North America Automotive Soft Trim Interior Materials Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

3.41 Billion

2024

2032

USD

2.38 Billion

USD

3.41 Billion

2024

2032

| 2025 –2032 | |

| USD 2.38 Billion | |

| USD 3.41 Billion | |

|

|

|

|

North America Automotive Soft Trim Interior Materials Market Segmentation, By Material (Fabric, Leather, Thermoplastic Polyurethanes (TPU), Thermoplastic Elastomers, Thermoplastic Polymers, and Thermoplastic Olefins (TPO)), Application (Seats, Cockpit and Dashboard, Door Trim, Trunk, Headliner, Pillar Trim, and Others), Distribution Channel (OEM and Aftermarket), Vehicle Type (Passenger Cars, Commercial Vehicles, and Electric Vehicles) – Industry Trends and Forecast to 2032

North America Automotive Soft Trim Interior Materials Market Size

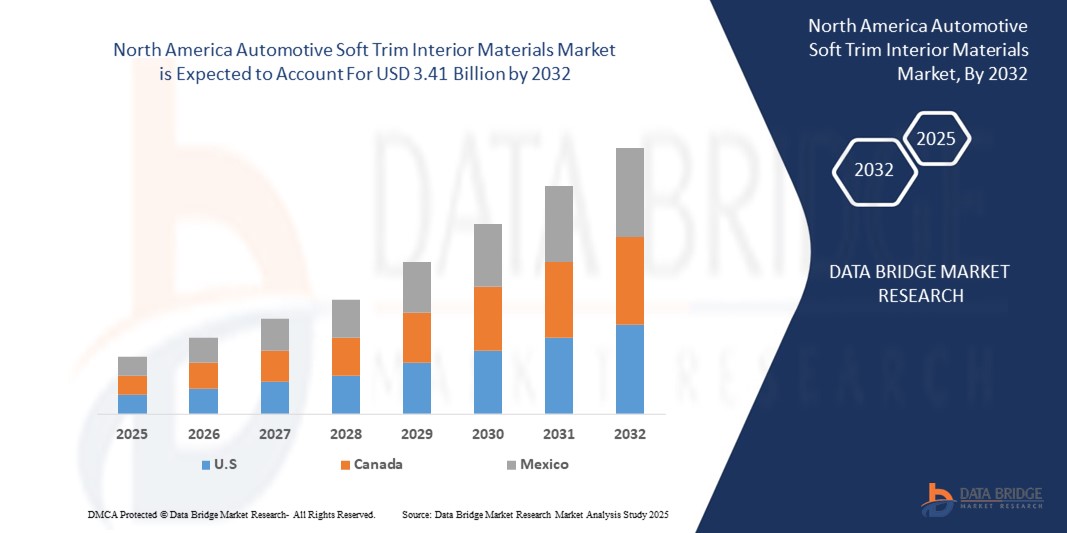

- The North America automotive soft trim interior materials market size was valued at USD 2.38 billion in 2024 and is projected to reach USD 3.41 billion by 2032, with a CAGR of 4.60% during the forecast period of 2025 to 2032

- The market growth is driven by rising consumer expectations for enhanced vehicle aesthetics, comfort, and premium in-cabin experiences, prompting automakers to integrate high-quality interior materials

- Additionally, growing demand for lightweight and sustainable materials, alongside advancements in material engineering and design innovation, is fostering significant expansion across the automotive soft trim sector in the region

North America Automotive Soft Trim Interior Materials Market Analysis

- Automotive soft trim interior materials, encompassing fabrics, leathers, foams, and polymers used for seats, headliners, door panels, and dashboards, play a critical role in enhancing vehicle comfort, aesthetic appeal, and overall user experience, especially in premium and mid-range vehicles

- The growing consumer preference for luxury, comfort, and customized interiors is a key driver of demand, supported by automakers’ focus on brand differentiation and passenger-centric design innovations

- U.S. is expected to dominate the market and emerge as the fastest-growing country, driven by a strong shift toward sustainable and eco-friendly materials, fueled by rising consumer awareness and demand for environmentally responsible products.

- Canda is anticipated to be the fastest growing region in the automotive soft trim interior materials market over the forecast period due to booming automotive production, expanding middle-class population, and growing consumer preference for upgraded vehicle interiors.

- Fabric segment dominated the automotive soft trim interior materials market with a market share of 41.5% in 2024, attributed to its cost-effectiveness, comfort, wide availability, and increasing use in mid-range and electric vehicles seeking sustainable yet affordable interior solutions.

Report Scope and Market Segmentation

|

Attributes |

Automotive Soft Trim Interior Materials Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Automotive Soft Trim Interior Materials Market Trends

Sustainability and Innovation Driving Material Advancements

- A key and accelerating trend in the automotive soft trim interior materials market is the growing emphasis on sustainable, lightweight, and innovative materials that meet both environmental standards and evolving consumer expectations for comfort and design aesthetics. Automakers are increasingly adopting eco-friendly alternatives to traditional materials to align with North America sustainability goals.

- For instance, companies like BMW and Ford are integrating recycled polyester, plant-based leathers, and natural fibers like hemp and kenaf into their vehicle interiors. BMW’s use of synthetic leather alternatives made from recycled plastics showcases how luxury design and sustainability can coexist without compromising on performance or appearance.

- Advancements in material science are also enabling manufacturers to produce soft trim materials that are lighter, more durable, and more resistant to wear and UV damage. This contributes to overall vehicle weight reduction, enhancing fuel efficiency and extending EV range—both critical in the transition toward electric mobility.

- In addition to sustainability, customization and sensory comfort are gaining traction. OEMs are offering personalized textures, color palettes, and tactile finishes to elevate the in-cabin experience. For instance, Mercedes-Benz offers customizable ambient lighting and a range of premium upholstery materials, enhancing emotional engagement with vehicle interiors.

- Regulatory pressures regarding emissions and recyclability are further driving R&D investment into bio-based, low-emission materials. Tier-1 suppliers like Adient and Faurecia are investing in circular economy initiatives, including closed-loop recycling systems for interior components.

- The demand for soft trim materials that combine aesthetic quality, comfort, and environmental responsibility is rising rapidly across mass-market and premium segments, as automakers and consumers alike shift toward more responsible and experience-driven mobility solutions.

North America Automotive Soft Trim Interior Materials Market Dynamics

Driver

Rising Demand for Enhanced In-Cabin Comfort and Sustainable Materials

- Growing consumer preference for comfortable, aesthetically pleasing, and personalized vehicle interiors is a major driver fueling the demand for advanced automotive soft trim interior materials. Consumers now prioritize not just functionality but also sensory and emotional experiences within their vehicles.

- For instance, luxury automakers such as Audi and Lexus have introduced soft-touch dashboards, premium upholstery, and ambient lighting as standard features across multiple models, reflecting the rising emphasis on interior quality and tactile satisfaction.

- Simultaneously, the automotive industry’s transition toward sustainable mobility is driving the use of eco-friendly and lightweight materials. Manufacturers are increasingly incorporating recycled fabrics, bio-based leathers, and low-VOC adhesives into soft trim components to align with environmental regulations and consumer expectations for greener products.

- In electric vehicles (EVs), reducing weight without compromising comfort is critical. Lightweight soft trim materials contribute to enhanced vehicle efficiency and range, making them essential in EV design strategies. Additionally, advancements in textile technology are enabling innovative textures, patterns, and finishes that cater to evolving style trends and brand identities.

- OEMs are also leveraging soft trim materials as a differentiator in competitive segments, using modular and customizable interior solutions to cater to diverse buyer preferences. This growing focus on interior refinement is expected to drive continued innovation and investment in the soft trim segment across all vehicle classes.

Restraint/Challenge

High Costs and Durability Concerns of Premium Materials

- While the demand for high-quality and sustainable interior materials is rising, the elevated cost of premium soft trim materials presents a significant restraint, particularly in mass-market and cost-sensitive vehicle segments. Natural leathers, eco-friendly polymers, and advanced textiles often come with higher production and processing costs.

- For instance, automakers aiming to meet luxury interior standards or eco-certifications may face increased material sourcing and manufacturing expenses, impacting overall vehicle pricing and margins. In addition, the integration of high-end or experimental materials can lead to supply chain complexities and longer lead times, challenging scalability.

- Durability and maintenance concerns also remain for certain materials. Some soft trim components, especially fabric and synthetic leather, can be prone to fading, staining, or wear under heavy usage or extreme climate conditions, raising questions about long-term performance and resale value.

- Moreover, ensuring consistent quality across large production volumes can be challenging for materials with natural variations, such as genuine leather or plant-based alternatives. OEMs must balance aesthetic goals with functional longevity and consumer expectations for low-maintenance interiors.

- Addressing these challenges will require continued R&D investment in cost-effective, durable, and sustainable material solutions, as well as strategic partnerships with suppliers to streamline production and ensure quality consistency at scale.

North America North America Automotive Soft Trim Interior Materials Market Scope

The market is segmented on the basis of material, application, distribution channel, and vehicle type.

- By Material

On the basis of material, the automotive soft trim interior materials market is segmented into fabric, leather, thermoplastic polyurethanes (TPU), thermoplastic elastomers, thermoplastic polymers, and thermoplastic olefins (TPO). The fabric segment dominated the largest market revenue share in 2024, driven by its cost-effectiveness, breathability, and wide use in mid-range and mass-market passenger vehicles. Fabric interiors are highly favored for their versatility, ease of customization, and comfort levels, especially in regions with warmer climates. In addition, advancements in stain-resistant and durable fabric technologies further enhance consumer preference, making it a long-standing dominant choice in both OEM and aftermarket supply chains.

The thermoplastic polyurethanes (TPU) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for lightweight, eco-friendly, and recyclable materials in modern automotive design. TPU provides excellent flexibility, abrasion resistance, and durability, which align well with automakers’ push for sustainable and high-performance interiors. Growing adoption in electric and premium vehicles, where both aesthetics and sustainability are prioritized, is also driving TPU’s expansion. Its compatibility with advanced manufacturing processes and ease of integration into complex interior structures make it a rapidly growing choice for next-generation automotive interiors.

- By Application

On the basis of application, the market is segmented into seats, cockpit and dashboard, door trim, trunk, headliner, pillar trim, and others. The seats segment dominated the largest market revenue share in 2024, as seats are the most critical interior component influencing both comfort and vehicle aesthetics. Consumers prioritize seat materials for durability, cushioning, and luxury appeal, while automakers increasingly enhance seating with ergonomic designs and integrated smart features. The heavy demand for customizable fabrics, leathers, and advanced composites in seating applications secures its dominant position in the market.

The cockpit and dashboard segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for sophisticated infotainment systems, digital instrument clusters, and premium surface finishes. The dashboard has become a focal point in vehicle design, combining safety, style, and connectivity features. Rising adoption of thermoplastic polymers and TPU in dashboards enables lightweight structures while providing durability and aesthetic appeal. With the growing popularity of electric and autonomous vehicles, where cockpit design is central to user experience, this segment is expected to witness rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the market is divided into OEM and aftermarket. The OEM segment dominated the largest market share in 2024, supported by the automotive industry’s reliance on factory-installed trim materials that ensure quality, consistency, and integration with vehicle designs. OEM channels benefit from long-term contracts with automakers, guaranteeing stable demand for bulk supplies of fabrics, leathers, and polymers. Furthermore, increased focus on vehicle branding and premiumization by leading car manufacturers boosts the dominance of the OEM segment.

The aftermarket segment is expected to record the fastest growth from 2025 to 2032, fueled by rising consumer interest in vehicle customization, refurbishment, and maintenance services. Car owners increasingly seek aftermarket solutions to upgrade seat covers, door trims, and dashboards with premium materials. The popularity of DIY upgrades and the growing second-hand car market also create significant opportunities for aftermarket suppliers. With the emergence of online platforms and specialized automotive accessory retailers, the aftermarket channel is gaining traction as a cost-effective and flexible distribution route.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment held the largest revenue share of in 2024, driven by the sheer volume of car production and consumer preference for comfort and aesthetics in daily-use vehicles. Interior materials play a pivotal role in differentiating vehicle classes, with fabric dominating entry-level cars and leather or premium composites preferred in luxury models. Rapid urbanization, rising disposable incomes, and a strong demand for mid-range passenger cars reinforce this segment’s dominance.

The electric vehicles (EVs) segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by automakers’ emphasis on lightweight, sustainable, and high-performance materials to enhance energy efficiency and eco-friendliness. EV manufacturers increasingly adopt TPU, TPO, and recycled fabrics to align with green mobility initiatives. In addition, EV interiors are designed with a futuristic approach, focusing on minimalism, advanced dashboards, and comfort-enhancing trims. Rising government incentives, coupled with consumer interest in sustainable vehicles, will further accelerate material innovation and adoption in this rapidly growing segment.

North America Automotive Soft Trim Interior Materials Market Regional Analysis

- The U.S. automotive soft trim interior materials market accounted for the largest share in North America in 2024, driven by strong consumer demand for luxury, comfort, and advanced interior features.

- Automakers are increasingly using premium materials such as vegan leather, recycled textiles, and soft-touch thermoplastics to enhance aesthetics and meet sustainability goals. The rise in SUV and electric vehicle production is further boosting demand for lightweight, durable, and eco-friendly interior components.

- A well-established automotive aftermarket, combined with growing interest in personalization and comfort upgrades, continues to support market expansion across both mass-market and premium vehicle segments.

Canada Automotive Soft Trim Interior Materials Market Insight

Canada’s automotive soft trim interior materials market is experiencing steady growth, supported by increasing demand for premium features in mid- to high-end vehicles and a growing focus on sustainable mobility. Automakers and suppliers are incorporating eco-friendly materials such as recycled textiles and synthetic leathers to align with Canada's environmental goals. The rising popularity of electric and hybrid vehicles, along with consumer interest in enhanced comfort and aesthetics, is encouraging the use of advanced soft trim components. Government incentives for EVs and green technologies further contribute to market development across both OEM and aftermarket channels.

Mexico Automotive Soft Trim Interior Materials Market Insight

Mexico plays a key role in the North American automotive supply chain, with its soft trim interior materials market growing steadily due to strong OEM presence and increasing vehicle production. As a major manufacturing hub, Mexico supports cost-effective production of soft trim components, including fabric, leather, and thermoplastics, for export and domestic use. Rising consumer demand for affordable vehicles with upgraded interiors is pushing manufacturers to adopt innovative, durable, and sustainable materials. Continued investment in automotive infrastructure and favorable trade policies are expected to support long-term market growth in both passenger and commercial vehicle segments.

North America Automotive Soft Trim Interior Materials Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Automotive Soft Trim Interior Materials Market Leaders Operating in the Market Are:

- Pangea (U.S.)

- Recticel Engineered Foams Belgium BV (Belgium)

- MACAUTO INDUSTRIAL CO., LTD. (Taiwan)

- Mayur Uniquoters Limited (India)

- The Haartz Corporation (U.S.)

- Classic Soft Trim (U.S.)

- TS TECH CO.,LTD (Japan)

- Sage Automotive Interiors (U.S.)

- Antolin (Spain)

- NHK SPRING Co.,Ltd (Japan)

- SEIREN CO., LTD. (Japan)

- Magna International Inc. (Canada)

- TOYOTA BOSHOKU CORPORATION (Japan)

- FORVIA (France), Adient plc. (U.S.)

- Lear (U.S.)

Recent Developments in North America Automotive Soft Trim Interior Materials Market

- In May 2024, Lear Corporation announced the expansion of its advanced materials R&D facility in Michigan to accelerate the development of sustainable and high-performance automotive interior solutions. The expansion supports Lear’s focus on integrating recycled and plant-based materials into soft trim products, reinforcing its commitment to sustainability and innovation in vehicle interiors across North America.

- In April 2024, Adient plc partnered with a U.S.-based startup specializing in bio-based polymers to co-develop next-generation soft trim materials for electric vehicles. The collaboration aims to produce lightweight, eco-friendly materials with premium tactile properties, aligning with automakers' growing demand for greener, more luxurious cabin components.

- In March 2024, Faurecia (a FORVIA Group company) launched its new eco-conscious interior trim line in North America, incorporating natural fibers and low-emission adhesives. This product line is targeted at OEMs seeking to meet tightening environmental regulations while delivering comfort and visual appeal in vehicle cabins, especially within the EV and luxury vehicle segments.

- In February 2024, Magna International unveiled a modular interior trim solution designed for commercial and electric vehicles in the U.S. market. The system allows for easy customization and integration of sustainable soft trim materials, offering OEMs flexibility in design while reducing manufacturing complexity and material waste.

- In January 2024, Toyota Boshoku America introduced its latest fabric innovation made from ocean-bound recycled plastic, tailored for soft trim applications in North American vehicles. The launch reflects the company’s broader sustainability strategy and supports OEMs in achieving environmental targets without compromising interior quality or durability.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。