Global Patient Monitoring Device/System/Equipment Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

12.98 Billion

USD

24.98 Billion

2024

2032

USD

12.98 Billion

USD

24.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.98 Billion | |

| USD 24.98 Billion | |

|

|

|

|

Global Patient Monitoring Device/System/Equipment Market Segmentation, By Product (Hemodynamic, Neuro monitoring, Cardiac, Fetal and Neonatal, Respiratory, Multi parameter, Remote Patient, Weight, Temperature, and Urine Output Monitoring Devices), Type (Vibration, Thermal, Motor Current, Alarm, and GPS), Process (Online and Portable), Deployment Type (On-Premise and Cloud), End Use (Hospitals and Clinics, Home Setting, and Ambulatory Surgical Centres) - Industry Trends and Forecast to 2032

Patient Monitoring Device/System/Equipment Market Size

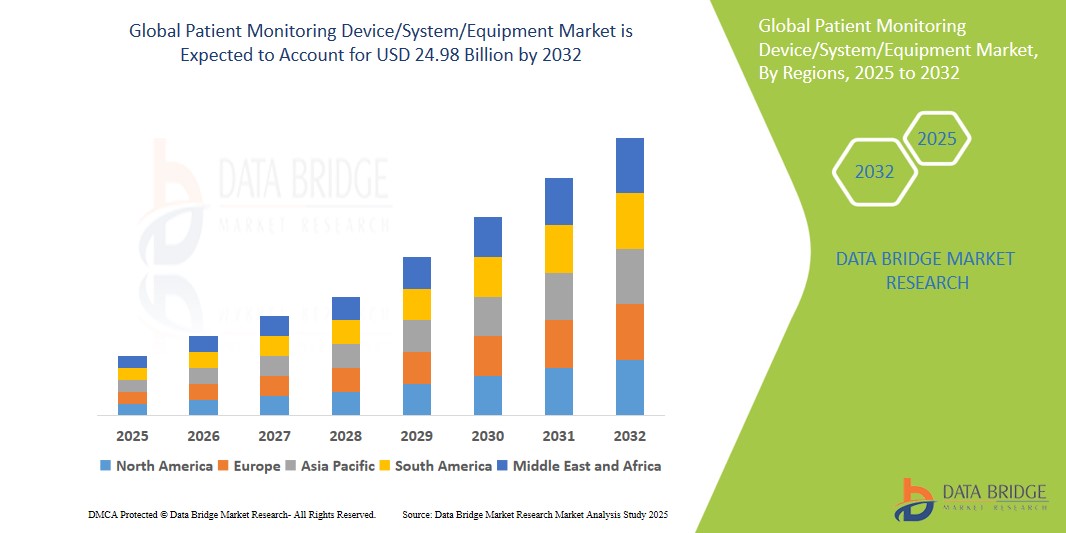

- The global patient monitoring device/system/equipment market size was valued atUSD 12.98 billionin 2024 and is expected to reachUSD 24.98 billionby 2032, at aCAGR of 8.52% during the forecast period

- This growth is driven by increasing incidence of chronic diseases

Patient Monitoring Device/System/Equipment Market Analysis

- Patient monitoring devices/systems/equipment are essential tools used for continuous monitoring of a patient's vital signs during surgical procedures, ICU stays, and remote healthcare settings. These devices enable healthcare providers to track real-time metrics such as heart rate, oxygen levels, blood pressure, and respiratory rate, improving patient outcomes, facilitating early detection of complications, and ensuring optimal treatment interventions

- The growing demand for patient monitoring devices/systems/equipment is primarily driven by the increasing prevalence of chronic diseases, the rising geriatric population, advancements in wearable technology, and the need for remote patient monitoring solutions

- North America is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 42.54%, attributed to its advanced healthcare infrastructure, widespread adoption of wireless and portable monitoring technologies, and strong market presence of key industry players such as GE HealthCare and Medtronic

- Asia-Pacific is expected to witness the highest growth rate in the patient monitoring device/system/equipment market during the forecast period, driven by rapid healthcare infrastructure improvements, increasing investments in healthcare facilities, and the growing burden of chronic diseases

- The multi parameter segment is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 23.69%, due to benefits offered by multi-parameter monitors, such as battery operation, low cost, and highly integrated silicon systems that combine multiple parameters into a compact, energy-efficient solution

Report Scope and Patient Monitoring Device/System/Equipment Market Segmentation

|

Attributes |

Patient Monitoring Device/System/Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Patient Monitoring Device/System/Equipment Market Trends

“Integration of Artificial Intelligence in Patient Monitoring Systems”

- A significant trend in the patient monitoring device/system/equipment market is the increasing integration ofartificial intelligence (AI) into monitoring systems, enabling real-time data analysis,predictive analytics, and automated alerts, improving patient care and operational efficiency

- AI-based monitoring systems can process large amounts of patient data, identifying critical trends and patterns that may be missed by traditional monitoring, enhancing decision-making processes in high-risk environments

- The trend is supported by the rise of AI-powered algorithms that assist clinicians in detecting early signs of deterioration, offering personalized treatment recommendations based on real-time data analysis

- For instance, in 2023, GE HealthCare introduced AI-powered patient monitoring solutions that assist in predicting critical events such as sepsis and heart failure, increasing response time and improving patient outcomes

- The integration of AI in patient monitoring is transforming the healthcare industry by enabling more proactive and data-driven approaches to patient care, driving further adoption of these advanced technologies

Patient Monitoring Device/System/Equipment Market Dynamics

Driver

“Rise in Remote Patient Monitoring and Telehealth Adoption”

- A key driver in the patient monitoring device/system/equipment market is the increased adoption of remote patient monitoring (RPM) andtelehealth services, particularly after the COVID-19 pandemic. This has led to greater demand for devices that can monitor patients' health metrics from the comfort of their homes

- The rising popularity of RPM is driven by its ability to track vital signs such as blood pressure, glucose levels, oxygen saturation, and heart rate in real-time, providing healthcare professionals with the ability to manage chronic diseases more effectively outside of clinical settings

- These technologies are becoming essential for managing chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders, further propelling the market

- For instance, in 2023, Philips Healthcare launched a new RPM platform that integrates with wearable devices to provide continuous health monitoring for chronic disease management, improving patient engagement and care outcomes

- The ongoing trend of remote patient monitoring is helping reduce hospital readmissions and providing patients with more flexibility in their care, enhancing the overall healthcare experience

Opportunity

“Growth in Demand for Home Healthcare Solutions”

- A significant opportunity for the patient monitoring device/system/equipment market is the growth in demand for home healthcare solutions, as more patients opt for care at home instead of in hospitals or clinics

- Home healthcare systems require advanced patient monitoring devices that can remotely track vital signs, ensuring that patients receive timely interventions and reducing the need for hospital visits

- The shift toward home-based care is further supported by the aging population, the rise in chronic conditions, and advancements in telehealth technologies

- For instance, in 2023, Medtronic expanded its home healthcare monitoring solutions by launching a remote monitoring platform that integrates with wearables, allowing patients to manage their health at home and share real-time data with their healthcare providers

- The growing preference for home healthcare presents a significant opportunity for patient monitoring companies to innovate and provide scalable, reliable solutions tailored to the needs of patients and healthcare professionals

Restraint/Challenge

“High Costs of Advanced Monitoring Systems”

- A major challenge in the patient monitoring device/system/equipment market is the high costs associated with advanced monitoring systems, which can limit their adoption, especially in low-resource settings and emerging markets

- The upfront investment required for state-of-the-art devices, combined with maintenance costs, makes it difficult for smaller healthcare facilities or hospitals to adopt these technologies, potentially hindering market growth

- The cost of training healthcare personnel to use these advanced systems adds to the financial burden, making it harder to implement cutting-edge solutions across the healthcare system

- For instance, in 2023, a leading healthcare provider in Southeast Asia faced difficulties adopting advanced patient monitoring systems due to the high capital investment required, which delayed the rollout of critical monitoring solutions in rural hospitals

- The high costs of patient monitoring systems are a significant barrier to widespread adoption, especially in underserved regions, where affordability remains a key concern

Patient Monitoring Device/System/Equipment Market Scope

The market is segmented on the basis of product, type, process, deployment type, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Process |

|

|

By Deployment Type |

|

|

By End Use |

|

In 2025, the multi parameter is projected to dominate the market with a largest share in product segment

The multi parameter segment is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 23.69% in 2025 due to benefits offered by multi-parameter monitors, such as battery operation, low cost, and highly integrated silicon systems that combine multiple parameters into a compact, energy-efficient solution.

The On-Premise is expected to account for the largest share during the forecast period in deployment type segment

In 2025, the On-Premise segment is expected to dominate the market with the largest market share of 52.14% due to widespread adoption of sophisticated monitoring systems within hospital environments, which facilitate continuous monitoring of vital signs and early detection of potential health issues.

Patient Monitoring Device/System/Equipment Market Regional Analysis

“North America Holds the Largest Share in the Patient Monitoring Device/System/Equipment Market”

- North America is expected to dominate the patient monitoring device/system/equipment market with the largest market share of 42.54%, driven by the strong presence of leading industry players, highly advanced healthcare infrastructure, increasing adoption of remote and real-time patient monitoring technologies, and favorable reimbursement policies

- The U.S. holds the largest share within the region, supported by the widespread integration of portable and wireless monitoring systems, a high prevalence of chronic diseases such as cardiovascular conditions and diabetes

- Growing investments in telehealth, remote patient monitoring platforms, and AI-driven healthcare applications, along with regulatory initiatives promoting digital health adoption, are expected to further reinforce North America's dominant position in the global patient monitoring device/system/equipment market

“Asia-Pacific is Projected to Register the Highest CAGR in the Patient Monitoring Device/System/Equipment Market”

- Asia-Pacific is expected to witness the highest growth rate in the patient monitoring device/system/equipment market, fueled by rapid enhancements in healthcare infrastructure, increasing incidence of chronic diseases, rising awareness of continuous patient monitoring benefits, and expanding healthcare access in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives promoting healthcare digitization, large-scale investments in hospital modernization, and the growing demand for cost-effective, portable monitoring devices in rural and urban settings

- Japan, recognized for its technological advancements and high healthcare standards, is actively adopting next-generation patient monitoring solutions, while China and India are experiencing a surge in demand driven by healthcare reforms, strategic public-private collaborations, and increased focus on telemedicine and home-based care services

Patient Monitoring Device/System/Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BioTelemetry (U.S.)

- Onduo LLC (U.S.)

- Medtronic (Ireland)

- Compumedics Limited (Australia)

- NIHON KOHDEN CORPORATION (Japan)

- Natus Medical Incorporated (U.S.)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens (Germany)

- OMRON Corporation (Japan)

- Johnson and Johnson Services, Inc. (U.S.)

- Care Innovations (U.S.)

- Smiths Group plc (U.K.)

- Drägerwerk AG and Co. KGaA (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CONTEC MEDICAL SYSTEMS CO., LTD (China)

- Fluke Deutschland GmbH (Germany)

- Analog Devices, Inc. (U.S.)

Latest Developments in Global Patient Monitoring Device/System/Equipment Market

- In April 2023, GE HealthCare’s CARESCAPE Canvas Patient Monitoring Platform received FDA clearance, with CARESCAPE Canvas and CARESCAPE ONE working together to create a scalable platform capable of adjusting monitoring capabilities based on each patient's disease severity, strengthening GE HealthCare's leadership in adaptive patient monitoring solutions

- In April 2023, Honeywell announced the development of a real-time health monitoring system that captures and records patients' vital signs both in hospitals and remotely, using a skin patch equipped with advanced sensing technology connected to mobile devices and an online dashboard, marking Honeywell’s expansion into the digital health space

- In January 2023, Senet and Telli Health launched the first remote patient monitoring (RPM) hardware powered by LoRaWAN, enabling healthcare providers to extend services to patients in remote and underserved areas globally, reinforcing their commitment to enhancing healthcare equity and smart home healthcare capabilities

- In June 2022, Abbott received FDA approval for the FreeStyle Libre 2 (iCGM) system for adults and children with diabetes in the U.S., which measures blood glucose levels every minute and offers real-time alarms, further solidifying Abbott’s position in continuous glucose monitoring technologies

- In May 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched the mWear wearable patient monitoring device, offering both wearable and continuous monitoring modes for customized patient status updates, expanding Mindray’s innovative product offerings in the wearable healthcare device segment

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。