Global Starch Coating Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

237.71 Million

USD

597.03 Million

2024

2032

USD

237.71 Million

USD

597.03 Million

2024

2032

| 2025 –2032 | |

| USD 237.71 Million | |

| USD 597.03 Million | |

|

|

|

|

Global Starch Coating Market Segmentation, By Source (Corn Starch, Potato Starch, Sweet Potato Starch, Cassava Starch, and Others), Application (Fruits and Vegetables, Meat, Poultry and Fish, Dairy Products, Nutritional Products, Bakery and Confectionery, and Others)- Industry Trends and Forecast to 2032

Starch Coating Market Size

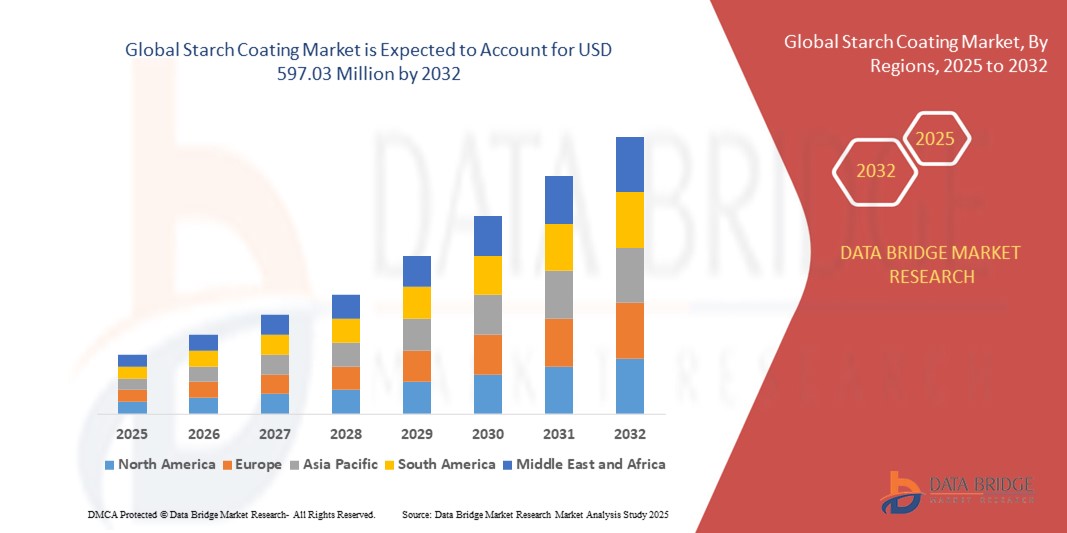

- The global starch coating market size was valued at USD 237.71 million in 2024 and is expected to reach USD 597.03 million by 2032, at a CAGR of 12.2% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and biodegradable coating materials across packaging, textiles, and paper industries

- Growing regulatory restrictions on petroleum-based and synthetic coatings are further driving the adoption of starch-based alternatives in industrial applications

Starch Coating Market Analysis

- The starch coating market is experiencing strong growth, driven by increasing demand for sustainable, biodegradable, and eco-friendly alternatives to conventional coatings in packaging, textiles, and paper industries

- Rising environmental concerns, along with stringent regulations on synthetic coatings, are pushing manufacturers to adopt starch-based solutions, which are cost-effective, renewable, and compatible with a wide range of applications

- North America dominated the starch coating market with the largest revenue share of 39.4% in 2024, driven by increasing sustainability mandates, strong demand for biodegradable packaging, and the region’s emphasis on reducing single-use plastics

- Asia-Pacific region is expected to witness the highest growth rate in the global starch coating market, driven by increasing industrialization, rising disposable incomes, and expansion of sustainable packaging across emerging economies

- The corn starch segment held the largest revenue share in 2024 due to its wide availability, cost-effectiveness, and suitability for various coating applications in food and packaging. Corn starch-based coatings are highly favored for their film-forming ability and biodegradability, aligning with growing demand for sustainable alternatives

Report Scope and Starch Coating Market Segmentation

|

Attributes |

Starch Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Starch Coating Market Trends

Growing Adoption of Biodegradable and Eco-Friendly Packaging Solutions

- The global starch coating market is experiencing a surge in demand due to the rising preference for sustainable and biodegradable packaging materials. Starch-based coatings are increasingly used as an alternative to petroleum-based products, helping industries reduce their environmental footprint while meeting regulatory compliance. This shift aligns with the growing circular economy movement

- Increasing consumer awareness about eco-friendly packaging, particularly in food and beverage sectors, is driving adoption. Retailers and manufacturers are integrating starch coatings to improve recyclability, compostability, and overall sustainability of packaging products. This trend is further supported by government initiatives promoting plastic reduction

- Cost-effectiveness and versatility of starch-based coatings are making them attractive for diverse applications such as paper packaging, textiles, and adhesives. Manufacturers benefit from a renewable, easily available raw material that improves product performance while reducing dependency on synthetic chemicals

- For instance, in 2023, several European paper manufacturers introduced starch-coated packaging to replace single-use plastics, resulting in enhanced recyclability and compliance with strict EU directives on plastic waste. These initiatives not only helped reduce waste but also boosted brand reputation and consumer trust

- While starch coatings are rapidly gaining ground in sustainable markets, their success relies on continued innovations in processing technologies and scaling production to meet growing global demand. Companies must also focus on balancing performance characteristics with cost efficiency to ensure long-term adoption

Starch Coating Market Dynamics

Driver

Increasing Demand for Sustainable Alternatives to Petroleum-Based Coatings

- Rising environmental concerns and regulatory pressures are pushing industries to replace traditional synthetic coatings with biodegradable options such as starch-based solutions. Their renewable origin and lower carbon footprint make them highly suitable for sustainable packaging and industrial applications, aligning with global climate action goals

- Food and beverage companies are particularly adopting starch coatings to extend shelf life, enhance barrier properties, and comply with global bans on single-use plastics. This transition is improving product sustainability, reducing waste generation, and addressing consumer demand for greener alternatives in everyday packaging

- Research collaborations and funding initiatives are fostering technological advancements in starch coating formulations, enhancing their durability, water resistance, and applicability across industries. These efforts are also opening up opportunities for new product categories, including textiles, pharmaceuticals, and construction materials

- For instance, in 2022, several North American packaging firms partnered with bio-based chemical companies to develop high-performance starch coatings, targeting both consumer packaging and industrial applications. These collaborations strengthened market competitiveness while also showcasing scalability for commercial use

- While sustainable demand is driving adoption, ensuring large-scale supply chain readiness and competitive pricing remains vital to accelerating starch coating integration into mainstream manufacturing. Industry stakeholders must also focus on educating manufacturers and consumers to build long-term market confidence

Restraint/Challenge

High Production Costs and Performance Limitations Compared to Synthetics

- Despite their eco-friendly appeal, starch-based coatings often involve higher production and processing costs, limiting their adoption among small and medium manufacturers. The inability to achieve economies of scale makes competing with cheaper petroleum-based coatings a persistent challenge in cost-sensitive markets

- Performance concerns, such as lower water resistance and mechanical strength compared to synthetic alternatives, also hinder widespread usage. Unless modified with additives or chemical treatments, starch coatings may fall short in demanding applications such as industrial packaging and high-moisture environments

- Supply chain inconsistencies, especially in regions with limited starch production, can restrict continuous availability of raw materials. This creates reliance on imports, exposes manufacturers to price fluctuations, and increases overall costs, affecting competitiveness in global markets

- For instance, in 2023, packaging companies in Asia-Pacific reported delays in adopting starch coatings due to higher raw material costs and concerns about product performance in humid conditions. These factors discouraged immediate large-scale adoption despite strong regulatory push

- While innovations in modification technologies are addressing performance gaps, reducing costs and ensuring consistent scalability remain critical to unlocking the full growth potential of starch coatings in global markets. Firms investing in R&D and localized production capacity are likely to gain a competitive edge

Starch Coating Market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the starch coating market is segmented into corn starch, potato starch, sweet potato starch, cassava starch, and others. The corn starch segment held the largest revenue share in 2024 due to its wide availability, cost-effectiveness, and suitability for various coating applications in food and packaging. Corn starch-based coatings are highly favored for their film-forming ability and biodegradability, aligning with growing demand for sustainable alternatives.

The cassava starch segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high amylose content, strong film-forming properties, and expanding adoption in emerging economies. Cassava starch coatings are gaining popularity in food preservation and packaging applications where improved barrier properties and eco-friendly solutions are prioritized.

- By Application

On the basis of application, the starch coating market is segmented into fruits and vegetables, meat, poultry and fish, dairy products, nutritional products, bakery and confectionery, and others. The fruits and vegetables segment accounted for the largest revenue share in 2024, supported by rising consumer demand for natural coatings that extend shelf life, maintain freshness, and reduce post-harvest losses. This segment continues to expand with growing global focus on reducing food waste.

The bakery and confectionery segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for edible coatings that enhance texture, improve moisture retention, and support clean-label product development. The rising use of starch coatings in confectionery glazing and bakery packaging is expected to create strong opportunities in this segment.

Starch Coating Market Regional Analysis

- North America dominated the starch coating market with the largest revenue share of 39.4% in 2024, driven by increasing sustainability mandates, strong demand for biodegradable packaging, and the region’s emphasis on reducing single-use plastics

- Food and beverage manufacturers are at the forefront of adopting starch-based coatings to improve shelf life and comply with eco-friendly standards

- The region benefits from abundant raw material availability, advanced processing technologies, and strong R&D capabilities that support innovation in starch coating formulations. In addition, rising consumer preference for green and recyclable packaging is accelerating adoption across industries

U.S. Starch Coating Market Insight

The U.S. starch coating market captured the dominant share in North America in 2024, propelled by stringent government regulations on plastics and a strong push from packaging companies toward renewable materials. The food and agricultural industries are heavily investing in starch-based coatings to enhance performance and sustainability. Collaborations between bio-based chemical firms and packaging producers are further driving commercialization.

Europe Starch Coating Market Insight

The Europe starch coating market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by strict environmental regulations and consumer demand for biodegradable alternatives. European companies are increasingly adopting starch-based coatings in food packaging, dairy, and bakery industries to align with sustainability targets. The region also benefits from an advanced research ecosystem fostering innovation in coating durability and barrier properties.

Germany Starch Coating Market Insight

The Germany starch coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by its strong packaging and food processing industries. The country’s regulatory framework emphasizing a circular economy and its commitment to sustainable innovation are accelerating starch coating adoption. Growing applications in fresh produce and dairy packaging further reinforce its leadership in the regional market.

U.K. Starch Coating Market Insight

The U.K. starch coating market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of biodegradable coatings across the food and retail sectors. Rising consumer awareness, combined with government restrictions on plastic usage, is encouraging industries to shift toward starch-based solutions. The U.K.’s dynamic retail and e-commerce environment is further fueling packaging innovations.

Asia-Pacific Starch Coating Market Insight

The Asia-Pacific starch coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid industrial growth, rising disposable incomes, and government-led initiatives to reduce plastic waste. Countries such as China, Japan, and India are leading adoption due to their strong food processing industries and large-scale starch production capacities.

China Starch Coating Market Insight

The China starch coating market captured the largest revenue share in Asia-Pacific in 2024, driven by its robust domestic manufacturing base and the government’s push for eco-friendly materials. With its growing packaging sector and strong middle-class demand for sustainable products, starch coatings are rapidly becoming mainstream across both consumer and industrial applications.

Japan Starch Coating Market Insight

The Japan starch coating market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s advanced food packaging sector and high consumer preference for sustainable, high-quality products. The integration of starch coatings into ready-to-eat and convenience food packaging is rising. Furthermore, Japan’s innovation-driven ecosystem supports continuous improvements in performance, shelf-life extension, and eco-efficiency of starch coatings.

Starch Coating Market Share

The Starch Coating industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Ingredion Incorporated (U.S.)

- Tate and Lyle PLC (U.K.)

- Agrana Beteiligungs-AG (Austria)

- Grain Processing Corporation (U.S.)

- Roquette Frères (France)

- The Tereos Group (France)

- Royal Cosun (Netherlands)

- Altia Industrial Services (Finland)

- Everest Starch Pvt. Ltd. (India)

- GreenTech Industries Ltd (India)

- Bangkok Starch Industrial Co., Ltd. (Thailand)

- Sahyadri Starch and Industries Pvt. Ltd. (India)

- Nova Transfers Pvt. Ltd. (India)

- Sanstar Bio-Polymers Ltd (India)

- Tantia Agrochemicals Private Limited (India)

- SPAC Starch Products Ltd (India)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。