North America Computed Tomography Devices Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

1.67 Billion

USD

2.60 Billion

2024

2032

USD

1.67 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.67 Billion | |

| USD 2.60 Billion | |

|

|

|

|

North America Computed Tomography Devices Market Segmentation, By Product Type (Low Slice CT Scanner (64 Slices)), Application (Cardiovascular Applications, Abdomen and Pelvic Application, Pulmonary Angiogram, Neurovascular Application, Spinal Application, Musculoskeletal Application and Oncology), End-User (Hospitals and Diagnostics Centres) - Industry Trends and Forecast to 2032

North America Computed Tomography Devices Market Size

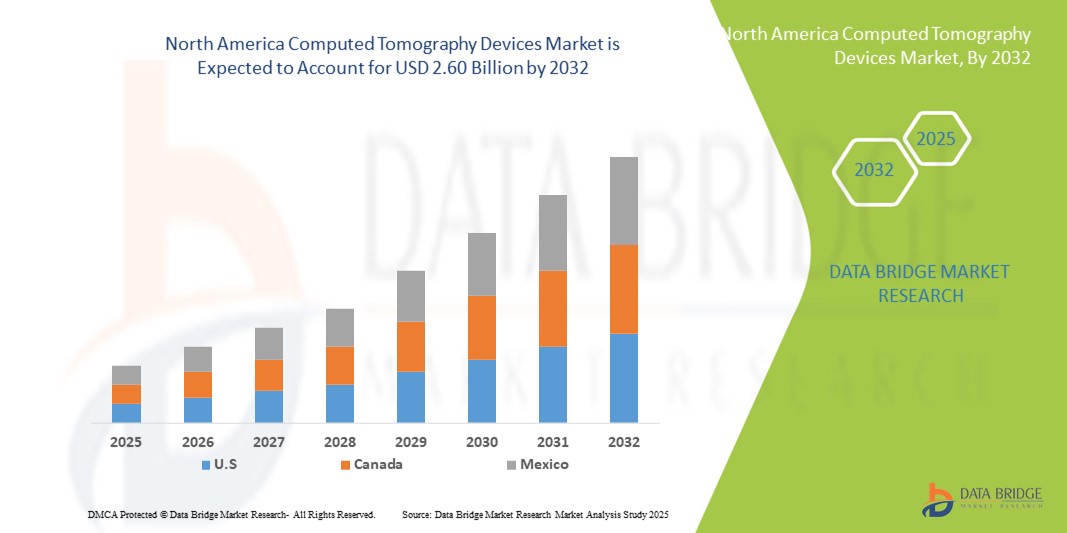

- The North America computed tomography devices market size was valued at USD 1.67 billion in 2024 and is expected to reach USD 2.60 billion by 2032, at a CAGR of 5.65% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic and lifestyle-related diseases, rising demand for early and accurate diagnostic imaging, and ongoing technological advancements in CT imaging systems, including AI integration and low-dose radiation techniques

- In addition, expanding healthcare infrastructure, favorable reimbursement policies, and growing adoption of advanced imaging solutions in hospitals, diagnostic centers, and specialty clinics are positioning CT devices as essential diagnostic tools in the region. These combined factors are accelerating the deployment of CT systems, thereby significantly propelling the market’s growth

North America Computed Tomography Devices Market Analysis

- Computed tomography (CT) devices, providing cross-sectional imaging for precise diagnosis and treatment planning, are increasingly essential components of modern medical diagnostics in hospitals and diagnostic centers due to their high imaging accuracy, speed, and integration with advanced imaging software and AI-assisted tools

- The rising demand for CT devices is primarily driven by the growing prevalence of chronic diseases, increasing need for early and accurate diagnosis, and technological advancements such as low-dose imaging, AI-enabled reconstruction, and multi-slice CT systems

- The U.S. dominated the North America computed tomography devices market with the largest revenue share of 88.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading imaging equipment manufacturers, with substantial adoption of high-slice CT scanners (>64 slices) in hospitals and diagnostic centers, supported by innovations in cardiovascular, neurovascular, and oncology imaging applications

- Canada is expected to be the fastest-growing country in the North America CT devices market during the forecast period due to increasing investments in healthcare infrastructure, rising patient awareness, and growing demand for advanced diagnostic imaging solutions

- High-slice CT scanners (>64 slices) dominated the North America CT devices market with a market share of 44.8% in 2024, driven by their superior imaging speed, high resolution, and versatility across cardiovascular, neurovascular, and oncology applications in hospital and diagnostic center settings

Report Scope and North America Computed Tomography Devices Market Segmentation

|

Attributes |

North America Computed Tomography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Computed Tomography Devices Market Trends

Advancements in AI-Assisted Imaging and Multi-Slice CT Systems

- A significant and accelerating trend in the North America CT devices market is the growing integration of artificial intelligence (AI) with multi-slice CT systems, enhancing imaging accuracy, workflow efficiency, and diagnostic capabilities

- For instance, instance of Siemens Healthineers’ AI-Rad Companion can automatically analyze CT scans and provide preliminary diagnostic insights, assisting radiologists in decision-making

- AI integration in CT devices enables features such as automated image reconstruction, anomaly detection, and predictive analytics for patient outcomes, improving scan reliability and reducing human error

- The seamless combination of multi-slice CT systems and AI platforms allows centralized management of imaging protocols, data sharing, and reporting across hospital networks, creating a more streamlined radiology workflow

- This trend toward more intelligent, high-resolution, and automated CT systems is reshaping radiology expectations. Consequently, companies such as GE Healthcare are developing AI-enabled CT scanners with advanced reconstruction algorithms and automated cardiac and neurovascular imaging analysis

- The demand for CT devices offering AI-assisted imaging and high-slice capabilities is growing rapidly across hospitals and diagnostic centers, as healthcare providers increasingly prioritize efficiency, accuracy, and comprehensive diagnostic functionality

North America Computed Tomography Devices Market Dynamics

Driver

Rising Demand Due to Growing Chronic Diseases and Diagnostic Imaging Needs

- The increasing prevalence of chronic diseases, cancer, and cardiovascular conditions, combined with the need for early and accurate diagnosis, is a major driver for the heightened demand for CT devices

- For instance, instance of Canon Medical Systems introducing advanced high-slice CT scanners with enhanced cardiac imaging capabilities to support early detection of heart disease

- As healthcare providers aim to improve patient outcomes and diagnostic precision, CT devices offer features such as high-resolution imaging, rapid scan times, and AI-assisted analysis, providing a compelling upgrade over conventional imaging modalities

- Furthermore, the expanding healthcare infrastructure and rising patient awareness in the U.S. and Canada are making CT systems an integral component of diagnostic workflows in hospitals and imaging centers

- The convenience of faster imaging, reduced scan times, and the ability to perform multi-organ imaging in a single session are key factors propelling CT device adoption in clinical settings. The trend toward outpatient imaging expansion and advanced diagnostic centers further contributes to market growth

Restraint/Challenge

High Equipment Costs and Regulatory Compliance Hurdles

- The relatively high acquisition and maintenance costs of advanced CT systems, particularly high-slice scanners, pose a significant challenge to broader market penetration, especially for smaller diagnostic centers

- For instance, instance of Medtronic highlighting budgetary constraints in smaller clinics delaying procurement of multi-slice CT systems despite clinical demand

- Addressing these cost concerns through financing options, service contracts, and scalable solutions is crucial for expanding market reach. In addition, regulatory compliance and rigorous safety standards for radiation exposure present hurdles for manufacturers and healthcare providers

- The need for regular software updates, training of radiology staff, and adherence to FDA and Health Canada guidelines can slow adoption rates, particularly for newly launched high-slice CT systems

- While costs and compliance challenges are gradually being managed through innovative financing, modular system designs, and AI-driven automation reducing operational burden, the high capital expenditure and regulatory complexities can still hinder widespread adoption in smaller or budget-constrained healthcare facilities

North America Computed Tomography Devices Market Scope

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the North America CT devices market is segmented into Low Slice CT Scanner (<64 Slices), Medium Slice CT Scanner (64 Slices), and High Slice CT Scanner (>64 Slices). The High Slice CT Scanner segment dominated the market with the largest revenue share of 44.8% in 2024, driven by its superior imaging speed, high-resolution capabilities, and versatility across multiple clinical applications. Hospitals and diagnostic centers prefer high-slice scanners for complex procedures such as cardiovascular, neurovascular, and oncology imaging, as these systems reduce scan times and improve diagnostic accuracy. The demand is further fueled by AI integration, which enhances image reconstruction, anomaly detection, and workflow efficiency. High-slice CT scanners are increasingly adopted in large hospitals and specialty diagnostic centers, where precision and speed are critical for patient outcomes. The segment’s dominance is also supported by continuous technological innovations, such as low-dose imaging and advanced software tools, enhancing their clinical appeal.

The Low Slice CT Scanner (<64 Slices) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in smaller hospitals, outpatient clinics, and diagnostic centers. These scanners offer a cost-effective solution for routine imaging, balancing affordability with sufficient diagnostic performance. Low-slice systems are particularly suitable for budget-conscious facilities or regions with moderate patient volumes, providing essential imaging capabilities without the high capital expenditure of high-slice systems. Their smaller footprint and lower maintenance requirements also contribute to their growing adoption. In addition, manufacturers are increasingly developing compact, user-friendly models that enable easy installation and operation, further expanding their market penetration. The growing trend toward decentralized and outpatient diagnostic imaging is expected to accelerate this segment’s growth.

- By Application

On the basis of application, the market is segmented into cardiovascular applications, abdomen and pelvic applications, pulmonary angiogram, neurovascular applications, spinal applications, musculoskeletal applications, and oncology. The Oncology application segment dominated the market in 2024, accounting for the largest revenue share, due to the increasing prevalence of cancer and the critical need for precise tumor detection, staging, and treatment planning. High-resolution and multi-slice CT scanners are widely used in oncology for accurate imaging of soft tissues, guiding biopsy procedures, and monitoring treatment response. Integration with AI-assisted imaging enhances lesion detection and volumetric analysis, further improving diagnostic outcomes. Hospitals and specialized cancer centers prefer CT devices for oncology applications as they provide comprehensive, non-invasive imaging solutions. The demand is also driven by rising awareness of early cancer detection and routine screening protocols.

The Cardiovascular Applications segment is expected to witness the fastest growth rate during 2025–2032, fueled by rising prevalence of heart disease and demand for precise cardiac imaging. Multi-slice CT scanners are increasingly employed for coronary artery imaging, calcium scoring, and pre-surgical planning, offering rapid and accurate assessments. The integration of AI in cardiac imaging helps reduce artifacts, optimize image quality, and enable automated analysis of complex cardiovascular structures. Growing adoption in both hospitals and diagnostic centers, along with increasing awareness of early cardiovascular disease detection, is expected to drive rapid market expansion. In addition, minimally invasive and outpatient cardiac imaging procedures are contributing to this segment’s growth.

- By End-User

On the basis of end-user, the North America CT devices market is segmented into hospitals and diagnostic centers. The Hospitals segment dominated the market in 2024 due to the availability of advanced infrastructure, large patient volumes, and a strong preference for high-slice and multi-purpose CT systems capable of handling diverse clinical applications. Hospitals rely on CT imaging for routine diagnostics, emergency care, oncology, cardiovascular, and neurovascular assessments, driving demand for versatile and high-performance CT devices. The presence of leading imaging equipment manufacturers and availability of technical expertise further support the adoption of CT devices in hospitals.

The Diagnostic Centers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of outpatient diagnostics, preventive health check-ups, and specialized imaging centers. Diagnostic centers increasingly invest in medium- and low-slice CT scanners to offer cost-effective yet high-quality imaging services. The growing patient preference for convenient, non-hospital-based diagnostic services and the expansion of insurance coverage for outpatient imaging further accelerate market growth in this segment. Manufacturers are also targeting this segment with compact, easy-to-maintain CT solutions, boosting adoption across North America.

North America Computed Tomography Devices Market Regional Analysis

- The U.S. dominated the North America CT devices market with the largest revenue share of 88.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading imaging equipment manufacturers, with substantial adoption of high-slice CT scanners (>64 slices) in hospitals and diagnostic centers, supported by innovations in cardiovascular, neurovascular, and oncology imaging applications

- Healthcare providers in the region highly value the accuracy, speed, and multi-application capabilities offered by high-slice and AI-integrated CT scanners, enabling precise diagnosis and improved patient outcomes

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading imaging equipment manufacturers, establishing CT devices as essential tools in hospitals and diagnostic centers across the region

U.S. Computed Tomography Devices Market Insight

The U.S. CT devices market captured the largest revenue share in 2024 within North America, driven by the rising prevalence of chronic diseases, cancer, and cardiovascular conditions requiring advanced diagnostic imaging. Hospitals and diagnostic centers are increasingly prioritizing high-slice and AI-integrated CT scanners to improve imaging accuracy, speed, and patient outcomes. The adoption of multi-slice CT systems, combined with AI-assisted reconstruction and automated analysis, further propels market growth. In addition, the U.S. benefits from advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading imaging equipment manufacturers, supporting rapid deployment of CT systems. The growing trend of outpatient imaging centers and preventive health check-ups is also contributing to the market expansion.

Canada Computed Tomography Devices Market Insight

The Canada CT devices market is expected to grow at a substantial CAGR during the forecast period, fueled by increasing investments in healthcare infrastructure and rising awareness of early disease detection. Canadian hospitals and diagnostic centers are progressively adopting medium- and high-slice CT scanners to meet clinical demands for cardiovascular, oncology, and neurovascular imaging. Government initiatives promoting healthcare modernization and improved access to diagnostic services are supporting the expansion of CT device installations. Moreover, the focus on outpatient diagnostic centers and preventive care is accelerating adoption across the country. Integration of AI and advanced imaging software is further enhancing the utility of CT systems in Canadian healthcare facilities.

Mexico Computed Tomography Devices Market Insight

The Mexico CT devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing healthcare investments and rising demand for diagnostic imaging in hospitals and specialty centers. The adoption of cost-effective low- and medium-slice CT scanners is gaining traction in urban and semi-urban areas. Growing awareness of early disease diagnosis, combined with government programs supporting healthcare access, is encouraging the deployment of CT systems. Mexico’s expanding private healthcare sector, alongside partnerships with leading imaging equipment manufacturers, is contributing to market growth. In addition, rising demand for multi-application imaging capabilities across oncology, cardiovascular, and neurovascular applications supports adoption of modern CT devices.

North America Computed Tomography Devices Market Share

The North America Computed Tomography Devices industry is primarily led by well-established companies, including:

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V., (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- NeuroLogica Corp (U.S.)

- Ryoei USA (U.S.)

- PrizMed imaging (U.S.)

- North Star Imaging Inc (U.S.)

- United Imaging Healthcare Co., Ltd. (U.S.)

- Xoran Technologies, LLC. (U.S.)

- CurveBeam (U.S.)

- Stryker (U.S.)

- Exact Metrology (U.S.)

- Pinnacle X-Ray Solutions (U.S.)

- Applied Technical Services Inc (U.S.)

- Jesse Garant Metrology Center (Canada)

- Micro-X (Australia)

- Thermo Fisher Scientific, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bruker (U.S.)

What are the Recent Developments in North America Computed Tomography Devices Market?

- In May 2025, GE HealthCare received FDA 510(k) clearance for its new hybrid imaging system, the Aurora, along with its integrated deep learning software, Clarify DL. This nuclear medicine SPECT/CT scanner combines single-photon emission computed tomography (SPECT) and computed tomography (CT) technologies to deliver sharper, more precise imaging across clinical specialties

- In March 2025, Siemens Healthineers announced that its Naeotom Alpha class of photon-counting computed tomography (CT) scanners received FDA clearance. This product class includes the Naeotom Alpha.Pro, a second dual-source CT scanner, and the Naeotom Alpha.Prime, the world’s first single-source scanner with photon-counting CT technology

- In December 2024, United Imaging Healthcare introduced the uCT 780, a 160-slice CT scanner equipped with a fully integrated Z-Detector and fast rotation speed of 0.3 seconds. The system aims to deliver superior diagnostics with low-dose imaging capabilities

- In November 2023, Canon Medical Systems introduced the Aquilion ONE / GENESIS Edition CT scanner. This system features advanced AI-enhanced reconstruction technology, offering improved image quality and reduced radiation dose

- In November 2021, GE Healthcare launched the Revolution Apex CT platform, featuring the world's fastest gantry rotation time of 0.23 seconds per rotation and 19.5 millisecond effective temporal resolution. This modular and scalable system aims to enhance cardiac imaging capabilities and improve workflow efficiency

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。