North America In

Market Size in USD Billion

CAGR :

%

USD

5.42 Billion

USD

15.46 Billion

2024

2032

USD

5.42 Billion

USD

15.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.42 Billion | |

| USD 15.46 Billion | |

|

|

|

|

North America In-Vitro Toxicology Testing Market Segmentation, By Product and Service (Consumables, Services, Assays, Equipments, and Software), Toxicology End Point and Test (ADME (Absorption, Distribution, Metabolism, & Excretion) Testing, Cytotoxicity Testing, Genotoxicity Testing, Dermal Toxicity Testing, Ocular Toxicity Testing, Organ Toxicity Testing, Skin Irritation, Corrosion, & Sensitization Testing, Phototoxicity Testing, and Other Toxicity Endpoints & Tests), Technology (Cell Culture Technologies, High-Throughput Technologies, Molecular Imaging, and OMICS Technology), Method (Cellular Assays, Biochemical Assays, Ex-Vivo Models, and In Silico Models), Industry (Pharmaceutical & Biopharmaceutical Companies, Diagnostics, Food, Chemicals, Cosmetics & Household Products), Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2032

North America In-Vitro Toxicology Testing Market Size

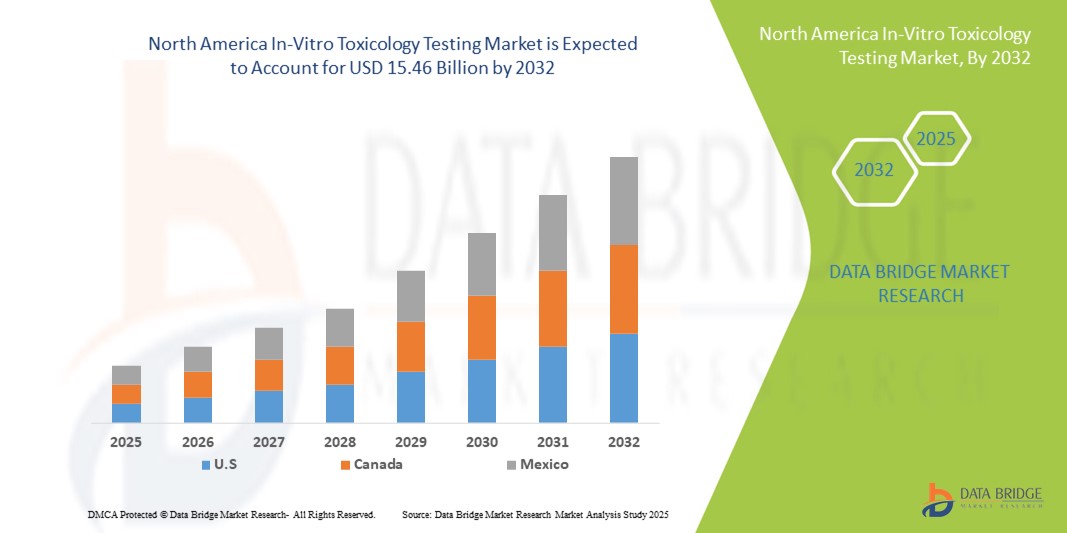

- The North America in-vitro toxicology testing market size was valued at USD 5.42 billion in 2024 and is expected to reach USD 15.46 billion by 2032, at a CAGR of 14.00% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within in-vitro toxicology testing solutions, driven by advancements in cell culture technologies, high-throughput screening, and predictive toxicology models. These innovations are enhancing testing accuracy, reducing dependency on animal studies, and accelerating drug development timelines across pharmaceutical and biotechnology sectors

- Furthermore, rising regulatory support for alternative testing methods, combined with increasing demand from pharmaceutical, cosmetic, and chemical industries, is establishing in-vitro toxicology testing as a reliable, ethical, and cost-effective solution. These converging factors are accelerating the uptake of in-vitro toxicology testing solutions, thereby significantly boosting the industry's growth

North America In-Vitro Toxicology Testing Market Analysis

- In-vitro toxicology testing, which involves evaluating the safety and potential toxicity of chemicals, drugs, and other substances outside the human body, is becoming an essential component of modern drug development and chemical safety assessment due to its ability to reduce reliance on animal testing, enhance accuracy, and improve regulatory compliance

- The growing demand for in-vitro toxicology testing is primarily fueled by increasing regulatory pressure to minimize animal testing, rising research and development activities in pharmaceuticals, and the growing need for rapid, cost-effective, and high-throughput testing solutions

- U.S. dominated the in-vitro toxicology testing market with the largest revenue share of 87.53% in 2024, supported by advanced healthcare infrastructure, strong government initiatives, and the presence of leading pharmaceutical and biotechnology companies. The country also benefits from robust regulatory frameworks and continuous technological advancements in cell-based assays, high-throughput screening, and organ-on-chip technologies, driving significant market growth

- Canada is expected to be the fastest-growing country in the in-vitro toxicology testing market during the forecast period, owing to rising healthcare investments, increasing adoption of advanced testing technologies, and government initiatives promoting alternatives to animal testing. The country’s expanding pharmaceutical research sector and growing collaborations between academic institutions and industry players are further accelerating this growth

- The pharmaceutical & biopharmaceutical companies segment dominated the North America in-vitro toxicology testing market market revenue share of 45.8% in 2024, fueled by the high volume of preclinical drug testing, the need for compliance with regulatory safety standards, and the adoption of advanced in-vitro toxicology platforms

Report Scope and In-Vitro Toxicology Testing Market Segmentation

|

Attributes |

In-Vitro Toxicology Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America In-Vitro Toxicology Testing Market Trends

Enhanced Convenience Through Advanced Testing Platforms

- A significant and accelerating trend in the North America in-vitro toxicology testing market is the adoption of advanced high-throughput screening (HTS) platforms and automated testing technologies. These innovations are streamlining toxicology workflows, reducing manual intervention, and providing faster, more reliable results

- For instance, companies are increasingly deploying organ-on-a-chip models and 3D cell culture technologies that replicate human physiology more accurately than conventional 2D cultures, enhancing the predictive value of toxicity assessments. Similarly, microfluidic-based systems are being integrated into toxicology testing workflows to improve reproducibility and scalability

- Automation in in-vitro toxicology testing enables laboratories to process large sample volumes while minimizing variability and errors. For example, several new systems now allow for automated liquid handling, advanced imaging, and integrated data analysis, significantly improving throughput and efficiency for both pharmaceutical and chemical safety testing

- Furthermore, the incorporation of advanced imaging techniques and AI-powered analytics (applied specifically to toxicology datasets rather than consumer applications) is enabling researchers to gain deeper insights into cell responses, biomarkers, and dose-response relationships. This helps in delivering more comprehensive toxicity profiles with higher accuracy

- The seamless integration of in-vitro toxicology platforms with laboratory information management systems (LIMS) facilitates centralized data collection, regulatory compliance, and standardized reporting across research centers and pharmaceutical companies. Through a single interface, laboratories can manage testing processes alongside other R&D activities, creating a unified workflow for drug discovery and chemical safety evaluation

- This trend towards more sophisticated, automated, and biologically relevant toxicology testing systems is fundamentally reshaping expectations in drug development and chemical safety assessments. Consequently, companies such as Eurofins Scientific and Charles River Laboratories are investing heavily in advanced in-vitro models, positioning themselves to meet the rising demand for accurate, ethical, and scalable toxicology solutions

- The demand for advanced in-vitro toxicology testing platforms is growing rapidly across both pharmaceutical and biotechnology sectors, as organizations increasingly prioritize predictive accuracy, cost efficiency, and reduced reliance on animal testing in alignment with evolving regulatory frameworks

North America In-Vitro Toxicology Testing Market Dynamics

Driver

Growing Need Due to Rising Safety Concerns and Regulatory Compliance

- The increasing concerns over human safety, ethical issues with animal testing, and stricter global regulations for chemical and pharmaceutical testing are major drivers fueling the demand for In-Vitro Toxicology Testing

- For instance, in April 2024, Charles River Laboratories announced the expansion of its in-vitro toxicology capabilities by integrating advanced 3D cell culture models into its safety testing portfolio. Such strategic initiatives by leading companies are expected to accelerate the growth of the In-Vitro Toxicology Testing market during the forecast period

- As industries, particularly pharmaceuticals, biotechnology, and chemicals, face heightened regulatory scrutiny, in-vitro testing methods offer a scientifically robust and ethically sound alternative to traditional animal studies. These methods provide accurate toxicity data while aligning with global efforts to reduce animal use in research

- Furthermore, the growing adoption of advanced technologies such as organ-on-a-chip platforms, stem-cell-derived models, and automated high-throughput screening systems is making in-vitro testing a central component of modern safety evaluation frameworks

- The ability of in-vitro toxicology platforms to deliver faster results, greater reproducibility, and more human-relevant data positions them as indispensable tools for drug development, chemical safety assessments, and cosmetic testing. In addition, the rising demand for cost-effective, ethical, and efficient solutions continues to expand adoption across both developed and emerging markets

Restraint/Challenge

Concerns Regarding High Costs and Technical Limitations

- Despite their growing popularity, in-vitro toxicology methods face challenges related to the high cost of advanced testing platforms and certain technical limitations. While innovative systems such as 3D organ models and microfluidic devices provide valuable insights, their adoption is often hindered by significant upfront investment requirements, particularly in smaller research facilities or cost-sensitive markets

- For instance, high-profile studies have highlighted that although in-vitro models provide strong predictive value, they cannot yet fully replicate the complexity of whole-organism responses, making it necessary to use them alongside complementary testing methods in certain cases

- Addressing these limitations through further technological innovation, broader standardization, and regulatory acceptance is essential for increasing confidence in in-vitro methods. Companies such as Eurofins Scientific and Labcorp are actively working on validating new assays and expanding affordable testing services to reduce cost barriers

- In addition, the high investment needed for equipment, consumables, and specialized expertise can discourage adoption in developing regions. While costs are gradually declining due to technological advancements, the perception of in-vitro toxicology as a premium service may slow penetration in lower-income markets

- Overcoming these challenges through industry collaboration, training initiatives, and continued innovation will be crucial to ensuring sustained growth and broader global acceptance of in-vitro toxicology testing

North America In-Vitro Toxicology Testing Market Scope

The market is segmented on the basis of product and service, toxicology end point and test, technology, method, industry, and distribution channel.

- By Product & Service

On the basis of product and service, the North America in-vitro toxicology testing market is segmented into consumables, services, assays, equipment, and software. The consumables segment dominated the largest market revenue share of 39.5% in 2024, driven by the recurring demand for reagents, kits, and culture media in routine toxicology testing workflows. Consumables are indispensable for day-to-day laboratory operations, making them a consistent revenue stream for suppliers. The increasing emphasis on reproducibility, accuracy, and faster turnaround times has further propelled the demand for high-quality consumables across pharmaceutical, biotech, and chemical industries. Moreover, the rising use of advanced 3D cell culture consumables and specialized assay kits for complex toxicity endpoints such as organ toxicity is strengthening this segment’s dominance. With new product launches and continuous innovations in consumables, the segment remains a cornerstone of the market.

The software segment is anticipated to witness the fastest CAGR of 12.8% from 2025 to 2032, driven by the rising adoption of digital platforms for data analysis, predictive modeling, and regulatory compliance in toxicology testing. Software tools allow researchers to integrate complex datasets from high-throughput screening, OMICS technologies, and in silico models, thereby accelerating decision-making and reducing experimental errors. Growing regulatory requirements for precise documentation and the need for advanced predictive analytics in drug development are boosting software adoption. Cloud-based platforms and AI-enabled tools are further enhancing efficiency by offering scalable, automated, and collaborative solutions for toxicology research. As laboratories move toward digital transformation, the software segment is expected to expand rapidly and reshape the overall testing ecosystem.

- By Toxicology End Point and Test

On the basis of toxicology end point and test, the North America in-vitro toxicology testing market is segmented into ADME (Absorption, Distribution, Metabolism, & Excretion) testing, cytotoxicity testing, genotoxicity testing, dermal toxicity testing, ocular toxicity testing, organ toxicity testing, skin irritation, corrosion, & sensitization testing, phototoxicity testing, and other toxicity endpoints & tests. The ADME testing segment dominated the largest market revenue share of 41.2% in 2024, driven by its critical role in evaluating the pharmacokinetic profiles of drugs during preclinical development. ADME studies provide essential insights into absorption efficiency, bioavailability, metabolic stability, and elimination pathways, which are pivotal for regulatory submissions. The rising adoption of high-throughput screening platforms, automation, and predictive in vitro models has further strengthened this segment. Pharmaceutical and biopharmaceutical companies are increasingly relying on ADME testing to reduce late-stage failures and optimize drug candidates early in the development cycle. Continuous improvements in microfluidic systems, 3D liver models, and co-culture assays have enhanced the accuracy and throughput of ADME testing.

The cytotoxicity testing segment is expected to witness the fastest CAGR of 13.4% from 2025 to 2032, fueled by the growing emphasis on safety assessment for new chemical entities, biologics, and cosmetic ingredients. Cytotoxicity assays enable early identification of toxic compounds, minimizing the risk of adverse effects in clinical trials. Increasing demand from contract research organizations (CROs) and regulatory agencies for standardized and reproducible cytotoxicity data is accelerating growth. The adoption of automated imaging systems, high-content screening, and 3D cell culture models is expanding the range and reliability of cytotoxicity assays. In addition, regulatory encouragement to reduce animal testing in line with the 3Rs (Replacement, Reduction, Refinement) is promoting the adoption of in vitro cytotoxicity platforms.

- By Technology

On the basis of technology, the North America in-vitro toxicology testing market is segmented into cell culture technologies, high-throughput technologies, molecular imaging, and OMICS technology. The cell culture technologies segment dominated the largest market revenue share of 38.7% in 2024, attributed to its wide application in predictive toxicity testing and drug safety evaluations. 2D and 3D cell culture models, including organ-on-a-chip and spheroid cultures, are extensively used for evaluating organ-specific toxicity, cytotoxicity, and mechanistic studies. The segment benefits from the increasing trend toward personalized medicine, improved assay reproducibility, and reduced animal testing. Enhanced availability of specialized cell lines, co-culture systems, and serum-free media further supports the demand for advanced cell culture technologies.

The OMICS technology segment is expected to witness the fastest CAGR of 14.1% from 2025 to 2032, driven by the growing use of genomics, proteomics, and metabolomics platforms to identify molecular biomarkers of toxicity. OMICS approaches enable comprehensive profiling of drug effects at the molecular level, enhancing predictive accuracy and safety assessments. Pharmaceutical companies are increasingly integrating OMICS data with in vitro models to accelerate preclinical research and meet stringent regulatory standards. Technological advancements in next-generation sequencing, mass spectrometry, and bioinformatics are expanding the adoption of OMICS technologies across pharmaceutical, chemical, and cosmetic industries.

- By Method

On the basis of method, the North America in-vitro toxicology testing market is segmented into cellular assays, biochemical assays, ex-vivo models, and in silico models. The cellular assays segment dominated the largest market revenue share of 42.5% in 2024, due to their broad applicability in evaluating cell viability, cytotoxicity, organ-specific toxicity, and pharmacological responses. Cellular assays are widely preferred because they offer faster turnaround, reproducibility, and compatibility with high-throughput screening. The increasing regulatory pressure to replace animal studies and the rising adoption of human-relevant models are further propelling this segment. Advanced imaging, automated analysis, and 3D cell culture techniques are driving efficiency and accuracy.

The in silico models segment is expected to witness the fastest CAGR of 13.9% from 2025 to 2032, driven by computational toxicology and predictive modeling. In silico approaches help in assessing toxicity risks, identifying off-target effects, and reducing experimental costs. The segment benefits from AI-driven predictive algorithms, machine learning integration, and regulatory support for alternative testing strategies. These models complement experimental data, enabling faster decision-making and reducing the reliance on animal studies. Moreover, the growing availability of public toxicological databases and open-source modeling tools is further accelerating adoption. Increasing collaboration between software developers, research institutions, and regulatory bodies is enhancing model accuracy and regulatory acceptance.

- By Industry

On the basis of industry, the North America in-vitro toxicology testing market is segmented into pharmaceutical & biopharmaceutical companies, diagnostics, food, chemicals, cosmetics & household products. The pharmaceutical & biopharmaceutical companies segment dominated the largest market revenue share of 45.8% in 2024, fueled by the high volume of preclinical drug testing, the need for compliance with regulatory safety standards, and the adoption of advanced in-vitro toxicology platforms. These companies utilize in-vitro testing to enhance the safety and efficacy profiles of their drug candidates while reducing the likelihood of late-stage failures. The trend of integrating high-throughput screening, organ-on-a-chip models, and automated platforms is strengthening the segment’s dominance.

The cosmetics & household products segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, driven by regulatory mandates to reduce animal testing and increasing demand for safer consumer products. Companies are increasingly adopting in-vitro cytotoxicity, genotoxicity, and skin sensitization assays to comply with international safety standards. Technological innovations in 3D skin models, reconstructed human epidermis, and organotypic assays are supporting rapid growth in this sector. Moreover, the rising consumer preference for cruelty-free and eco-friendly products is boosting market adoption. Collaboration between cosmetics manufacturers, biotech firms, and regulatory agencies is enhancing assay accuracy and accelerating product testing timelines.

- By Distribution Channel

On the basis of distribution channel, the North America in-vitro toxicology testing market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the largest market revenue share of 41.3% in 2024, driven by bulk procurement by pharmaceutical and biotech companies for routine toxicology testing. Long-term contracts with suppliers ensure consistent quality, timely delivery, and compliance with regulatory standards. Direct tender agreements also allow organizations to negotiate pricing, reduce operational costs, and secure reliable supply chains for consumables, equipment, and software.

The retail sales segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, fueled by the growing demand for smaller labs, academic research institutions, and contract research organizations requiring individual purchases of kits, reagents, and small-scale equipment. The increasing number of start-ups, research centers, and specialized laboratories is supporting growth through retail channels, providing flexibility and convenience for smaller-scale operations. In addition, the rise of e-commerce platforms and online scientific marketplaces is facilitating easy access to essential consumables and instruments. Enhanced after-sales support, training, and bundled solutions offered by retailers further drive adoption among smaller institutions.

North America In-Vitro Toxicology Testing Market Regional Analysis

- U.S. dominated the in-vitro toxicology testing market with the largest revenue share of 87.53% in 2024, supported by advanced healthcare infrastructure, strong government initiatives, and the presence of leading pharmaceutical and biotechnology companies. The country also benefits from robust regulatory frameworks and continuous technological advancements in cell-based assays, high-throughput screening, and organ-on-chip technologies, driving significant market growth

- Canada is expected to be the fastest-growing country in the in-vitro toxicology testing market during the forecast period, owing to rising healthcare investments, increasing adoption of advanced testing technologies, and government initiatives promoting alternatives to animal testing. The country’s expanding pharmaceutical research sector and growing collaborations between academic institutions and industry players are further accelerating this growth

U.S. In-Vitro Toxicology Testing Market Insight

The U.S. in-vitro toxicology testing market dominated the in-vitro toxicology testing market with the largest revenue share of 87.53% in 2024, supported by advanced healthcare infrastructure, strong government initiatives, and the presence of leading pharmaceutical and biotechnology companies. The country is at the forefront of technological innovations, including cell-based assays, high-throughput screening, and molecular imaging platforms, which significantly enhance toxicology studies. Moreover, increasing investment in drug discovery, stringent regulatory requirements, and the growing emphasis on replacing animal testing with more predictive models are fueling market growth. These factors collectively establish the U.S. as the clear leader in the North American market.

Canada In-Vitro Toxicology Testing Market Insight

The Canada in-vitro toxicology testing market is expected to be the fastest-growing country in the In-Vitro Toxicology Testing market during the forecast period, driven by rising healthcare investments and government initiatives promoting ethical and sustainable alternatives to animal testing. The country’s expanding pharmaceutical research sector and growing adoption of advanced technologies such as ex-vivo models, in silico methods, and organ toxicity testing are creating significant opportunities. Collaboration between universities, research institutions, and private companies further supports innovation, while supportive regulatory frameworks enhance the transition toward modern testing models. These dynamics position Canada as a high-potential growth market within North America.

North America In-Vitro Toxicology Testing Market Share

The In-vitro toxicology testing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Labcorp (U.S.)

- Merck KGaA (Germany)

- Charles River Laboratories (U.S.)

- Lonza (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

- Catalent, Inc. (U.S.)

- SGS Société Générale de Surveillance SA (Switzerland)

- Intertek Group plc (U.K.)

- Eurofins Scientific (Luxembourg)

- Promega Corporation (U.S.)

- Aragen Life Sciences Ltd. (India)

- Cyprotex Plc (U.K.)

- Shanghai Medicilon Inc. (China)

- Creative Biolabs (U.S.)

- BioIVT (U.S.)

- AAT Bioquest, Inc. (U.S.)

- Gentronix (U.K.)

- IONTOX (U.S.)

- InSphero (Switzerland)

- MB Research Laboratories (U.S.)

- Creative Bioarray (U.S.)

- Preferred Cell Systems (U.S.)

Latest Developments in North America In-Vitro Toxicology Testing Market

- In March 2023, Thermo Fisher Scientific Inc., a leading provider of laboratory equipment and reagents, announced the launch of its new high-throughput in-vitro toxicology testing platform. This platform integrates advanced cell culture technologies and automated screening capabilities, enabling researchers to assess potential toxicological effects more efficiently and accurately. The launch underscores Thermo Fisher's commitment to advancing in-vitro toxicology testing methodologies and supporting regulatory compliance in drug development

- In June 2024, Charles River Laboratories, a prominent contract research organization, expanded its in-vitro toxicology testing services by introducing a suite of new assays focused on dermal and ocular toxicity. These assays utilize reconstructed human epidermis and corneal models to provide more accurate predictions of skin and eye irritation potential. The expansion aims to meet the growing demand for alternative testing methods that reduce reliance on animal models and align with global regulatory trends

- In September 2024, Labcorp Drug Development, a global contract research organization, unveiled its enhanced in-vitro toxicology testing capabilities with the addition of advanced 3D cell culture models. These models offer more physiologically relevant environments for assessing drug-induced toxicity, particularly in the context of organ-specific effects. The integration of 3D cell culture systems reflects Labcorp's dedication to providing cutting-edge solutions that improve the predictability and relevance of toxicological assessment

- In December 2024, Bio-Rad Laboratories, a global leader in life science research and clinical diagnostics, launched a new line of in-vitro toxicology testing kits designed for high-throughput screening applications. These kits incorporate fluorescent-based assays to detect cytotoxicity and genotoxicity, facilitating rapid and reliable toxicity evaluations. The introduction of these kits aims to support pharmaceutical and cosmetic industries in meeting stringent safety standards while enhancing testing efficiency

- In February 2025, Merck KGaA, Darmstadt, Germany, a leading science and technology company, announced a strategic partnership with a U.S.-based biotech firm to co-develop next-generation in-vitro toxicology testing platforms. The collaboration focuses on integrating omics technologies with advanced in-vitro models to provide more comprehensive and predictive toxicological data. This partnership underscores Merck KGaA's commitment to advancing the field of in-vitro toxicology testing through innovation and collaboration

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。