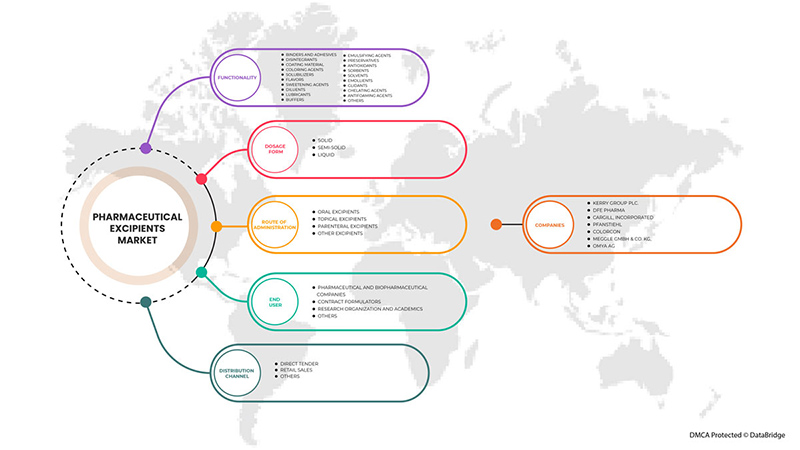

中東およびアフリカの医薬品添加剤市場、機能別(結合剤および接着剤、崩壊剤、コーティング材、着色剤、可溶化剤、香料、甘味料、希釈剤、潤滑剤、緩衝剤、乳化剤、保存料、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑剤、キレート剤、消泡剤、その他)、剤形別(固体、半固体、液体)、投与経路別(経口添加剤、局所添加剤、非経口添加剤、その他の添加剤)、エンドユーザー別(製薬およびバイオ医薬品会社、契約製剤製造業者、研究機関および学術機関、その他)、流通チャネル別(直接入札、小売販売、その他)、業界動向および2029年までの予測。

中東およびアフリカの医薬品添加剤市場の分析と洞察

医薬品添加剤は、薬剤の処方と開発において重要な役割を果たします。これらの物質には、薬理学的に活性な薬物またはプロドラッグ以外の物質が含まれます。医薬品添加剤は、薬物を標的部位に効率的に送達します。これらの分子は、薬物が同化して薬効を高める際に、薬物が早期に放出されるのを防ぎます。一部の医薬品添加剤は、薬物の統合を促進し、血流中の薬物の吸収を高めます。

さらに、医薬品添加剤は薬物の識別にも使用されます。医薬品添加剤は薬物の風味を高めるためにも使用され、患者のコンプライアンス、特に子供のコンプライアンスを高めます。医薬品添加剤の化学的性質に基づいて、これらは有機および無機の供給源から得ることができます。有機化学物質には、炭水化物、石油化学製品、油脂化学製品、タンパク質などが含まれます。医薬品添加剤は、結合剤、充填剤、希釈剤、懸濁剤またはコーティング剤、香味剤、崩壊剤、着色剤、潤滑剤および流動化剤、甘味料、保存料などとして機能することができます。医薬品添加剤には、結合剤および接着剤、崩壊剤、可溶化剤、香味料、乳化剤、保存料、抗酸化剤、流動化剤、キレート剤など、さまざまな目的で使用されるいくつかの機能があります。

しかし、医薬品や添加剤の承認に関する規制が厳格化していることや、医薬品開発プロセスにコストと時間がかかることから、この市場の成長は抑制されると予想されます。

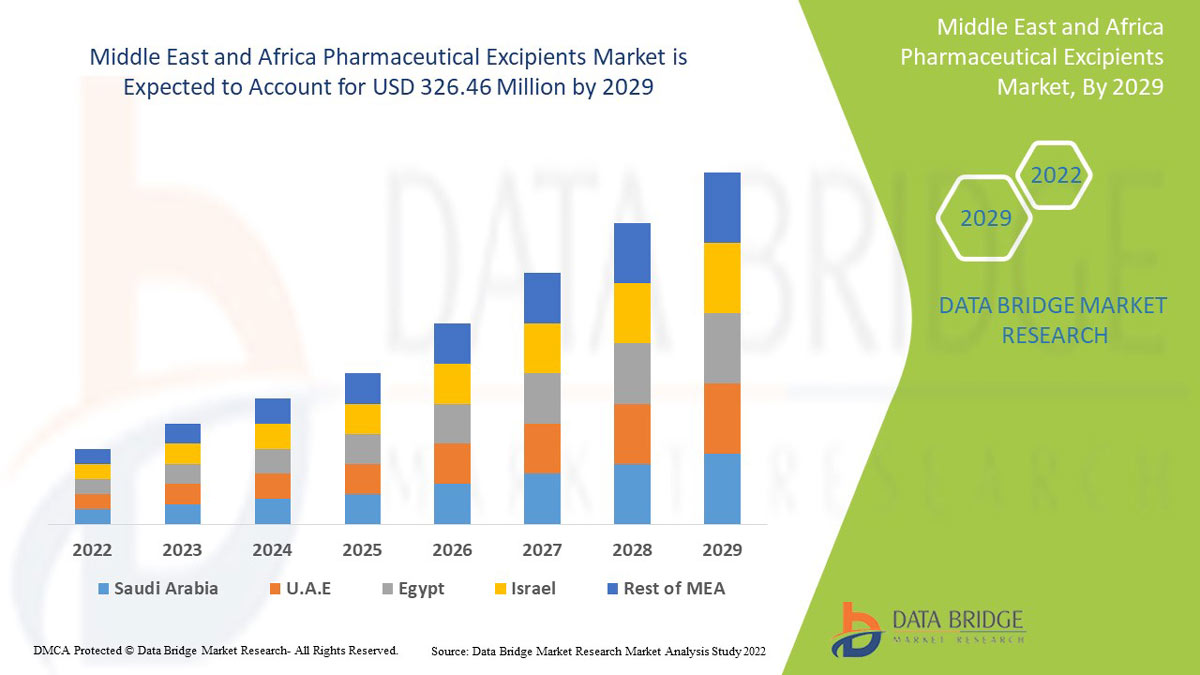

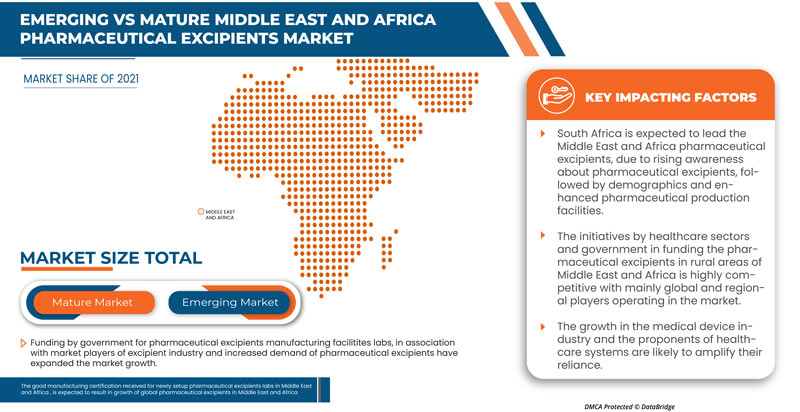

Data Bridge Market Research の分析によると、中東およびアフリカの医薬品添加剤市場は、予測期間中に 5.5% の CAGR で成長し、2029 年までに 3 億 2,646 万米ドルに達すると予想されています。中東およびアフリカでは IT ソリューションとサービスの需要が急増しているため、機能性が市場で最大のセグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

機能別(結合剤および接着剤、崩壊剤、コーティング材、着色剤、可溶化剤、香料、甘味料、希釈剤、潤滑剤、緩衝剤、乳化剤、保存料、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑沢剤、キレート剤、消泡剤、その他)、剤形別(固体、半固体、液体)、投与経路別(経口賦形剤、局所賦形剤、非経口賦形剤、その他の賦形剤)、最終使用者別(製薬会社およびバイオ医薬品会社、契約製剤製造業者、研究機関および学術機関、その他)、流通チャネル別(直接入札、小売販売、その他)。 |

|

対象国 |

南アフリカ、サウジアラビア、UAE、イスラエル、クウェート、エジプト、その他の中東およびアフリカ諸国。 |

|

対象となる市場プレーヤー |

Kerry Group plc.、DFE Pharma、Cargill, Incorporated、Pfanstiehl、Colorcon、MEGGLE GmbH & Co. KG、Omya AG、Peter Greven GmbH & Co. KG、Ashland.、Evonik、Dow、Croda International Plc、Roquette Frères.、The Lubrizol Corporation、BASF SE、Avantor, Inc.、BENEO、Chemie Trade など。 |

中東およびアフリカの医薬品添加剤市場の定義

医薬品添加剤には、医薬品有効成分以外のすべての成分が含まれます。これらの分子には薬効はなく、最終的には医薬品の生理的吸収を高めるために使用されます。医薬品添加剤は本質的に不活性であるため、医薬品分子を適切な形で患者に適用できます。従来、医薬品添加剤は単純な分子でしたが、技術革新と新しい薬物送達システムの需要の増加により、医薬品添加剤の複雑さが増しました。医薬品添加剤は、患者の薬物受容性を高め、薬物の安定性と生物学的利用能を高めます。

さらに、医薬品添加剤は薬剤の完全性を維持するのに役立ち、薬剤の保管に役立ちます。医薬品添加剤は、無機化学物質や有機化学物質など、化学的性質に基づいて分類されます。有機化学物質には、炭水化物、石油化学製品、油脂化学製品、タンパク質などがあります。医薬品添加剤は、結合剤、充填剤、希釈剤、懸濁剤またはコーティング剤、香味剤、崩壊剤、着色剤、潤滑剤、流動促進剤、甘味料、防腐剤などとして機能します。

添加剤の科学技術の将来は変化しており、今後も変化し続けます。添加剤の薬局方モノグラフの調和や、添加剤をより適切に特性評価するための新しい分析方法の適用などの分野で、大きな進歩が遂げられています。

中東およびアフリカの医薬品添加剤市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- ジェネリック医薬品の生産と使用の増加

米国食品医薬品局(FDA)と国立バイオテクノロジー情報センター(NCBI)によると、ジェネリック医薬品は、安全性、強度、投与経路、品質、およびパフォーマンスを備えた、承認されたブランド名の医薬品に似せて作成された医薬品です。医薬品の特許が切れた後、従来の医薬品の使用に関連するコスト削減はすぐには明らかではありません。ジェネリック医薬品は、ブランド名の医薬品と同様に、コストを削減する前にジェネリック医薬品市場での競争が必要です。独占権を失ってから2〜3年後、ジェネリック医薬品の価格は通常、ブランド名の医薬品よりも60〜70%低くなります。インドは一人当たりの支出が最も高いため、これらのジェネリック医薬品は他の健康問題に使用できる多くのお金を節約します。全国的に、ジェネリック医薬品の使用は近年大幅に増加しています。ブランド医薬品の安価な代替品が製薬業界の成長を促進する可能性が高い主な理由であるという事実。近い将来のジェネリック医薬品業界。

したがって、ジェネリック医薬品の需要の増加と生産の増加が、中東およびアフリカの医薬品添加剤市場の成長を牽引すると予想されます。また、ジェネリック医薬品のコストが低いため、ジェネリック医薬品の使用が増加します。

- 添加剤の需要の急増

医薬品添加剤は、医薬品の剤形に含まれる物質で、直接治療に用いられるものではなく、製造、保護、サポート、または安定性と可用性の向上を容易にするために使用されます。中東およびアフリカの医薬品産業の発展に伴い、添加剤の役割も小さくなっています。最近では、ジェネリック医薬品の需要が高まっており、添加剤の需要も増加しています。さらに、慢性疾患の症例が急増しています。

賦形剤は、医薬品の製造工程に導入されるか、医薬品の剤形に含まれる、薬学的に活性な薬物以外の不活性物質です。賦形剤は、固形製剤のかさを増し、長期安定性を提供し、薬物の吸収を促進するために、医薬品製剤に広く使用されています。さらに、使用中または保管中の製品の全体的な安全性や機能特性も向上させます。

Thus, wide uses of excipients in drug formulation and applications of excipients are expected to drive the market of the Middle East & Africa pharmaceutical excipients.

Restraint

- Increasing Regulatory Stringency Regarding The Approval of Drugs and Excipients

Generic drug approval rules are largely the same worldwide, with little difference in developing countries. This is because he is not required to undergo bioequivalence (BE) study in this part of the world to obtain generic drug approval. Governments must ensure consistent quality of all generic drugs, medical experts say. Only then will doctors be happy and confident in prescribing generic drugs. A major reason for physicians' (and even patients') lack of confidence in generic drugs has been the lack of strict regulatory requirements regarding the number of generic drugs and the number of impurities allowed.

Controlling the manufacture and distribution of excipients is now considered a top priority by regulators and drug manufacturers, as mixing excipients has resulted in adverse patient events. Furthermore, with the emergence of new excipients and delivery systems, better control of the quality and supply of pharmaceutical excipients has become increasingly important in the context of in vivo activity. Recognizing the important role of excipients in pharmaceutical dosage forms requires excipient suppliers to meet the quality requirements of the pharmaceutical industry, and the pharmaceutical industry, in general, must work to ensure the product's safety. The integrity of use or storage in the supply chain. Hence, the increasing regulatory stringency regarding the approval of drugs and excipients is expected to restrain the Middle East & Africa pharmaceutical excipients market growth.

Opportunity

-

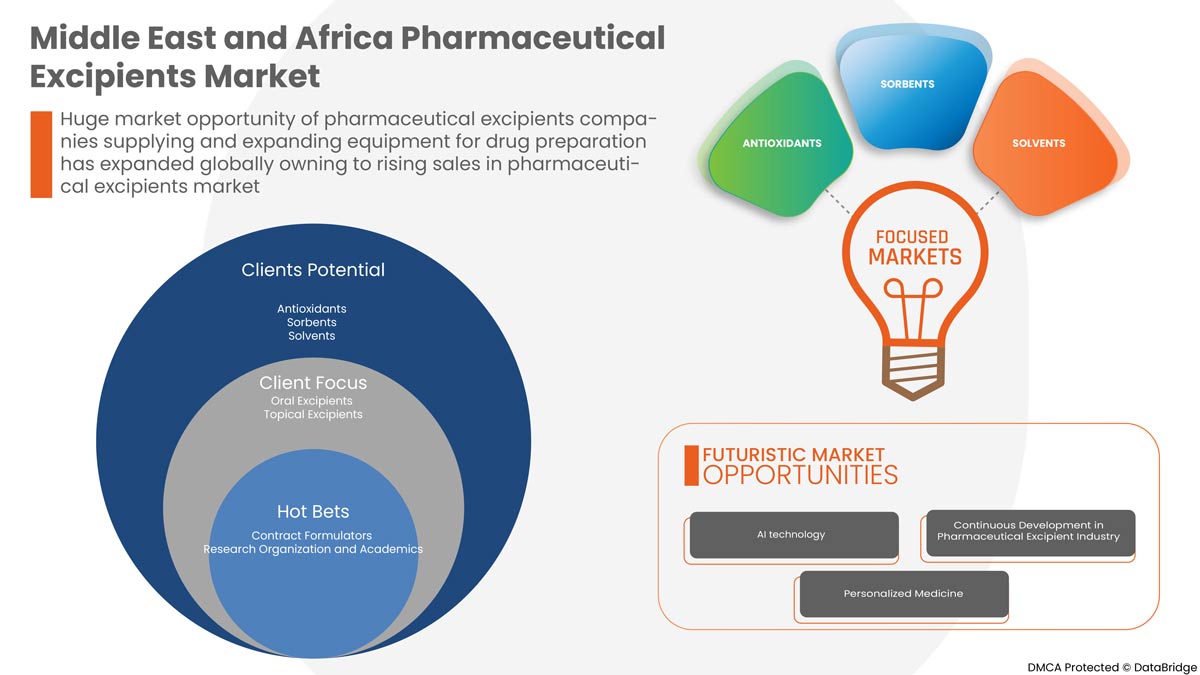

Strategic Initiatives by Market Players

The rise in the pharmaceutical excipients market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for pharmaceutical excipients, and to cope with this demand, companies are building new manufacturing sites, among other strategic initiatives.

These strategic initiatives, such as product launches, acquisitions, agreements, and business expansion by the major market player, will boost the pharmaceutical excipients market growth and is expected to act as an opportunity for the Middle East & Africa pharmaceutical excipients market.

Challenge

- Associated Side Effects

Adverse effects due to pharmaceutical excipients in drug formulations are generally uncommon, but the potential for toxicity is increased at high mg per kg doses, especially in neonates and infants. Methyl and Propyl para-hydroxybenzoate (Parabens), Benzyl Alcohol, Sodium Benzoate, Benzoic Acid, and Propylene Glycol, among others, are some of the common pharmaceutical excipients that have reported side effects.

Pharmaceutical excipients are not always the inert substances that we presume. They are intolerant to an individual or, if not properly screened, can cause chemical changes in the drug, causing the side-effect. This can affect the demand for the excipient and is expected to act as a challenge for the Middle East & Africa pharmaceutical excipients market.

Post-COVID-19 Impact on Middle East & Africa Pharmaceutical Excipients Market

The pharmaceutical industry has been severely affected by the COVID-19 pandemic. Lockdowns imposed due to the epidemic have disrupted the supply of raw materials from manufacturing centers such as India and China. This slowed drug development and production, severely affecting companies that relied heavily on outsourcing. Initially, the entire pharmaceutical ecosystem was disrupted. In addition, regulatory agencies had to draft and draft new laws to ensure maximum patient safety after using drugs. After the shutdowns ended, the pharmaceutical industry gained steam, especially due to the demand for drugs such as hydroxychloroquine and Remdesivir, which showed positive results against COVID-19. The growing demand for these drugs boosted the turnover of some companies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmaceutical excipients market.

Recent Developments

- In February 2022, Kerry Group Plc., the world’s leading taste and Nutrition Company, announced that it had made two significant biotechnology acquisitions that have expanded its expertise, technology portfolio, and manufacturing capabilities. The company has announced that it has acquired the leading biotechnology Innovation Company, c-LEcta, and Mexican-based enzyme manufacturer, Enmex. c-LEcta is a leading biotechnology innovation company specializing in precision fermentation, optimized bio-processing, and bio-transformation. Also, Enmex is a well-established enzyme manufacturer based in Mexico, supplying multiple bio-process solutions for food, beverage, and animal nutrition markets. This has helped company to increase its revenue.

- In September 2022, DFE Pharma, the Middle East & Africa leader in pharma- and nutraceutical excipient solutions, opened its new “Closer to the Formulator” (C2F), a Center of Excellence, in Hyderabad, India. C2F helped pharmaceutical companies to shorten the time from concept to finished commercial product through its expertise in all phases of pharmaceutical development. This has helped company to showcase its progress.

Middle East & Africa Pharmaceutical Excipients Market Scope

Middle East & Africa pharmaceutical excipients market is segmented into functionality, dosage forms, route of administration, end-user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

- BINDERS AND ADHESIVES

- DISINTEGRANTS

- COATING MATERIAL

- COLORING AGENTS

- SOLUBILIZERS

- FLAVORS

- SWEETENING AGENTS

- DILUENTS

- LUBRICANTS

- BUFFERS

- EMULSIFYING AGENTS

- PRESERVATIVES

- ANTIOXIDANTS

- SORBENTS

- SOLVENTS

- EMOLLIENTS

- GLIDENTS

- CHELATING AGENTS

- ANTIFOAMING AGENTS

- OTHERS

On the basis of functionality, the Middle East & Africa pharmaceutical excipients market is segmented into binders and adhesives, disintegrants, coating material, coloring agents, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidents, chelating agents, antifoaming agents, and others.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

- SOLID

- SEMI-SOLID

- LIQUID

On the basis of dosage forms, the Middle East & Africa pharmaceutical excipients market is segmented into solid, semi-solid, and liquid.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

- ORAL EXCIPIENTS

- TOPICAL EXCIPIENTS

- PARENTERAL EXCIPIENTS

- OTHER EXCIPIENTS

On the basis of route of administration, the Middle East & Africa pharmaceutical excipients market is segmented into oral pharmaceutical excipients, topical pharmaceutical excipients, parenteral pharmaceutical excipients, and other excipients.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END-USER

- PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- CONTRACT FORMULATORS

- RESEARCH ORGANIZATION AND ACADEMICS

- OTHERS

On the basis of end user, the Middle East & Africa pharmaceutical excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organizations, and academics, among others.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the Middle East & Africa pharmaceutical excipients market is segmented into direct tender, retail sales, and others.

Middle East & Africa Pharmaceutical Excipients Market Regional Analysis/Insights

The Middle East & Africa pharmaceutical excipients market is analyzed, and market size information is provided functionality, dosage forms, route of administration, end-user, and distribution channel.

The countries covered in this market report are South Africa, Saudi Arabia, UAE, Israel, Kuwait, Egypt, and Rest of the Middle East & Africa

- In 2022, Middle East & Africa is dominating due to the presence of key market players in the largest consumer market with high GDP. South Africa is expected to grow due to the rise in technological advancement in Healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Pharmaceutical Excipients Market Share Analysis

Middle East & Africa pharmaceutical excipients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Middle East & Africa pharmaceutical excipients market.

Some of the major players operating in the Middle East & Africa pharmaceutical excipients market are Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland. , Evonik, and Dow.

Research Methodology: Middle East & Africa Pharmaceutical Excipients Market

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、中東およびアフリカと地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 FUNCTIONALITY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 INDUSTRIAL INSIGHTS:

4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENT MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN GENERIC DRUG PRODUCTION AND USES

5.1.2 THE SURGE IN DEMAND FOR EXCIPIENTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MULTIFUNCTIONAL EXCIPIENTS

5.1.4 RISING FOCUS ON ORPHAN DRUGS

5.2 RESTRAINTS

5.2.1 INCREASING REGULATORY STRINGENCY REGARDING THE APPROVAL OF DRUGS AND EXCIPIENTS

5.2.2 HIGH PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 RISING DEMAND FOR EASE OF USE

5.3.3 RISING DISPOSABLE INCOME

5.3.4 INCREASING DEMAND FOR ALTERNATIVE ROUTES OF DELIVERY/DOSAGE FORMS

5.4 CHALLENGES

5.4.1 ASSOCIATED SIDE EFFECTS

5.4.2 SAFETY CONSIDERATION OF PHARMACEUTICAL EXCIPIENTS IN STORAGE & TRANSPORTATION

5.4.3 LACK OF NOVEL PHARMACEUTICAL PHARMACEUTICAL EXCIPIENTS

6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

6.1 OVERVIEW

6.2 BINDERS AND ADHESIVES

6.2.1 ORGANIC

6.2.2 INORGANIC

6.3 DISINTEGRANTS

6.3.1 ORGANIC

6.3.2 INORGANIC

6.4 COATING MATERIAL

6.4.1 ORGANIC

6.4.2 INORGANIC

6.5 COLORING AGENTS

6.5.1 ORGANIC

6.5.2 INORGANIC

6.6 SOLUBILIZERS

6.6.1 ORGANIC

6.6.2 INORGANIC

6.7 FLAVORS

6.7.1 ORGANIC

6.7.2 INORGANIC

6.8 SWEETENING AGENTS

6.8.1 ORGANIC

6.8.2 INORGANIC

6.9 DILUENTS

6.9.1 ORGANIC

6.9.2 INORGANIC

6.1 LUBRICANTS

6.10.1 ORGANIC

6.10.2 INORGANIC

6.11 BUFFERS

6.11.1 ORGANIC

6.11.2 INORGANIC

6.12 EMULSIFYING AGENTS

6.12.1 ORGANIC

6.12.2 INORGANIC

6.13 PRESERVATIVES

6.13.1 ORGANIC

6.13.2 INORGANIC

6.14 ANTIOXIDANTS

6.14.1 ORGANIC

6.14.2 INORGANIC

6.15 SORBENTS

6.15.1 ORGANIC

6.15.2 INORGANIC

6.16 SOLVENTS

6.16.1 ORGANIC

6.16.2 INORGANIC

6.17 EMOLLIENTS

6.17.1 ORGANIC

6.17.2 INORGANIC

6.18 GLIDENTS

6.18.1 ORGANIC

6.18.2 INORGANIC

6.19 CHELATING AGENTS

6.19.1 ORGANIC

6.19.2 INORGANIC

6.2 ANTIFOAMING AGENTS

6.20.1 ORGANIC

6.20.2 INORGANIC

6.21 OTHERS

7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

7.1 OVERVIEW

7.2 SOLID

7.2.1 PLANT

7.2.2 ANIMALS

7.2.3 SYNTHETIC

7.2.4 MINERALS

7.3 SEMI-SOLID

7.3.1 PLANT

7.3.2 ANIMALS

7.3.3 SYNTHETIC

7.3.4 MINERALS

7.4 LIQUID

7.4.1 PLANT

7.4.2 ANIMALS

7.4.3 SYNTHETIC

7.4.4 MINERALS

8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 ORAL EXCIPIENTS

8.3 TOPICAL EXCIPIENTS

8.4 PARENTERAL EXCIPIENTS

8.5 OTHER EXCIPIENTS

9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.2.1 COMPANY TENDER

9.2.2 TENDER THROUGH MARCH MERCHANDISER

9.3 RETAIL SALES

9.4 OTHERS

10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.3 CONTRACT FORMULATORS

10.4 RESEARCH ORGANIZATION

10.5 OTHERS

11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 U.A.E

11.1.3 SAUDI ARABIA

11.1.4 KUWAIT

11.1.5 EGYPT

11.1.6 ISRAEL

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DOW

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROQUETTE FRÈRES.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EVONIK

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THE LUBRIZOL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 BASF SE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASHLAND (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BENEO

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CARGILL, INCORPORATED.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CHEMIE TRADE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 COLORCON

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 CRODA INTERNATIONAL PLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 DFE PHARMA (SUBSIDIARY OF ROYAL FRIESLANDCAMPINA N.V)

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 KERRY GROUP PLC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEGGLE GMBH & CO. KG

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 OMYA AG

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PETER GREVEN GMBH & CO. KG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PFANSTIEHL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKETS, BY REGION, 2015-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SOLVENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SOLVENTS PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION, 2015-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA ORAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA TOPICAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA PARENTERAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHER EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA RETAIL SALES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER, 2015-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA CONTRACT FORMULATORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA RESEARCH ORGANIZATION AND ACADEMICS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 12 THE RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS ON PHARMACEUTICAL EXCIPIENTS IS DRIVING THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE BINDERS AND ADHESIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2021

FIGURE 16 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2021

FIGURE 32 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY FUNCTIONALITY (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。