Middle East and Africa Bakery Processing Equipment Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

5.92 Billion

USD

10.50 Billion

2024

2032

USD

5.92 Billion

USD

10.50 Billion

2024

2032

| 2025 –2032 | |

| USD 5.92 Billion | |

| USD 10.50 Billion | |

|

|

|

|

Middle East and Africa Bakery Processing Equipment Market Segmentation, By Type (Mixers, Proofers and Retarders, Sheeters, Dough Feeding Systems, Ovens, Slicers and Dividers, Depanners, Piston Filling Injectors, Handling Systems, Moulders, Pan Greasers and Depositors, Freezers and Coolers, Denester, Others), Function (Ingredient Handling, Mixing, Extrusion, Weighing and Packing, Baking, Enrobing, Moulding, Cooling, Others), Mode of Operation (Semi-Automatic, Automatic), Application (Bread, Cookies and Biscuits, Cakes and Pastries, Pancakes, Pizza Crusts, Croissants, Donuts and Pretzel, Others), End User (Bakery Processing Industry, Artesian Bakery, Food Service Industry) - Industry Trends and Forecast to 2032

Bakery Processing Equipment Market Size

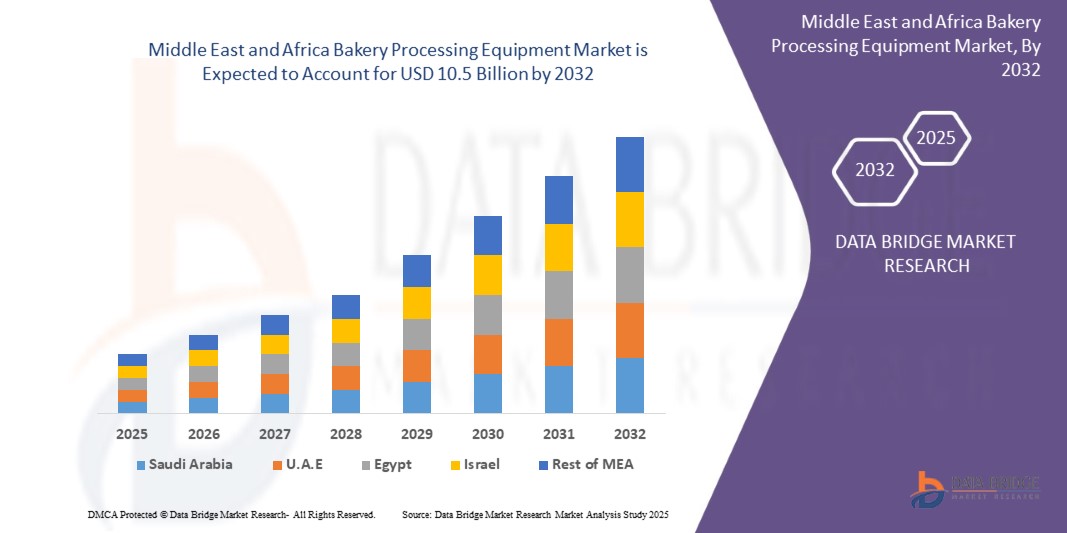

- The Middle East and Africa Bakery Processing Equipment Market size was valued at USD 5.92 Billion in 2024 and is expected to reach USD 10.5 Billion by 2032, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by increase in automation and robotics in bakery processing across the region acts as one of the major factors driving the growth of Bakery Processing Equipment Market.

- The high adoption of these systems owning to their various advantages offered by bakery processing equipment, such as reduction in labor cost and manual efforts, and rise in number of artisan bakeries and QSRs accelerate the market growth.

Bakery Processing Equipment Market Analysis

- The bakery processing equipment refer to the type of systems and machinery that are widely deployed in the bakery industry. The equipment is utilized for producing the bakery products such as pastries, cookies, biscuits, cakes, breads, pizza, and donuts, among others. These are highly beneficial for various production processes including cooling, enrobing, extrusion, mixing, baking, and moulding, among others.

- Rapid urbanization, shift in consumer preference toward high-quality products, change in lifestyle and increase in number of bakeries positively affect the Bakery Processing Equipment Market.

- Saudi Arabia dominates the Bakery Processing Equipment Market with the largest revenue share of 45% in 2025, characterized by extensive infrastructure projects, rapid urbanization, increased government investments in smart cities, booming commercial and residential construction, and strong demand for durable, efficient flooring solutions across diverse industries.

- UAE は、可処分所得の増加、急速な都市化、ベーカリー小売チェーンの拡大、食品加工に対する政府の支援、パッケージ化されたベーカリー製品の需要増加に牽引され、高い CAGR で高度なベーカリー加工機器の導入が進み、中東およびアフリカ市場の中で最も急速に成長しています。

- オーブンは、あらゆるベーカリー生産ラインで不可欠な役割を果たし、汎用性、拡張性、一貫した製品品質を提供することから、ベーカリー加工機器市場で 30% 以上の市場シェアを占めています。

レポートの範囲とベーカリー加工機器市場のセグメンテーション

|

属性 |

ベーカリー加工機器市場の主要な市場洞察 |

|

対象セグメント |

|

|

対象国 |

中東およびアフリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

ベーカリー加工機器市場の動向

“Rising demand for automation and hygienic design in bakery operations”

- Rapid industrialization across Middle East and Africa increases demand for bakery equipment with automated, hygienic features, ensuring consistent quality, regulatory compliance, and reduced human error in processing.

- Rising disposable incomes and lifestyle changes in urban areas are accelerating the adoption of processed bakery items, boosting modernization investments among small and large bakeries alike.

- Modern bakery chains are adopting energy-efficient and PLC-controlled equipment to improve productivity, ensure food safety, and reduce operational energy costs and long-term maintenance expenses.

- Consumers’ preference for artisanal and functional baked goods prompts bakeries to use modular systems for flexibility in recipes, seasonal offerings, and niche product experimentation.

For Instance:

- U.A.E Food Journal reports increasing regional investments in automated slicers, high-speed mixers, and smart ovens to meet growing demand for diverse, high-quality bakery products.

Bakery Processing Equipment Market Dynamics

Driver

“Growth in processed food consumption and retail expansion”

- Urbanization and the rise of nuclear families are fueling bakery product demand, requiring advanced equipment for faster, higher-volume production with consistent quality, food safety, and minimal labor dependency, especially in densely populated cities across Saudi Arabia, U.A.E, and Indonesia where demand for packaged foods is surging.

- Expansion of retail stores and QSR outlets across Southeast GCC drives industrial-scale bakery equipment sales to meet rising consumer expectations, brand standardization requirements, and growing needs for localized, fresh bakery production, particularly in convenience-focused urban centers like Bangkok, Ho Chi Minh City, and Kuala Lumpur.

- Government incentives and subsidies in Saudi Arabia, U.A.E, and GCC countries are boosting local food processing, enhancing demand for automation and high-efficiency bakery equipment that complies with food safety laws, improves employment opportunities, and attracts foreign direct investment into the processed food sector, especially in special economic zones.

- Rising bakery exports push manufacturers to meet international safety and quality standards, prompting investment in global-grade bakery processing machinery to meet export compliance, reduce rejections, and compete globally in terms of hygiene, shelf life, and taste — particularly in markets like U.A.E and South Africa with high quality thresholds.

- Increased consumer focus on food hygiene and traceability post-pandemic accelerates adoption of stainless steel, HACCP-compliant bakery equipment that meets safety regulations, supports digitized monitoring, and aligns with eco-certification programs, enhancing brand reputation among health-conscious, quality-seeking consumers across premium retail and hospitality sectors.

For Instance:

- GCC Food Journal highlights that bakery chains in Saudi Arabia, U.A.E, and South Africa are upgrading to smart ovens and conveyor-based systems, citing improved throughput, digital quality control, and integration with ERP systems, allowing them to meet both local demand and international food safety standards more efficiently and reliably.

Restraint/Challenge

“High capital investment and lack of skilled workforce”

- Initial investment for automated systems is high, discouraging adoption by small-scale bakeries operating in cost-sensitive markets with limited financial support options, especially when returns on investment are long-term, and capital access is difficult due to underdeveloped credit systems and informal market structures.

- Manual bakery operations remain prevalent in rural and peri-urban areas, where financial access, infrastructure, and awareness of advanced systems are significantly limited, and entrepreneurs rely on traditional methods, lacking exposure to modern equipment benefits, financing models, or regional equipment suppliers.

- Advanced equipment requires skilled operators and maintenance personnel, who are in short supply in less-developed regions, limiting efficiency and proper equipment usage, resulting in increased downtime, under-utilization, and dependence on external service providers, driving operational risks and inconsistent product quality.

- Import reliance on European or North American equipment inflates costs due to taxes, shipping, limited service availability, and lack of affordable local alternatives, complicating after-sales support, spare parts access, and language or training compatibility, particularly in remote markets with underdeveloped distribution networks.

For Instance:

- Food Machinery Middle East notes small bakeries in the Philippines and Indonesia struggle with equipment affordability, training gaps, lack of financing, and operational complexity barriers, often choosing outdated or refurbished systems, which increases maintenance frequency, shortens lifespan, and hampers competitiveness in both local and export-focused bakery segments.

Bakery Processing Equipment Market Scope

The market is segmented on the basis of type, function, mode of operation, application and end user.

- By Type

On the basis of type, the Bakery Processing Equipment Market is segmented into mixers, proofers and retarders, sheeters, dough feeding systems, ovens, slicers and dividers, depanners, piston filling injectors, handling systems, moulders, pan greasers and depositors, freezers and coolers, denester and others. Ovens dominate the Bakery Processing Equipment Market with over 30% market share due to their essential role in all bakery production lines, offering versatility, scalability, and consistent product quality.

Sheeters are the fastest-growing segment with a projected CAGR of 7.5%, driven by rising demand for automation, labor reduction, and uniform dough thickness in artisanal and industrial bakeries alike.

- By function

On the basis of function, the Bakery Processing Equipment Market is segmented into extrusion, mixing, ingredient handling, weighing and packing, moulding, baking, enrobing, cooling and others. Baking dominates due to its critical role in converting dough into finished products, accounting for the largest equipment share in all bakery lines across industrial, commercial, and artisanal bakeries globally.

Weighing and packing is the fastest growing due to increasing demand for automation in final product handling, ensuring portion control, reduced waste, and improved packaging efficiency across both large and small bakeries.

- By mode of operation

On the basis of mode of operation, the Bakery Processing Equipment Market is segmented into automatic and semi-automatic. Automatic systems dominate with over 60% share, driven by demand for high throughput, reduced labor costs, and consistent product quality in large-scale commercial bakery operations across developed and emerging markets.

Automatic is also the fastest growing segment with a high CAGR, as bakeries seek full-line integration, digital control, and efficiency enhancements to meet growing demand and mitigate skilled labor shortages.

- By Application

On the basis of application, the Bakery Processing Equipment Market is segmented into bread, cookies and biscuits, cakes and pastries, pancakes, pizza crusts, croissants, donuts and pretzel and others. Bread dominates due to its status as a global staple, requiring high-capacity continuous production lines and dedicated processing equipment in both industrial and retail bakery facilities across all regions.

Cookies and biscuits are the fastest growing segment, driven by rising snack consumption, product innovation, and export demand, especially in Middle East and Africa and Middle East regions with evolving consumer preferences.

- By end user

On the basis of end user, the Bakery Processing Equipment Market is segmented into bakery processing industry, artesian bakery and food service industry. The bakery processing industry dominates due to large-scale operations, high investment capacity, and demand for automated, high-efficiency equipment to meet mass production requirements for global and regional bakery brands.

Artisanal bakeries are the fastest growing, fueled by consumer preference for fresh, high-quality, handcrafted baked goods, and rising urban demand for premium, locally produced bakery items using small-batch equipment.

Bakery Processing Equipment Market Regional Analysis

- Saudi Arabia leads the Middle East and Africa Bakery Processing Equipment Market, capturing approximately 45% revenue share in 2025, driven by rapid urbanization, expanding commercial and residential construction, and strong government investments in smart city infrastructure. The government’s focus on advanced manufacturing technologies and export-oriented bakery product sectors also fuels this growth significantly.

- The market growth in Saudi Arabia is supported by modernization of manufacturing facilities and rising demand for efficient, automated bakery equipment to meet increasing consumer demand for bakery products. Increasing preference for hygienic, high-capacity processing lines and adoption of Industry 4.0 solutions further accelerate market expansion.

- Other key countries such as U.A.E and South Africa are also witnessing significant growth, fueled by rising disposable incomes, expanding retail bakery chains, and growing awareness of bakery product quality and safety standards. Additionally, increasing urban middle-class populations and investments in cold chain logistics enhance market penetration in these regions.

U.A.E Bakery Processing Equipment Market Insight

U.A.E is the fastest-growing Middle East and Africa market, driven by rising disposable incomes, rapid urbanization, expanding retail bakery chains, government support for food processing, and increasing demand for packaged bakery products, boosting adoption of advanced bakery processing equipment at a high CAGR.

Bakery Processing Equipment Market Share

The Bakery Processing Equipment Market industry is primarily led by well-established companies, including:

- ALFA LAVAL (Sweden)

- FRITSCH (Germany)

- Robert Bosch GmbH (Germany)

- Candy Worx (U.S.)

- BONGARD (France)

- Silvestri S.r.l. (Italy)

- Bettcher Industries, Inc. (U.S.)

- Aasted ApS (Denmark)

- Middle East and Africa Bakery Solutions (Australia)

- JBT (John Bean Technologies Corporation) (U.S.)

- Heat and Control, Inc. (U.S.)

- RHEON Automatic Machinery Co. Ltd. (Japan)

- Baker Perkins (UK)

- Markel Food Group (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- Gemini Bakery Equipment Company (U.S.)

- The Middleby Corporation (U.S.)

- The Henry Group, Inc. (U.S.)

- Precision Food Innovations (PFI) (U.S.)

- Mecatherm (France)

- Yoslon FOOD MACHINE UNION Co. LTD (China)

- GOSTOL-GOPAN d.o.o. Nova Gorica (Slovenia)

- LINXIS GROUP (France)

- Buhler AG (Switzerland)

- ANKO FOOD MACHINE CO., LTD. (Taiwan)

Latest Developments in Middle East and Africa Bakery Processing Equipment Market

- In May 2025, Bühler Saudi Arabia launched two new baking solutions—DirectBake Smart and RotaMold Smart—to enhance automation and energy efficiency for biscuit manufacturers in Saudi Arabia, targeting higher production capacity and improved product consistency across diverse bakery segments. These solutions also reduce waste and lower operational costs significantly.

- In April 2025, Bühler hosted 80 start-ups as part of the MassChallenge program at its CUBIC Innovation Campus, aiming to accelerate sustainable solutions in the food industry, fostering collaboration and technological advancements in bakery processing equipment innovation. The initiative encourages eco-friendly manufacturing and use of renewable energy in bakery processes.

- In March 2025, Bühler introduced the "Collaborative Innovation Summit," bringing together investors and industry leaders to promote sustainable solutions in food processing, encouraging development of eco-friendly machinery and digitization for enhanced bakery production. The summit emphasized adoption of smart sensors and AI-driven quality control technologies.

- In February 2025, Bühler opened a new Protein Application Center in partnership with Endeco, expanding its food innovation capabilities in Uzwil, Switzerland, to support development of protein-enriched bakery products and promote healthier, functional food options in Middle East and Africa markets. The center also focuses on reducing allergens and improving product shelf life.

- In January 2025, Bühler launched a new Protein Application Center in partnership with Endeco, enhancing its food innovation capabilities in Uzwil, Switzerland, focusing on cutting-edge bakery equipment that supports efficient production of high-protein and alternative ingredient bakery items. The launch aims to meet rising consumer demand for nutritious and sustainable bakery solutions globally.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。