北米の CRISPR 遺伝子検出および診断市場、クラス別 (クラス 1 - 複数のエフェクタータンパク質、クラス 2 - 単一の CrRNA 結合タンパク質)、製品とサービス (製品とサービス)、アプリケーション (バイオメディカル診断、ゲノムエンジニアリング、創薬、農業アプリケーションなど)、ワークフロー (サンプル調製、前増幅、CrRNA、Cas 酵素およびセンシング)、エンドユーザー (病院、診断センター、バイオテクノロジー企業、学術研究機関など)、流通チャネル (直接入札、小売販売) 業界動向と 2029 年までの予測

市場の定義と洞察

CRISPR は、規則的に間隔を空けた短い回文反復配列が密集したゲノム編集ツールであり、研究者が DNA 配列を変更し、遺伝子機能を簡単に修正できるようにします。遺伝子欠陥の修正、病気の治療と蔓延の防止など、多くの潜在的な用途があります。CRISPR ベースの診断は、感染性および非感染性疾患の核酸ベースのバイオマーカーの感知や遺伝性疾患の検出など、多くの生物医学用途に使用されています。CRISPR のアッセイ キットは、Cas9 と呼ばれるタンパク質と、特定の遺伝コードを持つ核酸分子の文字列であるガイド RNA の 2 つのコンポーネントで構成されています。

この CRISPR-Cas9 システムは、哺乳類細胞での使用向けに改良されています。非相同末端結合 (NHEJ) によるフレームシフト変異を導入することで、目的の遺伝子に固有のガイド配列 (sgRNA) を導入して特定の遺伝子をノックアウトするか、ノックイン変異を生成することができます。

CRISPR-Cas 9 システムにより、遺伝子および細胞治療における診断とサービスの範囲が拡大しました。製薬会社は新製品の開発に多額の投資を行っており、遺伝子および細胞治療薬が開発初期段階に急増しています。市場プレーヤーが投資することで、深刻な治療を必要とする患者に安全で効果的な治療を提供できるようになります。

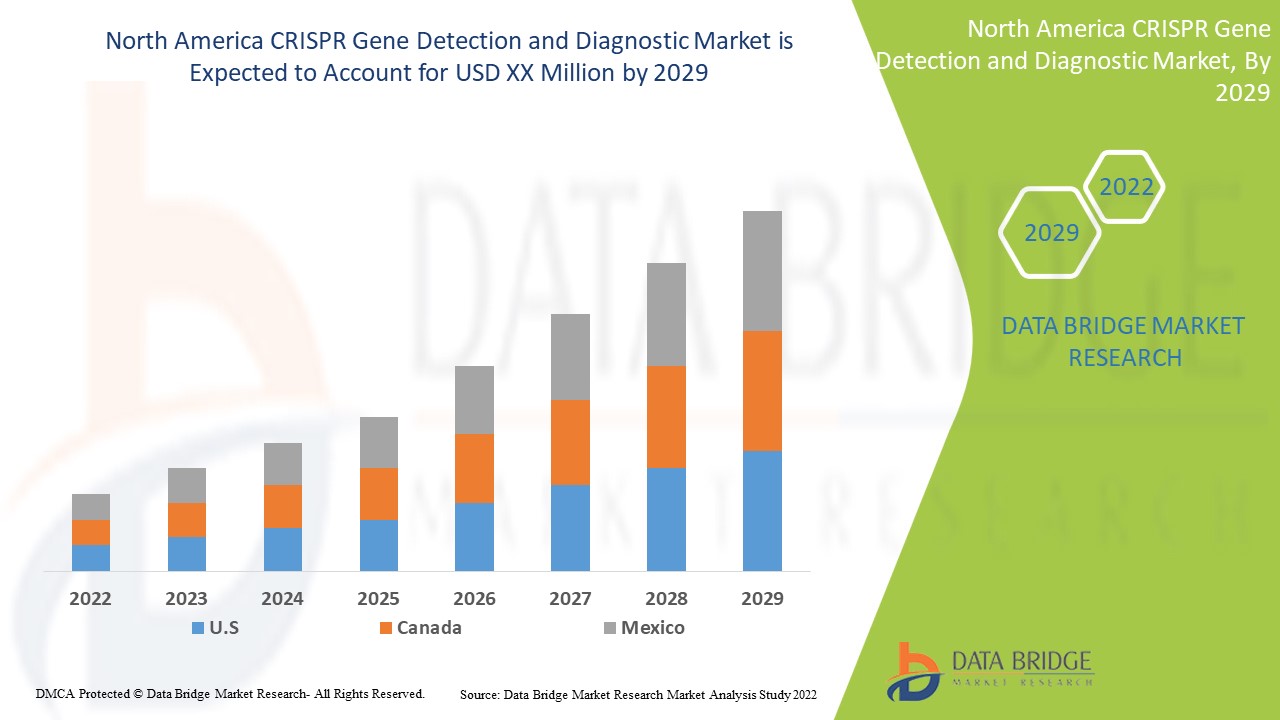

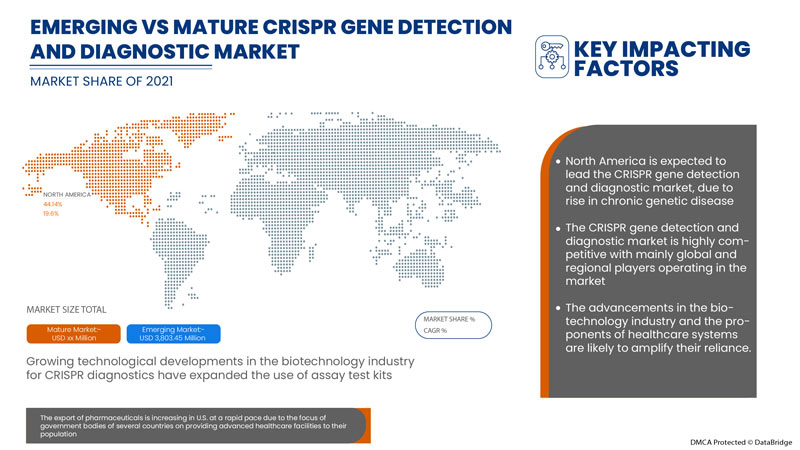

北米の CRISPR 遺伝子検出および診断は補助的であり、症状の重症度を軽減することを目的としています。Data Bridge Market Research は、CRISPR 遺伝子検出および診断市場は 2022 年から 2029 年の予測期間中に 19.6 % の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

クラス別 (クラス 1 - 複数のエフェクタータンパク質とクラス 2 - 単一の CrRNA 結合タンパク質)、製品とサービス別 (製品とサービス)、アプリケーション別 (バイオメディカル診断、ゲノム工学、創薬、農業アプリケーションなど)、ワークフロー別 (サンプル調製、前増幅、CrRNA、Cas 酵素とセンシングなど)、エンドユーザー別 (病院、診断センター、バイオテクノロジー企業、学術研究機関など)、流通チャネル別 (直接入札、小売販売) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

GenScript、OriGene Technologies、Inc.、Applied StemCell、GeneCopoeia、Inc.、Agilent Technologies、Inc.、Synthego、BioVision Inc.、Hera Biolabs、Cellecta、Inc.、New England Biolabs、10x Genomics、addgene CasTag Biosciences、Merck KGaA、Integrated DNA Technologies、Inc.(Danaherの子会社)、Thermo Fisher Scientific Inc.など |

北米の CRISPR 遺伝子検出および診断市場の動向

ドライバー

- 慢性疾患の有病率と発症率の上昇

慢性疾患は一般的な健康状態であり、成人の 3 人に 1 人が慢性疾患に苦しんでいます。慢性疾患は多くの国民の健康と生活の質に影響を及ぼしています。

CRISPR は、クラスター化された規則的に間隔を置いた短い回文反復の略称です。近年、CRISPR は細胞内の DNA の特定の配列を変更するために使用される遺伝子編集の強力なツールになりました。CRISPR は、ハンチントン病、筋ジストロフィー、癌、高コレステロールの研究と治療に重要な役割を果たしています。

例えば、

- 2021年、NORD(国立希少疾患組織)のデータによると、デュシェンヌ型筋ジストロフィー(DMD)の診断発生率は100%でした。デュシェンヌ型筋ジストロフィー(DMD)は、世界中で出生男児3,500人に1人が罹患する遺伝性疾患です。

- 研究開発への投資の増加

CRISPR-Cas 9 システムなどの遺伝子編集技術により、遺伝子および細胞治療における診断とサービスの範囲が拡大しました。製薬会社は新製品の開発に多額の投資を行っており、遺伝子および細胞治療薬が開発初期段階に急増しています。市場プレーヤーが投資することで、深刻な治療を必要とする患者に安全で効果的な治療を提供するという目標を達成できます。

例えば、

- 2022年2月、シンセゴは、CRISPRベースの医薬品の開発を初期段階の研究から臨床まで促進するための研究開発投資として2億ドルを調達しました。シンセゴは、シリーズEファイナンスからの投資額を使用して、CRISPR診断およびサービスの作成を加速します。

CRISPR遺伝子診断のための資金の入手可能性

CRISPR gene diagnostics and research are funded by the National Institute of Health (NIH) budget. The private sector also funds the CRISPR gene detection and research, but such investment generally occurs later, during the testing and development phase, then during initial basic research. With genome editing being such a new field, an unbiased governmental body must supervise them; the FDA is cautious and thorough, but they are endlessly struggling for funding, making a long-term investment that aligns the payment with the potential future beneficiaries., will further enhance the growth of the CRISPR gene detection and diagnostic market.

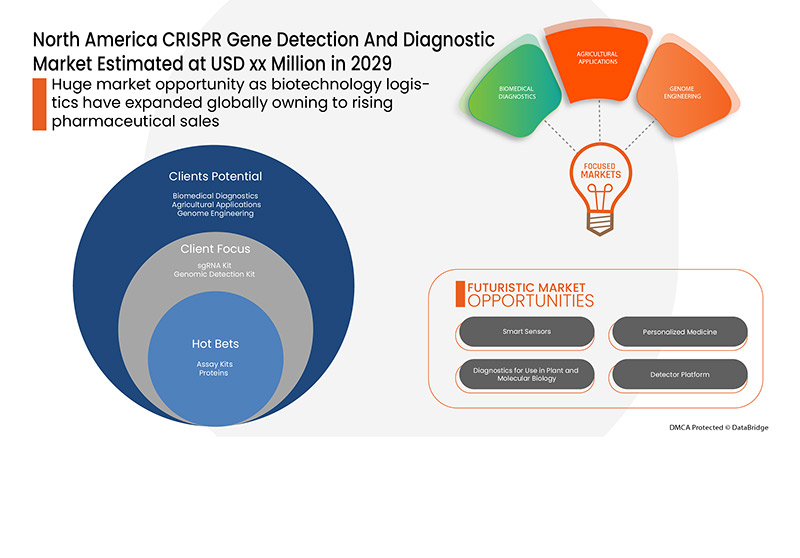

Furthermore, advancement in CRISPR gene diagnostics, rising initiatives by public and private organizations to spread awareness and growing government funding are the factors that will expand the CRISPR gene detection market. Other factors such as increase in the demand for effective therapies and rising awareness about the timely diagnosis and will positively impact the CRISPR gene detection and diagnostic market's growth rate. Additionally, high disposable income, rising number of chronic diseases, changing lifestyle will result in the expansion of the CRISPR gene detection and diagnostic market.

Opportunities

- The rise in healthcare expenditure

Moreover, the rise in the research and development activities and increasing investments by government and private organization will boost new opportunities for the market's growth rate.

- Strategic initiative by market players

The demand for CRISPR gene detection and diagnosis has increased the demand in the U.S. and owing to the timely treatment of chronic conditions. These favorable factors enhance the need for medications, and to achieve the market demand, minor and major market players are utilizing various strategies.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

For instance,

- In May 2021, Horizon Discovery Ltd. extended the gene modulation portfolio with the first synthetic single guide RNA and patent pending dcas9 repressor for CRISPR interference in Waltham. The expansion of the portfolio had increased the sales and revenue of the synthetic guide RNA portfolio across the U.S. and the U.K. region and had increased the collaboration with market players

Also, the launch of effective therapies and continuous clinical trials will provide beneficial opportunities for the CRISPR gene detection and diagnostic market in the forecast period of 2022-2029. Also, high unmet need of current and developments in healthcare technology will escalate the growth rate of the CRISPR gene detection and diagnostic market in future.

Restraints/Challenges

However, high cost of CRISPR diagnostics and risks faced while using the CRISPR diagnostics will impede the growth rate of CRISPR gene detection and diagnostic market. Additionally, the risks incurred while using the MRI devices will hinder the CRISPR gene detection and diagnostic market growth. The lack of skilled expertise and regulations will further challenge the market in the forecast period mentioned above.

- Rise in cost of CRISPR based diagnostics

The vast potential of CRISPR based therapeutics comes with a cost tag. Maximum genome editing therapies require an increased amount of time for development and production, and hence the rise in cost occurs. Besides, the assay kits and medications related to CRISPR gene detection and diagnostic are applicable to large section of population. These costs are pushed on patients. Therefore, the present high cost is expected to show a descending trend in the future.

For instance,

- In July 2021, according to Integrated DNA Technologies, Inc., the first commercially available CRISPR-based diagnostic assay for SARS-CoV-2 including reverse transcription LAMP (RT-LAMP) as pre-amplification is currently available at USD 30.15 per reaction

The CRISPR gene detection and diagnostic market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on CRISPR gene detection and diagnostic market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

According to a study by Globocan. In 2020, breast cancer had high incidence of cases, around 11.7%, followed by lung cancer which is 11.40%, colorectum cancer which is 10.00%, and cervix uteri and oesophagus cancer having less number of incident cases.

CRISPR gene detection and diagnostic market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

COVID-19 Impact on the CRISPR Gene Detection and Diagnostic Market

COVID-19 は市場に悪影響を及ぼしています。パンデミック中のロックダウンと隔離は、診断管理と治療を複雑にします。日常的な治療や投薬管理のために医療施設を利用できないことは、市場にさらなる影響を及ぼすでしょう。社会的孤立はストレス、絶望、社会的支援を増大させ、これらはすべてパンデミック中の抗けいれん薬の服薬遵守の低下を引き起こす可能性があります。

最近の開発

- 2020年8月、SHERLOCK BIOSCIENCESは、ダートマス・ヒッチコック・ヘルスと提携し、Sars-CoV-2用のSHERLOCK診断キットの臨床試験を実施すると発表しました。このキットは、米国食品医薬品局(FDA)の緊急使用許可(EUA)から緊急承認を受けました。

北米のCRISPR遺伝子検出および診断市場の範囲

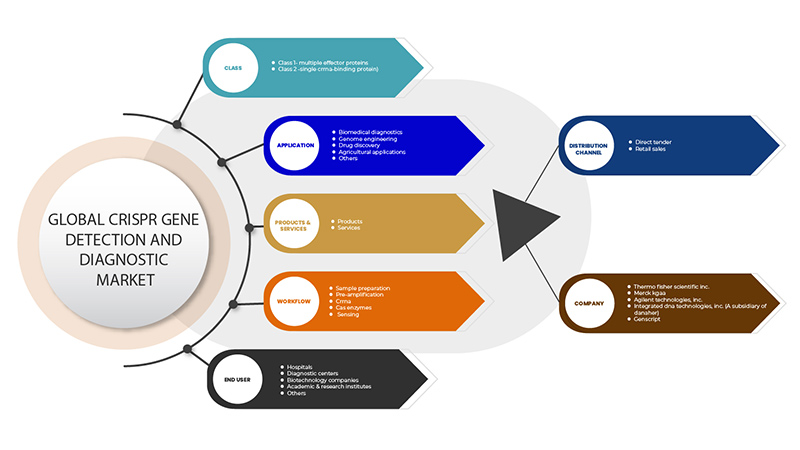

CRISPR 遺伝子検出および診断市場は、クラス、製品とサービス、アプリケーション、ワークフロー、エンド ユーザー、流通チャネルの 6 つのセグメントに基づいて分類されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

クラス

- クラス 1 - 多重エフェクタータンパク質

- クラス 2 - 単一 CrRNA 結合タンパク質

クラスに基づいて、CRISPR 遺伝子検出および診断市場は、クラス 1 (複数のエフェクター タンパク質) とクラス 2 (単一の CrRNA 結合タンパク質) に分類されます。

製品とサービス

- 製品

- サービス

製品とサービスに基づいて、CRISPR 遺伝子検出および診断市場は製品とサービスに分類されます。

応用

- バイオメディカル診断

- ゲノム工学

- 創薬

- 農業用途

- その他

アプリケーションに基づいて、CRISPR 遺伝子検出および診断市場は、生物医学診断、ゲノム工学、創薬、農業アプリケーションなどに分類されます。

ワークフロー

- サンプルの準備

- プリアンプ

- CrRNA

- Cas酵素

- センシング

ワークフローに基づいて、CRISPR 遺伝子検出および診断市場は、サンプル準備、前増幅、CrRNA、Cas 酵素、およびセンシングに分類されます。

エンドユーザー

- 病院

- 診断センター

- バイオテクノロジー企業

- 学術研究機関

- その他

エンドユーザーに基づいて、CRISPR 遺伝子検出および診断市場は、病院、診断センター、バイオテクノロジー企業、学術研究機関、その他に分類されます。

流通チャネル

- 直接入札

- 小売販売

流通チャネルに基づいて、CRISPR 遺伝子検出および診断市場は、直接入札と小売販売に分類されます。

CRISPR 遺伝子検出および診断市場の地域分析/洞察

北米の CRISPR 遺伝子検出および診断市場が分析され、上記の地域、クラス、製品とサービス、アプリケーション、ワークフロー、エンドユーザー、流通チャネル別に市場規模の洞察と傾向が提供されます。

CRISPR 遺伝子検出および診断市場レポートの対象国は、米国、カナダ、メキシコです。

米国は医療費の増加により、CRISPR 遺伝子検出および診断市場を独占しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境とCRISPR遺伝子検出および診断市場シェア分析

北米の CRISPR 遺伝子検出および診断市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、CRISPR 遺伝子検出および診断市場に関連する会社の焦点にのみ関連しています。

CRISPR 遺伝子検出および診断市場で活動している主要企業としては、GenScript、OriGene Technologies、Inc.、Applied StemCell、GeneCopoeia、Inc.、Agilent Technologies、Inc.、Synthego、BioVision Inc.、Hera Biolabs、Cellecta、Inc.、New England Biolabs、10x Genomics、addgene CasTag Biosciences、Merck KGaA、Integrated DNA Technologies、Inc. (Danaher の子会社)、Thermo Fisher Scientific Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CLASS SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INTELLECTUAL PROPERTY LANDSCAPE (PATENT LANDSCAPE)

6 EPIDEMIOLOGY

7 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: REGULATORY SCENARIO

8 PIPELINE ANALYSIS FOR NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, OF CRISPR DIAGNOSTICS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

9.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT

9.1.3 AVAILABILITY OF FUNDING FOR CRISPR GENE DIAGNOSTICS

9.1.4 RISE IN GMP-CERTIFICATION APPROVALS FOR CRISPR GENE DIAGNOSTIC

9.1.5 RISE IN CLINICAL TRIALS FOR CRISPR BASED DIAGNOSTICS

9.2 RESTRAINTS

9.2.1 RISE IN COST OF CRISPR BASED DIAGNOSTICS

9.2.2 RISKS FACED WHILE USING CRISPR DIAGNOSIS

9.2.3 ETHICAL CONCERNS RELATED TO CRISPR GENE DETECTION AND DIAGNOSTIC RESEARCH

9.2.4 AVAILABILITY OF ALTERNATIVES

9.3 OPPORTUNITIES

9.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

9.3.2 RISE IN HEALTHCARE EXPENDITURE

9.3.3 EMERGENCE OF TECHNOLOGICAL ADVANCEMENTS IN CRISPR BASED DIAGNOSTICS

9.4 CHALLENGES

9.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR CRISPR DIAGNOSTICS

9.4.2 STRINGENT REGULATIONS

10 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS

10.1 OVERVIEW

10.2 CLASS-2 SINGLE CRRNA-BINDING PROTEIN

10.2.1 BIOMEDICAL DIAGNOSTICS

10.2.2 AGRICULTURAL APPLICATIONS

10.2.3 GENOME ENGINEERING

10.2.4 DRUG DISCOVERY

10.2.5 OTHERS

10.3 CLASS-1 MULTIPLE EFFECTOR PROTEINS

11 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES

11.1 OVERVIEW

11.2 PRODUCTS

11.2.1 ASSAY KITS

11.2.1.1 SGRNA KIT

11.2.1.2 GENOMIC DETECTION KIT

11.2.1.3 OTHERS

11.2.2 PROTEINS

11.2.2.1 CAS9

11.2.2.2 CPF1

11.2.2.3 OTHERS

11.2.3 PLASMID AND VECTOR

11.2.4 LIBRARY

11.2.5 CONTROL KITS

11.2.6 DELIVERY SYSTEM PRODUCTS

11.2.7 DESIGN TOOLS

11.2.8 GENOMIC RNA

11.2.9 HDR BLOCKERS

11.2.9.1 AZIDOTHYMIDINE

11.2.9.2 TRIFLUOROTHYMIDINE

11.2.9.3 OTHERS

11.2.9.4 OTHERS

11.3 SERVICES

11.3.1 G-RNA DESIGN

11.3.2 CELL LINE ENGINEERING

11.3.3 MICROBIAL GENE EDITING

11.3.4 DNA SYNTHESIS

11.3.5 OTHERS

12 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BIOMEDICAL DIAGNOSTICS

12.2.1 CANCER

12.2.2 BLOOD DISORDERS

12.2.3 HEREDITARY DISORDERS

12.2.4 MUSCULAR DYSTROPHY

12.2.5 AIDS

12.2.6 NEURODEGENERATIVE CONDITION

12.2.7 OTHERS

12.3 AGRICULTURAL APPLICATIONS

12.4 GENOME ENGINEERING

12.4.1 CELL LINE ENGINEERING

12.4.2 HUMAN STEM CELLS

12.5 DRUG DISCOVERY

12.6 OTHERS

13 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW

13.1 OVERVIEW

13.2 CRRNA

13.3 CAS ENZYME

13.4 PRE-AMPLIFICATION

13.4.1 PCR

13.4.2 LAMP

13.4.3 RPA

13.5 SAMPLE PREPARATION

13.6 SENSING

13.6.1 FLUORESCENT PROBES

13.6.2 COLORIMETRIC

14 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOTECHNOLOGY COMPANIES

14.3 ACADEMIC AND RESEARCH INSTITUTES

14.4 DIAGNOSTIC CENTERS

14.5 HOSPITALS

14.6 OTHERS

15 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

16 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 THERMO FISHER SCIENTIFIC INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 MERCK KGA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 AGILENT TECHNILOGIES, INC

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 GENSCRIPT

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 10 X GENOMICS

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 APPLIED STEM CELL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 ADDGENE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 BIOVISION INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 CELLECTA, INC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 CAS TAG BIOSCIENCES

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GENECOPOEIA, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HORIZON DISCOVERY LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HERA BIOLABS

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NEW ENGLAND BIOLABS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 ORIGENE TECHNOLOGIES, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SYNTHEGO

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 TAKARA BIO INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 TOOLGEN, INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表のリスト

TABLE 1 PIPELINE ANALYSIS FOR NORTH AMERICA CRISPR GENE THERAPEUTICS

TABLE 2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CLASS-1 MULTIPLE EFFECTOR PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA AGRICULTURAL APPLICATIONS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA DRUG DISCOVERYIN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CRRNA IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CAS ENZYME IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA SAMPLE PREPARATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA DIAGNOSTIC CENTERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HOSPITALS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIRECT TENDER IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA RETAIL SALES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 57 U.S. CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 59 U.S. PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 U.S. GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 68 U.S. PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 69 U.S. SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 70 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 73 CANADA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 75 CANADA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 CANADA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 84 CANADA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 85 CANADA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 86 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 89 MEXICO CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 91 MEXICO PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 MEXICO PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 101 MEXICO SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 102 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN CRISPR DIAGNOSTICS, AND GOVERNMENT FUNDING FOR THE DEVELOPMENT OF CRISPR DETECTION KITS ARE EXPECTED TO DRIVE THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 TO 2029

FIGURE 13 CLASS SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 & 2029

FIGURE 14 NORTH AMERICA CRISPR GENE PATENT SCENARIO, BY APPLICATION

FIGURE 15 CRISPR PATENT LANDSCAPE AND NUMBER OF APPLICATIONS OF NEW PATENT FAMILIES FILED WORLDWIDE, 2001 TO 2019

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

FIGURE 17 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 18 PREVALENCE OF HUNTINGTON’S DISEASE IN 2019

FIGURE 19 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2021

FIGURE 20 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 24 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2021

FIGURE 32 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, LIFELINE CURVE

FIGURE 35 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2021

FIGURE 36 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 40 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS (2022-2029)

FIGURE 48 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。