中東およびアフリカのアニリン市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

422.47 Million

USD

603.39 Million

2025

2033

USD

422.47 Million

USD

603.39 Million

2025

2033

| 2026 –2033 | |

| USD 422.47 Million | |

| USD 603.39 Million | |

|

|

|

|

中東およびアフリカのアニリン市場セグメンテーション、製造プロセス別(ニトロベンゼンの水素化、ニトロ化・水素化統合(ベンゼンからアニリン)、バイオベースのルート(パイロット/新興)、その他の新興経路)、グレードと純度別(標準工業グレード(≥99.5%)、高純度グレード(≥99.9%)、塩および配合)、製造プロセス別(冷間圧延および焼鈍、溶融紡糸、粉末冶金、その他)、用途別(メチレンジフェニルジイソシアネート(MDI)製造、ゴム加工用化学薬品、染料および顔料、農薬、医薬品、その他)、エンドユーザー別(自動車、家具および家電製品、繊維および皮革、電気および電子機器、建設、その他)、流通チャネル別(直接、間接) - 2033年までの業界動向と予測

中東およびアフリカのアニリン市場規模

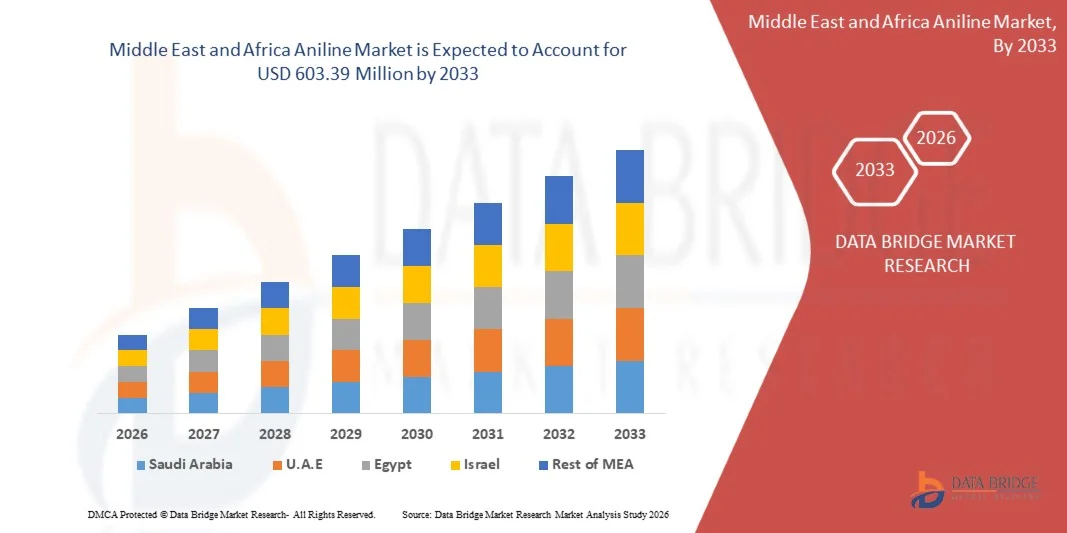

- 中東およびアフリカのアニリン市場規模は2025年に4億2,247万米ドルと評価され、予測期間中に4.7%のCAGRで成長し、2033年までに6億339万米ドル に達すると予想されています 。

- アニリン市場の成長は、主にポリウレタン製造におけるMDI(メチレンジフェニルジイソシアネート)の需要増加、建設、自動車、家具業界での用途拡大、新興経済国における工業化の進展による断熱材やコーティングの需要の増加によって推進されています。

- さらに、化学製造技術の進歩、医薬品、染料、ゴム加工用化学薬品におけるアニリンの使用拡大、そして持続可能な生産技術への投資の増加が市場を支えています。これらの要因が相まって、市場への導入が加速し、業界全体の拡大に大きく貢献しています。

中東およびアフリカのアニリン市場分析

- 中東およびアフリカのアニリン市場は、急速なインフラ開発、自動車製造の成長、地域全体の建設およびエネルギープロジェクトにおける断熱材の需要増加に牽引され、ポリウレタン、染料および顔料、ゴム加工用化学薬品、医薬品中間体におけるアニリンの生産、加工、利用を網羅しています。

- アニリンの採用増加は、ポリウレタンフォーム用途の拡大、化学製品製造への投資増加、および工業部門と消費者部門全体にわたる耐久性コーティング、高度なポリマー、および柔軟なフォームソリューションに対する地域的な要件の高まりを満たすことを目的とした、より高効率で特殊グレードの誘導体へのメーカーの戦略的シフトによって推進されています。

- サウジアラビアは、2026年に39.27%という最大の市場シェアを獲得し、中東・アフリカのアニリン市場を席巻すると予想されています。また、予測期間中に最高のCAGRを記録すると予測されています。これは、同国のポリウレタンおよび建設産業の急速な拡大、サウジ・ビジョン2030イニシアチブに基づく下流化学品製造への積極的な投資、そして大規模なMDIおよびイソシアネート生産施設の存在に牽引されています。さらに、インフラ、エネルギー、産業プロジェクトにおける断熱材の需要増加と、世界的な化学メーカーと国内メーカーとの戦略的パートナーシップにより、サウジアラビアは地域全体のアニリン消費と生産能力においてリーダーシップをさらに強化しています。

- ニトロベンゼン水素化セグメントは、2026年には中東およびアフリカのアニリン市場において最大の市場シェア70.82%を占めると予想されています。これは主に、アニリン製造において最も効率的で費用対効果が高く、産業規模で拡張可能な方法として確立された役割によるものです。このプロセスは、高い変換率、信頼性の高い収率の一貫性、そして大規模な石油化学プロセスとの互換性という利点があり、地域のメーカーの間で好まれる技術となっています。さらに、下流のポリウレタンおよびMDI製造への投資の増加と、サウジアラビアおよびGCC諸国全体における化学処理能力の拡大により、中東およびアフリカにおける主要生産ルートとしてのニトロベンゼン水素化の需要は引き続き高まっています。

レポートの範囲と中東およびアフリカのアニリン市場のセグメンテーション

|

属性 |

中東およびアフリカのアニリン主要市場インサイト |

|

対象セグメント |

|

|

対象国 |

中東およびアフリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

中東およびアフリカのアニリン市場動向

「ポリウレタン/MDIの需要が堅調」

- 高性能ポリウレタンシステムに対する産業界の関心の高まりは、アニリンがMDI製造に不可欠な原料であることから、世界のアニリン市場を強力に牽引しています。建設、自動車、断熱材、家電製品などの業界では、耐久性、熱効率、軽量性を兼ね備えた材料への需要が高まっており、これがMDI、ひいてはアニリンの消費量の増加に直接つながっています。

- 需要の増加は、MDIメーカーや総合化学メーカーに生産能力の拡大、原材料サプライチェーンの確保、そして効率と収率向上のための先進触媒技術への投資を促す要因となっています。その結果、アニリンメーカーは事業規模を拡大し、供給拠点を拡大し、プロセスの最適化を強化することで、ポリウレタン市場の長期的なニーズに対応しています。

- 2025年には、アジアと中東全域の建設部門の評価で、インフラ開発の加速とエネルギー効率の高い建築資材の採用増加が強調され、アニリン由来のMDIの最大の下流用途の1つである硬質ポリウレタンフォームの必要性が高まりました。

- 2024年には、複数の化学業界の展望レポートで自動車生産、特にEV製造において、軽量化、遮音性、車内快適性の目的でポリウレタンフォームやコーティングが使用され、アニリンベースのMDIの需要がさらに拡大すると予測されています。

- 2025年、世界的な材料イノベーションに関するブリーフィングでは、高性能で持続可能な断熱材および緩衝材への移行が強調され、優れた熱特性、機械特性、構造特性を持つポリウレタンソリューションが引き続き主流となることが指摘されました。こうした業界の動向は、ポリウレタンおよびMDIバリューチェーンを支える重要な原料としてのアニリンの需要を加速させます。

中東およびアフリカのアニリン市場の動向

ドライバ

「建設、自動車、家電製品におけるMDIベースのポリウレタンの需要増加」

- 建設、自動車、家電製品製造におけるポリウレタンを中心としたイノベーションの成長は、世界のアニリン市場の主要な需要牽引役となっています。これは、アニリンがMDIの中核原料であり、硬質および軟質ポリウレタンフォーム、コーティング、接着剤、断熱材の製造に不可欠であるためです。これらの最終用途セクターのメーカーは、優れたエネルギー効率、構造強度、軽量性、耐久性を備えた材料を優先し続けており、これらのニーズはMDIベースのポリウレタンを強く支持しています。この持続的な変化はアニリンの消費を加速させ、より高生産能力で効率的なMDI生産システムへの投資を刺激します。業界展望と製造政策の枠組みから得られる証拠は、建設およびモビリティセクターにおけるポリウレタン指向のバリューチェーンの継続的な拡大をさらに裏付けています。

- 2025年には、複数の世界的な化学メーカーが、建築業界を牽引する硬質断熱フォームの需要増加に対応するため、MDIおよびポリウレタンシステムの生産能力増強を発表しました。これは、熱効率と持続可能性を重視した建築基準において、硬質断熱フォームの義務化がますます進んでいるためです。これらの増強は、上流のアニリン生産に対する強い長期的な需要の高まりを示しています。

- BASF、ハンツマン、万華、コベストロといった業界リーダーは、プロセス効率の向上、アニリン-MDI統合設備の拡張、次世代自動車内装材、EVバッテリー断熱材、快適性向上フォーム、耐久家電部品向けの特殊ポリウレタン配合の開発に取り組んでいます。これらの生産能力増強と製品イノベーションは、高性能ポリウレタン用途がアニリン消費量の伸びに直接的に寄与していることを浮き彫りにしています。

- 同時に、グリーンビルディング認証、断熱基準、軽量化政策などを含む世界的な持続可能性とエネルギー効率に関する取り組みは、ポリウレタンの採用に有利な条件を作り出しており、MDIとその前駆体であるアニリンの需要が高まっています。エネルギー効率の高い建設や低排出ガス車を促進する規制は、MDIベースの材料ソリューションの需要を大幅に高めています。

- これらの展開は、機能性能要件、規制の持続可能性に対する圧力、そしてポリウレタン技術における急速なイノベーションの融合が、アニリンセクターにおける継続的な成長、多様化、そして上流投資をどのように促進しているかを示しています。MDI需要とポリウレタン市場の拡大の構造的な整合性により、アニリンは世界の工業製造業において戦略的に重要な化学物質であり続けています。

抑制/挑戦

「ベンゼン価格の変動と循環的芳香族マージンへのエクスポージャー」

- ベンゼン価格の変動は、世界のアニリン市場にとって大きな制約要因となっています。ベンゼンは主要原料であり、原油、製油所の操業、芳香族の需給サイクルの変動がアニリンの生産コストと利益率に直接影響を与えるためです。生産者と下流のMDIメーカーは、ベンゼン価格が予測不能に変動すると、継続的な利益率圧迫に直面し、操業調整、計画サイクルの短縮、そしてより保守的な生産戦略を余儀なくされます。こうした状況は、アニリンサプライヤーが安定した価格を維持したり、長期供給契約を締結したりする能力をしばしば制限し、バリューチェーン全体にわたる投資信頼を阻害します。

- 例えば、2024年から2025年にかけて、世界のベンゼン市場は、製油所の停止、改質油の経済状況の変化、そしてスチレンとシクロヘキサンの稼働率の変動といった要因により、急激な変動を経験しました。その結果、芳香族の需給バランスが逼迫し、アニリンメーカーのコストは著しく不安定になりました。これらの混乱は、アニリン業界が外部の原料ショックや芳香族の収益性サイクルにどれほど敏感であるかを浮き彫りにしました。

- BASF、コベストロ、万華などの業界リーダーは、ベンゼン価格が高騰する局面では、慎重な在庫管理、ヘッジ戦略、選択的なランレート最適化が必要であると報告しており、上流芳香族市場の変動により、不利なサイクル中に生産者が業務行動を変更し、新規投資を遅らせることを実証しています。

- 同時に、世界的な化学セクターの分析では、ベンゼン-MDIバリューチェーンが、マクロ経済の減速、建設活動の低迷、自動車生産の低迷などによって引き起こされる周期的な景気後退の影響をますます受けていることが強調されています。これらの景気後退は、芳香族化合物のマージンを圧迫し、生産者のコスト上昇への転嫁能力を低下させます。こうした周期的な景気後退は、ベンゼン由来のアニリン生産に関連する財務リスクとオペレーションリスクを増幅させます。

- これらの状況を総合すると、原料の変動性、芳香族の循環的なマージン、およびマクロ経済の敏感性の収束が、アニリン部門に持続的な構造的な課題をもたらし、マージンの安定性を制限し、世界のアニリン-MDI市場全体にわたる投資決定、生産能力の稼働率、および長期計画に影響を与えることがわかります。

中東およびアフリカのアニリン市場の範囲

中東およびアフリカの麦芽エキスおよびクワス麦汁濃縮物市場は、生産プロセス、グレードと純度、製造プロセス、アプリケーション、エンドユーザー、流通チャネルに基づいて6つのセグメントに分割されています。

- 製造工程別

アニリン市場は、生産プロセスに基づいて、ニトロベンゼン水素化、ニトロ化・水素化統合(ベンゼンからアニリン)、バイオベースルート(パイロット/新興)、その他の新興経路に分類されます。2026年には、ニトロベンゼン水素化セグメントが70.82%の市場シェアで市場を席巻すると予想されています。ライ麦は、2026年から2033年の予測期間において4.9%のCAGRで成長します。これは主に、このルートがアニリンの生産において最も確立され、費用対効果が高く、産業的に拡張可能な技術であるためです。このプロセスは、成熟した反応器設計、十分に最適化された触媒、そしてニトロベンゼンの広範な世界的な入手可能性の恩恵を受けており、メーカーは高い収率、一貫した製品品質、そして信頼性の高い大量生産を実現できます。さらに、主要なMDI生産者とニトロベンゼンアニリンバリューチェーンの強力な統合により、コスト競争力がさらに強化され、供給途絶のリスクが低減し、業務効率が向上します。

- グレードと純度別

アニリン市場は、グレードと純度に基づいて、標準工業グレード(99.5%以上)、高純度グレード(99.9%以上)、および塩と製剤に分類されます。2026年には、標準工業グレード(99.5%以上)セグメントが市場シェア71.21%で市場を席巻すると予想され、2026年から2033年の予測期間において4.9%のCAGRで成長する見込みです。これは主に、この純度レベルが主要な下流用途、特に建設、自動車、家電製品製造に使用されるポリウレタンフォーム用のMDI生産におけるバルク要件を満たすためです。このグレードは、費用対効果と性能の最適なバランスを提供し、大規模生産者が大量の工業プロセスにおいて一貫した化学仕様を維持しながら効率的に操業することを可能にします。

- 製造工程別

中東およびアフリカの麦芽エキスおよびクワス麦汁濃縮物市場は、形態に基づいて、液体、粉末、濃縮物に分類されます。2026年には、液体セグメントが市場シェアの58.28%を占め、2026年から2033年の予測期間において7.5%のCAGRで成長すると予想されています。これは、優れた溶解性、混合の容易さ、そして飲料、ベーカリー、医薬品製剤への幅広い用途によるものです。液体形態は、メーカーにとって優れた風味分散性、迅速な処理、そして高い効率性を提供するため、複数の最終用途産業において好ましい選択肢となっています。

- 製造工程別

製造プロセスに基づいて、アニリン市場は冷間圧延・焼鈍、メルトスピニング、粉末冶金、その他に分類されます。2026年には、冷間圧延・焼鈍セグメントが市場シェアの62.06%を占め、2026年から2033年の予測期間において7.1%のCAGRで成長すると予想されています。これは主に、この製造プロセスが、高性能アプリケーションに不可欠な優れた構造均一性、強化された機械的強度、および改善された表面品質を実現するためです。このプロセスは、厚さ、結晶粒微細化、および全体的な材料の完全性を正確に制御できるため、下流コンポーネントにおいて厳しい公差、高い耐久性、および一貫した性能が求められる産業にとって好ましい方法となっています。

- アプリケーション別

用途別に見ると、アニリン市場は、メチレンジフェニルジイソシアネート(MDI)生産、ゴム加工化学品、染料・顔料、農薬、医薬品、その他に分類されています。2026年には、メチレンジフェニルジイソシアネート(MDI)生産セグメントが57.71%のシェアで市場を席巻すると予想されており、2026年から2033年の予測期間において5.1%のCAGRで成長しています。これは主に、MDIが世界的にアニリンの最大かつ最も重要な下流用途であるためです。MDIは、建築断熱材、自動車部品、家具、寝具、冷蔵システム、およびさまざまな工業材料に広く使用されているポリウレタンフォームの主要な構成要素として機能します。インフラプロジェクト、エネルギー効率の高い建築基準、軽量自動車製造、および耐久家電製品の製造の継続的な拡大により、MDIに対する強力で持続的な需要が強化されています。

- エンドユーザー別

エンドユーザー別に見ると、アニリン市場は自動車、家具・家電、繊維・皮革、電気・電子、建設、その他に分類されます。2026年には、自動車分野が市場シェア41.92%で市場を席巻すると予想されており、2026年から2033年の予測期間において5.2%のCAGRで成長する見込みです。これは、アルコール飲料とノンアルコール飲料の両方で麦芽エキスとクワス麦汁濃縮物が広く使用されているためです。これらの濃縮物は、風味、甘味、色、発酵効率を高める効果があり、さらにクラフト飲料、機能性飲料、自然派飲料に対する消費者の需要の高まりも相まって、この分野の成長を力強く牽引しています。

- 流通チャネル別

流通チャネルに基づき、市場は直接販売と小売販売に区分されます。2026年には、直接販売セグメントが市場シェア73.65%を占め、市場を独占すると予想されます。2026年から2033年の予測期間には、CAGR 5.0%で成長します。これは主に、MDIメーカー、ポリウレタンメーカー、化学中間体メーカーなどの大規模産業消費者が、安定した供給、大量供給、競争力のある価格設定を確保するために、サプライヤーからの直接調達を好むためです。直接販売は、合理化された物流、長期供給契約、そして統合された品質保証を可能にし、これらは高度に専門化された下流工程における生産の中断を防ぐために不可欠です。

中東およびアフリカのアニリン市場地域分析

- 中東・アフリカ地域は、確固たる産業需要に加え、建築断熱材、自動車部品、特殊化学品といった新興用途に支えられ、2026年には39.27%の地域シェアを獲得する見込みです。また、同地域は6.5%という最も高い年平均成長率(CAGR)を示しており、他の地域と比較して急速な成長を示しています。この成長は、インフラ整備の進展、省エネ建材の導入、そしてMDI由来ポリウレタン製品を利用する自動車・家電製品製造への投資増加によって牽引されています。

- この地域は、主要な国内および域内の化学メーカーの存在、支援的な貿易政策、そして有利な規制・価格設定といった恩恵を受けており、これらはすべて市場への浸透を促進し、産業消費者への安定供給を確保しています。さらに、建設・自動車分野における持続可能かつ高性能な材料の普及促進に向けた取り組みは、中東・アフリカにおけるアニリンの長期的な成長見通しを強化しています。

サウジアラビアのアニリン市場に関する洞察

サウジアラビアのアニリン市場は、特に建設、自動車、家電業界におけるMDI需要の高まりに牽引され、同国のポリウレタンバリューチェーンの急速な拡大に支えられ、力強い成長が見込まれています。サウジアラビアのポリウレタン市場は、ビジョン2030に基づくインフラ整備と産業多様化によりMDIセグメントが拡大し、大幅な成長が見込まれています。

中東およびアフリカのアニリン市場シェア

アニリン業界は主に、次のような定評ある企業によって牽引されています。

- BASF(ドイツ)

- コベストロAG(ドイツ)

- 万華(中国)

- 中国理商集団有限公司(中国)

- ボンダルティ(ポルトガル)

- 住友化学株式会社(日本)

- グジャラート・ナルマダ・バレー肥料・化学品有限会社(インド)

- メルク社(米国)

- ランクセス(ドイツ)

- Panoli Intermediates India Pvt. Ltd.(インド)

- ハンツマン・インターナショナルLLC(米国)

- 東京化成工業株式会社(日本)

- JSKケミカルズ(インド)

- 河南シノウィン化学工業株式会社(中国)

中東・アフリカのアニリン市場の最新動向

- コベストロは2024年、ドイツのレーバークーゼンに植物由来のバイオマスからバイオアニリンを生産するパイロットプラントを稼働させました。この取り組みは、発酵と触媒変換を組み合わせることで、再生可能資源から完全にアニリンを生産する技術的実現可能性を実証し、持続可能な化学品製造における重要なマイルストーンとなりました。バイオアニリンは主に、断熱材、家具、自動車用途のポリウレタンフォームの主要成分であるMDI(メチレンジフェニルジイソシアネート)の製造に使用されます。この技術のスケールアップにより、コベストロは石油由来の原料への依存を低減し、環境に優しい化学プロセスへの世界的な取り組みを推進しています。

- 2024年4月、フランスのバイオテクノロジー企業Piliは、微生物発酵を用いたバイオベースのアニリン誘導体、具体的にはアントラニル酸の工業化に成功しました。同社は数トンを商業規模で生産し、染料、顔料、その他のファインケミカルへの利用を可能にしました。Piliの成果は、バイオテクノロジーが環境への影響を低減しながら、従来の石油化学ルートに代わる拡張性の高い再生可能な代替手段を提供できることを浮き彫りにしています。また、芳香族化合物に大きく依存する産業において、バイオベースの中間体に対する市場受容が拡大していることも示しています。

- BASFは2025年、中国・上海におけるMDI生産能力の拡張計画を発表しました。「Winning Ways」戦略の一環として、ニトロベンゼン/アニリンユニットの年間稼働時間を延長(約7,500時間から約8,000時間へ)します。アニリンはMDIの重要な前駆体であるため、この拡張により上流のアニリン需要が必然的に増加し、生産能力のさらなる増強につながります。この動きは、BASFのアジア太平洋地域における統合バリューチェーンをさらに強化し、中間体と下流のポリウレタン製品の両方の長期的な供給安定性を高めます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.3.1 MATERIAL SOURCING AND QUALITY

4.3.2 MANUFACTURING CAPABILITIES

4.3.3 COST COMPETITIVENESS

4.3.4 FLEXIBLITY AND COLLABORATIONS

4.3.5 SUPPLY CHAIN RELIABILITY

4.3.6 SUSTAINABILITY PRACTICES

4.4 BRAND OUTLOOK

4.4.1 COMPANY VS BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO – MIDDLE EAST AND AFRICA ANILINE MARKET

4.5.1 INTRODUCTION

4.5.2 ENVIRONMENTAL CONCERNS

4.5.3 INDUSTRY RESPONSE

4.5.4 GOVERNMENT’S ROLE

4.5.5 ANALYST RECOMMENDATIONS

4.5.6 CONCLUSION

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.6.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.6.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.6.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.6.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.6.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.7 COST ANALYSIS BREAKDOWN — MIDDLE EAST AND AFRICA ANILINE MARKET

4.7.1 RAW MATERIAL COSTS

4.7.2 UTILITIES AND ENERGY CONSUMPTION

4.7.3 LABOUR, WORKFORCE CAPABILITIES, AND STAFFING COSTS

4.7.4 PROCESS TECHNOLOGY, EQUIPMENT, AND MAINTENANCE COSTS

4.7.5 ENVIRONMENTAL COMPLIANCE AND SAFETY MANAGEMENT COSTS

4.7.6 PACKAGING AND PRODUCT HANDLING COSTS

4.7.7 LOGISTICS, TRANSPORTATION, AND STORAGE COSTS

4.7.8 OVERHEADS, ADMINISTRATIVE, AND SUPPORT COSTS

4.7.9 CONCLUSION

4.8 INDUSTRY ECOSYSTEM ANALYSIS — MIDDLE EAST AND AFRICA ANILINE MARKET

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM-SIZED COMPANIES

4.8.4 END USERS

4.8.5 CONCLUSION

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS — MIDDLE EAST AND AFRICA ANILINE MARKET

4.9.1.1 Joint Ventures

4.9.1.2 Mergers and Acquisitions

4.9.1.3 Licensing and Partnership

4.9.1.4 Technology Collaborations

4.9.1.5 Strategic Divestments

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 EGION PATENT LANDSCAPE

4.10.3 IP STRATEGY AND MANAGEMENT

4.10.4 PATENT FAMILIES

4.10.5 LICENSING & COLLABORATION

4.11 PROFIT MARGINS SCENARIO — MIDDLE EAST AND AFRICA ANILINE MARKET

4.11.1 FEEDSTOCK VOLATILITY AND MARGIN SENSITIVITY

4.11.2 OPERATIONAL EFFICIENCY AND COST-POSITIONING MARGINS

4.11.3 ENVIRONMENTAL COMPLIANCE, SAFETY INVESTMENTS, AND MARGIN PRESSURE

4.11.4 DOWNSTREAM DEMAND CYCLES AND MARGIN REALIZATION

4.11.5 REGIONAL COMPETITIVENESS AND MARGIN DIVERGENCE

4.11.6 COMPETITIVE INTENSITY AND MARGIN EROSION RISK

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

4.12.1 NITROBENZENE

4.12.2 BENZENE

4.12.3 HYDROGEN

4.12.4 CATALYST

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 INTRODUCTION

4.13.2 RAW MATERIAL SOURCING & PROCUREMENT

4.13.2.1 Feedstock Acquisition

4.13.2.2 Supplier Qualification & Quality Assurance

4.13.2.3 Risk Mitigation & Sustainability

4.13.3 PROCESSING & MANUFACTURING (CHEMICAL SYNTHESIS)

4.13.3.1 Nitration of Benzene

4.13.3.2 Hydrogenation to Aniline

4.13.3.3 Purification & Finishing

4.13.3.4 By-product and Waste Management

4.13.3.5 Occupational Safety & Process Safety

4.13.4 LOGISTICS, PACKAGING & DISTRIBUTION

4.13.4.1 Packaging for Transport

4.13.4.2 Storage and Warehousing

4.13.4.3 Transportation & Regulatory Compliance

4.13.4.4 Risk Management in Transit

4.13.5 COMMERCIAL CHANNELS & END-USE DISTRIBUTION

4.13.5.1 Primary End-Use Markets

4.13.5.2 Sales & Contracting Models

4.13.5.3 Value-Added Services

4.13.5.4 Logistics Alignment with Demand Patterns

4.13.6 QUALITY MANAGEMENT, TRACEABILITY & REGULATORY COMPLIANCE

4.13.6.1 Quality Assurance & Control

4.13.6.2 Regulatory Governance

4.13.6.3 Documentation Systems & Information Flow

4.13.7 RISK MANAGEMENT ACROSS THE SUPPLY CHAIN

4.13.7.1 Supply Risk

4.13.7.2 Process Safety Risk

4.13.7.3 Logistical Risk

4.13.7.4 Regulatory & Compliance Risk

4.13.7.5 Quality Risk

4.13.8 SUSTAINABILITY AND FUTURE TRENDS

4.13.8.1 Environmental Footprint Reduction

4.13.8.2 Circular Economy Initiatives

4.13.8.3 Regulatory & Policy Drivers

4.13.8.4 Technology Innovation

4.13.9 CONCLUSION

4.14 TECHNOLOGICAL ADVANCEMENT

4.14.1 ADVANCED CATALYTIC HYDROGENATION SYSTEMS

4.14.2 CLEANER AND SAFER NITRATION TECHNOLOGIES

4.14.3 BIO-BASED AND RENEWABLE-FEEDSTOCK ANILINE DEVELOPMENT

4.14.4 DIGITALIZATION, AUTOMATION, AND INDUSTRY 4.0 IN ANILINE PRODUCTION

4.14.5 EFFLUENT TREATMENT, EMISSION CONTROL, AND ENVIRONMENTAL TECHNOLOGIES

4.14.6 ENERGY EFFICIENCY AND HEAT-RECOVERY INNOVATIONS

4.14.7 WASTE MINIMIZATION, BY-PRODUCT UTILIZATION, AND CIRCULAR-ECONOMY APPROACHES

4.14.8 APPLICATION-SPECIFIC INNOVATION IN ANILINE DERIVATIVES

4.14.9 CONCLUSION

4.15 VALUE CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING & PRODUCTION

4.15.2 PROCESSING & MANUFACTURING

4.15.3 DISTRIBUTION & LOGISTICS

4.15.4 SALES & MARKETING

4.15.5 BUYERS / END USERS

4.15.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN MARKET

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 IMPACT ON PRICES

5.5.1 DIRECT IMPACT ON LANDED COSTS

5.5.2 IMPACT ON DOMESTIC PRODUCER PRICING POWER

5.6 CONCLUSION

6 REGULATION COVERAGE — MIDDLE EAST AND AFRICA ANILINE MARKET

6.1 INTRODUCTION:

6.2 PRODUCT CODES

6.2.1 CHEMICAL IDENTIFIERS

6.2.2 HARMONIZED SYSTEM AND TARIFF CODES

6.2.3 INDEX AND INVENTORY LISTINGS

6.3 CERTIFIED STANDARDS

6.3.1 INTERNATIONAL STANDARDS AND QUALITY SYSTEMS

6.3.2 PACKAGING AND CERTIFICATION FOR TRADE

6.3.3 ANALYTICAL AND ENVIRONMENTAL TESTING STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES

7.1.2 GROWTH IN RUBBER PROCESSING AND TIRE MANUFACTURING

7.1.3 HIGH DEMAND OF DYES, PIGMENTS & SPECIALTY CHEMICALS

7.1.4 RISING DEMAND FROM PHARMACEUTICALS AND AGROCHEMICALS

7.2 RESTRAINTS

7.2.1 BENZENE PRICE VOLATILITY AND EXPOSURE TO CYCLICAL AROMATICS MARGINS

7.2.2 STRINGENT ENVIRONMENTAL, HEALTH, AND SAFETY REGULATIONS FOR TOXIC AND HAZARDOUS SUBSTANCES

7.3 OPPORTUNITIES

7.3.1 BIO-BASED ANILINE DEVELOPMENT

7.3.2 CATALYST AND PROCESS INTENSIFICATION FOR ENERGY EFFICIENCY AND LOWER EMISSIONS

7.3.3 CAPACITY EXPANSIONS ACROSS ASIA-PACIFIC AND INTEGRATED UPSTREAM BENZENE ADVANTAGES

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH REACH/TSCA AND OCCUPATIONAL EXPOSURE LIMITS ACROSS REGIONS

7.4.2 LOGISTICS AND HANDLING CONSTRAINTS FOR HAZARDOUS MATERIALS IN BULK SHIPMENTS

8 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS

8.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

8.2 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.3 NITROBENZENE HYDROGENATION

8.4 INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE)

8.5 BIO-BASED ROUTES (PILOT/EMERGING)

8.6 OTHER EMERGING PATHWAYS

8.7 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.7.1 FIXED-BED TRICKLE FLOW REACTORS

8.7.2 SLURRY-PHASE REACTORS

8.7.3 OTHERS

8.8 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

8.8.1 RANEY NICKEL

8.8.2 PALLADIUM ON CARBON (PD/C)

8.8.3 COPPER-CHROMITE

8.8.4 PLATINUM ON CARBON (PT/C)

8.8.5 OTHERS

8.9 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

8.10.1 MIXED ACID ROUTE (HNO₃/H₂SO₄)

8.10.2 ORGANIC NITRATION ROUTE

8.10.3 OTHERS

8.11 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

8.11.1 CONTINUOUS

8.11.2 BATCH

8.12 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA PACIFIC

8.12.2 EUROPE

8.12.3 NORTH AMERICA

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

8.13.1 BIO-BASED NITROBENZENE PRECURSORS

8.13.2 FERMENTATION-DERIVED INTERMEDIATES

8.13.3 OTHERS

8.14 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 CATALYTIC AMINATION OF PHENOL/CHLOROBENZENE

8.15.2 ELECTROCATALYTIC / LOW-CARBON PROCESSES

8.15.3 DIRECT AMINATION OF BENZENE VIA NOVEL CATALYST SYSTEMS

8.15.4 PLASMA-ASSISTED NITRATION & HYDROGENATION

8.15.5 CO₂-DERIVED AROMATIC INTERMEDIATES (CARBON-UTILIZATION)

8.15.6 OTHERS

8.16 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA PACIFIC

8.16.2 EUROPE

8.16.3 NORTH AMERICA

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY

9.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

9.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

9.3 STANDARD INDUSTRIAL GRADE (≥99.5%)

9.4 HIGH PURITY GRADE (≥99.9%)

9.5 SALTS AND FORMULATIONS

9.6 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

9.6.1 ISO TANKS

9.6.2 DRUMS

9.6.3 IBC

9.6.4 OTHERS

9.7 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

9.8.1 PHARMACEUTICAL INTERMEDIATES

9.8.2 SPECIALTY DYES & PIGMENTS

9.8.3 OTHERS

9.9 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA PACIFIC

9.9.2 EUROPE

9.9.3 NORTH AMERICA

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 ANILINE HYDROCHLORIDE

9.10.2 BLENDED GRADES FOR RUBBER CHEMICALS

9.10.3 ANILINE SULFATE

9.10.4 STABILIZED ANILINE SOLUTIONS

9.10.5 CUSTOM SALT FORMULATIONS

9.10.6 ANILINE ACETATE

9.10.7 OTHERS

9.11 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION

10.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

10.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION

10.4 RUBBER PROCESSING CHEMICALS

10.5 DYES & PIGMENTS

10.6 AGROCHEMICALS

10.7 PHARMACEUTICALS

10.8 OTHERS

10.9 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 RIGID FOAMS

10.9.2 FLEXIBLE FOAMS

10.9.3 OTHERS

10.1 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.10.1 BUILDING INSULATION PANELS

10.10.2 REFRIGERATION INSULATION

10.10.3 OTHERS

10.11 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE & BEDDING

10.11.2 AUTOMOTIVE SEATING

10.11.3 OTHERS

10.12 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA PACIFIC

10.12.2 EUROPE

10.12.3 NORTH AMERICA

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 ANTIOXIDANTS (PPDS)

10.13.2 ACCELERATORS & OTHER INTERMEDIATES

10.13.3 OTHERS

10.14 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA PACIFIC

10.14.2 EUROPE

10.14.3 NORTH AMERICA

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST & AFRICA

10.15 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.15.1 AZO DYES INTERMEDIATES

10.15.2 SULFUR DYES INTERMEDIATES

10.15.3 OTHERS

10.16 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.16.1 ASIA PACIFIC

10.16.2 EUROPE

10.16.3 NORTH AMERICA

10.16.4 SOUTH AMERICA

10.16.5 MIDDLE EAST & AFRICA

10.17 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.17.1 HERBICIDE INTERMEDIATES

10.17.2 OTHER CROP PROTECTION INTERMEDIATES

10.18 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA PACIFIC

10.18.2 EUROPE

10.18.3 NORTH AMERICA

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 API INTERMEDIATES

10.19.2 PROCESSING AIDS

10.2 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.20.1 ASIA PACIFIC

10.20.2 EUROPE

10.20.3 NORTH AMERICA

10.20.4 SOUTH AMERICA

10.20.5 MIDDLE EAST & AFRICA

10.21 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.21.1 ASIA PACIFIC

10.21.2 EUROPE

10.21.3 NORTH AMERICA

10.21.4 SOUTH AMERICA

10.21.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER

11.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

11.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.3 AUTOMOTIVE

11.4 FURNITURE & APPLIANCES

11.5 TEXTILES & LEATHER

11.6 ELECTRICAL & ELECTRONICS

11.7 CONSTRUCTION

11.8 OTHERS

11.9 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 OEM APPLICATIONS

11.9.2 AFTERMARKET APPLICATIONS

11.1 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA PACIFIC

11.10.2 EUROPE

11.10.3 NORTH AMERICA

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 BEDDING & UPHOLSTERY

11.11.2 REFRIGERATION & HVAC

11.11.3 OTHERS

11.12 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA PACIFIC

11.12.2 EUROPE

11.12.3 NORTH AMERICA

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 DYEING

11.13.2 FINISHING

11.13.3 OTHERS

11.14 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.14.1 ASIA PACIFIC

11.14.2 EUROPE

11.14.3 NORTH AMERICA

11.14.4 SOUTH AMERICA

11.14.5 MIDDLE EAST & AFRICA

11.15 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.15.1 INSULATION FOAMS

11.15.2 ENCAPSULATION MATERIALS

11.15.3 OTHERS

11.16 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.16.1 ASIA PACIFIC

11.16.2 EUROPE

11.16.3 NORTH AMERICA

11.16.4 SOUTH AMERICA

11.16.5 MIDDLE EAST & AFRICA

11.17 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.17.1 RESIDENTIAL

11.17.2 COMMERCIAL & INDUSTRIAL

11.17.3 OTHERS

11.18 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.18.1 ASIA PACIFIC

11.18.2 EUROPE

11.18.3 NORTH AMERICA

11.18.4 SOUTH AMERICA

11.18.5 MIDDLE EAST & AFRICA

11.19 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.19.1 ASIA PACIFIC

11.19.2 EUROPE

11.19.3 NORTH AMERICA

11.19.4 SOUTH AMERICA

11.19.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL

12.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

12.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.3 DIRECT

12.4 INDIRECT

12.5 MIDDLE EAST AND AFRICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.6.1 ONLINE

12.6.2 OFFLINE

12.7 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA ANILINE MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 UNITED ARAB EMIRATES

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 KUWAIT

13.1.6 QATAR

13.1.7 OMAN

13.1.8 ISRAEL

13.1.9 BAHRAIN

13.1.10 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA ANILINE MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 DISTRIBUTORS COMPANY PROFILE

16.1 AZELIS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 KESSLER CHEMICAL, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRADE SYNDICATE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 UNIVAR SOLUTIONS LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 MANUFACTURERS COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 COVESTRO AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CHINA RISUN GROUP LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 WANHUA CHEMICAL GROUP CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 BONDALTI

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HUNTSMAN CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.9 JSK CHEMICALS AHMEDABAD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LANXESS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 MERCK (SIGMA-ALDRICH)

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PANOLI INTERMEDIATES INDIA PVT.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SUMITOMO CHEMICAL CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 KEY PERFORMANCE INDICATORS (KPIS) & METRICS FOR CLIMATE-CHANGE READINESS

TABLE 4 INDIAN AUTOMOBILE PRODUCTION TRENDS:

TABLE 5 PRODUCER PRICE INDEX BY INDUSTRY: SYNTHETIC DYE AND PIGMENT MANUFACTURING:

TABLE 6 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ANILINE MARKET, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ANILINE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA

TABLE 56 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 SAUDI ARABIA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 SAUDI ARABIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 85 SAUDI ARABIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 SAUDI ARABIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 SAUDI ARABIA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 SAUDI ARABIA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 SAUDI ARABIA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 SAUDI ARABIA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 SAUDI ARABIA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 103 SAUDI ARABIA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 SAUDI ARABIA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 SAUDI ARABIA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 SAUDI ARABIA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 SAUDI ARABIA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 SAUDI ARABIA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 UNITED ARAB EMIRATES ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 111 UNITED ARAB EMIRATES NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 112 UNITED ARAB EMIRATES NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 UNITED ARAB EMIRATES INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 114 UNITED ARAB EMIRATES INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 115 UNITED ARAB EMIRATES BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATES ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATES STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 119 UNITED ARAB EMIRATES HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATES SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATES ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATES METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 UNITED ARAB EMIRATES RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATES FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 UNITED ARAB EMIRATES RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATES DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 UNITED ARAB EMIRATES AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATES PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 UNITED ARAB EMIRATES ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATES TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATES CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 UNITED ARAB EMIRATES INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 SOUTH AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 138 SOUTH AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 139 SOUTH AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 SOUTH AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 141 SOUTH AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 142 SOUTH AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 143 SOUTH AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 SOUTH AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 SOUTH AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 SOUTH AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SOUTH AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SOUTH AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 EGYPT ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 165 EGYPT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 166 EGYPT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 EGYPT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 168 EGYPT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 169 EGYPT BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 170 EGYPT OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 EGYPT ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 172 EGYPT STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 173 EGYPT HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 EGYPT SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 EGYPT ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EGYPT RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 EGYPT FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 EGYPT RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EGYPT DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EGYPT AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 EGYPT PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 EGYPT ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 184 EGYPT AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 EGYPT FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 EGYPT TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EGYPT ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 EGYPT CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 EGYPT ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 190 EGYPT INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 KUWAIT ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 192 KUWAIT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 193 KUWAIT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 KUWAIT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 195 KUWAIT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 196 KUWAIT BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 197 KUWAIT OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 KUWAIT ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 199 KUWAIT STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 200 KUWAIT HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 201 KUWAIT SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 KUWAIT ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 KUWAIT METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 KUWAIT RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 KUWAIT FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 KUWAIT RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 KUWAIT DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 KUWAIT AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 KUWAIT PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 KUWAIT ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 211 KUWAIT AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 KUWAIT FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 KUWAIT TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 KUWAIT ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 KUWAIT CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 KUWAIT ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 KUWAIT INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 QATAR ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 219 QATAR NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 220 QATAR NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 QATAR INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 222 QATAR INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 223 QATAR BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 224 QATAR OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 QATAR ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 226 QATAR STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 227 QATAR HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 QATAR SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 QATAR ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 QATAR METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 QATAR RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 QATAR FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 QATAR RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 QATAR DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 QATAR AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 QATAR PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 QATAR ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 238 QATAR AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 QATAR FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 QATAR TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 QATAR ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 QATAR CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 QATAR ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 244 QATAR INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 OMAN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 246 OMAN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 247 OMAN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 OMAN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 249 OMAN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 250 OMAN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 251 OMAN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 OMAN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 253 OMAN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 254 OMAN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 255 OMAN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 OMAN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 OMAN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 OMAN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 OMAN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 OMAN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 OMAN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 OMAN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 OMAN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 OMAN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 265 OMAN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 OMAN FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 OMAN TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 OMAN ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 OMAN CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 OMAN ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 271 OMAN INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 ISRAEL ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 273 ISRAEL NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 274 ISRAEL NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 ISRAEL INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 276 ISRAEL INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 277 ISRAEL BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 278 ISRAEL OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 ISRAEL ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 280 ISRAEL STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 281 ISRAEL HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 282 ISRAEL SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 ISRAEL ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 284 ISRAEL METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 ISRAEL RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 ISRAEL FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 ISRAEL RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 ISRAEL DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 ISRAEL AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 ISRAEL PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 ISRAEL ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 292 ISRAEL AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 ISRAEL FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 ISRAEL TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 295 ISRAEL ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 ISRAEL CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 ISRAEL ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 298 ISRAEL INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 BAHRAIN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 300 BAHRAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 301 BAHRAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 BAHRAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 303 BAHRAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 304 BAHRAIN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 305 BAHRAIN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 BAHRAIN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 307 BAHRAIN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 308 BAHRAIN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 309 BAHRAIN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 BAHRAIN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 BAHRAIN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 BAHRAIN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 BAHRAIN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 BAHRAIN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 315 BAHRAIN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 BAHRAIN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 BAHRAIN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 BAHRAIN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 319 BAHRAIN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 BAHRAIN FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 BAHRAIN TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 BAHRAIN ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 BAHRAIN CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 324 BAHRAIN ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 325 BAHRAIN INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 REST OF MIDDLE EAST & AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 327 REST OF MIDDLE EAST & AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 328 REST OF MIDDLE EAST & AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 REST OF MIDDLE EAST & AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 330 REST OF MIDDLE EAST & AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 331 REST OF MIDDLE EAST & AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 332 REST OF MIDDLE EAST & AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 REST OF MIDDLE EAST & AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 334 REST OF MIDDLE EAST & AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 335 REST OF MIDDLE EAST & AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 336 REST OF MIDDLE EAST & AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 REST OF MIDDLE EAST & AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 338 REST OF MIDDLE EAST & AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 339 REST OF MIDDLE EAST & AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 340 REST OF MIDDLE EAST & AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 341 REST OF MIDDLE EAST & AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 342 REST OF MIDDLE EAST & AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 343 REST OF MIDDLE EAST & AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 REST OF MIDDLE EAST & AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 345 REST OF MIDDLE EAST & AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 346 REST OF MIDDLE EAST & AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 347 REST OF MIDDLE EAST & AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 348 REST OF MIDDLE EAST & AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 349 REST OF MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 350 REST OF MIDDLE EAST & AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 351 REST OF MIDDLE EAST & AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 352 REST OF MIDDLE EAST & AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

図表一覧

FIGURE 1 MIDDLE EAST AND AFRICA ANILINE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA ANILINE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ANILINE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ANILINE MARKET: MIDDLE EAST AND AFRICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ANILINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ANILINE MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA ANILINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA ANILINE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA ANILINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 MIDDLE EAST AND AFRICA ANILINE MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA ANILINE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 THE NITROBENZENE HYDROGENATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE MIDDLE EAST AND AFRICA ANILINE MARKET IN 2026 AND 2033

FIGURE 15 MIDDLE EAST AND AFRICA ANILINE MARKET, 2025-2033, AVERAGE SELLING PRICE (USD/KG)

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 PATENT ANALYSIS BY IPC CODE

FIGURE 18 PATENT ANALYSIS BY COUNTRIES

FIGURE 19 PATENT ANALYSIS BY YEAR

FIGURE 20 PATENT ANALYSIS BY APPLICANT

FIGURE 21 DROC ANALYSIS

FIGURE 22 MIDDLE EAST AND AFRICA ANILINE MARKET: BY PRODUCTION PROCESS, 2025

FIGURE 23 MIDDLE EAST AND AFRICA ANILINE MARKET: BY GRADE & PURITY, 2025

FIGURE 24 MIDDLE EAST AND AFRICA ANILINE MARKET: BY APPLICATION, 2025

FIGURE 25 MIDDLE EAST AND AFRICA ANILINE MARKET: BY END USER, 2025

FIGURE 26 MIDDLE EAST AND AFRICA ANILINE MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 27 MIDDLE EAST AND AFRICA ANILINE MARKET: SNAPSHOT

FIGURE 28 MIDDLE EAST AND AFRICA ANILINE MARKET: COMPANY SHARE 2025 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。