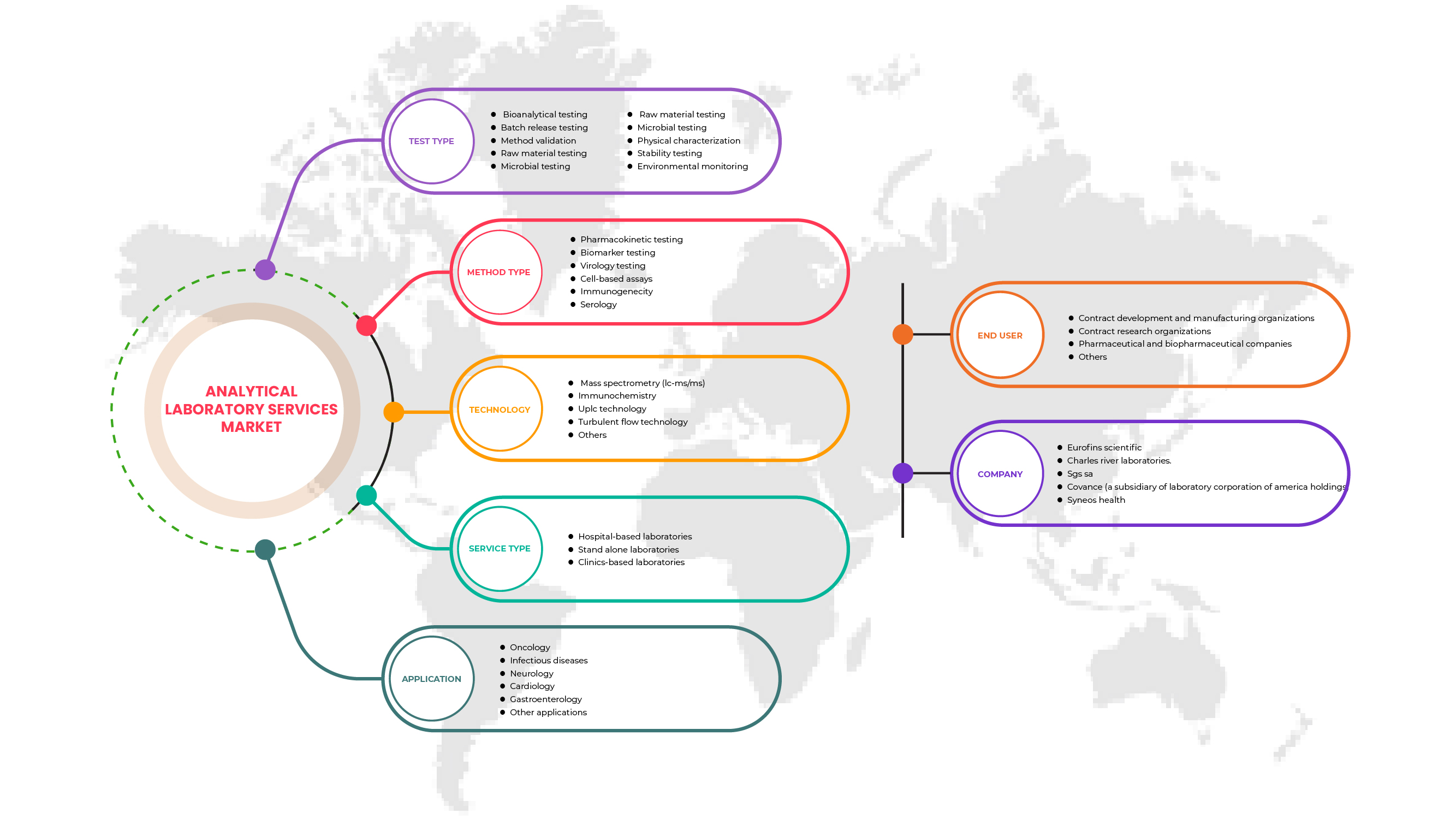

北米分析ラボサービス市場、テストタイプ別(バイオ分析テスト、バッチリリーステスト、安定性テスト、原材料テスト、物理的特性評価、メソッド検証、微生物テスト、環境モニタリング)、サービスタイプ別(病院ベースのラボ、独立ラボ、クリニックベースのラボ)、メソッドタイプ別(細胞ベースのアッセイ、ウイルステスト、バイオマーカーテスト、薬物動態テスト、免疫原性および血清学)、アプリケーション別(腫瘍学、神経学、感染症、消化器病学、心臓病学、その他のアプリケーション)、テクノロジー別(質量分析(LC-MS / MS)、免疫化学、UPLCテクノロジー、乱流テクノロジー、その他)、エンドユーザーチャネル別(製薬会社およびバイオ製薬会社、受託開発製造組織、受託研究組織、その他)-2029年までの業界動向と予測。

北米分析ラボサービス市場分析と規模

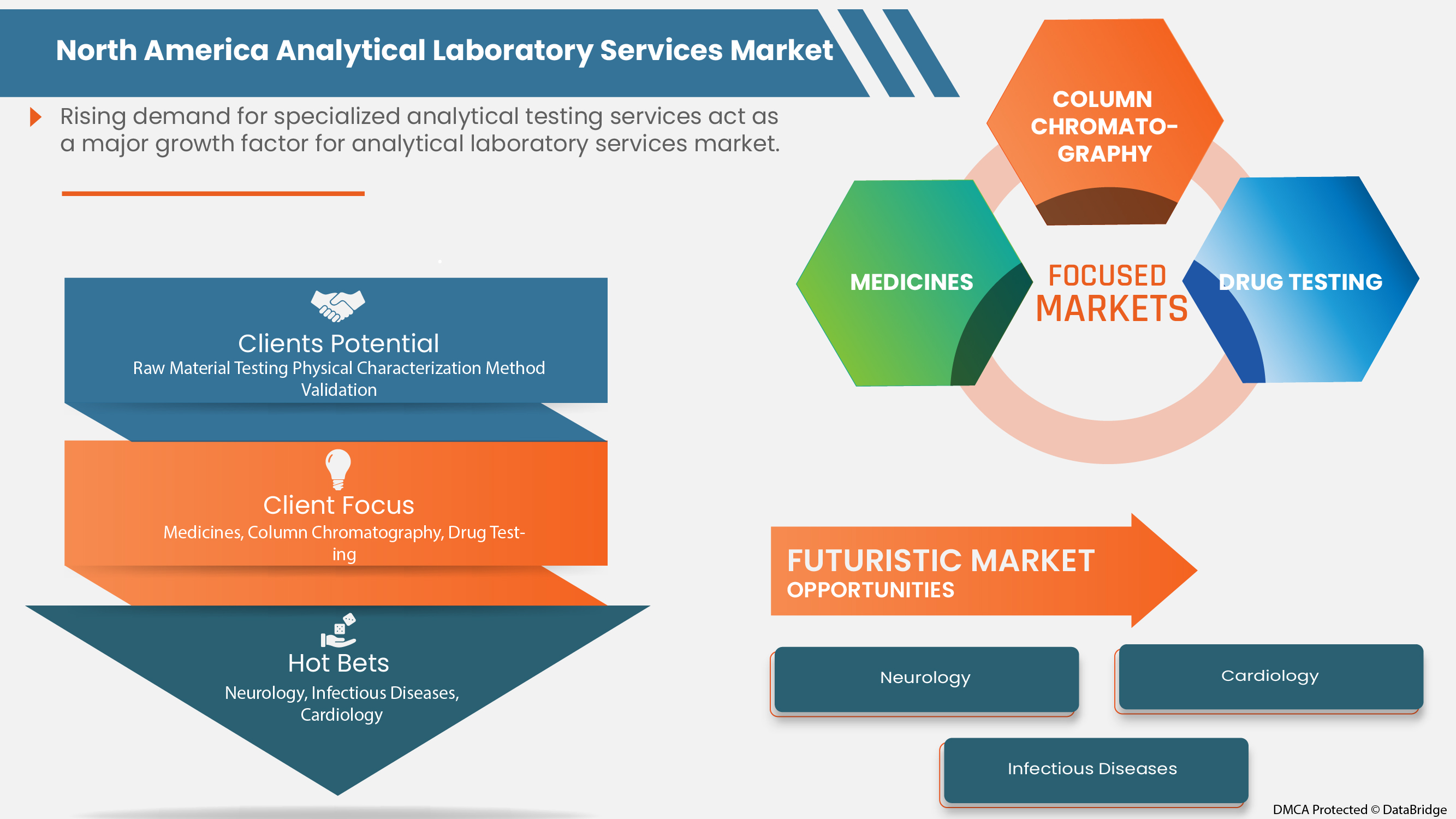

市場では、バイオ分析試験、原材料試験、バッチリリース試験、製品検証、物理的特性評価など、多数の分析サービスが提供されています。これらのサービスは、製薬会社、バイオ医薬品会社、医療機器会社などのヘルスケア部門で広く採用されています。これらのサービスは、正確性、品質、効率性の信頼できる情報源を提供します。これらは、腫瘍学、神経学、感染症、心臓病学などの分野で応用されています。分析ラボサービス市場は、分析試験機能を強化する政府の取り組みの増加と、医薬品の承認と臨床試験の増加に伴い成長しています。さらに、さまざまな治療領域での多数の高分子とバイオシミラーの使用と開発の増加、および新しいラボを設立するための政府による支出の増加は、ラボサービス市場の成長を加速させる他の要因です。

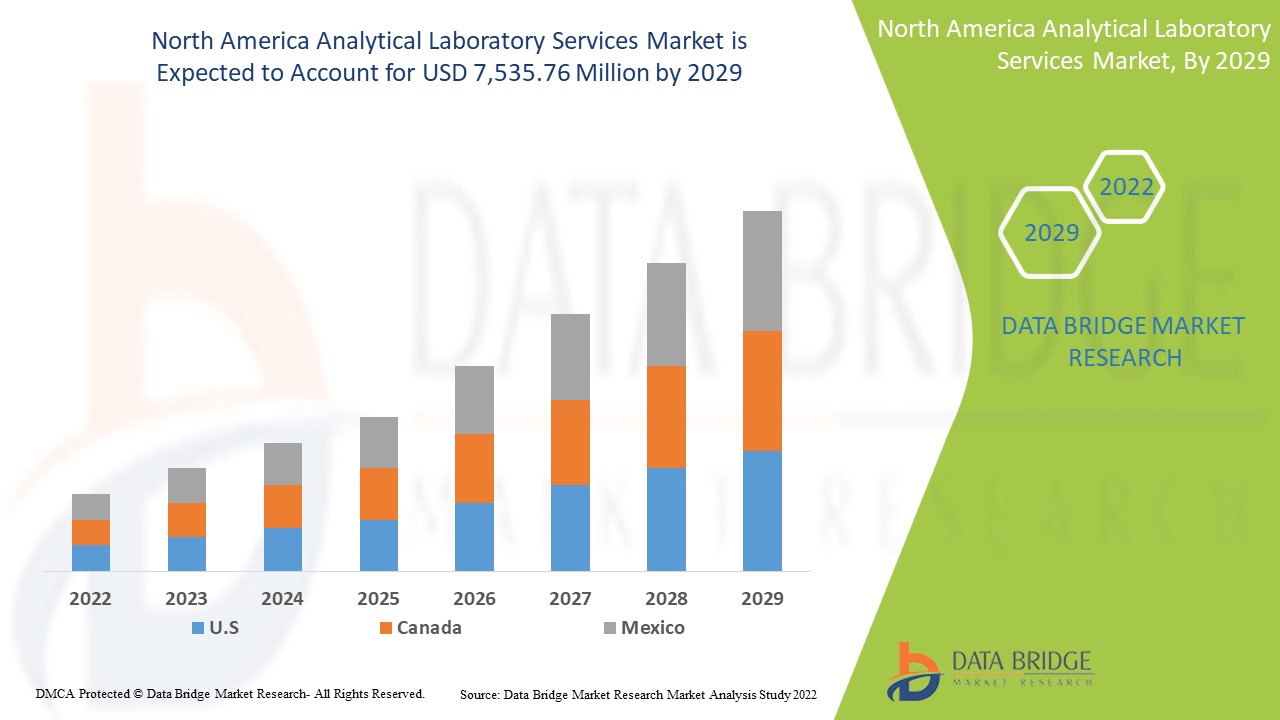

Data Bridge Market Research の分析によると、分析ラボ サービス市場は、予測期間中に 14.1% の CAGR で成長し、2029 年までに 75 億 3,576 万米ドルに達すると予想されています。分析ラボ サービス市場では、バイオ分析テスト セグメントが最大の提供セグメントを占めています。分析ラボ サービス市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (カスタマイズ可能 2019-2014) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

試験タイプ別(バイオ分析試験、バッチリリース試験、安定性試験、原材料試験、物理的特性評価、方法の検証、微生物試験、環境モニタリング)、サービスタイプ別(病院ベースの研究所、独立系研究所、診療所ベースの研究所)、方法タイプ別(細胞ベースのアッセイ、ウイルス学試験、バイオマーカー試験、薬物動態試験、免疫原性および血清学)、アプリケーション別(腫瘍学、神経学、感染症、消化器学、心臓病学、その他のアプリケーション)、テクノロジー別(質量分析法(LC-MS/MS)、免疫化学、UPLCテクノロジー、乱流テクノロジー、その他)、エンドユーザーチャネル別(製薬会社およびバイオ医薬品会社、受託開発製造組織、受託研究組織、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Charles River Laboratories、Medpace、WuXi AppTec、Eurofins Scientific、Q2 Solutions(IQVIAの子会社)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、Frontage Labs、TOXIKON、BioAgilytix Labs、VxP Pharma、Inc.、Pace Analytical Services、LLC、Pharmaceutical Research Associates Inc.、ALS Limited、Evotec SE、Intertek Group plc、Covance(Laboratory Corporation of Americaの子会社)、PPD Inc.(Thermo Fisher Scientific Inc.の子会社)など |

市場の定義

分析ラボ サービスは、幅広い化学分析および微生物学的分析に関係しています。分析ラボ サービスには、方法の開発と検証、濃度確認のためのサンプル分析、IND、NDA、ANDA 申請用の予備製剤および最終医薬品の純度、均質性、安定性分析が含まれます。分析サービスは「材料試験」とも呼ばれ、特定のサンプルの化学組成や特性を識別するために使用されるさまざまな手法を説明するために使用されます。医薬品、食品、電子機器、プラスチックなどの業界のメーカーは、リバース エンジニアリングや故障分析、製品の汚染物質や汚れの特定に分析試験を使用することがよくあります。

市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

-

医薬品と医療機器への支出の増加

製薬業界とバイオテクノロジー業界の台頭により、薬物動態試験やその他のバッチ試験、微生物試験などのサービスを提供するために医薬品市場に依存しているため、これらの分析サービスの市場が拡大するでしょう。したがって、予測期間中、北米の分析ラボサービス市場の成長の原動力となることが期待されます。

-

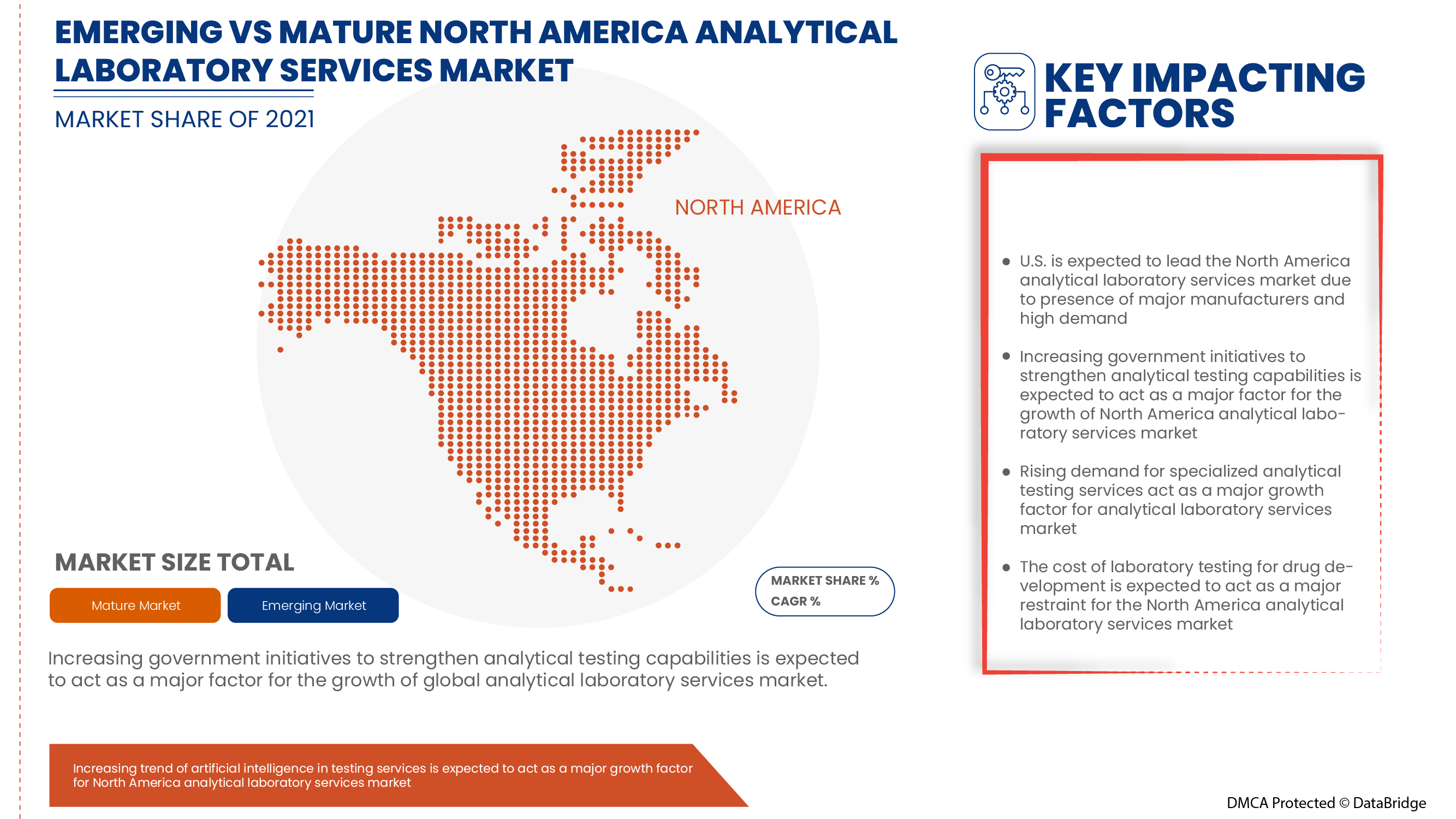

分析試験能力を強化する政府の取り組み

分析サービスを拡大するための政府の資金提供と取り組みは、予測期間中に市場の成長と市場プレーヤーの増加に役立ちます。これにより、市場規模が拡大し、予測期間中に北米の分析ラボサービス市場の成長の原動力となることが期待されます。

-

医薬品の承認と臨床試験の増加

市場プレーヤーは、契約研究の下で分析試験プロセスを提供しています。さらに、医薬品の生産と新製品の研究の増加を伴うバイオ医薬品産業の成長は、予測期間中の北米分析ラボサービス市場の成長の原動力となることが期待されています。

機会

-

市場参加者間の連携強化

市場におけるコラボレーションは、市場で機会を生み出すことが期待される主な要因です。契約、パートナーシップ、コラボレーションは、限られたグローバルプレゼンスやサプライチェーンなどのハードルを克服し、サービスポートフォリオを拡大するために行われます。分析ラボサービス市場では、さまざまな市場プレーヤーがこれを実行し、市場に機会を生み出しています。

制約/課題

- 高度な分析ラボの高コスト設定

限られた高効率機器を備えたバイオ分析施設の設置には多額の投資が必要であり、投資コストが高いため市場の成長が制限されると予想されます。これは、予測期間中の北米分析ラボサービス市場の成長の抑制要因となることが予想されます。

COVID-19による北米分析ラボサービス市場への影響

COVID-19は、ほぼすべての国が必需品を扱う施設を除くすべての施設の閉鎖を選択したため、さまざまな業界に大きな影響を与えました。政府は、COVID-19の拡散を防ぐために、施設の閉鎖や非必需品の販売、国際貿易のブロックなど、いくつかの厳しい措置を講じました。このパンデミック状況に対処している唯一のビジネスは、営業とプロセスの運営が許可された必須サービスでした。

COVID-19 患者の治療にリソースが転用されたことで、臨床試験の患者を募集し、治療するほとんどの研究施設の運営に大きな影響が出ています。これらの分析サービスは、さまざまなバイオ分析研究の臨床試験で広く使用されています。さらに、この結果、試験開始の減少や新規事業の受注の遅れが生じ、それぞれがさまざまな企業の収益減少につながっています。

COVID-19 has impacted the market of analytical laboratory services negatively. Due to the cancellation of the clinical trial, the demand for analytical services was also disrupted. The major portion of these analytical services comes from the clinical trials and CRO, which get badly impacted. However, some of the market players, such as Eurofins Scientific, which can provide analytical support, were successful in minimizing the loss during COVID-19. The supply chain was disrupted as the material and solvent that were mandatory for these analytical testing faced challenges in the customs department and were not allowed to cross international borders.

Hence, COVID-19 has negatively impacted the analytical testing business, but the strategic initiative of the market players is somehow gaining success in minimizing the loss in the net revenue or segmental revenue.

Recent Developments

- In February 2021, Eurofins Scientific announced that they had acquired Beacon Discovery, preeminent drug discovery and contract research organization (CRO). This will increase the company's access to contract research and will increase its revenue for the company

- In April 2021, SGS SA announced that the company SYNLAB Analytics & Services is now be called SGS Analytics which is due to the acquisition of the leading European environmental, food & health sciences testing and tribology services company. The acquisition will continue growth and innovation by helping businesses to comply with ever increasing regulations designed to ensure food, pharmaceutical, and environmental safety

North America Analytical Laboratory Services Market Scope

The analytical laboratory services market is segmented on the basis of test type, service type, method type, application, technology, and end users. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Test Type

- Bioanalytical testing

- Batch release testing

- Method validation

- Raw material testing

- Microbial testing

- Physical characterization

- Stability testing

- Environmental monitoring

On the basis of test type, the analytical laboratory services market is segmented into bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing and environmental monitoring.

By Service Type

- Hospital-based laboratories

- Stand-alone laboratories

- Clinics-based laboratories

On the basis of service type, the analytical laboratory services market is segmented into hospital-based laboratories, stand-alone laboratories and clinic-based laboratories.

By Method Type

- Pharmacokinetic testing

- Biomarker testing

- Virology testing

- Cell-based assays

- Immunogenicity

- Serology

On the basis of method type, the analytical laboratory services market is segmented into cell-based assays, virology testing, biomarker testing, pharmacokinetic testing, immunogenicity and serology.

By Application

- Oncology

- Neurology

- Infectious diseases

- Cardiology

- Gastroenterology

- Others

On the basis of application, the analytical laboratory services market is segmented into oncology, neurology, infectious diseases, gastroenterology, cardiology and other applications.

By Technology

- Mass spectroscopy

- Immunochemistry

- UPLC technology

- Turbulent flow technology

- Others

On the basis of technology, the analytical laboratory services market is segmented into mass spectroscopy, immunochemistry, UPLC technology, turbulent flow technology and others.

By End-User

- Pharmaceutical and biopharmaceutical companies

- Contract development and manufacturing organizations

- Contract research organizations

- Others

On the basis of end user, the analytical laboratory services market is segmented into pharmaceutical & biopharmaceutical industries, contract development & manufacturing organizations, contract research organizations and others.

Analytical Laboratory Services Market Regional Analysis/Insights

The analytical laboratory services market is analysed, and market size insights and trends are provided by country, test type, service type, method type, application, technology, and end user as referenced above.

The countries covered in the analytical laboratory services market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America analytical laboratory services market owing to the increasing development of laboratories in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Analytical Laboratory Services Market Share Analysis

The analytical laboratory services market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to analytical laboratory services market.

北米の分析ラボサービス市場で分析ラボサービスを提供している大手企業には、Charles River Laboratories、Medpace、WuXi AppTec、Eurofins Scientific、Q2 Solutions(IQVIA の子会社)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、Frontage Labs、TOXIKON、BioAgilytix Labs、VxP Pharma、Inc.、Pace Analytical Services、LLC、Pharmaceutical Research Associates Inc.、ALS Limited、Evotec SE、Intertek Group plc、Covance(Laboratory Corporation of America の子会社)、PPD Inc.(Thermo Fisher Scientific Inc. の子会社)などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET TYPE OF MANUFACTURER COVERAGE GRID

2.1 MULTIVARIATE MODELLING

2.11 TEST TYPE LIFELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY SCENARIO IN NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING EXPENDITURE ON DRUGS AND MEDICAL DEVICES

5.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN ANALYTICAL TESTING CAPABILITIES

5.1.3 INCREASING NUMBER OF DRUG APPROVALS & CLINICAL TRIALS

5.1.4 RISING DEMAND FOR SPECIALIZED ANALYTICAL TESTING SERVICES

5.1.5 INCREASING INVESTMENT IN ANALYTICAL TESTING BY MARKET PLAYERS

5.2 RESTRAINTS

5.2.1 LIMITATION IN ANALYZING NOVEL COMPLEX PRODUCTS

5.2.2 COST OF LABORATORY TESTING FOR DRUG DEVELOPMENT

5.2.3 MAINTENANCE AND UPDATING OF EQUIPMENT

5.2.4 HIGH COST SETTING AN ADVANCED ANALYTICAL LAB

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AMONG MARKET PLAYERS

5.3.2 INCREASING OUTSOURCING FACILITIES

5.3.3 INCREASING TREND OF ARTIFICIAL INTELLIGENCE IN TESTING SERVICES

5.4 CHALLENGES

5.4.1 MAINTAINING REGULATORY STANDARD FOR TESTING

5.4.2 DEVELOPMENT AND MAINTENANCE OF EXPERTISE

6 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE

6.1 OVERVIEW

6.2 CELL-BASED ASSAYS

6.3 VIRAL CELL-BASED ASSAYS

6.4 BACTERIAL CELL-BASED ASSAYS

6.5 VIROLOGY TESTING

6.6 IN VITRO VIROLOGY TESTING

6.7 IN VIVO VIROLOGY TESTING

6.8 SPECIES-SPECIFIC VIRAL PCR ASSAYS

6.9 SEROLOGY

6.1 IMMUNOGENICITY

6.11 BIOMARKER TESTING

6.12 PHARMACOKINETIC TESTING

7 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 BIOANALYTICAL TESTING

7.2.1 PHARMACOKINETIC TEST

7.2.2 PHARMACODYNAMICS TEST

7.2.3 BIOEQUIVALENCE TEST

7.2.4 BIOAVAILABILITY TEST

7.2.5 OTHER TEST

7.3 BATCH RELEASE TESTING

7.4 STABILITY TESTING

7.5 RAW MATERIAL TESTING

7.6 PHYSICAL CHARACTERIZATION

7.7 METHOD VALIDATION

7.8 MICROBIAL TESTING

7.9 ENVIRONMENTAL MONITORING

8 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 MASS SPECTROSCOPY (LC-MS/MS)

8.3 IMMUNOCHEMISTRY

8.4 UPLC TECHNOLOGY

8.5 TURBULENT FLOW TECHNOLOGY

8.6 OTHERS

9 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE

9.1 OVERVIEW

9.2 HOSPITAL-BASED LABORATORIES

9.3 STANDALONE LAORATORIES

9.4 CLINICS-BASED LABORATORIES

10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ONCOLOGY

10.3 INFECTIOUS DISEASES

10.4 NEUROLOGY

10.5 CARDIOLOGY

10.6 GASTROENTEROLOGY

10.7 OTHER APPLICATIONS

11 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

11.3 CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS

11.4 CONTRACT RESEARCH ORGANIZATIONS

11.5 OTHERS

12 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CHARLES RIVER LABORATORIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 SGS SA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 COVANCE (A SUBSIDIARY OF LABORATORY CORPORATION OF AMERICA HOLDINGS)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SERVICE PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 WUXI APPTEC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 SYNEOS HEALTH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 PHARMACEUTICAL RESEARCH ASSOCIATES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AGENZIA ITALIANA DEL FARMACO - AIFA

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIOAGILYTIX LABS

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 CENTRAL DRUGS STANDARD CONTROL ORGANIZATION

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EUROPEAN MEDICINES AGENCY

15.12.1 COMPANY SNAPSHOT

15.12.2 SERVICE PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 EVOTEC SE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 FEDERAL INSTITUTE FOR DRUGS & MEDICAL DEVICES (BFARM)

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 FOOD SAFETY AND DRUG ADMINISTRATION DEPARTMENT

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FRONTAGE LABS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE & SOLUTION PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 ICON PLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 INTERTEK GROUP PLC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 INDUSTRY & SERVICE PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 MEDPACE

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 NATIONAL MEDICAL PRODUCTS ADMINISTRATION

15.20.1 COMPANY SNAPSHOT

15.20.2 SERVICE PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 PACE ANALYTICAL SERVICES, LLC

15.21.1 COMPANY SNAPSHOT

15.21.2 SERVICE PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 PHARMACEUTICALS AND MEDICAL DEVICES AGENCY

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PPD INC. (A SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC.)

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 SOLUTION PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 Q2 SOLUTIONS (A SUBSIDIARY OF IQVIA)

15.24.1 COMPANY SNAPSHOT

15.24.2 SOLUTION PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SHANGHAI MEDICILON INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 SERVICE PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SPANISH AGENCY FOR MEDICINES AND HEALTH PRODUCTS

15.26.1 COMPANY SNAPSHOT

15.26.2 SERVICE PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SOLVIAS AG

15.27.1 COMPANY SNAPSHOT

15.27.2 SERVICE PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

15.28 TOXIKON

15.28.1 COMPANY SNAPSHOT

15.28.2 SERVICE PORTFOLIO

15.28.3 RECENT DEVELOPMENTS

15.29 VXP PHARMA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 SERVICE PORTFOLIO

15.29.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA CELL-BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SEROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA IMMUNOGENICITY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIOMARKER TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PHARMACOKINETIC TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA BIOANALYTICAL IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BATCH RELEASE IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA STABILITY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RAW MATERIAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PHYSICAL CHARACTERIZATION IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA METHOD VALIDATION IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MICROBIAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ENVIRONMENTAL MONITORING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MASS SPECTROMETRY (LC-MS/MS) IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA IMMUNOCHEMISTRY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UPLC TECHNOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TURBULENT FLOW TECHNOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITAL-BASED LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA STANDALONE LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICAL-BASED LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONCOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA INFECTIOUS DISEASES IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA NEUROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA CARDIOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA GASTROENTEROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHER APPLICATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 69 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: MARKET TYPE COVERAGE GRID

FIGURE 10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 12 GROWING EXPENDITURE ON DRUGS IS DRIVING THE NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 ANALYTICAL LABORATORY TESTING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET IN 2022 & 2029

FIGURE 14 OVERVIEW OF DIFFERENT GUIDELINES AROUND THE GLOBE

FIGURE 15 CGMP REQUIREMENT FOR ANALYTICAL LABORATORY INCLUDES

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

FIGURE 17 INCREASING PRESCRIPTION OF DRUGS

FIGURE 18 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2021

FIGURE 19 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, 2021-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, CAGR (2021-2029)

FIGURE 21 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2021

FIGURE 23 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE 2021-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE, CAGR (2021-2029)

FIGURE 25 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2021

FIGURE 27 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, 2021-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, CAGR (2021-2029)

FIGURE 29 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, 2021 (USD MILLION)

FIGURE 31 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, 2021-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, CAGR (2021-2029)

FIGURE 33 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, 2021 (USD MILLION)

FIGURE 35 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, 2021-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, CAGR (2021-2029)

FIGURE 37 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION , LIFELINE CURVE

FIGURE 38 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2021

FIGURE 39 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, CAGR (2021-2029)

FIGURE 41 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 43 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 44 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE (2022-2029)

FIGURE 47 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY SHARE 2020 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。