Middle East and Africa Small Molecule Sterile Injectable Drugs Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

7.23 Billion

2025

2033

USD

4.86 Billion

USD

7.23 Billion

2025

2033

| 2026 –2033 | |

| USD 4.86 Billion | |

| USD 7.23 Billion | |

|

|

|

|

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Segmentation, By Product (Vial Filling, Syringe Filling, Cartridge Filling and Others), Application (Oncology, Infectious Diseases, Cardiovascular Diseases, Metabolic Diseases, Neurology, Dermatology, Urology, Autoimmune Diseases, Respiratory Disorders and Others), End-Users (Hospitals, Specialty Clinics, Home Care Settings and Others), Distribution Channels (Direct Tender, Retail Pharmacy, Online Pharmacy and Others)- Industry Trends and Forecast to 2033

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Size

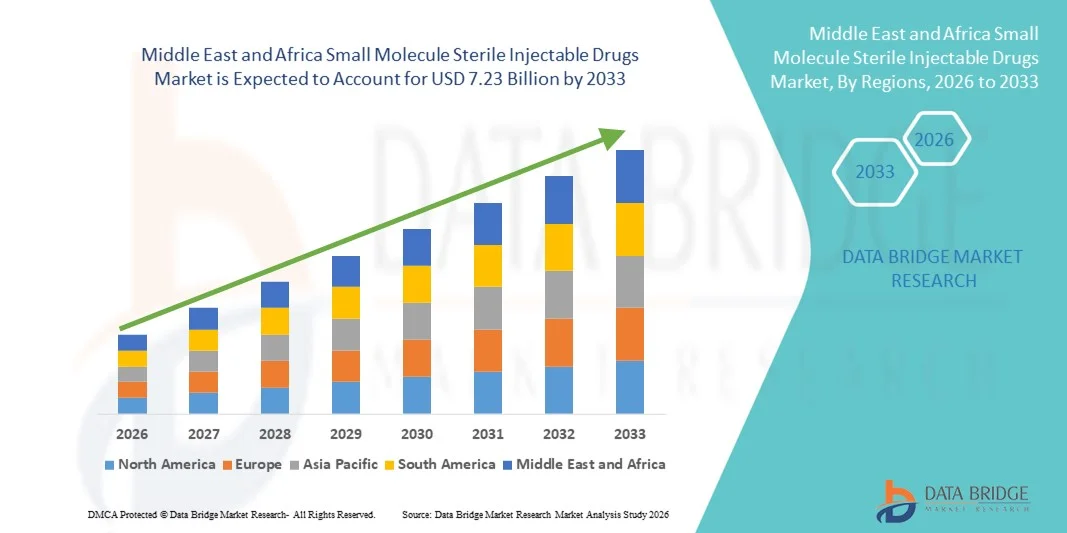

- The Middle East and Africa small molecule sterile injectable drugs market size was valued at USD 4.86 billion in 2025 and is expected to reach USD 7.23 billion by 2033, at a CAGR of 5.1% during the forecast period

- The market growth is largely driven by the rising prevalence of chronic and infectious diseases, increasing hospital admissions, and the growing reliance on injectable formulations for rapid and effective therapeutic outcomes across acute and critical care settings

- Furthermore, expanding healthcare infrastructure, improving access to essential medicines, and increasing government focus on local pharmaceutical manufacturing and regulatory compliance are positioning small molecule sterile injectables as a cornerstone of modern treatment protocols, thereby significantly supporting the market’s growth trajectory

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Analysis

- Small molecule sterile injectable drugs, produced under stringent aseptic conditions for parenteral administration, are essential to healthcare delivery across Middle East and Africa countries, as they enable rapid therapeutic action and are widely used in hospitals for acute, chronic, and life-saving treatments

- The market demand is largely driven by the rising prevalence of chronic and infectious diseases, increasing surgical volumes, and strong reliance on injectable formulations in emergency, oncology, and critical care settings across national healthcare systems

- Saudi Arabia dominated the market with the largest revenue share of 34.6% in 2025, supported by high healthcare spending, advanced hospital infrastructure, and robust government initiatives aimed at strengthening domestic pharmaceutical and sterile injectable manufacturing capacity

- South Africa is projected to experience the fastest growth during the forecast period, fueled by improving healthcare access, rising demand for essential injectable medicines in public hospitals, and growing investments in local pharmaceutical production facilities

- The vial filling segment dominated the market with a share of 47.8% in 2025, driven by its widespread use for multi-dose and single-dose injectable drugs, compatibility with a broad range of small molecule formulations, and strong preference among hospitals and manufacturers due to ease of storage, transport, and administration

Report Scope and Middle East and Africa Small Molecule Sterile Injectable Drugs Market Segmentation

|

Attributes |

Middle East and Africa Small Molecule Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Trends

Expansion of Local Manufacturing and Advanced Aseptic Filling Technologies

- A significant and accelerating trend in the Middle East and Africa small molecule sterile injectable drugs market is the increasing focus on local pharmaceutical manufacturing and the adoption of advanced aseptic filling and containment technologies to ensure drug safety and supply security

- For instance, several manufacturers in Saudi Arabia and the UAE are expanding sterile injectable production facilities with automated vial filling lines to reduce dependency on imports and meet rising domestic hospital demand

- Technological advancements in aseptic processing, including isolator-based filling systems and improved sterilization techniques, are enhancing product quality, reducing contamination risks, and improving compliance with international regulatory standards

- The growing emphasis on high-quality sterile production is also enabling manufacturers to handle complex injectable formulations, including antibiotics, oncology drugs, and critical care medicines, with greater efficiency and consistency

- This shift toward modern sterile manufacturing infrastructure is reshaping supplier capabilities and strengthening regional self-sufficiency in essential injectable medicines across public and private healthcare systems

- Consequently, regional pharmaceutical companies are increasingly investing in vial-based sterile filling technologies to support scalable production, regulatory compliance, and long-term supply stability

- Increasing collaborations between global pharmaceutical firms and regional manufacturers are accelerating technology transfer and the adoption of international best practices in sterile injectable production

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Dynamics

Driver

Rising Disease Burden and Increasing Hospital-Based Care Demand

- The rising prevalence of chronic diseases, infectious diseases, and cancer across Middle East and Africa countries, combined with increasing hospital admissions, is a key driver boosting demand for small molecule sterile injectable drugs

- For instance, the growing incidence of diabetes, cardiovascular disorders, and hospital-acquired infections has significantly increased the use of injectable antibiotics, analgesics, and cardiovascular drugs in inpatient settings

- Small molecule sterile injectables are widely preferred in emergency and critical care due to their rapid onset of action, reliable dosing, and high bioavailability, making them indispensable in modern treatment protocols

- In addition, expanding healthcare infrastructure, including new hospitals and specialized care centers, is driving higher consumption of injectable drugs across both public and private healthcare facilities

- Government initiatives aimed at improving access to essential medicines and strengthening national healthcare systems are further accelerating the adoption of sterile injectable therapies across the region

- Increasing health insurance coverage and reimbursement support in select Middle East and Africa countries is improving patient access to injectable treatments

- The growing aging population and rising surgical procedure volumes are further contributing to sustained demand for perioperative and postoperative injectable drug use

Restraint/Challenge

High Manufacturing Complexity and Regulatory Compliance Burden

- The production of small molecule sterile injectable drugs involves complex manufacturing processes, strict aseptic conditions, and significant capital investment, posing a major challenge for market participants

- For instance, maintaining contamination-free vial filling operations and complying with Good Manufacturing Practice (GMP) standards require continuous monitoring, skilled labor, and costly quality assurance systems

- Regulatory requirements across Middle East and Africa countries can be stringent and heterogeneous, increasing the time and cost associated with facility approvals, product registration, and ongoing compliance

- Any deviation in sterility assurance or quality control can result in production delays, product recalls, or regulatory penalties, directly impacting supply continuity and manufacturer profitability

- Addressing these challenges through process automation, regulatory harmonization, workforce training, and strategic investments in advanced sterile technologies will be critical for sustaining long-term market growth

- Limited availability of skilled personnel trained in aseptic manufacturing and quality control can further constrain production scalability in several countries

- Supply chain disruptions related to raw materials, packaging components, and cold-chain logistics also pose ongoing risks to consistent sterile injectable drug availability across the region

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Scope

The market is segmented on the basis of product, application, end-users, and distribution channels.

- By Product

On the basis of product, the Middle East and Africa small molecule sterile injectable drugs market is segmented into vial filling, syringe filling, cartridge filling, and others. The vial filling segment dominated the market in 2025 with revenue share of 47.8%, driven by its extensive use across hospitals for both single-dose and multi-dose injectable drugs. Vials are compatible with a wide range of small molecule formulations, including antibiotics, oncology drugs, and cardiovascular therapies, making them highly versatile. Their longer shelf life and ease of storage support bulk procurement by public and private hospitals. Established vial-based manufacturing infrastructure across the region further supports large-scale production. In addition, regulatory familiarity and standardized handling practices strengthen adoption. The dominance of hospital-centric care models reinforces sustained demand for vial-filled injectables.

The syringe filling segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing demand for prefilled syringes that enhance dosing accuracy and patient safety. Syringe-filled injectables reduce preparation time and minimize contamination risks, making them ideal for emergency and outpatient settings. Rising use in specialty clinics and home care environments is accelerating adoption. Healthcare providers prefer these formats for workflow efficiency and reduced medication errors. Growth is further supported by technological advancements in syringe filling and growing acceptance of ready-to-use injectables.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, metabolic diseases, neurology, dermatology, urology, autoimmune diseases, respiratory disorders, and others. The infectious diseases segment dominated the market in 2025, owing to the high burden of bacterial and viral infections across Middle East and Africa countries. Injectable antibiotics and antivirals are widely used in inpatient settings due to their rapid action and reliability in severe cases. Public healthcare systems rely heavily on sterile injectables for infection management. Limited oral alternatives for critical infections further support dominance. Ongoing concerns related to hospital-acquired infections sustain continuous demand. Government focus on essential injectable medicines also reinforces this segment’s leadership.

The oncology segment is expected to register the fastest growth over the forecast period, driven by the rising incidence of cancer and expanding access to chemotherapy services. Most oncology treatments require injectable administration, making sterile injectables indispensable. Increasing investment in oncology centers and diagnostic infrastructure is supporting growth. Wider availability of generic injectable cancer drugs is improving affordability. Growing awareness and early diagnosis are also contributing to higher treatment volumes.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home care settings, and others. The hospitals segment dominated the market in 2025, as hospitals are the primary centers for administering sterile injectable drugs. Acute care, surgical procedures, and critical treatments predominantly rely on injectable therapies delivered under professional supervision. High patient volumes in public hospitals drive large-scale consumption. The need for controlled environments to maintain sterility further favors hospital use. Government-funded healthcare facilities account for a significant share of demand. Continuous expansion of hospital infrastructure sustains dominance.

The home care settings segment is projected to witness the fastest growth during the forecast period, supported by the shift toward outpatient and home-based care. Advances in prefilled syringes and user-friendly delivery formats enable safe administration at home. Rising healthcare costs and pressure to reduce hospital stays are encouraging this trend. Increased availability of home healthcare services supports adoption. Patients with chronic conditions increasingly prefer home-based treatment options.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The direct tender segment dominated the market in 2025, driven by bulk procurement by government hospitals and public healthcare systems. Tender-based purchasing ensures cost efficiency, quality assurance, and consistent supply of essential injectable medicines. Centralized procurement mechanisms are widely adopted across Middle East and Africa countries. Long-term supply contracts further strengthen this channel. High-volume hospital demand sustains its leadership. Regulatory preference for controlled procurement also supports dominance.

The online pharmacy segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing digitalization of healthcare services. Improved cold-chain logistics and regulatory oversight are enabling safe online distribution of injectables. Urbanization and growing internet penetration are expanding reach. The Online platforms offer convenience and improved access for home care patients. Rising consumer trust in e-pharmacy services further accelerates growth.

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Regional Analysis

- Saudi Arabia dominated the market with the largest revenue share of 34.6% in 2025, supported by high healthcare spending, advanced hospital infrastructure, and robust government initiatives aimed at strengthening domestic pharmaceutical and sterile injectable manufacturing capacity

- Healthcare providers in Saudi Arabia place high importance on the rapid therapeutic effectiveness, reliability, and controlled administration of small molecule sterile injectables, particularly in acute care, oncology, and infectious disease treatment settings

- This widespread adoption is further supported by national healthcare transformation programs, increasing investments in local sterile injectable production, and rising demand from tertiary and specialty hospitals, establishing Saudi Arabia as the leading country in the regional market

The Saudi Arabia Small Molecule Sterile Injectable Drugs Market Insight

The Saudi Arabia small molecule sterile injectable drugs market captured the largest revenue share in 2025 within the Middle East and Africa, fueled by high healthcare spending and strong government support for pharmaceutical localization. Hospitals and tertiary care centers increasingly rely on sterile injectables for acute, oncology, and infectious disease treatments. The country’s Vision 2030 initiatives are encouraging domestic manufacturing of essential injectable medicines. Growing demand for high-quality, regulated products is strengthening market expansion. Moreover, investments in advanced aseptic filling and vial manufacturing facilities are significantly contributing to market growth.

United Arab Emirates Small Molecule Sterile Injectable Drugs Market Insight

The UAE small molecule sterile injectable drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by advanced healthcare infrastructure and a strong focus on medical tourism. The country emphasizes rapid, high-quality treatment solutions, increasing reliance on injectable drugs. Government initiatives promoting local pharmaceutical manufacturing and regulatory excellence are supporting market development. Rising demand from specialty hospitals and oncology centers is further boosting growth. The UAE’s role as a regional healthcare hub continues to stimulate injectable drug consumption.

South Africa Small Molecule Sterile Injectable Drugs Market Insight

The South Africa small molecule sterile injectable drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by a high burden of infectious and chronic diseases. Public hospitals account for a large share of injectable drug demand due to widespread use of antibiotics and critical care medicines. Government-led healthcare programs are increasing access to essential injectables. Growing investments in local pharmaceutical production are improving supply reliability. These factors are collectively supporting sustained market growth.

Egypt Small Molecule Sterile Injectable Drugs Market Insight

The Egypt small molecule sterile injectable drugs market is gaining momentum due to population growth and increasing demand for hospital-based treatments. Government support for domestic pharmaceutical manufacturing is strengthening local supply of injectables. Rising prevalence of chronic diseases and infections is increasing inpatient drug utilization. Expansion of public hospitals and healthcare reforms are further supporting market growth. Egypt’s strategic position as a pharmaceutical manufacturing hub in North Africa is also contributing to market development.

Middle East and Africa Small Molecule Sterile Injectable Drugs Market Share

The Middle East and Africa Small Molecule Sterile Injectable Drugs industry is primarily led by well-established companies, including:

- Ateco Pharma (Egypt)

- Pharmaceutical Solutions Industry (PSI) (Saudi Arabia)

- Quality Chemical Industries Limited (Uganda)

- EVA Pharma (Egypt)

- Atlantic Lifesciences Limited (Ghana)

- Minapharm Pharmaceuticals (Egypt)

- Hikma Pharmaceuticals PLC (Jordan)

- Aspen Pharmacare Holdings Limited (South Africa)

- Baxter (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- Bristol Myers Squibb Company (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

What are the Recent Developments in Middle East and Africa Small Molecule Sterile Injectable Drugs Market?

- In December 2025, Julphar signed a long‑term lease agreement to build an integrated pharmaceutical manufacturing facility in Jeddah, Saudi Arabia, with advanced sterile injectable production technologies. The project (~SAR 300 million) aims to localize pharmaceutical manufacturing, strengthen national health security, and create a regional export hub for sterile injectables and other products

- In October 2025, Mubadala Bio launched a new range of locally produced essential medications in the UAE, including small and large‑volume IV injectables, strengthening supply of critical hospital treatments. This effort reflects a broader push to expand local life sciences manufacturing and ensure continuous access to key therapies regionally

- In August 2025, MS Pharma officially inaugurated the Middle East’s first biologics manufacturing hub in Riyadh, Saudi Arabia, with GMP approval from the SFDA. Although focused on biologics, the facility also strengthens local capabilities for fill‑finish and injectable manufacturing, supporting broader sterile injectable drug production infrastructure

- In June 2025, Farmak International expanded into three new Middle East and Africa markets, introducing high‑potency injectable products such as vitamin infusions and hormone therapies for hospitals in Oman and Qatar. These market entries increase regional access to specialized hospital care injectables

- In January 2025, Egypt signed a USD 120 million agreement to establish a pharmaceutical industrial zone in the Suez Canal Economic Zone to produce key raw materials and intermediates used in drug manufacturing. While not exclusively sterile injectables, this hub will support broader pharmaceutical production capacity, including materials for injectable formulations

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。