北米眼科市場

Market Size in USD Billion

CAGR :

%

USD

31.77 Billion

USD

52.37 Billion

2024

2032

USD

31.77 Billion

USD

52.37 Billion

2024

2032

| 2025 –2032 | |

| USD 31.77 Billion | |

| USD 52.37 Billion | |

|

|

|

北米眼科市場のセグメンテーション、製品別(デバイス、医薬品、その他)、疾患別(白内障、屈折異常、緑内障、加齢黄斑変性、炎症性疾患、その他)、総合眼科検査(屈折検査、視力検査、眼圧検査、前眼部および瞳孔検査、視野検査、色覚検査、その他)、エンドユーザー別(クリニック、病院、在宅医療、その他)、流通チャネル別(小売販売、直接入札、その他) - 2032年までの業界動向と予測

北米眼科市場分析

北米の眼科市場は、エジプトやギリシャにおける古代の眼疾患治療法に始まり、数世紀にわたり大きく発展してきました。この分野は、より高度な外科手術技術と器具の開発に伴い、17世紀と18世紀に形成され始めました。19世紀には、検眼鏡などの革新が診断能力を変革しました。20世紀には、白内障手術や眼内レンズの発明といった画期的な進歩があり、1990年代にはレーシック手術が導入されました。21世紀は、人口の高齢化、技術の進歩、そして光干渉断層撮影(OCT)や網膜画像システムといった特殊な診断・手術機器の開発に牽引され、継続的な成長を遂げました。近年のトレンドは、人工知能、遠隔医療、そして遺伝子治療や幹細胞治療といった生物学的療法の利用拡大に重点が置かれており、市場の成長をさらに促進しています。今日、眼科市場は、眼疾患の罹患率の上昇、新しい技術、治療オプションの進化により拡大し続けています。

北米眼科市場規模

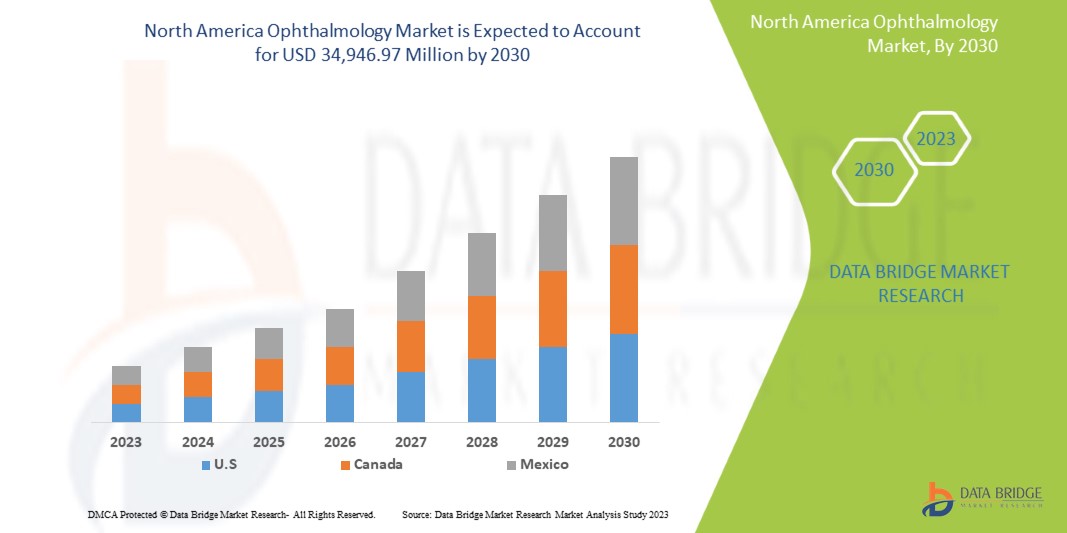

北米の眼科市場は、2025年から2032年の予測期間に6.5%のCAGRで成長し、2024年の317億7,000万米ドルから2032年には523億7,000万米ドルに達すると予想されています。

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。

北米眼科市場動向

「遠隔医療とAIを活用した診断ツールの導入拡大」

北米の眼科市場では、遠隔医療とAIを活用した診断ツールの導入が拡大しています。これらのイノベーションは、遠隔診療やスクリーニングを可能にすることで眼科医療の提供方法を変革し、特に医療サービスが行き届いていない地域や地方におけるアクセス性を向上させています。機械学習アルゴリズムを含むAI技術は、網膜画像の分析、糖尿病網膜症、緑内障、黄斑変性症などの早期兆候の検出、そしてより迅速で正確な診断の提供に活用されています。遠隔医療プラットフォームは、患者が眼科医と連絡を取り、フォローアップの診察を受けることを可能にするため、対面診療の必要性が軽減され、眼科医療の利便性と効率性が向上します。この傾向は、患者がタイムリーな治療を受けられるようになるだけでなく、医療システム全体の効率性を高め、眼科分野の市場成長を促進する重要な原動力となっています。その結果、これらの技術の統合は、特に医療インフラが未発達な新興市場において、今後も拡大していくと予想されます。

レポートの範囲と北米眼科市場のセグメンテーション

|

属性 |

北米眼科市場の洞察 |

|

対象セグメント |

製品別:デバイス、医薬品、その他 疾患別:白内障、屈折異常、緑内障、加齢黄斑変性、炎症性疾患など 総合的な 眼科 検査:屈折検査、視力検査、眼圧検査、前眼部・瞳孔検査、視野検査、色覚検査など エンドユーザー別:診療所、病院、在宅医療、その他 流通 チャネル別:小売販売、直接入札、その他 |

|

対象地域 |

米国、カナダ、メキシコ |

|

主要な市場プレーヤー |

Alcon(スイス)、Bausch + Lomb(カナダ)、Carl Zeiss Meditec(ドイツ)、HOYA株式会社(日本)、Johnson & Johnson Services, Inc.(米国)、Essilor International(フランス)、Topcon Corporation(日本)、Glaukos Corporation(米国)、Haag-Streit Group(スイス)、Nidek Co., Ltd(米国)、Staar Surgical(カリフォルニア)、Ziemer Ophthalmic Systems Ag(スイス)、Cooper Companies(米国)、Lumenis Be Ltd.(イスラエル)、Reichert Inc.(ニューヨーク)、Bayer Ag(ドイツ)、Novartis Ag(スイス)、Abbvie Inc.(米国)、F. Hoffmann-La Roche Ltd.(スイス)、Dompé(イタリア)、参天製薬株式会社(日本)など。 |

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

北米眼科市場の定義

眼科は、眼の疾患や障害の診断、治療、予防に重点を置いた医学および外科の一分野です。白内障、緑内障、黄斑変性、糖尿病網膜症など、眼や視覚系に影響を与える疾患に対する医学的および外科的治療が含まれます。

北米眼科市場の定義と動向

ドライバー

- 眼疾患の罹患率の増加

白内障、黄斑変性、糖尿病網膜症といった眼疾患の増加は、北米眼科市場の大きな牽引力となっています。北米では人口の高齢化に伴い、これらの疾患の発症率も上昇しています。白内障は視力低下や失明につながるため、手術や矯正治療の市場規模は拡大しています。同様に、黄斑変性と糖尿病網膜症は、高度な診断ツールと専門的な治療法の必要性を高めています。患者数の増加は、手術、投薬、革新的な診断技術を含む眼科サービスへの継続的な需要を保証しています。こうした眼疾患の急増は市場拡大の直接的な原動力となっており、医療提供者とメーカーは効果的な治療法とソリューションへの高まる需要に応えようと努力しています。

例えば、

- 2022年7月、NCBIが発表した論文によると、失明率は加齢とともに上昇し、50~59歳では0.45%であるのに対し、80歳以上では11.62%に増加しています。女性(2.31%)と地方居住者(2.14%)では失明率がさらに高くなっています。視覚障害も26.68%に見られ、同様の傾向を示しています。特に高齢者における眼疾患の増加は、眼科治療と技術の需要を押し上げ、眼科市場を押し上げています。

- 2023年8月、WHO北米支部が発表した記事によると、22億人以上が視力障害に苦しんでおり、そのうち約10億件は予防可能または未治療です。視力障害の罹患率の増加は、眼科サービス、治療、そして矯正ソリューションに対する需要の高まりを浮き彫りにしています。予防可能または未治療の症状で医療機関を受診する人が増えるにつれ、眼疾患の負担増加は眼科市場の大きな牽引力となっています。

The rising prevalence of age-related eye conditions like cataracts, macular degeneration, and diabetic retinopathy is fueling the North America ophthalmology market. As the population ages, these diseases become more common, increasing the demand for treatments, surgeries, and diagnostic tools. The need for advanced technologies and therapies grows as more people require care. This surge in eye conditions drives market growth, as healthcare providers and manufacturers aim to meet the rising demand for effective solutions.

- Focus on Preventative Eye Care

There is a growing emphasis on preventative eye care and early detection of vision-related issues, which is playing a significant role in driving the North America ophthalmology market. As awareness about the importance of eye health increases, more people are seeking routine eye checkups to detect conditions like glaucoma, diabetic retinopathy, and cataracts in their early stages. Early diagnosis allows for timely interventions, reducing the risk of vision loss and improving overall eye health. This proactive approach is not only improving patient outcomes but also fueling demand for ophthalmic services, diagnostic tools, and corrective treatments. The growing focus on preventative care is leading to a surge in investments in eye care technologies, ophthalmic devices, and services, thereby contributing to the market's expansion. This trend strongly acts as a driver for growth in the ophthalmology sector.

For instance,

- In October 2022, according to the article published by National Eye Institute, National Eye Health Education Program(NEHEP) collaborates with health professionals to promote awareness on early detection, treatment of eye diseases, and the benefits of vision rehabilitation. It also targets populations at high risk of eye disease and vision loss. This focus on preventative care encourages people to seek timely eye checkups and treatments, driving demand for ophthalmic services, diagnostic tools, and products, thereby fueling the ophthalmology market

- In October 2024, according to the article published by Directorate General of Health Services, The National Programme for Control of Blindness and Visual Impairment (NPCB&VI) aims to reduce blindness prevalence by identifying and treating curable blindness at all healthcare levels. By focusing on early detection and addressing avoidable blindness, the program highlights the importance of preventative care. This initiative drives demand for eye care services, diagnostic tools, and treatments, contributing significantly to the growth of the North America ophthalmology market

The increasing focus on preventative eye care and early detection is significantly driving the North America ophthalmology market. As awareness of eye health rises, more individuals are opting for routine eye exams to identify conditions like glaucoma and cataracts early. Early detection allows for effective treatments that prevent further vision loss. This proactive approach is driving demand for diagnostic tools, ophthalmic services, and corrective treatments. The growing importance of preventative care is prompting investment in advanced eye care technologies, thus contributing to the overall growth of the ophthalmology market and ensuring its continued expansion.

Opportunities

- Rise in the Aging Population

The rise in the aging population presents a significant opportunity for the North America ophthalmology market, as older individuals are more susceptible to various eye disorders and diseases. Conditions such as cataracts, age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma are prevalent among the elderly, creating a substantial demand for ophthalmic care and treatments. As a result, healthcare systems and ophthalmic providers are poised to expand their services, enhance diagnostic and therapeutic options, and cater to the unique needs of this demographic. This growing patient base necessitates an array of solutions, from surgical interventions and advanced drug therapies to vision correction products, ensuring a steady and increasing demand for ophthalmic procedures and products.

For instance,

- In March 2023, according to an article published in the National Library of Medicine, Cataract is a leading cause of visual impairment in old age. Lens opacification is notoriously associated with several geriatric conditions, including frailty, fall risk, depression and cognitive impairment. Moreover, according to the same source, in 2020, the leading worldwide causes of blindness in patients aged 50 years and older were cataract, followed by glaucoma, under-corrected refractive error, age-related macular degeneration, and diabetic retinopathy

- In August 2022, according to an article published in the American Academy of Ophthalmology, AMD is a common eye disease, usually found in adults over the age of 50. Moreover, it is stated that Half of Americans over the age of 75 develop cataracts

Moreover, addressing the eye health needs of the aging population can stimulate further investments in research and development within the ophthalmology sector. Pharmaceutical companies and medical device manufacturers are focus on creating innovative solutions tailored specifically for age-related conditions, potentially leading to breakthroughs in treatment protocols and patient care. The integration of new technologies, such as tele ophthalmology and advanced imaging techniques, facilitate better management of eye health in older adults, making it easier to monitor and treat conditions remotely. Overall, the aging population amplifies the need for existing ophthalmic services and presents a fertile ground for innovation and growth within the North America ophthalmology market.

- Rise in Online Retail and E-Health Platforms

The rise of online retail and e-health platforms offers a significant opportunity for the North America ophthalmology market by providing consumers with easier access to a wide array of eye care products and services. With the increasing adoption of e-commerce, patients can conveniently purchase items such as prescription glasses, contact lenses, and over-the-counter eye care products from the comfort of their homes. This trend is especially appealing to younger, tech-savvy consumers and those in remote areas with limited access to traditional optical stores. The ability to compare prices, read reviews, and access a wider range of products online enhances customer satisfaction and encourages usage, thereby driving growth in the ophthalmic product segment.

For instance,

- In September 2023, according to a news article from The Times of India, the 'pink eye' outbreak led to a surge in sales of ophthalmology medicine. Sales jumped nearly 30% year-on-year for the second month in a row in August - outgrowing the overall market by almost five times. The rise reflects the massive incidence of conjunctivitis and eye-complications in the last few months across the country

- In April 2020, according to an article, ‘Patient views about online purchasing of eyewear’, online purchasing of contact lenses is on the rise: 10%–20% of contact lens wearers in Australia, U.S. and the UK have considered or researched the possibility of Internet purchasing

In addition to retail opportunities, e-health platforms facilitate telehealth services that allow patients to consult with eye care professionals remotely. Virtual consultations for routine eye examinations, follow-ups, and triaging for more serious conditions can significantly improve access to care, particularly for older adults or individuals with mobility challenges. These platforms enhance patient engagement and adherence to eye health recommendations and allow ophthalmologists to reach a broader patient base without the constraints of geographic boundaries. Furthermore, the integration of digital health tools, such as mobile apps for monitoring eye health or managing chronic conditions, can create a seamless patient experience and foster proactive eye care, further propelling growth in the ophthalmology market.

Restraints/Challenges

- Side Effects and Complications Related to Eye Surgeries

Despite the significant advancements in ophthalmology treatments, certain ophthalmic procedures, particularly surgical interventions, carry risks of side effects and complications such as infection, scarring, or vision impairment. These potential risks can deter patients from undergoing specific therapies, especially those that involve invasive procedures. The fear of adverse outcomes, such as reduced vision or prolonged recovery times, can lead to hesitancy in seeking treatment, limiting the overall adoption of certain therapies. Additionally, complications arising from surgeries might require additional treatments, further raising healthcare costs and impacting patient trust in advanced treatments. This reluctance to undergo treatments due to the potential for negative side effects restricts the overall growth of the ophthalmology market by slowing down the adoption of new technologies and therapies.

For instance,

- In October 2024, according to the article published by Harvard Health, Modern eye surgeries, while effective in treating conditions like cataracts and glaucoma, often lead to complications such as dry eye disease, characterized by a burning, gritty, or itchy sensation. This side effect can be uncomfortable and discouraging for patients, leading some to hesitate or avoid eye surgeries. As a result, complications from treatments act as a restraint on the growth of the ophthalmology market

- In July 2021, according to the article published by Medical News Today, Up to 95% of individuals who undergo laser eye surgery may experience dry eyes, while 20% report visual disturbances like glare or halos. Additionally, 1 in 50 people may suffer from blurry vision or “sands of Sahara” syndrome. These side effects can discourage patients from opting for surgery, limiting the adoption of laser procedures and acting as a restraint on the ophthalmology market’s growth

眼科医療は進歩を遂げていますが、一部の外科治療には感染症、瘢痕、視力障害などのリスクが伴います。これらの合併症は、患者が特定の治療法、特に侵襲的な治療法を選択することを躊躇させる要因となっています。副作用や追加治療費への不安は、患者の治療意欲を低下させ、新しい治療法の導入を遅らせる可能性があります。こうした消極的な姿勢が、北米の眼科市場の成長を阻害しています。

- 地方における専門的な眼科医療へのアクセスの制限

医療インフラの進歩にもかかわらず、農村部や遠隔地では専門的な眼科医療へのアクセスが依然として限られており、これらの地域における眼科市場の成長ポテンシャルを大きく阻害しています。多くの農村部では、訓練を受けた眼科専門家の不足、設備の不足、高度な診断・治療技術へのアクセスの制限といった課題が依然として存在します。その結果、これらの地域の人々は、眼疾患の適切な診断と治療を受けるのに苦労することが多く、予防可能な失明や視力障害の発生率が高まっています。専門的な医療へのアクセスが限られているため、高度な眼科医療サービスや製品の導入が抑制され、市場拡大が阻害されています。こうしたアクセス障壁は、北米の眼科市場全体の成長を阻害する大きな要因となっています。

例えば、

- 2023年2月、NCBIが発表した記事によると、インドの農村人口は膨大で、満たされていない眼科医療ニーズが深刻化しています。医療施設や専門家のほとんどは都市部と準都市部に集中しています。農村部と都市部における眼科医療へのアクセス格差は依然として課題であり、治療へのアクセスを制限しています。この医療資源の不平等な配分は、農村部における必須サービスへの広範なアクセスを阻害し、北米の眼科市場の成長を阻害しています。

- 2024年3月、リサーチゲートが発表した記事によると、「遠隔地では、インターネット接続や訓練を受けたスタッフが不足しているため、眼科キャンプが成功した後でも、継続的な眼科ケアへのアクセスが妨げられています。これらの地域の患者は、適切なインフラが整備されていないため、フォローアップケアや高度な治療を受けるのに苦労しています。この医療提供のギャップは、眼科ケアプログラムの範囲と効果を制限し、北米の眼科市場の成長を阻害しています。」

医療の質が向上しているにもかかわらず、地方では専門的な眼科医療へのアクセスが依然として限られています。眼科医療従事者、高度な技術、そして設備の不足により、適切な治療と診断が受けられず、回避可能な失明率の上昇につながっています。こうしたアクセスの制限は、これらの地域における高度な治療やサービスの導入を制限し、北米の眼科市場の成長を阻害しています。

北米眼科市場の範囲

市場は、製品、疾患、総合眼科検査、エンドユーザー、流通チャネルに基づいてセグメント化されています。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

製品別

- デバイス

- 外科用デバイス

- 白内障手術器具

- 眼科用粘弾性デバイス

- 超音波乳化吸引装置

- 白内障手術用レーザー

- IOLインジェクター

- 硝子体網膜手術デバイス

- 硝子体切除術装置

- 硝子体網膜パック

- 光凝固レーザー

- 硝子体切除プローブ

- 照明装置

- 屈折矯正手術機器

- フェムト秒レーザー

- エキシマレーザー

- その他の屈折手術用レーザー

- 緑内障手術機器

- 緑内障ドレナージ装置

- 微小侵襲緑内障手術デバイス

- 緑内障レーザーシステム

- 診断装置

- 光干渉断層撮影(OCT)スキャナ

- オートレフラクトメーターと角膜計

- 眼圧計

- フォロプター

- 網膜鏡

- 検眼鏡

- スリットランプ

- 視野計/視野分析装置

- 角膜トポグラフィーシステム

- 眼底カメラ

- 眼科用超音波画像システム

- Aスキャンイメージングシステム

- Bスキャンイメージングシステム

- パキメーター

- 超音波生体顕微鏡

- レンズメーター

- 波面収差計

- 光学生体測定システム

- スペキュラー顕微鏡

- チャートプロジェクター

- 眼科手術用アクセサリー

- 手術器具とキット

- 眼科用鉗子

- 眼科用スパチュラ

- 眼科用チップとハンドル

- 眼科用カニューラ

- 眼科用はさみ

- その他外科用アクセサリー

- 眼科用顕微鏡

- 外科用デバイス

- 医薬品、副産物

- 抗VEGF薬

- ラニビズマブ

- ベバシズマブ

- 網膜疾患治療薬

- 緑内障治療薬

- プロスタグランジン類似体

- ラタノプロスト

- ビマトプロスト

- トラボプロスト

- タフルプロスト

- ラタノプロステン

- βアドレナリン拮抗薬

- チモラールマレイン酸塩

- ベタキソロール

- アルファアドレナリン作動薬

- エピネフリン

- デピベプリン

- 縮瞳薬

- ピロカルピン

- 彼の作品に

- プロスタグランジン類似体

- ドライアイ薬

- 抗炎症薬

- ステロイド系抗炎症薬

- 非ステロイド性抗炎症薬

- アレルギー性結膜炎の薬

- その他

- 抗VEGF薬

- 薬物、薬物の種類別

- ブランド

- ジェネリック

- 処方モード別医薬品

- 処方箋

- 店頭

- 投与経路別薬剤

- トピック

- 目薬

- アイソリューション

- クリームと軟膏

- ゲル

- その他

- 地元の眼科

- 硝子体内

- 結膜下

- 球後部

- 前房内

- 注射剤

- 筋肉内

- 静脈内

- その他

- オーラル

- 錠剤

- カプセル

- その他

- その他

- トピック

- その他

- 視力ケア製品

- 眼鏡

- コンタクトレンズ

- ソフトコンタクトレンズ

- ハイブリッドコンタクトレンズ

- 硬質ガス透過性レンズ

- その他

- 視力ケア製品

病気別

- 白内障

- 屈折異常

- 緑内障

- 加齢黄斑変性症

- 炎症性疾患

- その他

総合的な眼科検査によって

- 屈折

- 自動屈折計

- トライアルレンズセット

- 毛様体麻痺薬

- トライアルフレーム

- 自己照明型/ミラーレチノスコープ

- ジャクソンクロスシリンダー

- 視力検査

- スネレンチャート

- 近視力表

- 眼圧

- 眼圧計(ゴールドマン、トノペン、パーキンス、シオッツ)

- その他

- 前眼部および瞳孔検査

- スリットランプ生体顕微鏡

- トーチライト

- 視野検査

- セントラル30-2全閾値ハンフリー視野分析装置

- Frequency Doubling Perimeter

- Goldmann Kinetic Perimeter

- Color Vision Test

- Others

By End User

- Clinics

- Hospitals

- Home Healthcare

- Others

By Distribution Channel

- Retail sales

- Retail Shops

- Hospital Pharmacy

- Online Pharmacy

- Direct Tender

- Others

North America Ophthalmology Market Regional Analysis

The market is segmented on the basis of products, diseases, comprehensive eye examination, end user, and distribution channel.

The countries covered in this market are U.S, Canada, and Mexico.

U.S. is expected to dominate the market due to advanced healthcare infrastructure, high healthcare spending, and a large aging population with a growing prevalence of eye diseases. Additionally, significant investments in research, development, and the adoption of cutting-edge technologies drive market leadership in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Ophthalmology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Ophthalmology Market Leaders Operating in the Market Are:

- Alcon (Switzerland)

- Bausch + Lomb (Canada)

- Carl Zeiss Meditec( Germany)

- Hoya Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Essilor International (France)

- Topcon Corporation(Japan)

- Glaukos Corporation (U.S.)

- Haag-Streit Group (Switzerland)

- Nidek Co., Ltd (U.S.)

- Staar Surgical (California)

- Ziemer Ophthalmic Systems Ag (Switzerland)

- Cooper Companies (U.S.)

- Lumenis Be Ltd. (Israel)

- Reichert Inc. (New York)

- Bayer Ag (Germany)

- Novartis Ag (Switzerland)

- Abbvie Inc. (U.S.)

- F. Hoffmann-La Roche Ltd.(Switzerland)

- Dompé (Italy)

- Santen Pharmaceutical Co.(Japan), Ltd

Latest Developments in North America Ophthalmology Market

- In October 2024, At the AAO 2024 meeting, Alcon showcased its innovations, including the Voyager DSLT for glaucoma treatment, UNIFEYE and UNIPEXY handheld gas delivery systems, and pivotal data for AR-15512, a dry eye treatment. These advancements aimed to improve outcomes and surgical efficiency

- In September 2024, EssilorLuxottica and Meta have extended their partnership, entering a long-term agreement to develop multi-generational smart eyewear products. Building on the success of Ray-Ban Meta glasses, the companies aim to shape the future of wearable technology together

- In OCTOBER 2024, Bausch + Lomb presented new scientific data and educational events at the 2024 AAO meeting in Chicago. Highlights included studies on the enVista Envy IOL, TENEO Excimer Laser, VYZULTA, and presentations on Blink Nutritears, MIEBO, and Xiidra

- In April 2024, AbbVie has completed its acquisition of Cerevel Therapeutics, enhancing its neuroscience portfolio. The acquisition includes Cerevel’s promising clinical-stage assets like Emraclidine for schizophrenia and Tavapadon for Parkinson's disease, strengthening AbbVie’s position in neurology and psychiatry

- In September, 2023, Novartis completed the divestment of its 'front of eye' ophthalmology assets to Bausch + Lomb for up to USD 2.5 billion, including USD 1.75 billion in upfront cash and potential milestone payments. The deal included Xiidra, SAF312, AcuStream, and OJL332. Novartis advanced its strategy to focus on prioritized therapeutic areas for future growth

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 NORTH AMERICA OPHTHALMOLOGY MARKET : REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF EYE DISEASES

6.1.2 FOCUS ON PREVENTATIVE EYE CARE

6.1.3 GOVERNMENT EYECARE INITIATIVES

6.1.4 INNOVATIONS IN OPHTHALMIC SURGICAL TECHNIQUES

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS AND COMPLICATIONS RELATED TO EYE SURGERIES

6.2.2 LIMITED ACCESS TO SPECIALIZED OPHTHALMIC CARE IN RURAL AREAS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE AGING POPULATION

6.3.2 RISE IN ONLINE RETAIL AND E-HEALTH PLATFORMS

6.3.3 ENHANCED PATIENT EDUCATION

6.4 CHALLENGES

6.4.1 RISING COSTS OF OPHTHALMIC TREATMENTS

6.4.2 SHORTAGE OF EYE CARE PROFESSIONALS

7 NORTH AMERICA OPHTHALMOLOGY MARKETNORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 DEVICE

7.2.1 SURGICAL DEVICE

7.2.1.1 CATARACT SURGICAL DEVICES

7.2.1.2 OPHTHALMIC VISCOELASTIC DEVICES

7.2.1.2.1 PHACOEMULSIFICATION DEVICES

7.2.1.2.2 CATARACT SURGICAL LASERS

7.2.1.2.3 IOL INJECTORS

7.2.1.3 VITREORETINAL SURGICAL DEVICES

7.2.1.3.1 VITREORETINAL PACKS

7.2.1.3.2 VITRECTOMY MACHINES

7.2.1.3.3 VITRECTOMY PROBES

7.2.1.3.4 PHOTOCOAGULATION LASERS

7.2.1.3.5 ILLUMINATION DEVICES

7.2.1.4 REFRACTIVE SURGICAL DEVICES

7.2.1.4.1 FEMTOSECOND LASERS

7.2.1.4.2 EXCIMER LASERS

7.2.1.4.3 OTHER REFRACTIVE SURGICAL LASERS

7.2.1.5 GLAUCOMA SURGICAL DEVICES

7.2.1.5.1 GLAUCOMA DRAINAGE DEVICES

7.2.1.5.2 GLAUCOMA LASER SYSTEMS

7.2.1.5.3 MICRO INVASIVE GLAUCOMA SURGERY DEVICES

7.2.2 DIAGNOSTIC DEVICE

7.2.2.1 OPTICAL COHERENCE TOMOGRAPHY (OCT) SCANNERS

7.2.2.2 AUTOREFRACTORS & KERATOMETERS

7.2.2.3 TONOMETERS

7.2.2.4 PHOROPTERS

7.2.2.5 RETINOSCOPES

7.2.2.6 OPHTHALMOSCOPES

7.2.2.7 SLIT LAMPS

7.2.2.8 PERIMETERS/VISUAL FIELD ANALYZERS

7.2.2.9 CORNEAL TOPOGRAPHY SYSTEMS

7.2.2.10 FUNDUS CAMERAS

7.2.2.11 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

7.2.2.11.1 A- SCAN IMAGING SYSTEM

7.2.2.11.2 B-SCAN IMAGING SYSTEM

7.2.2.11.3 PACHYMETERS

7.2.2.11.4 ULTRASOUND BIOMICROSCOPES

7.2.2.12 LENSMETERS

7.2.2.13 WAVEFRONT ABERROMETERS

7.2.2.14 OPTICAL BIOMETRY SYSTEMS

7.2.2.15 SPECULAR MICROSCOPES

7.2.2.16 CHART PROJECTORS

7.2.3 OPHTHALMIC SURGICAL ACCESSORIES

7.2.3.1 SURGICAL INSTRUMENTS & KITS

7.2.3.2 OPHTHALMIC FORCEPS

7.2.3.3 OPHTHALMIC SPATULA

7.2.3.4 OPHTHALMIC TIPS AND HANDLES

7.2.3.5 OPHTHALMIC CANNULAS

7.2.3.6 OPHTHALMIC SCISSORS

7.2.3.7 OTHERS SURGICAL ACCESSORIES

7.2.4 OPHTHALMIC MICROSCOPES

7.3 DRUGS

7.3.1 ANTI-VEGF DRUGS

7.3.1.1 RANIBIZUMAB

7.3.1.2 BEVACIZUMAB

7.3.2 ANTI-GLAUCOMA DRUGS

7.3.2.1 PROSTAGLANDIN ANALOGS

7.3.2.1.1 LATANOPROST

7.3.2.1.2 BIMATOPROST

7.3.2.1.3 TRAVOPROST

7.3.2.1.4 TAFLUPROST

7.3.2.1.5 LATANOPROSTENE

7.3.2.2 BETA ADRENERGIC ANTAGONISTS

7.3.2.2.1 TIMOLAL MALEATE

7.3.2.2.2 BETAXOLOL

7.3.2.3 ALPHA ADRENERGIC AGONISTS

7.3.2.3.1 EPINEPHRINE

7.3.2.3.2 DEPIVEPRINE

7.3.2.4 MIOTICS

7.3.2.4.1 PILOCARPINE

7.3.2.4.2 ESERINE

7.3.3 ANTI-INFLAMMATION DRUGS

7.3.3.1 STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.3.2 NON-STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.4 RETINAL DISORDER DRUGS

7.3.5 DRY EYE DRUGS

7.3.6 ALLERGIC CONJUCTIVITIS DRUGS

7.3.7 OTHERS

7.3.7.1 BRANDED

7.3.7.2 GENERIC

7.3.7.3 PRESCRIPTION

7.3.7.4 OVER THE COUNTER

7.3.7.5 TOPICAL

7.3.7.6 LOCAL OCULAR

7.3.7.7 INJECTABLES

7.3.7.8 ORAL

7.3.7.9 OTHERS

7.3.7.10 EYE DROPS

7.3.7.11 EYE SOLUTION

7.3.7.12 CREAM & OINTMENTS

7.3.7.13 GEL

7.3.7.14 OTHERS

7.3.7.15 INTRAVITREAL

7.3.7.16 SUBCONJUNCTIVAL

7.3.7.17 RETROBULBAR

7.3.7.18 INTRACAMERAL

7.3.7.19 INTRAMUSCULAR

7.3.7.20 INTRAVENOUS

7.3.7.21 OTHERS

7.3.7.22 TABLET

7.3.7.23 CAPSULES

7.3.7.24 OTHERS

7.4 OTHERS

7.4.1 VISION CARE PRODUCTS

7.4.1.1 SPECTACLES

7.4.1.2 CONTACT LENSES

7.4.1.2.1 SOFT CONTACT LENSES

7.4.1.2.2 HYBRID CONTACT LENSES

7.4.1.2.3 RIGID GAS PERMEABLE LENSES

7.4.2 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES

8.1 OVERVIEW

8.2 CATARACT

8.3 REFRACTIVE DISORDERS

8.4 GLAUCOMA

8.5 AGE-RELATED MACULAR DEGENERATION

8.6 INFLAMMATORY DISEASES

8.7 OTHERS

9 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION

9.1 OVERVIEW

9.2 REFRACTION

9.2.1 AUTOMATED REFRACTOMETERS

9.2.2 SET OF TRIAL LENSES

9.2.3 CYCLOPLEGIC DRUGS

9.2.4 TRIAL FRAME

9.2.5 SELF-ILLUMINATED/ MIRROR RETINOSCOPE

9.2.6 JACKSON CROSS CYLINDER

9.3 VISUAL ACUITY TEST

9.3.1 SNELLEN'S CHART

9.3.2 NEAR VISION CHARTS

9.4 INTRAOCULAR PRESSURE

9.4.1 TONOMETERS (GOLDMANN, TONO-PEN, PERKINS, SHIOTZ)

9.4.2 OTHERS

9.5 ANTERIOR SEGMENT AND PUPILLARY EXAMINATION

9.5.1 SLIT LAMP BIOMICROSCOPE

9.5.2 TORCH LIGHT

9.6 VISUAL FIELDS TEST

9.6.1 CENTRAL 30-2 FULL THRESHOLD HUMPHREY VISUAL FIELD ANALYZER

9.6.2 FREQUENCY DOUBLING PERIMETER

9.6.3 GOLDMANN KINETIC PERIMETER

9.7 COLOR VISION TEST

9.8 OTHERS

10 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICS

10.3 HOSPITALS

10.4 HOME HEALTHCARE

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 RETAIL SHOPS

11.2.2 HOSPITAL PHARMACY

11.2.3 ONLINE PHARMACY

11.3 DIRECT TENDER

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY MARKET BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ALCON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON SERVICES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ESSILOR LUXOTTICA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BAUSCH + LOMB

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 REVENUE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBVIE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BAYER AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARL ZEISS MEDITEC AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COOPER COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.1 DOMPÉ

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 F. HOFFMANN-LA ROCHE LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 GLAUKOS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 HAAG-STREIT

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HOYA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LUMENIS BE LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NIDEK CO.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 REICHERT, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SANTEN PHARMACEUTICAL CO.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 STAAR SURGICAL

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TOPCON CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 ZIEMER OPHTHALMIC SYSTEMS AG

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 7 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 12 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 13 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 17 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 18 NORTH AMERICA ANTI INFLAMMATION DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 19 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA CATARACT IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA REFRACTIVE DISORDERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA GLAUCOMA IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA INFLAMMATORY DISEASES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA COLOR VISION TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA CLINICS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA HOME HEALTHCARE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA DIRECT TENDER IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 98 U.S. OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 99 U.S. DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 100 U.S. SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 101 U.S. OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 102 U.S. VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 103 U.S. REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 104 U.S. GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 105 U.S. DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 106 U.S. OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 107 U.S. OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 108 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 109 U.S. ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 110 U.S. ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 111 U.S. PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 112 U.S. BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 113 U.S. ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 114 U.S. MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 115 U.S. ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 116 U.S. OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 117 U.S. VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 118 U.S. CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 119 U.S. OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 120 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 121 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 122 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 123 U.S. TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 124 U.S. LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 125 U.S. INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 126 U.S. ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 127 U.S. OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 128 U.S. REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 129 U.S. VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 130 U.S. INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 131 U.S. ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 132 U.S. VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 133 U.S. OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 134 U.S. OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 135 U.S. RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 136 CANADA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 137 CANADA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 138 CANADA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 CANADA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 140 CANADA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 141 CANADA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 142 CANADA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 143 CANADA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 144 CANADA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 145 CANADA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 146 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 147 CANADA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 148 CANADA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 149 CANADA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 150 CANADA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 151 CANADA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 152 CANADA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 153 CANADA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 154 CANADA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 155 CANADA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 156 CANADA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 157 CANADA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 158 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 159 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 160 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 161 CANADA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 162 CANADA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 163 CANADA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 164 CANADA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 165 CANADA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 166 CANADA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 167 CANADA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 168 CANADA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 169 CANADA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 170 CANADA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 171 CANADA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 172 CANADA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 173 CANADA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 174 MEXICO OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 175 MEXICO DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 176 MEXICO SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 MEXICO OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 178 MEXICO VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 179 MEXICO REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 180 MEXICO GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 181 MEXICO DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 182 MEXICO OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 183 MEXICO OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 184 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 185 MEXICO ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 186 MEXICO ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 187 MEXICO PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 188 MEXICO BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 189 MEXICO ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 190 MEXICO MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 191 MEXICO ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 192 MEXICO OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 193 MEXICO VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 194 MEXICO CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 195 MEXICO OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 196 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 197 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 198 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 199 MEXICO TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 200 MEXICO LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 201 MEXICO INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 202 MEXICO ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 203 MEXICO OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 204 MEXICO REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 205 MEXICO VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 206 MEXICO INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 207 MEXICO ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 208 MEXICO VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 209 MEXICO OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 210 MEXICO OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 211 MEXICO RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING INCIDENCE OF EYE DISORDERS IS DRIVING THE GROWTH OF THE NORTH AMERICA OPHTHALMOLOGY MARKET FROM 2025 TO 2032

FIGURE 15 THE PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2024

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2025-2032 (USD MILLION)

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2024

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2025-2032 (USD MILLION)

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2024

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2025-2032 (USD MILLION)

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2024

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL ,2024

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY MARKET SNAPSHOT

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。