North America Preclinical Imaging Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.32 Billion

2024

2032

USD

1.38 Billion

USD

2.32 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.32 Billion | |

|

|

|

|

North America Preclinical Imaging Market Segmentation, By Product (Systems and Services), Reagents (Preclinical Optical Imaging Reagents, Preclinical Nuclear Imaging Reagents, Preclinical MRI Contrast Agents, Preclinical Ultrasound Contrast Agents, and Preclinical CT Contrast Agents), Application (Research and Development, Drug Discovery, Bio-Distribution, Cancer Cell Detection, Bio-Markers, and Others), End User (Contract Research Organization, Pharmaceutical & Biotech Companies, Academic & Government Research Institutes, Diagnostics Center, and Others)- Industry Trends and Forecast to 2032

North America Preclinical Imaging Market Size

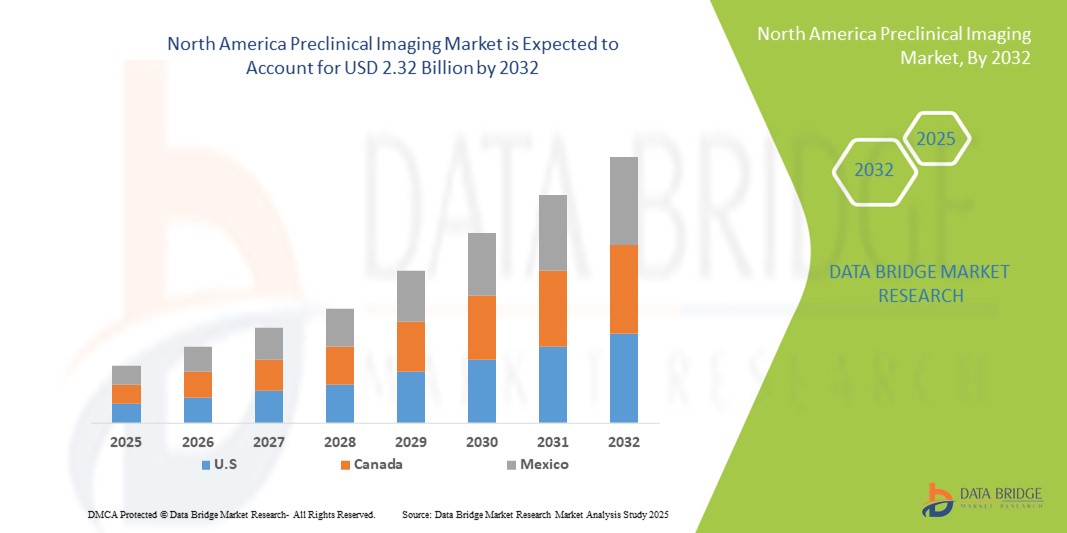

- The North America preclinical imaging market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.32 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely driven by increasing investments in drug discovery and development, coupled with the rising adoption of advanced imaging modalities such as MRI, PET, CT, and optical imaging for preclinical research

- Furthermore, growing focus on translational research, personalized medicine, and non-invasive imaging techniques for monitoring disease progression in animal models is fueling demand. These factors are collectively enhancing the adoption of preclinical imaging solutions, thereby significantly propelling the market’s growth

North America Preclinical Imaging Market Analysis

- Preclinical imaging, encompassing advanced imaging systems such as MRI, PET, CT, and optical imaging, is becoming increasingly vital in modern drug discovery and translational research due to its ability to provide non-invasive, real-time insights into disease progression, treatment efficacy, and biological mechanisms in animal models

- The escalating demand for preclinical imaging is primarily fueled by growing investments in pharmaceutical and biotechnology research, rising adoption of advanced imaging modalities, and the increasing need for faster and more accurate drug development pipelines

- U.S. dominated the North America preclinical imaging market with the largest revenue share of 82.5% in 2024, characterized by high R&D investments, strong presence of key imaging equipment manufacturers, and early adoption of cutting-edge imaging technologies, with substantial growth in preclinical imaging facilities across pharmaceutical companies and academic research institutes, driven by innovations in high-resolution MRI and multi-modal imaging systems

- Canada is expected to be the fastest-growing country in the North America preclinical imaging market during the forecast period due to expanding investments in life sciences research, growth of biotechnology startups, and increasing focus on translational and personalized medicine

- Systems segment dominated the preclinical imaging market with a market share of 49.5% in 2024, driven by their essential role in research and drug discovery, high-resolution imaging capabilities, and broad adoption across pharmaceutical, biotech, and academic research facilities

Report Scope and North America Preclinical Imaging Market Segmentation

|

Attributes |

North America Preclinical Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Preclinical Imaging Market Trends

Advancements in Multi-Modal and AI-Enhanced Imaging

- A significant and accelerating trend in the North America preclinical imaging market is the growing integration of multi-modal imaging systems with AI-driven analysis software, enabling more accurate, high-resolution visualization of disease models and treatment responses

- For instance, the combination of MRI-PET imaging platforms allows researchers to simultaneously capture anatomical and functional data, improving the quality of preclinical studies and accelerating drug development timelines

- AI integration in imaging systems enables features such as automated anomaly detection, predictive analysis of treatment outcomes, and optimized imaging protocols for better throughput. For instance, some Vevo LAZR-X systems utilize AI to enhance image reconstruction accuracy and provide predictive insights for longitudinal studies

- The seamless combination of imaging modalities with AI-assisted data analytics facilitates centralized management of imaging workflows, allowing researchers to analyze multiple datasets from a single platform and gain comprehensive insights into biological processes

- This trend towards more intelligent, automated, and integrated imaging solutions is fundamentally reshaping expectations for preclinical research efficiency. Consequently, companies such as Bruker and PerkinElmer are developing AI-enabled preclinical imaging systems with features such as automated segmentation, predictive modeling, and enhanced resolution

- The demand for multi-modal, AI-driven preclinical imaging platforms is growing rapidly across pharmaceutical and academic research facilities, as stakeholders increasingly prioritize accuracy, speed, and comprehensive analysis capabilities

North America Preclinical Imaging Market Dynamics

Driver

Increasing Demand Due to Rising R&D Investments and Drug Development Activities

- The increasing investments in pharmaceutical and biotechnology R&D, coupled with the need for faster and more accurate drug development, are a significant driver of the heightened demand for preclinical imaging systems

- For instance, in March 2024, Bruker launched a new high-throughput MRI-PET imaging solution designed to accelerate oncology and neurology preclinical studies, signaling growing industry adoption of advanced imaging platforms

- As researchers focus on translational studies and precision medicine, preclinical imaging provides critical insights into drug efficacy, safety, and disease progression, offering a compelling advantage over traditional evaluation methods

- Furthermore, the expansion of biotechnology startups and CROs in the U.S. is making preclinical imaging an integral part of early-stage research, providing scalable and standardized imaging solutions across multiple studies

- The ability to conduct non-invasive longitudinal studies, monitor biomarker expression, and integrate imaging data with AI analytics are key factors propelling adoption in pharmaceutical and academic research facilities. The trend towards high-throughput preclinical imaging and automated workflows further contributes to market growth

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- Concerns surrounding the high capital expenditure for advanced imaging systems, coupled with stringent regulatory and validation requirements, pose a significant challenge to broader market penetration. As preclinical imaging equipment requires specialized operation and adherence to GLP/GMP standards, small biotech firms may face adoption barriers

- For instance, limited funding for startups or smaller academic institutions can restrict access to high-resolution MRI, PET, or multi-modal imaging systems, slowing overall market uptake

- Addressing these challenges through modular system offerings, flexible leasing options, and regulatory support is crucial for enabling broader adoption. Companies such as PerkinElmer and MILabs emphasize scalable solutions and compliance support to build trust among potential buyers. In addition, ongoing maintenance, software updates, and trained personnel requirements increase operational costs for users, making adoption more complex for smaller facilities

- While some companies are introducing cost-effective benchtop or compact imaging systems, the premium for high-end AI-enabled multi-modal platforms remains a hurdle for widespread adoption, particularly for early-stage biotech and academic labs

- Overcoming these challenges through cost optimization, regulatory guidance, and training programs will be vital for sustained market growth in North America preclinical imaging

North America Preclinical Imaging Market Scope

The market is segmented on the basis of product, reagents, application, and end user.

- By Product

On the basis of product, the North America preclinical imaging market is segmented into systems and services. The Systems segment dominated the market with the largest revenue share of 49.5% in 2024, driven by the essential role of imaging platforms such as MRI, PET, CT, and optical systems in drug discovery and translational research. Systems provide high-resolution, non-invasive imaging critical for monitoring disease progression and evaluating treatment efficacy in animal models. The strong adoption of these systems by pharmaceutical companies, biotech firms, and academic research institutes contributes significantly to market revenue. Systems are also favored due to their compatibility with AI-assisted analytics and multi-modal imaging solutions, which improve research efficiency. In addition, government funding and R&D incentives in the U.S. further support system adoption.

The Services segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing outsourcing of preclinical imaging studies to contract research organizations (CROs). Services allow smaller biotech firms and academic labs to access advanced imaging capabilities without high capital expenditure. Growth is further fueled by the demand for end-to-end imaging solutions including data analysis, longitudinal studies, and imaging protocol optimization. The scalability and flexibility of service offerings make them attractive to organizations seeking cost-effective preclinical research support.

- By Reagents

On the basis of reagents, the North America preclinical imaging market is segmented into Preclinical MRI Contrast Agents, Preclinical Optical Imaging Reagents, Preclinical Nuclear Imaging Reagents, Preclinical Ultrasound Contrast Agents, and Preclinical CT Contrast Agents. The Preclinical MRI Contrast Agents segment dominated the market in 2024 due to the widespread use of MRI systems in preclinical research for high-resolution anatomical and functional imaging. MRI contrast agents enhance the visibility of tissues and organs, enabling detailed evaluation of disease progression and therapeutic effects. Researchers prefer MRI contrast agents for non-invasive, longitudinal studies that reduce animal usage while providing precise data. The segment also benefits from continuous technological improvements and regulatory approvals that expand its applicability across oncology, neurology, and cardiovascular research. Strong adoption in pharmaceutical and academic research institutions in the U.S. ensures steady market dominance.

The Preclinical Optical Imaging Reagents segment is anticipated to witness the fastest growth during forecast period, driven by increasing demand for real-time, non-invasive monitoring of molecular and cellular processes in live animal models. Optical imaging reagents are widely used in drug discovery and biomarker studies due to their sensitivity, cost-effectiveness, and compatibility with high-throughput imaging platforms. Innovations in fluorescent probes and bioluminescent reagents further enhance imaging quality and research efficiency. Growth is also supported by the rising focus on cancer research, bio-distribution studies, and development of targeted therapies.

- By Application

On the basis of application, the North America preclinical imaging market is segmented into research and development, drug discovery, bio-distribution, cancer cell detection, bio-markers, and others. The Drug Discovery segment dominated the market in 2024, as preclinical imaging is crucial for evaluating drug efficacy, safety, and pharmacokinetics before clinical trials. High-resolution imaging provides insights into cellular and tissue-level effects, enabling faster and more accurate decision-making in R&D pipelines. Pharmaceutical companies and CROs rely heavily on preclinical imaging to reduce late-stage failures and accelerate the drug development timeline. Adoption is also driven by regulatory encouragement for non-invasive animal studies, which optimize ethical compliance. The integration of AI and multi-modal imaging in drug discovery workflows enhances productivity and analytical precision.

The Bio-Markers segment is expected to witness the fastest growth during the forecast period during forecast period, fueled by the increasing focus on precision medicine and personalized therapies. Imaging-based biomarker detection allows researchers to track disease progression and treatment response in vivo, supporting translational research. Growth is further enhanced by rising collaborations between biotech firms and academic institutions to identify novel biomarkers for oncology, neurology, and immunology. The segment also benefits from technological advancements in high-sensitivity imaging probes and AI-assisted data analysis.

- By End User

On the basis of end user, the North America preclinical imaging market is segmented into contract research organizations (CROS), pharmaceutical & biotech companies, academic & government research institutes, diagnostics centers, and others. The Pharmaceutical & Biotech Companies segment dominated the market in 2024 due to significant investments in preclinical research and the need for high-throughput imaging solutions to accelerate drug development. These companies leverage advanced imaging systems and reagents to assess drug efficacy, safety, and bio-distribution. The dominance is supported by the presence of major pharmaceutical R&D hubs in the U.S. and Canada, as well as partnerships with imaging solution providers. The adoption of multi-modal imaging systems and AI-enhanced analytics further reinforces their market share.

The CROs segment is expected to witness the fastest growth from 2025 to 2032, as outsourcing preclinical imaging allows smaller biotech firms and academic labs to access advanced imaging capabilities without heavy capital investment. CROs offer scalable, end-to-end services including imaging, data analysis, and regulatory support. Growth is driven by rising demand for flexible and cost-effective preclinical research solutions, expansion of CRO networks in the U.S., and increasing collaboration between pharmaceutical companies and specialized service providers.

North America Preclinical Imaging Market Regional Analysis

- U.S. dominated the North America preclinical imaging market with the largest revenue share of 82.5% in 2024, characterized by high R&D investments, strong presence of key imaging equipment manufacturers

- Researchers and organizations in the region highly value the accuracy, high-resolution capabilities, and non-invasive nature of preclinical imaging systems, which enable efficient monitoring of disease progression, drug efficacy, and biomarker identification

- This widespread adoption is further supported by strong R&D infrastructure, collaborations between biotech firms and academic research institutes, and increasing focus on translational and personalized medicine, establishing preclinical imaging as a critical component of modern drug discovery and development workflows

U.S. Preclinical Imaging Market Insight

The U.S. preclinical imaging market captured the largest revenue share in 2024 within North America, fueled by substantial investments in pharmaceutical and biotechnology R&D and the presence of leading imaging equipment manufacturers. Researchers and organizations are increasingly prioritizing high-resolution, non-invasive imaging systems to monitor disease progression, drug efficacy, and biomarker discovery. The growing adoption of multi-modal imaging and AI-assisted analytics further propels the market. Moreover, collaborations between pharmaceutical companies, biotech firms, and academic institutions are significantly contributing to market expansion, particularly for oncology, neurology, and cardiovascular research.

Canada Preclinical Imaging Market Insight

The Canada preclinical imaging market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing government and private investments in life sciences research and biotechnology. The rise of CROs and biotech startups is fostering adoption, while the demand for translational and personalized medicine studies is increasing. Canadian research institutes are also leveraging advanced imaging systems to optimize drug discovery pipelines. The integration of AI and imaging software to improve efficiency and analytical accuracy is accelerating market growth. In addition, collaborations with U.S.-based pharmaceutical companies support knowledge transfer and adoption of state-of-the-art imaging technologies

Mexico Preclinical Imaging Market Insight

The Mexico preclinical imaging market is witnessing steady growth, driven by increasing pharmaceutical and biotechnology research activities and the expansion of academic and government research institutes. Growing investments in R&D and collaborations with U.S. and European pharmaceutical companies are supporting the adoption of advanced imaging systems. The rising presence of CROs providing preclinical imaging services is facilitating access to high-resolution MRI, PET, CT, and optical imaging platforms. Government initiatives promoting biotechnology innovation and life sciences research are further boosting the market. Mexico’s focus on improving research infrastructure and training skilled personnel is enhancing the adoption of preclinical imaging systems.

North America Preclinical Imaging Market Share

The North America preclinical imaging industry is primarily led by well-established companies, including:

- Bruker (U.S.)

- PerkinElmer (U.S.)

- Trifoil Imaging LLC (U.S.)

- Mediso Ltd. (Hungary)

- MILabs B.V. (Netherlands)

- MR Solutions (U.K.)

- Aspect Imaging Ltd. (Israel)

- VisualSonics Inc. (Canada)

- LI-COR, Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Cubresa Inc. (Canada)

- Scanco Medical AG (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Rigaku Holdings Corporatio (Japan)

- Agilent Technologies, Inc. (U.S.)

- Molecubes (Belgium)

- Shanghai United Imaging Healthcare Co., LTD (China)

What are the Recent Developments in North America Preclinical Imaging Market?

- In September 2025, Revvity established an In Vivo Imaging Center of Excellence in North Carolina. This facility aims to advance next-generation instruments, optical imaging systems, X-ray CT, multi-modal AI analysis software, and ultrasound systems. Key innovations from Revvity currently available at the site include the IVIS optical imaging systems, Quantum GX3 microCT system, Vega automated preclinical ultrasound system, and the VivoJect Image-Guided Injection System for targeted delivery of cells and therapies

- In August 2025, United Imaging announced the FDA clearance of its uMR Ultra and uOmniscan systems, marking significant advancements in preclinical imaging technology. These systems are designed to provide high-resolution imaging capabilities, enhancing the study of disease mechanisms and therapeutic interventions in small animal models

- In May 2025, United Imaging showcased its advanced imaging technologies at the ISMRM Annual Scientific Meeting in Honolulu. The company emphasized its differentiated technology, highlighting innovations in magnetic resonance imaging (MRI) systems. United Imaging's participation underscored its commitment to advancing imaging solutions for preclinical research applications

- In February 2024, Bruker Corporation, a leading scientific instruments company, acquired Spectral Instruments Imaging LLC. This acquisition was aimed at strengthening Bruker BioSpin's Preclinical Imaging (PCI) division by expanding its portfolio of in-vivo optical imaging systems. The move enhanced Bruker's capabilities in disease research and reinforced its position in the competitive preclinical imaging market

- In September 2023, Revvity, Inc., a company formerly known as PerkinElmer, unveiled a series of next-generation preclinical imaging technologies designed to accelerate scientific discoveries. This portfolio expansion included the IVIS Spectrum 2 and IVIS SpectrumCT 2 systems, which enhance in vivo optical imaging with greater sensitivity and versatility

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。