Global Ranch Water Drinks Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

128.36 Million

USD

248.36 Million

2024

2032

USD

128.36 Million

USD

248.36 Million

2024

2032

| 2025 –2032 | |

| USD 128.36 Million | |

| USD 248.36 Million | |

|

|

|

|

Global Ranch Water Drinks Market Segmentation, By Product Type (Dairy-Based Ranch Drinks and Plant- Based Ranch Drinks), Flavor (Original and Varieties), Packaging (Bottles, Cartons, and Cans), Distribution Channel (Online and Offline) - Industry Trends and Forecast to 2032

Ranch Water Drinks Market Size

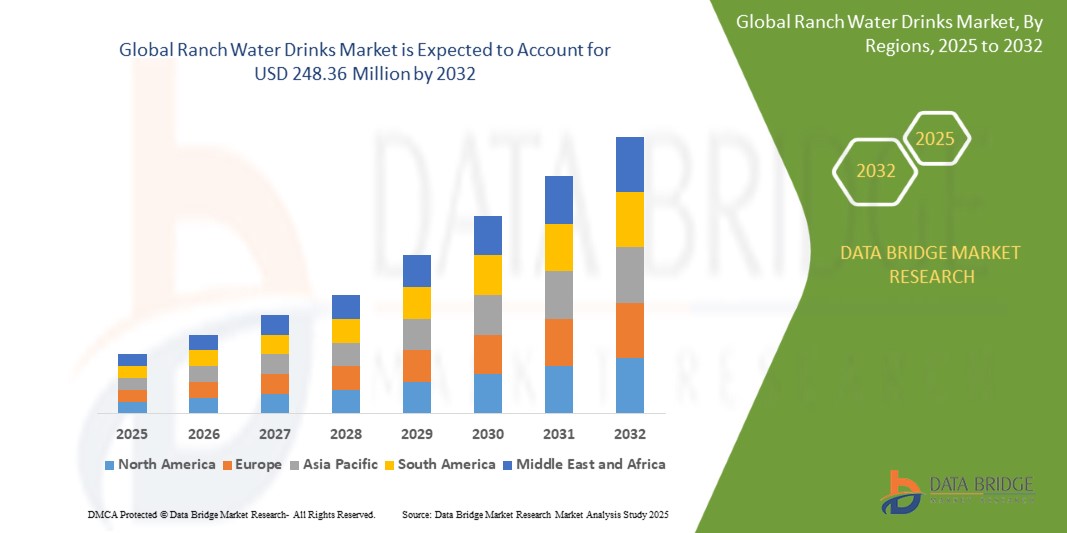

- The global ranch water drinks market size was valued at USD 128.36 million in 2024 and is expected to reach USD 248.36 million by 2032, at a CAGR of 8.6% during the forecast period

- The market growth is largely fueled by the increasing consumer shift toward ready-to-drink (RTD) alcoholic beverages, particularly ranch water drinks, which combine convenience, premium taste, and low-calorie appeal, driving strong adoption across younger demographics and urban consumers

- Furthermore, rising demand for tequila-based sparkling beverages, innovative flavor launches, and the expansion of distribution networks across online and offline channels are accelerating the uptake of ranch water drinks, thereby significantly boosting the industry’s growth

Ranch Water Drinks Market Analysis

- Ranch water drinks are tequila-based, ready-to-drink beverages often blended with soda water, lime, and other natural flavors, catering to consumers seeking refreshing, low-sugar, and portable alcoholic options. Their popularity is expanding rapidly in both on-trade and off-trade retail channels

- The escalating demand for ranch water drinks is primarily fueled by evolving lifestyle preferences, health-conscious consumption trends, and the growing premiumization of RTD cocktails. Increasing innovation in flavors and packaging formats, alongside strong marketing by leading brands, continues to drive market expansion across domestic and international markets

- North America dominated the ranch water drinks market with a share of 41.7% in 2024, due to the product’s rising popularity as a refreshing, low-calorie alcoholic beverage

- Asia-Pacific is expected to be the fastest growing region in the ranch water drinks market during the forecast period due to increasing urbanization, rising disposable incomes, and evolving social drinking culture in countries such as China, Japan, and India

- Dairy-based ranch drinks segment dominated the market with a market share of 61.9% in 2024, due to its traditional presence, wide consumer acceptance, and nutritional profile rich in protein and calcium. Dairy-based ranch drinks have long been associated with authentic taste and cultural consumption patterns, particularly in North America and Europe, where consumers prefer familiar and creamy beverages. Their strong positioning in retail and foodservice channels, coupled with continuous innovations such as reduced-fat and probiotic-infused formulations, further strengthens their dominance in the market

Report Scope and Ranch Water Drinks Market Segmentation

|

Attributes |

Ranch Water Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ranch Water Drinks Market Trends

Rising Flavored Innovations in Ranch Water Drinks

- The ranch water drinks market is witnessing rapid innovation in flavor profiles as brands focus on broadening appeal beyond the traditional tequila, lime, and sparkling water base. Consumers are increasingly drawn to new taste experiences that bring variety and novelty to this fast-growing ready-to-drink cocktail category

- For instance, Lone River Ranch Water, acquired by Diageo in 2021, has expanded its flavor line to include prickly pear, spicy grapefruit, and ranch-style lime variations. This diversification highlights how leading brands are meeting consumer demand for flavorful, refreshing, and creative twists on the classic ranch water recipe

- The influence of premiumization in alcoholic beverages is shaping ranch water innovations where natural ingredients, artisanal flavors, and clean-label claims are incorporated to differentiate offerings. Consumers are drawn to ranch water drinks positioned as high-quality beverages with fewer artificial flavors and lower sugar contents

- The rising popularity of limited-edition and seasonal flavors is also gaining traction. Brands are releasing ranch water variants tied to festivals, regional tastes, or summer campaigns, creating excitement and enhancing consumer engagement through exclusivity and scarcity strategies

- In addition, companies are blending local ingredients such as Texas-grown fruits, herbs, and botanicals into ranch water formulations. This localization trend strengthens brand authenticity and also appeals to consumers eager to explore regional specialties and craft-inspired beverages

- Health-conscious consumer preferences are further shaping flavor development as low-calorie, low-carbohydrate, and gluten-free ranch water innovations become a major trend. With consumers seeking indulgence without guilt, ranch water has an edge as a lighter alternative to heavy cocktails and beers, encouraging faster adoption across demographics

Ranch Water Drinks Market Dynamics

Driver

Rising Demand for Ready-to-Drink (RTD) Cocktails

- The global boom in ready-to-drink alcoholic beverages is one of the strongest drivers for the ranch water drinks market. Consumers worldwide are increasingly seeking convenient, refreshing, and portable cocktails that offer both flavor and ease of access without requiring mixology at home or bars

- For instance, Topo Chico Hard Seltzer, launched by Coca-Cola Company in collaboration with Molson Coors, entered the ranch water category by positioning its tequila-inspired concoctions as refreshing and easy-to-consume beverages. This demonstrates how major brands are leveraging the RTD cocktail wave to boost entry into this niche but fast-rising segment

- The younger demographic, particularly millennials and Gen Z, is highly receptive to RTD cocktails due to their alignment with social occasions, outdoor lifestyles, and convenience-driven consumption trends. This preference is making ranch water a standout within the broader RTD portfolio

- In addition, the shift towards at-home consumption of alcoholic beverages post-pandemic has accelerated reliance on RTD products. Ranch water’s portability and packaging in cans or bottles make it a perfect fit for at-home parties, picnics, and gatherings

- The growth of e-commerce platforms and direct-to-consumer distribution is also boosting sales. Consumers can easily explore, purchase, and try different ranch water varieties online, especially limited flavors that are not always available in physical retail stores

Restraint/Challenge

Regulatory Compliance and Labeling Requirements

- The ranch water drinks market faces challenges due to strict regulatory requirements governing alcoholic beverages. Compliance with rules related to alcohol content, nutritional information, and geographical manufacturing restrictions presents hurdles for companies looking to scale quickly across regions

- For instance, U.S. alcohol regulatory bodies such as the Alcohol and Tobacco Tax and Trade Bureau (TTB) enforce strict labeling rules for RTD beverages, which can delay product launches. Brands such as Lone River Ranch Water must carefully navigate these requirements to ensure clarity on alcohol content, ingredients, and health claims before reaching the market

- Differing legislative environments across countries further complicate international expansion. What may be permitted in one region, such as the advertising of flavored ranch water drinks, may be prohibited or restricted in another, creating uncertainties for global players

- In addition, stricter labeling requirements around sugar content, allergens, and calorie counts are becoming more regulated in several markets, forcing companies to invest additional resources into compliance testing and packaging adjustments

- Regulatory approval timelines also create significant market entry delays for smaller craft manufacturers with limited budgets, impacting innovation speed and reducing their competitiveness against larger, resource-rich players in the ranch water category

Ranch Water Drinks Market Scope

The market is segmented on the basis of product type, flavor, packaging, and distribution channel.

• By Product Type

On the basis of product type, the ranch water drinks market is segmented into dairy-based ranch drinks and plant-based ranch drinks. The dairy-based segment dominated the largest market revenue share of 61.9% in 2024, driven by its traditional presence, wide consumer acceptance, and nutritional profile rich in protein and calcium. Dairy-based ranch drinks have long been associated with authentic taste and cultural consumption patterns, particularly in North America and Europe, where consumers prefer familiar and creamy beverages. Their strong positioning in retail and foodservice channels, coupled with continuous innovations such as reduced-fat and probiotic-infused formulations, further strengthens their dominance in the market.

The plant-based ranch drinks segment is projected to witness the fastest growth from 2025 to 2032, owing to the rising demand for vegan, lactose-free, and environmentally sustainable alternatives. Consumers are increasingly shifting toward plant-based beverages due to growing awareness of health benefits, ethical considerations, and reduced environmental impact. This trend is further reinforced by the expansion of oat, almond, and soy-based ranch water formulations, which cater to diverse dietary preferences. The introduction of fortified plant-based ranch drinks with added vitamins and minerals also makes them attractive to health-conscious consumers, driving significant growth opportunities.

• By Flavor

On the basis of flavor, the ranch water drinks market is segmented into original and varieties. The original flavor segment held the largest market share in 2024, supported by its classic appeal and strong consumer loyalty. Original ranch drinks are perceived as authentic, refreshing, and balanced in taste, making them a staple choice among long-term consumers. This segment continues to benefit from established brand recognition and consistent demand across both retail and hospitality sectors. The simplicity and familiarity of the original flavor maintain its leadership position, ensuring strong repeat purchases.

The varieties segment is expected to register the fastest CAGR from 2025 to 2032, fueled by increasing experimentation and consumer preference for diverse taste profiles. Flavored ranch drinks such as lime, mango, berry, and spice-infused options are gaining popularity among younger demographics seeking novelty. Beverage companies are actively launching seasonal and region-specific flavors to appeal to evolving palates, thereby boosting sales. The varieties segment also benefits from marketing strategies that position these drinks as fun, innovative, and lifestyle-driven, which further accelerates their market growth.

• By Packaging

On the basis of packaging, the ranch water drinks market is segmented into bottles, cartons, and cans. The bottles segment dominated the largest market revenue share in 2024, primarily due to its convenience, durability, and consumer familiarity. Bottled ranch drinks are widely available in both retail and foodservice channels, making them a preferred choice for on-the-go consumption. Their ability to preserve freshness and withstand handling during transportation adds to their reliability. In addition, premium brands often opt for glass bottles to enhance brand positioning, which strengthens the segment’s dominance.

The cans segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for portable, lightweight, and recyclable packaging. Canned ranch drinks are gaining traction in younger demographics and urban markets due to their convenience and eco-friendly appeal. Beverage brands are leveraging this trend by launching limited-edition designs and multi-pack options that resonate with lifestyle-driven consumers. The rising influence of sustainability-focused packaging trends also contributes to the strong growth of the canned segment.

• By Distribution Channel

On the basis of distribution channel, the ranch water drinks market is segmented into online and offline. The offline segment dominated the market share in 2024, supported by the extensive presence of supermarkets, hypermarkets, and convenience stores. Consumers prefer offline retail channels for the immediate availability of products, the ability to physically compare options, and the influence of in-store promotions. Established shelf space and partnerships with leading retailers enhance the dominance of offline sales in both urban and rural markets.

The online segment is projected to expand at the fastest CAGR from 2025 to 2032, driven by the rapid growth of e-commerce platforms and shifting consumer preference for digital shopping. Online channels provide convenience, wider product variety, and competitive pricing, making them increasingly attractive for ranch water purchases. Subscription models, personalized recommendations, and direct-to-consumer strategies adopted by brands are further boosting online sales. Moreover, the rising penetration of smartphones and secure payment gateways continues to accelerate the online segment’s growth trajectory.

Ranch Water Drinks Market Regional Analysis

- North America dominated the ranch water drinks market with the largest revenue share of 41.7% in 2024, driven by the product’s rising popularity as a refreshing, low-calorie alcoholic beverage

- The region’s consumers are increasingly adopting ready-to-drink (RTD) options that align with health-conscious preferences and modern lifestyles. The growing inclination toward tequila-based beverages, combined with the appeal of simple, natural ingredients, has positioned ranch water as a leading choice

- Strong marketing efforts, wide availability across retail and on-premise channels, and the emergence of ranch water as a trendy alternative to traditional cocktails have further fueled adoption

U.S. Ranch Water Drinks Market Insight

The U.S. ranch water drinks market captured the largest revenue share in 2024 within North America, fueled by the beverage’s origins in Texas and its rapid spread across the country. American consumers are drawn to ranch water for its authenticity, light profile, and alignment with wellness trends that emphasize low-sugar and low-carb drinks. Major beverage brands and craft producers alike are expanding their ranch water portfolios, making the drink accessible nationwide. The U.S. market continues to benefit from a strong RTD culture, rising tequila consumption, and consumer interest in convenient, canned cocktail solutions.

Europe Ranch Water Drinks Market Insight

The Europe ranch water drinks market is projected to expand at a substantial CAGR during the forecast period, primarily supported by growing awareness of tequila-based beverages and the rising demand for healthier alcoholic alternatives. European consumers are increasingly shifting toward premium, innovative RTD cocktails, and ranch water fits well within this trend. Urbanization, an expanding millennial consumer base, and the popularity of canned cocktails in social settings are accelerating adoption. Countries such as the U.K., Spain, and Germany are expected to drive notable demand growth.

U.K. Ranch Water Drinks Market Insight

The U.K. ranch water drinks market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing penetration of RTD alcoholic beverages and shifting consumer lifestyles. The U.K.’s cocktail culture, combined with growing interest in low-calorie, tequila-infused drinks, has created a favorable environment for ranch water. Retailers and bars are expanding their offerings, while e-commerce platforms are making the drink more accessible. Heightened consumer focus on convenience and healthier alternatives to traditional cocktails continues to propel the market.

Germany Ranch Water Drinks Market Insight

The Germany ranch water drinks market is expected to expand at a considerable CAGR during the forecast period, supported by the rising demand for innovative and natural alcoholic beverages. German consumers are showing growing interest in low-calorie RTD cocktails, aligning with the country’s strong emphasis on health-conscious consumption. The integration of ranch water into social gatherings and festivals, along with its availability in sustainable packaging, is further encouraging adoption. In addition, younger demographics seeking variety and convenience in alcoholic drinks are contributing to the segment’s expansion.

Asia-Pacific Ranch Water Drinks Market Insight

The Asia-Pacific ranch water drinks market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and evolving social drinking culture in countries such as China, Japan, and India. The rising popularity of tequila-based beverages, coupled with growing consumer exposure to Western RTD trends, is fueling demand. APAC’s strong manufacturing ecosystem, combined with a shift toward healthier and lighter alcoholic beverages, is making ranch water more accessible and appealing to younger demographics.

Japan Ranch Water Drinks Market Insight

The Japan ranch water drinks market is gaining traction due to the country’s openness to innovative alcoholic beverages and its highly developed RTD segment. Japanese consumers place strong value on convenience, premium quality, and low-calorie options, all of which align with ranch water’s attributes. The market is also benefiting from a growing demand for tequila-based drinks and the integration of ranch water into modern retail and bar offerings. Furthermore, Japan’s urban lifestyle and increasing interest in Western drinking trends support ongoing expansion.

China Ranch Water Drinks Market Insight

The China ranch water drinks market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding middle class, rising disposable incomes, and increasing openness to global beverage trends. China has a strong and growing RTD market, and the entry of ranch water is finding significant consumer traction, especially among younger demographics. The availability of affordable options, aggressive marketing campaigns, and the expansion of premium tequila imports are propelling the market. The ongoing urbanization and nightlife culture in China further strengthen ranch water’s growth prospects.

Ranch Water Drinks Market Share

The ranch water drinks industry is primarily led by well-established companies, including:

- Lone River Ranch Water (U.S.)

- Ranch Rider Spirits Co. (U.S.)

- The Real McCoy Spirits Corp. (U.S.)

- High Noon Spirits Company (U.S.)

- Two Trees Beverage Co. (U.S.)

- Desert Door Distillery (U.S.)

- Ranch2O (U.S.)

- ShotGun Ranch Water (U.S.)

- Texas Ranch Water Co. (U.S.)

- Karbach Brewing Co. (U.S.)

- Dos Equis (Heineken USA) (U.S.)

- Modelo (U.S.)

Latest Developments in Global Ranch Water Drinks Market

- In June 2025, Lone River Beverage Company, recognized as the pioneer behind the original canned ranch water, introduced its new Lemonade Splash Variety Pack. This launch enhances the company’s portfolio by merging the refreshing appeal of lemonade with its Texas-inspired heritage, appealing to consumers seeking seasonal and innovative ready-to-drink (RTD) options. The move strengthens Lone River’s brand presence in the competitive RTD alcoholic beverages market and expands its influence among younger demographics looking for diverse flavor experiences

- In June 2024, Topo Chico expanded its U.S. product portfolio with the release of a new ranch water-inspired beverage, reflecting its commitment to innovation and consumer engagement. By diversifying its offerings, the brand capitalized on the rising demand for tequila-based, sparkling cocktails in the RTD category. This development further reinforced Topo Chico’s market positioning as a trend-driven beverage brand and broadened its consumer base in an increasingly crowded marketplace

- In March 2023, Texas Brands, LLC launched its Rio Agave Sparkling Ranch Water line in select Texas markets, including Houston, Dallas, Fort Worth, Austin, and San Antonio. By leveraging tequila as a base ingredient, the company tapped into both regional authenticity and consumer demand for premium, low-calorie RTD cocktails. The launch strengthened Texas Brands’ foothold in its home market while signaling its ambition to compete with established ranch water producers

- In November 2022, Elm Fork Beverage Company introduced its first product, The Standard Ranch Water, in Oklahoma, marking its entry into the RTD alcoholic beverage market. This debut allowed the company to establish early visibility and build consumer familiarity within a growing regional market. The launch highlighted the increasing appeal of ranch water outside its Texas origins, underscoring opportunities for expansion across neighboring states

- In June 2021, Heineken USA’s Dos Equis also expanded its portfolio by launching Dos Equis Ranch Water Hard Seltzer, inspired by the classic West Texas mix of tequila, sparkling mineral water, and lime. This strategic move allowed Heineken to strengthen its competitive positioning in the hard seltzer segment while addressing consumer demand for authentic, tequila-based beverages. The product launch further diversified the company’s RTD offerings and enhanced its appeal among younger, trend-driven consumers

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。