Global Organic Copper Fungicides Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

239.70 Million

USD

376.31 Million

2024

2032

USD

239.70 Million

USD

376.31 Million

2024

2032

| 2025 –2032 | |

| USD 239.70 Million | |

| USD 376.31 Million | |

|

|

|

|

Global Organic Copper Fungicides Market Segmentation, By Product Formulation (Liquid Copper Fungicides, Granular Copper Fungicides, Wettable Powder Copper Fungicides, and Copper Soap Products), Crop Type (Fruits and Vegetables, Cereals and Grains, Ornamental Plants, and Row Crops), Application Method (Foliar Application, Soil Drenching, Seed Treatment, and Systemic Application), End-User Industry (Agriculture, Horticulture, Residential Gardening, and Commercial Landscaping), Distribution Channel (Online Retailers, Specialty Stores, Agricultural Supply Stores, and Wholesale Distributors) - Industry Trends and Forecast to 2032

Organic Copper Fungicides Market Size

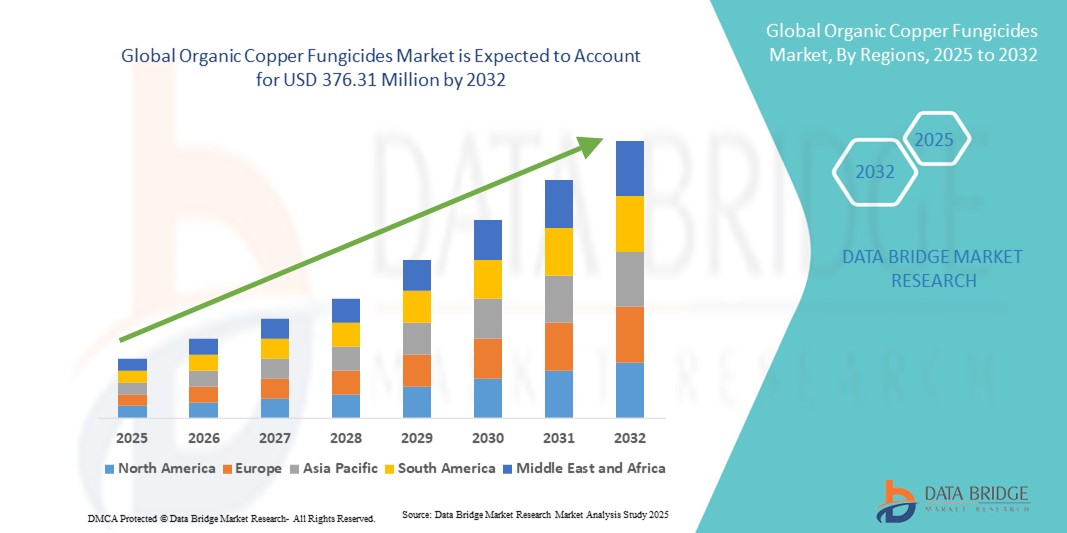

- The global organic copper fungicides market size was valued at USD 239.7 million in 2024 and is expected to reach USD 376.31 million by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and organic farming practices, driven by growing awareness of environmental safety and consumer demand for chemical-free produce. Farmers and horticulturists are shifting toward organic copper fungicides to protect high-value crops such as fruits, vegetables, and ornamental plants while maintaining soil health and complying with stringent residue regulations

- Furthermore, rising regulatory support for eco-friendly crop protection solutions and the development of advanced, broad-spectrum copper fungicide formulations are expanding market penetration. These factors are accelerating the adoption of organic copper fungicides, thereby significantly boosting the overall market growth

Organic Copper Fungicides Market Analysis

- Organic copper fungicides are biocompatible chemical formulations used to control fungal and bacterial diseases in crops such as cereals, fruits, vegetables, and flowers. They are available in various forms, including liquid, wettable powder, granular, and copper soap products, and can be applied via foliar sprays, soil drenching, or seed treatments to enhance crop yield and quality

- The escalating demand for organic copper fungicides is primarily driven by the global trend toward sustainable agriculture, increased consumer preference for residue-free produce, rising awareness of plant disease management, and the need for eco-friendly alternatives to synthetic pesticides

- North America dominated the organic copper fungicides market with a share of 30.5% in 2024, due to increasing adoption of sustainable farming practices and rising demand for chemical-free crop protection solutions

- Asia-Pacific is expected to be the fastest growing region in the organic copper fungicides market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising demand for high-quality organic crops in countries such as China, India, and Japan

- Liquid copper fungicides segment dominated the market with a market share of 46.5% in 2024, due to its ease of application, rapid absorption by plants, and suitability for a wide range of crops. Farmers prefer liquid formulations due to their uniform coverage, quick action against fungal infections, and compatibility with modern spraying equipment. In addition, liquid copper fungicides integrate well with organic farming practices and reduce the risk of phytotoxicity compared to more concentrated formulations

Report Scope and Organic Copper Fungicides Market Segmentation

|

Attributes |

Organic Copper Fungicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Copper Fungicides Market Trends

Growing Adoption of Sustainable Farming Practices

- The increasing adoption of sustainable farming practices worldwide is fueling the demand for organic copper fungicides. Farmers are seeking eco-friendly alternatives to conventional chemical fungicides to reduce soil contamination and protect biodiversity while ensuring safe crop protection

- For instance, Certis Biologicals has expanded its portfolio of copper-based fungicides targeting organic farming communities in the United States. This demonstrates how leading players are responding to the rising demand for sustainable crop protection solutions that align with organic certification standards

- Organic copper fungicides are gaining importance in integrated pest management (IPM) systems as they provide effective disease control while reducing long-term environmental impacts. Their compatibility with sustainable methods makes them valuable in promoting healthier ecosystems and safer farming practices

- Growing concerns about soil health and resistance to synthetic chemicals are further encouraging the shift toward organic fungicides. In crops such as grapes, tomatoes, and cereals, copper fungicides offer reliable control of fungal diseases while supporting practices that emphasize soil fertility and biodiversity preservation

- Many governments and agricultural organizations are also promoting sustainable agriculture through subsidies and training programs. This is reinforcing the use of organic copper-based products within farming models that emphasize reduced chemical residues and long-term farm sustainability

- In conclusion, the trend toward sustainable farming is reshaping crop protection practices globally. As the agriculture industry continues transitioning toward eco-friendly solutions, organic copper fungicides are cementing their role as crucial tools for balancing productivity with environmental responsibility

Organic Copper Fungicides Market Dynamics

Driver

Rising Demand for Organic, Residue-Free Produce

- The growth in consumer demand for organic and residue-free produce is a leading driver for organic copper fungicides. Consumers worldwide are prioritizing food safety, health, and environmental protection, creating robust incentives for farmers to adopt compliant crop protection strategies

- For instance, UPL Ltd. has introduced copper-based fungicidal formulations certified for organic farming, aiming to meet global demand for residue-free fruits and vegetables. This highlights how major companies are enhancing their portfolios to address the expanding organic produce market

- As disposable incomes rise and health awareness increases, consumers are more willing to pay a premium for organic produce. This has encouraged producers to use copper fungicides that align with organic certification standards while ensuring reliable fungal disease control

- Retailers and food chains are also playing a role by demanding certified organic produce from suppliers. This pressure at the supply chain level ensures that farmers turn to organically approved fungicides to protect their crops and maintain consistent production

- In summary, the heightened focus on health and environmental sustainability is tightly coupled with the rising global demand for organic foods. Organic copper fungicides are becoming indispensable tools in meeting this demand, thereby driving sustained market growth

Restraint/Challenge

High Cost and Limited Awareness in Some Regions

- The relatively high cost of organic copper fungicides compared to conventional alternatives poses a challenge to broader adoption. Many small-scale farmers in developing regions struggle to afford these products despite their long-term benefits for sustainability and soil health

- For instance, smaller farming communities in Africa and parts of Asia have shown slow adoption rates due to a lack of awareness and higher price points of organic-certified products from suppliers such as Certis and UPL. This underscores the uneven spread of knowledge and affordability across geographies

- The limited awareness about proper application techniques and dosage often leads to inefficient use of copper fungicides. Inadequate training and lack of extension services in some agricultural regions exacerbate misuse, which diminishes effectiveness and increases costs for farmers

- Further, competition from cheaper synthetic fungicides discourages farmers in price-sensitive markets from transitioning to organic copper-based products. Farmers often opt for conventional solutions due to immediate affordability, even though long-term soil health and market benefits lean toward organic practices

- In conclusion, high costs and gaps in awareness are restricting the growth potential of organic copper fungicides in certain regions. Addressing these challenges through farmer education programs, subsidies, and innovations in cost-effective formulations will be critical for enabling wider acceptance and global adoption

Organic Copper Fungicides Market Scope

The market is segmented on the basis of product formulation, crop type, application method, end-user industry, and distribution channel.

- By Product Formulation

On the basis of product formulation, the organic copper fungicides market is segmented into Liquid Copper Fungicides, Granular Copper Fungicides, Wettable Powder Copper Fungicides, and Copper Soap Products. The liquid copper fungicides segment dominated the largest market revenue share of 46.5% in 2024, driven by its ease of application, rapid absorption by plants, and suitability for a wide range of crops. Farmers prefer liquid formulations due to their uniform coverage, quick action against fungal infections, and compatibility with modern spraying equipment. In addition, liquid copper fungicides integrate well with organic farming practices and reduce the risk of phytotoxicity compared to more concentrated formulations.

The wettable powder copper fungicides segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in both small-scale and commercial farms. Wettable powders offer longer shelf life, lower application frequency, and better cost-efficiency, making them attractive to farmers seeking durable and effective disease control. Their ability to mix easily with other agrochemicals for foliar application further boosts demand, particularly in regions with diverse crop cultivation.

- By Crop Type

On the basis of crop type, the market is segmented into Fruits and Vegetables, Cereals and Grains, Ornamental Plants, and Row Crops. Fruits and vegetables dominated the largest market revenue share in 2024, driven by high susceptibility to fungal infections and the need for stringent quality standards for export and domestic consumption. Farmers rely on organic copper fungicides for effective protection against diseases such as downy mildew and blight, which directly impact yield and market value. Increasing consumer preference for chemical-free produce further propels the adoption of organic solutions in this crop segment.

The cereals and grains segment is expected to register the fastest growth from 2025 to 2032, fueled by rising awareness of sustainable farming practices and the prevention of common fungal infections such as rust and smut. Organic copper fungicides help maintain soil health and reduce chemical residues, making them increasingly preferred for large-scale cereal cultivation in countries focusing on food security.

- By Application Method

On the basis of application method, the market is segmented into Foliar Application, Soil Drenching, Seed Treatment, and Systemic Application. Foliar application dominated the largest market share in 2024, owing to its direct action on plant surfaces and immediate effectiveness against fungal pathogens. This method allows precise dosing, reduces environmental runoff, and can be easily integrated with automated spraying systems, making it suitable for both small-scale and commercial farms. The versatility of foliar sprays also ensures that crops of varying sizes and growth stages can be protected efficiently.

The seed treatment segment is projected to witness the fastest growth from 2025 to 2032, driven by its role in early-stage disease prevention and the reduction of crop losses. Treating seeds with organic copper fungicides enhances germination rates, protects seedlings from soil-borne pathogens, and minimizes the need for repeated applications during the growth cycle, making it increasingly popular among modern farmers.

- By End-User Industry

On the basis of end-user industry, the market is segmented into Agriculture, Horticulture, Residential Gardening, and Commercial Landscaping. The agriculture segment dominated the largest market share in 2024, driven by high-volume crop production and the pressing need to maintain crop yield and quality. Farmers prioritize organic copper fungicides for staple crops due to their proven efficacy, regulatory approval for organic farming, and contribution to sustainable agriculture practices.

The horticulture segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing cultivation of flowers, ornamental plants, and specialty crops. High-value horticultural crops demand disease-free growth, and organic copper fungicides provide an effective, eco-friendly solution that aligns with consumer preferences for ornamental and specialty produce.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Retailers, Specialty Stores, Agricultural Supply Stores, and Wholesale Distributors. Agricultural supply stores dominated the largest market revenue share in 2024, owing to their wide reach, availability of expert guidance, and trusted reputation among farmers. These stores offer bulk purchasing options, immediate access to products, and recommendations on crop-specific fungicide usage, which strengthens their dominance.

The online retailers segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing digital penetration in rural areas and the convenience of doorstep delivery. Online platforms also provide access to a broader range of products, detailed usage information, and competitive pricing, appealing to tech-savvy farmers and small-scale growers seeking efficient purchasing solutions.

Organic Copper Fungicides Market Regional Analysis

- North America dominated the organic copper fungicides market with the largest revenue share of 30.5% in 2024, driven by increasing adoption of sustainable farming practices and rising demand for chemical-free crop protection solutions

- Farmers and horticulturists in the region are highly focused on protecting high-value crops such as fruits, vegetables, and ornamental plants while maintaining soil health

- The market is further supported by government initiatives promoting organic agriculture, advanced distribution networks, and growing awareness of environmentally safe pest management solutions, establishing organic copper fungicides as a preferred choice for both large-scale and small-scale farmers

U.S. Organic Copper Fungicides Market Insight

The U.S. organic copper fungicides market captured the largest revenue share in North America in 2024, fueled by the growing emphasis on organic produce and sustainable farming. Increasing consumer preference for chemical-free fruits and vegetables, coupled with stringent regulatory standards for pesticide residues, is driving the demand for organic copper fungicides. The availability of advanced formulations such as liquid and wettable powder types, along with integration into precision agriculture practices, is further bolstering market growth. In addition, the rising adoption of e-commerce and agricultural supply stores provides convenient access to these products for farmers nationwide.

Europe Organic Copper Fungicides Market Insight

The Europe organic copper fungicides market is projected to expand at a significant CAGR during the forecast period, primarily driven by strict regulations on synthetic pesticides and the growing emphasis on sustainable agriculture. Increasing urbanization and the demand for high-quality organic produce are encouraging farmers to adopt organic copper fungicides. European growers are increasingly incorporating these solutions into fruits, vegetables, and cereal crops, while government subsidies and initiatives supporting eco-friendly farming practices further enhance adoption.

U.K. Organic Copper Fungicides Market Insight

The U.K. organic copper fungicides market is expected to grow at a notable CAGR, driven by rising awareness of organic farming and consumer demand for residue-free produce. Concerns regarding environmental sustainability and soil health are encouraging farmers and horticulturists to adopt safer crop protection solutions. The country’s robust distribution infrastructure and strong retail and e-commerce presence further facilitate access to organic copper fungicides, making them a preferred choice for residential gardening and commercial horticulture.

Germany Organic Copper Fungicides Market Insight

The Germany organic copper fungicides market is poised to expand at a considerable CAGR, fueled by the country’s emphasis on sustainable agriculture and organic crop cultivation. Growing awareness among farmers regarding environmentally friendly pest control and soil conservation is promoting the adoption of organic copper fungicides. Integration with modern application techniques such as foliar sprays and seed treatments, alongside well-established agricultural supply networks, is contributing to market growth across both small and large-scale farms.

Asia-Pacific Organic Copper Fungicides Market Insight

The Asia-Pacific organic copper fungicides market is expected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, increasing disposable incomes, and rising demand for high-quality organic crops in countries such as China, India, and Japan. Government initiatives promoting organic farming, coupled with the expansion of commercial horticulture and fruit production, are accelerating adoption. Moreover, the growing presence of distributors, online retailers, and affordable formulations is making organic copper fungicides more accessible to a wider farmer base across the region.

Japan Organic Copper Fungicides Market Insight

The Japan organic copper fungicides market is gaining traction due to the country’s focus on precision agriculture and high-value crop production. Farmers are adopting organic solutions to maintain quality standards, protect against fungal infections, and comply with stringent food safety regulations. The integration of advanced application methods, including foliar sprays and systemic treatments, is further driving market growth in both horticultural and row crop segments.

China Organic Copper Fungicides Market Insight

The China organic copper fungicides market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid adoption of sustainable agriculture practices and increasing demand for organic fruits and vegetables. Strong domestic production of organic copper fungicides, government support for eco-friendly farming, and expanding distribution channels, including wholesale and online retailers, are key factors propelling the market. China’s large-scale cultivation of cereals, fruits, and vegetables further ensures consistent demand for organic copper fungicide products.

Organic Copper Fungicides Market Share

The organic copper fungicides industry is primarily led by well-established companies, including:

- IQV Agro (Spain)

- Albaugh (U.S.)

- Nufarm (Australia)

- Spiess-Urania Chemicals (Germany)

- Isagro (Italy)

- ADAMA (Israel)

- Certis USA (U.S.)

- UPL (India)

- Bayer (Germany)

- Zhejiang Hisun (China)

- Jiangxi Heyi (China)

- Synthos Agro (Poland)

- Quimetal Chile (Chile)

- NORDOX (Norway)

Latest Developments in Global Organic Copper Fungicides Market

- In August 2025, ZDC launched an advanced formulation of its 40% Fluopyram · Oxine Copper SC (8% Fluopyram + 32% Oxine Copper). This product is designed for broad-spectrum disease management, effectively controlling both fungal and bacterial pathogens in crops such as cucumbers, fruits, and vegetables. Its registration and commercial availability have strengthened the presence of high-efficacy copper-based fungicides in the Chinese market, enabling farmers to adopt more sustainable and reliable solutions for crop protection. The introduction of this product also enhances market competition and encourages further innovation in multi-action fungicides

- In March 2025, ZDC’s 40% Fluopyram · Oxine Copper SC (8% Fluopyram + 32% Oxine Copper) obtained official registration from China’s Ministry of Agriculture and Rural Affairs. Registered specifically for controlling cucumber target spot, this fungicide has validated performance against both fungal and bacterial pathogens. Its approval marked a significant expansion in the availability of broad-spectrum, environmentally safer crop protection products, promoting the adoption of integrated disease management practices among commercial growers and advancing the overall organic copper fungicide market

- In February 2025, the organic copper fungicide market saw a notable increase in production and adoption, driven by rising global demand for chemical-free and sustainable crop protection. Manufacturers introduced improved formulations that offered longer shelf life, higher bioavailability, and compatibility with precision agriculture practices. This expansion increased market penetration in major crop-producing regions and also highlighted the growing importance of eco-friendly and residue-free solutions, shaping future market dynamics and influencing farmer preferences toward organic alternatives

- In October 2024, CALIBUR (Thiodiazole copper 20%SC), a Chinese patented fungicide, was distributed worldwide exclusively by CHICO. Extensive trials conducted by plant protection technology departments globally confirmed that CALIBUR® effectively treats and prevents bacterial and fungal diseases in key crops such as rice, fruit trees, vegetables, and flowers. Its international distribution underscored the global recognition of Chinese innovations in copper-based fungicides and reinforced the market’s trust in high-performance, eco-friendly products. This development also encouraged other manufacturers to pursue advanced, internationally compliant formulations

- In July 2024, several Chinese manufacturers introduced next-generation liquid and wettable powder copper fungicides with enhanced systemic activity and lower phytotoxicity. These formulations provided farmers with improved coverage, easier mixing with other organic inputs, and better adaptability to different crop cycles. The introduction of these advanced products helped strengthen farmer confidence in copper-based solutions, increased adoption rates across both small and large-scale farms, and contributed to the overall growth trajectory of the organic copper fungicide market

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。