pipeline of monoclonal antibodies and gene therapy-based approaches targeting underlying inflammatory pathways. Biologics offer the potential to address refractory or chronic ocular pain cases where traditional corticosteroids are less effective or associated with side effects. Moreover, the growing number of clinical trials, regulatory approvals, and increased investment in ophthalmic biologics are strengthening adoption. Rising awareness of targeted therapies, coupled with the push toward personalized medicine, positions biologics as the fastest-expanding category.

- By Indication

On the basis of indication, the market is segmented into post-operative ocular pain, intraocular inflammation, endophthalmitis, retinal vascular disease–associated pain, and neuropathic ocular pain. Post-operative ocular pain dominated the market in 2024, supported by the rising global volume of cataract and vitrectomy surgeries. These procedures frequently lead to inflammation and pain, making intravitreal corticosteroids and analgesics critical for effective recovery. Hospitals and ambulatory surgical centers rely heavily on intravitreal therapies to minimize complications, shorten recovery periods, and improve patient comfort. The segment’s growth is also supported by favorable reimbursement policies in developed markets and increased adoption of sustained-release implants, which reduce the need for multiple post-surgical interventions.

Neuropathic ocular pain is expected to be the fastest-growing segment during the forecast period, driven by increasing recognition of neuropathic eye conditions and unmet needs in chronic ocular pain management. Traditional treatments often fail to adequately address nerve-related pain, creating opportunities for novel analgesics, biologics, and advanced delivery systems. Research into targeted pathways, such as ion channel modulators and neuroprotective biologics, is expanding rapidly. As awareness grows among ophthalmologists and patients, coupled with advancements in diagnostic capabilities, neuropathic ocular pain therapies are projected to experience the sharpest rise in demand.

- By Delivery Route

On the basis of delivery route, the market is segmented into intravitreal injection, periocular, intracameral, and subretinal. Intravitreal injection dominated the market in 2024 with the largest share, as it remains the gold standard for delivering high drug concentrations directly to the posterior segment of the eye. Its widespread use in both hospitals and specialty clinics for corticosteroids, antibiotics, and biologics underscores its central role in ocular pain management. Physicians prefer this route due to its precision, rapid onset of action, and ability to bypass systemic exposure, thereby minimizing side effects. The well-established safety profile, supported by clinical data and decades of experience, further secures its leading position.

The subretinal route is anticipated to be the fastest-growing delivery mode over the forecast period, driven by its increasing application in advanced therapies such as gene therapy and regenerative medicine. Though still in the early stages of adoption, subretinal delivery enables highly targeted treatment for retinal disorders associated with pain. Rising investment in R&D, clinical trial activity, and technological innovation in micro-surgical techniques are accelerating this segment’s growth. As more therapies gain regulatory approval, subretinal delivery is expected to carve out a strong growth trajectory in the coming years.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASCs), specialty eye clinics, and pharmacies. Hospitals dominated the market in 2024 with a revenue share of 55%, supported by their advanced infrastructure, ability to handle complex surgical interventions, and access to the latest intravitreal therapies. Hospitals also manage a higher patient load for post-operative and acute conditions requiring immediate pain relief, making them the primary setting for ocular pain treatment. The presence of skilled ophthalmologists, coupled with reimbursement frameworks in developed countries, further strengthens this segment’s leadership.

Ambulatory Surgical Centers (ASCs) are expected to witness the fastest growth from 2025 to 2032, driven by the global shift toward cost-effective and outpatient ophthalmic procedures. ASCs provide quicker turnaround, reduced treatment costs, and greater patient convenience compared to hospitals. The rising demand for cataract and retina surgeries in outpatient settings, along with expanding investments in equipping ASCs with advanced intravitreal drug delivery capabilities, is fueling rapid adoption. This trend is especially prominent in North America and Asia-Pacific, where healthcare systems are focusing on efficiency and patient-centered care.

Ocular Pain Intravitreal Treatment Market Regional Analysis

- North America dominated the ocular pain intravitreal treatment market with the largest revenue share of 42.5% in 2024, supported by advanced healthcare infrastructure, a robust pipeline of ocular drugs and implants, and high adoption of intravitreal therapies across hospitals and specialty eye clinics in the U.S.

- Patients and providers in the region highly value the effectiveness of intravitreal injections, implants, and biologics in reducing ocular pain while maintaining vision outcomes

- This widespread adoption is further supported by favorable reimbursement policies, robust clinical research infrastructure, and the presence of leading pharmaceutical and biotech companies actively developing new ophthalmic therapies

U.S. Ocular Pain Intravitreal Treatment Market Insight

The U.S. ocular pain intravitreal treatment market captured the largest revenue share of 79% in 2024 within North America, fueled by the high prevalence of retinal diseases, glaucoma, and post-surgical ocular complications. Patients are increasingly prioritizing intravitreal therapies for effective pain relief and better visual outcomes. The strong presence of leading pharmaceutical companies, combined with rapid adoption of biologics and sustained-release implants, further propels market growth. Moreover, supportive reimbursement frameworks and extensive use of advanced delivery systems, such as sustained-release depots, are significantly contributing to the market’s expansion.

Europe Ocular Pain Intravitreal Treatment Market Insight

The Europe ocular pain intravitreal treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising surgical interventions for cataract and retinal conditions. The growing burden of ocular inflammation and endophthalmitis is fostering the adoption of intravitreal injections. European healthcare providers are also drawn to innovative biologics and anti-inflammatory agents offering durable relief. The region is experiencing strong adoption across hospitals, specialty eye clinics, and ambulatory surgical centers, with intravitreal treatments increasingly integrated into routine ophthalmic care.

U.K. Ocular Pain Intravitreal Treatment Market Insight

The U.K. ocular pain intravitreal treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing incidences of intraocular inflammation and heightened patient awareness of advanced ophthalmic care. In addition, concerns over post-operative ocular pain and vision preservation are encouraging patients and providers to adopt intravitreal biologics and analgesic therapies. The country’s robust healthcare infrastructure, coupled with high clinical trial activity, is expected to continue to stimulate market growth.

Germany Ocular Pain Intravitreal Treatment Market Insight

The Germany ocular pain intravitreal treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by growing demand for biologics and sustained-release implants to manage ocular pain effectively. Germany’s advanced healthcare infrastructure and emphasis on innovation support the integration of new therapies into clinical practice. The presence of leading academic research institutions, along with strong adoption in both public and private healthcare settings, is promoting the use of intravitreal solutions tailored for long-term pain management.

Asia-Pacific Ocular Pain Intravitreal Treatment Market Insight

The Asia-Pacific ocular pain intravitreal treatment market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing surgical volumes, aging populations, and rising incidence of diabetic retinopathy and retinal vascular diseases. The region’s growing adoption of advanced biologics and innovative delivery routes, supported by government-led healthcare modernization, is fueling rapid uptake. Furthermore, as APAC emerges as a clinical trial and manufacturing hub for ophthalmic drugs, the affordability and accessibility of intravitreal therapies are expanding to a wider patient base.

Japan Ocular Pain Intravitreal Treatment Market Insight

The Japan ocular pain intravitreal treatment market is gaining momentum due to the country’s advanced healthcare system, rising elderly population, and growing burden of retinal and inflammatory eye diseases. The Japanese market places a strong emphasis on innovative biologics and drug-delivery systems, driving the adoption of sustained-release implants. The integration of intravitreal treatments with broader ophthalmic care protocols, including diabetic eye disease management, is fueling growth. Moreover, Japan’s technological advancements and patient demand for minimally invasive therapies are expected to further accelerate adoption.

India Ocular Pain Intravitreal Treatment Market Insight

The India ocular pain intravitreal treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s high prevalence of post-operative ocular pain, infections, and diabetic retinopathy-related complications. India stands as one of the largest markets for ophthalmic surgeries, and intravitreal therapies are becoming increasingly popular across hospitals and specialty clinics. The push towards expanding ophthalmology infrastructure and the availability of cost-effective intravitreal injections, alongside strong domestic pharmaceutical manufacturing, are key factors propelling the market in India.

Ocular Pain Intravitreal Treatment Market Share

The Ocular Pain Intravitreal Treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Novartis AG (Switzerland)

- Alimera Sciences (U.S.)

- Bausch + Lomb (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Clearside Biomedical. (U.S.)

- Alcon Inc. (Switzerland)

- Apellis Pharmaceuticals, Inc. (U.S.)

- Opthea Limited (Australia)

- Astellas Pharma Inc. (U.S.)

- Oxurion NV (Belgium)

- Ocular Therapeutix, Inc. (U.S.)

- Kala Pharmaceuticals, Inc. (U.S.)

- Bayer AG (Germany)

- SIFI S.p.A. (Italy)

- Dompé (Italy)

What are the Recent Developments in Global Ocular Pain Intravitreal Treatment Market?

- In July 2025, positive Phase 2a trial results for PER-001, a novel slow-release intravitreal implant targeting endothelin receptors, were published. The implant demonstrated improvements in vision, retinal ischemia, and structural parameters in patients with glaucoma and diabetic retinopathy, highlighting its potential to address pain and ischemia associated with progressive ocular disease

- In April 2025, ANI Pharmaceuticals announced FDA approval expanding the label of ILUVIEN® to include chronic non-infectious uveitis of the posterior segment. The label extension enhances the clinical utility of the implant in ocular pain management and provides physicians with a durable intravitreal option for patients suffering from painful inflammatory eye disorders

- In March 2025, the U.S. FDA approved the fluocinolone acetonide intravitreal implant ILUVIEN® for the treatment of chronic non-infectious uveitis affecting the posterior segment of the eye (NIU-PS), expanding its therapeutic reach beyond diabetic macular edema. This approval underscores growing recognition of intravitreal implants as effective long-term solutions for inflammatory ocular pain and related complications

- In February 2025, Genentech’s Susvimo® received U.S. FDA approval as a continuous delivery platform of ranibizumab for the treatment of diabetic macular edema (DME). This approval provides patients with fewer intravitreal treatments than standard injections, reducing pain burden and improving compliance in long-term retinal disease management

- In October 2024, Okyo Pharma dosed the first patient in a Phase 2 trial of OK-101, a novel therapy designed for neuropathic corneal pain (NCP). As a chronic ocular pain condition with limited treatment options, this milestone trial represents a significant step toward developing non-opioid, non-systemic solutions to relieve persistent corneal pain

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。