北米日本食レストラン市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

5.11 Billion

USD

6.59 Billion

2024

2032

USD

5.11 Billion

USD

6.59 Billion

2024

2032

| 2025 –2032 | |

| USD 5.11 Billion | |

| USD 6.59 Billion | |

|

|

|

北米の日本食レストラン市場セグメンテーション、料理の種類別(伝統的な日本料理、専門日本料理、現代日本料理)、サービスの種類別(クイックサービスレストラン(QSR)、フルサービスレストラン、テイクアウトカウンター/アウトレット)、レストランのカテゴリー別(独立型レストラン、チェーン/フランチャイズモデル)、レストランモデル別(テイクアウト、宅配、店内飲食)、販売チャネル別(実店舗、デリバリーオンラインレストラン/ゴーストキッチン) - 2032年までの業界動向と予測

日本食レストラン市場規模

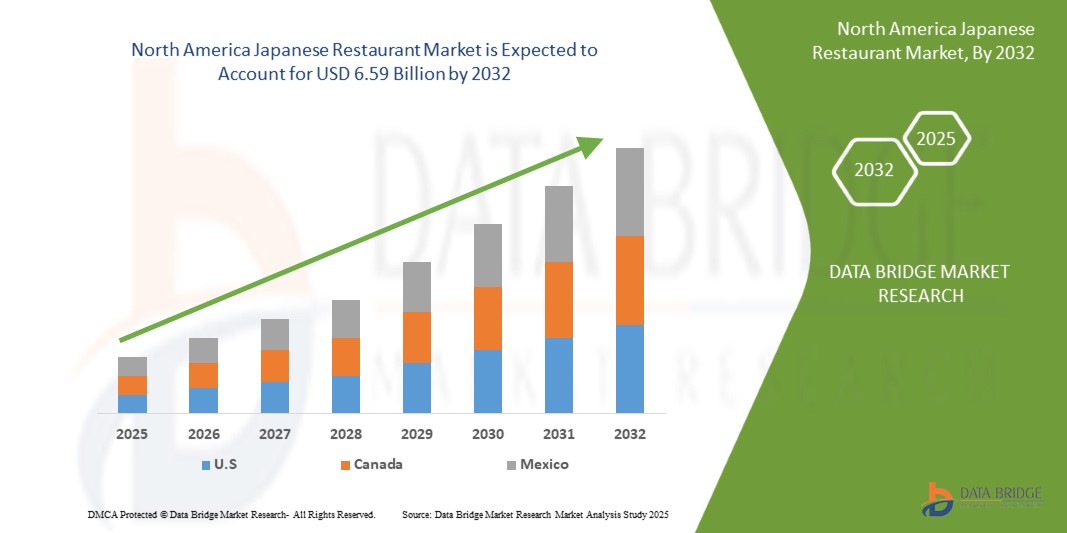

- 北米の日本食レストラン市場は2024年に51億1000万米ドルと評価され、 2032年までに65億9000万米ドルに達すると予想されています。

- 2025年から2032年の予測期間中、市場は主に寿司人気の高まりにより、3.28%のCAGRで成長すると予想されます。

- この成長は、北米における日本料理人気の高まり、消費者の健康志向、寿司の需要、文化的影響、都市化、利便性、革新、観光などの要因によって推進されています。

日本のレストラン市場分析

- 日本食レストラン市場は、寿司や伝統料理の需要増加に牽引され、世界中で成長を続けています。健康志向の消費者は、新鮮な食材、低脂肪のタンパク質、オメガ3脂肪酸を豊富に含む魚介類などから、日本食を好んでいます。都市化とライフスタイルの多様化により、便利で栄養価の高い食事の選択肢への需要が高まっています。

- メディア露出とフュージョン料理の革新により、市場の魅力はさらに高まります。しかし、課題としては、原材料費の高騰、市場の飽和、そして本物志向とローカライズのバランスなどが挙げられます。

- デジタルフードデリバリー、サステナビリティへの取り組み、そして消費者の嗜好の変化が成長を牽引し、将来は明るい。日本食レストランは、クイックサービスの寿司バーから高級なおまかせまで、多様なダイニング体験を提供し、引き続き繁栄している。

- これらのレストランの需要は、日本食の健康効果に対する意識の高まりによって大きく推進されています。世界の需要の半分以上は、ユネスコ無形文化遺産に認定されている日本料理へのニーズによって牽引されています。

- 例えば、ワールドメトリックスは2024年までに世界の寿司市場が大幅な成長を遂げ、業界規模は270億米ドルを超えると報告しています。この急成長は寿司人気の高まりを浮き彫りにし、日本食レストランの数を大幅に増加させ、世界中で日本食体験の拡大に貢献しています。

- 世界では、日本料理はイタリア料理に次いで2番目に人気があります。レストラン数では、中華料理がトップで、イタリア料理とインド料理がそれに続きます。しかし、日本はトップクラスのレストランの数を誇り、東京には世界で最も多くのミシュラン三つ星レストランがあります。

レポートの範囲と日本食レストラン市場のセグメンテーション

|

属性 |

日本食レストランの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

日本のレストラン市場の動向

「健康上の利点に対する意識の向上」

- 世界の日本食レストラン市場における顕著な傾向の一つは、健康上の利点に対する意識の高まりである。

- 日本食の健康効果への意識の高まりを背景に、日本食業界は著しい成長を遂げています。新鮮で高品質な食材とバランスの取れた栄養を重視することで知られる日本食は、健康とウェルネスへの世界的な関心の高まりと合致しています。

- 例えば、2019年2月、神戸ステーキハウスは、がんリスクの低減、心臓病発症率の低下、高タンパク質といった日本食の健康効果への認識が高まっていることを強調しました。こうした認識の高まりは、日本食への世界的な関心を高め、長寿と健康増進における日本食の役割を強調し、市場拡大に貢献しています。

- 寿司、刺身、味噌汁などの伝統的な料理は、風味豊かなだけでなく、脂肪が少なく、必須栄養素が豊富です。

- 日本食の健康効果に対する意識の高まりは、栄養価が高くバランスの取れた食事を求める消費者の需要の高まりと相まって、世界の日本食レストラン市場を牽引しています。この傾向は、日本食への国際的な関心を高め、市場を世界規模で拡大させ、世界中の日本食レストランの魅力を高めています。

日本のレストラン市場の動向

ドライバ

「寿司人気の高まり」

- 寿司人気の高まりは、日本食レストラン市場を大きく押し上げています。新鮮な食材や高タンパクといった健康効果は、栄養価の高い代替品を求める健康志向の消費者にとって魅力的です。

- ベジタリアンやグルテンフリーなどの選択肢がある寿司の多様性は、その世界的な魅力を高めている。

- 革新的なロールパンやフュージョン料理は多様な顧客層を惹きつけ、市場を拡大しています。さらに、メディア露出や世界各地での普及を通じた主流化により、寿司は現代の食文化の定番として確固たる地位を築き、世界中の日本食レストランの需要を押し上げています。

例えば、

- ワールドメトリックスは、2024年に世界の寿司市場が大幅な成長を遂げ、業界規模は270億米ドルを超えると報告しました。この急成長は、寿司人気の高まりを浮き彫りにし、日本食レストランの数を大幅に増加させ、世界中で日本食体験の拡大に貢献しています。

- 2024年、エル・インディア誌に掲載されたブログ記事によると、インドでは寿司の人気が急上昇しており、主要都市の日本食レストランへの投資が増加しているとのことです。この成長傾向は、インド地域における寿司の受容と熱意の高まりを反映しています。

- 2024年4月、Indian Retailerに掲載された記事によると、消費者の嗜好の変化と健康志向の高まりに伴い、インドでは寿司の人気が高まっているとのことです。インドにおける寿司人気の高まりは日本食レストランの成長を牽引しており、ムンバイ、デリー、バンガロールなどの主要都市で新しい店舗がオープンし、寿司を提供する店舗が増えています。この変化は、新鮮で栄養価の高い選択肢としての寿司の魅力が、変化する食生活の嗜好と合致するという、より広範な世界的なトレンドを反映しています。

- The surge in sushi’s popularity is a major driver for the global Japanese restaurant market. Its alignment with health trends, adaptability to diverse dietary needs, and mainstream acceptance contribute to its growing appeal. As consumers increasingly seek out nutritious, versatile, and trendy dining options, sushi continues to play a pivotal role in expanding the reach and success of Japanese dining establishments globally

Opportunity

“Innovation In Menu Offerings”

- Menu innovation presents a key growth opportunity for Japanese restaurants, allowing them to attract new customers and adapt to evolving dining trends. By modernizing traditional dishes, such as offering vegetarian sushi, fusion rolls, and sushi burritos, restaurants can cater to diverse dietary preferences

- In addition, integrating global culinary influences enhances creativity, blending flavors and techniques to create unique offerings. This adaptability helps Japanese restaurants differentiate themselves, expand market appeal, and meet the demands of contemporary consumers seeking innovative dining experiences

For instance,

- The Economic Times reported that the Japanese restaurant market saw significant innovation with the introduction of sushi doughnuts and sushi burritos. These novel creations, which blend traditional sushi ingredients with new formats, such as a doughnut-shaped sushi or a burrito-style wrap, reflect a growing trend towards inventive menu offerings

- According to Japan Travel, Narisawa in Tokyo exemplifies innovation in menu offerings within the Japanese restaurant market. Renowned for its unique approach to Japanese cuisine, Narisawa integrates cutting-edge culinary techniques and local, seasonal ingredients to create a dining experience that pushes the boundaries of traditional Japanese food

- Innovation in menu offerings provides substantial opportunities by adapting traditional dishes, integrating global trends, catering to health-conscious consumers, leveraging technology, and embracing sustainability. Japanese restaurants can enhance their appeal, differentiate themselves in a competitive market, and drive continued growth.

Restraint/Challenge

“High Costs Of Ingredients For Japanese Cuisine”

- Japanese cuisine relies on premium ingredients like sushi-grade fish and rare vegetables, which are costly and subject to price fluctuations

- These high costs impact restaurant pricing, potentially reducing consumer demand, especially for smaller establishments that struggle to absorb expenses

- Price volatility can lead to inconsistent menu pricing and availability, affecting customer perceptions of affordability. Rising costs may also limit menu diversity, reducing appeal to a broader audience

- As a result, maintaining quality while managing ingredient expenses is a key challenge for Japanese restaurants, influencing both operational sustainability and consumer behavior

For instance,

- 2024年1月、SeafoodSourceに掲載された記事によると、今年最初のクロマグロが記録的な高値で競り落とされ、驚異の310万ドルで落札された。これは、日本料理における高級食材の価格高騰を浮き彫りにしている。クロマグロは高級寿司や刺身の重要な食材であるため、価格高騰は、顧客獲得と維持のためにこうした高級食材に依存しているレストランが直面する財政難を浮き彫りにしている。

- 2023年8月、Hanaya FMに掲載されたブログ記事によると、新鮮な魚介類や良質な米といった高級食材の調達コストの高さが、寿司をはじめとする日本料理の価格設定に大きな影響を与えているという。日本料理の真正性と品質を保証するためには最高級の食材が必要となるため、コストが上昇し、それがメニュー価格に反映されることが多い。この要因は、日本食レストランでの飲食にかかる費用総額の増加に寄与し、消費者市場と世界中の日本食レストランの運営戦略の両方に影響を与えている。

- 食材価格の高騰は、運営費の増加や価格戦略への影響など、大きな制約要因となります。高級食材コストの管理は、特に小規模な店舗に大きな打撃を与え、メニュー価格の変動や消費者の認識にも影響を与える可能性があります。

日本のレストラン市場の展望

市場は、料理の種類、サービスの種類、レストランのカテゴリー、レストランのモデル、販売チャネルに基づいてセグメント化されています。

|

セグメンテーション |

サブセグメンテーション |

|

アプリケーション別 |

|

|

|

|

レストランカテゴリー別 |

|

|

レストランモデル別

|

|

|

販売チャネル別 |

|

日本のレストラン市場の地域分析

“U.S. is the Dominant Country in the Japanese Restaurant Market”

- U.S. dominates the Japanese restaurant market, driven by increasing awareness of health benefits related to Japanese food drives, and strong presence of key market players

- U.S. holds a significant share due to culinary authenticity, high-quality ingredients, strong domestic demand, tourism, and North America cultural influence.

- The high-quality ingredients, strong demand, tourism, skilled chefs, innovation, seafood supply, Michelin restaurants, and North America influence.

- In addition, the increasing culinary authenticity, premium ingredients, strong domestic demand, tourism, skilled chefs, innovation, Michelin-starred restaurants, seafood supply, government support, food technology, North America influence, rich heritage, efficient logistics, and dining culture is driving the market growth.

“U.S. is Projected to Register the Highest Growth Rate”

- U.S. is expected to witness the highest growth rate in the Japanese restaurant market, driven by the increase in popularity of the dish sushi

- U.S., dominates due to culinary authenticity, premium ingredients, strong domestic demand, tourism, Michelin-starred restaurants, skilled chefs, innovation, seafood supply, government support, advanced food technology, rich heritage, efficient logistics, high dining culture, and North America influence.

Japanese Restaurant Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- KATSU-YA GROUP, INC (U.S.)

- Wokcano Asian Restaurant & Bar. (U.S.)

- 893 Ryōtei Berlin (Germany)

- Chiba Japanese Restaurant (U.S.)

- Tsujita Artisan Noodle. (Japan)

- Florilège (Japan)

- KAITEN ZUSHI (U.S.)

- Kura Sushi USA (U.S.)

- My Concierge Japan (Japan)

- NARISAWA (Japan)

- RE&S (Singapore)

- SAZENKA (Japan)

- SEZANNE (Japan)

- Sushi A Go Go (U.S.)

- Sushi Den (U.S.)

- Sushi Gen Enterprises. (U.S.)

- Sushi Nozawa Group (US.)

- Sushiya (India)

- Takami Sushi & Robata Restaurant (U.S.)

- Tatsu Ramen LLC. (U.S.)

- Yamashiro Hollywood (U.S.)

Latest Developments in North America Japanese Restaurant Market

- In May 2024, Sushi Den has announced the relaunch of its highly anticipated lunch service. In addition, OTOTO, a latest addition to the Sushi Den and Izakaya Den, has launched a delightful Sunday Brunch starting from 11:00 AM to 2:00 PM. The company look forward to sharing this new chapter with their customer’s and enjoying the season’s fresh offerings together

- In June 2024, Sézanne at Four Seasons Hotel Tokyo at Marunouchi has been ranked 15 in the World's 50 Best Restaurants 2024 and named Best Restaurant in Asia. Led by Chef Daniel Calvert, it showcases French culinary excellence with Japanese ingredients, offering an elegant, seasonally inspired dining experience in a sophisticated setting

- In May 2024, Southern Capital Group and RE&S Holdings Limited jointly announced the acquisition of the company through a Scheme of Arrangement. This strategic move is part of a planned reorganization that will see Southern Capital Group taking ownership of RE&S Holdings. The acquisition was agreed upon by both parties, and the Scheme of Arrangement will facilitate a smooth transition, ensuring that the company continues to operate efficiently under new ownership. This development marks a significant milestone for RE&S Holdings as it embarks on a new chapter under Southern Capital Group’s leadership

- In August 2024, Kura Sushi USA has teamed up with Toei Animation to celebrate “One Piece” with a special Bikkura Pon promotion from Aug. 2 to Sept. 30, 2024. The collaboration features exclusive One Piece prizes, including figurines and can badges, and limited-time menu items like Gum-Gum Fruit Ice Cream Monaka and Jumbo Spicy Roast Beef Roll. Guests can also purchase a themed bottle for USD 16.00 with free soft drink refills. Kura Sushi Rewards Members spending USD 80 or more from Aug. 2-8 will receive a One Piece Cooling Towel. All prizes come in eco-friendly, biodegradable capsules

- In May 2024, Kura Sushi USA launched a Dragon Ball Super-themed Bikkura Pon promotion from May 1 to June 30, 2024. The collaboration featured exclusive Dragon Ball Super prizes, including limited-edition acrylic stand keychains and enamel pins. A rare glow-in-the-dark Goku keychain was available in limited quantities. From June 5-9, Rewards Members received a Dragon Ball Super graphic tee with a USD 70 in-restaurant spend. A Dragon Ball Super Bottle Set with a straw and lanyard was available for USD 16.00 starting June 1. The Bikkura Pon Prize System rewarded diners with Dragon Ball Super-themed prizes for every 15 plates enjoyed

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL SOURCING

4.1.2 PROCESSING & PACKAGING

4.1.3 LOGISTICS & DISTRIBUTION

4.1.4 RESTAURANT OPERATIONS

4.1.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS FOR THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.2 VENDOR SELECTION CRITERIA

4.2.1 INGREDIENT QUALITY AND AUTHENTICITY

4.2.2 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.2.3 COMPLIANCE WITH FOOD SAFETY AND REGULATORY STANDARDS

4.2.4 COST COMPETITIVENESS AND PRICING STABILITY

4.2.5 SUSTAINABILITY AND ETHICAL SOURCING PRACTICES

4.2.6 TECHNOLOGICAL INTEGRATION AND ORDERING EFFICIENCY

4.3 FACTORS INFLUENCING PURCHASING DECISION OF END USERS IN THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.3.1 AUTHENTICITY AND CULTURAL EXPERIENCE

4.3.2 QUALITY AND FRESHNESS OF INGREDIENTS

4.3.3 MENU VARIETY AND DIETARY PREFERENCES

4.3.4 PRICING AND VALUE FOR MONEY

4.3.5 AMBIENCE AND RESTAURANT DESIGN

4.3.6 BRAND REPUTATION AND REVIEWS

4.3.7 CONVENIENCE AND ACCESSIBILITY

4.3.8 CUSTOMER SERVICE AND HOSPITALITY

4.3.9 HEALTH AND SAFETY CONCERNS

4.3.10 CULTURAL TRENDS AND POPULARITY

4.3.11 CONCLUSION

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS IN THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.4.1 EXPANSION THROUGH FRANCHISING

4.4.2 MENU INNOVATION AND DIVERSIFICATION

4.4.3 DIGITAL TRANSFORMATION AND ONLINE PRESENCE

4.4.4 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.4.5 SUSTAINABLE PRACTICES AND ETHICAL SOURCING

4.4.6 PREMIUMIZATION AND FINE DINING CONCEPTS

4.4.7 GEOGRAPHIC EXPANSION INTO EMERGING MARKETS

4.4.8 LOYALTY PROGRAMS AND CUSTOMER ENGAGEMENT

4.4.9 TECHNOLOGY-DRIVEN EFFICIENCY

4.4.10 HEALTH AND WELLNESS-FOCUSED OFFERINGS

4.4.11 CONCLUSION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.5.1 RISING POPULARITY OF AUTHENTIC AND REGIONAL JAPANESE CUISINE

4.5.2 GROWTH OF FAST-CASUAL AND TAKEAWAY CONCEPTS

4.5.3 INCREASED FOCUS ON SUSTAINABILITY AND ETHICAL SOURCING

4.5.4 DIGITAL TRANSFORMATION AND SMART RESTAURANT TECHNOLOGY

4.5.5 EXPANSION INTO EMERGING MARKETS

4.5.6 HEALTH AND WELLNESS-DRIVEN MENUS

4.5.7 INFLUENCE OF JAPANESE POP CULTURE ON FOOD TRENDS

4.5.8 PERSONALIZATION AND CUSTOMIZATION

4.5.9 ALCOHOL PAIRING AND SAKE CULTURE EXPANSION

4.5.10 FUTURE OUTLOOK: THE EVOLUTION OF THE JAPANESE RESTAURANT MARKET

4.5.11 CONCLUSION

4.6 TECHNOLOGICAL ADVANCEMENT OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET

4.6.1 AUTOMATION AND ROBOTICS

4.6.2 AI AND SMART ORDERING SYSTEMS

4.6.3 DIGITAL PAYMENT AND CONTACTLESS SOLUTIONS

4.6.4 SMART KITCHENS AND IOT INTEGRATION

4.6.5 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.6.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING AWARENESS OF HEALTH BENEFITS

6.1.2 THE INCREASE IN POPULARITY OF THE DISH SUSHI

6.1.3 JAPANESE CUISINE, RECOGNIZED AS A UNESCO INTANGIBLE CULTURAL HERITAGE, INCREASES THE NORTH AMERICA CONSUMER INTEREST FOR JAPANESE CUISINE

6.2 RESTRAINTS

6.2.1 FOOD CONTAMINATION, RISKING THE SAFETY, AND QUALITY OF THE PRODUCT

6.2.2 HIGH COSTS OF INGREDIENTS FOR JAPANESE CUISINE

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN MENU OFFERINGS

6.3.2 COLLABORATION WITH LOCAL CULTURAL EVENTS AND FESTIVALS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ITALIAN AND CHINESE CUISINES

6.4.2 MAINTAINING AUTHENTICITY AND LABOR SHORTAGES

7 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE

7.1 OVERVIEW

7.2 TRADITIONAL JAPANESE CUISINE

7.2.1 SUSHI

7.2.2 RAMEN

7.2.3 TEMPURA

7.2.4 SASHIMI

7.2.5 KAISEKI

7.2.6 UDON/SOBA

7.2.7 OTHERS

7.3 SPECIALTY JAPANESE CUISINE

7.4 MODERN JAPANESE CUISINE

8 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 QUICK SERVICE RESTAURANTS (QSR)

8.3 FULL SERVICE RESTAURANTS

8.4 TAKE-OUT COUNTERS/OUTLETS

9 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY

9.1 OVERVIEW

9.2 STANDALONE RESTAURANT

9.3 CHAIN/FRANCHISE MODEL

10 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL

10.1 OVERVIEW

10.2 TAKEAWAY

10.3 HOME DELIVERY

10.4 DINE-IN

11 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 PHYSICAL OUTLETS

11.3 DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN

12 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KATSU-YA GROUP, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 WOKCANO ASIAN RESTAURANT & BAR.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 893 RYŌTEI BERLIN

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CHIBA JAPANESE RESTAURANT

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TSUJITA ARTISAN NOODLE.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FLORILÈGE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KAITEN ZUSHI

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 KURA SUSHI USA

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 MY CONCIERGE JAPAN

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NARISAWA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RE&S

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 SAZENKA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 SEZZANE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT NEWS

15.14 SUSHI A GO GO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SUSHI DEN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SUSHI GEN ENTERPRISES

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUSHI NOZAWA GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUSHIYA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TAKAMI SUSHI & ROBATA RESTAURANT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TATSU RAMEN LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 YAMASHIRO HOLLYWOOD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MODERN JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA QUICK SERVICE RESTAURANTS (QSR) IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FULL SERVICE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA TAKE-OUT COUNTERS/OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA STANDALONE RESTAURANT IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA CHAIN/FRANCHISE MODEL IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TAKEAWAY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HOME DELIVERY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DINE-IN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA PHYSICAL OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 134 MEXICO RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 MEXICO JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 155 MEXICO JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

図表一覧

FIGURE 1 NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 2 NORTH AMERICA JAPANESE RESTAURANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA JAPANESE RESTAURANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA JAPANESE RESTAURANT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA JAPANESE RESTAURANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA JAPANESE RESTAURANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA JAPANESE RESTAURANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA JAPANESE RESTAURANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA JAPANESE RESTAURANT MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING AWARENESS OF HEALTH BENEFITS IS EXPECTED TO DRIVE THE NORTH AMERICA JAPANESE RESTAURANT MARKET IN THE FORECAST PERIOD

FIGURE 15 TRADITIONAL JAPANESE CUISINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA JAPANESE RESTAURANT MARKET IN 2025 AND 2032

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA JAPANESE RESTAURANT MARKET

FIGURE 19 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 20 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY SERVICE TYPE, 2024

FIGURE 21 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY RESTAURANT CATEGORY, 2024

FIGURE 22 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY RESTAURANT MODEL, 2024

FIGURE 23 NORTH AMERICA JAPANESE RESTAURANT MARKET: BY SALES CHANNEL, 2024

FIGURE 24 NORTH AMERICA JAPANESE RESTAURANT MARKET: SNAPSHOT, 2024

FIGURE 25 NORTH AMERICA JAPANESE RESTAURANT MARKET: COMPANY SHARE, 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。